U.K. Competition Watchdog Sets Out 30 Reforms for Energy Market

June 24 2016 - 3:27AM

Dow Jones News

By Razak Musah Baba

LONDON--The U.K antitrust body Friday concluded its energy

market investigation setting out a range of reforms to modernize

the market for the benefit of customers.

The Competition and Markets Authority said 30 measures will help

drive down costs by increasing competition between suppliers and

helping more customers switch to better deals, while protecting

those less able to benefit from competition.

As part of the investigation, the CMA said it has found that 70%

of domestic customers of the six largest energy firms are still on

an expensive 'default' standard variable tariff.

The 'big six' energy firms are Centrica PLC (CNA.LN), owner of

British Gas, RWE AG (RWE) which owns RWE npower, SSE PLC (SSE.LN),

E.ON SE (EOAN), EDF Energy and Iberdrola (IBE), which own Scottish

Power.

The CMA said it has found that in aggregate customers have been

paying GBP1.4 billion a year more than they would in a fully

competitive market.

"Competition is working well for some customers in this market -

but nowhere near enough of them. Our measures will help more

customers get a better deal and put in place a modernized energy

market equipped for the future," said Roger Witcomb who led the

energy market investigation.

The CMA is set to send orders and recommendations to the U.K

energy regulator Ofgem and government, while it will shortly

publish a timetable setting out this remedies implementation

process over the next six months.

The CMA said Ofgem will also be given much greater influence

over the working of the market and more powers to enable it to

scrutinize prices and suppliers as well as the impact of

policy.

-Write to Razak Musah Baba at razak.baba@wsj.com; Twitter:

@Raztweet

(END) Dow Jones Newswires

June 24, 2016 03:12 ET (07:12 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

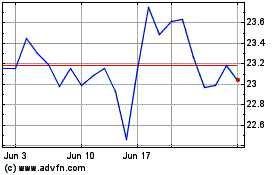

SSE (PK) (USOTC:SSEZY)

Historical Stock Chart

From Jun 2024 to Jul 2024

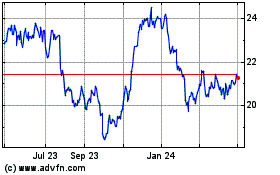

SSE (PK) (USOTC:SSEZY)

Historical Stock Chart

From Jul 2023 to Jul 2024