UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant [X]

Filed by a Party other than the Registrant?

Check the appropriate box:

[ ] Preliminary Proxy Statement

[ ] Confidential, for Use of the Commission Only

(as permitted by Rule 14a-6(e)(2))

[X] Definitive Proxy Statement

[ ] Definitive Additional Materials

[ ] Soliciting Material Pursuant to Rule 14a-12

SIGNAL ADVANCE, INC.

(Name of Registrant as Specified In Its Charter)

N/A

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

[X] No fee required.

[ ] Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

(1)Title of each class of securities to which transaction applies:

(2)Aggregate number of securities to which transaction applies:

(3)Per unit price or other underlying value of transaction computed

pursuant to Exchange Act Rule 0-11 (set forth the amount on which the

filing fee is calculated and state how it was determined):

(4)Proposed maximum aggregate value of transaction:

(5)Total fee paid:

[ ] Fee paid previously with preliminary materials.

[ ] Check box if any part of the fee is offset as provided by Exchange Act Rule

0-11(a)(2) and identify the filing for which the offsetting fee was paid

previously. Identify the previous filing by registration statement number,

or the form or schedule and the date of its filing.

(1)Amount Previously Paid:

(2)Form, Schedule or Registration Statement No.:

(3)Filing Party:

(4)Date Filed:

On the letterhead of Signal Advance, Inc.

Notice of Annual Meeting of Stockholders

June 27, 2014, 10:00AM CDT

To the Stockholders of Signal Advance, Inc.:

NOTICE IS HEREBY GIVEN that the 2014 Annual Meeting of Stockholders (the "2014

Meeting") of Signal Advance, Inc. (the "Company") will be held at our offices at

2520 County Road 81, Rosharon, Texas 77583 on Friday, June 27, 2014, at 10:00 AM

CDT, for the following purposes:

1. To elect four (4) directors for a one-year term or until their successors are

elected and qualified;

2. To ratify the appointment by the Company's Board of Directors of Bobby J.

Hutton, Certified Public Accountant, as the Company's independent registered

public accounting firm for the fiscal year ending December 31, 2013;

3. To ratify the Board of Directors' actions and decisions since the last

stockholders' meeting,

4. To approve the minutes of previous annual stockholders' meeting, and

5. To transact such other business as may properly come before the meeting or

any adjournment or postponement thereof. Except with respect to the

procedural matters incident to the conduct of the 2014 Meeting, management

is not aware of any other such business.

Only stockholders of record at the close of business on June 2, 2014 will be

entitled to notice of and to vote at the 2014 Meeting or any adjournment of the

2014 Meeting.

We cordially invite you to attend the 2014 Meeting in person. However, whether

or not you plan to attend the 2014 Meeting in person, it is important that your

shares are represented at the meeting. We ask that you either vote your shares

or return the enclosed proxy card at your earliest convenience. If you give a

proxy, you may revoke it at any time before it is used and if you vote in person

at the 2014 Meeting, your proxy will automatically be revoked as to each matter

on which you vote in person.

By Order of the Board of Directors

/s/ Malcolm Skolnick

Malcolm Skolnick, Secretary

Rosharon, Texas

June 5, 2014

|

SIGNAL ADVANCE, INC.

2520 County Road 81

Rosharon, Texas 77583

Phone:(713) 510-7445, Fax:928-441-5564

Notice of Annual Meeting of Stockholders

June 27, 2014, 10:00 AM CDT

Proxy Statement

Solicitation of Proxies

The Board of Directors (the "Board") of Signal Advance, Inc (the "Company") is

soliciting the accompanying proxy in connection with matters to be considered at

the Annual Meeting of Stockholders (the "2014 Meeting") to be held at our

offices at 2520 County Road 81, Rosharon, Texas 77583 on Friday, June 27, 2014

at 10:00 AM CDT. The individuals named on the proxy card will vote all shares

represented by proxies in the manner designated or, if no designation is made,

they will vote as follows:

(1) FOR each of the four (4) nominees named in this proxy statement for election

to the Board;

(2) FOR ratification of the selection of Bobby J. Hutton, Certified Public

Accountant as the Company's independent registered public accounting firm

for the Company's fiscal year ending December 31, 2014; and

(3) FOR ratification of the Board of Directors' actions and decisions since the

last stockholders' meeting,

(4) To approve the minutes of previous annual stockholders' meeting, and

(5) In their best judgment with respect to any other matters that properly come

to a vote at the 2014 Meeting. The individuals who act as proxies will not

vote shares that are the subject of a proxy card on a particular matter if

the proxy card instructs them to abstain from voting on that matter or to

the extent the proxy card is marked to show that some of the shares

represented by the proxy card are not to be voted on that matter.

Record Date

Only stockholders of record at the close of business on June 2, 2014 will be

entitled to notice of or to vote at this 2014 Meeting or any adjournment of the

2014 Meeting. The approximate date of mailing for this proxy cover letter and

statement, proxy card, minutes of the previous stockholders' meeting and a copy

of our Annual Report on Form 10-K for the year ended December 31, 2013, is

June 5, 2014.

Shares Outstanding and Voting Rights

We have one class of voting stock outstanding: Common Stock, no par value

("Common Stock"), As of June 2, 2014, 9,787,409 shares of Common Stock were

outstanding. Each outstanding share of Common Stock entitles the holder to one

(1) vote.

A list of stockholders entitled to vote at the meeting will be available at the

meeting, and for 10 days prior to the meeting, at our office at 2520 County Road

81, Rosharon, Texas 77583, between the hours of 9:00 a.m. and 4:00 p.m. local

time.

-1-

Proxies and Voting Procedures

Holders of Common Stock entitled to vote can vote their shares by completing and

returning a proxy card pursuant to the directions on the proxy card.

You can revoke your proxy at any time before it is exercised by timely delivery

of a properly executed, later-dated proxy or by voting in person at the 2014

Meeting.

All shares entitled to vote and represented by properly completed proxies

received prior to the 2014 Meeting and not revoked will be voted at the 2014

Meeting in accordance with your instructions.

If your shares are registered directly in your name with Nevada Agency and

Transfer Company, our transfer agent, you are considered a stockholder of

record. As a stockholder of record at the close of business on June 2, 2014, you

can vote in person at the 2014 Meeting or you can provide a proxy to be voted at

the 2014 Meeting by signing and returning the enclosed proxy card pursuant to

its instructions. If you submit a proxy card, we will vote your shares as you

direct. If you submit a proxy card without giving specific voting instructions,

those shares will be voted as recommended by the Board. If your shares are held

in a stock brokerage account or otherwise by a nominee, you are considered the

beneficial owner of those shares, and your shares are held in "street name". If

you hold your shares in "street name", you will receive instructions from your

broker or other nominee describing how to vote your shares. If you do not

instruct your broker or other nominee how to vote such shares, they may vote

your shares as they decide as to each matter for which they have discretionary

authority under the applicable law. On those matters as to which those rules do

not permit brokers or other nominees to vote in the absence of instructions from

the account holder, the broker or other nominee will not vote the shares on the

matter (this is a "broker non-vote").

All proxies must be received by the Company's Secretary on or before 10:00 am

(CST) on Wednesday, June 25, 2014. If you do not indicate your voting prefer-

ences, your shares will be voted as recommended by the Board. Complete, sign and

date the proxy card you received and return by:

Mail: Mail or otherwise deliver your completed proxy to: Signal Advance, Inc.,

Attn: Corporate Secretary, 2520 County Road 81, Rosharon, Texas 77583.

Fax: Fax your completed proxy to 928 441 5564.

Email: Scan or otherwise convert proxy into a format deliverable via email to:

info@signaladvance.com.

|

If any other matters are properly presented at the 2014 Meeting for considera-

tion, including, among other things, consideration of a motion to adjourn the

2014 Meeting to another time or place, the individuals named as proxies and

acting thereunder will have discretion to vote on those matters according to

their best judgment to the same extent as the person delivering the proxy would

be entitled to vote. If the 2014 Meeting is postponed or adjourned, your proxy

will remain valid and may be voted at the postponed or adjourned meeting. You

will still be able to revoke your proxy until it is voted. At the date this

proxy statement went to press, we did not anticipate that any other matters

would be raised at the 2014 Meeting.

-2-

Voting Requirements

The presence, in person or by proxy, of the majority of the outstanding shares

entitled to vote at the 2014 Meeting shall constitute a quorum, which is

required in order to transact business at the 2014 Meeting. You may vote in

favor or against any or all of the director nominees and/or proposals. You may

also withhold your vote as to any or all of the nominees and/or proposals. The

affirmative vote of a majority of the votes cast by the shares entitled to vote

in the election at the 2014 Meeting, at which a quorum is present, is required

for the election of directors. For purposes of the vote on this matter,

abstentions and broker non-votes will not be counted as votes cast and will

have no effect on the result of the vote, although each type of vote will count

toward the presence of quorum.

Cost of Proxy Distribution and Solicitation

The Company will pay the expenses of the preparation of the proxy materials and

the solicitation by the Board of proxies. Proxies may be solicited on behalf of

the Company in person or by telephone, e-mail, facsimile or other electronic

means by directors, officers or employees of the Company, who will receive no

additional compensation for soliciting. If required by the rules of the

Securities and Exchange Commission (the "Commission"), we will reimburse

brokerage firms and other custodians, nominees and fiduciaries for their

expenses incurred in sending proxies and proxy materials to beneficial owners

of Common Stock.

PROPOSAL 1 - ELECTION OF DIRECTORS

The Bylaws of the Company provide that the Board shall consist of not less than

three (3) or more than five (5) members. Currently, the membership of the Board

is set at five and, at present, consists of five (5) members. Our Bylaws give

the Board the authority to establish, increase or decrease the number of

directors. Due to other personal and professional commitments, Karl Zercoe, has

decided not to stand for re-election to the Company's Board of Directors upon

the expiration of his current term at the Company's annual meeting of stock-

holders to be held on June 27, 2014. Mr. Zercoe has no disagreement with our

company relating to our operations, policies and practices, or otherwise. He has

been a valuable member of the Board since 2005 and his contribution to the

Company will be greatly missed. We are, therefore, recommending the following

four (4) nominees for election at the 2014 Meeting to the Board are Chris Hymel,

Richard Seltzer, Malcolm Skolnick and Ron Stubbers, all of whom currently serve

on the Board and all of whom have advised the Company of their willingness to

serve as a member of the Board if elected. You can find information about each

of the nominees below under the Section entitled "Biographies of Director

Nominees". There are no arrangements or understandings between the persons named

as nominees for director at the 2014 Meeting and any other person pursuant to

which such nominee was selected as a nominee.

If elected, the nominees will serve as directors until the Company's annual

meeting of stockholders in 2015, or until their successors are elected and

qualified. If a nominee declines to serve or becomes unavailable for any

reason, the proxies may be voted for such substitute nominee as the proxy

holders may designate.

THE BOARD RECOMMENDS THAT YOU VOTE "FOR" THE ELECTION OF EACH OF THE ABOVE

NOMINEES FOR DIRECTOR

-3-

PROPOSAL 2 - PROPOSAL TO RATIFY THE APPOINTMENT OF OUR INDEPENDENT AUDITORS

The Company engaged Bobby J. Hutton, Certified Public Accountant ("Hutton"), on

October 25, 2011. During the Company's two (2) most recent fiscal years, there

were no disagreements (as defined in Item 304(a)(1)(iv) of Regulation S-K and

the related instructions) between the Company and Hutton on any matter of

accounting principles or practices, financial statement disclosures, or auditing

scope or procedure, which disagreements, if not resolved to the satisfaction of

Hutton, would have caused it to make reference to the subject of such

disagreements in connection with any report prepared by Hutton, except that the

financial statements of the Company for the fiscal year ended December 31, 2013

expressed, in an explanatory paragraph, that "...the Company's operating losses

raise substantial doubt about its ability to continue as a going concern."

Further, there have been no reportable events (as described in Item 304(a)(1)(v)

of Regulation S-K).

Neither the Company, nor anyone on its behalf, consulted with LBB on any matters

described in Item 304(a)(2) of Regulation S-K during the Company's two (2) most

recent fiscal years or any prior period. A representative of Hutton will not be

present at the 2014 Meeting.

Stockholder ratification of the appointment of our independent auditors is not

required by the Company's Bylaws or otherwise. However, we are submitting this

proposal to the stockholders as a matter of good corporate practice. Approval of

this proposal requires the affirmative vote of a majority of the votes repre-

sented at the 2014 Meeting and entitled to vote thereat. If the appointment of

Hutton is not ratified, the Board may reconsider the appointment. Even if the

appointment is ratified, the Board in its discretion may direct the appointment

of a different independent audit firm at any time during the year if it is

determined that such change would be in best interests of the Company and its

stockholders.

THE BOARD RECOMMENDS THAT YOU VOTE "FOR" THE RATIFICATION OF THE APPOINTMENT

OF BOBBY J. HUTTON, CERIFIED PUBLIC ACCOUNTANT, AS THE COMPANY'S INDEPENDENT

AUDITORS FOR THE YEAR 2014.

Audit Disclosures

Services Provided: 2013 2012

------ ------

Audit Fees $2,720 $4,265

Audit Related Fees - -

Tax Fees - -

All Other Fees - -

====== ======

Total $2,720 $4,265

|

-4-

Audit Fees - The aggregate fees billed for the years ended December 31, 2013 and

2012 were for the audits of our financial statements and reviews of our interim

financial statements included in our annual and quarterly reports.

Audit Related Fees - The aggregate fees billed for the years ended December 31,

2013 and 2012 were for the audit or review of our financial statements that are

not reported under Audit Fees.

Tax Fees - The aggregate fees billed for the years ended December 31, 2013 and

2012 were for professional services related to tax compliance, tax advice and

tax planning.

All Other Fees - The aggregate fees billed for the years ended December 31, 2013

and 2012 were for services other than the services described above.

Auditing Service Pre-approval Policies

The policy of our Board is to pre-approve all audit and permissible non-audit

services to be performed by the Company's independent auditors during the fiscal

year. Under these procedures, the Board pre-approves both the type of services

to be provided by our auditor and the estimated fees related to these services.

PROPOSAL 3 - RATIFICATION OF THE BOARD OF DIRECTORS' ACTIONS AND DECISIONS SINCE

THE LAST STOCKHOLDER'S MEETING

Stockholders are being asked to ratify the actions and decisions of the Board of

Directors as disclosed in the current (8K), quarterly (10Q) and annual (10K)

reports filed with the Commission since the last stockholders' meeting.

THE BOARD RECOMMENDS THAT THE STOCKHOLDERS VOTE "FOR" APPROVAL OF THE

RATIFICATION OF THE BOARD OF DIRECTORS' ACTION AND DECISIONS SINCE THE LAST

STOCKHOLDERS' MEETING.

EXECUTIVE OFFICERS - BOARD OF DIRECTORS

The following table sets forth the names, positions and ages of the current SAI

Directors and Officers. Directors are elected during the annual shareholders'

meeting and serve for one year and until their successors are elected and

qualify. Officers are elected by our board of directors and their terms of

office are at the discretion of our board. There are no family relationships

among our directors, executive officers, director nominees or significant

employees. One of our Directors are independent per NASDAQ listing standards.

Director/Officer Age Title

---------------- --- -----

Chris Hymel 56 Director, President/Treasurer (Nominee

Malcolm Skolnick 78 Director, Secretary (Nominee)

Ron Stubbers 51 Director, Vice-President (Nominee)

Richard Seltzer 58 Director (Nominee)

Karl Zercoe 50 Director (Not standing for re-election)

|

-5-

BIOGRPAHIES OF DIRECTOR NOMINEES:

CHRIS M. HYMEL, PhD (President/Treasurer, Director) an experienced entrepreneur,

founded the Company in 1992 and has served as a director and its President and

Treasurer since its inception. Dr. Hymel previously founded a computer systems/

network consulting and technology development firm, and later, a medical-legal

firm which developed over 60 animations used in litigation support. He was also

on the board of a non-profit corporation, Educational Enrichment Center through

2009. Professional experience also includes technology development at the Uni-

versity of Texas, Neurophysiology Research Center, including the development of

proprietary neurostimulation, signal generation and data acquisition systems,

and control systems engineering for Shell Oil & Shell Development Companies and

Johnson Controls, Inc. Dr. Hymel holds a doctorate in biomedical sciences from

the University of Texas Health Science Center, Houston as well as Bachelor's

and Master's degrees in electrical engineering from Texas A&M University. Dr.

Hymel holds multiple patents and has authored a number of scientific/technical

publications. Dr. Hymel, developed the proprietary Signal Advance technology

and successfully demonstrated temporally advanced detection of a range of

analog (including bioelectric) signals in his doctorate research completed at

the University of Texas Health Science Center in August 2010.

MALCOLM SKOLNICK, PhD, JD (Secretary, Director) received his Ph.D. in physics

from Cornell University and J.D. from the University of Houston Law Center. He

retired in 2008 after ten years as a Director, President/CEO of CytoGenix, Inc.,

a public biotechnology firm in Houston Texas. Prior to joining CytoGenix, Dr.

Skolnick, a tenured professor, held academic positions in the Medical School,

the Graduate School of Biomedical Sciences and the School of Public Health

(SPH) of the University of Texas Health Science Center, Houston (UTHSC). In

addition to his service as a Department Chair in the Medical School and

professorial duties, Dr. Skolnick directed the UTHSC Office of Technology

Management, overseeing the University's activities in protecting and licensing

its technology portfolio. He also headed the Neurophysiology Research Center

and served as principal investigator of several clinical trials in pain

management, smoking cessation and reduction of withdrawal symptoms in drug

addiction. Dr. Skolnick also serves as Director and Vice President of the

Southwest Health Technology Foundation, Resolution Forum, Inc., Responsible

Community Design International, Inc., and Hudson Forest Homeowners' Assoc-

iation. He has served as an expert witness in intellectual property, product

liability, and accident reconstruction matters. Dr. Skolnick is a registered

patent attorney, patented inventor and is licensed to practice law in the

State of Texas. In addition to his service on various corporate boards, since

his retirement from CytoGenix, Inc., he has been active in patent prosecution

and licensing for selected clients and has been an invited lecturer at several

local universities.

RON A, STUBBERS, BS, MBA, (Vice-President, Director) has been developing and

manufacturing electronic biomedical devices for over 20 years, much of it

while VP of Engineering and VP of Operations for Neuroscan, Inc. and its

successor Compumedics, USA from 1991-2003, and aDEPtas, Inc. and its successor

InGeneron, Inc. from 2004-Present. His experience includes development and

production of medical devices ranging from neurostimulation systems to EEG

acquisition and analysis systems. He has also worked in the areas of product

design and manufacturing engineering, quality, regulatory and technical support

for startup companies. Mr. Stubbers has managed corporate ISO/EN/QSR quality

management systems requirements and compliance and European CE and FDA 510K

Class II as well as other regulatory approvals for world-wide medical device

-6-

distribution. Mr. Stubbers received his bachelor's degree in electrical

engineering from the University of Idaho in 1985, completed graduate coursework

at the University of Texas, Graduate School of Biomedical Sciences and at Rice

University, and completed his MBA at the University of Houston (2013).

Richard C. SELTZER, JD, LLM (Director) Mr. Seltzer received his J.D. from South

Texas College of Law in 1981 and his LL.M. in Taxation from the University of

Florida in 1982. Mr. Seltzer has been in private practice for more than thirty

years representing both established and startup businesses in acquisitions and

mergers, financial and tax issues, contractual matters, shareholder disputes,

real estate acquisitions and general business litigation in Texas State Courts.

His practice includes arranging viable capital infusions for ongoing businesses,

negotiating business and real estate related contracts. He has handled the

licensing of proprietary information for a non-profit organization in Texas. He

also continues to successfully represent numerous taxpayer corporations and

individuals before the Internal Revenue Service, including both its Appellate

and Collection Divisions as well as representing taxpayers for matters filed

with the U.S. Tax Court. For more than fifteen years Mr. Seltzer has been a

frequent invited speaker covering general business topics at the People's Law

School in conjunction with the University of Houston Law School. He is also an

approved mediator in the State of Texas having received his certification in

2008. Mr. Seltzer has continued to serve as a member of the Board of Directors

of Bridges to Life, a nonprofit organization in Houston, since 2003. He was

appointed in 2011 as a member of the Board of Directors of STARBASE, Inc.,

a federally funded educational program working in conjunction with the Depart-

ment of Defense and the National Guard that works with upper elementary school

students particularly interested in math, science, engineering and technology

related programs. In addition, Mr. Seltzer serves on the Boards of Directors of

the following Texas corporations: Atlas Management, Inc. (appointed in 2000),

Innovative Tooling and Accessories, Inc. (appointed in 2007), Intuitec, Inc.

(appointed in 2003), Milsob Properties, Inc. (appointed in 2008). He has also

served on the Board of Directors of Delta Shaver Company, Inc., a Delaware

corporation since 2011.

CORPORATE GOVERNANCE AND BOARD MEMBERS

Family Relationships

There are no family relationships by and between or among the Directors or other

officers. None of our Directors or officers is a director or executive officer

of any company that files reports with the Commission except as set forth in the

"Biographies Director Nominees" section above.

Election of Directors and Officers

Directors hold office until the next succeeding annual meeting and the election/

qualification of their respective successors. Officers are elected annually by

our Board and hold office at the discretion of our Board. Our Bylaws permit our

Board to fill any vacancy and such director may serve until the next annual

meeting of stockholders and the due election and qualification of their

successor.

-7-

Legal Proceedings

To the knowledge of management, no director, executive officer or affiliate of

the Company or owner of record or beneficially of more than 5% of the Company's

common stock is a party adverse to the Company or has a material interest

adverse to the Company in any legal proceeding.

To the knowledge of management, during the past five years, no present or former

director, executive officer, affiliate or person presently nominated to become a

director or an executive officer of the Company:

(1) Filed a petition under the federal bankruptcy laws or any state insolvency

law, nor had a receiver, fiscal agent or similar officer appointed by a court

for the business or property of such person, or any partnership in which he or

she was a general partner at or within two years before the time of such filing,

or any corporation or business association of which he or she was an executive

officer at or within two years before the time of such filing;

(2) Was convicted in a criminal proceeding or named the subject of a pending

criminal proceeding (excluding traffic violations and other minor offenses);

(3) Was the subject of any order, judgment or decree, not subsequently reversed,

suspended or vacated, of any court of competent jurisdiction, permanently or

temporarily enjoining him or her from or otherwise limiting his or her involve-

ment in any type of business, commodities, securities or banking activities;

(4) Was the subject of any order, judgment or decree, not subsequently reversed,

suspended or vacated, of any Federal or State authority barring, suspending or

otherwise limiting him or her for more than 60 days from engaging in, or being

associated with any person engaging in, any type of business, commodities,

securities or banking activities;

(5) Was found by a court of competent jurisdiction in a civil action or by the

Commission to have violated any federal or state securities law, and the

judgment in such civil action or finding by the Commission has not been

subsequently reversed, suspended, or vacated.

Promoters and Control Persons

None.

Board Leadership and Role in Risk Oversight

Our Board recognizes that the leadership structure and combination or separation

of the President and Chairman roles is driven by the needs of the Company at any

point in time. The Company has no policy requiring combination or separation of

leadership roles and our governing documents do not mandate a particular

structure. This has allowed our Board the flexibility to establish the most

appropriate structure for the Company at any given time.

The Board oversees our stockholders' interest in the long-term health and the

overall success of the Company and its financial strengths. The full Board is

actively involved in overseeing risk management for the Company done so in part

through discussion and review of our business, financial and corporate

governance practices and procedures. The Board, as a whole, reviews the risks

confronted by the Company with respect to its operations and financial

condition, and establishes limits of risk tolerance with respect to the

Company's activities.

-8-

Meetings of the Board and Stockholder Communications

Our Board conducted all of its business and approved all corporate action during

the fiscal year ended December 31, 2013 and from January 1, 2014 to present, by

the unanimous consent of its members, in the absence of formal board meetings.

Holders of the Company's securities can send communications to the Board via

mail or telephone to the Secretary at the Company's principal executive offices.

The Company has not yet established a policy with respect to Board members'

attendance at the annual meetings. A stockholder who wishes to communicate with

our Board may do so by directing a written request addressed to our President

at the address appearing on the first page of this proxy statement.

Code of Business Conduct and Ethics Policy

We have adopted a Code of Business Conduct and Ethics that applies to our

employees, officers and directors. This document was provided to the Commission

as Exhibit 14.1 with Registration Statement submitted November 18, 2013

(available at http://www.sec.gov/search/search.htm).

Committees of the Board of Directors

We do not presently have a separately constituted audit committee, compensation

committee, nominating committee, executive committee or any other committees of

our board of directors. Our Board does not believe that it is necessary to have

such committees because it believes the functions of such committees can be

adequately performed by the Board. We have not adopted any procedures by which

security holders may recommend nominees to our Board.

Audit Committee Financial Expert

Not applicable, as we do not presently have an audit committee.

Director Independence

Although the Company is not listed on the NASDAQ Stock Market, the Board has

determined that Mr. Zercoe is an "Independent Director", as defined by NASDAQ

listing standards. None of the current nominees will be considered

"Independent".

Executive Compensation

We are providing compensation disclosure that satisfies the requirements that

apply to emerging growth companies, as defined in the JOBS Act. The summary

compensation table below shows certain compensation information paid for

services rendered in all capacities to us by our principal executive officer and

by each other executive officer whose total annual salary and bonus exceeded

$100,000 during years ending December 31, 2012 and 2013. Other than as set forth

below, no executive officer's total annual compensation exceeded $100,000 during

our last fiscal period.

-9-

Summary Compensation Table:

Non-Qualified

Stock Non-Equity Deferred All Other

Year or Awards Options Incentive Plan Compensation Compensation

Name Position Period Salary Bonus (1) Awards Compensation Earnings (2) Total

----------- ---------- ------- ------ ------ -------- ------- -------------- ------------- ------------ --------

Chris Hymel Pres/Treas 2012 -0- -0- $108,000 -0- -0- -0- $4,683 $112,683

Chris Hymel Pres/Treas 2013 -0- -0- $108,000 -0- -0- -0- $4,078 $112,078

|

(1) Non-cash compensation: Equity issued for services rendered

(2) Reimbursement of medical and professional development expenses

SAI entered into a consulting agreement with Dr. Chris M. Hymel, the Company

President, whereby his annual compensation was 108,000 per year in 2012 and

2013, plus limited reimbursement of professional development and medical

expenses. Dr. Hymel is expected to devote essentially full-time (at least 40

hours/week) on activities related to the Company. The term of the agreement

is year-to-year but may be terminated by giving one month's notice. Eligible

medical and professional development expenses are either paid or reimbursed in

cash and annual compensation for services rendered has been in the form of

equity, specifically common stock.

In years ending December 31, 2012 and 2013, Dr Skolnick received $18,500 and

$5,000, respectively, in the form of equity (common stock) in exchange for

services, the majority of which was related to intellectual property protection.

Other than as described above, all other directors and executive officers

received well under less than $5,000 compensation in the same periods, also in

the form of equity (common stock) in exchange for their services. No executive

officers received a bonus or deferred compensation.

There are no employment contracts, compensatory plans or arrangements (except

as referenced above for the Company President), including payments to be

received from the Company with respect to any executive officer of the Company

which would result in payments to any such person because of his or her resig-

nation, retirement or other termination of employment with the Company or its

subsidiaries, any change in control of the Company or a change in the person's

responsibilities following a change in control of the Company. Nor are there any

agreements or understandings for any director or officer to resign at the

request of another person. None of the Company's directors or executive officers

is acting on behalf of or will act at the direction of any other person.

Compensation Pursuant to Plans:

There is no retirement, pension, profit-sharing, or other plan covering any of

our officers and directors. The Company has adopted no formal stock option plans

for our officers, directors and/or employees. SAI reserves the right to adopt

one or more stock options plans in the future. Presently, there is no plan to

issue additional equity in the Company or options to acquire the same to our

officers, directors or their affiliates or associates except for compensation

of Director and Officers as described previously.

-10-

SECURITY OWNERSHIP OF CERTIAN BENEFICIAL OWNERS

The Company is authorized to issue 100,000,000 shares of common stock, with no

par value. Holders of common stock are entitled to one vote per share on all

matters subject to shareholder vote. The common stock has no cumulative,

preemptive or other subscription rights. All of the presently issued shares of

common stock are fully paid and non-assessable. The Board of Directors may

declare dividends payable to holders of common stock out of legally available

funds. If the Company is liquidated or dissolved, holders of shares of common

stock will be entitled to share ratably in any assets of the Company remaining

after satisfaction of all of its liabilities. As of June 2, 2014, 9,787,409

shares had been issued to 173 shareholders. The following table sets forth the

number of shares of common stock that are beneficially owned as of June 2, 2014

by (i) each person known by us to be the beneficial owner of more than 5% of the

outstanding shares of our common stock, (ii) each of our directors and executive

officers, (iii) all officers and directors as a group and, (iv) all officers and

directors and each person known by us to be the beneficial owner of more than 5%

of the outstanding shares of our common stock as a group. The persons and

entities named in the table have sole voting and sole investment power with

respect to the shares set forth opposite the stockholder's name, subject to

community property laws, where applicable.

Amount/Nature

Title of Beneficial Percent

Name of Beneficial Owner of Class Ownership(1) of Class

-------------------------------------- -------- ------------- --------

Chris Hymel, Director/Officer(2,4) Common 4,490,013 46.0%

Ray and Tricia Corkran(3,4) Common 821,250 8.4%

Malcolm Skolnick, Director/Officer(2,4) Common 296,834 3.0%

Ron Stubbers, Director/Officer(2,4) Common 261,250 2.7%

Karl Zercoe, Director(2,4) Common 256,250 2.6%

Richard C. Seltzer, Director(2) Common 118,000 1.0%

Officers/Directors as a group (5 total) Common 5,397,347 55.3%

Officers/Directors & >5% Shareholders Common 6,211,597 63.7%

|

Certain Relationships and Related transactions:

The Company owed its President, Chris M Hymel, $118,406 as of December 31, 2013,

in the form of an unsecured short-term loan. The note is due on demand and

carries a simple interest of 2.5% per quarter. The Company currently leases

office space, from its president, on a month to month basis at a rate of $700

per month. The Company obtained rights to the intellectual property though an

assignment agreement with its President in exchange for equity (common stock).

Other than the President's compensation and related transactions, discussed

previously, since the company's inception, there has not been, nor is there

currently proposed, any transaction or series of similar transactions with

related parties to which the Company was or will be a party:

1) in which the amount involved exceeds $120,000; and

2) in which any director, executive officer, shareholder who beneficially

owns 5% or more of SAI common stock, or any member of their immediate

family, had or will have a direct or indirect material interest.

-11-

REGISTRATION OF SHARES, DTC ELIGIBILITY

On May 21, 2013 we received a Notice of Effectiveness regarding our Registration

Statement on Form S-1, from the Commission. All shares held by non-affiliate

stockholders (holders other than Directors, Officers and holders owning greater

than 10% of the equity in the company) are now registered with the Commission.

You can obtain a copies of these filings as well as related communications and

notices from the SEC's EDGAR database at http://www.sec.gov/search/search.htm.

In addition, we are beginning the process of applying for DTC eligibility,

which, when completed, will allow SAI Common Stock to be traded electronically.

FORM 10-K ANNUAL REPORT TO STOCKHOLDERS, STOCKHOLDER COMMUNICATIONS

The Company filed with the Commission an Annual Report on Form 10-K for the

fiscal year ended December 31, 2013 (the "Annual Report") which was amended on

March 17, 2014 (to correct formatting errors). We have enclosed the Annual

Report with this proxy statement. The Annual Report includes our audited

financial statements for the fiscal year ended December 31, 2013, along with

other financial information and management discussion. We urge you to read the

Annual Report carefully, however, it is not to be regarded as proxy solicitation

material.

You can also obtain a copy of our Annual Report on Form 10-K and other periodic

filings that we make with the Commission from our website: www.signaladvance.com

or from the SEC's EDGAR database at http://www.sec.gov/search/search.htm.

We intend to announce preliminary voting results at the 2014 Meeting, and

publish final results in a Current Report on Form 8-K, which will be filed with

the Commission within 4 days from the 2014 Meeting. You may obtain a copy of

this and other reports for the sites listed above.

These reports can also be obtained, free of charge by:

- mail: Signal Advance, Inc.,

2520 County Road 81, Rosharon, Texas 77583

telephone: (713) 510 7445 (SIGL)

- fax: (928) 441 5564

- email: info@signaladvance.com

Stockholders may obtain information relating to their own share ownership by

contacting the Company's stock transfer agent:

Nevada Agency and Transfer Company

50 West Liberty, Suite 880

Reno, Nevada 89501

(775) 322-0626

-12-

OTHER MATTERS

The notice of meeting provides for the election of directors, ratification of

the selection of independent auditors, ratification of the action of the

Board of Directors' actions and decisions since the last stockholders' meeting,

approval of the minutes of the previous annual stockholders' meeting, and for

the transaction of such other business, as may properly come before the meeting.

As of the date of this proxy statement, the Board of Directors does not intend

to present to the meeting any other business, and it has not been informed of

any business intended to be presented by others. However, if any other matters

properly come before the meeting, the persons named in the enclosed proxy will

take action and vote proxies, in accordance with their judgment of such matters.

Action may be taken on the business to be transacted at the meeting on the date

specified in the notice of meeting or on any date or dates to which such meeting

may be adjourned.

STOCKHOLDER PROPOSALS FOR THE 2015 ANNUAL MEETING

Any stockholder who intends to present a proposal at the 2013 Annual Meeting of

Stockholders must ensure that the proposal is submitted pursuant to Rule 14a-8

under the Securities Exchange Act of 1934 and received by the Corporate Secre-

tary of the Company: 1) not later than January 1, 2015; or, 2) if the date of

next year's annual meeting is moved more than 30 days before or after the

anniversary date of this year's meeting, the deadline for inclusion of proposals

in our proxy statement is instead 120 days before we begin to print and mail

our proxy materials for next year's meeting.

By Order of the Board of Directors

/s/ Malcolm Skolnick

By: Malcolm Skolnick

Corporate Secretary

Rosharon, Texas

June 5, 2014

|

-13-

SHAREHOLDER PROXY FORM

Instructions

1. Your name and address

On the envelope appears your name and address as it appears on the Company's

share register. If this information is incorrect, please mark the box and make

the correction on the form. Please note that you cannot change ownership of your

securities using this form.

2. Appointment of a proxy

If you wish to appoint the Chairman of the meeting as your proxy, mark the box.

If the person you wish to appoint as your proxy is someone other than the

Chairman of the meeting, please write the name of that person. If you leave this

section blank, or your named proxy does not attend the meeting, the Chairman of

the meeting will be your proxy. A proxy need not be a security holder of the

Company.

3. Votes on items of business

You may direct your proxy how to vote by placing a mark in one of the three

boxes opposite each item of business. All your securities will be voted in

accordance with such a direction unless you indicate only a portion of voting

rights are to be voted on any item by inserting the percentage or number of

securities you wish to vote in the appropriate box or boxes. If you do not mark

any of the boxes on a given item, your proxy may vote as he or she chooses. If

you mark more than one box on an item your vote on that item will be invalid.

4. Appointment of a second proxy

You are entitled to appoint up to two persons as proxies to attend the meeting

and vote on a poll. If you wish to appoint a second proxy, an additional proxy

form may be obtained by contacting the Company's Secretary or you may copy this

form.

To appoint a second proxy you must:

(a) on each of the first and second proxy form state the percentage of your

voting rights or number of securities applicable to that form. If the

appointments do not specify the percentage or number of votes that each

proxy may exercise, each proxy may exercise half your votes. Fractions of

votes will be disregarded.

(b) return both forms together in the same envelope.

5. Signing instructions

You must sign this form as follows in the spaces provided:

- Individual: where the holding is in one name, the holder must sign.

- Joint holding: where the holding is in more than one name, all of the

security holders should sign.

- Power of attorney: to sign under power of attorney, a copy of the executed

power of attorney should accompany this form. If this proxy form is signed

under power of attorney, the attorney hereby states that no notice of

revocation of the power of attorney has been received.

- Companies: this form must be signed by a duly authorized officer of the

Company. This officer must also indicate the office held. If a representa-

tive of the corporation other than an officer is to attend the meeting, a copy

of a corporate resolution authorizing the representative to act on behalf of

the corporation should accompany this form.

Submission of a Proxy

This proxy form (and any power of attorney under which it is signed) must be

received at the address given below no later than 10:00 am, Wednesday, June 25,

2014. Any proxy form received after that time will not be valid for the

scheduled meeting. Documents may be lodged by U.S. mail, other delivery method,

facsimile or via electronic mail to Signal Advance, Inc. If delivered by

electronic mail, the completed/signed form must be scanned or otherwise

converted to a format that is deliverable electronically.

Mailing Address: Signal Advance, Inc., Attn: Corporate Secretary,

2520 County Road 81, Rosharon, Texas 77583

Electronic Mail: info@signaladvance.com

Facsimile No.: 928 441 5564

|

[ ] Name Address/Contact Information ("X" indicates the information has changed)

Name(s): _______________________________________________________________________

Street: __________________________________________ City: ______________________

State: ___________________ Zip/Postal Code: __________ Country: ______________

Phone Number: ________________ Email Address(se): _____________________________

-1-

SHAREHOLDER PROXY FORM

Please inform the company of your intent to attend the annual shareholders'

meeting or complete this proxy form and deliver same to Signal Advance, Inc. per

the instructions on the reverse side of this form. The cut-off time is 10:00 am,

Wednesday, June 25, 2014. For all inquiries, please contact the company at

713 510 7445.

[ ] Mark this box with an "X" if you have made any changes to your address and

provide your new address in the space proved on the reverse side of this

form.

Appointment of Proxy

[ ] l/We, shareholder(s) of Signal Advance, Inc. and entitled to attend and vote

hereby appoint: The meeting Chairman (please mark the box with an "X"), or

Write the name of the person you are appointing if other than the Chairman

of the meeting.

Or failing the person named, or if no person is named, the Chairman of the

meeting, as my/our proxy to act generally at the meeting on my/our behalf and

to vote in accordance with the following directions (or, if no directions have

been given, as the proxy sees fit) at the Annual Shareholders Meeting of Signal

Advance, Inc., to be held at 2520 County Road 81, Rosharon, Texas 77583, at

10:00am, Friday, June 27, 2014 and continuing through any adjournment of that

meeting.

Voting directions to your proxy = please mark "X" to indicate your directions.

*If you mark the Abstain box for a particular item, you are directing your proxy

not to vote on your behalf on a show of hands or on a poll and your votes will

not be counted in computing the required majority on a poll.

Resolutions: For Against Abstain*

1. To Elect Members of the Board of Directors:

Chris Hymel [ ] [ ] [ ]

Richard Seltzer [ ] [ ] [ ]

Malcolm Skolnick [ ] [ ] [ ]

Ron Stubbers [ ] [ ] [ ]

2. To ratify the appointment of Bobby J. Hutton [ ] [ ] [ ]

as the company's independent registered public

accountant for fiscal year 2014

3. To ratify all proceedings of the corporation [ ] [ ] [ ]

and actions of the Officers since the last

stockholders' meeting

4. To approve minutes of previous annual [ ] [ ] [ ]

stockholders' meeting

|

SIGN HERE - this section must be signed in accordance with the instructions

for your directions to be followed.

_______________________ ______________________________________ _______________

Authorized Signature Authorized Signature (if held jointly) Date

_______________________ _________________________________ ___________________

|

Printed Contact Name Printed Contact Name Telephone Number

For:___________________________________________ Office Held:___________________

(if shares are held as a custodian or in the name of a business entity)

-2-

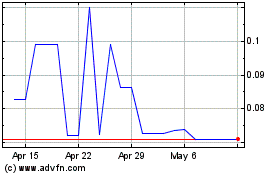

Signal Advance (PK) (USOTC:SIGL)

Historical Stock Chart

From Apr 2024 to May 2024

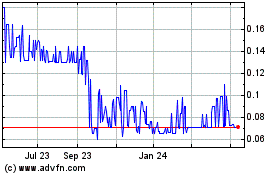

Signal Advance (PK) (USOTC:SIGL)

Historical Stock Chart

From May 2023 to May 2024