Sharp Cuts Full-Year Earnings Forecast

October 26 2015 - 6:30AM

Dow Jones News

TOKYO—Sharp Corp. slashed its earnings forecast for the current

fiscal year on Monday, citing worse-than-expected performance in

its smartphone display-panel business due to intensifying

competition, especially from China.

For the full-year ending in March, Sharp restated its

operating-profit guidance to 10 billion Japanese yen ($82.7

million), down from the previous forecast of ¥ 80 billion. Revenue

guidance was revised down to ¥ 2.7 trillion from ¥ 2.8

trillion.

"Prices of display panels for smartphones sold in China have

declined and our sales have slowed," Sharp said in a statement.

The Osaka-based electronics maker has been implementing a wide

range of restructuring measures, such as job cuts, selling

buildings in Osaka including its headquarters and pulling back from

some overseas markets.

As a supplier to Apple Inc., display-panel manufacturing has

been a core business for Sharp, but the unit was hit hard as

competitors eroded the company's customer base with cheaper

offerings.

After obtaining its second bailout in three years from banks in

May, Sharp's chief executive Kozo Takahashi pledged that he would

speed up overhaul efforts and that the company would turn around by

the second quarter, with a projected profit of ¥ 10 billion for the

April-September period. That figure was revised to a loss of ¥ 26

billion on Monday.

The downgrade was expected because Sharp's turnaround plan was

seen as too optimistic when it was announced. Mr. Takahashi

admitted in July the plan may need some adjustment as market

conditions in the display-panel business were "worsening at a

faster pace than we had expected."

Sharp's share price rose 0.74% Monday.

The company will report second-quarter earnings on Friday, with

analysts focusing on any updates on the panel business.

Sharp is in discussions with Japan Display Inc. and Hon Hai

Precision Industry Co. over possible investments in its smartphone

panel business, according to people with knowledge of the matter.

Sharp executives, including Mr. Takahashi, have said the firm won't

rule out any possibilities, including giving up majority control of

the unit.

Write to Takashi Mochizuki at takashi.mochizuki@wsj.com

Access Investor Kit for "Apple, Inc."

Visit

http://www.companyspotlight.com/partner?cp_code=P479&isin=US0378331005

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

October 26, 2015 06:15 ET (10:15 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

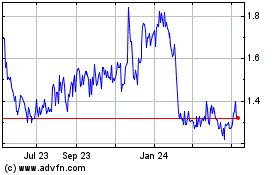

Sharp (PK) (USOTC:SHCAY)

Historical Stock Chart

From Jun 2024 to Jul 2024

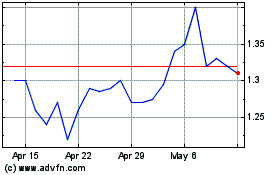

Sharp (PK) (USOTC:SHCAY)

Historical Stock Chart

From Jul 2023 to Jul 2024