Rolls-Royce Plans Simpler Staff Structure Amid Streamlining -- Earnings Review

March 07 2018 - 6:19AM

Dow Jones News

By Oliver Griffin

Engineering company Rolls-Royce Holdings PLC (RR.LN) reported

full-year results on Wednesday. Here's how they came in:

UNDERLYING PRETAX PROFIT: Rolls-Royce reported underlying pretax

profit--a closely watch figure that strips out one-time items and

currency fluctuations--of 1.07 billion pounds ($1.48 billion), a

31% increase on the previous year that also beat expectations. A

consensus estimate from 14 analysts had forecast underlying pretax

profit of GBP869 million, according to FactSet.

PRETAX PROFIT: Rolls-Royce smashed analysts' expectations,

swinging to a pretax profit of GBP4.9 billion from a pretax loss of

GBP4.64 billion in 2016. A consensus estimate from four analysts

had forecast pretax profit of GBP933 million.

WHAT WE WATCHED:

FURTHER STREAMLINING: Financial services company Hargreaves

Lansdown expected news on further efforts to restructure the

business, and weren't disappointed. Rolls-Royce said it is

proposing a simplified staff structure with fewer layers and

greater spans of control, but stressed that it doesn't have any

figures on expected job losses at present.

ENGINE PROBLEMS: Rolls-Royce said that cash costs associated

with component flaws on its Trent 1000 and Trent 900 engines are

expected to double in 2018, compared with an impact of GBP170

million in 2017. The company said it will take until 2022 for the

Trent 1000 and Trent 900 engines to be fully upgraded with more

durable components.

Write to Oliver Griffin at oliver.griffin@dowjones.com

(END) Dow Jones Newswires

March 07, 2018 06:04 ET (11:04 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

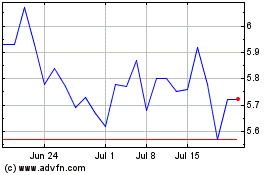

Rolls Royce (PK) (USOTC:RYCEY)

Historical Stock Chart

From Jun 2024 to Jul 2024

Rolls Royce (PK) (USOTC:RYCEY)

Historical Stock Chart

From Jul 2023 to Jul 2024