Emirates Airline Chief Concerned About Rolls-Royce Engine For Airbus A380

November 18 2016 - 8:11AM

Dow Jones News

By Robert Wall

LONDON--Emirates Airline president Tim Clark has expressed

concern about engines made by Rolls-Royce Holdings PLC used to

power the Airbus Group SE A380 super jumbo.

There are "technical issues" with the so-called Trent 900

engine, Mr. Clark told reporters Friday in Berlin, without

specifying the nature of his concerns. Emirates is the biggest A380

customer and the largest international airline by traffic.

Emirates Airline last year signed a $9.2 billion deal with

Rolls-Royce to power 50 A380s planes. The landmark deal was unusual

because the Dubai-based carrier took the unusual step of switching

engine suppliers. It previously bought A380 engines from a joint

venture of General Electric Co. and Pratt & Whitney, the engine

arm of United Technologies Corp.

Mr. Clark said the airline still hoped to receive the first of

its Rolls-Royce-powered A380 double-decker planes on Dec. 2,

according to reports confirmed by a spokesman. The airline

executive said the engines should be delivered as specified.

Rolls-Royce said it was working with the carrier and Airbus to

meet the planned entry into service of the planes in Emirates

Airline's fleet.

A spokesman for Airbus Friday said: "We are working with our

customers, supporting their delivery stream."

The issue with the A380 engine are the latest in a number of

setback suffered by Rolls-Royce. Problems with another of its

widebody engines this year forced ANA Holdings Inc.'s All Nippon

Airways Co. to ground some of its Boeing Co. 787 Dreamliner

long-range planes because a component didn't last as long as

expected.

Rolls-Royce previously had problems with the Dreamliner engine

meeting performance promises. Its A380 engine also required

redesign after one of the powerplants exploded on a Qantas Airways

Ltd. plane in 2010. The plane landed safely, though it sustained

extensive damage.

Widebody engines are critical for Rolls-Royce, which has

retreated from supplying engines for more commonly used narrowbody

planes, such as the Airbus A320. Rolls-Royce sales of engines to

power business jet aircraft are also under pressure, management has

said.

Eric Schulz, president of Rolls-Royce's civil aerospace

business, warned investors this week of market uncertainty. Order

intake this year is lower than deliveries for the first time for

many years, he said. Order cancellations were low and the company

was insulated by a huge backlog of engines already ordered that

still need to be built, he said.

Earnings at Rolls-Royce, which is no longer affiliated with the

luxury car maker, have been under pressure also from low demand for

its marine engines. Sales and profit are set to decline this year.

Management said this week that new accounting standards would

further depress reported profit beyond 2020.

Write to Robert Wall at robert.wall@wsj.com

(END) Dow Jones Newswires

November 18, 2016 07:56 ET (12:56 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

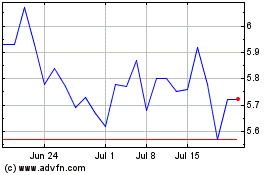

Rolls Royce (PK) (USOTC:RYCEY)

Historical Stock Chart

From Jun 2024 to Jul 2024

Rolls Royce (PK) (USOTC:RYCEY)

Historical Stock Chart

From Jul 2023 to Jul 2024