Companies Scramble to Assess Vote's Impact

June 24 2016 - 7:00AM

Dow Jones News

LONDON—Executives from Europe Inc. woke up Friday facing a new

world.

Britons' vote to leave the European Union sent executives

scrambling to assess the short- and long-term impact, as they

watched the pound tumble and their own shares plunge. A few

multinationals, including aircraft maker Airbus Group SE, which

makes the wings for its jets in Britain, bluntly threatened to

reassess their U.K. businesses.

"This is a lose-lose ‎result for both, Britain and

Europe," said Airbus Chief Executive Tom Enders in a statement. The

company's shares fell almost 10% in early trading. He called on

politicians to proceed with the "divorce" in a way to minimize

economic damage and said the plane maker would review its U.K.

investment strategy, "like everybody else will."

BMW AG, the Germany luxury car maker, said Friday there would be

no immediate changes at its Rolls-Royce and Mini car plants in the

U.K., but it said it understood "relevant conditions for supplying

the European market will have to be renegotiated." Investors sent

BMW shares down more than 8% early in the day.

Other executives reacted with less measure. "It's like a wake,"

said Chris Hirst, chief of advertising firm Havas SA's

‎European and U.K. unit. He was up all night in London

commenting on the vote for TV. "Everyone's trying to stay

professional, but there's shock, amazement, disbelief," he said.

Havas shares were down about 9% early Friday.

Most major companies based in Britain, and many in Europe and as

far away as Asia and the U.S., had warned a British exit from the

bloc would sow widespread uncertainty that would hurt profits and

endanger jobs: Britain might be forced to renegotiate trade pacts,

country-by-country, to maintain current export and import tariffs,

they had warned. The free flow of labor between the U.K. and the EU

could ebb. If the vote causes long-term market turmoil, economic

growth—and company profits—could take a hit for years to come.

Many small British business owners, meanwhile, advocated

leaving, saying they'd be better off unbridled from EU regulations.

William Hynett, chief executive of plane maker Britten-Norman used

one of the company's planes to fly a banner across the U.K. urging

voters to "VoteLeave." On Friday, he said he was "extremely happy"

with the outcome.

The vote would spur some near-term economic pain, but he said he

was confident in the long-term benefits of breaking away from EU

regulations that he considers burdensome for a small business.

Rachel Meadows, proprietor of Katie's Garden, a tea room in

downtown Sunderland, a northeast city that reported a

better-than-expected turnout for leave voters, underscores the

divide. She voted to exit. But her friends who work at a local

Nissan Motor Co. factory were worried that a leave vote could

threaten their jobs, she said.

"They think it will be terrible," she said. Nissan declined to

comment.

In the short term, sterling's volatility is the biggest risk for

many companies, big and small. Pierre-Emmanuel Taittinger, chairman

of his family's Reims, France-based champagne producer, rose at

dawn for the final results. With sterling's steep fall Friday, his

wine is suddenly more expensive for British buyers, his biggest

market. Mr. Taittinger said he would give rebates to his British

distributor at the end of the year to compensate.

"I've already called him and told him nothing would change

between us," said Mr. Taittinger.

PSA Peugeot Citroen is studying different pricing scenarios for

its models "to quickly react to the market," the company said

Friday. Peugeot sold more than 85,000 vehicles under all of its

brands in the U.K. in the first five months of 2016, about 13% of

its total sales in Western Europe in that period, according to

figures from the U.K. and European automobile manufacturer trade

groups. Peugeot could decide to boost prices in the U.K. to account

for the weaker British pound, or take a loss on selling some

vehicles in order to protect market share.

Peugeot declined to give figures on what the U.K.'s departure

could cost it. "It is too soon to measure the real impact," the

company said in a statement. It said that Peugeot "has demonstrated

its know-how in successfully managing its business in the context

of highly volatile currencies, such as Argentina." Its shares were

down 13% early in Europe.

Sam Schechner and William Boston contributed to this

article.

(END) Dow Jones Newswires

June 24, 2016 06:45 ET (10:45 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

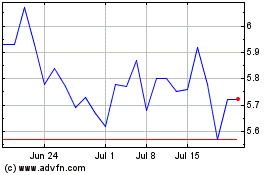

Rolls Royce (PK) (USOTC:RYCEY)

Historical Stock Chart

From Jun 2024 to Jul 2024

Rolls Royce (PK) (USOTC:RYCEY)

Historical Stock Chart

From Jul 2023 to Jul 2024