Rolls-Royce Shakes Up Management to Boost Growth -- Update

December 16 2015 - 4:20AM

Dow Jones News

By Ian Walker and Robert Wall

LONDON-- Rolls-Royce Holdings PLC Chief Executive Warren East on

Wednesday unveiled a top-level management overhaul that undoes many

of the changes implemented in recent years at the British engine

maker that have failed to deliver the intended turn around.

Mr. East, already saddled with two profit warnings in less than

six months in the job, on Wednesday announced that two of the

company's top executives would exit the company. The existing

division structure would be scrapped from next year for one the new

CEO executive promises will allow faster decision making.

Tony Wood, the president of the aerospace division that delivers

the bulk of the business's profit, would exit the company. Lawrie

Haynes, currently president of its land and sea business, will

retire. Both will remain with the company into 2016 to assist with

its transition to the new structure, it said.

Rolls-Royce has been reeling from financial problems amid

weakness in core markets where the company failed to adapt rapidly

enough. Demand for some of its most profitable aircraft engines has

dried up faster than expected, and sales of turbines for ships and

power stations have fallen sharply.

Shares in Rolls-Royce have dropped 35% this year and the company

warned it may cut its dividend.

Mr. East last month signaled a new management structure would be

put in place before the year-end as he warned that turning around

the company would take time.

"The changes we are announcing today are the first important

steps in driving operational excellence and returning Rolls-Royce

to its long-term trend of profitable growth," Mr. East said.

Rolls-Royce faces investor pressure to act. U.S. activist

investor ValueAct Capital Management LP has become its largest

shareholder and is seeking a board seat.

Neil Woodford, a highly regarded British investment fund

manager, who has held Rolls-Royce stock for almost a decade, said

his CF Woodford Equity Income Fund and the Woodford Patient Capital

Trust fund have sold their Rolls-Royce shares. He cited a lack of

confidence in Rolls-Royce's near-term prospects for the

decision.

The move announced Wednesday reverses management changes

implemented by Mr. East's predecessor aimed at boosting efficiency.

It put one executive in charge for all aerospace programs and

another for its land and sea activities.

Under the new management structure that is due to take effect at

the start of 2016, London-based Rolls-Royce, which makes aircraft

engines for Boeing Co.and Airbus Group SE widebody jets, will

operate as five market-facing businesses, with the presidents of

Civil Aerospace, Defense Aerospace, Marine, Nuclear and Power

Systems all reporting directly to Mr. East.

Rolls-Royce said it would disclose costs from the restructuring

in February.

Robert Wall contributed to this article.

Write to Ian Walker at ian.walker@wsj.com

(END) Dow Jones Newswires

December 16, 2015 04:05 ET (09:05 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

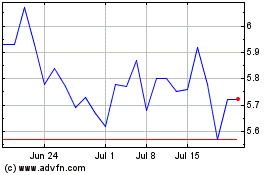

Rolls Royce (PK) (USOTC:RYCEY)

Historical Stock Chart

From Jun 2024 to Jul 2024

Rolls Royce (PK) (USOTC:RYCEY)

Historical Stock Chart

From Jul 2023 to Jul 2024