Rolls-Royce Eyes Extra Cost Savings in Latest Business Review

November 24 2015 - 2:58AM

Dow Jones News

By Ian Walker

LONDON--Rolls-Royce Holdings PLC (RR.LN) said Tuesday it expects

cost savings of 150 million pounds ($228.14 million) to GBP200

million a year from 2017, adding that the medium to long-term

outlook for the engine-making group remains strong.

The British company, which has announced a series of profit

warnings in the past year, said it is also planning to improve its

communication with investors and further simplify its business, the

result of the initial findings of Chief Executive Warren East's

operational review.

Rolls-Royce maintains a strong portfolio of products and

services providing highly differentiated, mission-critical, power

systems, Mr. East said.

"My review has underpinned my confidence about the opportunities

before us and I am convinced that our long-term outlook is

positive," Mr. East said.

"It has also highlighted a number of areas where we can simplify

the way we work, inject pace into our decision-making and

responsiveness, and improve our operational gearing and operational

effectiveness."

"This is fundamental to ensuring Rolls-Royce best positions

itself to compete for the long-term opportunities before us," he

added.

Rolls-Royce said earlier this month that its earnings outlook

for next year had worsened and that it may cut its dividend,

prompting the worst selloff in the company's stock in 15 years. The

company has struggled to deliver on cost-cutting efforts and been

hit by weakening demand for some civil aircraft engines, its

largest profit contributor.

-Write to Ian Walker at ian.walker@wsj.com; @IanWalk40289749

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

November 24, 2015 02:43 ET (07:43 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

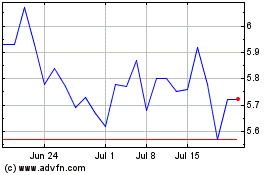

Rolls Royce (PK) (USOTC:RYCEY)

Historical Stock Chart

From Jun 2024 to Jul 2024

Rolls Royce (PK) (USOTC:RYCEY)

Historical Stock Chart

From Jul 2023 to Jul 2024