THE RESERVE PETROLEUM COMPANY

6801 Broadway

Ext.

Suite 300

Oklahoma City, Oklahoma 73116-9092

SECURTIES AND EXCHANGE COMMISSION

Washington DC

Dear Sir:

Forwarded herewith is the Annual Report to security holders for the year ended December 31, 2018, to be mailed to the security holders along with proxy material on or about April 18, 2019. No changes were made from 2017 in accounting principles or practices, or in the methods of application of those principles or practices.

|

|

Very truly yours,

|

|

|

|

|

|

THE RESERVE PETROLEUM COMPANY

|

|

|

|

|

Date: April 18, 2019

|

/s/ Lawrence R. Francis

|

|

|

|

|

|

Lawrence R. Francis

|

|

|

1

st

Vice President

|

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

|

|

☑

|

ANNUAL REPORT

PURSUANT TO

SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the Fiscal Year Ended December 31, 2018

|

|

☐

|

TRANSITION REPORT

PURSUANT TO

SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

Commission File Number 0-8157

THE RESERVE PETROLEUM COMPANY

(Exact Name of Registrant as Specified in Its Charter)

|

DELAWARE

|

73-0237060

|

|

(State or Other Jurisdiction of Incorporation or Organization)

|

(I.R.S. Employer Identification No.)

|

|

6801 Broadway

ext.

, Suite 300

Oklahoma City, Oklahoma

73116-90

37

(405) 848-7551

|

|

(Address and telephone number, including area code, of registrant’s principal executive offices)

|

Securities registered under Section 12(b) of the Exchange Act:

NONE

Securities registered under Section 12(g) of the Exchange Act:

|

COMMON STOCK ($0.50 PAR VALUE)

|

|

(Title of Class)

|

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ☐Yes ☑No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. ☐Yes ☑No

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☑Yes ☐No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ☑Yes ☐No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☑

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act:

|

Large accelerated filer ☐

|

Non-accelerated filer ☑

|

Accelerated filer ☐

|

|

|

|

|

|

|

Smaller reporting company ☑

|

Emerging growth company ☐

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ☐Yes ☑No

As of June 30, 2018 (the last business day of the registrant’s most recently completed second fiscal quarter), the aggregate market value of the voting and non-voting common stock of the registrant held by non-affiliates of the registrant was $20,938,864, as computed by reference to the last reported sale which was on June 29, 2018.

As of March 21, 2019, there were 156,962 shares of the registrant’s common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the definitive proxy statement (the “Proxy Statement”) relating to the registrant’s Annual Meeting of Shareholders to be held on May 21, 2019, which will be filed within 120 days of the end of the registrant’s year ended December 31, 2018, are incorporated by reference into Part III of this Form 10-K to the extent described therein.

TABLE OF CONTENTS

|

|

|

Page

|

|

Forward-Looking Statements

|

3

|

|

|

|

|

|

PART I

|

|

Item 1.

|

Business

|

3

|

|

Item 1A.

|

Risk Factors

|

5

|

|

Item 1B.

|

Unresolved Staff Comments

|

5

|

|

Item 2.

|

Properties

|

5

|

|

Item 3.

|

Legal Proceedings

|

6

|

|

Item 4.

|

Mine Safety Disclosures

|

7

|

|

|

|

|

|

PART II

|

|

Item 5.

|

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

7

|

|

Item 6.

|

Selected Financial Data

|

7

|

|

Item 7.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

7

|

|

Item 7A.

|

Quantitative and Qualitative Disclosures about Market Risk

|

15

|

|

Item 8.

|

Financial Statements and Supplementary Data

|

15

|

|

Item 9.

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

|

37

|

|

Item 9A.

|

Controls and Procedures

|

37

|

|

Item 9B.

|

Other Information

|

38

|

|

|

|

|

|

PART III

|

|

Item 10.

|

Directors, Executive Officers and Corporate Governance

|

38

|

|

Item 11.

|

Executive Compensation

|

38

|

|

Item 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

38

|

|

Item 13.

|

Certain Relationships and Related Transactions and Director Independence

|

38

|

|

Item 14.

|

Principal Accountant Fees and Services

|

38

|

|

|

|

|

|

PART IV

|

|

Item 15.

|

Exhibits and Financial Statement Schedules

|

39

|

|

Item 16.

|

Form 10-K Summary

|

39

|

Forward-Looking Statements

This Report on Form 10-K contains forward-looking statements. Actual events and/or future results of operations may differ materially from those contemplated by such forward-looking statements. See Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” for a summation of some of the risks and uncertainties inherent in forward-looking statements. Readers should consider the risks and uncertainties described in connection with any forward-looking statements that may be made in this Form 10-K. Readers should carefully review this Form 10-K in its entirety including, but not limited to, the Company's financial statements and the notes thereto and the risks and uncertainties described herein. Forward-looking statements contained in this Form 10-K speak only as of the date of this Form 10-K. The Company does not undertake to update its forward-looking statements.

PART I

Overview

The Reserve Petroleum Company (the “Company,” “we,” “our” or “us”) is engaged principally in managing its owned mineral properties and the exploration for and the development of oil and natural gas properties. Other business segments are not significant factors in our operations. The Company is a corporation organized under the laws of the State of Delaware in 1931.

Oil and Natural Gas Properties

For a summary of certain data relating to the Company’s oil and gas properties including production, undeveloped acreage, producing and dry wells drilled and recent activity, see Item 2, “Properties.” For a discussion and analysis of current and prior years’ revenue and related costs of oil and gas operations and a discussion of liquidity and capital resource requirements, see Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

Owned Mineral Property Management

The Company owns non-producing mineral interests in 256,270 gross acres equivalent to 88,246 net acres. These mineral interests are located in ten different states in the north and south central United States. A total of 81,113 (92%) net acres are located in the states of Arkansas, Kansas, Oklahoma, South Dakota, and Texas, the areas of concentration for the Company in our exploration and development programs.

The Company has several options relating to the exploration and/or development of our owned mineral interests. Management continually reviews various industry reports and other sources for activity (leasing, drilling, significant discoveries, etc.) in areas where the Company has mineral ownership. Based on our analysis of any activity and assessment of the potential risk relative to the particular area, management may negotiate a lease or farmout agreement and accept a royalty interest, or we may choose to participate as a working interest owner and pay our proportionate share of any exploration or development drilling costs.

A substantial amount of the Company’s oil and gas revenue has resulted from our owned mineral property management. In 2018, $3,149,054 (41%) of oil and gas sales was from royalty interests versus $1,737,841 (28%) in 2017. As a result of our mineral ownership, the Company had royalty interests in 23 gross (0.31 net) wells, which were drilled and completed as producing wells in 2018. This resulted in an average royalty interest of about 1.4% for these 23 new wells. The Company has very little control over the timing or extent of the operations conducted on our royalty interest properties. See the following paragraphs for a discussion of mineral interests in which the Company chooses to participate as a working interest owner.

Development Program

Development drilling by the Company is usually initiated in one of three ways. The Company may participate as a working interest owner with a third party operator in the development of non-producing mineral interests, which it owns; with a joint interest operator, we may participate in drilling additional wells on our producing leaseholds; or if our exploration program, discussed below, results in a successful exploratory well, we may participate in the drilling of additional wells on the exploratory prospect. In 2018, the Company participated in the drilling of 7 development wells with 5 wells (0.68 net) completed as producers and 2 wells in progress at year-end 2018.

Exploration Program

The Company’s exploration program is normally conducted by purchasing interests in prospects developed by independent third parties; participating in third party exploration of Company-owned non-producing minerals; developing our own exploratory prospects; or a combination of the above.

The Company normally acquires interests in exploratory prospects from someone in the industry with whom management has conducted business in the past and/or if management has confidence in the quality of the geological and geophysical information presented for evaluation to Company personnel. If evaluation indicates the prospect is within our risk limits, we may negotiate to acquire an interest in the prospect and participate in a non-operating capacity.

The Company develops exploratory drilling prospects by identification of an area of interest, development of geological and geophysical information and purchase of leaseholds in the area. The Company may then attempt to sell an interest in the prospect to one or more companies in the petroleum industry with one of the purchasing companies functioning as operator. In 2018, we participated in the drilling of 8 exploratory wells with 2 wells (0.18 net) completed as producers, 3 wells in progress at the end of 2018 and 3 wells (0.24 net) completed as dry holes.

For a summation of exploratory and development wells drilled in 2018 or planned for in 2019, see Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” subheading “Update of Oil and Gas Exploration and Development Activity from December 31, 2017.”

Customers

In 2018, the Company had two customers whose total purchases were greater than 10% of revenues from oil and gas sales. Redland Resources, LLC purchases were $1,481,719 or 19% of total oil and gas sales and Luff Exploration Company purchases were $889,496 or 12% of total oil and gas sales. The Company sells most of its oil and gas under short-term sales contracts that are based on the spot market price.

Competition

The oil and gas industry is highly competitive in all of its phases. There are numerous circumstances within the industry and related market place that are out of the Company’s control such as cost and availability of alternative fuels, the level of consumer demand, the extent of other domestic production of oil and gas, the price and extent of importation of foreign oil and gas, the cost of and proximity of pipelines and other transportation facilities, the cost and availability of drilling rigs, regulation by state and federal authorities, and the cost of complying with applicable environmental regulations.

The Company does not operate any of the wells in which we have an interest; rather, we partner with companies that have the resources, staff, and experience to operate wells both in the drilling and production phases. The Company uses its strong financial base and its mineral and leasehold acreage ownership, along with its own geologic and economic evaluations, to participate in drilling operations with these companies. This methodology allows us to participate in exploration and development activities we could not undertake on our own due to financial and personnel limits and allows us to maintain low overhead costs.

Regulation

The Company’s operations are affected in varying degrees by political developments and federal and state laws and regulations. Although released from federal price controls, interstate sales of natural gas are subject to regulation by the Federal Energy Regulatory Commission (FERC). Oil and gas operations are affected by environmental laws and other laws relating to the petroleum industry, and both are affected by constantly changing administrative regulations. Rates of production of oil and gas have, for many years, been subject to a variety of conservation laws and regulations, and the petroleum industry is frequently affected by changes in the federal tax laws.

Generally, the respective state regulatory agencies supervise various aspects of oil and gas operations within their states and the transportation of oil and gas sold intrastate.

Environmental Protection and Climate Change

The operation of the various producing properties, in which the Company has an interest, is subject to federal, state, and local provisions regulating discharge of materials into the environment, the storage of oil and gas products, and the contamination of subsurface formations. The Company’s lease operations and exploratory activity have been and will continue to be affected by existing regulations in future periods. However, the known effect to date has not been material as to capital expenditures, earnings, or industry competitive position. Environmental compliance expenditures produce no increase in productive capacity or revenue and require more of management’s time and attention at a cost which cannot be estimated with any assurance or certainty.

In 2009, the EPA officially published its findings that greenhouse gas emissions present an endangerment to human health and the environment. According to the EPA, these emissions are contributing to global warming and climate change. These findings allowed the EPA to adopt and implement regulations in recent years to restrict these emissions under existing provisions of the Federal Clean Air Act.

The Company may be, directly and indirectly, subject to the effects of climate change and may, directly or indirectly, be affected by government laws and regulations related to climate change. We cannot predict with any degree of certainty what effect, if any, climate change and government laws and regulations related to climate change will have on the Company and our business, whether directly or indirectly. While we believe that it is difficult to assess the timing and effect of climate change and pending legislation and regulation related to climate change on our business, we believe that those laws and regulations may affect, directly or indirectly, (i) the costs associated with drilling and production operations in which we participate; (ii) the demand for oil and natural gas; (iii) insurance premiums, deductibles and the availability of coverage; and (iv) the cost of utilities paid by the Company. In addition, climate change may increase the likelihood of property damage and the disruption of operations of wells in which we participate. As a result, our financial condition could be negatively impacted, but we are unable to determine at this time whether that impact would be material.

Othe

r

Business

See Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” subheading “Equity Method and Other Investments” and Item 8, Notes 2 and 7 to the accompanying financial statements for a discussion of other business including guarantees.

Employees

At December 31, 2018, the Company had nine employees, including officers. See the Proxy Statement for additional information. During 2018, all of our employees devoted a portion of their time to duties with affiliated companies, and we were reimbursed for the affiliates’ share of compensation directly from those companies. See Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” subheading “Certain Relationships and Related Transactions” and Item 8, Note 12 to the accompanying financial statements for additional information.

Not applicable.

|

|

ITEM 1B.

|

UNRESOLVED

STAFF

COMMENTS

|

Not applicable.

The Company’s principal properties are oil and natural gas properties. We have interests in approximately 900 producing properties with 40% of them being working interest properties and the remaining 60% being royalty interest properties. About 81% of all properties are located in Oklahoma and Texas and account for approximately 74% of our annual oil and gas sales. About 15% of the properties are located in Arkansas, Kansas and South Dakota and account for approximately 24% of our annual oil and gas sales. The remaining 4% of these properties are located in Colorado, Montana, Nebraska and New Mexico and account for about 2% of our annual oil and gas sales. No individual property provides more than 10% of our annual oil and gas sales. See discussion of revenues from Robertson County, Texas, royalty interest properties in Item 7, “Operating Revenues” for additional information about significant properties.

OIL AND NATURAL GAS OPERATIONS

Oil and Gas Reserves

Reference is made to the Unaudited Supplemental Financial Information beginning on Page 32 for working interest reserve quantity information.

Since January 1, 2018, the Company has not filed any reports with any federal authority or agency, which included estimates of total proved net oil or gas reserves, except for its 2017 Annual Report on Form 10-K and federal income tax return for the year ended December 31, 2017. Those reserve estimates were identical.

Production

The average sales price of oil and gas production for the Company’s royalty and working interests, as well as the average working interest production cost (lifting cost) per equivalent thousand cubic feet (MCF) of gas, are presented in the table below for the years ended December 31, 2018, 2017 and 2016. Equivalent MCF was calculated using approximate relative energy content.

|

|

|

Royalties

|

|

|

Working Interests

|

|

|

|

|

Sales Price

|

|

|

Sales Price

|

|

|

Average Production

|

|

|

|

|

Oil

|

|

|

Gas

|

|

|

Oil

|

|

|

Gas

|

|

|

Cost per

|

|

|

|

|

Per Bbl

|

|

|

Per MCF

|

|

|

Per Bbl

|

|

|

Per MCF

|

|

|

Equivalent MCF

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2018

|

|

$

|

62.48

|

|

|

$

|

2.93

|

|

|

$

|

60.87

|

|

|

$

|

2.79

|

|

|

$

|

2.72

|

|

|

2017

|

|

$

|

47.95

|

|

|

$

|

2.91

|

|

|

$

|

46.00

|

|

|

$

|

2.91

|

|

|

$

|

2.25

|

|

|

2016

|

|

$

|

38.53

|

|

|

$

|

2.21

|

|

|

$

|

36.49

|

|

|

$

|

2.16

|

|

|

$

|

1.85

|

|

At December 31, 2018, the Company had working interests in 183 gross (26.7 net) wells producing primarily gas and 241 gross (23.86 net) wells producing primarily oil. These interests were in 66,160 gross (7,892 net) producing acres. These wells include 49 gross (1.53 net) wells associated with secondary recovery projects.

Undeveloped Acreage

The Company’s undeveloped acreage consists of non-producing mineral interests and undeveloped leaseholds. The following table summarizes the Company’s gross and net acres in each at December 31, 2018.

|

|

|

Acreage

|

|

|

|

|

Gross

|

|

|

Net

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-producing Mineral Interests

|

|

|

256,270

|

|

|

|

88,246

|

|

|

Undeveloped Leaseholds

|

|

|

77,559

|

|

|

|

13,655

|

|

Net Productive and Dry Wells Drilled

The following table summarizes the net wells drilled, in which the Company had a working interest for the years ended December 31, 2016 and thereafter, as to net productive and dry exploratory wells drilled and net productive and dry development wells drilled. Net exploratory and development totals for 2018 include the 3 exploratory wells still drilling at the end of 2017. As indicated in the “Exploration Program” on Page 4, 3 exploratory wells were still in progress at the time of this Form 10-K.

|

|

|

Number of Net Working Interest Wells Drilled

|

|

|

|

|

Exploratory

|

|

|

Development

|

|

|

|

|

Productive

|

|

|

Dry

|

|

|

Productive

|

|

|

Dry

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2018

|

|

|

0.18

|

|

|

|

0.24

|

|

|

|

0.68

|

|

|

|

---

|

|

|

2017

|

|

|

0.50

|

|

|

|

0.95

|

|

|

|

0.35

|

|

|

|

---

|

|

|

2016

|

|

|

0.16

|

|

|

|

1.41

|

|

|

|

0.47

|

|

|

|

---

|

|

Recent Activities

See Item 7, under the subheading “Update of Oil and Gas Exploration and Development Activity from December 31, 2017” for a summary of recent activities related to oil and natural gas operations.

|

|

Item 3.

|

Legal Proceedings

|

There are no material legal proceedings pending affecting the Company or any of its properties.

|

|

Item 4.

|

MINE SAFETY DISCLOSURES

|

Not applicable.

PART II

|

|

Ite

m 5.

|

Market for REGISTRANT’S Common Equity, Related Stockholder

M

atters AND ISSUER PURCHASES OF EQUITY SECURITIES

|

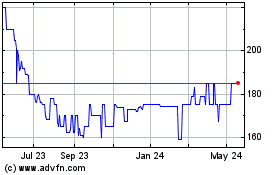

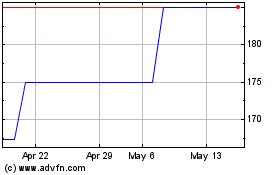

The Company’s stock is dually traded in the Pink Sheet Electronic Quotation Service and the OTC Bulletin Board under the symbol “RSRV.” The following high and low bid information was quoted on the Pink Sheets OTC Market Report. Prices reflect inter-dealer prices without retail markup, markdown, or commission and may not reflect actual transactions.

|

|

|

Quarterly Ranges

|

|

|

Quarter Ending

|

|

High Bid

|

|

|

Low Bid

|

|

|

|

|

|

|

|

|

|

|

|

|

03/31/17

|

|

$

|

245

|

|

|

$

|

197

|

|

|

06/30/17

|

|

$

|

246

|

|

|

$

|

211

|

|

|

09/30/17

|

|

$

|

230

|

|

|

$

|

205

|

|

|

12/31/17

|

|

$

|

226

|

|

|

$

|

195

|

|

|

03/31/18

|

|

$

|

220

|

|

|

$

|

201

|

|

|

06/30/18

|

|

$

|

212

|

|

|

$

|

182

|

|

|

09/30/18

|

|

$

|

207

|

|

|

$

|

180

|

|

|

12/31/18

|

|

$

|

212

|

|

|

$

|

178

|

|

There was limited public trading in the Company’s common stock in 2018 and 2017. There were 5 brokered trades appearing in the Company’s transfer ledger for 2018 and 2017.

At March 21, 2019, the Company had approximately 1,841 record holders of its common stock. The Company paid dividends on its common stock in the amount of $5.00 per share in the second quarter of 2018 and in the second quarter of 2017. See the “Financing Activities” section of Item 7 below for more information about dividends paid. Management will review the amount of the annual dividend to be paid in 2019, if any, with the Board of Directors for its approval.

ISSUER PURCHASES OF EQUITY SECURITIES

|

Period

|

|

Total

Number of

Shares

Purchased

|

|

|

Average

Price Paid

Per Share

|

|

|

Total Number of Shares

Purchased as Part of

Publicly Announced

Plans or Programs

1

|

|

|

Approximate Dollar

Value of Shares that

May Yet Be Purchased

Under the Plans or

Programs

1

|

|

|

October 1 to October 31, 2018

|

|

|

9

|

|

|

$

|

150

|

|

|

|

---

|

|

|

|

---

|

|

|

November 1 to November 30, 2018

|

|

|

6

|

|

|

$

|

150

|

|

|

|

---

|

|

|

|

---

|

|

|

December 1 to December 31, 2018

|

|

|

25

|

|

|

$

|

150

|

|

|

|

---

|

|

|

|

---

|

|

|

Total

|

|

|

40

|

|

|

$

|

150

|

|

|

|

---

|

|

|

|

---

|

|

1

The Company has no formal equity security purchase program or plan. The Company acts as its own transfer agent, and most purchases result from requests made by shareholders receiving small, odd lot share quantities as the result of probate transfers.

|

|

I

TEM

6.

|

SELECTED FINANCIAL DATA

|

Not applicable.

|

|

ITEM

7

.

|

MANAGEMENT’S DISCUSSION AND

ANALYSIS OF

FINANCIAL CONDITION AND

RESULTS OF OPERATIONS

|

Please refer to the financial statements and related notes in Item 8 of this Form 10-K to supplement this discussion and analysis.

Forward-Looking Statements

In addition to historical information, from time to time the Company may publish forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements provide the reader with management’s current expectations of future events. They include statements relating to such matters as anticipated financial performance, business prospects such as drilling of oil and gas wells, technological development, and similar matters.

Although management believes that the expectations reflected in forward-looking statements are based on reasonable assumptions, a variety of factors could cause the Company’s actual results and experience to differ materially from the anticipated results or other expectations expressed in the Company’s forward-looking statements. The risks and uncertainties that may affect the operations, performance, development, and results of our business include, but are not limited to, the following:

|

|

●

|

The Company’s future operating results will depend upon management’s ability to employ and retain quality employees, generate revenues, and control expenses. Any decline in operating revenues, without corresponding reduction in operating expenses, could have a material adverse effect on our business, results of operations, and financial condition.

|

|

|

●

|

The Company has no significant long-term sales contracts for either oil or gas. For the most part, the price we receive for our product is based upon the spot market price, which in the past has experienced significant fluctuations. Management anticipates price fluctuations will continue in the future, making any attempt at estimating future prices subject to significant uncertainty.

|

|

|

●

|

Exploration costs have been a significant component of the Company’s capital expenditures in the past and are expected to remain so in the near term. Under the successful efforts method of accounting for oil and gas properties which the Company uses, these costs are capitalized if drilling is successful or charged to operating costs and expenses if unsuccessful. Estimating the amount of future costs which may relate to successful or unsuccessful drilling is extremely imprecise at best.

|

The Company does not undertake any obligation to publicly revise forward-looking statements to reflect events or circumstances that arise after the filing date of this Form 10-K. Readers should carefully review the information described in other documents the Company files from time to time with the Securities and Exchange Commission, including the Quarterly Reports on Form 10-Q to be filed by the Company in 2019 and any Current Reports on Form 8-K filed by the Company.

Critical Accounting Estimates

|

|

●

|

Estimates of future revenues from oil and gas sales are derived from a combination of factors which are subject to significant fluctuation over any given period of time. Reserve estimates, by their nature, are subject to revision in the short-term. The evaluating engineer considers production performance data, reservoir data, and geological data available to the Company, as well as makes estimates of production costs, sale prices, and the time period the property can be produced at a profit. A change in any of the above factors can significantly change the timing and amount of net revenues from a property. The Company’s producing properties are composed of many small working interest and royalty interest properties. As a non-operating owner, we have limited access to the underlying data from which working interest reserve estimates are calculated, and estimates of royalty interest reserves are not made because the information required for the estimation is not available to the Company. While reserve estimates are not accounting estimates, they are the basis for impairment, depreciation, depletion, and amortization described below. Additionally, the estimated economic life for each producing property from the reserve estimates is used in the calculation of asset retirement obligations.

|

|

|

●

|

The provisions for depreciation, depletion, and amortization of oil and gas properties all constitute critical accounting estimates. Non-producing leaseholds are amortized over the life of the leases using a straight line method; however, when leases are impaired or condemned, an appropriate adjustment to the provision is made at that time.

|

|

|

●

|

The provision for impairment of long-lived assets is determined by review of the estimated future cash flows from the individual properties. A significant, unforeseen downward adjustment in future prices and/or potential reserves could result in a material change in estimated long-lived assets impairment.

|

|

|

●

|

Depletion and depreciation of oil and gas properties are computed using the units-of-production method. A significant, unanticipated change in volume of production or estimated reserves would result in a material, unexpected change in the estimated depletion and depreciation provisions.

|

|

|

●

|

The Company has significant obligations to remove tangible equipment and facilities associated with oil and gas wells and to restore land at the end of oil and gas production operations. Removal and restoration obligations are most often associated with plugging and abandoning wells. Estimating the future restoration and removal costs is difficult and requires estimates and judgments because most of the removal obligations will take effect in the future. Additionally, these operations are subject to private contracts and government regulations that often have vague descriptions of what is required. Asset removal technologies and costs are constantly changing as are regulatory, political, environmental, and safety considerations. Inherent in the present value calculations are numerous assumptions and judgments including the ultimate removal cost amounts, inflation factors, and discount rate.

|

|

|

●

|

The estimation of the amounts of income tax to be recorded by the Company involves interpretation of complex tax laws and regulations as well as the completion of complex calculations, including the determination of the Company’s percentage depletion deduction, if any. To calculate the exact excess percentage depletion allowance, a well-by-well calculation is, and can only be, performed at the end of each year. During interim periods, a high-level estimate is made taking into account historical data and current pricing. Although our management believes its income tax accruals are adequate, differences may occur in the future depending on the resolution of pending and new tax matters.

|

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

The Company is affiliated by common management and ownership with Mesquite Minerals, Inc. (Mesquite), Mid-American Oil Company (Mid-American) and Lochbuie Limited Liability Company (LLTD). The Company also owns interests in certain producing and non-producing oil and gas properties as tenants in common with Mesquite, Mid-American and LLTD.

Jerry Crow, a director of the Company, is a director of Mesquite and Mid-American. Kyle McLain and Cameron McLain are brothers and directors of the Company. Kyle McLain and Cameron McLain each own more than 7% of the common stock of the Company and are officers. Kyle McLain and Cameron McLain are officers and directors of Mesquite and Mid-American. Kyle McLain and Cameron McLain each own an approximate 11% interest in LLTD.

The above named officers, directors, and employees as a group beneficially own approximately 20% of the common stock of the Company, approximately 13% of the common stock of Mesquite, and approximately 10% of the common stock of Mid-American. Each of these three corporations have only one class of stock outstanding. See Item 8, Note 12 to the accompanying financial statements for additional disclosures regarding these relationships.

EQUITY

METHOD

AND OTHER

INVESTMENT

S

For equity method investments, the Company records the original investment in the entities as an asset and adjusts the asset balance for the Company’s share of any income or loss, as well as any additional contributions to or distributions from the entities. The Company does not have actual or effective control of the entities. The management of the entities could, at any time, make decisions in their own best interests that could affect the Company’s net income or the value of the Company’s investments. These investments include Broadway Sixty-Eight, Ltd. (the “Partnership”), Grand Woods Development, LLC (the “LLC”), and QSN Office Park (“QSN”).

Other Investments are mostly investments in limited liability companies (“LLC’s”) with smaller ownership interests that do not allow the Company to significantly influence the operations or management of the LLC’s. These investments are recorded at cost, less any impairment, plus or minus changes resulting from observable price changes in orderly transactions for the identical or a similar investment of the same issuer. Cash distributions from the investment are recognized as income when received. These investments include OKC Industrial Properties (“OKC”), Bailey Hilltop Pipeline (“Bailey”), Cloudburst Solutions (“Solutions”), and Ocean’s NG (“Ocean”).

See Item 8, Note 7 to the accompanying financial statements for related disclosures and additional information regarding all investments.

LIQUIDITY AND CAPITAL RESOURCES

To supplement the following discussion, please refer to the balance sheets and the statements of cash flows included in this Form 10-K.

In 2018, as in prior years, the Company funded its business activity through the use of internal sources of capital. For the most part, these internal sources are cash flows from operations, cash, cash equivalents and available-for-sale debt securities. When cash flows from operating activities are in excess of those needed for other business activities, the remaining balance is used to increase cash, cash equivalents and/or available-for-sale debt securities. When cash flows from operating activities are not adequate to fund other business activities, withdrawals are made from cash, cash equivalents and/or available-for-sale debt securities. Cash equivalents are highly liquid debt instruments purchased with a maturity of three months or less. All of the available-for-sale debt securities are U.S. Treasury Bills.

In 2018, net cash provided by operating activities was $4,846,100. Sales (including lease bonuses), net of production costs and general and administrative costs were $4,286,085, which accounted for 88% of net cash provided by operations. The remaining components provided 12% of cash flow. In 2018, net cash applied to investing activities was $2,161,108. In 2018, dividend payments and treasury stock purchases totaled $1,024,303 and accounted for all of the cash applied to financing activities.

Other than cash and cash equivalents, other significant changes in working capital include the following:

Equity securities decreased $105,878 (19%) to $454,058 in 2018 from $559,936 in 2017. The net decrease is due to $181,818 in unrealized losses, which represent the change in the fair value of the securities from their original cost, plus $75,940 of 2018 income.

Refundable income taxes decreased $310,443 (95%) to $16,387 in 2018 from $326,830 in 2017.

In 2018, the Company added a note receivable in the amount of $43,158 to the LLC.

Accounts payable increased $83,380 (35%) to $318,387 in 2018 from $235,007 in 2017. This increase was primarily due to increased drilling activity.

Discussion of Selected Material Line Items in Cash Flows.

The following is a discussion of material changes in cash flow by activity between the years ended December 31, 2018 and 2017. Also, see the discussion of changes in operating results under “Results of Operations” below in this Item 7.

Operating Activities

As noted above, net cash flows provided by operating activities in 2018 were $4,846,100, which, when compared to the $2,771,452 provided in 2017, represents a net increase of $2,074,648. The increase was mostly due to an increase in lease bonus cash flows of $377,902 and an increase in oil and gas sales of $1,760,668. Additional discussion of the significant items follows.

The $1,760,668 (29%) increase in cash received from oil and gas sales to $7,790,371 in 2018 from $6,029,703 in 2017 was the result of an increase in oil and gas sales volumes and an increase in oil sales price, offset by a decrease in gas sales price. See “Results of Operations” below for a price/volume analysis and the related discussion of oil and gas sales.

Cash received for lease bonuses increased $377,902 (205%) to $562,184 in 2018 from $184,282 in 2017.

The 2018 cash distribution of $24,750 from our equity method investment in Broadway Sixty-Eight, Ltd. was primarily for our share of operating profits versus $49,500 in 2017. See Item 8, Note 7 to the accompanying financial statements for additional information regarding Broadway Sixty-Eight, Ltd.

Investing Activities

Net cash applied to investing activities decreased $3,041,054 (58%) to $2,161,108 in 2018 from $5,202,162 in 2017. This decrease was primarily due to increases in the maturity of available-for-sale debt securities of $2,944,915 and property dispositions of $436,460, offset by a decrease in cash received from other investments of $428,500. See “Equity Method and Other Investments” discussion on page 9 for additional information regarding the investments purchased in 2018 and 2017.

Financing Activities

Cash applied to financing activities increased $150,969 (17%) to $1,024,303 in 2018 from $873,334 in 2017. Cash applied to financing activities consist of cash dividends on common stock and cash used for the purchase of treasury stock. In 2018, cash dividends paid on common stock amounted to $959,499 as compared to $837,505 in 2017. Dividends of $5.00 per share were paid in 2018 and 2017. Cash applied to purchase treasury stock increased $28,975 to $64,804 in 2018 from $35,829 in 2017.

Forward-Looking Summary

The Company’s latest estimate of business to be done beyond 2018 indicates the projected activity can be funded from cash flow from operations and other internal sources, including net working capital. The Company is engaged in exploratory drilling. If this drilling is successful, substantial development drilling may result. Also, should other exploration projects which fit the Company’s risk parameters become available or other investment opportunities become known, capital requirements may be more than the Company has available. If so, the Company could require external sources of financing.

RESULTS OF OPERATIONS

As disclosed in the statements of income in Item 8 of this Form 10-K, in 2018 the Company had net income of $2,313,692 as compared to net income of $685,687 in 2017. Net income per share, basic and diluted, was $14.69 in 2018, an increase of $10.34 per share from $4.35 in 2017. Material line item changes in the statements of income will be discussed in the following paragraphs.

Operating Revenues

Operating revenues increased $2,017,908 to $8,327,498 in 2018 from $6,309,590 in 2017. Oil and gas sales increased $1,640,006 (27%) to $7,765,314 in 2018 from $6,125,308 in 2017. Lease bonuses and other revenues increased $377,902 (205%) to $562,184 in 2018 from $184,282 in 2017. The increase in oil and gas sales is discussed in the following paragraphs.

The $1,640,006 increase in oil and gas sales was the result of a $41,339 increase in gas sales, a $1,537,330 increase in oil sales and a $61,337 increase in miscellaneous oil and gas product sales. The following price and volume analysis is presented to explain the changes in oil and gas sales from 2017 to 2018. Miscellaneous oil and gas product sales of $267,929 in 2018 and $206,592 in 2017 are not included in the analysis.

|

|

|

|

|

|

|

Variance

|

|

|

|

|

|

|

Production

|

|

2018

|

|

|

Price

|

|

|

Volume

|

|

|

2017

|

|

|

Gas –

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MCF (000 omitted)

|

|

|

837

|

|

|

|

|

|

|

|

31

|

|

|

|

806

|

|

|

$ (000 omitted)

|

|

$

|

2,388

|

|

|

$

|

(47)

|

|

|

$

|

89

|

|

|

$

|

2,346

|

|

|

Unit Price

|

|

$

|

2.85

|

|

|

$

|

(.06)

|

|

|

|

|

|

|

$

|

2.91

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Oil –

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Bbls (000 omitted)

|

|

|

83

|

|

|

|

|

|

|

|

6

|

|

|

|

77

|

|

|

$ (000 omitted)

|

|

$

|

5,110

|

|

|

$

|

1,251

|

|

|

$

|

287

|

|

|

$

|

3,572

|

|

|

Unit Price

|

|

$

|

61.45

|

|

|

$

|

15.03

|

|

|

|

|

|

|

$

|

46.42

|

|

The $41,339 (2%) increase in natural gas sales to $2,387,611 in 2018 from $2,346,272 in 2017 was the result of an increase in gas sales volumes offset by a decrease in the average price received per thousand cubic feet (MCF). The average price per MCF of natural gas sales decreased $0.06 per MCF to $2.85 per MCF in 2018 from $2.91 per MCF in 2017, resulting in a negative gas price variance of $47,016. A positive volume variance of $88,355 was the result of an increase in natural gas volumes sold of 30,363 MCF to 836,938 MCF in 2018 from 806,575 MCF in 2017. The increase in the volume of gas production was the net result of new 2018 production of about 152,000 MCF, offset by a decline of about 122,000 MCF in production from previous wells. As disclosed in Supplemental Schedule 1 of the Unaudited Supplemental Financial Information included in Item 8 below, working interests in natural gas extensions and discoveries were not adequate to replace working interest reserves produced in 2018 or 2017.

The gas production for 2018 and 2017 includes production from about 100 royalty interest properties drilled by various operators in Robertson County, Texas. These properties accounted for approximately 277,000 MCF and $802,000 of the 2018 gas sales and approximately 187,000 MCF and $544,000 of the 2017 gas sales. These properties accounted for about 35% of the Company’s gas revenues in 2018 versus 23% in 2017. The Company has no control over the timing of future drilling on the acreage in which we hold mineral interests.

The $1,537,330 (43%) increase in crude oil sales to $5,109,773 in 2018 from $3,572,443 in 2017 was the result of increases in the average price per barrel (Bbl) and oil sales volumes. The average price received per Bbl of oil increased $15.03 to $61.45 in 2018 from $46.42 in 2017, resulting in a positive oil price variance of $1,250,183. An increase in oil sales volumes of 6,186

Bbls to 83,151 Bbls in 2018 from 76,965 Bbls in 2017 resulted in a positive volume variance of $287,146. The increase in the oil volume production was the net result of new 2018 production of about 20,000 Bbls, offset by a 14,000 Bbl decline in production from previous wells. As disclosed in Supplemental Schedule 1 of the Unaudited Supplemental Financial Information included below in Item 8, working interests in oil extensions and discoveries were not adequate to replace working interest reserves produced in 2018 or 2017.

For both oil and gas sales, the price change was mostly the result of a change in the spot market prices upon which most of the Company’s oil and gas sales are based. These spot market prices have had significant fluctuations in the past and these fluctuations are expected to continue.

Operating Costs and Expenses

Operating costs and expenses decreased $457,750 (7%) to $6,370,156 in 2018 from $6,827,906 in 2017, primarily due to a decrease in exploration expense. The material components of operating costs and expenses are discussed below.

Production Costs.

Production costs increased $201,636 (9%) to $2,391,656 in 2018 from $2,190,020 in 2017. The increase was a result of a $104,875 (37%) increase in gross production tax to $390,563 in 2018 from $285,688 in 2017, and an increase in lease operating and other production costs of $96,762 (5%) to $2,001,093 in 2018 from $1,904,331 in 2017. Gross production taxes are state taxes, which are calculated as a percentage of gross proceeds from the sale of products from each producing oil and gas property, therefore, they fluctuate with the change in the dollar amount of revenues from oil and gas sales.

Exploration and Development Costs.

Under the successful efforts method of accounting used by the Company, geological and geophysical costs are expensed as incurred as are the costs of unsuccessful exploratory drilling. The costs of successful exploratory drilling and all development costs are capitalized. Total costs of exploration and development, excluding asset retirement obligations but inclusive of geological and geophysical costs, were $2,428,412 in 2018 and $2,251,662 in 2017. See Item 8, Note 8 to the accompanying financial statements for a breakdown of these costs. Exploration costs charged to operations were $195,111 in 2018 and $883,593 in 2017, inclusive of geological and geophysical costs of $162,514 in 2018 and $243,251 in 2017.

Update of Oil and Gas Exploration and Development Activity from December 31, 2017.

For the year ended December 31, 2018, the Company participated in the drilling of 8 gross exploratory working interest wells (including 3 in progress at the end of 2017) and 7 gross development working interest wells, with working interests ranging from a high of 18% to a low of 4.7%. Of the 8 exploratory wells, 2 were completed as producing wells, 3 as dry holes and 3 were in progress. Five (5) development wells were completed as producing wells and 2 were in progress at the end of 2018.

The following is a summary as of March 6, 2019, updating both exploration and development activity from December 31, 2017, for the period ended December 31, 2018.

The Company participated with 12% and 8% working interests in the drilling of two development wells on a Woods County, Oklahoma prospect. Both wells were completed as commercial oil and gas producers. Capitalized costs for the period were $135,623.

The Company participated with 12.1% and 9.5% working interests in the drilling of two development wells on a Woods County, Oklahoma prospect. One well has been completed and is awaiting pipeline connection and a completion is in progress on the other. Capitalized costs for the period were $105,615.

The Company participated with its 18% working interest in the drilling of a development well on a Barber County, Kansas prospect. The well was completed as a commercial oil and gas producer. Capitalized costs for the period were $70,875.

The Company participated with its 8.4% working interest in the drilling of an exploratory well on a Thomas County, Kansas prospect. The well was completed as a dry hole. No additional drilling is planned on the prospect. Dry hole costs for the period were $15,107 and an impairment expense of $19,258 was taken against the leasehold.

The Company participated with its 10.5% working interest in the drilling of an exploratory well on a Thomas County, Kansas prospect. The well was completed as a dry hole. No additional drilling is planned on the prospect. Dry hole costs for the period were $19,949 and an impairment expense of $684 was taken against the leasehold.

The Company participated with its 18% working interest in the drilling of two step-out wells (one a re-entry) on a Kiowa County, Kansas prospect. Both wells were completed as commercial oil and gas producers. Actual costs of $122,627 for the period were offset by prepaid costs from 2017 for a net capitalized amount of $0.

The Company participated with its 14% working interest in the drilling of two injection wells on a Hansford County, Texas waterflood unit. One well was completed and is injecting water and the other missed the reservoir and was plugged. There are three other injection wells and two producing wells in the unit. Actual costs of $268,250 for the period were offset by $103,936 of prepaid costs from 2017 for a net capitalized amount of $164,314.

The Company is participating with its 14% interest in the reworking of previously acquired 3-D seismic and in the acquisition of additional leasehold on a Creek County, Oklahoma prospect. The Company also participated in the deepening of an existing well on the prospect. The well has been completed and appears to be a marginal oil producer. Leasehold costs for the period were $17,622 and seismic costs were $3,357. Additional capitalized costs were $17,873.

The Company owns a 35% interest in 16,472.55 net acres of leasehold on a Crockett and Val Verde Counties, Texas prospect. The Company is participating in the development of the prospect and has entered into an agreement whereby a third party will drill two strat tests on the prospect, earning the option to purchase a 50% interest in the acreage and conduct a thermal recovery pilot test. The strat tests will be drilled in March 2019. Geological costs for the period were $1,916.

The Company is participating with a 35% interest in the development of a Val Verde County, Texas prospect on which 312.6 net acres of leasehold have been acquired. Leasehold costs for the period were $10,603.

The Company owns a 12.25% interest in 4,882.5 net acres of leasehold on a Crockett County, Texas prospect. An exploratory well was drilled on the prospect in 2017. A completion attempt of the well was unsuccessful and it has been plugged. A dry hole expense of $32,040 was taken against the well.

The Company is participating with a 13% interest in a 3-D seismic prospect covering approximately 35,000 acres in San Patricio County, Texas. A 3-D seismic survey of the prospect area has been completed and analysis of the data is ongoing. Eleven prospects have already been identified and lease acquisition is in progress on five. An exploratory well has been drilled and completed on one prospect and is awaiting pipeline connection. Leasehold costs for the period were $44,107 and seismic costs were $107,752. Prepaid drilling costs were $155,125.

The Company participated with its 10.5% working interest in the completion of an exploratory well that was drilled in 2017 on a Lea County, New Mexico prospect. The well is a marginal oil producer. Capitalized costs for the period were $65,421 and an impairment expense of $265,818 was taken against the well.

The Company participated with its 7% working interest in the drilling of an exploratory well on a Summit County, Utah prospect. The well has been completed as a commercial gas and gas condensate producer and is awaiting pipeline connection. Capitalized costs for the period were $994,180.

The Company is participating with its 11.2% working interest in workovers on a group of wells that were purchased in 2017 on a Tyler County, Texas prospect. The workovers performed so far have been successful in significantly increasing production. Capitalized costs for the period were negligible as most of the work was charged to expense.

The Company participated with its 8.33% working interest in the drilling of a horizontal well in a Harding County, South Dakota producing unit in an effort to develop the unit for waterflooding. An attempt to complete the well as an oil producer was unsuccessful and it is under evaluation for possible use as an injector. Capitalized costs for the period were $150,969.

The Company has been participating with a 50% interest in an attempt to develop shallow oil prospects in the Permian Basin. Lease acquisition is in progress on one prospect in Crane County, Texas. The Company will sell a portion of its interest prior to any drilling. Geological costs were $48,961 for the period and leasehold costs were $13,691.

In October 2018, the Company purchased a 16% interest in 784.12 net acres of leasehold on a Barber County, Kansas prospect for $12,546. An exploratory well has been drilled on the prospect and a completion is in progress. Additional capitalized costs for the period were $51,814.

In October 2018, the Company entered into an agreement to acquire mineral rights in Tyler, Doddridge and Ritchie Counties, West Virginia. The Company is funding the acquisition of the mineral rights which will then be sold to a third party for a profit, with the Company retaining an interest in the minerals. Costs for the period were $173,220.

In November 2018, the Company purchased a 10.5% interest in 3,410 net acres of leasehold on an Oldham County, Texas prospect for $179,025. The Company participated in the drilling of an exploratory well on the prospect. A completion is in progress. Additional capitalized costs for the period were $187,051.

Depreciation, Depletion, Amortization and Valuation Provisions (DD&A).

Major DD&A components are the provision for impairment of undeveloped leaseholds, provision for impairment of long-lived assets, depletion of producing leaseholds and depreciation of tangible and intangible lease and well costs. Undeveloped leaseholds are amortized over the life of the leasehold (most are 3 years) using a straight line method, except when the leasehold is impaired or condemned by drilling and/or geological interpretation of seismic data; if so, an adjustment to the provision is made at the time of impairment. The provision for impairment of undeveloped leaseholds was $240,635 in 2018, of which $27,463 were specific impairments, and $363,431 in 2017.

As discussed in Item 8, Note 10 to the accompanying financial statements, accounting principles require the recognition of an impairment loss on long-lived assets used in operations when indicators of impairment are present. Impairment evaluation is a two-step process. The first step is to measure when the undiscounted cash flows estimated to be generated by those assets, determined on a well basis, is less than the assets’ carrying amounts. Those assets meeting the first criterion are adjusted to estimated fair value. Evaluation for impairment was performed in both 2018 and 2017. The 2018 impairment loss was $832,651 and the 2017 impairment loss was $426,823.

The depletion and depreciation of oil and gas properties are computed by the units-of-production method. The amount expensed in any year will fluctuate with the change in estimated reserves of oil and gas, a change in the rate of production or a change in the basis of the assets. The provision for depletion and depreciation declined $311,113 to $1,000,945 in 2018 from $1,312,058 in 2017. This decrease is due to higher oil prices in 2018 compared to 2017. The provision also includes $65,615 for 2018 and $81,035 for 2017 for the amortization of the asset retirement costs. See Item 8, Note 2 to the accompanying financial statements for additional information regarding the asset retirement obligation.

Other Income

,

Net.

See Item 8, Note 11 to the accompanying financial statements for an analysis of the components of this line item for 2018 and 2017. Other income, net increased $145,317 (21%) to $828,714 in 2018 from $683,397 in 2017. The line items responsible for this net increase are described below.

Net realized and unrealized gain (loss) on equity securities decreased $192,490 to a net loss of $(108,868) in 2018 from a net gain of $83,622 in 2017. Realized gains or losses result when an equity security is sold. Unrealized gains or losses result from adjusting the Company’s carrying amount in equity securities owned at the reporting date to estimated fair value. In 2018, the Company had realized gains of $72,950 and unrealized losses of $(181,818). In 2017, the Company had realized gains of $34,884 and unrealized gains of $48,738.

Income from other investments decreased $428,500 to $16,500 in 2018 from $445,000 in 2017.

Gains on asset sales increased $551,598 to $611,281 in 2018 from $59,683 in 2017.

Interest income increased $218,117 to $348,615 in 2018 from $130,498 in 2017. This increase was the result of a rise in the average interest rate and an increase in the average balance of cash equivalents and average balance of available-for-sale debt securities from which most of the interest income is derived. The average interest rate increased from 0.43% in 2017 to 1.56% in 2018. The average balance outstanding increased $3,633,895 to $19,045,941 in 2018 from $15,412,046 in 2017.

Provision for Income Taxes.

In 2018, the Company had an estimated income tax provision of $387,880 as the result of a deferred tax provision of $292,221 and a current tax provision of $95,659. In 2017, the Company had an estimated income tax benefit of $582,582 as the result of a deferred tax benefit of $593,111, offset by a current tax provision of $10,529. The deferred tax benefit of $593,111 includes a $577,797 deferred tax benefit adjustment due to a decrease in the federal income tax rate at the end of 2017. See Item 8, Note 6 to the accompanying financial statements for an analysis of the various components of income taxes and a discussion of the federal tax rate change.

|

|

ITEM 7A.

|

QUANTITATIVE

AND QUALiTATIVE DISCLOSURES ABOUT MARKET RISKS

|

Not applicable.

|

|

ITEM 8.

|

FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

|

Index to Financial Statements

|

|

Page

|

|

Report of Independent Registered Public Accounting Firm, HoganTaylor LLP

|

16

|

|

Balance Sheets – December 31, 2018 and 2017

|

17

|

|

Statements of Income – Years Ended December 31, 2018 and 2017

|

19

|

|

Statements of Stockholders’ Equity – Years Ended December 31, 2018 and 2017

|

20

|

|

Statements of Cash Flows – Years Ended December 31, 2018 and 2017

|

21

|

|

Notes to Financial Statements

|

23

|

|

Unaudited Supplemental Financial Information

|

32

|

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Stockholders and the Board of Directors

of The Reserve Petroleum Company

Opinion on the Financial Statements

We have audited the accompanying balance sheets of The Reserve Petroleum Company (the Company) as of December 31, 2018 and 2017, the related statements of income, stockholders' equity and cash flows for the years then ended, and the related notes to the financial statements (collectively, the financial statements). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Company as of December 31, 2018 and 2017, and the results of its operations and its cash flows for the years then ended, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Company's management. Our responsibility is to express an opinion on the Company's financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Company in accordance with U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Company's internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

We have served as the Company's auditor since 2009.

Oklahoma City, Oklahoma

March 27, 2019

|

THE RESERVE PETROLEUM COMPANY

|

|

BALANCE SHEETS

|

|

|

|

ASSETS

|

|

|

|

December 31,

|

|

|

|

|

2018

|

|

|

2017

|

|

|

Current Assets:

|

|

|

|

|

|

|

|

|

|

Cash and Cash Equivalents (Note 2)

|

|

$

|

6,428,499

|

|

|

$

|

4,767,810

|

|

|

Available-for-Sale Debt Securities (Notes 2, 5 & 9)

|

|

|

16,249,414

|

|

|

|

16,371,544

|

|

|

Equity Securities (Notes 2, 5 & 9)

|

|

|

454,058

|

|

|

|

559,936

|

|

|

Refundable Income Taxes

|

|

|

16,387

|

|

|

|

326,830

|

|

|

Accounts Receivable (Note 2)

|

|

|

846,419

|

|

|

|

829,824

|

|

|

Notes Receivable (Note 7)

|

|

|

218,158

|

|

|

|

175,000

|

|

|

Total Current Assets

|

|

|

24,212,935

|

|

|

|

23,030,944

|

|

|

|

|

|

|

|

|

|

|

|

|

Investments:

|

|

|

|

|

|

|

|

|

|

Equity Method Investments (Notes 2 & 7)

|

|

|

881,860

|

|

|

|

991,094

|

|

|

Other Investments (Notes 2 & 7)

|

|

|

1,689,249

|

|

|

|

1,633,300

|

|

|

Total Investments

|

|

|

2,571,109

|

|

|

|

2,624,394

|

|

|

|

|

|

|

|

|

|

|

|

|

Property, Plant and Equipment (Notes 2, 8 & 10):

|

|

|

|

|

|

|

|

|

|

Oil and Gas Properties, at Cost,

|

|

|

|

|

|

|

|

|

|

Based on the Successful Efforts Method of Accounting –

|

|

|

|

|

|

|

|

|

|

Unproved Properties

|

|

|

2,249,113

|

|

|

|

2,296,686

|

|

|

Proved Properties

|

|

|

54,789,836

|

|

|

|

53,536,453

|

|

|

Oil and Gas Properties, Gross

|

|

|

57,038,949

|

|

|

|

55,833,139

|

|

|

|

|

|

|

|

|

|

|

|

|

Less – Accumulated Depreciation, Depletion, Amortization and Valuation Allowance

|

|

|

46,008,467

|

|

|

|

45,335,894

|

|

|

Oil and Gas Properties, Net

|

|

|

11,030,482

|

|

|

|

10,497,245

|

|

|

Other Property and Equipment, at Cost

|

|

|

403,718

|

|

|

|

404,256

|

|

|

|

|

|

|

|

|

|

|

|

|

Less – Accumulated Depreciation

|

|

|

249,333

|

|

|

|

253,239

|

|

|

Other Property and Equipment, Net

|

|

|

154,385

|

|

|

|

151,017

|

|

|

Total Property, Plant and Equipment

|

|

|

11,184,867

|

|

|

|

10,648,262

|

|

|

Total Assets

|

|

$

|

37,968,911

|

|

|

$

|

36,303,600

|

|

See Accompanying Notes

|

THE RESERVE PETROLEUM COMPANY

|

|

BALANCE SHEETS

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY

|

|

|

|

December 31,

|

|

|

|

|

2018

|

|

|

2017

|

|

|

Current Liabilities:

|

|

|

|

|

|

|

|

|

|

Accounts Payable

|

|

$

|

318,387

|

|

|

$

|

235,007

|

|

|

Other Current Liabilities

|

|

|

25,243

|

|

|

|

25,243

|

|

|

Total Current Liabilities

|

|

|

343,630

|

|

|

|

260,250

|

|

|

|

|

|

|

|

|

|

|

|

|

Long-Term Liabilities:

|

|

|

|

|

|

|

|

|

|

Asset Retirement Obligation (Note 2)

|

|

|

1,774,114

|

|

|

|

1,774,634

|

|

|

Dividends Payable (Note 3)

|

|

|

1,057,483

|

|

|

|

1,228,648

|

|

|

Deferred Tax Liability, Net (Note 6)

|

|

|

1,210,271

|

|

|

|

918,050

|

|

|

Total Long-Term Liabilities

|

|

|

4,041,868

|

|

|

|

3,921,332

|

|

|

Total Liabilities

|

|

|

4,385,498

|

|

|

|

4,181,582

|

|

|

|

|

|

|

|

|

|

|

|

|

Commitments and Contingencies (Notes 2 & 7)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stockholders’ Equity (Notes 3 & 4):

|

|

|

|

|

|

|

|

|

|

Common Stock

|

|

|

92,368

|

|

|

|

92,368

|

|

|

Additional Paid-in Capital

|

|

|

65,000

|

|

|

|

65,000

|

|

|

Retained Earnings

|

|

|

35,023,662

|

|

|

|

33,497,463

|

|

|

Stockholders’ Equity Before Treasury Stock

|

|

|

35,181,030

|

|

|

|

33,654,831

|

|

|

|

|

|

|

|

|

|

|

|

|

Less – Treasury Stock, at Cost

|

|

|

1,597,617

|

|

|

|

1,532,813

|

|

|

Total Stockholders’ Equity

|

|

|

33,583,413

|

|

|

|

32,122,018

|

|

|

Total Liabilities and Stockholders’ Equity

|

|

$

|

37,968,911

|

|

|

$

|

36,303,600

|

|

See Accompanying Notes

|

THE RESERVE PETROLEUM COMPANY

|

|

STATEMENTS OF INCOME

|

|

|

|

Year Ended December 31,

|

|

|

|

|

2018

|

|

|

2017

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating Revenues:

|

|

|

|

|

|

|

|

|

|

Oil and Gas Sales (Note 2)

|

|

$

|

7,765,314

|

|

|

$

|

6,125,308

|

|

|

Lease Bonuses and Other

|

|

|

562,184

|

|

|

|

184,282

|

|

|

Total Operating Revenues

|

|

|

8,327,498

|

|

|

|

6,309,590

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating Costs and Expenses: