Spanish Energy Giant Repsol Writes Down Oil, Gas Assets -- Update

December 03 2019 - 11:44AM

Dow Jones News

By Sarah McFarlane

Spanish energy company Repsol SA said it is cutting the value of

its assets by billions of dollars because the global transition to

a lower carbon economy is weakening the outlook for oil and gas

prices.

Repsol's move is the first by a major oil and gas player

acknowledging a lower value of its assets was linked to a long-term

view that a transition to less carbon-intensive energy will make

oil and natural gas less valuable.

The impairment charge won't impact cash payments to

shareholders, the company said, but it is likely to increase the

company's market cap-to-debt ratio, known as gearing. The charge,

totaling more than $5 billion, is set to show up in the company's

fourth-quarter results due in February.

"This valuation adjustment will mainly affect exploration and

production assets located in the United States of America and

Canada due to the reduction in the expectations of future gas

prices," said the company in a statement.

Energy companies have been reassessing the value of their

assets, particularly in the U.S., where natural gas prices have

been historically low, for the past couple of years. BP PLC's last

set of results included a $2.6 billion impairment charge, mostly

from selling U.S. assets at lower prices than it had on its balance

sheet.

Repsol, which controls around 8% of Europe's oil refining

capacity, also said it aims to achieve net-zero carbon emissions by

2050. That includes reducing greenhouse-gas emissions from the oil

products they sell, such as gasoline, which is similar to

commitments made by Royal Dutch Shell PLC. Many other energy

companies have resisted such moves.

The Madrid-based company's announcement coincided with the

United Nations' climate change meeting in the Spanish capital,

known as COP25, where governments are expected to negotiate ways to

limit the global temperature rise to less than 2 degrees

Celsius.

Some analysts said it was a coincidence that Repsol needed to

change its oil and gas price assumptions, and therefore asset

values, at the same time as the company is changing its strategy to

align with the energy transition.

Repsol bought Canada's Talisman Energy in 2015 in a deal which

included U.S. shale assets.

"They've got a significant North American asset base which had

quite aggressive oil and gas price assumptions, gas in particular,"

said Jason Kenney, an analyst at Spanish bank Santander, adding

that it had to be written down at some point.

Repsol has committed to invest a larger proportion of its budget

to zero carbon energy than its peers. It plans to more than double

its low-carbon electricity generation capacity to 7,500 megawatts

by 2025, mostly from renewable energy, with solar and wind projects

planned.

"Repsol's push into new energy is unique for a company of this

size; 17% of its overall budget is allocated to zero-carbon energy

over its three-year plan, way ahead of the majors," said consulting

firm Wood Mackenzie in a report.

--Max Bernhard contributed to this article

Write to Sarah McFarlane at sarah.mcfarlane@wsj.com

(END) Dow Jones Newswires

December 03, 2019 11:29 ET (16:29 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

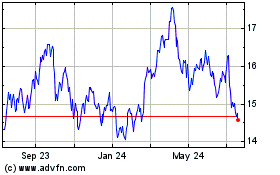

Repsol (QX) (USOTC:REPYY)

Historical Stock Chart

From Jun 2024 to Jul 2024

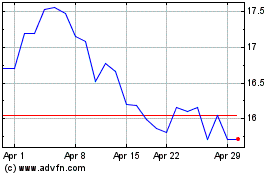

Repsol (QX) (USOTC:REPYY)

Historical Stock Chart

From Jul 2023 to Jul 2024