Repsol 4Q Net Profit Falls on Impairments, U.S. Tax Reform -- Update

February 28 2018 - 10:27AM

Dow Jones News

By Marc Bisbal Arias

Repsol SA (REP.MC) said Wednesday that its fourth-quarter net

profit fell year-on-year, citing impairments of assets in Venezuela

and the impact of the U.S. tax reform.

Net profit was 538 million euros ($658.2 million) compared with

EUR616 million the year-earlier period. Earnings before interest,

taxes, depreciation and amortization rose to EUR2.01 billion from

EUR1.67 billion, Repsol said.

The company said that it will propose raising its a dividend for

2017 to EUR0.9 a share, from EUR0.8 a share, as well as a full

buyback on its scrip dividend.

Adjusted net profit was EUR703 million, above consensus

expectations of EUR560 million, according to a survey provided by

the company.

Repsol said that adjusted net profit from its

exploration-and-production business increased year-on-year due to

higher oil and natural-gas prices, resumption of production in

Libya, and lower operating costs. Its refining, marketing and

distribution services faced a more challenging environment due to

higher costs and increased competition, Repsol said.

Earnings before interest, taxes, depreciation and amortization

is expected to be close to EUR7 billion in 2018 at current cost of

supply.

The Spanish oil-and-gas company said that at the end of 2017,

net debt stood at EUR6.27 billion compared with EUR8.14 billion a

year earlier.

Write to Marc Bisbal Arias at marc.bisbalarias@dowjones.com

(END) Dow Jones Newswires

February 28, 2018 10:12 ET (15:12 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

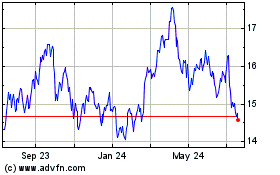

Repsol (QX) (USOTC:REPYY)

Historical Stock Chart

From Jun 2024 to Jul 2024

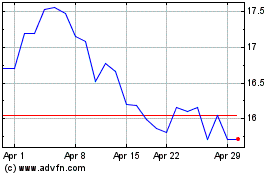

Repsol (QX) (USOTC:REPYY)

Historical Stock Chart

From Jul 2023 to Jul 2024