Spain's Repsol Faces $5.5 Billion Claim From China's Sinopec--Update

June 17 2016 - 11:24AM

Dow Jones News

By Selina Williams and Razak Musah Baba

Repsol SA said it faces a $5.5 billion arbitration claim from a

Chinese state-controlled energy firm in the latest problem to crop

up from the Spanish oil company's biggest-ever acquisition.

Sinopec International Petroleum Exploration and Production Corp.

and its subsidiary Addax Petroleum U.K. are seeking compensation to

cover their initial investment in 2012 in a partnership in the

British North Sea with Talisman Energy Inc., a Canadian company

that Repsol bought last year for $8.3 billion, excluding debt.

The claim also includes a demand for lost opportunities in a

British joint venture that has stakes in 57 North Sea oil and gas

fields and related infrastructure, including pipelines and

processing facilities, Repsol said. The company didn't say where

the arbitration had been filed.

Repsol on Friday said the $5.5 billion claim is groundless and

has been classed as "remote risk" by the firm's legal advisers.

Repsol said the claim reflected Sinopec's feeling that the U.K.

investment "has not delivered the results expected."

Addax and Sinopec weren't immediately reachable for comment.

The news is the most recent wrinkle for Repsol's acquisition of

Talisman completed in May last year.

The Talisman deal was meant to bring new production capacity for

a company that saw a large portion of its resources wrested away by

a populist Argentine government in 2012. Folding in Talisman, a

Canadian owner of shale acreage and offshore oil rigs, nearly

doubled Repsol's daily oil output and lowered the Spanish company's

exposure to volatile Latin American economies by increasing its

exposure to North America.

But the purchase expanded the Spanish company's debt as revenues

and profits fell during a prolonged oil-price slump.

Repsol announced the transaction at the end of 2014, some six

months into what has become a two-year long rout in oil prices that

has forced the entire industry to rein in spending as their

revenues and profits have plummeted.

At the time of the deal's announcement in December 2014, oil

prices had already more than halved from the mid-summer peak of

around $115 a barrel. However, oil prices failed to recover into

2015, as had previously been forecast by executives and analysts,

as a supply glut filled up crude storage tanks and weighed on

markets.

Amid the fall in oil prices, Repsol's profits have plunged and

the company has lowered its dividend. Its cost-cutting efforts in

recent quarters have done little to dent the company's expanding

debt load. Analysts have pointed to the company's "stretched"

balance sheet as a risk.

Repsol's net debt was EUR12 billion ($13.47 billion) in the

first quarter of this year, slightly higher than in the previous

quarter while its net profit was EUR434 million, down 43% from a

year earlier.

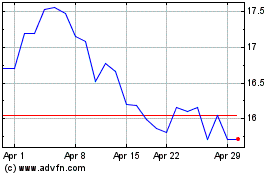

Repsol's share price has fallen around a third since it

announced the deal, more than the 17% fall in the oil price over

the same period and underperforming its European oil and gas peers,

reflecting investors concerns over the company.

Write to Selina Williams at selina.williams@wsj.com and Razak

Musah Baba at Razak.Baba@wsj.com

(END) Dow Jones Newswires

June 17, 2016 11:09 ET (15:09 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

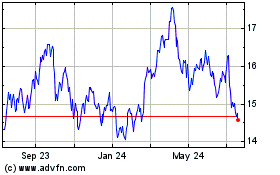

Repsol (QX) (USOTC:REPYY)

Historical Stock Chart

From Jun 2024 to Jul 2024

Repsol (QX) (USOTC:REPYY)

Historical Stock Chart

From Jul 2023 to Jul 2024