Cannabis and CBD stocks to Watch

This Week

May 14, 2019 -- InvestorsHub NewsWire -- Microcap Speculators --

According to a recent article in The New York Post, major retailers

are "angling for a piece of the exploding CBD

industry, which is expected to more than double to $2.1

billion by next year as consumers pay premium prices for products

to treat maladies ranging from arthritis to ADHD. Till now, the

lion's share of the CBD market has been going to smaller

mom-and-pop shops. But a few bigger chains, including

Walgreens, CVS and GNC, have begun selling CBD-infused topical

creams that treat wrinkles and pain in states where they're

allowed, including New York.

Looking at opportunities in the CBD market for investors to

start researching, Real Brands (USOTC:

RLBD) jumps out. The company gives you all the

benefit of the growing market without some of the risk producers

face. RLBD is a branding company that is growing its

portfolio of CBD brands by the day. The company has strong

management with a solid background in branding and the beverage

industry and plans to expand their holdings focusing on at least

three CBD Categories: smokables, edibles and topical balms

and lotions. The company recently updated their logo and

brand identity. It is also developing an E-Commerce website

and plans to launch it during the early part of the second quarter

(which if you’re paying attention could be any day now) on their

newly acquired domain name, to support online sales of a variety of

smokable, edible, and topical CBD derived from Hemp based products

for each of their brands. Start your research today.

Today we are highlighting: Real Brands,

Inc. (USOTC:

RLBD), Aphria (NYSE:

APHA), HEXO Corp. (AMEX:

HEXO), Auxly Cannabis Group Inc. (CBWTF), and Cara Therapeutics

(NASDAQ:

CARA).

Real Brands, Inc. (USOTC:

RLBD) (Market Cap: $12.488M; Share Price:

$0.0849) is first and foremost a marketing and

branding company, which has been slowly building its portfolio of

trademarked brand names that could each represent on their own

major partnerships and joint ventures going forward.

Jerry Pearring, the CEO of Real Brands commented, “As the demand

for CBD infused products continues to grow, we intend to create

marketing strategies in at least three CBD Categories: smokables,

edibles and topical balms and lotions.”

Products like CBD gums are something which golfers Tiger Woods and

Phil Mickelson are rumored to be chewing. The

non-psychoactive health benefits of CBD are appealing for

golfers.

That’s why RLBD announcing that PGA professional Scott Piercy is

coming aboard as Brand Ambassador is big news. In March ‘19,

he made a further commitment by making a long-term investment into

Real Brands.

RLBD is launching a CBD beverage. The audit on the horizon

means this could also be another major event for investors to pay

attention to. Start your research today.

________

OTHER CANNABIS COS TO RESEARCH INCLUDE:

Aphria Inc. (NYSE: APHA)

(Market Cap: $1.753B; Share Price: $7.01) shares

fell after the Canadian cannabis company reported fiscal

third-quarter results. It posted a C$108.2 million

($81.1 million) loss for its fiscal third quarter, or 43 cents

a share, after a profit of C$12.9 million, or 8 cents a share, in

the same period a year ago. Revenue climbed to C$73.6 million

from C$10.3 million in the first full quarter of Canadian legal

cannabis. But the company sold less cannabis than a year

ago—kilograms sold fell to 2,636.5 from 3,408.9, while the average

retail selling price for medical cannabis increased to C$8.03 per

gram from C$7.51, primarily because of higher oil sales.

In April, it announced that the previously announced take-over

bid (the "Offer") by Green Growth Brands Inc. ("GGB") has failed to

meet the statutory minimum tender condition and has now expired and

is terminated. As previously announced on April 15,

2019, the company entered into a definitive agreement with GGB to

accelerate the expiry date of the Offer to April 25, 2019, as well

as to terminate certain arrangements with GA Opportunities Corp.

("GAOC") for consideration of $89.0 million payable on future dates

as set out in the April 15th press release. The Offer is now

expired and terminated and no longer open to any Aphria shareholder

to tender their shares. Accordingly, GGB will not be taking

up any securities that may have been tendered to the Offer.

GGB will promptly return to the securityholder any Aphria shares

tendered and not withdrawn during the period from the commencement

of the Offer up to the expiry time of the Offer.

________

HEXO Corp (AMEX:

HEXO) (Market Cap: $1.458B; Share Price:

$6.87) and Newstrike Brands Ltd. ("Newstrike")

(TSX-V: HIP) had announced in March that they had entered into

a definitive arrangement agreement (the "Arrangement Agreement")

under which HEXO will acquire all of Newstrike’s issued and

outstanding common shares in an all-share transaction valued at

approximately $263 million. The Transaction

gives HEXO the capacity to produce approximately 150,000

kg of high-quality cannabis annually. The Transaction also

provides HEXO access to four cutting-edge production

campuses totalling close to 1.8 million sq. ft. of near-term

cultivation space and diversified growing and production

techniques. This is in addition to HEXO’s 579,000 sq.

ft. facility for a manufacturing and product development centre of

excellence in Belleville, Ontario. HEXO Corp has its headquarters

in Gatineau Canada, and it produces and sells most of its cannabis

products in the country.

The Brantford, Ontario-based Newstrike Brands were granted a

cultivation license on 16 December 2016, and the company expects

its harvest to be about 42,000 kg of cannabis. Although the company

has not been around for long compared to HEXO, it has high capacity

for cannabis production. HEXO recently announced that it had

completed the first harvest in its 1 million sq. ft. expansion,

marking an important execution milestone in the company's

continuous growth.

HEXO Corp., through its subsidiary, HEXO Operations Inc.,

produces, markets, and sells cannabis in Canada. The company

offers dried cannabis under the Time of Day and H2 lines; Elixir, a

cannabis oil sublingual mist product line; and Decarb, an activated

fine-milled cannabis powder product. It provides its products

under the HEXO and Hydropothecary brand names. The company

serves medical and adult-use markets. As one of the largest

licensed cannabis companies in Canada, HEXO Corp operates with

1.8 million sq. ft of facilities in Ontario and Quebec and a

foothold in Greece to establish a Eurozone processing, production

and distribution center.

_________

Auxly Cannabis Group Inc. (CBWTF) (Market Cap:

$371.291M; Share Price: $0.60425) released its fourth

quarter and full year 2018 financial results in March 2019.

These filings and additional information regarding Auxly are

available for review on SEDAR. For the year ended December

31, 2018, Auxly recognized $747,000 of research revenues from the

recently completed acquisition of KGK in the third quarter of

2018. Auxly realized a gross loss of $188,000 in 2018

comprised of revenues less KGK expenses of $1,078,000 in support of

third-party research contracts.

On April 8, it announced that its wholly-owned subsidiary,

Robinsons Cannabis Inc. ("Robinsons"), has been granted standard

cultivation and processing licenses by Health Canada pursuant to

the Cannabis

Act and Cannabis

Regulations. The licenses give Robinsons the ability

to begin cultivation at its fully constructed 27,700 square-foot

facility in Kentville, Nova Scotia, which was purpose-built to

produce high-quality cannabis.

Auxly Cannabis Group Inc. operates as a cannabis streaming

company. It provides funding for cannabis production; and

holds contractual rights and minority equity interest relating to

the operation of cannabis facilities. The company was

formerly known as Cannabis Wheaton Income Corp. and changed its

name to Auxly Cannabis Group Inc. in June 2018. Auxly

Cannabis Group Inc. was incorporated in 1987 and is headquartered

in Vancouver, Canada.

________

Cara Therapeutics, Inc. (NASDAQ:

CARA) (Market Cap: $734.212M; Share Price:

$18.47), a clinical-stage biopharmaceutical company,

has a comprehensive report issued by Traders News Source, a leading

independent equity research and corporate access firm focused on

small and mid-cap public companies. Cara Therapeutics focuses

on developing and commercializing chemical entities with a primary

focus on pruritus and pain by selectively targeting kappa opioid

receptors.

Cara Therapeutics is a clinical-stage biopharmaceutical company

focused on developing and commercializing new chemical entities

with a primary focus on pruritus by selectively targeting

peripheral kappa opioid receptors (KORs). Cara is developing

a novel and proprietary class of product candidates, led by

KORSUVA™ (CR845/difelikefalin), a first-in-class KOR agonist

that targets the body's peripheral nervous system, as well as

certain immune cells.

Legal Disclaimer:

This article was written by Regal Consulting, LLC (“Regal

Consulting”). Regal Consulting has agreed to a three-month

term consulting agreement with RLBD dated 8/31/18. The

agreement calls for $100,000 note issued to Regal Consulting, and

2,500,000 restricted 144 shares of RLBD for three months of

service. Regal has elected to convert $73,000 of principal of

the $100,000 note into 2,761,872 Restricted 144 shares of RLBD.

Regal Consulting has agreed to a twelve- month term consulting

agreement with RLBD dated 1/4/2019. The agreement calls for

$10,000 in cash and 500,000 shares per month. All payments were

made directly by Real Brands, Inc. to Regal Consulting, LLC. to

provide investor relations services, of which this article is a

part of. Regal Consulting also paid one thousand dollars cash

to microcapspeculators.com to distribute this article. Regal

Consulting may have a position in the securities mentioned in this

article at the time of publication, and may increase or decrease

its position without notice. This article is based on public

information and the opinions of Regal Consulting. RLBD was given an

opportunity to edit this article. This article contains

forward-looking statements that are subject to certain risks and

uncertainties that could cause actual results to differ materially

from any results predicted herein. Regal Consulting is not

registered with any financial or securities regulatory authority,

and does not provide or claim to provide investment advice.

http://www.regalconsultingllc.com/full

legal disclaimer/

Full Legal Disclaimer Click

Here.

Contact Information:

Company Name: ACR Communication LLC.

Contact Person: Media Manager

Email: info@microcapspeculators.com

Phone: 1-702-720-6310

Country: United States

SOURCE: Microcap Speculators

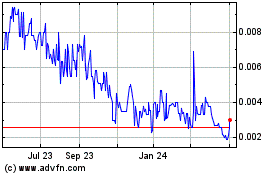

Real Brands (CE) (USOTC:RLBD)

Historical Stock Chart

From Oct 2024 to Nov 2024

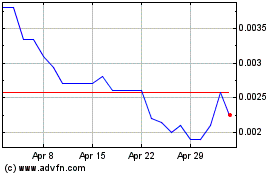

Real Brands (CE) (USOTC:RLBD)

Historical Stock Chart

From Nov 2023 to Nov 2024