UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Filed by the Registrant ☐

Filed by a Party other than the

Registrant ☒

Check the appropriate box:

☐ Preliminary Proxy Statement

☐Confidential, for Use of the Commission Only (as

permitted by Rule 14a-6(e)(2))

☐ Definitive Proxy Statement

☒ Definitive Additional Materials

☐ Soliciting Material Under Rule

14a-12

PARKS! AMERICA, INC.

(Name of Registrant as Specified in Its Charter)

FOCUSED COMPOUNDING FUND, LP

FOCUSED COMPOUNDING CAPITAL MANAGEMENT, LLC

ANDREW KUHN

GEOFF GANNON

JACOB MCDONOUGH

RALPH MOLINA

(Name of Persons(s) Filing Proxy Statement,

if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate

box):

☒ No fee required

☐ Fee paid previously with preliminary

materials

☐ Fee computed on table in exhibit

required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11

On May 17, 2024, Focused Compounding Fund,

LP (“Focused Compounding”) posted a video addressing shareholder questions regarding the operating plan that it filed as

additional soliciting materials

on May 8, 2024. The video pertains to the upcoming annual meeting of Parks! America, Inc. (the “Company”), currently

scheduled for June 6, 2024 at 10:00 a.m. Eastern Time, for which Focused Compounding has nominated four (4) director-nominees for election

to the Company’s board of directors. The video was uploaded to YouTube (https://www.youtube.com/watch?v=p1m_XuIT_NY),

which was posted to X (@FocusedCompound). The X post and a transcript of the video are reproduced below:

| Andrew: | Alrighty, we are going to get started here tonight. How’s everyone doing? Hope you are doing well.

My name is Andrew Kuhn with Focused Compounding. I am on air live with Geoff Gannon. Today is May 15, and we are going to be discussing

and answering questions that investors and shareholders had wrote in about Parks! America. A couple days ago, we had put out a SurveyMonkey

link where we told people we were going to do this, and individuals had asked some questions. |

Before jumping into that,

just some housekeeping items. We are in the middle of a proxy fight with Parks! America. We are the largest shareholder. To get access

to our proxy statement, you could go to the SEC’s website. Type in PRKA, and you should find it there, or go to prkaproxyfight.com

to get access to that. We are nominating or we have nominated four individuals for the annual meeting on June 6, and if elected in, this

is a lot of what we will be doing afterwards, taking the company in a new direction. Couple days ago, last week, we had put out our operating

plan if that happens, and this Q&A is basically questions that we have received from that operating plan. We put out two phases: Phase

1, returning capital to shareholders and then, Phase 2, more of an ongoing thing at the company.

Before we jump into questions

from shareholders and individuals, yesterday, Parks! America, they actually reported earnings, and on the earnings call, Lisa had asked

publicly some questions for us to answer on this podcast. Before jumping into the shareholders and individuals that are just curious,

their questions about our plan, we’ll just go through Lisa’s questions to the CEO of Parks! America and then go from there.

The first question she had asked, if you gain control of the PRKA board, will you reimburse the Focused Compounding proxy fight cost from

the company, yes or no?

| Geoff: | No. The company won’t pay any proxy fight cost that we have. |

| Andrew: | 2) Geoff and Andrew, when have either of you visited our Georgia park subsequent to the March 2023 tornado?

Have you visited our other parks as well, and when did you visit? |

| Geoff: | We’ve not visited the park since the new CEO came in. |

| Andrew: | We’ve been to each park many times. |

| Geoff: | Yeah. That was with previous management, was in at that time. Yeah, we haven’t thought it appropriate

to go to the parks. |

| Andrew: | 3) Your latest plan indicates immediate sale of the Missouri and Texas parks with the Georgia park being

continuously up for sale. This leads to the conclusion that you have an undisclosed alternative plan for the PRKA public entity. With

all the bluster you’ve made about alleged excess spending, why hire a head of investor relations unless you plan on doing something

else with the holding company that is left after you sell the Georgia park? |

| Geoff: | The investor relations purpose is for handling things like stock buyback, special dividends, all these

extraordinary events the company will be going through, so it’s really important. There’s a wide bid-ask spread in the stock.

The stock is highly illiquid. It’s on the pink sheets and all sorts of things, so it’s very easy for an inefficient market

where people don’t understand these things, where people who might know some stuff take advantage of people who don’t know

that stuff in terms of just people who are very sophisticated investors and people who aren’t, the dates on which these things will

be paid, all that. It’s critically important that as the company goes through these things that that – you have an investor

relations function. The most important time for the investor relations will be while this Phase 1 of the plan especially is going through

and stuff, so I think it’s super important. |

| Andrew: | Do you have any thoughts on her conclusion that we have an undisclosed alternative plan for the PRKA public

entity? |

| Geoff: | No. The plan that we have is out there. There’s some wording stuff there. I think the question says

that Georgia park will be continuously up for sale or something. The plan is to sell the two parks that don’t earn anything, Aggieland

and Missouri. Then, yes, you’re a public company, and you have a responsibility to sell the entire company if you get an offer that’s

much higher than what shareholders could ever get from continuing to operate the company. Every public company is or should be up for

sale all the time in the sense that if someone comes in the same industry to acquire them or there’s an LBO private equity that

comes and says that – for companies that are billions and billions of dollars to own a company that are hundreds of millions. In

that sense, yes, it’s always for sale, but there’s not going to be any effort to go out and try to find a buyer for the Georgia

property. |

I think I said in the

presentation that the most likely scenario is that there is – that we continue to operate the Georgia park, and in fact, it’s

very possible that it could be operating indefinitely. I think it just takes you back to what the company looked like before they bought

Missouri and Aggieland. It was a public company, it owned one asset, that was Georgia, so that takes you back to 2008 or before then.

It’s dialing back to that phase for the company. We feel like Missouri and Aggieland aren’t performing well. They haven’t

performed well. Instead of having taken all that capital and put it into those things, you need to reverse that process, so it’s

going backwards in that way.

I just feel that those are not the best

uses of capital and so bringing it back down to what it was before, but you can see what the company was before. It was a public company

that owned one asset and everything, so it’ll go back to that. Then who knows where it goes from there? They didn’t know back

then where it would go.

| Andrew: | Mm-hmm. Mm-hmm. Do you have a non-disparagement agreement with Dale Van Voorhis? Most of the issues Focused

Compounding continues to use to attempt to vilify me are in fact issues that extend from Mr. Van Voorhis’ leadership. She says no

annual meeting since 2010, excess spending that started after Mark Whitfield was hired in September 2020, holding on to the losing Missouri

park. She admitted that Missouri’s losing. |

| Geoff: | No, we’re free to disparage Dale. Yeah, we’re free to disparage Dale as much as we want. No,

there’s no agreements between us and Dale. |

| Andrew: | Let’s see. Given you have not been able to attract board candidates with meaningful business experience,

why should PRKA shareholders believe you can attract and retain qualified talent to run the Georgia park? |

| Geoff: | We already have retained – I mean, we already have – we have had discussions about people

taking over on Day 1 for key positions, and so we’ve attracted them in that sense. They’re obviously not signed on and stuff

because that would have to take place after the annual meeting. Yeah, there’s already talent in place in that sense. Yeah, there’s

people interested. |

| Andrew: | Mm-hmm. Mm-hmm. Okay. Let’s go into questions. What I did for questions from individuals that wrote

in on SurveyMonkey was I broke it down between Phase 1 and Phase 2 questions just to keep the flow and the speed of everything as smooth

as possible so we don’t have to jump back and forth. One thing I also tried to do is group the questions as well so we’re

not being too repetitive, just to make it as best about listening experience for people listening. The first question as relates to Phase

1, why does Focused Compounding’s plan to return the potential land sale proceeds to investors rather than using the capital to

expand operations through CapEx spend at the existing Georgia park or through acquisitions of new parks make sense? |

| Geoff: | That’s not the plan. The plan is to sell the other two parks, but as you can see, the Georgia park

has historically been self-funding. The company does have unproductive assets in Missouri and Aggieland, and yet, that hasn’t stopped

them from doing lots of CapEx in Georgia or anything else. Actually, throughout its entire history, Georgia has financed itself and more,

all of the things that you see there. In fact, it is the source of eventually what happened with everything that went to Aggieland and

Missouri, really. They borrowed at first, but then they paid down and stuff. Georgia’s funded everything, and it can certainly fund

itself if it’s performing well. Those aren’t mutually exclusive in any sense. You wouldn’t need to use proceeds from

selling other parks to invest in Georgia. |

Then the acquisition thing,

I mean, like we said, Georgia in good years does produce some free cash flow and stuff like that. Obviously, the other two parks don’t.

The plan is to sell down those parks and to have that capital to be returned, but obviously, Georgia may tend to produce free cash flow

over time in the future if it performs well. It may not if it doesn’t, but in its long history, on average, it’s produced

quite a bit of free cash flow, certainly enough to fund both CapEx of itself and acquisitions. You saw. They acquire two things using

what they had from Georgia. If you think of it like dialing the clock back to what this company looked like before, Missouri and Aggieland,

it was obviously able to use Georgia to reinvest in Georgia and also to use the cash flow from Georgia to acquire things. It’s not

mutually exclusive if Georgia does well in terms of free cash flow.

| Andrew: | Why are the Missouri and Texas parks not worthy of keeping and attempting to increase EBITDA? |

| Geoff: | The Missouri and Aggieland parks may appear to be somewhat close to being able to have some improvements

which cause them to report earnings or at least report EBITDA, a positive EBITDA. However, to really justify the cost of capital, the

thing that causes a stock to go up more over time than other stocks is you have to beat the opportunity cost that people have in other

stocks. If you invest in the market and the market tends to do 10% a year or something, the only way that you as a public company are

going to outperform that is if the places you put your capital to work earn 10% or better after tax and in cash, basically, on what they’re

invested in, and so those are projects of any kind from the smallest things inside a park to entire acquisitions of things and stuff.

They’re nowhere near getting to that, so given the current levels of capital, you can look at there – they would need great

increases in sales without much in the way of increases in expenses or without much in the increases in the amount of capital in them

versus the possibility that their highest and best use is actually something else. It could be sold as an ongoing park to someone else

who thinks that they’re capable of running it better than Parks! America is, or it could be to the highest and best uses, for example,

as ranch land. If you take something, let’s say, on the books that’s $7 million or something for the land, that really needs

to be generating something like $700,000 in free cash flow, and you’re very, very far away from that. In terms of EBITDA, it needs

to be a really high number just to generate that much. |

You can’t tie up

that much equity in things and not generate a lot of cash back for them. It’s possible that, sure, you could eke out an accounting

profit in some years, but you’re nowhere near being able to justify the cost of capital, which is what matters for economic results

over time. That’s the only thing that makes one stock as attractive or more attractive than the overall market. You don’t

want to use investor money to try to produce returns that are much lower than returns they could get anywhere else. You need to get those

that are generally available in the market and stuff. You got a target like double digit type stuff, and they’re nowhere near that.

There’s not a clear path to getting to that. It’s too much capital versus too little opportunity to generate returns on it.

| Andrew: | How tough will it be to sell two unprofitable parks? Why are you confident someone would offer a reasonable

price or a price? |

| Geoff: | Again, highest and best use. The estimates are based in large part – I mean, the estimates are based

entirely on what would happen in cases in which someone does not want to operate it as a park. Now, you might possibly get a higher or

lower offer to continue to operate as a park, but it’s just based on the assets that are there, which is basically like ranch land.

You can see where the parks are located, divide the amount of – you can see the number of acres they have and put in an idea of,

well, what’s the – how many dollars per acre would someone pay for this and stuff? That gets you to what the numbers might

be. The answer is that, yeah, they – their best use may not be as an ongoing animal safari. It might not or it might be. It depends

on if there’s an eager entrepreneur who wants to try to run it and then can come up with money to do that or if there isn’t

and someone wants to operate something as a ranch or something. Yeah. It’s basically the value – the land value is quite a

large portion of the estimated proceeds. |

| Andrew: | Mm-hmm. Next question, how did you arrive at the 10 to 25 cent return on capital on the Texas and Missouri

sales? |

| Geoff: | Okay. To be clear, I did not. I said Texas selling Aggieland and Missouri and borrowing, and you also

have to factor in there could be some cash build or cash burn during that period and stuff. That’s Phase 1, so that’s very

close to being what we’re saying. The bottom end of that range is fairly okay but not great price for some but not all the properties,

and then the very high end of that range is getting prices for all the properties and being able to borrow somewhat and stuff. I would

adjust that range down a little bit because of some cash burn that’s happened to the company recently, but let’s not discuss

that. Let’s just get to the next question. |

| Andrew: | Next question, Lisa Brady made a comment on their call. On May 10, less than one month before the park’s

annual meeting which is on June 6 and after five months of needless distractions and expenses, Focused finally revealed that their ultimate

goal is to liquidate the company’s assets. My question to you, gentlemen, is if there is any merit to this remark? |

| Geoff: | Yes. There is merit to the remark in so far as looking at the assets of the company, but there’s

no merit in looking at the earnings of the company. The company has a lot of assets in two parks, one in Missouri and one in Texas that’s

called Aggieland. By acreage, that’s most of the company, and by assets on the books, that’s most of the company. However,

it produces no earnings, so in the sense that it’s dialing it back to what it looked like before the expansion into Missouri and

Aggieland which they bought then so going back in time to when it was a company that was just Georgia, which it was originally as a public

company, yeah, that’s true. I think that it’s better to think of it as selling two of the three parks, the two that are not

producing any earnings, and having still the park that is producing the earnings. |

There gets to be a little confusion when

you’re talking about it as if the difference between liquidating some assets of selling things over time and stuff versus selling

an entire company. A hundred percent of the cumulative earnings come from the thing that will be kept, but yes, a big chunk of the assets

on the books are from things that would be sold. Yes, true, if you look on the balance sheet perspective. Not true if you look on the

earnings perspective. Two ways of looking at it.

| Andrew: | We care about the earnings. |

| Geoff: | We don’t care. I mean, we think the assets have better uses. Actually, I think everyone thinks the

assets have better uses. They’re not earning anything right now, so that’s clear. |

| Andrew: | Is that just more so like a buzz thing to say? Their ultimate goal is to liquidate the company’s

assets? I mean, we have said that the Georgia park is something that we – the most likely outcome is continuing to hold that. It’s

just liquidating or selling the two unproductive assets that don’t generate any cash and actually are a drag on that cash flow. |

| Geoff: | I mean, I think it’s true in the sense that we will be taking most of the acreage of the company

and turning it into cash. If you don’t want that, if you want the land that doesn’t have earnings instead of the cash which

can earn 5% if it’s put into T-bills and stuff right now, then, yeah, if you prefer land to cash, then, absolutely, you should not

vote along with us and stuff on these things, but if you prefer having that cash to owning land that is not earning anything, then no.

I mean, it is – yeah, by acreage, it is definitely a huge reduction in the company. It’s dialing it back to what it looked

like before and focusing on things that earn and not just on ownership of land in other places. At this point, what they – they

just own land out there, basically. That’s what most of the capital is tied up in and stuff. It has not accumulatively produced

earnings. I don’t disagree with the way of thinking about it that you’re trading land for cash. I think that is an accurate

way of looking at it, and if you want to phrase that as liquidating, then, yes, it’s a partial liquidation in the sense of selling

land to have cash, yes. |

| Andrew: | Next question, long-time listener of the podcast. I would love to know what you think of the product economics

of the Georgia park. I understand that there is a moat because of high barriers to entry. However, I still see the park competing for

attendance against other forms of outdoor recreation in the area; thoughts. |

| Geoff: | Yeah. I think this year will not be good for this kind of business or this year and next year and stuff

just because of where we are in the consumer economy and everything. It’s not going to be great for those kinds of things. I don’t

think you’ll see amazing earnings coming out of Six Flags and Disney and whatever things, and so you shouldn’t expect them

from something like this. You do get some trading down and some – from people who have something now closer to home and whatever

versus what you might have when people are more flush with cash or not able to do other things like you saw during COVID. Yeah, probably

not great that way, and there’s lots of other ways to spend their money. |

I wouldn’t talk about it as having

a moat that way. It does have some awareness, some mind share and stuff in the area, so it’s known as an option of what you can

do. It absolutely competes with all sorts of other leisure choices, entertainment choices, uses of your time and money and everything.

Yeah, you always have to look at substitutes just because there’s not necessarily a ton of other competing products right in the

exact same area. It doesn’t mean that there isn’t a lot of competition for your time and stuff. Then, also, there is –

obviously, competition from being able to be drawn away from other places, but I wouldn’t think of it first as people going out

and saying this is the kind of experience I want to have. Then what do I pick and stuff? It is a unique experience, but it is part of

people’s overall entertainment choices. That’s what it really competes with. Yeah.

| Andrew: | What do you think about the product economics of the Georgia park? |

| Geoff: | We’ll see. I think that they are – I think the historical attendance of the park and its amount

of capital in it and the amount of expenses it once had before COVID is good. I don’t know that the dwell time and the cross selling

of other things and the – things like that are necessarily all prefect in terms of food and beverage and gift and all that. There

may be opportunities for those sorts of things and stuff, but the amount of attendance relative to the amount of land and the amount of

expenses pre-COVID is – it was good. Yeah. |

| Andrew: | Okay. We could go on to Phase 2. This is after capital has been returned. Missouri and Aggieland, the

Texas park, have been sold or closed down. If the plan as laid out by your video is to sell all three locations, Missouri and Texas in

Phase 1 and Georgia after Phase 2 once an offer is received, what does the future of the company look like? Are there plans to buy more

locations in the future, dissolve the company, or something else? |

| Geoff: | Right. I would say that’s not really the plan. The plan would be to sell those two parks and to

have Georgia continue to operate it. You’re a public company, so if you have a very high offer for things, you got to consider it.

That would be probably selling the entire company. Now, functionally, the buyer would almost certainly be someone who doesn’t want

to continue to operate as a public company. What they actually want is Georgia, but they’ll buy the company to get Georgia. How

that’s structured, it could be either a purchase of the entire company of a purchase of other things. It’s probably a purchase

of the entire company, but it can be structured in such a way that what you’re really buying is the assets and stuff. |

In that case, it wouldn’t

look like anything. If you really got a very high offer for a company, then it would be sold, and you would presumably get cash or something.

That would be the end of your time owning the company. That happens all the time in public markets. If you continue to operate Georgia,

I think we have some breakdown of that. It would probably be that there would be some net leverage on it from time to time. It wouldn’t

be allowed to build up excess cash, really, and then things would be paid out as dividends. It shouldn’t be seen as being something

that would ever be extremely highly leveraged nor operating with negative leverage in the sense of having more cash than debt and all

of that.

It would be a Georgia park that would then

use what it needs in terms of cash to invest in projects that it thinks gets a good enough return, which would be double digit type stuff,

and then when it has exhausted those possibilities, then the capital would be returned to you. You would look for double digit type returns

in any projects that you could invest in. Once you’d exhausted those possibilities, you would return the capital to shareholders

each year. I think that’s kind of what’s laid out, actually, in Phase 2, an ongoing thing. We talk about it exactly that way.

| Andrew: | Next question, I skimmed Focused Compounding’s video for the future of parks and had a few questions.

I understand the capital allocation part due to the overcapitalization of the business. But what is the long-term plan for Parks! America?

Assuming a sale of the two unprofitable parks, you have the holding company, and then you have the park that generates all the income.

Is your long-term play to continue to grow the Georgia park’s income or is it to expand through potential other safari-related acquisitions,

or since the holding company is separate from the operations of the business, will the holding company be exploring acquisitions outside

of the safari park’s landscape? |

| Geoff: | You’ll be exactly back in the position that you were before they bought Missouri and Aggieland.

You’re exactly back to your a public company. You just own Georgia, and eventually, some cash or something piles up if Georgia generates

free cash flow. What was decided there is to buy safari parks, but they probably looked at other kinds of investments too, other kinds

of acquisitions, maybe an amusement park, or an attraction of some kind, or whatever. They may have considered other things, dividends

and whatever. I don’t know what they considered, but you’re back to there. You’re a public company with this one asset

that throws off free cash flow. Now you have to decide what to do with it, and the decision will be to only do things that you think earn

a high enough return. That means it has to be performing asset and that you like the business and that you have someone who can run it.

Maybe someone stays on or maybe you know who will be able to run it and stuff, and then it has to be at the right price. It’s all

those things. |

I think it would’ve been good if that

was exactly what the strategy was implemented in those parks. In terms of what will happen with it, how much capital will be just a total

return of the capital each year and how much will be possibly reinvested will depend on if there’s possible things to do that get

better than 10% type returns, but if we only see single digit type return possibilities, then we will return everything that would be

a single digit type return possibility. I can tell you that. We’re only going to be looking at things that we think cross the threshold

into we think this will make double digits over time in terms of return per year. Yeah.

| Andrew: | Can you talk about this concept of shrinking to grow? I feel like, for people listening, that could be

maybe counterintuitive to what they would expect. |

| Geoff: | Yeah. I mean, so if you read the book The Outsiders, there’s all these chapters, Warren Buffett,

John Malone, whatever, lots of famous people, but one of the best chapters is about General Dynamics. Over a period of two or three years

or whatever, the CEO that went in there shrunk the company down with a focus on return on equity and cash generation stuff, and you can

just read about that and just one thing after another that would be a very similar sort of thing. You focus on generating cash. You focus

on reducing the amount of capital in the business. You focus on selling off things that use a lot of assets and generate no earnings,

and you focus on, say, buying back stock, for instance, which is what they did, to generate higher returns on equity and more returns

on equity that are in cash form. |

Now, what that company

ended up doing is, after it shrank down so much in those first few years and had great returns but after it did that, then it did expand.

I don’t remember if it was two or three years, that period, but then they went and expanded. Then they tried to expand with that

same idea of focus on return on equity on actual cash earnings and everything. The company was way out of whack in terms of size. It was

bloated with too much in the way of assets, not enough cash generation. There was problems with how the management was tracking results

and how they were compensated and all sorts of things. The same sorts of problems that we have here.

You got to shrink down

to your best assets first, and then you can build off of that base. I mean, if you just run the math on it now with the things that they

have and everything, it’s a huge anchor on the company, tremendous. All the earnings come from one place. Most of the assets are

in the other place. You get such a worse result by being dragged down by having a majority of your weight in terms of capital earning

nothing. I mean, it’s like people know a 60/40 portfolio and stuff. This is like a 70/30 portfolio where 30% earns everything and

70% earns nothing. You know what I mean?

| Geoff: | That’s not a very good mix. You got to get it down to where it’s 100% a performing asset that’s

doing well. Then if you want to build on to that with another performing asset that does well – no one’s saying that if you

could of ever find something that looks like Georgia that people wouldn’t buy it and run it the same way. No one’s saying

that. What we’re saying is you don’t want to repeat the mistakes of Missouri and Aggieland. You’re in the situation

that you are, which is you can get capital out from there, and you can reallocate it to better things. It’s a capital reallocation

situation. |

You’ve got to do

something about the fact that it’s earning nothing. You cannot tie up investor money in something that earns nothing. I mean, it

actually is worse than nothing when you do the accumulative stuff on it and in the terms we would think in terms of cash after taxes and

all that. It’s worse than nothing, but you can get out of it because it has other uses. Land has other uses, and there may be people

that want to buy a park or something. You can redirect that into something else, but it doesn’t make sense to continue to do something

that hasn’t worked for 15 years, or for 4 years, or whatever and do it year after year the same way and just say, well, because

we hope that this works and we want it to be a success that we can somehow will it to do that. Instead, you have to say, look, here’s

something that can actually work. Let’s focus on that. Let’s bring the capital back to that and only use it for that purpose.

I’m not against

growing if you grow in, like I said, those 10% plus type returns on capital, but I am totally against growing if you mean growing the

amount of capital while the capital earns single digits. That makes no sense. Yeah. Yeah, you’d have to shrink first. Then could

you grow? Maybe. First, you got to shrink. Yeah.

| Andrew: | Three times debt to EBITDA seems conservative for a business of this quality. I am, of course, referencing

when Georgia’s the only park remaining. I would love to see a couple of more turns, especially given how much of EBITDA flows through

to free cash flow to the firm. Not really a question. More of a comment. Maybe just a good – just for you to – your thoughts

on leverage in general and debt. |

| Geoff: | Mm-hmm. I think that’s quite – I think people should have really low expectations for the

amount of leverage that we put on something because very small firms have a hard time accessing capital. It’s more like being a

private company than being a public company when you’re this small. You’re in industries where people – banks and things

don’t normally lend a lot into and stuff, so I just think that you have to be very realistic about that. And then the other things

like structure of that and everything. |

I would say this. The

easiest way to think about this, we are absolutely not going to run something that just has excess cash sitting there earning nothing.

You know we won’t do that, and then you also can look at what a leverage buyout looks like. We’re not going to run it that

way. I think that that – maybe that’s the easiest way for people to think about it. What does an LBO look like? We’re

not doing that. That will never happen. What does something that just piles up loads of cash and doesn’t do anything with it look

like? We’re not doing that either.

It will not be operated

with cash and no leverage just sitting there. The cash will be returned to you or it will be used for some purpose, but on the other hand,

it won’t be used with the maximum amount of leverage that someone could possibly borrow and stuff. It’s not going to happen.

Yeah.

| Andrew: | Mm-hmm. What kind of inflation adjusted tangible asset growth can you expect at PRKA in, say, 5, 10, 15

years from now? |

| Geoff: | I don’t know. Obviously, from the starting point, not much. You should expect that a lot of tangible

assets are going to be taken out of it because, like I said, most of the tangible assets in terms of the book value and all that kind

of stuff is in the two parks that don’t earn anything. You got to first imagine the shrinking thing. After it’s shrunk down

to being Georgia, where do you go from there and stuff? It depends on what I said, which is that you’ve got to earn at least 10%

plus returns on your equity in cash terms after tax and stuff. That’s what you got to do. |

That does not mean that

you would never have a capital project at all or something, but it means that it has to be the kind of thing that drives earnings from

that. I don’t want to get into all the different specific things of what that looks like in an attraction industry and stuff, but

it is different. There are different ways of doing that and stuff, so it will be a combination of things, which is sometimes you will

put capital into things that will grow tangible assets if it gets that kind of return, meaning that it drives higher revenue primarily

that way. It adds either to attendance, a little less likely but possible, but also, that it leads to bringing in more money per person

coming there and things like that. It’s possible. You would think the same way about advertising and stuff, marketing. That would

not show up as a tangible asset and stuff, but it’s an expense just the same way. You spend and then you see what the return on

the investment is, so it’s determined by that.

The growth rate will be determined by the

return on the investment, and it will not be the other way around. We would never say let’s try to grow X amount. We would say let’s

target double digit type returns. Then the question is how much can you put into that? There’s no bias against growing if that growth

is highly profitable in terms of return on capital, in terms of – we talk about economic value, cost of capital, opportunity cost.

People can look up terms like that to understand what we’re talking about, but you have to compound the economic value of something.

That’s what matters, and so if it is generating good returns, then, yeah, it could grow. There’s no doubt.

| Andrew: | Okay. We could head over to investor relations/other questions that people had sent in. We had a few different

questions on this, so I grouped this one into this question. Why do you propose a holding company with no assets? That’s a shell

company. What are you not telling about the purpose of the holding company? Why have it? What would it contain as assets? |

| Geoff: | Yeah. This is just trying to break down the concept that you’re going to have someone, it will be

me, working for free above the level of the parks. The way the company operates now and this is where it gets complicated is the company

operates with layers to some extent and with involvement of the CEO and making decisions at parks and stuff like that, each of the individual

parks, instead of operating them independently. What we’re talking about is just that those things will be operating independently,

and so headquarters will be responsible for spending capital and for paying out dividends and things like that independent of the decisions

that are made at the park level. If it’s easier to think of that as headquarters, that’s fine. It’s not literally true,

I should point out. There is no headquarters at this company now. It’s all remote, and there’s no plan to put in a headquarters.

The hypothetical, the figurative HQ, if you want to think about it that way, fine, yeah. If you want to replace the term holding company

with figurative HQ, yeah, that works, but the decision’s made at the level of the park and the decision’s made at the –

at headquarters will be two different things. That’s what we’re talking about there. |

| Andrew: | I mean, that’s a key component of our plan. Why do you think that is something that is so important? |

| Geoff: | It’s the most important. I mean, look, anyone can look at the history of the company. The company

had a good success with Georgia, and then everything else has been terrible. On a blended rate, it looks pretty good because Georgia was

so great. Over a period of time, you do forge an anchor that’s just insurmountable to get over, and you’re seeing that happen

with the company now. There’s so much assets in just earning nothing. At first, it didn’t happen. You had a small asset in

Missouri. If it’s close to break even, you don’t put too much in over time. It drags down results, but if results are really

good, people barely notice you’re dragging down you results. You know what I mean? |

Then, over time, as you

build that up and put everything outside of Georgia, then you continue to have worse and worse results that way. It’s critically

important to make the decisions for the shareholders that is not based on just being decisions that are made at the park that way, and

the other thing is it’s not so great sometimes for people to making decisions from afar about running the parks and stuff. I don’t

want to get into that, but look, not all the parks have been run super well and some of that may be that the people aren’t there

or don’t have direct responsibility that they share with other people and stuff. Everyone says it’s someone else’s doing

that this is – this was a joint decision or it’s not my fault. It’s this person’s fault and this person’s

and whatever. This will make very clear lines of responsibility, and you’ll be able to judge each person’s performance quite

well.

| Andrew: | Will you talk a bit about the board members that you are proposing? Why do you like each of them? |

| Geoff: | Yeah. Our focus is on capital allocation and investor relations, so we have one nominee who wrote a book

called Capital Allocation, which was about the early days Berkshire Hathaway, the first few decades, and is really interested in

those kinds of topics, historical research on that, a podcast that talks about that, everything, so just a real focus on how companies

have allocated capital well and poorly in the past and how to reallocate capital and all of that. The best person you possibly pick for

capital allocation. Then the other person that we have is someone who’s worked in investor relations and things like that, and that’s

the other area that we’ve talked about. Basically, you’ve got two areas of focus: capital allocation, investor relations,

and we’ve picked someone who we think is one of the absolute best that way. They’re also super high energy people and very

interested in doing these kinds of things, so they’re very engaged and stuff, whereas sometimes you have board members who look

on paper highly qualified but they put in five minutes at each meeting and stuff. You don’t want that and stuff. They weren’t

picked to look good on a proxy thing. They were picked because they’re going to do a great job when they’re in there. |

| Andrew: | That’s a very important concept, a very important point too because that sometimes get lost in all

of these things. |

| Geoff: | Obviously. If we were doing it to just win an election, we would have seven nominees, not four, and we

would have a bunch of old people. They’d have a lot of experience and stuff. The ages would be a lot higher and everything. That’s

not why we picked the people that we did. We picked the people that we did because they’re going to do a great job over the next

few years for shareholders. |

| Andrew: | What is Geoff’s long-term plan for Focused Compounding’s ownership of the corporation assuming

he’s able to execute his intended plan? Does he intend to hold shares for greater than 10 years, or does he intend to sell at some

point? That was the last question we have on investor relations. |

| Geoff: | Okay. I mean, like we said, look, if you’re a public company, then you always have to be responsive

to the needs of the shareholders and stuff. If someone comes along with some huge offer or something to acquire you, then you have to

consider it, so I don’t know. There’s a company, EncoreWire. I think they did a great job, built out a great company and stuff.

They’re selling it. I think that’s probably because they got a great price. That’s what you do when you’re a public

company, and you might not as a private company. I can never promise that a public company will still be public 10 years from now. Yeah,

we own a lot of shares, and we would expect to hold that and stuff. |

I don’t think people should expect

any sort of exit liquidity event, etc. that would be something that Focused Compounding would be doing and is not something that would

affect all of the shareholders. You know what I mean? If you’re asking would Focused Compounding ever sell its shares of Parks!

America, yeah, of course, that’s possible, but it’s probably in a transaction in which people all sell all their shares or

something. You know what I mean? I mean, that’s the most likely thing because you’re a big holder of something that way. In

the past, if we were likely to sell our shares look, I mean, let’s be honest, why would be have been likely to sell our shares?

It’s because there’d be a board and management there that we weren’t too happy with and stuff. If we were to win at

the annual meeting, that would no longer be the case. It does eliminate that need of sometimes you have to vote with your feet. We wouldn’t

have that need anymore, right?

| Andrew: | Mm-hmm. Mm-hmm. All right, well, there’s two points that I’m glad that we went over. The reimbursement

of the proxy fight costs, would we seek that from Parks! America? |

| Geoff: | There was more questions on that? |

| Andrew: | There was a few different questions on that, yeah. Obviously, we knocked that out in the beginning, but

I just think it’s important to reiterate that, no, we are not going to seek to reimburse our costs from Parks! America, right? |

| Andrew: | Then just the concept of, again, Georgia long-term in Phase 2 and what that looks like because I think

there was some misunderstanding about that. |

| Geoff: | Right. I’m working from memory, so I don’t remember exactly what I said in the presentation.

What I think I said is that the most likely outcome would be that we continue to hold Georgia. I think I said that I thought it would

not be a good idea to sell it within a few years, and I think that I said it’s very possible that we could hold onto Georgia indefinitely.

What I was trying to say is, look, obviously, you’re a public company and stuff. If there are offers for a company or whatever,

then you have to consider selling them. Yeah, that’s absolutely true. |

| Andrew: | I think you actually said, if the animal spirits are crazy and somebody makes a very high multiple offer,

then it’s clearly something that you have to consider, yeah… |

| Geoff: | Yeah, I mean, look… |

| Geoff: | When we’re saying why do we pick the directors that we’re picking, why do we – the nominees,

why do we have this focus on investor relations? Isn’t this wasteful to do that. Would we ever consider selling something? It’s

a public company. That’s why. If it doesn’t want to be a public company, that’s fine, but if you’re a public company,

you probably should be doing something in investor relations to explain things to people or else people can be taken advantage of and

stuff and bad things can happen. You need to communicate. |

If you’re a public

company, you need to consider things like selling assets that you have like that, things like returning capital to people, and you also

have to be willing to consider someone coming along and saying I would like to buy everything from you and put you out of a job and stuff.

By saying I’m going to work for a public company, you accept that risk, that you could end up putting yourself out of work doing

that and stuff because you’re getting a good deal for the shareholders, but that’s what the company is run for. If you’re

not going to do that, if you don’t want to do investor relations, if you don’t want to ever consider selling things and stuff,

you should not be a public company. Someone should take the company private or something, and we’re talking about a plan that has

the company continuing to be public, which means that you have to do these sorts of things that are responsible things for a public company

to do. We’ve said we’re going to be super responsive to shareholders, and we’re going to focus on returns to shareholders.

It’s because it’s a public company. Would I run a private company that I got personal enjoyment out of running exactly the

same way? Probably not. That’s not your job when you’re running a public company because you got to take care of all the other

people that are invested.

| Andrew: | Mm-hmm. Mm-hmm. One question that may come up and while we’re talking about it, so this concept

in Phase 2 of continuing to run Georgia and what do you do with that capital that ultimately – if we do what we think we’re

going to do, that’s going to pile up. If you’re going to do – look to maybe purchase other companies in adjacent industries

or in the same industry or maybe perhaps you’re going to return that capital to shareholders, some people may think why would you

even return capital from Phase 1 as opposed to just letting it sit there to go and acquire something else if that’s ultimately what

you want to do? |

| Geoff: | I don’t want to do that, but I don’t not want to do that. What I want to do is earn double

digit type returns for shareholders because it’s a public company. That’s what you do. If I can do that and we can do that

by growing, then I’ll do it by growing. If you can do it by shrinking, you’ll do it by shrinking. If you do it by staying

the same size, you do it by staying the same size. Your job is to get a fair return on the capital for people who are invested in the

company. |

This company has never

paid dividends or done buybacks. They’re not presumably selling the company or whatever. How do people ever get value for the money

that they have tied up in it? You have a responsibility to get a good return that way. I think the disconnect and the thing that I did

not communicate well is we’re not committing to a strategy of shrinking forever, or shrinking and then growing, or shrinking and

staying the same size. We’re committing to a strategy of here’s a threshold of what your returns have to be. If you can’t

accomplish that, you have to pay that money out to shareholders. If you can accomplish it, then no one has ever said that we’re

100% opposed to growth. No one said that we would not invest CapEx into Georgia. Our problem has never been that there is some CapEx in

Georgia. It’s that it doesn’t earn a good return.

I do think that the idea that – initially,

to think of it that it will shrink to grow or something, yeah, that makes sense. That is probably a fair way of looking at it in the initial

phases and stuff. Yeah. I think, speculation beyond that, at that point, you have to go based on what return possibilities there are and

stuff.

| Geoff: | You can’t stay committed to either you will never grow or you will – or you’ll definitely

grow no matter what or something. If you sell for that variable, then you don’t sell for the variable the return on capital, which

is the variable that really matters. What we got to stay focused on is getting a return for everybody in the stock through some method.

Exactly what that method is and stuff, you got to stay flexible on that. You can’t be stubborn on the other stuff and flexible on

the return on capital. You got to be stubborn on the return on capital and flexible on exactly how that’s achieved. |

| Andrew: | Well said. Well said. Any other final parting thoughts, Geoff, on the key… |

| Andrew: | The questions that people sent in, just the overall process. The vote is coming up. I mean, we’re

probably what? Tomorrow I think is actually three weeks out, June 6. |

| Geoff: | Yeah. The next time you’d hear from us if we win at the annual meeting is at the first earnings

call. There’ll be Q&A for the earnings call with us doing it, with me answering questions, and that will happen if the –

if we win at the annual meeting. That’s the next time that you’ll hear from us, and hopefully, we’ll get good questions

then. It’s not too far away anymore. |

| Geoff: | Hope to talk to you then. |

| Andrew: | Sounds good. Sounds good. If anyone has any questions about the proxy, how to vote, just anything pertaining

to that, reach out to our proxy solicitor, John Grau. I will put all of his information in the description below. I want to thank everybody

for listening. I want to thank everybody who sent in questions, and we will see you in the next podcast. Take care. |

Additional Information

and Certain Information Regarding the Participants

On May 7, 2024, Focused Compounding Fund, LP

(“Focused Compounding”) filed a definitive proxy statement (the “Proxy Statement”) with the U.S. Securities and

Exchange Commission (“SEC”) in connection with the 2024 annual meeting of Parks! America, Inc. (“Parks!”), which

is currently scheduled to be held virtually on June 6, 2024 at 10:00 a.m. Eastern Time.

FOCUSED COMPOUNDING STRONGLY ADVISES ALL SHAREHOLDERS

OF PARKS! TO READ THE PROXY STATEMENT BECAUSE IT CONTAINS IMPORTANT INFORMATION. SUCH PROXY STATEMENT IS AVAILABLE AT NO CHARGE ON THE

SEC’S WEB SITE AT HTTP://WWW.SEC.GOV. IN ADDITION, FOCUSED COMPOUNDING WILL PROVIDE COPIES OF THE PROXY STATEMENT

WITHOUT CHARGE UPON REQUEST. REQUESTS FOR COPIES SHOULD BE DIRECTED TO FOCUSED COMPOUNDING’S PROXY SOLICITOR, INVESTORCOM, AT 19

OLD KINGS HIGHWAY S., SUITE 130 DARIEN, CT 06820, PROXY@INVESTOR-COM.COM. SHAREHOLDERS MAY CALL TOLL-FREE: (877) 972-0090. BANKS AND BROKERS

CALL: (203) 972-9300.

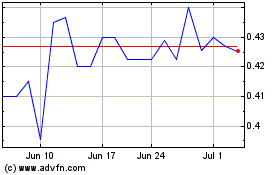

Parks America (PK) (USOTC:PRKA)

Historical Stock Chart

From May 2024 to Jun 2024

Parks America (PK) (USOTC:PRKA)

Historical Stock Chart

From Jun 2023 to Jun 2024