UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14C INFORMATION

Information

Statement Pursuant to Section 14(c) of the Securities Exchange Act of 1934

Check

the appropriate box:

[ ]

Preliminary Information Statement

[ ]

Confidential, for Use of the Commission Only (as permitted by Rule 14c-5(d)(2))

[X]

Definitive Information Statement

Pacific

Ventures Group Inc.

(Exact

Name Of Registrant As Specified In Its Charter)

Payment

of Filing Fee (Check the appropriate box):

[X]

No fee required.

[ ]

Fee computed on table below per Exchange Act Rules 14c-5(g) and 0-11.

1)

Title of each class of securities to which transaction applies:

2)

Aggregate number of securities to which transaction applies:

3)

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which

the filing fee is calculated and state how it was determined):

4)

Proposed maximum aggregate value of transaction:

5)

Total fee paid:

[ ]

Fee paid previously with preliminary materials.

[ ]

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting

fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of

its filing.

1)

Amount Previously Paid:

2)

Form, Schedule or Registration Statement No.:

3)

Filing Party:

4)

Date Filed:

We

Are Not Asking You for a Proxy and You are Requested Not To Send Us a Proxy

INFORMATION

STATEMENT

OF

PACIFIC

VENTURES GROUP, INC.

117

West 9th Street, Suite 316

Los

Angeles, California 90015

310-392-5606

To

Our Stockholders:

This

Notice and the accompanying Information Statement (the “Information Statement”) is being furnished to the stockholders

of Pacific Ventures Group, Inc., a Delaware Corporation (“Pacific Ventures,” the “Company” or the “Registrant”),

in connection with actions taken by the Registrant’s Board of Directors (the “Board”) with the consent of the

holders of a majority of the issued and outstanding shares of common stock, par value $0.0001 (“Common Stock”) of

the Registrant (the “Majority Consenting Stockholders”).The Board and the Majority Consenting Stockholders executed

a joint written consent dated February 7, 2019 (the “Joint Written Consent”), a copy of which is attached as

Exhibit

A

hereto, pursuant to which they authorized and approved the filing of a Certificate of Amendment to the Registrant’s

Certificate of Incorporation with the State of Delaware to increase the authorized capital stock of the Registrant from 510,000,000

shares of capital stock consisting of 500,000,000 shares of Common Stock and 10,000,000 shares of preferred stock, par value $0.001

(“Preferred Stock”) to 910,000,000 shares of capital stock consisting of 900,000,000 shares of Common Stock and 10,000,000

shares of Preferred Stock (the “Authorized Share Increase”). The foregoing is referred to as the “Corporate

Action.”

The

Corporate Action will be evidenced by the filing of the Certificate of Amendment with the Secretary of State of the State

of Delaware, but in no event will become effective earlier than the 20th day after this Information Statement is mailed or furnished

to the stockholders of record as of February 7, 2019 (the “Record Date”), subject to approval by FINRA. The Certificate

of Amendment, a copy of which is attached hereto as

Exhibit B

, was authorized and approved by the Joint Written Consent

of the Board and the Majority Consenting Stockholders, attached as

Exhibit A

hereto.

This

Information Statement is being sent to you for information purposes only and you are not required to take any action.

We

Are Not Asking You for a Proxy and You are Requested Not To Send Us a Proxy

|

By Order of the Board of Directors:

|

|

|

|

|

|

/s/

Shannon Masjedi

|

|

|

Shannon Masjedi

|

|

|

CEO and Director

|

|

|

February

12, 2019

|

|

PACIFIC

VENTURES GROUP, INC.

117

West 9th Street, Suite 316

Los

Angeles, California 90015

310-392-5606

Information

Statement Pursuant to Section 14C of the Securities Exchange Act of 1934

This

Information Statement is being filed by Pacific Ventures with the United States Securities and Exchange Commission (the “SEC”)

on February 7, 2019, in connection with the Joint Written Consent dated February 7, 2019 to amend the Registrant’s Certificate

of Incorporation to increase the authorized capital stock of the Registrant from 510,000,000 shares of capital stock consisting

of 500,000,000 shares of Common Stock and 10,000,000 shares of Preferred Stock to 910,000,000 shares of capital stock consisting

of 900,000,000 shares of Common Stock and 10,000,000 shares of Preferred Stock (the “Authorized Share Increase”).

Pacific

Ventures was incorporated under the laws of the State of Delaware on October 3, 1986, under the name AOA Corporation. On November

12, 1991, the Company changed its name to American Eagle Group, Inc. On October 22, 2012, the Company changed its name to Pacific

Ventures Group, Inc.

The

current structure of Pacific Ventures resulted from a share exchange with Snöbar Holdings, Inc. (“Snöbar”),

which was treated as a reverse merger for accounting purposes. As the result of the Share Exchange, Snöbar Holdings became

Pacific Venture’s wholly owned operating subsidiary and the business of Snöbar Holdings became the Company’s

sole business operations, and Snöbar Holdings’ majority owned subsidiary, MAS Global Distributors, Inc., a California

corporation (“MGD”), became indirect subsidiary of Pacific Ventures.

Snöbar

Holdings was formed under the laws of the State of Delaware on January 7, 2013.

Snöbar

Holdings is the trustor and sole beneficiary of

Snöbar

Trust, a California

trust (“Trust”), which was formed in June 1, 2013. The current trustee that holds legal title to the Trust is Clark

Rutledge, who is the father of Shannon Masjedi, who is the Company’s President, Chief Executive Officer and majority stockholder

.

The Trust owns 100% of the shares of International Production Impex Corporation, a California

corporation (“IPIC”), which was formed on August 2, 2001. IPIC

is in the business of selling alcohol-infused

ice cream and ice-pops and holds all of the rights to the liquor licenses to sell such products

and

trade names “SnöBar”. As such,

the Trust holds all ownership interest of IPIC and its liquor licenses,

permitting IPIC to sell its product to distributors, with all income, expense, gains and losses rolling up to the Trust, of which

Snöbar Holdings is the sole beneficiary. Snöbar Holdings

also owns 99.9% of

the shares of MAS Global Distributors, Inc., a California corporation (“MGD”). MGD is in the business

of selling

and leasing freezers and providing

marketing services. As a result of the foregoing,

Snöbar Holdings

is the primary beneficiary of all assets, liabilities and any income

received from the business of the Trust and IPIC through the Trust and is the parent company of MGD.

MGD,

a majority owned subsidiary of Snöbar Holdings, is the sole marketer for SnöBar ice cream and SnöBar ice pops.

MGD handles all the marketing and promotional aspect for the SnöBar product line.

On

May 1, 2018, Royalty Foods Partners, LLC, a Florida Limited Liability Corporation and a subsidiary of Pacific Ventures Group,

Inc., completed an asset acquisition of San Diego Farmers Outlet, Inc., a California Corporation. San Diego Farmers Outlet provides

primarily restaurants customers in southern California’s three largest counties with quality food and produce and does business

under the name of Farmers Outlet and San Diego Farmers Outlet.

On

September 24, 2018, the Company signed an Asset Purchase Agreement (“Agreement”) to acquire a

Florida-based wholesale distributor for general merchandise (the “Wholesaler”), the closing of which

Agreement is subject to final due diligence.

The

Wholesaler is a registered wholesale distribution company that is involved in the distribution of food, beverages

and general merchandise to retailers, households, hotels, restaurants, mom and pop markets, liquor stores, gas stations and others.

Since 1996, the Wholesaler has provided quality merchandise at discounted prices to local customers in and surrounding

areas on the East Coast with deliveries made on a daily basis through the Wholesaler’s own trucks and

outside trucking companies.

The Wholesaler’s corporate warehouse

and administrative offices are located in Florida and consist of a 50,000 square foot warehouse facility large enough hold

its entire inventory under one roof with multiple docks for loading and unloading merchandise.

If

and when we complete the acquisition pending final due diligence, of which there can be no assurance, our

marketing strategy will include selling our product line to high-end restaurants, resorts, cruise lines and hotels. We plan to

sell our product line in grocery stores such as Kroger, Wal-Mart and others, and thereafter to begin a national marketing program

to all U.S. retailers. Our sales strategy is based on a top-down marketing plan where products are placed with the largest retailer

then trickle down to the smallest seller in each market area.

The

Corporate Action will be evidenced by the filing of the Certificate of Amendment with the Secretary of State of the State of Delaware

but will not become effective until the Registrant receives approval from FINRA of the Authorized Share Increase (the “Effective Date”).

Pursuant

to Rule 14c-2(b) promulgated by the SEC under the Securities Exchange Act of 1934 (the “Exchange Act”), the actions

approved by the Joint Written Consent and Majority Consenting Stockholders cannot become effective until twenty (20) days from

the date of mailing of the Definitive Information Statement to our stockholders.

New

Common Stock certificates will not be issued on the Effective Date. The Registrant’s Common Stock is subject to quotation

on the OTC Pink Market under the symbol PACV.

ACTION

TAKEN BY THE JOINT WRITTEN CONSENT OF THE BOARD OF DIRECTORS AND MAJORITY CONSENTING STOCKHOLDERS OF THE REGISTRANT

ACTION

I

AMENDMENT

TO THE CERTIFICATE OF INCORPORATION TO INCREASE THE AUTHORIZED CAPITAL STOCK

The

Registrant’s Board and the Majority Consenting Stockholders have adopted and approved the Certificate of Amendment to increase

the authorized capital stock from five hundred ten million (510,000,000) shares of capital stock, consisting of five hundred million

(500,000,000) shares of Common Stock and ten million (10,000,000) shares of Preferred Stock to nine hundred and ten million (910,000,000)

shares of capital stock consisting of nine hundred million (900,000,000) shares of Common Stock and ten million (10,000,000) shares

of Preferred Stock.

The

shares of Preferred Stock may be issued in one or more series and the Registrant’s is authorized to fix the powers, preferences,

rights, qualifications, limitations or restrictions of the Preferred Stock and any series thereof pursuant to Section 151 of the

Delaware General Corporation Law (“DGCL”), without further action by the stockholders. Our board of directors can

also increase (but not above the total number of authorized shares of the class) or decrease (but not below the number of shares

then outstanding) the number of shares of any series of preferred stock, without any further vote or action by our stockholders.

Our board of directors may authorize the issuance of preferred stock with voting or conversion rights that could adversely affect

the voting power or other rights of the holders of our common stock or other series of preferred stock. The issuance of preferred

stock, while providing flexibility in connection with possible financings, acquisitions and other corporate purposes, could, among

other things, have the effect of delaying, deferring or preventing a change in our control of our company and might adversely

affect the market price of our common stock and the voting and other rights of the holders of our common stock.

Holders

of the Registrant’s Common Stock do not have preemptive rights to purchase or subscribe for any new shares of upon any future

issuances of Common Stock and the authorization and any subsequent issuance of additional shares of Common Stock will reduce the

current stockholders’ percentage ownership interest in the total outstanding shares of Common Stock. This Amendment will

not alter current stockholders’ relative rights and limitations.

Series

E Convertible Preferred Stock

In

October 2016, the Company designated 1,000,000 shares of preferred stock as Series E Preferred Stock (the “Series E Preferred

Stock”). Under the rights, preferences and privileges of the Series E Preferred Stock, for every share of Series E Preferred

Stock held, the holder thereof has the voting rights equal to 10 shares of common stock. The Series E Preferred Stock is not convertible

into any class of stock of the Company and has no preferences to dividends or liquidation rights. As of the date of this Information

Statement, there were 1,000,000 shares of Series E Preferred Stock issued and outstanding.

Shannon

Masjedi, our Chief Executive Officer and principal common stockholder, is the record and beneficial owner of all of the issued

and outstanding shares of Series E Preferred Stock having ten (10) votes per share on all matters subject to the vote of the Company’s

holders of Common Stock.

11%

Series G Cumulative Redeemable Perpetual Preferred Stock (the “Series G Preferred Stock”)

In

connection with our offering the Series G Preferred Stock, our board of directors has designated 2,000,000 shares of our authorized

preferred stock as 11% Series G Preferred Stock, having the rights and privileges described in this prospectus, by adopting and

filing the certificate of designations with the State of Delaware. Assuming all of the 400,000 shares of Series G Preferred Stock

offered hereunder are issued, we will have available for issuance 1,600,000 authorized but unissued shares of Series G Preferred

Stock. Our board of directors may, without the approval of holders of the Series G Preferred Stock or our common stock, designate

additional series of authorized preferred stock ranking junior to or on parity with the Series G Preferred Stock or designate

additional shares of the Series G Preferred Stock and authorize the issuance of such shares. Designation of preferred stock ranking

senior to the Series G Preferred Stock will require approval of the holders of Series G Preferred Stock, as described below in

“Voting Rights.”

The

Joint Written Consent approving the Certificate of Amendment to the Certificate of Incorporation and the Corporate Action

is attached hereto as

Exhibit A

.

The

Certificate of Amendment to the Registrant’s Certificate of Incorporation that reflects the newly-increased shares of Common

Stock, without change in the number of authorized shares of Preferred Stock, is attached hereto as

Exhibit B

. The increase

in Authorized Capital Stock will become effective upon the filing of the Certificate of Amendment to the Certificate of Incorporation

with the Secretary of State of the State of Delaware, which is expected to occur as soon as is reasonably practicable on or after

the twentieth (20th) day following the mailing of this Information Statement to the Registrant’s stockholders.

Reasons

for Increase in Authorized Capital Stock

In

order to facilitate our ability to raise capital in furtherance of our business plan, we may be expected to issue additional shares

of Common Stock at the discretion of the Board of Directors, from time to time. After the implementation of the increase in the

authorized shares of Common stock from 500,000,000 shares to 900,000,000 shares of Common Stock, the Registrant will have 269,838,107

shares of Common Stock issued and outstanding, 900,000,000 shares of Common Stock authorized and have available 630,161,893 authorized

but unissued shares. We contemplate that we will issue shares of Common Stock, from time to time, to raise equity capital from

the private sale of our securities as well as issuance in connection with acquisitions that we may undertake in the future. Notwithstanding

the foregoing, we have no present plans, nor have we entered into any definitive agreements or understandings, that will require

the issuance of any of the newly-authorized shares of Common Stock. While we previously announced a contemplated plan to issue

shares of Common Stock in connection with an acquisition of a Florida-based wholesale distributor for general merchandise, this

potential acquisition is still in the due diligence stage and we cannot estimate when or if we will close this acquisition.

Our

Board of Directors and the Majority Consenting Stockholders have determined that it is in the best interests of the Registrant

and all our stockholders to have available additional authorized but unissued shares of Common Stock. As a result of the increase

in Authorized Capital Stock, the Registrant will be able to issue Common Stock, from time to time, as may be required for proper

business purposes, such as raising additional capital for ongoing operations, establishing strategic relationships with corporate

partners, acquiring or investing in complementary businesses or products and/or having shares available for employee stock option

plans or for hiring and retaining new and existing employees and consultants.

SECURITY

OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS.

The

following table lists the number of shares of Common Stock of our Company and, with respect to Shannon Masjedi, our Chief Executive

Officer and principal stockholder, shares of Series E Preferred Stock, as of February 7, 2019, the Record Date, and as of the

date of this Information Statement, that are beneficially owned by (i) each person or entity known to our Company to be the beneficial

owner of more than 5% of the outstanding Common Stock; (ii) each officer and director of our Company; and (iii) all officers and

directors as a group. Information relating to beneficial ownership of Common Stock and voting Preferred Stock by our principal

stockholders and management is based upon information furnished by each person using “beneficial ownership” concepts

under the rules of the Securities and Exchange Commission. Under these rules, a person is deemed to be a beneficial owner of a

security if that person has or shares voting power, which includes the power to vote or direct the voting of the security, or

investment power, which includes the power to vote or direct the voting of the security. The person is also deemed to be a beneficial

owner of any security of which that person has a right to acquire beneficial ownership within sixty (60) days. Under the rules

of the SEC, more than one person may be deemed to be a beneficial owner of the same securities, and a person may be deemed to

be a beneficial owner of securities as to which he/she may not have any pecuniary beneficial interest. Except as noted below,

each person has sole voting and investment power. Beneficial ownership is determined in accordance with the rules of the SEC and

includes voting or investment power with respect to the shares. Except as otherwise indicated, and subject to applicable community

property laws, the persons named in the table have sole voting and investment power with respect to all shares of our common stock

held by them.

|

Name of Stockholder

|

|

Number of Shares of Common Stock

|

|

|

Number of Votes of Series E Preferred Stockholder

|

|

|

Number of Votes Held Stockholders

|

|

|

Percentage of Voting Equity (1)(3)

|

|

|

Shannon Masjedi (2)

|

|

|

40,000,000

|

|

|

|

10,000,000

|

|

|

|

50,000,000

|

|

|

|

14.29

|

%

|

|

Shannon Masjedi TTEE of ACD

Trust (3)

|

|

|

13,726,901

|

|

|

|

-

|

|

|

|

13,726,901

|

|

|

|

5.09

|

%

|

|

ACD Trust (4)

|

|

|

51,500,000

|

|

|

|

-

|

|

|

|

51,500,000

|

|

|

|

19.09

|

%

|

|

Azita Davidyan (5)

|

|

|

16,035,000

|

|

|

|

-

|

|

|

|

16,035,000

|

|

|

|

5.94

|

%

|

|

Marc Shenkman (6)

|

|

|

11,414,000

|

|

|

|

-

|

|

|

|

11,414,000

|

|

|

|

4.08

|

%

|

|

All directors and officers as a group

(2 persons) (7)

|

|

|

51,414,000

|

|

|

|

10,000,000

|

|

|

|

61,414,000

|

|

|

|

21.94

|

%

|

|

Total

|

|

|

132,675,901

|

|

|

|

10,000,000

|

|

|

|

142,675,901

|

|

|

|

47.41

|

%

|

|

(1)

|

Based

upon 269,838,107 shares of Common Stock issued and outstanding as of the Record Date of February 7, 2019, except with respect

to Shannon Masjedi, whose percentage also reflects the 10,000,000 votes attributable to the 1 million shares of Series E Preferred

Stock and is based on 279,838,107 shares of voting capital stock.

|

|

(2)

|

Shannon

Masjedi, our Chief Executive Officer and principal common stockholder, is the record and beneficial owner of all of the issued

and outstanding shares of Series E Preferred Stock having ten (10) votes per share on all matters subject to the vote of the

Company’s holders of Common Stock.

|

|

(3)

|

Represents

of 13,726,901 shares of Common Stock owned by the Shannon Masjedi TTEE of ACD Trust of which Shannon Masjedi is the Trustee

and holds voting and investment power over.

|

|

(4)

|

Represents

of 51,500,000 shares of Common Stock owned by ACD Trust. Shannon Masjedi holds voting and investment power over these shares.

As such, Shannon Masjedi has 38.47% of the voting control of the issued and outstanding stock when the 10,000,000 shares of

voting Series E Preferred Stock are added to the existing 40,000,000 shares of common stock held in her names and 13,726,901

held in the Shannon Masjedi TTEE of ACD Trust subject to her control, for an aggregate total of 115,226,901or 41.18% of the

outstanding voting capital stock.

|

|

(5)

|

Does

not include 12,050,000 shares of Common Stock owned by Classic Beverage Corporation, a Nevada corporation, the control person

of which is Azita Davidyan, a resident of Israel. Mr. Davidyan disclaims beneficial ownership of the share owned by Classic

Beverage Corporation.

|

|

(6)

|

Represents

1,414,000 shares of our Common Stock owned of record and beneficially by Mr. Shenkman, and 10,000,000 shares of our Common

Stock owned of record by The Entrust Group f/b/o Marc Shenkman.

|

|

(7)

|

Includes

shares of Common Stock and Series E Preferred Stock owned by our officers and directors as a group (2 persons).

|

ADDITIONAL

INFORMATION

We

are subject to the disclosure requirements of the Securities Exchange Act of 1934, as amended, and in accordance therewith, file

reports, information statements and other information, including annual and quarterly reports on Form 10-K and 10-Q, respectively,

with the Securities and Exchange Commission (the “SEC”). Reports and other information filed by the Company can be

inspected and copied at the public reference facilities maintained by the SEC at 100 F Street, N.E., Washington, DC 20549.

Copies of such material can also be obtained upon written request addressed to the SEC, Public Reference Section, 100 F Street,

N.E., Washington, D.C. 20549, at prescribed rates. In addition, the SEC maintains a web site on the Internet (http://www.sec.gov)

that contains reports, information statements and other information regarding issuers that file electronically with the SEC through

the Electronic Data Gathering, Analysis and Retrieval System.

This

Information Statement is provided to the holder of Common Stock of the Company only for information purposes in connection with

the Corporate Action, pursuant to and in accordance with Rule 14c-2 of the Exchange Act. Please carefully read this Information

Statement.

By

order of the Board of Directors of Pacific Ventures Corp.

|

/s/

Shannon Masjedi

|

|

|

Shannon

Masjedi

|

|

|

Chief

Executive Officer and Director

|

|

February

12, 2019

Exhibit

A

JOINT

WRITTEN CONSENT

OF

THE

BOARD

OF DIRECTORS

AND

MAJORITY

CONSENTING STOCKHOLDERS

OF

PACIFIC

VENTURES GROUP, INC.

The

undersigned, being all of the members of the Board of Directors of Pacific Ventures Group, Inc., a Delaware corporation (the

“Corporation”), acting together with the written consent of the holders (the “Majority Consenting

Stockholders”) of a majority of the outstanding voting shares of the Corporation’s common stock, par value $0.001

(the “Common Stock”) and Series E Preferred Stock, par value $0.001, acting pursuant to the authority granted by

the provisions of Section 228 of Title 8 of the DGCL do hereby adopt the following resolutions as of this 7th day of

February 2019 (the “Joint Written Consent”).

WHEREAS,

the Corporation has received the written consent of the Majority Consenting Stockholders, a copy of which is attached to this

Joint Written Consent of the Corporation’s Board of Directors and Majority Consenting Stockholders.

NOW,

THEREFORE, BE IT RESOLVED as follows:

RESOLVED,

that the Corporation file: (i) an Information Statement on Schedule 14C with the SEC with respect increase the authorized capital

stock from five hundred ten million (510,000,000) shares of capital stock, consisting of five hundred million (500,000,000) shares

of Common Stock and ten million (10,000,000) shares of Preferred Stock to nine hundred and ten million (910,000,000) shares of

capital stock consisting of nine hundred million (900,000,000) shares of Common Stock and ten million (10,000,000) shares of Preferred

Stock; and (ii) to implement the Authorized Share Increase within ninety (90) days of the filing of the Definitive Information

Statement.

FURTHER

RESOLVED, that this Joint Written Consent of the Board of Directors and Majority Consenting Stockholders shall be added to the

corporate records of this Corporation and made a part thereof, and the resolutions set forth above shall have the same force and

effect as if adopted at a meeting duly noticed and held by the Board of Directors and the Majority Consenting Stockholders of

this Corporation; and

FURTHER

RESOLVED, that this Joint Written Consent may be executed in counterparts and with facsimile signatures with the effect as if

all parties hereto had executed the same document, all counterparts of which shall be construed together and shall constitute

a single Joint Written Consent; and

FURTHER

RESOLVED, that pursuant to the provisions of the DGCL, based upon the 269,838,107 issued and outstanding shares of Common Stock

and 1 million shares of Series E Preferred Stock having ten (10) votes per share, the affirmative vote of 139,919,055 shares of

voting capital stock are required to approve the Corporate Action, and pursuant to this Joint Written Consent of the Corporation’s

Board of Directors and the Majority Consenting Stockholders of the Corporation, the Corporate Action has received the affirmative

vote of holders of 154,725,901 shares of voting capital stock and have hereby authorized, ratified and approved the forgoing actions

and thereby direct that this Joint Written Consent of the Board of Directors and Majority Stockholder be filed with the minutes

of the meetings of the Corporation.

The

number of shares of Corporation’s voting capital stock issued and outstanding as of February 7, 2019 (the “Record

Date”) are: (i) 269,838,107 shares of Common Stock; and (ii) 1,000,000 shares of Series E Preferred Stock having ten (10)

votes per share or 10,000,000 votes, collectively representing a total 279,838,107 shares of voting capital stock. The number

of shares of the Corporation’s voting capital stock, including shares of Common Stock and Series E Preferred Stock owned

of record and beneficially by the Majority Consenting Stockholders and consenting to the adoption of these resolutions, total

154,725,901 shares of voting capital stock, representing 55.29% of the total voting capital stock of the Corporation.

FURTHER

RESOLVED, that any action or actions heretofore taken by any officer of the Corporation for and on behalf of the Corporation in

connection with the foregoing resolutions are hereby ratified and approved as duly authorized actions of the Corporation. This

Joint Written Consent shall be added to the corporate records of the Corporation and made a part thereof, and the resolutions

set forth above shall have the same force and effect as if adopted at a meeting duly noticed and held by the Corporation. This

Joint Written Consent may be executed in counterparts and with facsimile signatures with the effect as if all parties hereto had

executed the same document. All counterparts shall be construed together and shall constitute a single Joint Written Consent.

|

By

Order of the Board of Directors:

|

|

|

|

|

|

|

/s/

Shannon Masjedi

|

|

|

Name:

|

Shannon

Masjedi

|

|

|

Title:

|

Chief

Executive Officer and Director

|

|

|

|

|

|

|

/s/

Marc Shenkman

|

|

|

Name:

|

Marc

Shenkman

|

|

|

Title:

|

Chairman

of the Board

|

|

|

|

|

|

|

Los

Angeles, California

|

|

|

February

7, 2019

|

|

TABLE

OF MAJORITY CONSENTING STOCKHOLDERS

|

Name of Stockholder

|

|

Number of Shares of Common Stock

|

|

|

Number of Votes of Series E Preferred Stockholder

|

|

|

Number of Votes Held Stockholders

|

|

|

Percentage of Voting Equity (1)(3)

|

|

Shannon

Masjedi (2)

/s/ Shannon Masjedi

|

|

|

40,000,000

|

|

|

|

10,000,000

|

|

|

|

50,000,000

|

|

|

|

17.87

|

%

|

Shannon

Masjedi TTEE of ACD Trust (3)

/s/ Shannon Masjedi

|

|

|

13,726,901

|

|

|

|

-

|

|

|

|

13,726,901

|

|

|

|

4.90

|

%

|

ACD Trust

(4)

/s/ Shannon Masjedi

|

|

|

51,500,000

|

|

|

|

-

|

|

|

|

51,500,000

|

|

|

|

18.40

|

%

|

Azita

Davidyan

/s/ Azita Davidyan

|

|

|

16,035,000

|

|

|

|

-

|

|

|

|

16,035,000

|

|

|

|

5.73

|

%

|

Classic

Beverage Corporation (5)

/s/ Azita Davidyan

|

|

|

12,050,000

|

|

|

|

-

|

|

|

|

12,050,000

|

|

|

|

4.30

|

%

|

Marc

Shenkman (6)

/s/ Marc Shenkman

|

|

|

11,414,000

|

|

|

|

-

|

|

|

|

11,414,000

|

|

|

|

4.08

|

%

|

|

Total

|

|

|

144,725,901

|

|

|

|

10,000,000

|

|

|

|

154,725,901

|

|

|

|

55.29

|

%

|

|

(1)

|

Based

upon 269,838,107 shares of Common Stock issued and outstanding as of the Record Date of February 7, 2019, except with respect

to Shannon Masjedi, whose percentage also reflects the 10,000,000 votes attributable to the 1 million shares of Series E Preferred

Stock and is based on 279,838,107 shares of voting capital stock.

|

|

(2)

|

Shannon

Masjedi, our Chief Executive Officer and principal common stockholder, is the record and beneficial owner of all of the issued

and outstanding shares of Series E Preferred Stock having ten (10) votes per share on all matters subject to the vote of the

Company’s holders of Common Stock.

|

|

(3)

|

Represents

of 13,726,901 shares of Common Stock owned by the Shannon Masjedi TTEE of ACD Trust of which Shannon Masjedi is the Trustee

and holds voting and investment power over.

|

|

(4)

|

Represents

of 51,500,000 shares of Common Stock owned by ACD Trust. Shannon Masjedi holds voting and investment power over these shares.

As such, Shannon Masjedi has 38.47% of the voting control of the issued and outstanding stock when the 10,000,000 shares of

voting Series E Preferred Stock are added to the existing 40,000,000 shares of common stock held in her names and 13,726,901

held in the Shannon Masjedi TTEE of ACD Trust subject to her control, for an aggregate total of 115,226,901or 41.18% of the

outstanding voting capital stock.

|

|

(5)

|

Classic

Beverage Corporation is organized under the laws of the State of Nevada. The control person of Classic Beverage Corporation

is Azita Davidyan, a resident of Israel. The shares of Common Stock owned by Classic Beverage Corporation do not include the

16,035,000 shares of Common Stock owned of record and beneficially by Azita Davidyan.

|

|

(6)

|

Represents

1,414,000 shares of our Common Stock owned of record and beneficially by Mr. Shenkman, and 10,000,000 shares of our Common

Stock owned of record by The Entrust Group f/b/o Marc Shenkman, Chairman.

|

Exhibit

B

STATE

OF DELAWARE

CERTIFICATE

OF AMENDMENT

OF

CERTIFICATE

OF INCORPORATION

Pacific

Ventures Group, Inc., a Registrant organized and existing under and by virtue of the General Corporation Law of the State of Delaware

does hereby certify:

FIRST:

That at a meeting of the Board of Directors of Pacific Ventures Group, Inc. (the “Registrant”) resolutions were

duly adopted setting forth a proposed amendment of the Certificate of Incorporation of said Registrant, declaring said amendment

to be advisable and based upon the written consent of stockholders of said Registrant holding a majority of the outstanding shares

of common stock for consideration thereof. The resolution setting forth the proposed amendment is as follows:

RESOLVED,

that the Certificate of Incorporation of this Registrant be amended by changing the Article thereof numbered “FOURTH”

so that, as amended, said Article shall be and read as follows:

“FOURTH:

A.

Common Stock and Preferred Stock

. The Corporation is authorized to issue a total of 910,000,000 shares of capital

stock, consisting of 10,000,000 shares of preferred stock, $0.001 par value per share (hereinafter referred to as the “Preferred

Stock”), 1,000,000 of which shall be designated Series E Preferred Stock (the “Series E Preferred Stock”), and

900,000,000 shares of common stock, $0.001 par value per share (hereinafter referred to as the “Common Stock”). Shares

of any class of stock may be issued without shareholder action, from time to time in one or more series as may from time to time

be determined by the board of directors.

Board

of Directors is expressly authorized at any time, and from time to time, to provide for the issuance of shares of Preferred Stock

in one or more series, with such voting powers, full or limited, or without voting powers and with such designations, preferences

and relative, participating, optional or other special rights, qualifications, limitations or restrictions thereof, as shall be

stated and expressed in the resolution or resolutions providing for the issue thereof adopted by the Board of Directors and as

are not stated and expressed in this Fourth Amended and Restated Certificate of Incorporation, or any amendment thereto, including

(but without limiting the generality of the foregoing) the following:

(i)

the designation of such series;

(ii)

the dividend rate of such series, the conditions and dates upon which such dividends shall be payable, the preference or relation

which such dividends shall bear to the dividends payable on any other class or classes or of any other series of capital stock,

whether such dividends shall be cumulative or noncumulative, and whether such dividends may be paid in shares of any class or

series of capital stock or other securities of the Corporation;

(iii)

whether the shares of such series shall be subject to redemption by the Corporation, and, if made subject to such redemption,

the times, prices and other terms and conditions of such redemption;

(iv)

whether or not the shares of such series shall be convertible into or exchangeable for shares of any other class or classes or

series of capital stock or other securities of the Corporation, and, if provision be made for conversion or exchange, the times,

prices, rates, adjustment and other terms and conditions of such conversion or exchange;

(v)

the extent, if any, to which the holders of the shares of such series shall be entitled to vote, as a class or otherwise, with

respect to the election of the directors or otherwise, and the number of votes to which the holder of each share of such series

shall be entitled;

(vi)

the restrictions, if any, on the issue or reissue of any additional shares or series of Preferred Stock; and

(vii)

the rights of the holders of the shares of such series upon the dissolution of, or upon the distribution of assets of, the Corporation.

B.

Rights, Preferences and Restrictions of Series E Preferred Stock

. The relative rights, preferences, privileges, limitations

and restrictions granted to or imposed on the Series E Preferred Stock or the holders thereof are as follows:

(i)

Redemption Rights

. The Series E Preferred Stock shall not be redeemable by the Corporation.

(ii)

Dividends and Liquidation Rights

. The Series E Preferred Stock shall have no Corporation. preferences as to dividends or

liquidation rights.

(iii)

Voting Rights

. With respect to all matters upon which the Corporation’s stockholders are entitled to vote or to which

the Corporation’s stockholders are entitled to give consent, the holder of the outstanding shares of the Common Stock and

the holders of the outstanding shares of the Series E Preferred Stock shall, except as otherwise required by law, vote together

as a single class, and every holder of outstanding shares of the Common Stock shall be entitled to cast thereon one (1) vote in

person or by proxy for each share of the Common Stock standing in his name, and every holder of the outstanding shares of the

Series E Preferred Stock shall be entitled to cast thereon ten (10) votes in person or by proxy for each share of the Series E

Preferred Stock standing in his, her or its name. With respect to any proposed amendment to the Certificate of Incorporation which

would change the powers, preferences, relative voting power or special rights of the shares of the Common Stock or the Series

E Preferred Stock so as to affect either class adversely relative to the other, the approval of a majority of the votes entitled

to be cast by the holders of the class adversely affected by the proposed amendment, voting separately as a class, shall be obtained

in addition to the approval of a majority of the votes entitled to be cast by the holders of the Common Stock and the Series E

Preferred Stock voting together as a single class as hereinbefore provided.

(iv)

Conversion Rights

. The Series E Preferred Stock shall not be convertible into any other class of stock of the Corporation.

(v)

Most or Stolen Certificates

. Upon receipt by the Corporation of evidence reasonably satisfactory to the Corporation of

the loss, theft, destruction or mutilation of any Preferred Stock Certificates representing the Series E Preferred Stock, and,

in the case of loss, theft or destruction, of an indemnification undertaking by the holder to the Corporation in customary form

(accompanied by the posting of a standard indemnity bond if so requested by the Corporation) and, in the case of mutilation, upon

surrender and cancellation of the Series E Preferred Stock Certificate(s), the Corporation shall execute and deliver new preferred

stock certificate(s) of like tenor and date.

(vi)

Transfer of Preferred Shares

. A holder of shares of the Series E Preferred Stock may assign some or all of the Preferred

Shares and the accompanying rights hereunder held by such holder without the consent of the Corporation; provided that such assignment

is in compliance with applicable securities laws.

(vii)

Preferred Share Register

. The Corporation shall maintain at its principal executive offices (or such other office or agency

of the Corporation as it may designate by notice to the holders of the Series E Preferred Stock), a register for the Series E

Preferred Stock, in which the Corporation shall record the name and address of the persons in whose name the shares of the Series

E Preferred Stock have been issued, as well as the name and address of each transferee. The Corporation may treat the person in

whose name any shares of the Series E Preferred Stock is registered on the register as the owner and holder thereof for all purposes,

notwithstanding any notice to the contrary, but in all events recognizing any properly made transfers.

SECOND:

That thereafter, pursuant to resolution of its Board of Directors, and based upon the written consent of holders of a majority

of the shares of common of said Registrant in accordance with Section 228 of the General Corporation Law of the State of Delaware,

the necessary number of shares as required by statute, were voted in favor of the amendment.

THIRD:

That said amendment was duly adopted in accordance with the provisions of Section 242 of the General Corporation Law of the

State of Delaware.

IN

WITNESS WHEREOF, said Registrant has caused this certificate to be signed this 7th day of February 2019.

|

By:

|

/s/

Shannon Masjedi

|

|

|

Name:

|

Shannon

Masjedi

|

|

|

Title:

|

CEO

and Director

|

|

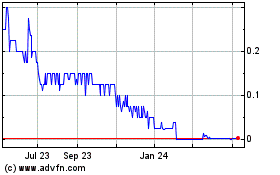

Pacific Ventures (CE) (USOTC:PACV)

Historical Stock Chart

From Jan 2025 to Feb 2025

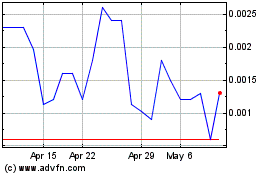

Pacific Ventures (CE) (USOTC:PACV)

Historical Stock Chart

From Feb 2024 to Feb 2025