U.S. SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C.20549

FORM 8-K/A

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

August 1, 2013

ONCOLOGIX TECH, INC.

(Name of Small Business Issuer as Specified

in Its Charter)

Nevada 0-15482 86-1006416

(State or other jurisdiction of (Commission

File Number) (I.R.S. Employer

Organization or Incorporation) Identification

Number)

1604 West Pinhook Drive

Suite # 200

Lafayette, Louisiana 70508

(Address of principal executive offices)

(616) 977-9933

(Issuer’s telephone number)

Check the appropriate box below if the Form 8-K is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under

the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under

the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e-4(c))

Explanatory Note – This current report

on Form 8-K is being amended to include the financial statements and Pro Forma financial information required by Regulation S-K.

ITEM 9.01 – Financial Statements and

Exhibits

| (a) | Financial Statements of Business Acquired |

Angels of Mercy, Inc.

Financial Statements

Year Ended December 31, 2012

Contents

| Report of Seale & Beers, CPAs, Independent Registered Public Accounting Firm |

F-1 |

| |

|

| Audited Financial Statements |

|

| |

|

| Balance Sheets |

F-3 |

| Statements of Operations |

F-4 |

| Statements of Changes in Stockholders' Deficit |

F-5 |

| Statements of Cash Flows |

F-6 |

| Notes to Financial Statements |

F-7 |

PCAOB Registered Auditors – www.sealebeers.com

REPORT OF INDEPENDENT REGISTERED PUBLIC

ACCOUNTING FIRM

To the Board of Directors and Stockholders

of

Angels of Mercy, Inc.

We have audited the accompanying balance sheets

of Angels of Mercy, Inc. as of December 31, 2012, and the related statements of income, stockholders’ equity (deficit), and

cash flows for the period ended December 31, 2012. Angels of Mercy, Inc.’s management is responsible for these financial

statements. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with

the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform

the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. The company

is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audit included

consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the

circumstances, but not for the purpose of expressing an opinion on the effectiveness of the company’s internal control over

financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting

the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made

by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable

basis for our opinion.

In our opinion, the financial statements referred

to above present fairly, in all material respects, the financial position of Angels of Mercy, Inc. as of December 31, 2012, and

the related statements of income, stockholders’ equity (deficit), and cash flows for the year ended December 31, 2012, in

conformity with accounting principles generally accepted in the United States of America.

/s/ Seale and Beers, CPAs

Seale and Beers, CPAs

Las Vegas, Nevada

December 18, 2014

ANGELS OF MERCY, INC.

BALANCE SHEET

AS OF DECEMBER 31, 2012

| | |

|

| | |

December 31, |

| | |

2012 |

| ASSETS |

| |

|

| Current Assets: | |

| | |

| Cash and cash equivalents | |

$ | 18,420 | |

| Accounts receivable (net of allowance of $3,000) | |

| 225,593 | |

| Inventory | |

| — | |

| Prepaid expenses and other current assets | |

| (75 | ) |

| | |

| | |

| Total current assets | |

| 243,938 | |

| | |

| | |

| Property and equipment (net of accumulated depreciation | |

| | |

| of $67,508) | |

| 30,079 | |

| | |

| | |

| Total assets | |

$ | 274,017 | |

| | |

| | |

| LIABILITIES AND STOCKHOLDERS' EQUITY | |

| | |

| Current liabilities: | |

| | |

| Line of credit payable | |

$ | 22,100 | |

| Accounts payable and accrued expenses | |

| 86,510 | |

| | |

| | |

| Total current liabilities | |

| 108,610 | |

| | |

| | |

| | |

| | |

| Total liabilities | |

| 108,610 | |

| | |

| | |

| Stockholders' equity: | |

| | |

| Common stock, par value $1.00 per share; 1,000 shares authorized; | |

| | |

| 1,000 and 1,000 shares issued and outstanding at | |

| | |

| December 31, 2012 | |

| 1,000 | |

| Additional paid-in capital | |

| 14,368 | |

| Accumulated earnings | |

| 150,039 | |

| | |

| | |

| Total stockholders' equity | |

| 165,407 | |

| | |

| | |

| Total liabilities and stockholders' equity | |

| 274,017 | |

See accompanying notes to financial statements.

ANGELS OF MERCY, INC.

STATEMENTS OF OPERATIONS

FOR THE YEAR ENDED DECEMBER 31, 2012

| | |

|

| | |

For the Year Ended |

| | |

December 31, |

| | |

2012 |

| | |

| | |

| Revenues | |

$ | 2,948,677 | |

| | |

| | |

| Cost of revenues | |

| 2,501,430 | |

| | |

| | |

| Gross profit | |

| 447,247 | |

| | |

| | |

| Operating expenses: | |

| | |

| General and administrative | |

| 484,779 | |

| Depreciation and amortization | |

| 1,868 | |

| | |

| | |

| Total operating expenses | |

| 486,647 | |

| | |

| | |

| Loss from operations | |

| (39,400 | ) |

| | |

| | |

| Other income (expense): | |

| | |

| Interest income | |

| 114 | |

| Interest and finance charges | |

| (1,437 | ) |

| | |

| | |

| Total other income (expense) | |

| (1,323 | ) |

| | |

| | |

| Net loss before income taxes | |

| (40,723 | ) |

| | |

| | |

| Income taxes | |

| — | |

| | |

| | |

| Net loss attributable to common shareholders | |

$ | (40,723 | ) |

| | |

| | |

| Loss per common share, basic and diluted: | |

$ | (40.72 | ) |

| | |

| | |

| Weighted average number of shares | |

| | |

| outstanding - basic and diluted | |

| 1,000 | |

See accompanying notes to

financial statements.

ANGELS OF MERCY, INC.

STATEMENTS OF CHANGES IN STOCKHOLDERS’

EQUITY

FOR THE PERIOD JANUARY 1, 2012 THROUGH DECEMBER

31, 2012

| | |

| |

| |

| |

| |

|

| | |

| Common Stock | | |

| Additional Paid-in | | |

| Accumulated Earnings |

| |

|

|

|

| | |

| Shares | | |

| Amount | | |

| Capital | | |

| (Deficit) | | |

| Total | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance, December 31, 2011 | |

| 1,000 | | |

$ | 1,000 | | |

$ | 14,368 | | |

$ | 190,762 | | |

$ | 206,130 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net loss | |

| — | | |

| — | | |

| — | | |

| (40,723 | ) | |

| (40,723 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance, December 31, 2012 | |

| 1,000 | | |

$ | 1,000 | | |

$ | 14,368 | | |

$ | 150,039 | | |

$ | 165,407 | |

See accompanying notes to financial statements

ANGELS OF MERCY, INC.

STATEMENTS OF CASH FLOWS

FOR THE YEAR ENDED DECEMBER 31, 2012

| | |

|

| | |

For the Year Ended |

| | |

December 31, |

| | |

2012 |

| Operating activities: | |

| | |

| Net income | |

$ | (40,723 | ) |

| | |

| | |

| Adjustments to reconcile net loss to net cash used | |

| | |

| in operating activities: | |

| | |

| Depreciation and amortization | |

| 1,868 | |

| | |

| | |

| Changes in operating assets and liabilities: | |

| | |

| Accounts receivable | |

| (118,765 | ) |

| Prepaid expenses and other current assets | |

| 15,986 | |

| Accounts payable | |

| 86,510 | |

| | |

| | |

| Net cash used in operating activities | |

| (55,124 | ) |

| | |

| | |

| Investing activities: | |

| | |

| Purchase of property and equipment | |

| — | |

| | |

| | |

| Net cash used in investing activities | |

| — | |

| | |

| | |

| Financing activities: | |

| | |

| Repayment of notes payable | |

| (24,412 | ) |

| | |

| | |

| Net cash provided by financing activities | |

| (24,412 | ) |

| | |

| | |

| Net increase (decrease) in cash and cash equivalents | |

| (79,536 | ) |

| | |

| | |

| Cash and cash equivalents, beginning of period | |

| 97,956 | |

| | |

| | |

| Cash and cash equivalents, end of period | |

$ | 18,420 | |

See accompanying notes to financial statements.

ANGELS OF MERCY, INC.

NOTES TO FINANCIAL STATEMENTS

NOTE 1 — DESCRIPTION OF THE COMPANY

General

Angels of Mercy provides non-medical, Personal

Care Attendant (PCA) services, Supervised Independent Living (SIL), Long-Term Senior Care, and other approved programs performed

by a trained caregiver that will meet the health service needs of beneficiaries whose disabilities preclude the performance of

certain independent living skills related to the activities of daily living (ADL).

PCA services that are reimbursed to AOM under

the waiver:

| · | Assisting with personal hygiene, dressing, bathing, and grooming |

| · | Performing or assisting in the performance of tasks related to maintaining a safe, healthy and

stable living environment such as: |

| · | Light cleaning tasks in areas of the home used by the recipient, |

| · | Shopping for such items as health and hygiene products, clothing and groceries, |

| · | Performing activities of daily living inside and outside of the home which require attendant care, |

| · | Assisting with or performing beneficiary laundry care chores |

| · | Assisting with bladder and/or bowel requirements, including bed pan routines |

| · | If indicated on the Plan of Care, assisting beneficiary to clinics, physician’s offices,

and other appointments, |

| · | Assisting the beneficiary to receive any service specified in the written Plan of Care, including

leisure skills development, |

| · | Assisting in activities which would enhance the individual employability and improve and enhance

the beneficiary’s quality of life. |

Supervised Independent Living (SIL) is an alternative

program for mentally challenged, developmentally disabled or physically disabled individuals. AOM provides the following personal

health services:

| · | Assistance with safety procedures and emergency contacts within the home environment |

| · | Counseling during the transition period |

| · | Assistance in meeting needs with medical management, employment, financial, budgeting, household

management, personal care, recreation and transportation |

| · | Accessibility to community resources |

| · | Independence and personal growth |

| · | Freedom from abuse, neglect and exploitation |

Services and Fee Structure

AOM is reimbursed for each approved “Unit

of Service” provided, as determined by the Health Care Financing Administration (HCFA), the Department of Social Services

and based upon a detailed Case Management, Plan of Care for each beneficiary. A unit of service for PCA services will be one-half

hour. At least fifteen (15) minutes of service must be provided to the individual in order for AOM to bill for a unit of service.

A maximum of 1,825 hours (3,650 half-hour units) per beneficiary, per year can be billed under the Medicaid waiver program.

Long Term Care (LTC)

- Older population or anyone whose disability occurred after their 21st birthday. Reimbursement rate: $2.89/quarter hour

Early Periodic Screening

Diagnostic Treatment (EPSDT) – This service is provided from 3 years of age or older until 21 years of age. Reimbursement

rate: $2.53/quarter hour

Elderly and Young

Adult Waiver (EDA) – This service is provided by age 22 and normally up through death of the client. Reimbursement rate:

$2.83/quarter hour

New Opportunity Waiver

(NOW) The longest running Medicaid Waiver program and has the most resources available for the clients.

Several programs within

the NOW- Title 19.

Reimbursement rates:

IFS day program: $3.61/quarter

hour

IFS night: $2.17quarter

hour

IFS day x2: $2.72/quarter

hour

IFS day x3: 2.36/quarter

hour

IFS night x2: $1.52/quarter

hour

Supervised Independent

Living (SIL) - Clients live independently but with supervision and assistance from AOM trained staff. Activities of Daily Living

skills are taught by staff to clients. Some clients go to day programs, some are employed, and some clients receive 24 hours/day

personal care services. Reimbursement rate: 16.93/hour/daily care 24/7.

NOTE 2 — SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

BASIS OF PRESENTATION

In the opinion of management,

the accompanying balance sheets and related statements of income, cash flows, and stockholders' equity include all adjustments,

consisting only of normal recurring items, necessary for their fair presentation in conformity with accounting principles generally

accepted in the United States of America ("U.S. GAAP"). Preparing financial statements requires management to make estimates

and assumptions that affect the reported amounts of assets, liabilities, revenue, and expenses. Actual results and outcomes may

differ from management's estimates and assumptions. Interim results are not necessarily indicative of results for a full year.

USE OF ESTIMATES

The preparation of financial

statements in accordance with accounting principles generally accepted in the United States of America requires management to make

estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities

at the date of the financial statements and the reportable amounts of revenues and expenses during the reporting period. Actual

results could differ from those estimates.

REVENUE RECOGNITION

Revenue is recognized by

the Company when all the following criteria are met: persuasive evidence of an arrangement exists; delivery has occurred; the seller’s

price to the buyer is fixed and determinable; and collectability is reasonably assured. Currently the company does not have products

to sell.

CASH AND CASH EQUIVALENTS

The Company considers

all highly liquid instruments, with an initial maturity of three (3) months or less to be cash equivalents.

ACCOUNTS RECEIVABLE

Receivables are generally

collected within 14 days of billing to the State of Louisiana. Rejected claims are and maybe resubmitted up to a year following

the initial billing claim. The Company reviews its outstanding claims

on an annual basis and adjusts them appropriately.

Currently the company maintains a reserve of $3,000 for rejected claims.

PROPERTY AND EQUIPMENT

Property and equipment

is recorded at cost. Depreciation is provided for on the straight-line method over the estimated useful lives of the related assets

as follows:

| Furniture and fixtures |

5 to 10 years |

| Computer equipment |

5 years |

| Equipment |

5 to 10 years |

| Software |

3 to 5 years |

The cost of maintenance

and repairs is charged to expense in the period incurred. Expenditures that increase the useful lives of assets are capitalized

and depreciated over the remaining useful lives of the assets. When items are retired or disposed of, the cost and accumulated

depreciation are removed from the accounts and any gain or loss is included in income.

LONG-LIVED ASSETS

ASC

360 – Property, Plant and Equipment addresses financial accounting and reporting for the impairment or disposal of long-lived

assets. The Company periodically evaluates whether events and circumstances have occurred that may warrant revision of the estimated

useful life of property and equipment or whether the remaining balance of property and equipment, or other long-lived assets, should

be evaluated for possible impairment. Instances that may lead to an impairment include: (i) a significant decrease in the

market price of a long-lived asset group; (ii) a significant adverse change in the extent or manner in which a long-lived

asset or asset group is being used or in its physical condition; (iii) a significant adverse change in legal factors or in

the business climate that could affect the value of a long-lived asset or asset group, including an adverse action or assessment

by a regulatory agency; (iv) an accumulation of costs significantly in excess of the amount originally expected for the acquisition

or construction of a long-lived asset or asset group; (v) a current-period operating or cash flow loss combined with a history

of operating or cash flow losses or a projection or forecast that demonstrates continuing losses associated with the use of a long-lived

asset or asset group; or (vi) a current expectation that, more likely than not, a long-lived asset or asset group will be

sold or otherwise disposed of significantly before the end of its previously estimated useful life.

An estimate of the related

undiscounted cash flows, excluding interest, over the remaining life of the property and equipment and long-lived assets is used

in assessing recoverability. Impairment loss is measured by the amount which the carrying amount of the asset(s) exceeds the fair

value of the asset(s). The Company primarily employs two methodologies for determining the fair value of a long-lived asset: (i) the

amount at which the asset could be bought or sold in a current transaction between willing parties or (ii) the present value

of estimated expected future cash flows grouped at the lowest level for which there are identifiable independent cash flows.

ADVERTISING COSTS

Advertising costs included

with selling, general and administrative expenses in the accompanying consolidated statements of operations were $1,189 for the

year ended December 31, 2012. Such costs are expensed when incurred.

INCOME TAXES

The Company adopted the

provisions of FASB ASC 740 - Income Taxes provides detailed guidance for the financial statement recognition, measurement and disclosure

of uncertain tax positions recognized in the financial statements. Income taxes are determined using the asset and liability method.

This method gives consideration to the future tax consequences associated with temporary differences between the carrying amounts

of assets and liabilities for financial statement purposes and the amounts used for income tax purposes.

FAIR VALUE OF FINANCIAL INSTRUMENTS

The estimated fair values

for financial instruments are determined at discrete points in time based on relevant market information. These estimates involve

uncertainties and cannot be determined with precision. The carrying amounts of accounts payable, accrued expenses, and notes payable

approximate fair value.

RECLASSIFICATIONS

Certain prior year amounts

have been reclassified to conform to the current year presentation.

RECENT ACCOUNTING PRONOUNCEMENTS

We have evaluated all Accounting

Standards Updates through the date the financial statements were issued and do not believe any will have a material impact.

NEW ACCOUNTING STANDARD

In July 2012, the Financial

Accounting Standards Board (“FASB”) issued Accounting Standards Update 2012-02 “Intangibles – Goodwill

and Other (Topic 350): Testing Indefinite-Lived Intangible Assets for Impairment” (“ASU 2012-02”). ASU 2012-02

permits entities to first assess qualitative factors to determine whether it is more likely than not that the fair value of an

indefinite-lived intangible asset is impaired as a basis for determining whether it is necessary to perform the quantitative impairment

test. Under the amendments in ASU 2012-02, an entity is not required to calculate the fair value of an indefinite-lived intangible

asset unless it determines that it is more likely than not that the fair value of the asset is less than its carrying amount. An

entity also will have the option to bypass the qualitative assessment for any indefinite-lived intangible asset in any period and

proceed directly to performing the quantitative impairment test. ASU 2012-02 is effective for interim and annual indefinite-lived

intangible asset impairment tests performed for fiscal years beginning on or after September 15, 2012, with early adoption permitted.

The Company’s adoption of ASU 2012-02 is not expected to have an impact on its consolidated financial statements.

ANGELS OF MERCY, INC.

NOTES TO FINANCIAL STATEMENTS

NOTE 3 — STOCKHOLDERS EQUITY

COMMON STOCK:

The Company has authorized 1,000

shares of $1.00 par value common stock. As of December 31, 2012, there are 1,000 shares issued and outstanding.

NOTE 4 – STATEMENT OF CASH FLOWS

For the year ended December

31, 2012, there are no supplemental non-cash investing and financing activities disclosures.

NOTE 5 —

SUBSEQUENT EVENTS

In accordance with ASC

855-10, Company management reviewed all material events through the date of this report and there are no other material subsequent

events to report except the following:

On August 1,

2013, the Oncologix Tech, Inc., a publicly traded company, acquired all of the outstanding shares of common stock of ANGELS OF

MERCY, INC. (“Dotolo”), a personal care company. The acquisition was accounted for using the acquisition method of

accounting and the purchase price was allocated to the assets acquired and liabilities assumed based upon their estimated fair

values at the date of acquisition. Identifiable intangible assets include goodwill. The purchase price consisted of the following:

a) payment of $100,000 cash at closing; b) issuance of a promissory note in the amount of $550,000; c) issuance of one million

warrants to purchase the common stock of Oncologix Tech, Inc. with an exercise price of $0.015; d) payment of $65,000 in broker

fees.

The purchase price was

allocated to assets acquired and liabilities assumed as follows:

| | |

| | |

| Cash and cash equivalents | |

$ | 27,121 | |

| Accounts receivable (net) | |

| 111,581 | |

| Prepaid expenses and other current assets | |

| 7,851 | |

| Property and equipment | |

| 57,000 | |

| Purchased goodwill | |

| 478,721 | |

| | |

| | |

| Total assets acquired | |

$ | 682,274 | |

| | |

| | |

| Accounts payable and other accrued expenses | |

$ | 9,688 | |

| | |

| | |

| Total liabilities assumed | |

$ | 9,688 | |

NOTE 6 - INCOME TAXES

As of December 31, 2012,

the Company has federal general business credit carryforwards totaling approximately $145,000. The general business credit carry-forwards

expire in various amounts beginning in 2027 and ending in 2030. The Company does not have any current state net operating loss

carry-forwards.

ASC 740 requires a

company to determine whether it is more likely than not that a tax position will be sustained upon examination based upon the

technical merits of the position. If the more-likely-than-not threshold is met, a company must measure the tax position to

determine the amount to recognize in the financial statements. As a result of the implementation of ASC 740 – Income

Taxes, the Company performed a review of its material tax positions. At the adoption date of ASC 740, the Company had no

unrecognized tax benefit which would affect the effective tax rate. December 31, 2012, the Company had no accrued

interest and penalties related to uncertain tax positions. The Company is primarily subject to U.S. and Louisiana income

taxes. The tax years 2011 to current remain open to examination by U.S. federal and state tax authorities.

| (b) | Pro Forma Financial Information |

ONCOLOGIX TECH, INC. AND SUBSIDIARIES

UNAUDITED PRO FORMA CONDENSED CONSOLIDATED

BALANCE SHEET

AS OF AUGUST 31, 2012

| |

|

|

|

|

|

|

For the year ended August 31, 2012 |

| |

|

|

|

|

|

|

|

|

Pro Forma |

|

|

| |

|

|

|

|

|

|

Historical |

|

Adjustments |

|

Pro Forma |

| |

|

|

|

|

|

|

|

|

|

|

|

| Revenues |

|

|

|

$ - |

|

$ 2,860,429 |

(A) |

$ 195,067 |

| |

|

|

|

|

|

|

|

|

|

|

|

| Cost of revenues |

|

|

- |

|

2,362,245 |

(A) |

- |

| |

|

|

|

|

|

|

|

|

|

|

|

| |

Gross profit |

|

|

|

- |

|

498,184 |

|

195,067 |

| |

|

|

|

|

|

|

|

|

|

|

|

| |

General and administrative |

130,769 |

|

517,813 |

(A) |

195,067 |

| |

Depreciation and amortization |

450 |

|

1,245 |

(A) |

1,471 |

| |

|

|

|

|

|

|

|

|

|

|

|

| |

Total operating expenses |

131,219 |

|

519,058 |

|

196,538 |

| |

|

|

|

|

|

|

|

|

|

|

|

| |

Loss from operations |

|

(131,219) |

|

(20,874) |

|

(1,471) |

| |

|

|

|

|

|

|

|

|

|

|

|

| Other income (expense): |

|

|

|

|

|

|

| |

Interest and finance charges |

(10,768) |

|

(1,437) |

(A) |

(14,707) |

| |

Interest and finance charges - related parties |

(25,312) |

|

- |

|

(18,241) |

| |

Loss on conversion of notes payable - related parties |

(92,758) |

|

- |

|

- |

| |

Induced conversion expense |

(25,402) |

|

- |

|

(6,076) |

| |

Loss on disposal of assets |

(110) |

|

- |

|

- |

| |

Other expenses |

|

|

- |

|

10,146 |

(A) |

(47) |

| |

|

|

|

|

|

|

|

|

|

|

|

| |

Total other income (expense) |

(154,350) |

|

8,709 |

|

(39,071) |

| |

|

|

|

|

|

|

|

|

|

|

|

| Loss from operations |

|

(285,569) |

|

(12,165) |

|

(40,542) |

| |

|

|

|

|

|

|

|

|

|

|

|

| |

Less loss attributable to noncontrolling interest |

(14) |

|

- |

|

(13) |

| |

|

|

|

|

|

|

|

|

|

|

|

| Net loss before income taxes |

(285,555) |

|

(12,165) |

|

(40,529) |

| |

|

|

|

|

|

|

|

|

|

|

|

| Income taxes |

|

|

|

- |

|

- |

|

- |

| |

|

|

|

|

|

|

|

|

|

|

|

| Net loss attributable to common shareholders |

$ (285,555) |

|

$ (12,165) |

|

$ (40,529) |

| |

|

|

|

|

|

|

|

|

|

|

|

| Loss per common share, basic and diluted: |

$ (0.01) |

|

|

|

$ (0.00) |

| |

|

|

|

|

|

|

|

|

|

|

|

| Weighted average number of shares |

|

|

|

|

|

| |

outstanding - basic and diluted |

54,443,649 |

|

|

|

47,915,734 |

See accompanying notes to unaudited pro forma

condensed consolidated financial information.

ONCOLOGIX TECH, INC. AND SUBSIDIARIES

UNAUDITED PRO FORMA CONDENSED CONSOLIDATED

BALANCE SHEET

AS OF AUGUST 31, 2011

| | |

For the year ended August 31, 2011 |

| | |

| |

Pro Forma | |

|

| | |

Historical | |

Adjustments | |

Pro Forma |

| ASSETS |

| |

|

|

| Current Assets: | |

| | | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 1,931 | | |

$ | 27,484 | (B) | |

$ | 29,415 | |

| Accounts receivable (net of $3,000 allowance) | |

| — | | |

| 423,915 | (B) | |

| 423,915 | |

| Prepaid expenses and other current assets | |

| 2,993 | | |

| 4,090 | (B) | |

| 7,083 | |

| | |

| | | |

| | | |

| | |

| Total current assets | |

| 4,924 | | |

| 455,489 | | |

| 460,413 | |

| | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | |

| Property and equipment (net of accumulated depreciation) | |

| 1,481 | | |

| 46,845 | (B) | |

| 48,326 | |

| | |

| | | |

| | | |

| | |

| Total assets | |

$ | 6,405 | | |

$ | 502,334 | | |

$ | 508,739 | |

| | |

| | | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDERS' DEFICIT | |

| | | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | | |

| | |

| Line of credit payable | |

$ | — | | |

$ | — | | |

$ | — | |

| Accounts payable and other accrued expenses | |

| 142,990 | | |

| 18,542 | (B) | |

| 161,532 | |

| Accrued interest payable | |

| 42,575 | | |

| — | | |

| 42,575 | |

| Accrued interest payable - related parties | |

| 48,216 | | |

| — | | |

| 48,216 | |

| | |

| | | |

| | | |

| | |

| Total current liabilities | |

| 233,781 | | |

| 18,542 | | |

| 252,323 | |

| | |

| | | |

| | | |

| | |

| Long-term liabilities: | |

| | | |

| | | |

| | |

| Convertible notes payable - (net of discount of $0 and $0) | |

| 125,000 | | |

| — | | |

| 125,000 | |

| Convertible notes payable - related parties (net of discount of $0 and $0) | |

| 235,025 | | |

| — | | |

| 235,025 | |

| | |

| | | |

| | | |

| | |

| Total long-term liabilities | |

| 360,025 | | |

| — | | |

| 360,025 | |

| | |

| | | |

| | | |

| | |

| Total liabilities | |

| 593,806 | | |

| 18,542 | | |

| 612,348 | |

| | |

| | | |

| | | |

| | |

| Stockholders' Deficit: | |

| | | |

| | | |

| | |

| Preferred stock, par value $.001 per share; 10,000,000 shares authorized | |

| | | |

| | | |

| | |

| 129,062 and 129,062 shares issued and outstanding at | |

| | | |

| | | |

| | |

| August 31, 2012 and August 31, 2011, respectively | |

| 129 | | |

| — | | |

| 129 | |

| Common stock, par value $.001 per share; 200,000,000 shares authorized; | |

| | | |

| | | |

| — | |

| 57,563,258 and 50,998,814 shares issued and outstanding at | |

| | | |

| | | |

| — | |

| August 31, 2012 and August 31, 2011, respectively | |

| 57,563 | | |

| — | | |

| 57,563 | |

| Additional paid-in capital | |

| 57,697,233 | | |

| 15,368 | (B) | |

| 57,712,601 | |

| Accumulated deficit prior to reentering development stage | |

| (58,004,869 | ) | |

| — | | |

| (58,004,869 | ) |

| Deficit accumulated during the development stage | |

| (333,982 | ) | |

| 468,424 | (B) | |

| 134,442 | |

| Noncontrolling interest | |

| (3,475 | ) | |

| — | | |

| (3,475 | ) |

| | |

| | | |

| | | |

| | |

| Total stockholders' deficit | |

| (587,401 | ) | |

| 483,792 | | |

| (103,609 | ) |

| | |

| | | |

| | | |

| | |

| Total liabilities and stockholders' deficit | |

$ | 6,405 | | |

$ | 502,334 | | |

$ | 508,739 | |

See accompanying notes to unaudited pro forma

condensed consolidated financial information.

ONCOLOGIX TECH, INC. AND SUBSIDIARIES

UNAUDITED PRO FORMA CONDENSED CONSOLIDATED

STATEMENT OF OPERATIONS

FOR THE YEAR ENDED AUGUST 31, 2012

| | |

For the year ended August 31, 2012 |

|

|

|

|

|

|

| | |

| |

Pro Forma | |

|

| | |

Historical | |

Adjustments | |

Pro Forma |

| ASSETS | |

|

|

| Current Assets: | |

| | | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 1,931 | | |

$ | 53,805 | (A) | |

$ | 55,736 | |

| Accounts receivable (net of allowance) | |

| — | | |

| 222,664 | (A) | |

| 222,664 | |

| Prepaid expenses and other current assets | |

| 2,993 | | |

| — | | |

| 2,993 | |

| | |

| | | |

| | | |

| | |

| Total current assets | |

| 4,924 | | |

| 276,469 | | |

| 281,393 | |

| | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | |

| Property and equipment (net of accumulated depreciation) | |

| 1,481 | | |

| 30,701 | (A) | |

| 32,182 | |

| | |

| | | |

| | | |

| | |

| Total assets | |

$ | 6,405 | | |

$ | 307,170 | | |

$ | 313,575 | |

| | |

| | | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDERS' DEFICIT | |

| | | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | | |

| | |

| Line of credit payable | |

$ | — | | |

$ | 41,612 | (A) | |

$ | 41,612 | |

| Accounts payable and other accrued expenses | |

| 142,990 | | |

| 11,163 | (A) | |

| 154,153 | |

| Accrued interest payable | |

| 42,575 | | |

| — | | |

| 42,575 | |

| Accrued interest payable - related parties | |

| 48,216 | | |

| — | | |

| 48,216 | |

| | |

| | | |

| | | |

| | |

| Total current liabilities | |

| 233,781 | | |

| 52,775 | | |

| 286,556 | |

| | |

| | | |

| | | |

| | |

| Long-term liabilities: | |

| | | |

| | | |

| | |

| Convertible notes payable - (net of discount of $0 and $0) | |

| 125,000 | | |

| — | | |

| 125,000 | |

| Convertible notes payable - related parties (net of discount of $0 and $0) | |

| 235,025 | | |

| — | | |

| 235,025 | |

| | |

| | | |

| | | |

| | |

| Total long-term liabilities | |

| 360,025 | | |

| — | | |

| 360,025 | |

| | |

| | | |

| | | |

| | |

| Total liabilities | |

| 593,806 | | |

| 52,775 | | |

| 646,581 | |

| | |

| | | |

| | | |

| | |

| Stockholders' Deficit: | |

| | | |

| | | |

| | |

| Preferred stock, par value $.001 per share; 10,000,000 shares authorized 129,062 and 129,062

shares issued and outstanding at August 31, 2012 and August 31, 2011, respectively | |

| 129 | | |

| — | | |

| 129 | |

| Common stock, par value $.001 per share; 200,000,000 shares authorized; | |

| | | |

| | | |

| — | |

| 57,563,258 and 50,998,814 shares issued and outstanding at | |

| | | |

| | | |

| — | |

| August 31, 2012 and August 31, 2011, respectively | |

| 57,563 | | |

| — | | |

| 57,563 | |

| Additional paid-in capital | |

| 57,697,233 | | |

| 15,368 | (A) | |

| 57,712,601 | |

| Accumulated deficit prior to reentering development stage | |

| (58,004,869 | ) | |

| — | | |

| (58,004,869 | ) |

| Deficit accumulated during the development stage | |

| (333,982 | ) | |

| 239,027 | (A) | |

| (94,955 | ) |

| Noncontrolling interest | |

| (3,475 | ) | |

| — | | |

| (3,475 | ) |

| | |

| | | |

| | | |

| | |

| Total stockholders' deficit | |

| (587,401 | ) | |

| 254,395 | | |

| (333,006 | ) |

| | |

| | | |

| | | |

| | |

| Total liabilities and stockholders' deficit | |

$ | 6,405 | | |

$ | 307,170 | | |

$ | 313,575 | |

See accompanying notes to unaudited pro forma

condensed consolidated financial information.

ONCOLOGIX TECH, INC. AND SUBSIDIARIES

UNAUDITED PRO FORMA CONDENSED CONSOLIDATED

STATEMENT OF OPERATIONS

FOR THE YEAR ENDED AUGUST 31, 2011

| | |

For the year ended August 31, 2011 |

| | |

| |

Pro Forma | |

|

| | |

Historical | |

Adjustments | |

Pro Forma |

| | |

| |

| |

|

| Revenues | |

$ | — | | |

$ | 2,875,579 | (B) | |

$ | 195,067 | |

| | |

| | | |

| | | |

| | |

| Cost of revenues | |

| — | | |

| 2,339,789 | (B) | |

| — | |

| | |

| | | |

| | | |

| | |

| Gross profit | |

| — | | |

| 535,790 | | |

| 195,067 | |

| | |

| | | |

| | | |

| | |

| General and administrative | |

| 130,769 | | |

| 548,380 | (B) | |

| 195,067 | |

| Depreciation and amortization | |

| 450 | | |

| — | | |

| 1,471 | |

| | |

| | | |

| | | |

| | |

| Total operating expenses | |

| 131,219 | | |

| 548,380 | | |

| 196,538 | |

| | |

| | | |

| | | |

| | |

| Loss from operations | |

| (131,219 | ) | |

| (12,590 | ) | |

| (1,471 | ) |

| | |

| | | |

| | | |

| | |

| Other income (expense): | |

| | | |

| | | |

| | |

| Interest and finance charges | |

| (10,768 | ) | |

| (124 | )(B) | |

| (14,707 | ) |

| Interest and finance charges - related parties | |

| (25,312 | ) | |

| — | | |

| (18,241 | ) |

| Loss on conversion of notes payable - related parties | |

| (92,758 | ) | |

| — | | |

| — | |

| Induced conversion expense | |

| (25,402 | ) | |

| — | | |

| (6,076 | ) |

| Loss on disposal of assets | |

| (110 | ) | |

| — | | |

| — | |

| Other expenses | |

| — | | |

| 1,945 | (B) | |

| (47 | ) |

| | |

| | | |

| | | |

| | |

| Total other income (expense) | |

| (154,350 | ) | |

| 1,821 | | |

| (39,071 | ) |

| | |

| | | |

| | | |

| | |

| Loss from operations | |

| (285,569 | ) | |

| (10,769 | ) | |

| (40,542 | ) |

| | |

| | | |

| | | |

| | |

| Less loss attributable to noncontrolling interest | |

| (14 | ) | |

| — | | |

| (13 | ) |

| | |

| | | |

| | | |

| | |

| Net loss before income taxes | |

| (285,555 | ) | |

| (10,769 | ) | |

| (40,529 | ) |

| | |

| | | |

| | | |

| | |

| Income taxes | |

| — | | |

| — | | |

| — | |

| | |

| | | |

| | | |

| | |

| Net loss attributable to common shareholders | |

$ | (285,555 | ) | |

$ | (10,769 | ) | |

$ | (40,529 | ) |

| | |

| | | |

| | | |

| | |

| Loss per common share, basic and diluted: | |

$ | (0.01 | ) | |

| | | |

$ | (0.00 | ) |

| | |

| | | |

| | | |

| | |

| Weighted average number of shares | |

| | | |

| | | |

| | |

| outstanding - basic and diluted | |

| 54,443,649 | | |

| | | |

| 47,915,734 | |

See accompanying notes to unaudited pro forma

condensed consolidated financial information.

ONCOLOGIX TECH, INC. AND SUBSIDIARIES

NOTES TO UNAUDITED PRO FORMA CONDENSED CONSOLIDATED

FINANCIAL STATEMENTS

The following is a description of the pro forma adjustments to the

historical condensed consolidated financial statements.

| A. | The increase of assets, liabilities, equity, revenues and expenses represents the acquisition of Angels of Mercy, Inc as if

the sale occurred on August 31, 2012. |

| B. | The increase of assets, liabilities, equity, revenues and expenses represents the acquisition of Angels of Mercy, Inc as if

the sale occurred on August 31, 2012. |

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant caused this report to be signed on its behalf by the undersigned thereunto

duly authorized.

|

Dated: January 14, 2015

|

|

| |

ONCOLOGIX TECH, INC. |

| |

|

| |

By: /s/ Roy Wayne Erwin |

| |

Roy Wayne Erwin, Chief Executive Officer |

| |

By: /s/ Michael A. Kramarz |

| |

Michael A. Kramarz, Chief Financial Officer |

| |

|

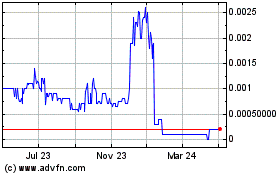

Oncologix Tech (CE) (USOTC:OCLG)

Historical Stock Chart

From Nov 2024 to Dec 2024

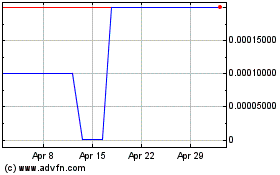

Oncologix Tech (CE) (USOTC:OCLG)

Historical Stock Chart

From Dec 2023 to Dec 2024