UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of

Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 under the

Securities Exchange Act of 1934

For the month of September, 2014

Commission File Number 1-8910

NIPPON TELEGRAPH AND TELEPHONE CORPORATION

(Translation of registrant’s name into English)

OTEMACHI FIRST SQUARE, EAST TOWER

5-1, OTEMACHI 1-CHOME

CHIYODA-KU, TOKYO 100-8116 JAPAN

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F x Form 40-F ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by

Regulation S-T Rule 101(b)(1):

Indicate by check mark if

the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

NOTICE REGARDING THE RESULTS OF TENDER OFFER FOR SHARE REPURCHASE BY NTT DOCOMO, INC. AND REVISION OF

NON-CONSOLIDATED FINANCIAL FORECASTS AS A RESULT OF EXTRAORDINARY GAIN

On September 4, 2014, the registrant filed with the Tokyo

Stock Exchange a notice regarding the results of its subsidiary NTT DOCOMO, INC.’s tender offer for share repurchase and the registrant’s revision of its non-consolidated financial forecasts as a result of extraordinary gain. Attached is

an English translation of the notice filed with the Tokyo Stock Exchange.

The information included herein contains forward-looking

statements. The registrant desires to qualify for the “safe-harbor” provisions of the Private Securities Litigation Reform Act of 1995, and consequently is hereby filing cautionary statements identifying important factors that could cause

the registrant’s actual results to differ materially from those set forth in the attachment.

The registrant’s forward-looking

statements are based on a series of assumptions, projections, estimates, judgments and beliefs of the management of the registrant in light of information currently available to it regarding the registrant and its subsidiaries and affiliates, the

economy and telecommunications industry in Japan and overseas, and other factors. These projections and estimates may be affected by the future business operations of the registrant and its subsidiaries and affiliates, the state of the economy in

Japan and abroad, possible fluctuations in the securities markets, the pricing of services, the effects of competition, the performance of new products, services and new businesses, changes to laws and regulations affecting the telecommunications

industry in Japan and elsewhere, other changes in circumstances that could cause actual results to differ materially from any future results that may be derived from the forward-looking statements, as well as other risks included in the

registrant’s most recent Annual Report on Form 20-F and other filings and submissions with the United States Securities and Exchange Commission.

No assurance can be given that the registrant’s actual results will not vary significantly from any expectation of future results that

may be derived from the forward-looking statements included herein.

The information on any website referenced herein or in the attached

material is not incorporated by reference herein or therein.

The attached material is a translation of the Japanese original. The

Japanese original is authoritative.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

|

|

|

|

|

| NIPPON TELEGRAPH AND TELEPHONE CORPORATION |

|

|

| By |

|

/s/ Yasutake Horinouchi |

|

|

Name: |

|

Yasutake Horinouchi |

|

|

Title: |

|

Vice President |

|

|

|

|

Investor Relations Office |

Date: September 4, 2014

September 4, 2014

Company Name: Nippon Telegraph and Telephone Corporation

Representative: Hiroo Unoura, President and Chief Executive Officer

(Code No.: 9432, First section of Tokyo Stock Exchange)

Notice regarding the Results of Tender Offer for Share Repurchase by NTT DOCOMO, INC. and

Revision of Non-Consolidated Financial Forecasts as a Result of Extraordinary Gain

| 1. |

Results of NTT DOCOMO, INC. (“NTT DOCOMO”) Share Repurchase |

NTT DOCOMO, a subsidiary

of Nippon Telegraph and Telephone Corporation (“NTT”), conducted a tender offer for the repurchase of its shares from August 7, 2014 through September 3, 2014. For more details, please see the attached release by NTT DOCOMO.

Of the NTT DOCOMO common shares that NTT holds, NTT tendered, and NTT DOCOMO repurchased, 176,991,100 shares. As a result, NTT expects to

record an extraordinary gain of 299.0 billion yen (gain on sale of investments in affiliated companies) in its non-consolidated financial statements. Accordingly, NTT announced the following revisions to its non-consolidated financial forecasts for

the fiscal year ending March 31, 2015, previously announced on May 13, 2014.

| 2. |

Revised Non-Consolidated Financial Forecasts for the Fiscal Year Ending March 31, 2015 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

(Millions of yen) |

|

|

|

|

|

|

|

| |

|

Operating

Revenues |

|

|

Operating

Income |

|

|

Recurring

Profit |

|

|

Net Income |

|

|

Earnings

per Share |

|

| Previous Forecast (A) |

|

|

422,000 |

|

|

|

277,000 |

|

|

|

272,000 |

|

|

|

274,000 |

|

|

|

250.00 yen |

|

| Revised Forecast (B) |

|

|

417,000 |

|

|

|

272,000 |

|

|

|

267,000 |

|

|

|

557,000 |

|

|

|

510.00 yen |

|

| Change (B-A) |

|

|

(5,000 |

) |

|

|

(5,000 |

) |

|

|

(5,000 |

) |

|

|

283,000 |

|

|

|

|

|

| Percentage Change (%) |

|

|

(1.2 |

) |

|

|

(1.8 |

) |

|

|

(1.8 |

) |

|

|

103.3 |

|

|

|

|

|

| (Reference) Results of the Fiscal Year Ended March 31, 2014 |

|

|

430,843 |

|

|

|

283,530 |

|

|

|

277,322 |

|

|

|

279,224 |

|

|

|

242.86 yen |

|

* The decrease in operating revenues is due to the decrease in dividend income as a result of the sale of NTT DOCOMO shares.

There is no impact on the consolidated financial forecasts for the fiscal year ending March 31, 2015.

|

|

|

| For further inquiries, please contact: |

|

| Tatsuya Watanabe or Yuta Kosuge |

| Investor Relations Office |

| Finance and Accounting Department |

| Nippon Telegraph and Telephone Corporation |

| Phone: |

|

+81-3-6838-5481 |

| Fax: |

|

+81-3-6838-5499 |

NTT DOCOMO, INC.

President and CEO: Kaoru Kato

Tokyo

Stock Exchange: 9437

New York Stock Exchange: DCM

September

4, 2014

Announcement of Outcome of Tender Offer for Repurchase of Shares

NTT DOCOMO, Inc. (“the Company”) resolved at a meeting of the Board of Directors on August 6, 2014 to repurchase the

treasury stock by means of a Tender Offer (the “Tender Offer”), using the acquisition method specified under Article 156, Paragraph 1 of the Companies Act, as applied pursuant to the provisions of Article 165, Paragraph 3 of the same

Act, and the provisions of the Company’s Articles of Incorporation. The Company hereby provides notice that implementation of the Tender Offer began on August 7, 2014 and ended on September 3, 2014. Details are set forth below.

| 1. |

Description of the Offer |

| (1) |

Name and address of the offeror |

NTT DOCOMO, Inc. 2-11-1, Nagatacho, Chiyoda-ku, Tokyo,

Japan

| (2) |

Class of listed shares to be repurchased |

Common shares

From Thursday, August 7, 2014 to Wednesday, September 3, 2014

(20 business days)

1,695 yen per common share

| |

A. |

Name and head office address of financial instruments business operator, bank, or other institution in charge of settlement of the Tender Offer |

Nomura Securities Co., Ltd. 1-9-1, Nihonbashi, Chuo-ku, Tokyo

| |

B. |

Settlement commencement date |

Monday, September 29, 2014

Notification of the purchases under the Tender Offer will be sent to the

address of tendering shareholders (or the standing proxy for foreign shareholders) after the conclusion of the tender offer period without delay.

Purchases will be settled in cash. Tendering shareholders will be able to receive the purchase amount for the Tender Offer, less applicable

withholding taxes (see note), by wire transfer or other method as instructed by the tendering shareholder without delay after the settlement commencement date (wire transfer fees may apply).

Note: Taxes on shares purchased under the tender offer

* Please make any decisions after consulting a tax advisor or other professional about specific tax questions.

1

| |

(a) |

Tax treatment for individual shareholders tendering shares under the Tender Offer |

| |

(i) |

For tendering shareholders who are residents, or non-residents with a permanent establishment in Japan |

When the amount of money received for accepting the Tender Offer exceeds the amount of the portion of the Company’s

capital (or for a consolidated corporation, its consolidated individual stated capital) attributable to the shares that are the basis for that payment (when the per-share purchase amount is greater than the per-share amount of capital), the amount

in excess will be deemed a dividend and taxed accordingly. Furthermore, the amount derived after deducting the amount deemed to be a dividend from the amount received for accepting the Tender Offer will be deemed income from the transfer of shares.

When there is no amount deemed to be a dividend (when the per-share purchase amount is less than the per-share amount of capital) the entire amount received will be transfer income.

The amount deemed to be a dividend is subject to a withholding of 20.315% (15.315% for income tax and special income tax for

reconstruction and 5% for resident tax) (There will be no special withholding of the 5% resident tax for non-residents with a permanent establishment in Japan). However, if the shareholder is considered a principal shareholder, the withholding is

20.42% (income tax and special income tax for reconstruction only). As a general rule, the amount after deducting the cost of acquiring the shares from the transfer income is subject to declared separate income taxes.

| |

(ii) |

For tendering shareholders who are non-residents without a permanent establishment in Japan |

The amount deemed to be a dividend will be subject to withholding of 15.315% (income tax and special income tax for

reconstruction only). If the shareholder is considered a principal shareholder, the withholding will be 20.42% (income tax and special income tax for reconstruction only). As a general rule, income arising from the transfer will not be subject to

taxation.

| |

(b) |

For corporate shareholders, when the amount of money received for accepting the Tender Offer exceeds the amount of the portion of the Company’s capital (or for a consolidated corporation, its consolidated

individual stated capital) attributable to the shares that are the basis for that payment, the amount of this excess will be deemed a dividend. As a general rule, the portion deemed to be a dividend is subject to withholding of 15.315% (income tax

and special income tax for reconstruction only). |

A foreign shareholder who wishes to receive an income tax reduction or

exemption for such deemed dividends pursuant to an applicable tax treaty should notify the tender offer agent by the last day of the tender offer period that he plans to submit the tax treaty application form, and then submit that form to tender

offer agent by the business day prior to the settlement commencement date.

| 2. |

Results of the Tender Offer |

| (1) |

Number of shares purchased |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Share class |

|

Anticipated number

of shares to be

purchased |

|

|

Number of excess

shares to be

purchased |

|

|

Number of shares

tendered |

|

|

Number of shares to

be repurchased |

|

| Common shares |

|

|

206,489,675 shares |

|

|

|

0 shares |

|

|

|

181,530,121 shares |

|

|

|

181,530,121 shares |

|

| (2) |

Calculation method where proportional allocation is used |

Not applicable.

2

| 3. |

Locations for Examination of Copies of the Tender Offer Report |

NTT DOCOMO, Inc. 2-11-1,

Nagatacho, Chiyoda-ku, Tokyo, Japan

Tokyo Stock Exchange, Inc. 2-1 Nihonbashi Kabutocho, Chuo-ku, Tokyo, Japan

(Reference) Resolution Adopted by the Board of Directors on April 25, 2014

| (1) |

Class of shares to be purchased: Common shares |

| (2) |

Aggregate number of shares to be repurchased: Up to 320,000,000 shares |

(equal to 7.72% of

total issued shares (excluding treasury shares) as of April 25, 2014)

| (3) |

Aggregate price of shares to be repurchased: Up to 500,000,000,000 yen |

| (4) |

Period of share repurchase: From April 26, 2014 to March 31, 2015 |

3

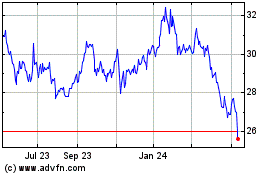

Nippon Telegraph and Tel... (PK) (USOTC:NTTYY)

Historical Stock Chart

From Sep 2024 to Oct 2024

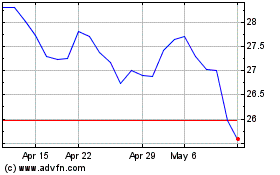

Nippon Telegraph and Tel... (PK) (USOTC:NTTYY)

Historical Stock Chart

From Oct 2023 to Oct 2024