CEZ Attributes Profit Fall To Taxes, Power Prices, Unrepeated Gains

August 16 2011 - 5:22AM

Dow Jones News

Czech state-owned power company CEZ AS (BAACEZ.PR) Tuesday said

its 40% annual decline in second-quarter net profit was due to

lower power prices than a year earlier, new taxes and

foreign-exchange losses, as well as gains in 2010 that didn't recur

this year.

Last year, CEZ benefited from a 600 million koruna ($35.4

million) rise in shares in Hungary's MOL Nyrt. (MOL.BU), while this

year those shares didn't match the gain, said Martin Roman, CEZ's

chairman and chief executive. CEZ last year also gained over CZK1

billion in profit from sales of carbon emissions allowances, which

weren't repeated, he said.

Profit was also hit by a CZK2.6 billion annual decline in

earnings before interest, taxes, depreciation and amortization due

to lower power prices than in the second quarter of last year, CEZ

Finance Chief Martin Novak said.

The Czech koruna's appreciation on year and new taxes on revenue

from solar power generation, as well as taxes on the market value

of carbon emissions allowances the company got for free, also hit

profit, the company said.

On Monday, the company said its net profit for the second

quarter fell 40% to CZK6.74 billion.

-By Sean Carney, Dow Jones Newswires; +420 222 315 290,

sean.carney@dowjones.com

Go to http://blogs.wsj.com/emergingeurope/ for the new Dow Jones

blog on Central and Eastern Europe, covering business, politics,

society and more, written by our correspondents across the

region.

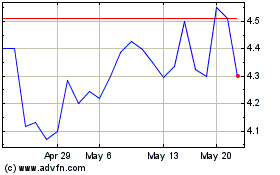

Mol Magyar Olay Es Gazip... (PK) (USOTC:MGYOY)

Historical Stock Chart

From Jun 2024 to Jul 2024

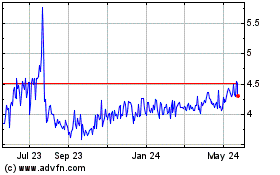

Mol Magyar Olay Es Gazip... (PK) (USOTC:MGYOY)

Historical Stock Chart

From Jul 2023 to Jul 2024