UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549-1004

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): April 28, 2015 (April 22, 2015)

Merge Healthcare Incorporated

(Exact name of registrant as specified in its charter)

|

Delaware

|

001–33006

|

39-1600938

|

|

(State of incorporation)

|

(Commission File Number)

|

(I.R.S Employer Identification No.)

|

| |

|

|

|

350 North Orleans Street, 1st Floor

|

|

|

|

Chicago, Illinois

|

|

60654

|

|

(Address of Principal Executive Offices)

|

|

(ZIP Code)

|

(312) 565-6868

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17-CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

Item 2.02

|

Results of Operations and Financial Condition.

|

On April 28, 2015, Merge Healthcare Incorporated (the “Company”) issued a News Release containing information about its financial condition and results of operations for the quarter ended March 31, 2015.

A copy of the Company’s News Release is being furnished as Exhibit 99.1 to this Current Report on Form 8-K.

|

Item 5.02

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

|

(b)

On April 22, 2015 and April 23, 2015, Dennis Brown and Nancy J. Koenig, respectively, informed the Company that they are resigning from the board of directors of the Company, effective as of the date of the Company’s next annual meeting of stockholders, and that they do not intend to seek reelection to the board of directors of the Company at such meeting. Neither director resigned because of a disagreement with the Company. Ms. Koenig has not resigned from her position as Chief Operating Officer of the Company.

(d)

Michael P. Cole was elected to the board of directors of the Company effective April 23, 2015. Mr. Cole has been the president of MAEVA Group LLC, a turnaround–oriented merchant bank, since 2014. From 1997 to 2014, he was employed by Madison Dearborn Partners, LLC (“MDP”), a Chicago–based private equity investment firm that manages approximately $20 billion in equity capital, where he focused on investments in the media, telecommunications and technology services sectors. In 2007, Mr. Cole was named a Managing Director of MDP, which he remained until his departure in 2014. At MDP, he led or worked on investments in companies such as MetroPCS (now T–Mobile), XM Satellite Radio Holdings, Intelsat Ltd. (NYSE: I), Univision Communications, Inc., Alaska Native Wireless (now AT&T), Telemundo Communications Group and Council Tree Hispanic Broadcasters (now Comcast NBCU), Reiman Publications, Cbeyond Communications, Sorenson Communications, The Topps Company, Inc., Wind Telecom SpA (now Vimpelcom) and Q9 Networks. He was named a “Top 40 Global Dealmaker Under 40” by Dealmaker Magazine and a “Top 40 Under 40” leader by Crain’s Chicago Business. Since 2007, Mr. Cole has been a director on the board of directors of Univision Communications Inc. Previously, Mr. Cole served on the boards of directors of several other companies, including Wind Telecom SpA from 2008 to 2012, The Topps Company, Inc. from 2007 to 2014, and Sorenson Communications Holdings, LLC from 2006 to 2014. Within the past two years, he has also served on the boards of directors of several 501(c)(3) charitable organizations, including the Big Shoulders Fund, the Chicago Entrepreneurial Center, and The Lyric Opera of Chicago where he is a member of the investment committee, as well as the Illinois Venture Capital Association. Early in his career, Mr. Cole was a health care investment banker with Bear, Stearns & Co. Inc. and advised major health care companies on over $3 billion in mergers, acquisitions and financing activity. Mr. Cole received his A.B. degree from Harvard College.

Mr. Cole will be entitled to receive the same compensation paid to non-employee directors as determined by the Nominating and Governance Committee. Mr. Cole has not entered into or proposed to enter into any transactions required to be reported under Item 404(a) of Regulation S–K.

|

Item 9.01

|

Financial Statements and Exhibits.

|

|

Exhibit 99.1

|

News Release of the Company dated April 28, 2015

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

MERGE HEALTHCARE INCORPORATED

|

| |

(Registrant)

|

| |

|

|

|

Date: April 28, 2015

|

By:

|

/s/ Justin C. Dearborn |

| |

Name:

|

Justin C. Dearborn

|

| |

Title:

|

Chief Executive Officer

|

EXHIBIT INDEX

|

Exhibit Number

|

|

Description

|

|

|

|

News Release of the Company dated April 28, 2015.

|

Exhibit 99.1

News Release

|

Media Contact:

Michael Klozotsky

Vice President, Corporate Marketing

312.946.2535

Michael.Klozotsky@merge.com

|

|

MERGE REPORTS FIRST QUARTER FINANCIAL RESULTS

Increases healthcare segment sales bookings by 60% YOY

Chicago, IL (April 28, 2015) – Merge Healthcare Incorporated (NASDAQ: MRGE), a leading provider of health information systems for medical imaging, interoperability, and communication, today announced its financial and business results for the first quarter of 2015.

“Merge achieved strong sales momentum in the first quarter of the year in spite of a traditionally slow time of the year and the acquisition of D.R. Systems, Inc. in the quarter. Exclusive of the limited contribution from D.R. Systems, our healthcare segment bookings increased 60% over the first quarter of 2014,” said Justin Dearborn, chief executive officer of Merge Healthcare. “Our sales results were heavily influenced by increased traction in our large hospital system installed base and a few large net new hospital wins. Increased contract volume within our hospital market and cross sell opportunities into our newly acquired D.R. Systems installed base of more than 200 clients give us confidence that we can exceed revenue of $248 million, which aligns with our current covering analysts’ 2015 average revenue estimates.”

Financial Summary:

|

·

|

GAAP net sales increased 7% to $54.4 million in the first quarter of 2015 compared to $50.9 million in the first quarter of 2014;

|

|

·

|

GAAP net income in the first quarter of 2015 was $17.7 million compared to $0.3 million in the first quarter of 2014, primarily due to $16.8 million of net benefits and costs associated with the acquisition of D.R. Systems, the vast majority of which relates to the release of $18.4 million of tax asset valuation reserves in 2015 which reflect additional value unlocked in the corporate tax structure as a result of the acquisition;

|

|

·

|

Adjusted net income increased 14% to $4.9 million (or $0.05 per share) in the first quarter of 2015 compared to $4.3 million (or $0.04 per share) in the first quarter of 2014;

|

|

·

|

Adjusted EBITDA was $10.5 million in the first quarter of 2015 compared to $10.2 million in the first quarter of 2014; and

|

|

·

|

Cash balance increased to $24.8 million as of March 31, 2015, compared to $19.8 million, as of March 31, 2014, an increase of 25%, inclusive of the $13 million spent in February 2015 to acquire D.R. Systems, Inc.

|

Business Highlights:

|

·

|

Launched new business , iConnect® Network Services, to support hospitals’ and health systems’ need to connect clinical decision-making, economic outcomes, and patient populations through online ordering, automated prior-authorization, and real-time electronic distribution of exam results to referring healthcare providers;

|

|

·

|

Signed 14 enterprise-level imaging deals at a combination of large hospitals and multi-site health systems in the first quarter of 2015;

|

|

·

|

Displaced competitive imaging products with Merge solutions at a combination of more than 40 hospitals and health systems in the first quarter of 2015; and

|

|

·

|

Increased the number of active trials on eClinicalOS™ to 505 at the end of the first quarter of 2015, or by 62%, compared to 311 active trials at the end of the first quarter of 2014. Increased active customers on the platform to 125 as of the end of the first quarter 2015, or 43%, compared to 87 customers at the end of the first quarter 2014.

|

Quarter Results:

Results compared to the same quarter in the prior year on a GAAP basis are as follows (in millions, except per share data):

|

|

|

Q1 2015 |

|

|

Q1 2014 |

|

|

Net sales

|

|

$

|

54.4

|

|

|

$

|

50.9

|

|

|

Operating income

|

|

|

3.8

|

|

|

|

4.4

|

|

|

Net income

|

|

|

17.7

|

|

|

|

0.3

|

|

|

Net income per diluted share

|

|

$

|

0.11

|

|

|

$

|

0.00

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash balance at period end

|

|

$

|

24.8

|

|

|

$

|

19.8

|

|

Non-GAAP results and other measures compared to the same quarter in the prior year are as follows (in millions, except percentages and per share data):

|

|

|

Q1 2015 |

|

|

Q1 2014 |

|

|

Non-GAAP results

|

|

|

|

|

|

|

|

|

|

Adjusted net income

|

|

$

|

4.9

|

|

|

$

|

4.3

|

|

|

Adjusted EBITDA

|

|

|

10.5

|

|

|

|

10.2

|

|

|

Adjusted net income per diluted share

|

|

$

|

0.05

|

|

|

$

|

0.04

|

|

|

|

|

|

|

|

|

|

|

|

|

Other measures

|

|

|

|

|

|

|

|

|

|

Subscription, maintenance & EDI revenue as % of net sales

|

|

|

65.1

|

%

|

|

|

65.9

|

%

|

|

Days sales outstanding

|

|

|

79

|

|

|

|

90

|

|

A reconciliation of GAAP net income to adjusted net income and adjusted EBITDA is included after the financial information below. See “Explanation of Non-GAAP Financial Measures” for definitions of each of these non-GAAP measures and the reason management believes that the adjustments made to arrive at the non-GAAP financial measures provide useful information to investors.

Operating Group Results:

Results (in millions) for our operating groups are as follows:

| |

|

Three Months Ended March 31, 2015

|

|

| |

|

Healthcare

|

|

|

DNA

|

|

Corporate/

Other

|

|

|

Total

|

|

|

Net sales:

|

|

|

|

|

|

|

|

|

|

|

|

|

Software and other

|

|

$

|

13.1

|

|

|

$

|

3.7

|

|

|

|

|

$

|

16.8

|

|

|

Service

|

|

|

7.2

|

|

|

|

2.3

|

|

|

|

|

|

9.5

|

|

|

Maintenance

|

|

|

28.0

|

|

|

|

0.1

|

|

|

|

|

|

28.1

|

|

|

Total net sales

|

|

|

48.3

|

|

|

|

6.1

|

|

|

|

|

|

54.4

|

|

|

Gross Margin

|

|

|

28.2

|

|

|

|

4.0

|

|

|

|

|

|

32.2

|

|

|

Gross Margin %

|

|

|

58.4

|

%

|

|

|

65.6

|

%

|

|

|

|

|

59.2

|

%

|

|

Expenses

|

|

|

22.1

|

|

|

|

3.5

|

|

|

|

|

|

25.6

|

|

|

Segment income

|

|

$

|

6.1

|

|

|

$

|

0.5

|

|

|

|

|

$

|

6.6

|

|

|

Operating Margin %

|

|

|

13

|

%

|

|

|

8

|

%

|

|

|

|

|

12

|

%

|

|

Net corporate/other expenses (1)

|

|

|

|

|

|

|

|

|

|

$

|

7.3

|

|

|

|

7.3

|

|

|

Income (loss) before income taxes

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(0.7

|

)

|

|

Adj. EBITDA reconciling adjustments

|

|

|

5.4

|

|

|

|

0.6

|

|

|

|

5.2

|

|

|

|

11.2

|

|

|

Adjusted EBITDA

|

|

$

|

11.5

|

|

|

$

|

1.1

|

|

|

$

|

(2.1

|

)

|

|

$

|

10.5

|

|

|

Adjusted EBITDA %

|

|

|

23.8

|

%

|

|

|

18.0

|

%

|

|

|

|

|

|

|

19.3

|

%

|

| (1) |

Net corporate/other expenses include public company costs, corporate administration costs, acquisition-related expenses and net interest expense. |

| |

|

Net Sales in the Three Months Ended

March 31, 2015

|

|

|

|

|

|

|

|

| |

|

Healthcare

|

|

|

DNA

|

|

|

Total

|

|

|

Revenue Source

|

|

$

|

|

|

|

%

|

|

|

$

|

|

|

|

%

|

|

|

$

|

|

|

|

%

|

|

|

Maintenance & EDI

|

|

$

|

28.0

|

|

|

|

58.0

|

%

|

|

$

|

0.1

|

|

|

|

1.6

|

%

|

|

$

|

28.1

|

|

|

|

51.7

|

%

|

|

Subscription

|

|

|

1.3

|

|

|

|

2.7

|

%

|

|

|

6.0

|

|

|

|

98.4

|

%

|

|

|

7.3

|

|

|

|

13.4

|

%

|

|

Non-recurring

|

|

|

19.0

|

|

|

|

39.3

|

%

|

|

|

-

|

|

|

|

0.0

|

%

|

|

|

19.0

|

|

|

|

34.9

|

%

|

|

Total

|

|

$

|

48.3

|

|

|

|

100.0

|

%

|

|

$

|

6.1

|

|

|

|

100.0

|

%

|

|

$

|

54.4

|

|

|

|

100.0

|

%

|

| |

|

|

88.8

|

%

|

|

|

|

|

|

|

11.2

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

Explanation of Non-GAAP Financial Measures:

We report our financial results in accordance with U.S. generally accepted accounting principles, or GAAP. This press release includes certain non-GAAP financial measures to supplement this GAAP information. Non-GAAP measures are not an alternative to GAAP and may be different from and directly comparable with non-GAAP measures used by other companies. A quantitative reconciliation of GAAP net income available to common shareholders to adjusted net income and adjusted EBITDA is included after the financial information included in this press release.

Management believes that the presentation of non-GAAP results, when shown in conjunction with corresponding GAAP measures, provides useful information to it and investors regarding financial and business trends related to results of operations, because certain charges, costs and expenses reflect events that are not essential to recurring business operations. In addition, management believes these non-GAAP measures provide investors useful information regarding the underlying performance of the post-acquisition business operations when compared to the pre-acquisition results of Merge and any significant acquired company. Purchase accounting adjustments made in accordance with GAAP can make it difficult to make meaningful comparisons of the underlying operations of the business without considering the non-GAAP adjustments that are provided and discussed herein. Further, management believes that these non-GAAP measures improve its and investors’ ability to compare Merge’s financial performance with other companies in the technology industry. Management also uses financial statements that exclude these charges, costs and expenses for its internal budgets. While GAAP results are more complete, these supplemental metrics are offered since, with reconciliations to GAAP, they may provide greater insight into our financial results. Management does not intend for the presentation of these non-GAAP financial measures to be considered in isolation or as a substitute for results prepared in accordance with GAAP.

Additional information regarding the non-GAAP financial measures presented herein is as follows:

|

·

|

Subscription revenue is comprised of software, hardware and professional services (including installation, training, etc.) contracted with and payable by the customer over a number of years. As such, the revenue from these transactions is recognized ratably over an extended period of time. These types of arrangements will include monthly payments (including leases), SaaS and transaction-based clinical trial contracts, renewable annual software agreements (with very high renew rate), to specify a few contract methods, and may include minimum volume or dollar commitments.

|

|

·

|

Non-recurring revenue is comprised of perpetual software license sales and includes software, hardware and professional services (including installation, training and consultative engineering services).

|

|

·

|

Adjusted net income consists of GAAP net income available to common stockholders, adjusted to exclude (a) preferred stock dividends (b) share-based compensation expense, (c) restructuring and other costs, (d) one-time tax benefits related to acquisitions (e) preferred stock accretion of dividend equivalents, (f) acquisition-related amortization, (g) cost of acquisitions, (h) acquisition-related sales adjustments, and (i) acquisition-related cost of sales adjustments.

|

|

·

|

Adjusted EBITDA adjusts GAAP net income available to common stockholders for the items considered in adjusted net income as well as (a) remaining depreciation and amortization, (b) net interest expense, (c) income tax expense (benefit).

|

Management has excluded certain items from non-GAAP adjusted net income because it believes (i) the amount of certain expenses in any specific period may not directly correlate to the underlying performance of business operations and (ii) the adjustment facilitates comparisons of pre-acquisition results to post-acquisition results. In addition, certain adjustments are described in more detail below:

|

·

|

Acquisition-related amortization expense is a non-cash expense arising from the acquisition of intangible assets in connection with significant acquisitions. Management excludes acquisition-related amortization expense from non-GAAP adjusted net income because it believes such expenses can vary significantly between periods as a result of new acquisitions and full amortization of previously acquired intangible assets.

|

|

·

|

Share-based compensation expense is a non-cash expense arising from the grant of stock awards to employees and is excluded from non-GAAP adjusted net income because management believes such expenses can vary significantly between periods as a result of the timing of grants of new stock-based awards, including grants to new employees resulting from acquisitions.

|

|

·

|

Acquisition-related sales and costs of sales adjustments reflect the fair value adjustment to deferred revenues acquired in connection with significant acquisitions. The fair value of deferred revenue represents an amount equivalent to the estimated cost plus an appropriate profit margin to perform services-related software and product support, which assumes a legal obligation to do so, based on the deferred revenue balances as of the date the acquisition was completed. Management adds back this deferred revenue adjustment, net of related costs, for adjusted net income and adjusted EBITDA because it believes the inclusion of this amount directly correlates to the underlying performance of operations and facilitates comparisons of pre-acquisition to post-acquisition results.

|

|

·

|

Fully diluted shares as used in our non-GAAP measures includes (a) GAAP weighted shares outstanding, (2) GAAP incremental shares from the assumed exercise of stock options and the assumed lapse of restrictions on restricted stock awards and (3) preferred shares on an if-converted basis adjusted for the period of time that the preferred shares are outstanding. For the current period, preferred shares were outstanding for 35 of the 90 days in the quarter.

|

Notice of Conference Call:

Merge will host a conference call at 8:30 AM ET on Tuesday, April 28, 2015. The call will address first quarter results and will provide a business update on the company’s market outlook and strategies for 2015.

Participants may preregister for this teleconference at

http://emsp.intellor.com?p=419634&do=register&t=8. Upon registration, a confirmation page will display dial-in numbers and a unique PIN, and the participant will also receive an email confirmation with this information.

A replay via the Internet or phone will be available after the call at

http://www.merge.com/Company/Investors/Conference-Call-Info.aspx.

About Merge

Merge is a leading provider of innovative enterprise imaging, interoperability and clinical systems that seek to advance healthcare. Merge’s enterprise and cloud-based technologies for image intensive specialties provide access to any image, anywhere, any time. Merge also provides clinical trials software with end-to-end study support in a single platform and other intelligent health data and analytics solutions. With solutions that have been used by providers for more than 25 years, Merge is helping to reduce costs, improve efficiencies and enhance the quality of healthcare worldwide. For more information, visit merge.com and follow us @MergeHealthcare.

Cautionary Notice Regarding Forward-Looking Statements

The matters discussed in this press release may include forward-looking statements, which could involve a number of risks and uncertainties. When used in this press release, the words “will,” “believes,” “intends,” “anticipates,” “expects” and similar expressions are intended to identify forward-looking statements. Actual results could differ materially from those expressed in, or implied by, such forward-looking statements. The potential risks and uncertainties include those risks and uncertainties included under the captions “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our Annual Report on Form 10-K for the year ended December 31, 2014, which is on file with the SEC and are available on our investor relations website at merge.com and on the SEC website at www.sec.gov. Except as expressly required by the federal securities laws, Merge undertakes no obligation to update such factors or to publicly announce the results of any of the forward-looking statements.

MERGE HEALTHCARE INCORPORATED AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands)

(unaudited)

| |

|

|

|

|

|

|

|

Current assets:

|

|

|

|

|

|

|

|

Cash (including restricted cash)

|

|

$

|

24,784

|

|

|

$

|

42,531

|

|

|

Accounts receivable, net

|

|

|

47,877

|

|

|

|

51,300

|

|

|

Inventory

|

|

|

6,483

|

|

|

|

5,686

|

|

|

Prepaid expenses

|

|

|

5,551

|

|

|

|

3,690

|

|

|

Deferred income taxes

|

|

|

564

|

|

|

|

1,131

|

|

|

Other current assets

|

|

|

8,746

|

|

|

|

11,110

|

|

|

Total current assets

|

|

|

94,005

|

|

|

|

115,448

|

|

| |

|

|

|

|

|

|

|

|

|

Property and equipment, net

|

|

|

5,193

|

|

|

|

4,079

|

|

|

Purchased and developed software, net

|

|

|

42,248

|

|

|

|

14,585

|

|

|

Other intangible assets, net

|

|

|

34,706

|

|

|

|

17,956

|

|

|

Goodwill

|

|

|

267,263

|

|

|

|

214,374

|

|

|

Deferred income taxes

|

|

|

5,211

|

|

|

|

5,396

|

|

|

Other assets

|

|

|

2,502

|

|

|

|

2,499

|

|

|

Total assets

|

|

$

|

451,128

|

|

|

$

|

374,337

|

|

| |

|

|

|

|

|

|

|

|

|

Current liabilities:

|

|

|

|

|

|

|

|

|

|

Accounts payable

|

|

$

|

20,972

|

|

|

$

|

21,072

|

|

|

Current maturities of long-term debt

|

|

|

11,750

|

|

|

|

11,750

|

|

|

Accrued wages

|

|

|

6,795

|

|

|

|

11,169

|

|

|

Restructuring accrual

|

|

|

1,165

|

|

|

|

-

|

|

|

Other current liabilities

|

|

|

3,502

|

|

|

|

4,996

|

|

|

Deferred revenue

|

|

|

63,206

|

|

|

|

53,184

|

|

|

Total current liabilities

|

|

|

107,390

|

|

|

|

102,171

|

|

| |

|

|

|

|

|

|

|

|

|

Long-term debt, less current maturities, net of unamortized discount

|

|

|

210,352

|

|

|

|

213,676

|

|

|

Deferred income taxes

|

|

|

3,769

|

|

|

|

4,025

|

|

|

Deferred revenue

|

|

|

503

|

|

|

|

1,091

|

|

|

Income taxes payable

|

|

|

1,114

|

|

|

|

1,109

|

|

|

Other liabilities

|

|

|

1,757

|

|

|

|

1,664

|

|

|

Total liabilities

|

|

|

324,885

|

|

|

|

323,736

|

|

| |

|

|

|

|

|

|

|

|

|

Series A convertible preferred stock

|

|

|

50,000

|

|

|

|

-

|

|

| |

|

|

|

|

|

|

|

|

|

Total Merge shareholders' equity

|

|

|

68,728

|

|

|

|

50,115

|

|

|

Noncontrolling interest

|

|

|

7,515

|

|

|

|

486

|

|

|

Total shareholders' equity

|

|

|

76,243

|

|

|

|

50,601

|

|

| |

|

|

|

|

|

|

|

|

|

Total liabilities and shareholders' equity

|

|

$

|

451,128

|

|

|

$

|

374,337

|

|

MERGE HEALTHCARE INCORPORATED AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except for share and per share data)

(unaudited)

| |

|

Three Months Ended

|

|

| |

|

March 31,

|

|

| |

|

2015

|

|

|

2014

|

|

|

Net sales

|

|

|

|

|

|

|

|

Software and other

|

|

$

|

16,802

|

|

|

$

|

15,083

|

|

|

Professional services

|

|

|

9,484

|

|

|

|

10,489

|

|

|

Maintenance and EDI

|

|

|

28,117

|

|

|

|

25,331

|

|

|

Total net sales

|

|

|

54,403

|

|

|

|

50,903

|

|

|

Cost of sales

|

|

|

|

|

|

|

|

|

|

Software and other

|

|

|

6,182

|

|

|

|

6,101

|

|

|

Professional services

|

|

|

6,764

|

|

|

|

6,347

|

|

|

Maintenance and EDI

|

|

|

7,800

|

|

|

|

6,963

|

|

|

Depreciation and amortization

|

|

|

1,481

|

|

|

|

1,595

|

|

|

Total cost of sales

|

|

|

22,227

|

|

|

|

21,006

|

|

|

Gross margin

|

|

|

32,176

|

|

|

|

29,897

|

|

|

Operating costs and expenses:

|

|

|

|

|

|

|

|

|

|

Sales and marketing

|

|

|

8,978

|

|

|

|

8,007

|

|

|

Product research and development

|

|

|

8,228

|

|

|

|

7,580

|

|

|

General and administrative

|

|

|

7,512

|

|

|

|

7,360

|

|

|

Acquisition-related expenses

|

|

|

351

|

|

|

|

26

|

|

|

Restructuring and other expenses

|

|

|

1,178

|

|

|

|

-

|

|

|

Depreciation and amortization

|

|

|

2,099

|

|

|

|

2,482

|

|

|

Total operating costs and expenses

|

|

|

28,346

|

|

|

|

25,455

|

|

|

Operating income

|

|

|

3,830

|

|

|

|

4,442

|

|

|

Other expense, net

|

|

|

(4,526

|

)

|

|

|

(4,136

|

)

|

|

Income (loss) before income taxes

|

|

|

(696

|

)

|

|

|

306

|

|

|

Income tax benefit

|

|

|

(18,391

|

)

|

|

|

(19

|

)

|

|

Net income

|

|

|

17,695

|

|

|

|

325

|

|

|

Less: noncontrolling interest's share

|

|

|

(76

|

)

|

|

|

2

|

|

|

Net income attributable to Merge

|

|

|

17,771

|

|

|

|

323

|

|

|

Less: preferred stock dividends and dividend equivalents related to accretion

|

|

|

5,328

|

|

|

|

-

|

|

|

Net income available to common shareholders

|

|

$

|

12,443

|

|

|

$

|

323

|

|

| |

|

|

|

|

|

|

|

|

|

Net income per share - basic

|

|

$

|

0.11

|

|

|

$

|

0.00

|

|

|

Weighted average number of common shares outstanding - basic

|

|

|

96,616,916

|

|

|

|

94,656,786

|

|

| |

|

|

|

|

|

|

|

|

|

Net income per share - diluted

|

|

$

|

0.11

|

|

|

$

|

0.00

|

|

|

Weighted average number of common shares outstanding - diluted

|

|

|

96,616,916

|

|

|

|

95,996,566

|

|

MERGE HEALTHCARE INCORPORATED AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands)

(unaudited)

| |

|

Three Months Ended

March 31,

|

|

|

|

|

2015

|

|

|

2014

|

|

|

Cash flows from operating activities:

|

|

|

|

|

|

|

|

Net income

|

|

$

|

17,695

|

|

|

$

|

325

|

|

|

Adjustments to reconcile net income to net cash provided by operating activities:

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization

|

|

|

3,580

|

|

|

|

4,077

|

|

|

Share-based compensation

|

|

|

1,265

|

|

|

|

1,530

|

|

|

Amortization of debt issuance costs & discount

|

|

|

222

|

|

|

|

492

|

|

|

Provision for doubtful accounts receivable and allowances, net of recoveries

|

|

|

290

|

|

|

|

525

|

|

|

Deferred income taxes

|

|

|

(18,320

|

)

|

|

|

279

|

|

|

Net change in assets and liabilities

|

|

|

(3,981

|

)

|

|

|

2,620

|

|

|

Net cash provided by operating activities

|

|

|

751

|

|

|

|

9,848

|

|

|

Cash flows from investing activities:

|

|

|

|

|

|

|

|

|

|

Cash paid for acquisitions, net of cash acquired

|

|

|

(63,059

|

)

|

|

|

-

|

|

|

Purchases of property, equipment and leasehold improvements

|

|

|

(1,248

|

)

|

|

|

(333

|

)

|

|

Purchased technology and capitalized software development

|

|

|

(393

|

)

|

|

|

(766

|

)

|

|

Change in restricted cash

|

|

|

23

|

|

|

|

160

|

|

|

Net cash used in investing activities

|

|

|

(64,677

|

)

|

|

|

(939

|

)

|

|

Cash flows from financing activities:

|

|

|

|

|

|

|

|

|

|

Proceeds from issuance of preferred stock

|

|

|

50,000

|

|

|

|

-

|

|

|

Stock issuance cost paid

|

|

|

(288

|

)

|

|

|

-

|

|

|

Preferred stock dividends

|

|

|

(413

|

)

|

|

|

-

|

|

|

Principal payments on term loans

|

|

|

(2,938

|

)

|

|

|

(8,592

|

)

|

|

Waiver and amendment costs paid

|

|

|

(573

|

)

|

|

|

-

|

|

|

Principal payments on capital leases

|

|

|

(140

|

)

|

|

|

(167

|

)

|

|

Proceeds from exercise of stock options and employee stock purchase plan

|

|

|

578

|

|

|

|

51

|

|

|

Net cash provided by (used in) financing activities

|

|

|

46,226

|

|

|

|

(8,708

|

)

|

|

Effect of exchange rate changes on cash

|

|

|

(24

|

)

|

|

|

-

|

|

|

Net (decrease) increase in cash and cash equivalents

|

|

|

(17,724

|

)

|

|

|

201

|

|

|

Cash and cash equivalents, beginning of period (net of restricted cash) (1)

|

|

|

42,322

|

|

|

|

19,337

|

|

|

Cash and cash equivalents, end of period (net of restricted cash) (2)

|

|

$

|

24,598

|

|

|

$

|

19,538

|

|

| (1) |

Restricted cash of $209 and $392 as of December 31, 2014 and 2013, respectively. |

| (2) |

Restricted cash of $186 and $232 as of March 31, 2015 and 2014, respectively. |

MERGE HEALTHCARE INCORPORATED AND SUBSIDIARIES

RECONCILIATION OF NET INCOME AVAILABLE TO COMMON SHAREHOLDERS TO ADJUSTED EBITDA

(in thousands, except for share and per share data)

(unaudited)

| |

|

Three Months Ended

March 31,

|

|

| |

|

2015

|

|

|

2014

|

|

|

Net income available to common shareholders of Merge

|

|

$

|

12,443

|

|

|

$

|

323

|

|

|

Preferred stock dividend

|

|

|

413

|

|

|

|

-

|

|

|

Share-based compensation expense

|

|

|

1,265

|

|

|

|

1,530

|

|

|

Restructuring and other

|

|

|

1,178

|

|

|

|

-

|

|

|

Items associated with significant acquisitions:

|

|

|

|

|

|

|

|

|

|

Tax benefits

|

|

|

(18,393

|

)

|

|

|

-

|

|

|

Preferred stock accretion of dividend equivalents

|

|

|

4,915

|

|

|

|

-

|

|

|

Amortization of significant intangibles

|

|

|

2,185

|

|

|

|

2,247

|

|

|

Costs of acquisitions

|

|

|

351

|

|

|

|

26

|

|

|

Sales adjustments

|

|

|

632

|

|

|

|

162

|

|

|

Cost of sales adjustments

|

|

|

(120

|

)

|

|

|

(25

|

)

|

|

Adjusted net income

|

|

|

4,869

|

|

|

|

4,263

|

|

|

Depreciation and amortization

|

|

|

1,395

|

|

|

|

1,830

|

|

|

Net interest expense

|

|

|

4,258

|

|

|

|

4,161

|

|

|

Income tax expense (benefit)

|

|

|

2

|

|

|

|

(19

|

)

|

|

Adjusted EBITDA

|

|

$

|

10,524

|

|

|

$

|

10,235

|

|

| |

|

|

|

|

|

|

|

|

|

Adjusted net income per share - diluted

|

|

$

|

0.05

|

|

|

$

|

0.04

|

|

| |

|

|

|

|

|

|

|

|

|

Non-GAAP fully diluted share count (1)

|

|

|

104,083,899

|

|

|

|

95,996,566

|

|

|

(1)

|

Includes convertible preferred stock on an if-converted basis for the period outstanding.

|

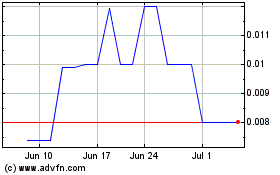

Mirage Energy (PK) (USOTC:MRGE)

Historical Stock Chart

From Jul 2024 to Aug 2024

Mirage Energy (PK) (USOTC:MRGE)

Historical Stock Chart

From Aug 2023 to Aug 2024