MRGE???s 4Q Loss Widens Y/Y, Revs Miss - Analyst Blog

February 19 2013 - 6:10AM

Zacks

Imaging and interoperability

solutions provider Merge Healthcare Incorporated

(MRGE) reported net loss of 19 cents per share in the fourth

quarter of 2012, worse than the year-ago net loss of a penny per

share. Considering stock-based compensation and interest expense as

regular expense for the company, adjusted loss per share in fourth

quarter was 9 cents, a huge disappointment when compared to the

year-ago adjusted earnings of 7 cents.

Merge Healthcare recorded annual

adjusted earnings per share of 2 cents in 2012, in line with the

corresponding Zacks Consensus Estimate. However, the annual result

was a downfall from the 2011 adjusted earnings per share of 30

cents.

Although total revenue edged up

0.9% year over year to $64.7 million, quarterly revenues missed the

Zacks Consensus Estimate of $65 million. Annual revenues rose 7.1%

to $248.9 million in 2012, trailing the corresponding Zacks

Consensus Estimate of $250 million. The company noted that its

latest subscription-based pricing model, which was launched in the

first quarter of 2012, generated 13.5% of total revenue in the

fourth quarter with 13% and 82% rise in subscription backlog in the

quarter and full year, respectively.

Quarter in

Detail

Merge Healthcare primarily derives

revenues from three segments – software and others (39% of total

sales in the quarter), professional services (16%), and maintenance

and EDI (45%). Barring professional services, which recorded a

year-over-year decline of 5.5% to $10.4 million, the software and

other business, and maintenance and EDI registered annualized

improvement of 2.4% to $25.2 million and 1.8% to $29 million,

respectively, in the quarter.

Total cost (excluding depreciation

and amortization) surged 27.8% year over year to $27.6 million.

Fourth-quarter gross margin declined a whopping 896 basis points

(bps) from the year-ago quarter to 57.3%.

Sales and marketing expenses in the

quarter were down 5% (to $11.4 million) while product research and

development expenses jumped 22.7% (to $8.1 million) on a

year-over-year basis. General and administrative expenses shot up

81.4% year over year ($18.5 million).

As a result, operating expenses

surged 31.9% year over year to $38 million. With a massive decline

in gross margin and a significant increase in operating

expenditure, the company incurred an operating loss of $0.9 million

in the quarter compared with operating income of $13.7 million in

the year-ago quarter.

Merge Healthcare exited 2012 with

cash (including restricted cash) of $35.9 million, down 8.7% from

2011.

Outlook

Merge Healthcare reaffirmed its

outlook for 2013. The company continues to expect revenues in the

band of $265 million and $275 million. The current Zacks Consensus

Estimate of $265 million tallies with the lower end of the

guidance. Adjusted EBITDA is envisaged in the range of 22% to 24%.

Subscription backlog is expected to grow by more than $25 million

through 2013.

Our Take

Merge Healthcare posted another

weak quarter to end a challenging 2012. However, the company’s

subscription-based model is gaining traction. Moreover, the

company’s recent contract wins and bookings growth cannot be

overlooked. It is commendable that Merge Healthcare inked several

contracts amid a tough reimbursement environment for advanced

medical imaging. We are encouraged by the bookings growth despite

the general slowdown in hospital spending and low demand for

imaging equipment and related technology.

Going forward, Merge Healthcare is

better positioned for execution in 2013. The stock carries a Zacks

Rank #2 (Buy). Besides Merge Healthcare, medical stocks such as

NuVasive (NUVA) Given Imaging

(GIVN) and Medical Action (MDCI), each carrying a

Zacks Rank #1 (Strong Buy) are expected to do well in the near

term.

GIVEN IMAGING (GIVN): Free Stock Analysis Report

MEDICAL ACTION (MDCI): Free Stock Analysis Report

MERGE HEALTHCAR (MRGE): Free Stock Analysis Report

NUVASIVE INC (NUVA): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

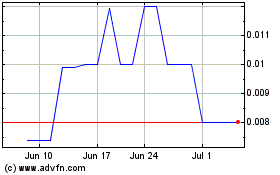

Mirage Energy (PK) (USOTC:MRGE)

Historical Stock Chart

From Jun 2024 to Jul 2024

Mirage Energy (PK) (USOTC:MRGE)

Historical Stock Chart

From Jul 2023 to Jul 2024