Merge Receives EHR Certification - Analyst Blog

October 17 2011 - 5:30AM

Zacks

Recently, the leading developer of

healthcare information software solutions, Merge

Healthcare (MRGE) received the ‘Meaningful Use’ stamp from

the federal government for its Merge RIS v7.0. The product enables

healthcare providers to efficiently record patient details.

With this complete Electronic

Health Record (EHR) Ambulatory certification, RIS v7.0 has emerged

as the industry’s leading radiology information system (RIS). With

RIS v7.0, the users can now utilize a single product for

radiology-specific workflow to qualify for up to $44,000 in funding

under the Health Information Technology for Economic and Clinical

Health (HITECH) Act.

The overall US health IT (HIT)

market witnessed a drastic change in February 2009 with the passing

of the HITECH Act, as a part of the American Recovery and

Reinvestment Act (ARRA), which is an economic stimulus bill. The

ARRA provision includes $20 billion in incentives. Within that,

radiologists using certified EHRs are eligible for receiving

rewards of approximately $1.5 billion.

As per estimates, the US HIT

market, valued at $7.6 billion in 2010, is expected to grow to $9.6

billion by 2014. The US HIT market is gradually adopting EHRs to

meet HITECH funding requirements. Merge is expected to target this

market given its imaging interoperability platform. In such a

scenario, our recommendation could go wrong. Earlier, in September,

Merge got the complete EHR Ambulatory certification for its

OrthoEMR v4.0 that enables healthcare providers to efficiently

record patient details.

However, in recent years, medicare

reimbursement for advanced medical imaging has

declined significantly. At the beginning of 2011, the health

care reform law, Patient Protection and Affordable Care Act

(PPACA), reduced reimbursements for advanced imaging by mandating

an equipment utilization rate of 75%, thereby increasing the

multiple procedural reductions up to 50% from 25%.

Further, the Centers for Medicare

and Medicaid Services (CMS) implemented additional reimbursement

changes using the Physician Payment Information Survey (PPIS) data,

resulting in further reimbursements cuts in the range of 30%-40%

for advanced modalities by 2013.

Although Merge reported revenue

growth during the second quarter 2011, the general slowdown in

hospital spending, low demand for imaging equipment and related

technology due to global credit crisis and macroeconomic factors

could result in lower product sales. This could negatively affect

hospital and imaging clinic revenue, which in turn could impact the

demand for imaging-related software and services offered by Merge.

Furthermore, the presence of major players like General

Electric (GE) and McKesson Corporation

(MCK) has made the diagnostic imaging market highly

competitive.

GENL ELECTRIC (GE): Free Stock Analysis Report

MCKESSON CORP (MCK): Free Stock Analysis Report

MERGE HEALTHCAR (MRGE): Free Stock Analysis Report

Zacks Investment Research

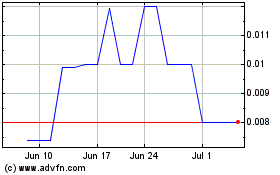

Mirage Energy (PK) (USOTC:MRGE)

Historical Stock Chart

From Jun 2024 to Jul 2024

Mirage Energy (PK) (USOTC:MRGE)

Historical Stock Chart

From Jul 2023 to Jul 2024