Merge Remains 'Underperform' - Analyst Blog

August 29 2011 - 10:00AM

Zacks

We recently reiterated our

Underperform rating on Merge Healthcare

Incorporated (MRGE) with a target price of $5.25.

Merge reported an adjusted EPS of 6

cents in the second quarter of fiscal 2011, well above the year-ago

quarter's loss of 3

cents per share. Solid growth across all the company’s segments

triggered a 92% year-over-year increase in total revenue to $55.6

million in the quarter. However, reported revenues were in line

with the Zacks Consensus Estimate.

We are pleased with Merge’s huge

market potential based on the various incentives proposed by the

HITECH Act. Moreover, we believe Merge’s iConnect platform with its

interoperability infrastructure holds immense potential.

However, the company’s growth

prospect is highly dependent on capital investments by hospitals

for advanced imaging solutions, which in turn is tied to general

economic conditions. The global downturn in the macroeconomic

scenario negatively impacted the market for medical imaging

technologies in the US.

General slowdown in hospital

spending, low demand for imaging equipment and related technology

arising from the global

credit crisis and macroeconomic factors could result in lower Merge

product sales. Additionally, medical imaging facilities have

reduced spending as lower reimbursements and a changing regulatory

environment have dampened profitability. Moreover, any reduction in

reimbursement rates for radiology procedures could affect the

company as demand for imaging related software and services would

be hampered.

Additionally, declining consumer and

business confidence, shifts in consumer spending patterns,

increased unemployment, reduced levels of capital expenditures,

fluctuating commodity prices, bankruptcies and other challenges are

currently forcing customers to delay or reduce purchases. This

could result in lower revenues, longer sales cycles, slower

adoption of new technologies and increased price competition.

In recent years, medicare

reimbursement for advanced medical imaging has

declined significantly. At the beginning of 2011, the health

care reform law, Patient Protection and Affordable Care Act

(PPACA), again reduced reimbursements for advanced imaging by

mandating an equipment utilization rate of 75%, thereby increasing

the multiple procedural reductions up to 50% from 25%.

Further, the Centers for Medicare

and Medicaid Services (CMS) implemented additional reimbursement

changes using the Physician Payment Information Survey (PPIS) data,

resulting in further reimbursements cuts in the range of 30%-40%

for advanced modalities by 2013. This could negatively affect

hospital and imaging clinic revenue, which in turn could reduce

demand for imaging-related software and services offered by

Merge.

Furthermore, the presence of many

big players like General Electric (GE) and

McKesson Corporation (MCK) has made the diagnostic

imaging market highly competitive.

GENL ELECTRIC (GE): Free Stock Analysis Report

MCKESSON CORP (MCK): Free Stock Analysis Report

MERGE HEALTHCAR (MRGE): Free Stock Analysis Report

Zacks Investment Research

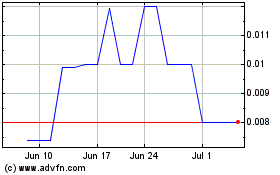

Mirage Energy (PK) (USOTC:MRGE)

Historical Stock Chart

From Jun 2024 to Jul 2024

Mirage Energy (PK) (USOTC:MRGE)

Historical Stock Chart

From Jul 2023 to Jul 2024