UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________

FORM 8-K

_______________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of report (Date of earliest event reported) September 3, 2015 (September 2, 2015)

_______________

MINERCO RESOURCES, INC.

(Exact name of registrant as specified in its charter)

_______________

|

| | |

NEVADA | 333-156059 | 27-2636716 |

(State or Other Jurisdiction of Incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

800 Bering Drive

Suite 201

Houston, TX 77057

(Address of principal executive offices, including zip code.)

(888) 473-5150

(Registrant’s telephone number, including area code)

Not applicable.

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

| |

¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

| |

¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

| |

¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

| |

¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

ITEM 1.01. ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT

On September 2, 2015, Minerco Resources, Inc. ("Minerco") and MSF International, Inc. ("MSF") entered into a Mutual Release and Settlement Agreement for the Pledge and Security Agreement dated May 5, 2015. MSF pledged 50 shares, or approximately five percent (5%), of Level Beverage Company, Inc. ("Level 5") owned by MSF in exchange for a promissory note in the Amount of Six Hundred Eighty-Two Thousand Six Hundred Forty-Two US Dollars ($682,850).

RECITALS:

| |

1. | On or about May 5, 2015, Minerco and MSF entered into a Pledge and Security Agreement (the “Pledge and Security Agreement”) for the acquisition of all of Minerco’s right, title and interest in the: (i) Chiligatoro Hydro-Electric Project and Minerco’s earned interest therein (ii) Iscan Hydro-Electric Project and Minerco’s 10% royalty interest therein; and (iii) Sayab Wind Project and Minerco’s 6% royalty interest therein (the “Assets”). |

| |

2. | In accordance with the terms of the Pledge and Security Agreement MSF issued to Minerco a Secured Promissory Note (the “Note”) in the Amount of Six Hundred Eight-Two Thousand Six Hundred Forty-Two US Dollars ($682,850) with interest accruing at the rate of 5% per annum and MSF agreed to assume Thirty-Two Thousand Six Hundred Forty-Two US Dollars ($32,642) of certain payables owed by Minerco. |

| |

3. | In accordance with the terms of the Pledge and Security Agreement MSF to Pledged as security of the payment of the Note a Security Interest in 50 shares of of common stock, or approximately five percent (5%), of Level 5 owned by MSF (the “Shares”). |

| |

4. | MSF has defaulted on its obligations under the Note and the parties hereto have agreed to satisfy the obligations owed under the Note with the Shares which were pledged under the Pledge and Securities Agreement on the terms agreed to herein. |

| |

5. | MSF owns the Shares pledged to Minerco that are being transferred and assigned to Minerco and that are the subject hereof free and clear of all liens, encumbrances, mortgages and pledges of every kind (collectively, "Claims”), MSF has the right to pledge and assign the Shares to Minerco, the Shares when assigned to Minerco will be free and clear of all Claims and MSF has not entered into any agreements for the sale, transfer or pledge of the Shares. |

The foregoing description of the Mutual Release and Settlement Agreement is qualified in its entirety by reference to the full text of the Agreement, attached as Exhibit 10.1 to the Current Report on Form 8-K filed with the Securities and Exchange Commission and incorporated herein by reference.

On September 2, 2015, we executed an amendment to the exclusive employment agreement with V, Scott Vanis, our Chief Executive Officer, Secretary, President and Chairman of the Board of Directors. The Five Hundred Thousand (500,000) shares of Preferred B Stock, subsequently exchanged for Two Hundred Fifty Thousand (250,000) shares Preferred C Stock on January 7, 2015, shall vest as of July 31, 2017.

The foregoing description of the Amendment to Employment Agreement between V. Scott Vanis and the Company is qualified in its entirety by reference to the full text of the Agreement, attached as Exhibit 10.2 to the Current Report on Form 8-K filed with the Securities and Exchange Commission and incorporated herein by reference.

On September 2, 2015, we executed an amendment to the exclusive employment agreement with Sam J Messina III, our Chief Financial Officer, Treasurer and a member of the Board of Directors. The Five Hundred Thousand (500,000) shares of Preferred B Stock, subsequently exchanged for Two Hundred Fifty Thousand (250,000) shares Preferred C Stock on January 7, 2015, shall vest as of July 31, 2017.

The foregoing description of the Amendment to Employment Agreement between Sam J Messina III and the Company is qualified in its entirety by reference to the full text of the Agreement, attached as Exhibit 10.3 to the Current Report on Form 8-K filed with the Securities and Exchange Commission and incorporated herein by reference.

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS

EXHIBITS, FINANCIAL STATEMENT SCHEDULES

|

| | | | | | |

| | Incorporated by reference | |

Exhibit | Document Description | Form | | Date | Number | Filed herewith |

10.1 | Mutual Release and Settlement Agreement | | | | | X |

10.2 | Amendment to Employment Agreement with V. Scott Vanis dated September 2, 2015 | | | | | X |

10.3 | Amendment to Employment Agreement with Sam J Messina III dated September 2, 2015 | | | | | X |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

| | | |

| MINERCO RESOURCES, INC. | |

| | | |

9/3/2015 | By: | /s/ V. Scott Vanis | |

| | | |

| | | |

| | | |

SETTLEMENT AGREEMENT

AND

MUTUAL RELEASE

This Settlement Agreement and Mutual Release of all Claims (“Agreement”) is entered into and executed on the date(s) indicated below, by and between Minerco Resources, Inc. (“Minerco”), a Nevada corporation, on the one hand, and MSF International, Inc. (“MSF”), a Belize Corporation, on the other hand.

RECITALS:

| |

1. | On or about May 5, 2015, Minerco and MSF entered into a Pledge and Security Agreement (the “Pledge and Security Agreement”) for the acquisition of all of Minerco’s right, title and interest in the: (i) Chiligatoro Hydro-Electric Project and Minerco’s earned interest therein (ii) Iscan Hydro-Electric Project and Minerco’s 10% royalty interest therein; and (iii) Sayab Wind Project and Minerco’s 6% royalty interest therein (the “Assets”). |

| |

2. | In accordance with the terms of the Pledge and Security Agreement MSF issued to Minerco a Secured Promissory Note (the “Note”) in the Amount of Six Hundred Eight-Two Thousand Six Hundred Forty-Two US Dollars ($682,850) with interest accruing at the rate of 5% per annum and MSF agreed to assume Thirty-Two Thousand Six Hundred Forty-Two US Dollars ($32,642) of certain payables owed by Minerco. |

| |

3. | In accordance with the terms of the Pledge and Security Agreement MSF to Pledged as security of the payment of the Note a Security Interest in 50 shares of of common stock of Level 5 Beverage Company, Inc. (“Level 5”) owned by MSF (the “Shares”). |

| |

4. | MSF has defaulted on its obligations under the Note and the parties hereto have agreed to satisfy the obligations owed under the Note with the Shares which were pledged under the Pledge and Securities Agreement on the terms agreed to herein. |

| |

5. | MSF owns the Shares pledged to Minerco that are being transferred and assigned to Minerco and that are the subject hereof free and clear of all liens, encumbrances, mortgages and pledges of every kind (collectively, Claims”), MSF has the right to pledge and assign the Shares to Minerco, the Shares when assigned to Minerco will be free and clear of all Claims and MSF has not entered into any agreements for the sale, transfer or pledge of the Shares. |

NOW THEREFORE, in consideration of the promises and covenants hereinafter set forth, the parties hereto covenant and agree as follows:

COVENANTS:

| |

1. | Incorporation of Recitals: |

The recitals set forth above are acknowledged by the parties to be true and correct and are incorporated herein as terms of this Agreement.

Upon Minerco’s receipt of the Shares duly endorsed for transfer to Minerco or accompanied by an executed stock power transferring the Shares to Minerco, each of the parties hereto and their respective and applicable officers, directors, agents, representatives, successors and assigns hereby release, acquit and forever discharge the other party and the other party’s officers, directors, shareholders, employees, consultants, attorneys, agents, insurers, successors and assigns, from any and all claims, demands, causes of action, liabilities, obligations and responsibilities of whatever kind or nature, whether at law, statutory, tort, contract, equity, or otherwise, whether known or unknown, whether fixed or contingent, and whether now or at any time hereafter discovered or asserted, in existence or arising at any time or times on or prior to the date of this Agreement and based upon, relating to or arising out of the matters set forth in the Recitals, above, and/or that were asserted or could have been asserted in a lawsuit related to the Pledge and Security Agreement.

| |

3. | No Admissions of Liability: |

It is hereby specifically acknowledged and agreed by the parties that this Agreement is entered into and made by way of compromise in settlement of disputed claims, as to which liability has been and is expressly denied. Nothing about this Agreement is intended as, or shall be construed as, an admission by any party.

| |

4. | Execution of Other Instruments, Documents and Papers: |

The parties agree to cooperate in carrying out and effecting the intent of this Agreement and further agree to execute any other instruments, documents or other papers as may be necessary to carry out and effect the intent of this Agreement.

The parties agree to execute or effecting other instruments, documents or other papers as may be necessary to carry out and effect prior resolutions or obligations, as so far as not to conflict with this agreement.

The parties represent and warrant that they have not assigned any right, title or interest to any claims released hereby and that they have the authority to execute this Agreement, make the covenants contained herein and release the claims as set forth above.

| |

6. | Construction of the Agreement: |

The construction and effect of this Agreement shall be governed by the laws of the State of Texas wherein it is executed. This Agreement contains the entire understanding between the parties hereto with respect to the subject matter hereof and supersedes all prior Agreements and understandings, inducements or conditions, express or implied, oral or written, except as contained herein.

| |

7. | Execution by Counterparts and Facsimile: |

It is further agreed that this Agreement may be executed in counterparts and by facsimile and that each counterpart and facsimile copy, taken together, shall be considered the Agreement between the parties.

| |

8. | Attorneys’ Fees and Costs: |

In the event of any litigation or legal proceedings to enforce or interpret this Agreement, the prevailing party shall be entitled to recover their reasonable attorneys' fees and costs.

If a court of competent jurisdiction makes a final determination that any term or provision hereof is invalid, illegal or unenforceable, the invalid, illegal or unenforceable term or provision shall be deemed replaced by a term or provision that is legal, valid and enforceable and that comes closest to expressing the intention of the illegal, invalid or unenforceable term or provision, and the remaining terms and provisions hereof shall remain unimpaired.

MSF has good and marketable title to, and full right and power to sell, the Interests. Minerco will acquire good and valid title to the Interests free and clear of all mortgages, pledges, liens, security interests, encumbrances, conditional sale agreements, charges, claims and restrictions of any kind and nature whatsoever (“Liens”).

IN WITNESS WHEREOF, the parties hereto have executed this Agreement as of the dates set forth below.

MINERCO RESOURCES, INC. MSF INTERNATIONAL, INC.

By:_/s/ V. Scott Vanis____________ By: __/s/ Marco Mena_______________

Dated: September 2, 2015 Dated: September 2, 2015

AMENDMENT TO EMPLOYMENT AGREEMENT

This Amendment to Employment Agreement (the "Agreement") is entered into as of the 2nd day of September, 2015 as an amendment to the original Employment Agreement dated September 10, 2014 between V. Scott Vanis ("Employee") and Minerco Resources, Inc., a Nevada Corporation, it’s affiliates, predecessors and subsidiaries (the "Company”).

WHEREAS, Employee and the Company desire to enter into this Amendment Agreement setting forth the terms and conditions for the employment relationship of Employee with the Company during the Employment Term (as defined below). This agreement shall amend the Employment Agreement dated September 10, 2014 between Employee and Company.

NOW, THEREFORE, in consideration of the mutual promises contained herein, the parties to this Amendment Agreement hereby agree to Amend the sections as follows:

2.2 Stock. The Company shall grant to Five Hundred Thousand (500,000) shares of its Class B Preferred Stock, which were subsequently exchanged on January 7, 2015 for Two Hundred Fifty Thousand (250,000) shares of its Class C Preferred Stock, upon the effective date of this original Employment Agreement dated September 10, 2014. The stock shall be fully paid, non-assessable and shall contain other customary rights and privileges, including piggy back registration rights. All stock shall vest as of July 31, 2017.

6.5. Termination in Case of Death. In case of Employee's death, any and all unvested stock or options granted to Employee under Section 2.2 of this Agreement shall vest in favor of Employee's estate as provided for in this Section(s) 6.51, 6.5.2, 6.5.3, and 6.5.4 herein. Company shall also continue any health benefits for family for one year. All stock shall vest as of July 31, 2017.

The Company:

Minerco Resources, Inc.

800 Bering Drive, Suite 201

Houston, TX 77057

Employee:

V. Scott Vanis

800 Bering Drive, Suite 201

Houston, TX 77057

IN WITNESS WHEREOF, the parties have executed this Amendment Agreement as of the date first above written.

Minerco Resources, Inc., a Nevada Corporation

By:___/s/ V. Scott Vanis____________

V. Scott Vanis, President, Director

Employee

By:___/s/ V. Scott Vanis____________

V. Scott Vanis, an Individual

AMENDMENT TO EMPLOYMENT AGREEMENT

This Amendment to Employment Agreement (the "Agreement") is entered into as of the 2nd day of September, 2015 as an amendment to the original Employment Agreement dated September 10, 2014 between Sam J Messina III ("Employee") and Minerco Resources, Inc., a Nevada Corporation, it’s affiliates, predecessors and subsidiaries (the "Company”).

WHEREAS, Employee and the Company desire to enter into this Amendment Agreement setting forth the terms and conditions for the employment relationship of Employee with the Company during the Employment Term (as defined below). This agreement shall amend the Employment Agreement dated September 10, 2014 between Employee and Company.

NOW, THEREFORE, in consideration of the mutual promises contained herein, the parties to this Amendment Agreement hereby agree to Amend the sections as follows:

2.2 Stock. The Company shall grant to Five Hundred Thousand (500,000) shares of its Class B Preferred Stock, which were subsequently exchanged on January 7, 2015 for Two Hundred Fifty Thousand (250,000) shares of its Class C Preferred Stock, upon the effective date of this original Employment Agreement dated September 10, 2014. The stock shall be fully paid, non-assessable and shall contain other customary rights and privileges, including piggy back registration rights. All stock shall vest as of July 31, 2017.

6.5. Termination in Case of Death. In case of Employee's death, any and all unvested stock or options granted to Employee under Section 2.2 of this Agreement shall vest in favor of Employee's estate as provided for in this Section(s) 6.51, 6.5.2, 6.5.3, and 6.5.4 herein. Company shall also continue any health benefits for family for one year. All stock shall vest as of July 31, 2017.

The Company:

Minerco Resources, Inc.

800 Bering Drive, Suite 201

Houston, TX 77057

Employee:

Sam J Messina III

7620 Miramar Road, Suite 4200

San Diego, CA 92126

IN WITNESS WHEREOF, the parties have executed this Amendment Agreement as of the date first above written.

Minerco Resources, Inc., a Nevada Corporation

By:___/s/ V. Scott Vanis____________

V. Scott Vanis, President, Director

Employee

By:___/s/ Sam J Messina III____________

Sam J Messina III, an Individual

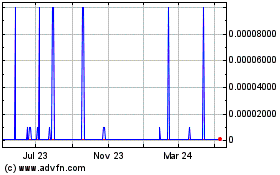

Minerco (CE) (USOTC:MINE)

Historical Stock Chart

From Apr 2024 to May 2024

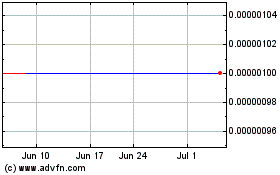

Minerco (CE) (USOTC:MINE)

Historical Stock Chart

From May 2023 to May 2024