UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________

FORM 8-K

_______________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of report (Date of earliest event reported) June 25, 2015 (June 25, 2015)

_______________

MINERCO RESOURCES, INC.

(Exact name of registrant as specified in its charter)

_______________

|

| | |

NEVADA | 333-156059 | 27-2636716 |

(State or Other Jurisdiction of Incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

800 Bering Drive

Suite 201

Houston, TX 77057

(Address of principal executive offices, including zip code.)

(888) 473-5150

(Registrant’s telephone number, including area code)

Not applicable.

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

| |

¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

| |

¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

| |

¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

| |

¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

ITEM 8.01. OTHER EVENTS

On June 25, 2015, the Company released a Press Release to discuss the Company's operations and business outlook. A copy of the press release is furnished as Exhibit 99.1, to this Current Report on Form 8-K filed with the Securities and Exchange Commission.

The information in this Item 8.01 and Exhibit 99.1 is being furnished and shall not be deemed "filed" for the purposes of Section 18 of the Securities Exchange Act of 1934 or otherwise subject to the liabilities of that Section. The information in this Current Report, and its Exhibit(s), shall not be incorporated by reference into any registration statement or other document filed with the Securities and Exchange Commission.

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS

EXHIBITS, FINANCIAL STATEMENT SCHEDULES

|

| | | | | | |

| | Incorporated by reference | |

Exhibit | Document Description | Form | | Date | Number | Filed herewith |

99.1 | Press Release, dated June 25, 2015 | | | | | X |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

| | | |

| MINERCO RESOURCES, INC. | |

| | | |

Date: 6/25/2015 | By: | /s/ V. Scott Vanis | |

| | | |

| | | |

| | | |

V. Scott Vanis

Minerco's Chairman and CEO

A Letter from the Chairman

June 25, 2015

Dear Shareholders,

As most of you know, we just filed our Form 10-Q for the quarterly period ending on April 30 of this year. Frankly, it's a mix of good news but also missed expectations. My job is to shed light on the facts and that’s what I pledge always to do. That said, our trajectory of progress and achievement in less than one year is solid. We continue to be confident that our overall growth strategy of accumulating greater equity holdings and value for shareholders is the correct course and is leading us to our goal of upgrading to a listed exchange.

I would also like to thank you for your patience in regards to the timing of this update. I wanted to be in the position to affirmatively state that, as of yesterday, we have started the process of returning common shares to the company treasury. Additionally, I can now also definitively state that we believe our current share structure will be suitable to see us through to the next step in our growth, expansion and evolution. After more than six months of planning, consultations and meetings with financial / banking partners, the generalities of this coming move are finalized. However, the exact mechanics are still being sorted out. In our customary fashion, the mechanics of the next step will be advantageous to our shareholders, and we will let you know the full story after the details are locked in.

Here’s my quick evaluation of the ups and downs reflected in this latest 10Q:

The ups -

| |

• | Assets are up to $3,511,368 (up approx. $800K from January 31, 2015). This increase is due mostly to our acquisition of branded cash flowing assets, such as our increased ownership of Avanzar Sales & Distribution and VitaminFIZZ, as well as from interest accruing notes receivable. |

| |

• | Derivative liabilities are down more than $700K quarter over quarter. We are consistently working to reduce our overall debt burden. This is essential for Minerco to evolve from a small cap to a listed exchange. The detailed procedure of clearing out the remaining debt has been initiated, and we plan to provide updates on this topic as we reach closure. |

| |

• | The company is now fully divested of its last remaining clean energy projects, including hydro-electric and wind. Purchase price was in the form of the assignment of over $32k of Minerco debt (which is no longer our obligation) as well as receiving an interest accruing note receivable of more than $680K. This transaction adds more than $700K in gross assets to our balance sheet. Now we have completely cut the cord with our former line of business and are now completely |

focused on the beverage industry and taking our flagship product, VitaminFIZZ, to a national market.

| |

• | Incremental revenues are up $33K year-over-year, with well over $600k in sales for the quarter. This increase is a net result of increased VitaminFIZZ sales counterbalanced by lower sales numbers from other Avanzar products due to seasonality. |

| |

• | VitaminFIZZ is consistently building sales momentum in its domestic test markets and has only just now arrived in the UK. VitaminFIZZ booked revenues (as of 4/30/2015) increased by approximately 60% quarter over quarter (excluding double booking with Avanzar). This increase does not accurately represent the rapid expansion of VitaminFIZZ. The addition of numerous new key accounts, many of which we leveraged inventory in lieu of cash to open, increased product sales and placement in Q2 (ending 4/30/2015) by over 500% (excluding Walgreen’s promotion) in Q3. This is the critical benchmark of VitaminFIZZ progress: marketplace performance. |

The downs -

| |

• | Quarterly gross profits are down YTD due primarily to the promotional and advertising costs of entering VitaminFIZZ into new key accounts and markets. Promotion is a necessary investment spend in any business scenario and absolutely essential for an early stage product like VitaminFIZZ. |

| |

• | An increase in total liabilities, quarter over quarter. This is a result of the traditional debt we took on to be able to execute on our strategy of vertical integration, and expand our equity ownership of branded cash flowing assets such as Avanzar and VitaminFIZZ. |

| |

• | Revenues are down, quarter over quarter. For Avanzar, February through April is the slowest sales season due to seasonality and inclement weather. This phenomenon held true for Avanzar the quarter ending 4/30/2015. However, as mentioned above, this trend was not true for VitaminFIZZ, which sold and placed more product in Q3 than any quarter since its launch. |

| |

• | Since the end of the quarter, we also took an additional Debenture to continue to fund our vertical integration, expand equity ownership but mostly to quickly cover an emergency / increased production run this month to supply our newest key account. Regarding this newest key account: we expect it to be our game changer based on the path taken by the category leader in the VitaminFIZZ space. |

Even though we interpreted some of our quarterly numbers as below expectations, I hope you can see, as I do, that the mixed messages of our latest 10-Q are a result of the normal vicissitudes of doing business. For our company, business is good and value is being built. For our shareholders, we believe the evolution of our company will finally deliver the true value of your loyalty, support and investment. Personally, I have never been more convinced that our robust progress to date is only the beginning of building a progressive, world-class company.

As always, my thanks for your confidence and support.

Sincerely,

Minerco Resources, Inc. (OTC: MINE)

http://minercoresources.com/

Minerco Company Background: Minerco Resources, Inc. (OTC:MINE) is an emerging growth company specializing in the food and beverage industry. Its portfolio of companies include Level 5 Beverage Company, Inc. (Level 5), Avanzar Sales & Distribution, LLC and The Herbal Collection™. Level 5 is a specialty beverage company that develops, produces, markets and distributes a diversified collection of forward-thinking, healthful consumer brands. Level 5 brands include VitaminFIZZ®, Vitamin Creamer® and Island Style™. http://minercoresources.com

Recent Media Coverage: Bevnet, Orange County Business Journal, ConvenienceStoreNews, Food Navigator

Safe Harbor Statement: This document contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Act of 1934 that are based upon current expectations or beliefs, as well as a number of assumptions about future events. Although we believe that the expectations and assumptions upon which they are based are reasonable, we can give no assurance that such expectations and assumptions will prove to have been correct. Some of these uncertainties include, without limitation, the company's ability to perform under existing contracts or to procure future contracts. The reader is cautioned not to put undue reliance on these forward-looking statements, as these statements are subject to numerous factors and uncertainties, including without limitation, successful implementation of our business strategy and competition, any of which may cause actual results to differ materially from those described in the statements. We undertake no obligation and do not intend to update, revise or otherwise publicly release any revisions to these forward-looking statements to reflect events or circumstances after the date hereof or to reflect the occurrence of any unanticipated events. Although we believe that our expectations are based on reasonable assumptions, we can give no assurance that our expectations will materialize. Many factors could cause actual results to differ materially from our forward-looking statements.

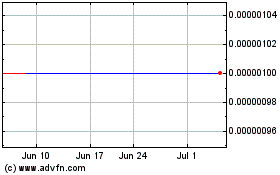

Minerco (CE) (USOTC:MINE)

Historical Stock Chart

From May 2024 to Jun 2024

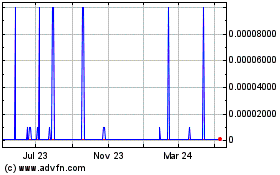

Minerco (CE) (USOTC:MINE)

Historical Stock Chart

From Jun 2023 to Jun 2024