UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________

FORM 8-K

_______________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of report (Date of earliest event reported): January 8, 2015 (January 5, 2015)

_______________

MINERCO RESOURCES, INC.

(Exact name of registrant as specified in its charter)

_______________

|

NEVADA

|

333-156059

|

27-2636716

|

|

(State or Other Jurisdiction of Incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

800 Bering Drive

Suite 201

Houston, TX 77057

(Address of principal executive offices, including zip code.)

(888) 473-5150

(Registrant’s telephone number, including area code)

Not applicable.

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

o

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

o

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

|

ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT

|

On January 7, 2015, Minerco Resources, Inc. (“we” or the “Company”) entered into an Agreement (the “Exchange Agreement”) with V. Scott Vanis, an individual and our Principal Executive Officer (“Vanis”), where, among other things, the Company and Vanis shall exchange Vanis’ five hundred thousand (500,000) shares of the Company’s Class ‘B’ Preferred stock and all accrued and unpaid dividends for two hundred fifty thousand (250,000) shares of the Company’s Class ‘C’ Preferred stock.

The entire Exchange Agreement is attached as Exhibit 10.1 to this Current Report on Form 8-K filed with the Securities and Exchange Commission:

On January 7, 2015, Minerco Resources, Inc. (“we” or the “Company”) entered into an Agreement (the “Exchange Agreement”) with Sam J Messina III, an individual and our Principal Accounting Officer (“Messina”), where, among other things, the Company and Messina shall exchange Messina’s five hundred thousand (500,000) shares of the Company’s Class ‘B’ Preferred stock and all accrued and unpaid dividends for two hundred fifty thousand (250,000) shares of the Company’s Class ‘C’ Preferred stock.

The entire Exchange Agreement is attached as Exhibit 10.2 to this Current Report on Form 8-K filed with the Securities and Exchange Commission:

Item 5.03 Amendment of Certificate of Incorporation

On January 7, 2015, the Company filed a Certificate of Designations for the creation of a class of Series C Preferred Stock with the Nevada Secretary of State. The number of shares constituting Series C Preferred is 1,000,000. The stated value is $20.00 per share. The holders of the Series C Preferred are also entitled to a liquidation preference equal to the stated value plus all accrued and unpaid dividends. Each share of Series B Preferred is convertible into 1,000 shares of common stock; however the conversion price is subject to adjustment. Holders of shares of Series B Preferred vote together with the common stock as a single class and each holder of Series C Preferred shall be entitled to 5 votes for each share of Common Stock into which such shares of Series C Preferred held by them could be converted. The Company has the right to redeem the shares of Series C Preferred at any time after the date of issuance at a per share price equal to 125% of the stated value. The Series C Preferred automatically converts to common stock upon certain specified events.

The foregoing description of the Certificate of Designation does not purport to be complete and is qualified in its entirety by reference to the full text of the Certificate of Designation which is filed as Exhibit 10.3 to this Current Report on Form 8-K and incorporated herein by reference.

On January 5, 2015, the Company released a Press Release to discuss the Company's operations and business outlook. A copy of the press release is furnished as Exhibit 99.1, to this Current Report on Form 8-K filed with the Securities and Exchange Commission.

On January 6, 2015, Level 5 Beverage Company, Inc. entered into a Termination and Mutual Release of Sales Commission Agreement with Anthony Skinner, an individual. The parties agreed to terminate a Commission Sales Agreement dated February 24, 2014 between the parties.

The entire Exchange Agreement is attached as Exhibit 10.4 to this Current Report on Form 8-K filed with the Securities and Exchange Commission).

On January 8, 2015, the Company released a Press Release to discuss the Company's operations and business outlook. A copy of the press release is furnished as Exhibit 99.2, to this Current Report on Form 8-K filed with the Securities and Exchange Commission.

EXHIBITS, FINANCIAL STATEMENT SCHEDULES.

| |

|

Incorporated by reference

|

|

|

Exhibit

|

Document Description

|

Form

|

Date

|

Number

|

Filed herewith

|

|

10.1

|

Exchange Agreement, Minerco – Vanis, dated January 7, 2015

|

|

|

|

X

|

|

10.2

|

Exchange Agreement, Minerco – Messina, dated January 7, 2015

|

|

|

|

X

|

|

10.3

|

Certificate of Designations for Series C Preferred Stock

|

|

|

|

X

|

|

10.4

|

Termination and Mutual Release of Sales Commission Agreement with Anthony Skinner, dated January 6, 2015

|

|

|

|

X

|

|

99.1

|

Press Release, dated January 5, 2015

|

|

|

|

X

|

|

99.2

|

Press Release, dated January 8, 2015

|

|

|

|

X

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| |

MINERCO RESOURCES, INC.

|

|

| |

|

|

|

|

|

By:

|

/s/ V. Scott Vanis

|

|

| |

|

V. Scott Vanis

|

|

| |

|

Chief Executive Officer

|

|

| |

|

|

|

Exhibit 10.1

AGREEMENT TO EXCHANGE

CLASS B PREFERRED SHARES FOR CLASS C PREFERRED SHARES

THIS AGREEMENT, dated as of January 7, 2015 is entered into by and between Minerco Resources, Inc. (the “Company”) and V. Scott Vanis (”Vanis”).

WITNESSETH:

WHEREAS, Vanis is the Chief Executive Officer (“CEO”) of the Company and has been the Company’s CEO since July 9, 2014; and

WHEREAS, Vanis was issued five hundred thousand (500,000) shares of the Company’s Series B Preferred stock pursuant to his employment agreement dated September 10, 2014; and

WHEREAS, Vanis is willing to exchange five hundred thousand (500,000) shares of the Company’s Series B Preferred Stock and all accrued and unpaid dividends for two hundred fifty thousand (250,000) shares of the Company’s Class C Preferred stock AND the Company is willing to exchange Vanis’s five hundred thousand (500,000) shares of the Company’s Class B Preferred stock for two hundred fifty thousand (250,000) shares of the Company’s Class C Preferred stock;

NOW, THEREFORE, in consideration for the foregoing, the parties hereto agree as follows:

|

1.

|

Exchange. Vanis agrees to exchange his five hundred thousand (500,000) shares of the Company’s Series B Preferred Stock and all accrued and unpaid dividends for two hundred fifty thousand (250,000) shares of the Company’s Class C Preferred stock

|

|

2.

|

Vanis Representations, Warranties, Etc. Vanis represents and warrants to, and covenants and agrees with, the Company as follows:

|

|

a.

|

Due Authorization. Vanis has all requisite legal capacity to execute, deliver and perform this Agreement and the transactions hereby contemplated. This Agreement constitutes a valid and binding agreement on the part of Vanis and is enforceable in accordance with its terms.

|

|

b.

|

No Consents; No Contravention. The execution, delivery and performance by Vanis of this Agreement (i) requires no authorization, registration, consent, approval or action by or in respect of, or filings with, any governmental body, agency or official or other person (including but not limited to the Securities and Exchange Commission), and (ii) do not contravene, conflict with, result in a breach of or constitute a default under any material provision of applicable law or regulation, or of any material agreement to which Vanis is a party.

|

|

3.

|

Company Representations, Etc. The Company represents and warrants to Vanis that:

|

|

a.

|

Exchange Agreement. This Agreement and the transactions contemplated hereby, have been duly and validly authorized by the Company. This Agreement has been duly executed and delivered by the Company and is a valid and binding agreement of the Company enforceable in accordance with its terms, subject as to enforceability to general principles of equity and to bankruptcy, insolvency, moratorium, and other similar laws affecting the enforcement of creditors' rights generally.

|

|

b.

|

Non-contravention. The execution and delivery of this Agreement by the Company, and the consummation by the Company of the other transactions contemplated by this Agreement do not and will not conflict with or result in a breach by the Company of any of the terms or provisions of, or constitute a default under (i) the articles of incorporation or by-laws of the Company, (ii) any indenture, mortgage, deed of trust, or other material agreement or instrument to which the Company is a party or by which it or any of its properties or assets are bound, (iii) to its knowledge, any existing applicable law, rule, or regulation or any applicable decree, judgment, or (iv) to its knowledge, order of any court, United States federal or state regulatory body, administrative agency, or other governmental body having jurisdiction over the Company or any of its properties or assets, except such conflict, breach or default which would not have a material adverse effect on the transactions contemplated herein. The Company is not in violation of any material laws, governmental orders, rules, regulations or ordinances to which its property, real, personal, mixed, tangible or intangible, or its businesses related to such properties, are subject.

|

|

c.

|

Approvals. No authorization, approval or consent of any court, governmental body, regulatory agency, self-regulatory organization, or stock exchange or market is required to be obtained by the Company for the Exchange as contemplated by this Agreement, except such authorizations, approvals and consents that have been obtained.

|

|

4.

|

Certain Covenants And Acknowledgments. The Company undertakes and agrees to make all necessary filings in connection with the exchange effected hereby under any United States laws and regulations, and to provide a copy thereof to Vanis promptly after such filing.

|

|

5.

|

Governing Law; Miscellaneous. This Agreement shall be governed by and interpreted in accordance with the laws of the State of Nevada. A facsimile transmission of this signed Agreement shall be legal and binding on all parties hereto. This Agreement may be signed in one or more counterparts, each of which shall be deemed an original. The headings of this Agreement are for convenience of reference and shall not form part of, or affect the interpretation of, this Agreement. If any provision of this Agreement shall be invalid or unenforceable in any jurisdiction, such invalidity or unenforceability shall not affect the validity or enforceability of the remainder of this Agreement or the validity or enforceability of this Agreement in any other jurisdiction. This Agreement may be amended only by an instrument in writing signed by the party to be charged with enforcement. This Agreement, and the related agreements referred to herein, contain the entire agreement of the parties with respect to the subject matter hereto, superceding all prior agreements, understandings or discussions.

|

|

6.

|

Notices. Any notice required or permitted hereunder shall be given in writing (unless otherwise specified herein) and shall be deemed effectively given, (i) on the date delivered, (a) by personal delivery, or (b) if advance copy is given by fax, (ii) seven business days after deposit in the United States Postal Service by regular or certified mail, or (iii) three business days mailing by international express courier, with postage and fees prepaid, addressed to each of the other parties thereunto entitled at the last known mailing address, or at such other addresses as a party may designate by ten days advance written notice to each of the other parties hereto.

|

|

7.

|

Successors And Assigns. This Agreement shall be binding upon and inure to the benefit of the parties hereto and their respective successors and permitted assigns.

|

IN WITNESS WHEREOF, the Company and Vanis have caused this Agreement to be executed by their duly authorized representatives on the date as first written above.

MINERCO RESOURCES, INC.

By: /s/ V. Scott Vanis

Name: V. Scott Vanis

Title: CEO

V. SCOTT VANIS

By: /s/ V. Scott Vanis________________

Name: V. Scott Vanis

An Individual

Exhibit 10.2

AGREEMENT TO EXCHANGE

CLASS B PREFERRED SHARES FOR CLASS C PREFERRED SHARES

THIS AGREEMENT, dated as of January 7, 2015 is entered into by and between Minerco Resources, Inc. (the “Company”) and Sam J Messina III (”Messina”).

WITNESSETH:

WHEREAS, Messina is the Chief Financial Officer (“CFO”) of the Company and has been the Company’s CFO since July 1, 2014; and

WHEREAS, Messina was issued five hundred thousand (500,000) shares of the Company’s Series B Preferred stock pursuant to his employment agreement dated September 10, 2014; and

WHEREAS, Messina is willing to exchange five hundred thousand (500,000) shares of the Company’s Series B Preferred Stock and all accrued and unpaid dividends for two-hundred fifty thousand (250,000) shares of the Company’s Class C Preferred stock AND the Company is willing to exchange Messina’s five hundred thousand (500,000) shares of the Company’s Class B Preferred stock for two hundred fifty thousand (250,000) shares of the Company’s Class C Preferred stock;

NOW, THEREFORE, in consideration for the foregoing, the parties hereto agree as follows:

|

1.

|

Exchange. Messina agrees to exchange his five hundred thousand (500,000) shares of the Company’s Series B Preferred Stock and all accrued and unpaid dividends for two-hundred fifty thousand (250,000) shares of the Company’s Class C Preferred stock

|

|

2.

|

Messina Representations, Warranties, Etc. Messina represents and warrants to, and covenants and agrees with, the Company as follows:

|

|

a.

|

Due Authorization. Messina has all requisite legal capacity to execute, deliver and perform this Agreement and the transactions hereby contemplated. This Agreement constitutes a valid and binding agreement on the part of Messina and is enforceable in accordance with its terms.

|

|

b.

|

No Consents; No Contravention. The execution, delivery and performance by Messina of this Agreement (i) requires no authorization, registration, consent, approval or action by or in respect of, or filings with, any governmental body, agency or official or other person (including but not limited to the Securities and Exchange Commission), and (ii) do not contravene, conflict with, result in a breach of or constitute a default under any material provision of applicable law or regulation, or of any material agreement to which Messina is a party.

|

|

3.

|

Company Representations, Etc. The Company represents and warrants to Messina that:

|

|

a.

|

Exchange Agreement. This Agreement and the transactions contemplated hereby, have been duly and validly authorized by the Company. This Agreement has been duly executed and delivered by the Company and is a valid and binding agreement of the Company enforceable in accordance with its terms, subject as to enforceability to general principles of equity and to bankruptcy, insolvency, moratorium, and other similar laws affecting the enforcement of creditors' rights generally.

|

|

b.

|

Non-contravention. The execution and delivery of this Agreement by the Company, and the consummation by the Company of the other transactions contemplated by this Agreement do not and will not conflict with or result in a breach by the Company of any of the terms or provisions of, or constitute a default under (i) the articles of incorporation or by-laws of the Company, (ii) any indenture, mortgage, deed of trust, or other material agreement or instrument to which the Company is a party or by which it or any of its properties or assets are bound, (iii) to its knowledge, any existing applicable law, rule, or regulation or any applicable decree, judgment, or (iv) to its knowledge, order of any court, United States federal or state regulatory body, administrative agency, or other governmental body having jurisdiction over the Company or any of its properties or assets, except such conflict, breach or default which would not have a material adverse effect on the transactions contemplated herein. The Company is not in violation of any material laws, governmental orders, rules, regulations or ordinances to which its property, real, personal, mixed, tangible or intangible, or its businesses related to such properties, are subject.

|

|

c.

|

Approvals. No authorization, approval or consent of any court, governmental body, regulatory agency, self-regulatory organization, or stock exchange or market is required to be obtained by the Company for the Exchange as contemplated by this Agreement, except such authorizations, approvals and consents that have been obtained.

|

|

4.

|

Certain Covenants And Acknowledgments. The Company undertakes and agrees to make all necessary filings in connection with the exchange effected hereby under any United States laws and regulations, and to provide a copy thereof to Messina promptly after such filing.

|

|

5.

|

Governing Law; Miscellaneous. This Agreement shall be governed by and interpreted in accordance with the laws of the State of Nevada. A facsimile transmission of this signed Agreement shall be legal and binding on all parties hereto. This Agreement may be signed in one or more counterparts, each of which shall be deemed an original. The headings of this Agreement are for convenience of reference and shall not form part of, or affect the interpretation of, this Agreement. If any provision of this Agreement shall be invalid or unenforceable in any jurisdiction, such invalidity or unenforceability shall not affect the validity or enforceability of the remainder of this Agreement or the validity or enforceability of this Agreement in any other jurisdiction. This Agreement may be amended only by an instrument in writing signed by the party to be charged with enforcement. This Agreement, and the related agreements referred to herein, contain the entire agreement of the parties with respect to the subject matter hereto, superceding all prior agreements, understandings or discussions.

|

|

6.

|

Notices. Any notice required or permitted hereunder shall be given in writing (unless otherwise specified herein) and shall be deemed effectively given, (i) on the date delivered, (a) by personal delivery, or (b) if advance copy is given by fax, (ii) seven business days after deposit in the United States Postal Service by regular or certified mail, or (iii) three business days mailing by international express courier, with postage and fees prepaid, addressed to each of the other parties thereunto entitled at the last known mailing address, or at such other addresses as a party may designate by ten days advance written notice to each of the other parties hereto.

|

|

7.

|

Successors And Assigns. This Agreement shall be binding upon and inure to the benefit of the parties hereto and their respective successors and permitted assigns.

|

IN WITNESS WHEREOF, the Company and Messina have caused this Agreement to be executed by their duly authorized representatives on the date as first written above.

MINERCO RESOURCES, INC.

By: /s/ V. Scott Vanis

Name: V. Scott Vanis

Title: CEO

SAM J MESSINA III

By: /s/ Sam J Messina III

Name: Sam J Messina III

An Individual

Exhibit 10.3

MINERCO RESOURCES, INC.

CERTIFICATE OF DESIGNATIONS, RIGHTS AND PREFERENCES

OF THE SERIES B CONVERTIBLE PREFERRED STOCK

I, V. Scott Vanis, President of MINERCO RESOURCES, INC., a Nevada corporation (hereinafter called the “Corporation”), pursuant to the provisions of Chapter 78 of the Nevada Revised Statutes, hereby makes this Certificate of Designation under the corporate seal of the Corporation and hereby states and certifies that pursuant to the authority expressly vested in the Board of Directors of the Corporation by the Certificate of Incorporation, the Board of Directors duly adopted the following resolutions:

RESOLVED, that there shall be a series of shares of the Corporation designated Series B Convertible Preferred Stock (the “Series B Preferred”); that the number of shares of such series shall be Two Million (2,000,000) and that the rights and preferences of such Series B Preferred and the limitations or restrictions thereon, shall be as set forth herein;

The following shall be adopted and incorporated by reference into the foregoing resolutions as if fully set forth therein:

1. Number of Shares. The number of shares constituting the Series B Preferred is hereby fixed at One Million (1,000,000).

2. Stated Capital. The stated value per share of the Series B Preferred shall be Twenty Dollars ($20.00) herein the “Stated Value”) and the par value per share shall be $.001 per share.

3. Voting Rights. Except as provided by law or by the other provisions of the Certificate of Incorporation, holders of Series B Preferred shall vote together with holders of the Common Stock of the Corporation as a single class on any matter presented to the Common Stock holders of the Corporation for their action or consideration at any meeting of such stockholders of the Corporation (or by written consent of the stockholders in lieu of a meeting), and each holder of Series B Preferred shall be entitled to 5 votes for each share of Common Stock into which such shares of Series B Preferred respectively held by them could be converted pursuant to the provisions of Section 6 at the record date for determining stockholders entitled to vote on such matter. The holders of Series B Preferred shall not be entitled to vote on any matter for which voting is expressly reserved, by law solely for a class of classes of stock other than the Preferred Stock or a class other than the Series B Preferred.

4. Liquidation, Dissolution, Winding-Up.

(a) Preference Payments to Holders of Series B Preferred. Upon any liquidation, dissolution or winding up of the Corporation, whether voluntary or involuntary (each, a “Liquidation Event”), before any distribution or payment shall be made to the holders of any shares of Common Stock or any series of Preferred Stock not expressly identified as ranking senior to, or pari passu with, the Series B Preferred on liquidation other than the Series A Preferred Stock which shall be senior with respect to liquidation rights, each holder of Series B Preferred shall be entitled to be paid, out of the assets of the Corporation, an amount in cash per share equal to the sum of: (x) the Stated Value (as adjusted for any stock splits, stock dividends, reorganizations, recapitalizations and the like) held by such holder and (y) all accrued but unpaid dividends on such shares.

If upon any such Liquidation Event the assets of the Corporation available for distribution to its stockholders shall be insufficient to pay the Holders of shares of Series B Preferred the full amount to which they shall be entitled under this Section 5(a), the Holders of shares of Series B Preferred shall share ratably in any distribution of the assets available for distribution in proportion to the respective amounts which would otherwise be payable in respect of the shares held by them upon such distribution if all amounts payable on or with respect to such shares were paid in full. “Liquidation Event” means any termination, liquidation, dissolution or winding up of the Corporation either voluntary or involuntary.

(b) Payments to Holders of Common Stock and Series B Preferred. Upon any Liquidation Event, after the payment of all preferential amounts required to be paid to the Holders of shares of Series B Preferred, the remaining assets of the Corporation available for distribution to its stockholders shall be distributed among the holders of any other class or series of Preferred Stock and then to holders of shares of Common Stock and the Series B Preferred on a pro-rata as-if converted basis, pro rata based on the number of shares held by each such holder; provided, however that the aggregate amount distributed to each holder of Series B Preferred shall not exceed 125% of the sum of the Stated Value and any accrued dividends.

(c) Additional Liquidation Events. The following events (each an “Additional Liquidation Event”) shall each be considered a Liquidation Event under this Section 5; provided, however that if the holders of at least two-thirds of the Series B Preferred elect not have an event treated as an Additional Liquidation Event then the event shall not be treated as an Additional Liquidation Event:

(i) any consolidation or merger of the Corporation with or into any other individual, corporation, partnership, limited liability company, joint venture, trust, unincorporated organization or other entity (each a “Person”), or any other corporate reorganization or similar transaction, in which the stockholders of the Corporation, immediately prior to such consolidation, merger, reorganization or similar transaction, possess less than a majority of the voting power of the Corporation (or the surviving entity if the Corporation is not the surviving entity) immediately after such consolidation, merger, reorganization or similar transaction, or any other transaction or series of related transactions to which the Corporation is a party in which, as a result thereof, in excess of 50% of the Corporation’s voting power is vested in Persons other than the stockholders of the Corporation immediately prior thereto;

(ii) any sale, transfer, lease, assignment, conveyance or other disposition by the Corporation or its subsidiaries or an exclusive license of all or substantially all of the Corporation’s material intellectual property, other than a sale, transfer, lease, assignment, conveyance or other disposition to a wholly owned subsidiary; or

(iii) Any other transaction which results in the holders of the Corporation’s capital stock as of immediately before the transaction owning less than 50% of the voting power of the Corporation’s capital stock as of immediately after the transaction; provided, however, that an equity financing transaction in which the Corporation is the surviving corporation and does not (directly or through a subsidiary) receive any assets other than cash and rights to receive cash shall be deemed not to constitute an Additional Liquidation Event.

(iv) For purposes of this Section 4(c) a series of related transactions shall be deemed to constitute a single transaction, and where such transactions involve securities issuances, they shall be deemed “related” if under applicable securities laws they would be treated as integrated.

(d) Valuation of Consideration. If the consideration received by the Corporation is other than cash in connection with any of the events set forth above, its value will be deemed its fair market value (“Fair Market Value”) on the closing date of any such event. The Fair Market Value of any such consideration, other than securities, shall be the amount which a willing buyer would pay a willing seller in an arm’s-length transaction determined in good faith by the Board of Directors acting by vote of a majority of the Board of Directors.

(e) Notice of Liquidation Event; Distribution of Proceeds.

(i) The Corporation shall give each record holder of Series B Preferred written notice of any impending Liquidation Event (including any Additional Liquidation Event) no later than the date on which notice is given to stockholders of the meeting called to approve such transaction, or 15 business days prior to the closing of such Liquidation Event, whichever is earlier, and shall also notify such holders in writing of the final approval of such Liquidation Event. The first of such notices shall describe the material terms and conditions of the impending Liquidation Event (including, without limitation, the amount of proceeds to be paid in respect of each share in connection with the Liquidation Event) and the provisions of this Section 5, and the Corporation shall thereafter give such holders prompt notice of any material changes to the information set forth in such notice. The Liquidation Event shall in no event take place sooner than 15 business days after the Corporation has given the first notice provided for herein or sooner than 15 business days after the Corporation has given notice of any material changes provided for herein.

5. Conversion Right.

(a) Right to Convert by Holders of Series B Preferred.

(i) At any time after the date that a Holder purchases shares of Series B Preferred, such Holder may, at its election, convert each share of Series B Preferred into that number of fully paid and non-assessable shares of Common Stock (or such other equity security of the Corporation for which all of its Common Stock has been exchanged or into which all of its Common Stock has been converted) equal to (x) the Stated Value divided by (y) the Conversion Price, subject to adjustments as set forth in Section 7 hereof. The initial Conversion Price shall be .02; provided, however, that the Conversion Price shall be subject to adjustment as set forth in Section 7 hereof.

(ii) In order to convert shares of the Series B Preferred into shares of Common Stock, the holder thereof shall surrender the certificate or certificates therefor, duly endorsed, at the office of the Corporation or its transfer agent, together with written notice to the Corporation stating that it elects to convert the same and setting forth the name or names it wishes the certificate or certificates for Common Stock to be issued, and the number of shares of Series B Preferred being converted. The Corporation shall, as soon as practicable after the surrender of the certificate or certificates evidencing shares of Series B Preferred for conversion at the office of the Corporation or its transfer agent, issue to each holder of such shares, or its nominee or nominees, a certificate or certificates evidencing the number of shares of Common Stock to which it shall be entitled and, in the event that only a part of the shares evidenced by such certificate or certificates are converted, a certificate evidencing the number of shares of Series B Preferred which are not converted. Such conversion shall be deemed to have been made immediately prior to the close of business on the date of such surrender of the shares of Series B Stock to be converted, and the person or persons entitled to receive the shares of Common Stock issuable upon such conversion shall be treated for all purposes as the record holder or holders of such shares of Common Stock at such date and shall, with respect to such shares, have only those rights of a holder of Common Stock of the Corporation.

6. Protection Against Dilution. If the Corporation, with respect to the Common Stock (i) pays a dividend or makes a distribution on shares of Common Stock that is paid in shares of Common Stock or in securities convertible into or exchangeable or exercisable for Common Stock (in which latter event the number of shares of common stock initially issuable upon the conversion, exchange or exercise of such securities shall be deemed to have been distributed); (ii) subdivides outstanding shares of Common Stock; (iii) combines outstanding shares of Common Stock into a smaller number of shares; or (iv) issues by reclassification of Common Stock any shares of capital stock of the Corporation, the Conversion Price in effect immediately prior thereto shall be adjusted so that each Holder thereafter shall be entitled to receive the number and kind of shares of Common Stock or other capital stock of the Corporation that it would have owned or been entitled to receive in respect of the Series B Preferred immediately after the happening of any of the events described above had the Series B Preferred been converted immediately prior to the happening of that event. An adjustment made in accordance with this Section 7 shall become effective immediately after the record date, in the case of a dividend, and shall become effective immediately after the effective date, in the case of a subdivision, combination, or reclassification. If, as a result of an adjustment made in accordance with this Section 7, the Holder becomes entitled to receive shares of two or more classes of capital stock or shares of Common Stock and other capital stock of the Corporation, the board of directors (whose determination shall be conclusive) shall determine in good faith the allocation of the adjusted Conversion Price between or among shares of such classes of capital stock or shares of Common Stock and other capital stock.

7. Company Redemption. The Company shall have the right, at any time after the date the Series B Preferred have been issued, to redeem all or a portion of any Holder's Series B Preferred at a price per Series B Preferred equal to the Stated Value, multiplied by 125% (the "Company Redemption Price"). To exercise this right, the Company must deliver to the Holder an irrevocable written notice (a “Redemption Notice”), indicating the date the Company intends to pay the Company Redemption Price (the “Redemption Date”), which date may not be less than 120 days from the date the Redemption Notice is delivered to Holder. The Holder of Series B Preferred on the Redemption Date shall have the right to receive such amount in cash equal to the Company Redemption Price per Series B Preferred, such amount to be paid on the Redemption Date, and each Series B Preferred shall have no further rights. The provisions of this Section 7 shall not be deemed to restrict the ability of a Holder to convert the Series B Preferred pursuant to the provisions of Section 5 at any time and from time to time after receipt of the Redemption Notice until the date prior to the Redemption Date.

8. Lost or Stolen Certificates. Upon receipt by the Corporation of evidence reasonably satisfactory to the Corporation of the loss, theft, destruction or mutilation of any certificates representing shares of Series B Preferred, and, in the case of loss, theft or destruction, of an indemnification undertaking by the Holder thereof to the Corporation in customary form and, in the case of mutilation, upon surrender and cancellation of the certificate(s), the Corporation shall execute and deliver new certificate(s) of like tenor and amount.

9. Notice. Any notice required or permitted to be given to a Holder under this Certificate of Designations shall be mailed, postage prepaid, to the post office address last shown on the records of the Corporation, or given by electronic communication in compliance with the provisions of the Nevada General Corporation Law, and shall be deemed sent upon such mailing or electronic transmission.

10. Preferred Share Register. The Corporation and/or its transfer agent may treat the Person in whose name any share of Series B Preferred is registered on the register of the Corporation as the owner and holder of such shares of Series B Preferred for all purposes, notwithstanding any notice to the contrary, but in all events recognizing any properly made transfers.

11. Reservation of Stock Issuable Upon Conversion. The Corporation shall at all times reserve and keep available out of its authorized but unissued shares of Common Stock, solely for the purpose of effecting the conversion of the Series B Preferred, such number of its shares of Common Stock as shall from time to time be sufficient to effect the conversion of all outstanding shares of Series B Preferred, and if at any time the number of authorized but unissued shares of Common Stock shall not be sufficient to effect the conversion of all then outstanding shares of the Series B Preferred, the Corporation will take such corporate action as may, in the opinion of its counsel, be necessary to increase its authorized but unissued shares of Common Stock to such number of shares as shall be sufficient for such purpose, including, without limitation, engaging in best efforts to obtain the requisite stockholder approval of any necessary amendment to the Certificate of Incorporation.

12. Fractional Shares. No fractional share shall be issued upon the conversion of any share or shares of Series B Preferred. All shares of Common Stock (including fractions thereof) issuable upon conversion of more than one share of Series B Preferred by a Holder shall be aggregated for purposes of determining whether the conversion would result in the issuance of any fractional share. If, after the aforementioned aggregation, the conversion would result in the issuance of a fraction of a share of Common Stock, the Corporation shall, in lieu of issuing any fractional share, round such fractional share up to the next whole share of Common Stock and issue such whole share of Common Stock to the Holder upon such conversion.

13. No Other Rights. Shares of Series B Preferred: (a) shall not have any rights of preemption as to any securities of the Corporation, or any warrants, rights or options issued or granted with respect thereto, regardless of how such securities, or such warrants, rights or options may be designated, issued or granted; (b) shall not be redeemable; and (c) shall not have any other rights, preferences, privileges or voting powers or relative, participating, optional or other special rights, or qualifications, limitations or restrictions thereof not set forth herein or in the Certificate of Incorporation, as amended, or as provided by applicable law.

IN WITNESS WHEREOF, MINERCO RESOURCES, INC. has caused this certificate of designation to be signed by V. Scott Vanis, its President and Chief Executive Officer, on this 7th day of January, 2015.

MINERCO RESOURCES, INC.

By: /s/ V. Scott Vanis

V. Scott Vanis, President

Exhibit 10.4

Termination and Mutual Release

of

Sales Commission Agreement

This Termination and Mutual Release Agreement (the "Agreement") is entered into on January 6, 2015 (the “Signing Date”) and is effective as of January 1, 2015 (the “Effective Date”), by and among Level 5 Beverage Company, Inc. (“Level 5”), a Delaware corporation, a subsidiary of Minerco Resources, Inc. (“Minerco”), a Nevada corporation, hereinafter referred to, individually and jointly, as the “Company”, and Anthony R Skinner (“Sales Representative”), an individual residing in the State of Indiana, hereinafter sometimes referred to collectively as the “Parties”).

WHEREAS, pursuant to that certain Commission Sales Agreement, dated February 25, 2014 (the " Commission Sales Agreement "), by and between the Company and Anthony R. Skinner, subject to the terms and conditions therein; and

WHEREAS, the Parties hereto now mutually desire to terminate the Commission Sales Agreement and release each other from any and all claims that they may have arising under or in connection with the Commission Sales Agreement.

NOW THEREFORE, in consideration of the mutual covenants of the Parties hereto hereinafter set forth, and for other good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged, the parties hereto hereby agree as follows:

1. Termination. The Commission Sales Agreement is hereby terminated and of no further force or effect.

2. Mutual Release. The parties hereby mutually release each other and each of their respective successors and assigns from and against any and all costs, damages, actions, proceedings, demands or claims whatsoever that either of them now has or may hereafter have against the other party hereto, by reason of or in connection with the Commission Sales Agreement.

3. Further Assurances. The parties each agree to promptly execute, acknowledge, deliver, file and record such additional documents, instruments and certificates, and to do all such other acts, as are necessary or desirable to evidence the termination of the Commission Sales Agreement and release of all obligations of the parties thereunder as set forth in this Agreement.

4. Termination Fee. The Company shall pay to Anthony R. Skinner five million (5,000,000) shares of Minerco Resources, Inc. common stock with a restrictive legend as the Termination Fee in lieu of any and all monies owed to Anthony R. Skinner, earned before the Effective Date, under the Commission Sales Agreement, dated February 25, 2014.

5. Confidentiality. Under no circumstances, and at no time, shall Sales Representative, or any agents or representatives under Sales Representative's control, disclose to any person any of the secrets, methods or systems used by Company in its business. All customer lists, brochures, reports, and other such information of any nature made available to Sales Representative by virtue of Sales Representative's association with Company shall be held in strict confidence in perpetuity.

6. Representation and Warranties: The Parties warrant and represent that each of them has reviewed the Agreement independently, has had the opportunity to consult counsel, is fully informed of the terms and effect of this Agreement, and has not relied in any way on any inducement, representation, or advice of any other Party in deciding to enter this Agreement.

7. No Admissions: This Agreement and the terms of the termination embodied in this Agreement represent a compromise, and the negotiations, discussions and communications in connection with or leading up to this Agreement are agreed to be within the protection of Confidentiality and shall not be construed as admissions or concessions by the Parties, or any of them, either as to any liability or wrongdoing.

8. Choice of Law; Venue; Jurisdiction; Attorneys’ Fees. The parties acknowledge and agree that this Agreement has been made in the State of Nevada, and that it shall be governed by, construed, and enforced in accordance with the laws of the State of Nevada, without reference to its conflicts of laws principles. The parties also acknowledge and agree that any action or proceeding arising out of or relating to this Agreement or the enforcement thereof shall be brought in the State of Nevada, and each of the parties irrevocably submits to the exclusive jurisdiction of that Court in any such action or proceeding, waives any objection the party may now or hereafter have to venue or to convenience of forum, agrees that all claims in respect of such action or proceeding shall be heard and determined only in that Court, and agrees not to bring any action or proceeding arising out of or relating to this Agreement or the enforcement hereof in any other court. The parties also acknowledge and agree that either or both of them may file a copy of this paragraph with any court as written evidence of the knowing, voluntary and bargained agreement between the parties irrevocably to waive any objections to venue or convenience of forum, or to personal or subject matter jurisdiction. The parties also acknowledge and agree that any action or proceeding referred to above may be served on any party anywhere in the world without any objection thereto. The parties also acknowledge and agree that the prevailing party in any such action or proceeding shall be awarded the party’s reasonable attorneys’ fees and costs (including, but not limited to, costs of court).

9. Entire Agreement. This Agreement sets forth the entire agreement between the parties regarding the Termination and Mutual Release of Commission Sales Agreement, and no statement, whether written or oral, made before or at the signing of this Agreement will vary or modify these written terms.

10. Fair Meaning. The parties agree that the wording of this Agreement shall be construed as a whole according to its fair meaning, and not strictly for or against any of the parties to this Agreement, including the party responsible for drafting the Agreement.

11. Mutual Drafting. The parties hereto acknowledge and agree that they are sophisticated and have been represented by attorneys who have carefully negotiated the provisions of this Agreement. As a consequence, the parties also agree that they do not intend that the presumptions of any laws or rules relating to the interpretation of contracts against the drafter of any particular clause should be applied to this Agreement and therefore waive their effect.

12. Counterparts. This Agreement may be executed in any number of counterparts, each of which shall be deemed an original but all of which shall constitute one and the same instrument.

13. Headings. Headings of the Articles and Sections of this Agreement are for the convenience of the parties only, and shall be given no substantive or interpretive effect whatsoever.

14. Severability. If for any reason whatsoever, any one or more of the provisions of this Agreement shall be held or deemed to be inoperative, unenforceable or invalid as applied to any particular case or in all cases, such circumstances shall not have the effect of rendering such provision invalid in any other case or of rendering any of the other provisions of this Agreement inoperative, unenforceable or invalid.

15. Assignability. Neither this Agreement nor any of the parties' rights hereunder shall be assignable by any party hereto without the prior written consent of the other parties hereto.

16. Binding Effect. This Agreement shall be binding on and shall inure to the benefit of each party, its successors, and assigns. This Agreement and the rights and obligations hereunder shall not be assignable or transferable by either party without the prior written consent of the other party.

17. Third-Party Beneficiaries. This Agreement is for the sole benefit of the parties hereto and their permitted successors or assigns, and nothing herein expressed or implied shall give or be construed to give to any person, other than the parties hereto and such successors or assigns, any legal or equitable rights, remedy or claim hereunder.

18. Notices. All notices or other communications required or permitted to be given hereunder shall be in writing and shall be deemed given to a party when:

|

●

|

delivered by hand or by a nationally recognized overnight courier service (costs prepaid),

|

|

●

|

sent by facsimile with confirmation of transmission by the transmitting equipment, or;

|

|

●

|

received or rejected by the addressee, if sent by certified mail, postage prepaid and return receipt requested, in each case to last known place of business address.

|

19. Authority of Signers. The parties represent and warrant that the person whose signature is set forth below on behalf of a party is fully authorized to execute this Agreement on behalf of that party.

[INTENTIONALLY LEFT BLANK – SIGNATURE PAGE FOLLOWS]

IN WITNESS WHEREOF, the parties have executed this Sales Commission Agreement and caused the same to be duly delivered on their behalf on the day and year first above written.

SALES REPRESENTATIVE:

Anthony R Skinner

By: /s/ Anthony R. Skinner

Name: Anthony R Skinner

Its: Own Entity

COMPANY:

LEVEL 5 BEVERAGE COMPANY, INC.

By: /s/ V. Scott Vanis

V. Scott Vanis

Its: CEO

MINERCO RESOURCES, INC.

By: /s/ V. Scott Vanis

V. Scott Vanis

Its: Chairman & CEO

Exhibit 99.1

Kmart to Carry VitaminFIZZ®

Minerco's Level 5 Places VitaminFIZZ in All 47 Southern California Kmart Locations

HOUSTON, January 5, 2015 -- Level 5 Beverage Company, Inc., a subsidiary of Minerco Resources, Inc. (OTC:MINE), has announced that it’s functional sparkling water line, VitaminFIZZ®, is now available in Southern California Kmart stores. This new account was placed through Avanzar Sales and Distribution, which was recently acquired by Level 5. Starting this week, VitaminFIZZ will be in the cooler sections and on the shelves of all 47 Kmart locations in the Southern California region. Kmart is the third largest discount store chain in the world.

"We are very excited to be associated with one of the most recognizable retailers in the world," says V. Scott Vanis, Minerco's Chairman and CEO. "This is certainly a milestone for the VitaminFIZZ brand and starts the year with a bang. This placement is the first of many key accounts in this year’s plan: controlled exponential growth of VitaminFIZZ and evolution of the Company.”

Currently, VitaminFIZZ, the only sparkling water that offers 100% of the Recommended Daily Intake of Vitamin B3, B5, B6, B12 and Vitamin C, can be found in in approximately 900 locations within the NYC metro and Southern California markets as well as online at Amazon.com. The fast growing beverage is distributed to locations in New York and Southern California through distributors Drink King and Avanzar, respectively. Level 5 also recently signed a deal with Advantage Sales and Marketing to increase the distribution footprint throughout the US.

About Kmart

Kmart, a wholly owned subsidiary of Sears Holdings Corporation (NASDAQ: SHLD), is a mass merchandising company and part of SHOP YOUR WAY, a social shopping experience where members have the ability to earn points and receive benefits across a wide variety of physical and digital formats through ShopYourWay.com. Kmart offers customers quality products through a portfolio of exclusive brands that include Sofia by Sofia Vergara, Jaclyn Smith, Joe Boxer, Route 66 and Smart Sense.

For more information visit the company's website at www.kmart.com | Sears Holdings Corporation website at www.searsholdings.com | Facebook: www.facebook.com/kmart.

About VitaminFIZZ®

VitaminFIZZ is a lightly sparkling, flavor-filled, refreshing beverage with an awesome boost of essential vitamins developed to quench your thirst, naturally. VitaminFIZZ is caffeine free, is Non GMO, has zero calories and contains 100% of recommended daily Vitamin B3, B5, B6, B12 and Vitamin C. Awaken your taste buds. Now that's refreshing. VitaminFIZZ comes in six flavors: Orange Mango, Strawberry Watermelon, Lemon Lime, Black Raspberry, Strawberry Lemonade and Pineapple Coconut. See more at: www.vitamin-fizz.com, www.twitter.com/vitaminfizz and www.facebook.com/drinkvitaminfizz.

About Minerco Resources, Inc.

Minerco Resources, Inc. (OTC:MINE), is the parent company of Level 5 Beverage Company, Inc. (Level 5), a specialty beverage company which develops, produces, markets and distributes a diversified portfolio of forward-thinking, good-for-you consumer brands. The Level 5 brand umbrella includes: VitaminFIZZ(R), Vitamin Creamer(R), Coffee Boost(TM), The Herbal Collection(TM) and LEVEL 5(R). http://minercoresources.com.

Details of the Company's business, finances and agreements can be found as part of the Company's continuous public disclosure as a fully reporting issuer under the Securities Exchange Act of 1934 filed with the Securities and Exchange Commission's ("SEC") EDGAR database. For more information, please visit: http://www.minercoresources.com. The above statements have not been evaluated by the Food and Drug Administration (FDA). These products are not intended to diagnose, treat, cure or prevent any disease.

Safe Harbor Statement

This release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Act of 1934 that are based upon current expectations or beliefs, as well as a number of assumptions about future events. Although we believe that the expectations and assumptions upon which they are based are reasonable, we can give no assurance that such expectations and assumptions will prove to have been correct. Some of these uncertainties include, without limitation, the company's ability to perform under existing contracts or to procure future contracts. The reader is cautioned not to put undue reliance on these forward-looking statements, as these statements are subject to numerous factors and uncertainties, including without limitation, successful implementation of our business strategy and competition, any of which may cause actual results to differ materially from those described in the statements. We undertake no obligation and do not intend to update, revise or otherwise publicly release any revisions to these forward-looking statements to reflect events or circumstances after the date hereof or to reflect the occurrence of any unanticipated events. Although we believe that our expectations are based on reasonable assumptions, we can give no assurance that our expectations will materialize. Many factors could cause actual results to differ materially from our forward-looking statements.

###

Exhibit 99.2

Minerco Achieves a Zero Balance on All Mature Convertible Notes

HOUSTON, January 8, 2015 -- Minerco Resources, Inc. (OTC:MINE), announces today that as of this week, the company has completely satisfied its obligations under all existing, mature Convertible Promissory Notes. All mature Minerco convertible notes have a zero balance as they complete the transition to more traditional, non-dilutive financing.

V. Scott Vanis commented, “After years of heavily discounted convertible notes from less than friendly lenders, we finally turned the corner in 2014. Now, we start 2015 with a zero balance on mature convertible notes. With our explosive product lines, our world class management and now, our non-toxic balance sheet, we believe our company will explode and evolve into a monster in 2015!”

Minerco also reports their Chief Executive Officer, V. Scott Vanis, and Chief Financial Officer, Sam J. Messina III, exchanged all of their Class B Preferred Stock for non-interest bearing (no dividend) Class C Preferred Stock. The transactions were an even monetary exchange; however, the Class C Preferred Stock holders are not entitled to any dividends.

“Neither Sam nor I believe our shareholders should be responsible for paying us a dividend. To correct this oversight, we have forgiven all accrued interest earned under our Class B Preferred Stock in the exchange to Class C. The zero balance of mature convertible notes, our switch from Class B to Class C Stock and many more upcoming events have and will continue to evidence the company’s commitment to our loyal shareholders,” stated V. Scott Vanis.

About VitaminFIZZ®

VitaminFIZZ is a lightly sparkling, flavor-filled, refreshing beverage with an awesome boost of essential vitamins developed to quench your thirst, naturally. VitaminFIZZ is caffeine free, is Non GMO, has zero calories and contains 100% of recommended daily Vitamin B3, B5, B6, B12 and Vitamin C. Awaken your taste buds. Now that's refreshing. VitaminFIZZ comes in six flavors: Mango Orange, Strawberry Watermelon, Lemon Lime, Black Raspberry, Strawberry Lemonade and Coconut Pineapple. See more at: www.vitamin-fizz.com, www.twitter.com/vitaminfizz and www.facebook.com/drinkvitaminfizz.

About Minerco Resources, Inc.

Minerco Resources, Inc. (OTC:MINE), is the parent company of Level 5 Beverage Company, Inc. (Level 5), a specialty beverage company which develops, produces, markets and distributes a diversified portfolio of forward-thinking, good-for-you consumer brands. The Level 5 brand umbrella includes: VitaminFIZZ(R), Vitamin Creamer(R), Coffee Boost(TM), The Herbal Collection(TM) and LEVEL 5(R). http://minercoresources.com.

Details of the Company's business, finances and agreements can be found as part of the Company's continuous public disclosure as a fully reporting issuer under the Securities Exchange Act of 1934 filed with the Securities and Exchange Commission's ("SEC") EDGAR database. For more information, please visit: http://www.minercoresources.com. The above statements have not been evaluated by the Food and Drug Administration (FDA). These products are not intended to diagnose, treat, cure or prevent any disease.

Safe Harbor Statement

This release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Act of 1934 that are based upon current expectations or beliefs, as well as a number of assumptions about future events. Although we believe that the expectations and assumptions upon which they are based are reasonable, we can give no assurance that such expectations and assumptions will prove to have been correct. Some of these uncertainties include, without limitation, the company's ability to perform under existing contracts or to procure future contracts. The reader is cautioned not to put undue reliance on these forward-looking statements, as these statements are subject to numerous factors and uncertainties, including without limitation, successful implementation of our business strategy and competition, any of which may cause actual results to differ materially from those described in the statements. We undertake no obligation and do not intend to update, revise or otherwise publicly release any revisions to these forward-looking statements to reflect events or circumstances after the date hereof or to reflect the occurrence of any unanticipated events. Although we believe that our expectations are based on reasonable assumptions, we can give no assurance that our expectations will materialize. Many factors could cause actual results to differ materially from our forward-looking statements.

###

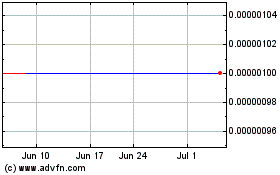

Minerco (CE) (USOTC:MINE)

Historical Stock Chart

From Jun 2024 to Jul 2024

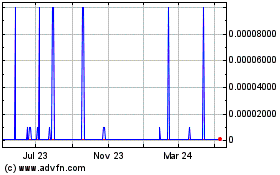

Minerco (CE) (USOTC:MINE)

Historical Stock Chart

From Jul 2023 to Jul 2024