Minerco Resources, Inc. Negotiating 30-Year Operations Contract With Honduran Government

June 21 2010 - 9:00AM

Marketwired

Minerco Resources, Inc. (OTCBB: MINE), a progressive developer,

producer and provider of clean, renewable energy solutions in Latin

America, announced today the company is currently negotiating the

terms of the 30-Year Operations Contract with Secretaria de

Recursos Naturales y Ambiente ("SERNA"), Honduras's Natural

Resources and Environmental Ministry, for its Chiligatoro

Hydro-Electric Project.

As previously released, the National Commission of Energy

("NCE") approved the Chiligatoro Project with an initial capacity

of 5.2 mega-watts with consideration for increased capacity based

on final plant design and SERNA approval. Minerco expects to

receive increased capacity approval after submission of the Final

Design.

The NCE Approval defined an initial capacity of 5.2 mega-watts

per hour, which equates to 45,552 mega-watts per year, and a term

of 30 years for a total of 1.37 million mega-watts over the term of

the agreement. The company is also negotiating for a "First Right

of Refusal" for renewal and allowances for all generation, sales

and transmission of energy from the Chiligatoro Project.

Additionally, the Approval's "Transmission Clause" provides Minerco

with the ability to charge transmission fees from other operators

through the Minerco owned transmission lines.

Energy sales rates are defined by National Decree and are based

on season and peak hours. All electricity sales are paid in US

Dollars for the life of the Contract. Electricity prices currently

range from US$93 to US$109 per mega-watt hour of energy delivered.

SERNA and Empresa Nacional de Energia Electrica, Honduras National

Electric Company ("ENEE") will further define energy sales (rates)

and stipulations in the Operations Contract which is being

negotiated by Minerco. Based on the current Marginal Energy rates

and Honduran Clean Energy incentives as defined by National Decree,

Minerco expects receive a sales mega-watt-hour rate at the higher

end of the range.

Safe Harbor Statement This release contains forward-looking

statements within the meaning of Section 27A of the Securities Act

of 1933 and Section 21E of the Securities Act of 1934 that are

based upon current expectations or beliefs, as well as a number of

assumptions about future events. Although we believe that the

expectations and assumptions upon which they are based are

reasonable, we can give no assurance that such expectations and

assumptions will prove to have been correct. Some of these

uncertainties include, without limitation, the company's ability to

perform under existing contracts or to procure future contracts.

The reader is cautioned not to put undue reliance on these

forward-looking statements, as these statements are subject to

numerous factors and uncertainties, including without limitation,

successful implementation of our business strategy and competition,

any of which may cause actual results to differ materially from

those described in the statements. We undertake no obligation and

do not intend to update, revise or otherwise publicly release any

revisions to these forward-looking statements to reflect events or

circumstances after the date hereof or to reflect the occurrence of

any unanticipated events. Although we believe that our expectations

are based on reasonable assumptions, we can give no assurance that

our expectations will materialize. Many factors could cause actual

results to differ materially from our forward-looking statements.

C. Jones Consulting, Inc. is being compensated $4000.00/month to

handle Investor Relations.

Please contact: C. Jones Consulting, Inc.

cjones@cjonesconsulting.com

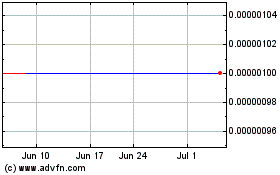

Minerco (CE) (USOTC:MINE)

Historical Stock Chart

From Jun 2024 to Jul 2024

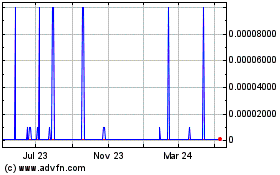

Minerco (CE) (USOTC:MINE)

Historical Stock Chart

From Jul 2023 to Jul 2024