UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A INFORMATION

Proxy

Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed

by the Registrant ☒

Filed

by a Party other than the Registrant ☐

Check

the appropriate box:

| ☒ |

Preliminary

Proxy Statement |

| |

|

| ☐ |

Confidential,

for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

|

| ☐ |

Definitive

Proxy Statement |

| |

|

| ☐ |

Definitive

Additional Materials |

| |

|

| ☐ |

Soliciting

Material Under §240.14a-12 |

MARIZYME,

INC.

(Name

of Registrant as Specified In Its Charter)

(Name

of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment

of Filing Fee (Check all boxes that apply):

☒

No fee required

☐

Fee paid previously with preliminary materials

☐

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) an 0-11

MARIZYME,

INC.

555

Heritage Drive, Suite 205

Jupiter,

FL 33458

NOTICE

OF SPECIAL MEETING OF SHAREHOLDERS

To

Be Held August 9, 2023

Dear

Shareholders:

Marizyme,

Inc. (“we,” “us,” “Marizyme,” or the “Company”) cordially

invites you to attend a special meeting of shareholders (the “Special Meeting”). The meeting will be held on August 9, 2023,

at 12:00 p.m. (EST). The meeting will be held virtually via live audio webcast at https://agm.issuerdirect.com/mrzm (please note

this link is case sensitive). At the meeting we will be considering and voting on the following matters:

| 1. | To

approve an amendment to the Company’s articles of incorporation, as amended to date

(the “Articles of Incorporation,” to increase the total number of shares

of authorized common stock to 2,000,000,000; |

| | | |

| 2. | To

approve an amendment to the Company’s Articles of Incorporation, as amended to date,

to provide that holders of any of the Company’s bonds, debentures or other obligations

of the Company may have, at the option of the board of directors of the Company,

any of the rights of a stockholder of the Company; |

| | | |

| 3. | To

consider and vote upon a Proposal to authorize the board of directors of the Company,

in its discretion, to adjourn the Special Meeting to another place, or a later date or

dates, if necessary or appropriate, to solicit additional proxies in favor of the Proposals

listed above at the time of the Special Meeting; and |

| | | |

| 4. | To

act upon such other business as may properly come before the meeting or any adjournment thereof. |

Shareholders

who owned our common stock at the close of business on June 20, 2023 (the “Record Date”), may attend and vote at the

meeting. A shareholders list will be available at our offices at 555 Heritage Drive, Suite 205, Jupiter, Florida, 33458, for a period

of ten days prior to the meeting. We hope that you will be able to attend the meeting.

The

enclosed Proxy Statement is also available at www.iproxydirect.com/MRZM. This website also includes copies of the form of proxy and the

Company’s Annual Report on Form 10-K for the year ended December 31, 2022, which was filed with the SEC on March 24, 2023.

Shareholders may also request a copy of the Proxy Statement and the Company’s Annual Report by contacting our main office at (561)

935-9955.

Whether

or not you plan to attend the meeting, please vote electronically via the Internet or by telephone, or, if you requested paper copies

of the proxy materials, please complete, sign, date and return the accompanying proxy card in the enclosed postage-paid envelope.

See “How do I cast my vote?” in the Proxy Statement for more details.

We

look forward to seeing you at the meeting.

| |

By

order of the Board of Directors, |

| |

|

| |

|

| |

David

Barthel |

| |

Chief

Executive Officer |

Jupiter,

Florida

June

30, 2023

TABLE

OF CONTENTS

| GENERAL INFORMATION |

1 |

| DEFINITIONS |

1 |

| INFORMATION CONCERNING SOLICITATION AND VOTING |

2 |

| QUESTIONS AND ANSWERS |

2 |

| INSTRUCTIONS FOR THE VIRTUAL SPECIAL MEETING |

5 |

| FORWARD LOOKING STATEMENTS |

5 |

| Proposal 1 AMENDMENT TO THE COMPANY’S ARTICLES OF INCORPORATION, AS AMENDED TO DATE, TO INCREASE THE TOTAL NUMBER OF SHARES OF AUTHORIZED COMMON STOCK TO 2,000,000,000 |

6 |

| Proposal 2 AMENDMENT TO THE COMPANY’S ARTICLES OF INCORPORATION, AS AMENDED TO DATE, TO PROVIDE THAT HOLDERS OF ANY OF THE BONDS, DEBENTURES OR OTHER OBLIGATIONS OF THE COMPANY MAY HAVE, AT THE OPTION OF THE BOARD OF DIRECTORS OF THE COMPANY, ANY OF THE RIGHTS OF A STOCKHOLDER OF THE COMPANY |

8 |

| PROPOSAL 3 ADJOURNMENT OF THE SPECIAL MEETING |

10 |

| PRINCIPAL SHAREHOLDERS |

10 |

| DISSENTERS’ RIGHTS |

15 |

| ADDITIONAL INFORMATION |

15 |

| OTHER MATTERS |

15 |

| INTEREST OF CERTAIN PERSONS IN OR OPPOSITION TO MATTERS TO BE ACTED UPON |

15 |

555

Heritage Drive, Suite 205

Jupiter,

Florida 33458

PROXY

STATEMENT

GENERAL

INFORMATION

Marizyme,

Inc. (“Marizyme,” “we,” “us”, “our” or the “Company”)

has made these materials available to you on the Internet or, upon your request, has delivered printed versions of these materials to

you by mail, in connection with the Company’s solicitation of proxies for use at our special meeting of shareholders (the “Special

Meeting” or the “Meeting”) to be held on August 9, 2023 at 12:00 pm (EST), and at any postponement(s) or

adjournment(s) thereof. The meeting will be held virtually via live audio webcast at https://agm.issuerdirect.com/mrzm (please

note this link is case sensitive). These materials were first sent or given to shareholders on June 30, 2023. You are invited to attend

the Special Meeting and are requested to vote on the Proposals described in this Proxy Statement.

Information

Contained In This Proxy Statement

The

information in this Proxy Statement relates to the Proposals to be voted on at the Special Meeting. Included with this Proxy Statement

is a copy of the Company’s Annual Report on Form 10-K for the year ended December 31, 2022, which was filed with the SEC on March

24, 2023 (the “Annual Report”). If you requested printed versions of these materials by mail, these materials also

include the proxy card or vote instruction form for the Special Meeting.

Important

Notice Regarding the Availability of Proxy Materials

Pursuant

to rules adopted by the Securities and Exchange Commission, the Company uses the Internet as the primary means of furnishing proxy materials

to shareholders. Accordingly, the Company is sending a Notice of Internet Availability of Proxy Materials (the “Notice”)

to the Company’s shareholders. All shareholders will have the ability to access the proxy materials (including the Company’s

Annual Report, which does not constitute a part of, and shall not be deemed incorporated by reference into, this Proxy Statement or the

enclosed form of proxy) via the Internet at www.iproxydirect.com/MRZM or request a printed set of the proxy materials. Instructions on

how to access the proxy materials over the Internet or to request a printed copy may be found in the Notice. The Notice contains a control

number that you will need to vote your shares. Please keep the Notice for your reference through the meeting date. In addition, shareholders

may request to receive proxy materials in printed form by mail or electronically by email on an ongoing basis. The Company encourages

shareholders to take advantage of the availability of the proxy materials on the Internet to help reduce the environmental impact of

its special meetings.

DEFINITIONS

Unless

the context requires otherwise, references to the “Company,” “we,” “us,” “our,”

“Marizyme” and “Marizyme, Inc.” refer specifically to Marizyme, Inc. and its consolidated subsidiaries.

In

addition, unless the context otherwise requires and for the purposes of this Proxy Statement only:

| ● |

“Code”

means the Internal Revenue Code of 1986, as amended from time to time; |

| |

|

| ● |

“Exchange Act”

refers to the Securities Exchange Act of 1934, as amended; |

| |

|

| ● |

“SEC”

or the “Commission” refers to the United States Securities and Exchange Commission; and |

| |

|

| ● |

“Securities Act”

refers to the Securities Act of 1933, as amended. |

INFORMATION

CONCERNING SOLICITATION AND VOTING

Our

board of directors (the “Board”) is soliciting proxies for the Special Meeting of shareholders to be held on August

9, 2023 and at any adjournments or postponements of the Special Meeting. This Proxy Statement contains important information for you

to consider when deciding how to vote on the matters brought before the Special Meeting. Please read it carefully.

The

Company will pay the costs of soliciting proxies from shareholders. Our directors, officers and regular employees may solicit proxies

on behalf of the Company, without additional compensation, personally or by telephone.

QUESTIONS

AND ANSWERS

General

Questions and Answers

| Q: |

Who can vote at the meeting? |

| |

|

| A: | The

Board set June 20, 2023, as the record date for the meeting. You can attend and vote at the

meeting if you were a holder of our common stock at the close of business on the record date.

On the record date, there were [*] shares of common stock issued and outstanding, voting

in aggregate [*] total voting shares at the meeting. |

| | |

| Q: |

What Proposals will be

voted on at the meeting? |

| |

|

| A: |

Three Proposals are scheduled

to be voted upon at the meeting: |

| ● | To

approve an amendment to the Company’s Articles of Incorporation, as amended to date,

to increase the total number of shares of authorized common stock to from 300,000,000 shares

to 2,000,000,000 shares. |

| | | |

| ● | To

approve an amendment to the Company’s Articles of Incorporation, as amended to date,

to provide that holders of any of the Company’s convertible promissory notes, whether

already issued or to be issued in the future, shall have the right, at the option of our

Board, to vote on an as-converted to common stock basis, with respect to all corporate matters

of the Company on which the holders of common stock are entitled to vote. |

| | | |

| ● | To

consider and vote upon a Proposal to authorize our Board, in its discretion, to adjourn the

Special Meeting to another place, or a later date or dates, if necessary or appropriate,

to solicit additional proxies in favor of the Proposals listed above at the time of the Special

Meeting. |

| Q: |

Why did I receive a one-page

notice in the mail regarding the Internet availability of proxy materials instead of a full set of proxy materials? |

| |

|

| A: | Pursuant

to rules adopted by the SEC, we have elected to provide access to our proxy materials over

the Internet. Accordingly, on or about June 30, 2023, we are sending a Notice of Internet

Availability of Proxy Materials to our shareholders of record and beneficial owners. All

shareholders will have the ability, beginning on or about June 30, 2023, to access the proxy

materials on the website referred to in the Notice of Internet Availability of Proxy Materials

or request to receive a printed set of the proxy materials. Instructions on how to access

the proxy materials over the Internet or to request a printed copy may be found in the Notice

of Internet Availability of Proxy Materials. In addition, shareholders may request to receive

proxy materials in printed form by mail or electronically by email on an ongoing basis. |

| Q: |

Can I vote my shares by

filling out and returning the Notice of Internet Availability of Proxy Materials? |

| |

|

| A: | No.

The Notice of Internet Availability of Proxy Materials identifies the items to be voted on

at the meeting, but you cannot vote by marking the Notice of Internet Availability of Proxy

Materials and returning it. The Notice of Internet Availability of Proxy Materials provides

instructions on how to vote via the Internet, by telephone or by requesting and returning

a paper proxy card, or by submitting a ballot in person at the meeting. |

| Q: |

How can I get electronic

access to the proxy materials? |

| |

|

| A: |

The Notice of Internet Availability

of Proxy Materials will provide you with instructions regarding how to: |

| |

● |

View our proxy

materials for the meeting on the Internet; and |

| |

|

|

| |

● |

Instruct us

to send future proxy materials to you electronically by email. |

Choosing

to receive future proxy materials by email will save us the cost of printing and mailing documents to you and will reduce the impact

of our special meetings on the environment. If you choose to receive future proxy materials by email, you will receive an email next

year with instructions containing a link to those materials and a link to the proxy voting site. Your election to receive proxy materials

by email will remain in effect until you terminate it.

| Q: |

How do I cast my vote? |

| |

|

| A: | For

shareholders whose shares are registered in their own names, as an alternative to voting

at the meeting, you may vote via the Internet, by fax, by telephone or, for those shareholders

who request a paper proxy card in the mail, by mailing a completed proxy card. The Notice

of Internet Availability of Proxy Materials provides information on how to vote via the Internet,

fax or by telephone or request a paper proxy card and vote by mail. Those shareholders who

request a paper proxy card and elect to vote by mail should sign and return the mailed proxy

card in the prepaid and addressed envelope that was enclosed with the proxy materials, and

your shares will be voted at the meeting in the manner you direct. In the event that you

return a signed proxy card on which no directions are specified, your shares will be voted

as recommended by our Board on all matters, and in the discretion of the proxy holders as

to any other matters that may properly come before the meeting or any postponement or adjournment

of the meeting. |

If

your shares are registered in the name of a broker, bank or other nominee (typically referred to as being held in “street name”),

you will receive instructions from your broker, bank or other nominee that must be followed in order for your broker, bank or other nominee

to vote your shares per your instructions. Many brokerage firms and banks have a process for their beneficial holders to provide instructions

via the Internet, via fax or over the telephone. If Internet, fax or telephone voting is unavailable from your broker, bank or other

nominee, please request a paper copy of the proxy and complete and return the voting instruction card in the addressed, postage paid

envelope provided.

In

the event you do not provide instructions on how to vote, your broker may have authority to vote your shares. Under the rules of the

New York Stock Exchange (“NYSE”), which apply to brokers regardless of whether an issuer is listed on the NYSE or The Nasdaq

Stock Market LLC (“Nasdaq”) or quoted on one of the OTC Markets, Inc. tiers, brokers have the discretion to vote such shares

on “routine matters, but not on non-routine matters. Routine matters include Proposal 1 relating to the increase in the total number

of authorized shares of our common stock from 300,000,000 to 2,000,000,000 and Proposal 3 relating to the approval to adjourn the meeting,

but not to Proposal 2 relating to providing our Board with the right to issue our convertible notes with, built into the notes, a right

to vote with the holders of our common stock on as converted basis (the “non-routine matter”). Your vote is especially

important. If your shares are held by a broker, your broker will have discretionary authority to vote on Proposals 1 and 3 but will

not have discretionary authority to vote on Proposal 2. Your broker cannot vote your shares for this non-routine matter unless you provide

voting instructions. Therefore, please instruct your broker regarding how to vote your shares on this non-routine matter - Proposal

2 - promptly. See “Vote Required” for further information.

If

you hold shares through a broker, bank or other nominee and wish to be able to vote at the meeting in person, you must obtain a legal

proxy from your broker, bank or other nominee and present it to the inspector of election with your ballot at the meeting.

| Q: |

Can I revoke or change

my proxy? |

| |

|

| A: | Yes.

You may revoke or change a previously delivered proxy at any time before the meeting by delivering

another proxy with a later date, by voting again via the Internet, fax or by telephone, or

by delivering written notice of revocation of your proxy to our Secretary at our principal

executive offices before the beginning of the meeting. You may also revoke your proxy by

attending the meeting and voting in person, although attendance at the meeting will not,

in and of itself, revoke a valid proxy that was previously delivered. If you hold shares

through a broker, bank or other nominee, you must contact that nominee to revoke any prior

voting instructions. You also may revoke any prior voting instructions by voting in person

at the meeting if you obtain a legal proxy as described above. |

| | |

| Q: |

How does the Board recommend

I vote on the Proposals? |

| |

|

| A: | The

Board recommends that you vote “FOR” the increase in our authorized

common stock, “FOR” the right of our Board to attach voting rights,

on an as converted basis, to our convertible notes, and “FOR” the

approval to adjourn the meeting to a later date, as described above. |

| | |

| Q: |

Who will count the vote? |

| |

|

| A: |

The inspector of election

will count the vote. |

| |

|

| Q: |

What is a “quorum?” |

| |

|

| A: | A

quorum is the number of shares that must be present to hold the meeting. The quorum requirement

for the meeting is a majority (more than 50%) of the outstanding voting shares as of the

record date, present in person or represented by proxy. Your shares will be counted for purposes

of determining if there is a quorum if you are present and vote in person at the meeting;

or have voted on the Internet, by fax, by telephone or by properly submitting a proxy card

or voting instruction card by mail. Abstentions and broker non-votes (as explained below)

also count toward the quorum. If there is no quorum, the meeting may be adjourned to another

date by the chairman of the meeting or the holders of a majority of the voting power present

in person or represented by proxy at the Special Meeting and entitled to vote. |

| | |

| Q: |

What are broker non-votes? |

| |

|

| A: | Broker

non-votes occur when a beneficial owner of shares held in “street name” does

not give instructions to the broker holding the shares as to how to vote on matters deemed

“non-routine” and there is at least one “routine” matter to be voted

upon at the meeting. Generally, if shares are held in street name, the beneficial owner of

the shares is entitled to give voting instructions to the broker holding the shares. If the

beneficial owner does not provide voting instructions, the broker can still vote the shares

with respect to matters that are considered to be “routine,” but not with respect

to “non-routine,” matters. In the event that a broker votes shares on the “routine”

matters, but does not vote shares on the “non-routine” matters, those shares

will be treated as broker non-votes with respect to the “non-routine” proposals.

Accordingly, if you own shares through a nominee, such as a broker or bank, please be sure

to instruct your nominee how to vote to ensure that your vote is counted on each of the proposals. |

| Q: |

What is the effect of

a withhold vote? |

Withhold

votes will be counted as shares present and entitled to vote for purposes of determining a quorum.

| Q: |

What are the effects of

abstentions and broker non-votes? |

An

abstention represents a stockholder’s affirmative choice to decline to vote on a proposal. If a stockholder indicates on its proxy

card that it wishes to abstain from voting its shares, or if a broker, bank or other nominee holding its customers’ shares of record

causes abstentions to be recorded for shares, these shares will be considered present and entitled to vote at the Special Meeting. As

a result, abstentions will be counted for purposes of determining the presence or absence of a quorum and will also count as votes against

a proposal in cases where approval of the proposal requires the affirmative vote of a majority of the shares present in person or represented

by proxy and entitled to vote at the Special Meeting (Proposals No. 1, 2 and 3).

| Q: |

What vote is required

to approve each item? |

| A: |

The following table sets

forth the voting requirement with respect to each of the Proposals: |

| |

Proposal

1 – Approval of an amendment to the Company’s Articles of Incorporation, as amended to date, to increase the total number

of shares of authorized common stock to 2,000,000,000 (the “Proposed Authorized Share Increase Amendment”). |

|

To

be approved by shareholders, this Proposal must receive the affirmative “FOR” vote of the holders of a

majority of the shares represented at the meeting, in person or by proxy, and entitled to vote. |

| |

|

|

|

| |

Proposal

2 – Approval of an amendment to the Company’s Articles of Incorporation, as amended to date, to provide that holders

of any of the bonds, debentures or other obligations of the company may have, at the option of the board of directors of the company,

any of the rights of a stockholder of the company (the “Proposed Obligations Rights Amendment”). |

|

To

be approved by shareholders, this Proposal must receive the affirmative “FOR” vote of the holders of a

majority of the shares represented at the meeting, in person or by proxy, and entitled to vote. |

| |

|

|

|

| |

Proposal

3 – Approval to adjourn the Special Meeting to another place, or a later date or dates, if necessary or appropriate, to solicit

additional proxies in favor of the Proposals listed above at the time of the Special Meeting. |

|

To

be approved by shareholders, this Proposal must receive the affirmative “FOR” vote of the holders of a

majority of shares represented at the meeting, in person or by proxy, and entitled to vote. |

| Q: |

What does it mean if I

get more than one Notice of Internet Availability of Proxy Materials? |

| |

|

| A: |

Your shares are probably

registered in more than one account. Please provide voting instructions for all Notices of Internet Availability of Proxy Materials,

proxy and voting instruction cards you receive. |

| |

|

| Q: |

How many votes can I cast? |

| |

|

| A: |

Holders of our common stock

receive one vote for each share of common stock which they hold as of the Record Date. |

| |

|

| Q: |

Where can I find the voting

results of the meeting? |

| |

|

| A: |

The preliminary voting results

will be announced at the meeting. The final results will be published in a Current Report on Form 8-K to be filed by us with the SEC

within four business days of the meeting. |

INSTRUCTIONS

FOR THE VIRTUAL SPECIAL MEETING

This

year our Special Meeting will be a completely virtual meeting. There will be no physical meeting location. The meeting will only be conducted

via live audio webcast.

To

participate in the virtual meeting, visit https://agm.issuerdirect.com/mrzm (please note this link is case sensitive) and enter

the control number included on your notice of Internet availability of the proxy materials, on your proxy card, or on the instructions

that accompanied your proxy materials.

You

may vote during the meeting by following the instructions available on the meeting website during the meeting. To the best of our knowledge,

the virtual meeting platform is fully supported across browsers (Microsoft Edge, Internet Explorer, Firefox, Chrome, and Safari) and

devices (desktops, laptops, tablets, and cell phones) running the most updated version of applicable software and plugins. Participants

should ensure they have a strong Internet connection wherever they intend to participate in the meeting. Participants should also allow

plenty of time to log in and ensure that they can hear streaming audio prior to the start of the meeting.

Questions

pertinent to meeting matters will be answered during the meeting, subject to time constraints. Questions which are not pertinent to meeting

matters will not be answered.

FORWARD

LOOKING STATEMENTS

Statements

in this Proxy Statement that are “forward-looking statements” are based on current expectations and assumptions that

are subject to risks and uncertainties. In some cases, forward-looking statements can be identified by terminology such as “may,”

“should,” “potential,” “continue,” “expects,” “anticipates,”

“intends,” “plans,” “believes,” “estimates,” and similar

expressions. These forward-looking statements are based on our current estimates and assumptions and, as such, involve uncertainty and

risk. Actual results could differ materially from projected results.

We

do not assume any obligation to update information contained in this document, except as required by federal securities laws. Although

this Proxy Statement may remain available on our website or elsewhere, its continued availability does not indicate that we are reaffirming

or confirming any of the information contained herein. Neither our website nor its contents are a part of this Proxy Statement.

PROPOSAL

1

AMENDMENT

TO THE COMPANY’S ARTICLES OF INCORPORATION, AS AMENDED TO DATE, TO INCREASE THE TOTAL NUMBER OF SHARES OF AUTHORIZED COMMON STOCK

FROM 300,000,000 SHARES TO 2,000,000,000 SHARES

General

The

Company is asking stockholders to adopt and approve the Proposed Authorized Share Increase Amendment. Pursuant to the Company’s

Articles of Incorporation, as amended to date, the Company has authorized capital stock of 325,000,000 shares, of which 300,000,000 shares

are designated as common stock and 25,000,000 shares are designated as preferred stock, with no shares of preferred stock outstanding.

On May 8, 2023, our Board authorized and approved an amendment to our Articles of Incorporation to increase the number of authorized

shares of our common stock from 300,000,000 to 2,000,000,000 (the “Proposed Authorized Share Increase”). The par value

of our common stock will continue to be $0.001 per share. We are not proposing any change to the authorized number of shares of our preferred

stock.

As

of [June 15], 2023, 43,420,350 shares of our common stock were outstanding. This number does not include 53,661,498 shares of our common

stock issuable upon conversion of our outstanding convertible notes, including shares issuable due to accrued interest if such notes

are held to maturity, 120,010,957 shares of common stock issuable upon conversion of our outstanding convertible notes that are not currently

convertible, 115,830,920 shares of our common stock issuable upon the exercise of outstanding warrants, not including 362,926,213 shares

of common stock issuable upon exercise of our outstanding warrants that are not currently exercisable, and 4,275,943 shares of our common

stock issuable upon the exercise of outstanding options and restricted stock units. Additionally, as of [June 15, 2023], we had conducted

[two closings] of [$3,781,335] in our ongoing private placement (the “2023 Private Placement”) of up to $10,000,000

for an aggregate of up to 100,000,000 units (the “Units”), each Unit consisting of (i) a 15% original issue discount

unsecured subordinated convertible promissory note (collectively, the “2023 Convertible Notes”), convertible into

shares of common stock plus additional shares based on accrued interest at $0.10 per share, subject to adjustment, (ii) a warrant for

the purchase of 125% of the shares of common stock into which the related 2023 Convertible Notes may be converted at $0.10 per share,

subject to adjustment, and (iii) a warrant for the purchase of 125% of the shares of common stock into which the related 2023 Convertible

Notes may be converted at $0.20 per share, subject to adjustment (collectively, the “2023 Warrants”). Assuming we

sell $[6,218,665] of additional Units in the 2023 Private Placement, we would be required to issue an additional [62,186,650] shares

of our common stock upon conversion of the 2023 Convertible Notes and [155,466,624] shares of our common stock upon exercise of all of

the 2023 Warrants. On a fully diluted basis, including all of our currently outstanding common stock, the common stock issuable upon

conversion of our currently outstanding convertible notes, the common stock issuable upon the exercise of our currently outstanding warrants,

options and other contractual rights to common stock, and the common stock issuable upon the conversion of the 2023 Convertible

Notes and upon exercise of the 2023 Warrants sold to date, we would have an aggregate total of [700,125,881] shares of our common stock

issued and outstanding, resulting in a deficit of [400,125,881] shares of common stock. These amounts include securities currently subject

to waivers of exercise or conversion rights or limitations on exercise or conversion rights. Assuming that such waivers or limitations

on exercise or conversion rights are enforceable and effective, we believe that we are not currently in breach of any existing commitments

to our securities holders or in violation of our Articles of Incorporation. However, should such waivers or limitations be found to be

unenforceable or ineffective, as a result of our current commitments, with only 300,000,000 shares of common stock authorized for issuance,

the Company does not have a sufficient number of shares of common stock available under its Articles of Incorporation for the issuance

of shares of common stock to (i) all current holders of outstanding warrants, convertible notes options and other contractual rights

to common stock of the Company upon the conversion or exercise of such securities by such holders, as applicable. Additionally, if

the entire $[6,218,665] amount of our 2023 Private Placement is sold, on a fully diluted basis the total number of shares outstanding

would be [917,779,155] shares of common stock resulting in a total deficit of 617,779,155 shares of our common stock.

The

Board believes that the proposed increase in the number of authorized shares of the common stock under the Articles of Incorporation,

to provide availability to meet its current common stock share reservation deficit and for future issuances, including those in connection

with the 2023 Private Placement, is in the best interest of the Company. Such increase will provide the Company with sufficient shares

to meet its current commitments and for future issuances of securities to fund the operations and growth of the Company and will also

provide the Company with greater flexibility to respond quickly to advantageous business opportunities since we may from time to time

explore opportunities to make acquisitions through the use of our common stock. For the reasons described above, the Company proposes

to adopt an amendment to its Articles of Incorporation to increase the number of authorized shares of its common stock from 300,000,000

shares to 2,000,000,000 shares (the “Proposed Authorized Share Increase”).

The

Board notes that while the proposed increase in the number of authorized shares of common stock to 2,000,000,000 may appear high, that

number was selected by the Board, in part, based on the Company’s intent to effect a reverse stock split in order to enable it

to meet applicable stock exchange listing requirements with respect to stock price. Such a reverse split, although not imminent, would

have the effect of substantially reducing the number of authorized and outstanding shares of common stock to a more typical number.

The

Board has unanimously approved and declared advisable the Proposed Authorized Share Increase and recommends that our stockholders adopt

and approve the Proposed Authorized Share Increase Amendment. The foregoing description of the Proposed Authorized Share Increase is

a summary and is subject to the full text of the Proposed Authorized Share Increase Amendment, which is attached to this proxy statement

as Annex A. The text of the Proposed Authorized Share Increase Amendment may be altered to reflect any changes required by applicable

law or otherwise deemed necessary or advisable by the Board.

If

the Proposed Authorized Share Increase is approved by our stockholders, it will become effective immediately upon the filing of a Certificate

of Change to our Articles of Incorporation with the Secretary of State of the State of Nevada, which we expect to file promptly after

the Special Meeting. No further action on the part of stockholders will be required to implement the Proposed Authorized Share Increase.

If the proposed amendment is not approved by our stockholders, the authorized shares of our common stock will remain unchanged and we

may not be able to comply with all of our obligations relating to the exercise of outstanding warrants, options and other contractual

rights to common stock and the conversion of outstanding convertible notes or to issue additional securities in the future because

we would not have a sufficient number of shares of common stock authorized and available for issuance upon the exercise or conversion

of all such securities, as the case may be.

Vote

Required

The

affirmative vote of a majority of the shares present in person or represented by proxy at the Special Meeting will be required to approve

the Proposed Authorized Share Increase. Abstentions will have the effect of a vote against and broker-non-votes, if any, see above (although

none are anticipated since this is a routine matter for which brokers may vote in their discretion if beneficial owners of our stock

do not provide voting instructions directing their brokers how to vote), will have no effect on the outcome of this proposal.

Board

Recommendation

Our

Board of Directors recommends that stockholders vote “FOR” the Proposed Authorized Share Increase.

PROPOSAL

2

AMENDMENT

TO THE COMPANY’S ARTICLES OF INCORPORATION, AS AMENDED TO DATE, TO PROVIDE THAT HOLDERS OF ANY OF THE BONDS, DEBENTURES OR OTHER

OBLIGATIONS OF THE COMPANY MAY HAVE, AT THE OPTION OF THE BOARD OF DIRECTORS OF THE COMPANY, ANY OF THE RIGHTS OF A STOCKHOLDER OF THE

COMPANY

General

The

Company is asking stockholders to adopt and approve the Proposed Obligations Rights Amendment.

Between

December 21, 2021 and August 12, 2022, the Company issued its two-year, 10% secured convertible promissory notes (the “Convertible

Notes”) in the aggregate principal amount of $14,771,177 to 33 persons. The Convertible Notes were issued as part of a series

of notes offered in a private placement in the aggregate principal amount of up to a maximum of Seventeen Million Dollars ($17,000,000)

in reliance upon the exemption from securities registration afforded by Section 4(a)(2) of the Securities Act and/or Rule 506 of Regulation

D promulgated by the SEC under the Securities Act.

As

an inducement for prospective investors to purchase the Convertible Notes, our Board approved a provision in the Convertible Notes entitling

the holders of the Convertible Notes to vote with the shares of the Company’s common stock, on an as-converted to common stock

basis without actually having converted the Convertible Notes to shares of our common stock, with respect to all corporate matters of

the Company on which the holders of common stock are entitled to vote, subject to any applicable beneficial ownership limitations.

Under

the Nevada Revised Statutes (the “NRS”) the right to vote is generally a feature of a share of any class or series

of stock of a corporation and, thus, a right granted to stockholders of a corporation. Under the NRS, convertible promissory notes (or

any other form of bond, debenture or other obligation) typically do not provide holders with voting rights. However, Section 78.197 of

the NRS provides that a corporation organized in Nevada “may provide in its articles of incorporation that the holder of a bond,

debenture or other obligation of the corporation may have any of the rights of a stockholder in the corporation.” Although we provided

voting rights as a contractual feature of the Convertible Notes, our Articles of Incorporation currently do not provide that the holders

of the Convertible Notes will be able to vote as stockholders of the Company. Our Board now wants to amend the Articles of Incorporation

(i) to enable holders of the Convertible Notes to be able to exercise the right to vote that we granted them in the Convertible Notes,

on a going forward basis, and (ii) to enable the Board to approve future issuances of bonds, debentures or other forms of obligations,

including, but not limited to, convertible promissory notes, that give the holders of such instruments the rights of a stockholder of

the Company including, but not limited to, voting rights.

We

are proposing to amend Article III of our Articles of Incorporation to add the following provision that embodies the Proposed Obligations

Rights Amendment:

ARTICLE

III: Article III of the Articles of Incorporation, as amended, of Marizyme, Inc. is hereby further amended to add the following provision:

Rights

of Persons Holding Obligations of the Company: As provided by NRS Section 78.197, holders of bonds, debentures or other obligations

of the Company may have any of the rights of a stockholder of the Company. More specifically and by way of example, the Board of Directors

of the Company may approve and/or ratify the issuance of bonds, debentures and other obligations of the Company including, but not limited

to, convertible promissory notes of the Company, that include a provision entitling the holders of any such instruments to vote with

the shares of the Company’s common stock, on an as-converted to common stock basis without actually having converted the instruments

to shares of the Company’s common stock, with respect to all corporate matters of the Company on which the holders of common stock

are entitled to vote. Additionally, holders of those certain 10% secured convertible promissory notes of the Company issued between December

21, 2021 and August 12, 2022 (the “10% Convertible Notes”), shall be entitled, from the date of the filing with the Secretary

of State of the State of Nevada of the Certificate of Amendment to the Articles of the Incorporation of which this provision is a part,

to vote with the shares of the Company’s common stock, on an as-converted to common stock basis without actually having converted

the 10% Convertible Notes to shares of the Company’s common stock, with respect to all corporate matters of the Company on which

the holders of common stock are entitled to vote, as provided in Section 4.6 of the 10% Convertible Notes.

The

Board has unanimously approved and declared advisable the Proposed Obligations Rights Amendment and recommends that our stockholders

adopt and approve the Proposed Obligations Rights Amendment. The foregoing description of the Proposed Obligations Rights Amendment is

a summary and is subject to the full text of the Proposed Obligations Rights Amendment, which is attached to this proxy statement as

Annex A. The text of the Proposed Obligations Rights Amendment may be altered to reflect any changes required by applicable law

or otherwise deemed necessary or advisable by the Board.

If

the Proposed Obligations Rights Amendment is approved by our stockholders, it will become effective immediately upon the filing of a

Certificate of Amendment to our Articles of Incorporation with the Secretary of State of the State of Nevada, which we expect

to file promptly after the Special Meeting. No further action on the part of stockholders will be required to implement the Proposed

Obligations Rights Amendment. If the proposed amendment is not approved by our stockholders, the holders of the Convertible Notes will

not be able to vote on future matters brought before the stockholders of the Company for a vote and we will not be able to issue future

debt instruments, whether convertible or otherwise, that provide for voting rights (or other rights typically granted to stockholders)

to the holders of such instruments.

Vote

Required

The

approval of the Proposed Obligations Rights Amendment requires the vote of a majority of the shares of stock entitled to vote that are

present, in person or by proxy at the Special Meeting. As a result, abstentions will have the same practical effect as votes against

this Proposal. Broker non-votes will be counted toward a quorum but will not be counted for any purpose in determining whether this Proposal

has been approved. For the approval of this proposal, you may vote “FOR” or “AGAINST”

or abstain from voting.

Board

Recommendation

Our

Board of Directors recommends that you vote “FOR” the approval of the Proposed Obligations Rights Amendment.

PROPOSAL

3

ADJOURNMENT

OF THE SPECIAL MEETING

General

Our

shareholders may be asked to consider and act upon one or more adjournments of the Special Meeting, if necessary or appropriate, to solicit

additional proxies in favor of any or all of the other Proposals set forth in this Proxy Statement.

If

a quorum is not present at the Special Meeting, our shareholders may be asked to vote on the Proposal to adjourn the Special Meeting

to solicit additional proxies. If a quorum is present at the Special Meeting, but there are not sufficient votes at the time of the Special

Meeting to approve one or more of the Proposals, our shareholders may also be asked to vote on the Proposal to approve the adjournment

of the Special Meeting to permit further solicitation of proxies in favor of the other Proposals. However, a shareholder vote may be

taken on one of the Proposals in this Proxy Statement prior to any such adjournment if there are sufficient votes for approval on such

Proposal.

If

the adjournment Proposal is submitted for a vote at the Special Meeting, and if our shareholders vote to approve the adjournment Proposal,

the meeting will be adjourned to enable the Board to solicit additional proxies in favor of one or more Proposals. If the adjournment

Proposal is approved, and the Special Meeting is adjourned, the Board will use the additional time to solicit additional proxies in favor

of any of the Proposals to be presented at the Special Meeting, including the solicitation of proxies from shareholders that have previously

voted against the relevant Proposal.

The

Board believes that, if the number of voting shares voting in favor of any of the Proposals presented at the Special Meeting is insufficient

to approve a Proposal, it is in the best interests of our shareholders to enable the Board, for a limited period of time, to continue

to seek to obtain a sufficient number of additional votes in favor of the Proposal. Any signed proxies received by us in which no voting

instructions are provided on such matter will be voted in favor of an adjournment in these circumstances. The time and place of the adjourned

meeting will be announced at the time the adjournment is taken. Any adjournment of the Special Meeting for the purpose of soliciting

additional proxies will allow our shareholders who have already sent in their proxies to revoke them at any time prior to their use at

the Special Meeting as adjourned or postponed.

Vote

Required

The

approval of the adjournment of the Special Meeting requires the vote of a majority of the shares of stock entitled to vote which are

present, in person or by proxy at the Special Meeting. Abstentions will have the effect of a vote against and broker-non-votes, if any,

see above (although none are anticipated since this is a routine matter for which brokers may vote in their discretion if beneficial

owners of our stock do not provide voting instructions not directed by stockholders how to vote), will have no effect on the outcome

of this proposal. For the approval of the adjournment, you may vote “FOR” or “AGAINST”

or abstain from voting.

Board

Recommendation

Our

Board of Directors recommends that you vote “FOR” the approval of the adjournment of the Special Meeting, if

necessary or appropriate, to another place, date or time, if deemed necessary or appropriate, in the discretion of the Board of Directors.

PRINCIPAL

SHAREHOLDERS

Security

Ownership of Certain Beneficial Owners and Management

The

following table presents certain information as of [June 15], 2023, as to:

| ● | each

shareholder known by us to be the beneficial owner of more than five percent of our outstanding

shares of common stock, |

| | | |

| |

● |

each executive officer and

director, and |

| |

|

|

| |

● |

all directors and executive

officers as a group. |

The

percentages shown in the table under the column “Percent” are based on [43,420,350]

shares of common stock outstanding as of [June 15], 2023.

Beneficial

ownership is determined in accordance with the rules of the SEC and includes voting and/or investing power with respect to securities.

These rules generally provide that shares of common stock subject to options, warrants or other convertible securities that are currently

exercisable or convertible, or exercisable or convertible within 60 days of the Record Date, are deemed to be outstanding and to be beneficially

owned by the person or group holding such options, warrants or other convertible securities for the purpose of computing the percentage

ownership of such person or group, but are not treated as outstanding for the purpose of computing the percentage ownership of any other

person or group.

To

our knowledge, except as indicated in the footnotes to this table and pursuant to applicable community property laws, the persons named

in the table have sole voting and investment power with respect to all shares of common stock shown as beneficially owned by them, subject

to applicable community property laws. Unless otherwise indicated, the address for each of the officers or directors listed in the table

below is 555 Heritage Drive, Suite 205, Jupiter, Florida, 33458.

| | |

Amount

and Nature of Shares of Common Stock Beneficially Owned | | |

Percentage

of Shares Beneficially

Owned | |

| Name

of Beneficial Owner | |

#(1) | | |

%(2) | |

| David Barthel(3)(4) | |

| 250,000 | (5) | |

| 0.6 | |

| Dr. Catherine Pachuk(3) | |

| 349,323 | (6) | |

| 0.8 | |

| Dr. Steven Brooks(3) | |

| 56,666 | (7) | |

| 0.1 | |

| Terry Brostowin(4) | |

| 555,000 | (8) | |

| 1.3 | |

| Dr. William Hearl(4) | |

| 165,000 | (9) | |

| * | |

| Dr. Vithalbhai Dhaduk(4) | |

| 4,775,548 | (10) | |

| 11.0 | |

| Julie Kampf(4) | |

| 165,000 | (11) | |

| * | |

| Dr. Nilesh Patel(4) | |

| 40,000 | (12) | |

| * | |

| Michael Stewart(4) | |

| 40,000 | (13) | |

| * | |

| George Kovalyov(14) | |

| 776,802 | (15) | |

| 1.8 | |

| Harrison Ross(14) | |

| 694,094 | (16) | |

| 1.6 | |

| All directors and executive officers as a group

(11 persons) | |

| 7,867,433 | | |

| 17.1 | |

| ESC Holdings LLC(17) | |

| 2,555,640 | | |

| 5.9 | |

| Bologna Family Restaurant SpA | |

| 4,819,123 | (18) | |

| 5.9 | |

| RCA Capital Partners Inc. | |

| 3,910,299 | (19) | |

| 10.0 | |

| About Investment Ltd | |

| 39,165,465 | (20) | |

| 8.3 | |

| Bryce Ferrell | |

| 3,757,904 | (21) | |

| 38.3 | |

| BWL Investments Ltd | |

| 9,324,628 | (22) | |

| 8.0 | |

| Li Lin | |

| 3,709,678 | (23) | |

| 17.7 | |

| Oleg Kovalyov | |

| 4,451,985 | (24) | |

| 7.9 | |

| T&J Brothers Group LLC | |

| 4,819,123 | (25) | |

| 9.3 | |

| Alpha Capital Anstalt | |

| 37,106,065 | (26) | |

| 10.0 | |

| Chiu Hoi Cheung | |

| 7,395,096 | (27) | |

| 46.1 | |

| Qing Fu | |

| 3,696,900 | (28) | |

| 14.6 | |

| Xiaoqing Wang | |

| 3,752,917 | (29) | |

| 7.8 | |

| Xiaoli Duan | |

| 3,697,455 | (30) | |

| 8.0 | |

| Jingfeng Chen | |

| 3,696,900 | (31) | |

| 7.8 | |

| Rafael Lopes Rogo | |

| 3,697,455 | (32) | |

| 7.8 | |

| Honey Tree Trading | |

| 4,819,123 | (33) | |

| 7.8 | |

| Jason Douglas Riley | |

| 3,697,640 | (34) | |

| 10.0 | |

| Noah Boeken | |

| 3,753,756 | (35) | |

| 7.8 | |

| 1319983 BC Ltd. | |

| 2,939,191 | (36) | |

| 6.3 | |

| Ranjanben

Dhaduk | |

| 4,610,548 | (37) | |

| 10.6 | |

| Amar Dhaduk(38) | |

| 2,294,097 | | |

| 5.3 | |

| Darpan Dhaduk(39) | |

| 2,294,097 | | |

| 5.3 | |

| Payal Dhaduk(40) | |

| 2,294,097 | | |

| 5.3 | |

*

Non-officer director beneficially owning less than 1% of the shares of the Company’s common stock.

(1)

Beneficial ownership is determined in accordance with the rules of the SEC and generally includes voting or investment power with respect

to securities. Except as disclosed in the following footnotes, each of the beneficial owners listed above has direct ownership of and

sole voting and investment power to the shares of the Company’s common stock.

(2)

As of [June 1], 2023, a total of 43,420,350 shares of the Company’s common stock are considered to be outstanding. This number

does not include shares of common stock issuable upon conversion or exercise of outstanding convertible or exercisable securities. Contractual

limitations on conversion or exercise of outstanding securities that would currently prevent a person from being or becoming a beneficial

owner of the Company’s securities have been assumed to apply for purposes of determining whether a person has beneficial ownership

of such securities. Beneficial ownership is determined in accordance with the rules of the SEC and generally includes voting or investment

power with respect to securities. Except as disclosed in the following footnotes, each of the beneficial owners listed above has direct

ownership of and sole voting and investment power over the shares of the Company’s common stock. Pursuant to Exchange Act

Rule 13d-3(d)(1), for each beneficial owner listed above, any options, warrants, convertible notes, or other convertible securities that

are exercisable within 60 days have also been included for purposes of calculating their percent of class, but not for any other beneficial

owner listed above.

(3)

Named executive officer.

(4)

Director.

(5)

Consists of an option to purchase 250,000 shares of common stock within 60 days of [June 1], 2023.

(6)

Consists of (i) 268,710 shares of common stock, and (ii) a warrant to purchase 80,613 shares of common stock.

(7)

Consists of (i) 20,000 shares of common stock, and (ii) an option to purchase 36,666 shares of common stock within 60 days of [June 1],

2023.

(8)

Consists of (i) a fully-vested option to purchase 140,000 shares of common stock, (ii) a fully-vested option to purchase 250,000 shares

of common stock, (iii) a fully-vested option to purchase 125,000 shares of common stock and (iv) a fully-vested option to purchase 40,000

shares of common stock.

(9)

Consists of (i) a fully vested option to purchase 125,000 shares of common stock, and (ii) a fully-vested option to purchase 40,000 shares

of common stock.

(10)

Consists of (i) 4,610,548 shares of common stock held indirectly through Ranjanben Dhaduk, Dr. Dhaduk’s wife, (ii) 125,000 shares

of common stock issuable upon exercise of an option and (iii) 40,000 shares of common stock issuable upon exercise of an option.

(11)

Consists of (i) a fully vested option to purchase 125,000 shares of common stock, and (ii) a fully vested option to purchase 40,000 shares

of common stock within 60 days of [June 1], 2023.

(12)

Consists of an option to purchase 40,000 shares of common stock within 60 days of [June 1], 2023.

(13)

Consists of an option to purchase 40,000 shares of common stock within 60 days of [June 1], 2023.

(14)

Executive officer.

(15)

George Kovalyov may be deemed to beneficially own (i) 111,509 shares of common stock held directly; (ii) 273,750 shares of common stock

issuable upon exercise of an option held directly; (iii) 124,877 shares of common stock held by AAT Services Inc., of which George Kovalyov

is the sole beneficial owner; and (iv) 266,666 shares of common stock beneficially owned through AAT Services Inc., consisting of (a)

100,000 shares of common stock issuable upon exercise of a cashless warrant; and (b) 166,666 shares of common stock issuable upon exercise

of an option within 60 days of [June 1], 2023. AAT Services Inc. was also granted 175,000 restricted shares of common stock, subject

to the following milestone vesting schedule: (A) 75,000 restricted shares vesting upon the Company successfully listing its common stock

on Nasdaq or the NYSE; (B) 50,000 restricted shares vesting upon any Company financing after January 1, 2022 of debt or equity in which

the gross proceeds equal or exceed $5,000,000; (C) 25,000 restricted shares vesting upon the completion of valuation reports for both

Somahlution LLC and HLII; and (D) 25,000 restricted shares vesting upon a material commercial partnership for MATLOC 1. AAT Services

Inc. is subject to a side agreement, under which the granting of its restricted shares will occur upon vesting, and therefore such restricted

shares are not considered to be beneficially owned on [June 1], 2023.

(16)

Harrison Ross may be deemed to beneficially own (i) 141,948 shares of common stock held directly; (ii) 273,750 shares of common stock

issuable upon exercise of an option held directly; (iii) 11,730 shares of common stock held by Rydra Capital Corp., of which Harrison

Ross is the sole beneficial owner; and (iv) 266,666 shares of common stock beneficially owned through Rydra Capital Corp., consisting

of (a) 100,000 shares of common stock issuable upon exercise of a cashless warrant; and (b) 166,666 shares of common stock issuable

upon exercise of an option within 60 days of [June 1], 2023. Rydra Capital Corp. was also granted 175,000 restricted shares of common

stock, subject to the following milestone vesting schedule: (A) 75,000 restricted shares vesting upon the Company successfully listing

its common stock on Nasdaq or the NYSE; (B) 50,000 restricted shares vesting upon any Company financing after January 1, 2022 of debt

or equity in which the gross proceeds equal or exceed $5,000,000; (C) 25,000 restricted shares vesting upon the completion of valuation

reports for both Somahlution LLC and HLII; and (D) 25,000 restricted shares vesting upon a material commercial partnership for MATLOC

1. Rydra Capital Corp. is subject to a side agreement, under which the granting of its restricted shares will occur upon vesting, and

therefore such restricted shares are not considered to be beneficially owned on [June 1], 2023.

(17)

Emmanuelle Schleipfer-Conley has voting and dispositive control over ESC Holding LLC. Its business address is 1 Channel Drive #1706,

Monmouth Beach, New Jersey 07750. The beneficial ownership information of this person is as of February 6, 2022.

(18)

Consists of 4,058,897 shares of common stock issuable upon exercise of a Class C Warrant and 760,226 shares of common stock issuable

upon conversion of a Convertible Note. Saverio Solimeo, President of Bologna Family Restaurant SpA, has sole voting and dispositive power

over the securities held by Bologna Family Restaurant SpA. The business address of Bologna Family Restaurant SpA is Via De Gombruti 20,

40123, Bologna, Italy.

(19)

Consists of 2,691,334 shares of common stock issuable upon exercise of a Class C Warrant and 1,218,965 shares of common stock issuable

upon conversion of a Convertible Note within 60 days of [June 1], 2023. Wayne Andrews, President of RCA Capital Partners Inc., has sole

voting and dispositive power over the securities held by RCA Capital Partners Inc. The mailing address of RCA Capital Partners Inc. is

1241 Darlington Oak Cir NE, St. Petersburg, FL 33703.

(20)

Consists of 26,956,337 shares of common stock issuable upon exercise of a Class C Warrant and 12,209,128 shares of common stock issuable

upon conversion of a Convertible Note within 60 days of [June 1], 2023. Jiaming Li, Chief Executive Officer of About Investment Ltd,

has sole voting and dispositive power over the securities held by About Investment Ltd. The mailing address of About Investment Ltd is

Wickhams Cay 2, Road Town, Vistra Corporate Service Centre, Tortola, VG 1110, British Virgin Islands.

(21)

Consists of 2,586,445 shares of common stock issuable upon exercise of a Class C Warrant and 1,171,459 shares of common stock issuable

upon conversion of a Convertible Note within 60 days of [June 1], 2023. The mailing address of Bryce Ferrell is 3337 Eldorado Trail East,

Minnetonka, MN 55305.

(22)

Consists of 6,430,654 shares of common stock issuable upon exercise of a Class C Warrant and 2,893,974 shares of common stock issuable

upon conversion of a Convertible Note within 60 days of [June 1], 2023. Braeden Lichti, President of BWL Investments Ltd, has sole voting

and dispositive power over the securities held by BWL Investments Ltd. The mailing address of BWL Investments Ltd is 650 Georgia St.

#3200, Vancouver, British Columbia, V6B 4P7, Canada.

(23)

Consists of 2,570,785 shares of common stock issuable upon exercise of a Class C Warrant and 1,138,893 shares of common stock issuable

upon conversion of a Convertible Note within 60 days of [June 1], 2023. The mailing address of Li Lin is 6-2-24, Jiaochangba West Street,

Jinjiang District, Chengdu, Sichuan, 610021, China.

(24)

Consists of 3,085,200 shares of common stock issuable upon exercise of a Class C Warrant and 1,366,785 shares of common stock issuable

upon conversion of a Convertible Note within 60 days of [June 1], 2023. The mailing address of Oleg Kovalyov is 10591 Sceptre Cr., Richmond,

BC V7E 2A6, Canada.

(25)

Consists of 3,600,000 shares of common stock issuable upon exercise of a Class C Warrant and 1,219,123 shares of common stock issuable

upon conversion of a Convertible Note within 60 days of [June 1], 2023. Xingyu Yang, Partner of T&J Brothers Group LLC, has sole

voting and dispositive power over the securities held by T&J Brothers Group LLC. The mailing address of T&J Brothers Group LLC

is 1400 University Ave, A-306A, Riverside, CA.

(26)

Consists of 25,714,285 shares of common stock issuable upon exercise of a Class C Warrant and 11,391,780 shares of common stock issuable

upon conversion of a Convertible Note within 60 days of [June 1], 2023. Nicola Feuerstein, Chief Executive Officer of Alpha Capital Anstalt,

has sole voting and dispositive power over the securities held by Alpha Capital Anstalt. The mailing address of Alpha Capital Anstalt

is 510 Madison Ave., Suite 1400, New York, NY 10022.

(27)

Consists of 5,142,985 shares of common stock issuable upon exercise of a Class C Warrant and 2,252,111 shares of common stock issuable

upon conversion of a Convertible Note within 60 days of [June 1], 2023. The mailing address of Chiu Hoi Cheung is Flat H, 24/F, Block

36, Laguna City, 7 South Laguna Street, Kwun Tong, Kowloon, Hong Kong, 999077, China.

(28)

Consists of 2,571,042 shares of common stock issuable upon exercise of a Class C Warrant and 1,125,858 shares of common stock issuable

upon conversion of a Convertible Note within 60 days of [June 1], 2023. The mailing address of Qing Fu is 3760 W. 11th Ave.,

Vancouver, British Columbia, V6R2K6, Canada.

(29)

Consists of 2,610,000 shares of common stock issuable upon exercise of a Class C Warrant and 1,142,917 shares of common stock issuable

upon conversion of a Convertible Note within 60 days of [June 1], 2023. The mailing address of Xiaoqing Wang is 6829 Corintia St., Carlsbad,

CA 92009.

(30)

Consists of 2,571,428 shares of common stock issuable upon exercise of a Class C Warrant and 1,126,027 shares of common stock issuable

upon conversion of a Convertible Note within 60 days of [June 1], 2023. The mailing address of Xiaoli Duan is 1519 Errigal Pl., West

Vancouver, Vancouver, British Columbia, V733H1, Canada.

(31)

Consists of 2,571,042 shares of common stock issuable upon exercise of a Class C Warrant and 1,125,858 shares of common stock issuable

upon conversion of a Convertible Note within 60 days of [June 1], 2023. The mailing address of Jingfeng Chen is 180 E 2nd Ave., Unit

512, Vancouver, British Columbia, V5T0K4, Canada.

(32)

Consists of 2,571,428 shares of common stock issuable upon exercise of a Class C Warrant and 1,126,027 shares of common stock issuable

upon conversion of a Convertible Note within 60 days of [June 1], 2023. The mailing address of Rafael Lopes Rogo is 52 Aberdeen Ave.,

Cambridge, CB2 8DZ, United Kingdom.

(33)

Consists of 3,857,142 shares of common stock issuable upon exercise of a Class C Warrant and 961,981 shares of common stock issuable

upon conversion of a Convertible Note within 60 days of [June 1], 2023. Barbara Knight, Owner of Honey Tree Trading, has sole voting

and dispositive power over the securities held by Honey Tree Trading. The mailing address of Honey Tree Trading is 501 Silver Lane, Boca

Raton, FL 33432.

(34)

Consists of 2,571,557 shares of common stock issuable upon exercise of a Class C Warrant and 1,126,083 shares of common stock issuable

upon conversion of a Convertible Note within 60 days of [June 1], 2023. The mailing address of Jason Douglas Riley is 1196 Jefferson

Ave., West Vancouver, British Columbia, V7T2A8, Canada.

(35)

Consists of 2,571,428 shares of common stock issuable upon exercise of a Class C Warrant and 1,182,328 shares of common stock issuable

upon conversion of a Convertible Note within 60 days of [June 1], 2023. The mailing address of Noah Boeken is Keizersgracht 169, Amsterdam,

1016 DV, Netherlands.

(36)

Consists of 2,028,008 shares of common stock issuable upon exercise of a Class C Warrant and 911,183 shares of common stock issuable

upon conversion of a Convertible Note within 60 days of the date of this prospectus. Lisa Ross, Director of 1319983 BC Ltd., has sole

voting and dispositive power over the securities held by 1319983 BC Ltd. The mailing address of 1319983 BC Ltd. is 2000 West Carmichael,

Hornby Island, British Columbia, V0R1Z0, Canada.

(37)

Ranjanben Dhaduk shares voting and investment power over her shares of common stock with her husband, Vithalbhai Dhaduk. The mailing

address of Ranjanben Dhaduk is 1008 Windemere Circle, Dalton, PA 18414.

(38)

The mailing address of Amar Dhaduk is 3800 N. Ocean Dr., Apt. 1453, Riviera Beach, FL 33404.

(39)

The mailing address of Darpan Dhaduk is 2700 Noam Ocean Dr., Riviera Beach, FL 33404.

(40)

The mailing address of Payal Dhaduk is 800 Avenue At Port Imperial, Apt. 1010, Weehawken, NJ 07810.

DISSENTERS’

RIGHTS

Under

Nevada law there are no dissenters’ rights available to our shareholders in connection with any of the Proposals.

ADDITIONAL

INFORMATION

The

Company’s Forms 10-K, 10-Q, 8-K and all amendments to those reports are available without charge through the Company’s website

at https://marizyme.com/investors/ as soon as reasonably practicable after they are electronically filed with, or furnished to,

the Securities and Exchange Commission. Information on our website does not constitute part of this Proxy Statement.

The

Company will provide, without charge, to each person to whom a Proxy Statement is delivered, upon written or oral request of such person

and by first class mail or other equally prompt upon receipt of such request, a copy of any of the filings described above. Individuals

may request a copy of such information by sending a request to the Company, Attn: Corporate Secretary, Marizyme, Inc., 555 Heritage Drive,

Suite 205, Jupiter, Florida 33458.

OTHER

MATTERS

As

of the date of this Proxy Statement, our management has no knowledge of any business to be presented for consideration at the Special

Meeting other than that described above. If any other business should properly come before the Special Meeting or any adjournment thereof,

it is intended that the shares represented by properly executed proxies will be voted with respect thereto in accordance with the judgment

of the persons named as agents and proxies in the enclosed form of proxy.

The

Board of Directors does not intend to bring any other matters before the Special Meeting of stockholders and has not been informed that

any other matters are to be presented by others.

INTEREST

OF CERTAIN PERSONS IN OR OPPOSITION TO MATTERS TO BE ACTED UPON

(a)

No officer or director of the Company has any substantial interest in the matters to be acted upon, other than his role as an officer

or director of the Company.

(b)

No director of the Company has informed the Company that he intends to oppose the action taken by the Company set forth in this proxy

statement.

| |

Sincerely, |

| |

|

| |

|

| |

David

Barthel |

| |

Chief

Executive Officer |

Jupiter,

Florida

June

30, 2023

Annex

A

Proposed

Authorized Share Increase Amendment

AND

PROPOSED

OBLIGATIONS RIGHTS AMENDMENT

Article

III of the Articles of Incorporation of Marizyme, Inc. (the “Company”) is hereby amended to increase the authorized capital

stock of the Company to 2,025,000,000 shares, consisting of 2,000,000,000 shares of Common Stock, par value $0.001 per share, and 25,000,000

shares of “blank check” Preferred Stock, par value $0.001 per share, which class shall have the rights, powers, designations,

preferences and relatives, participating, optional and other rights and qualifications, limitations and restrictions as established by

the Board of Directors of the Company, in one or more series from time to time, without the consent of the shareholders of the Company.

Article

III of the Articles of Incorporation of the Company is hereby further amended to add the following provision:

Rights

of Persons Holding Obligations of the Company: As provided by NRS Section 78.197, holders of bonds, debentures or other obligations

of the Company may have any of the rights of a stockholder of the Company. More specifically and by way of example, the Board of Directors

of the Company may approve and/or ratify the issuance of bonds, debentures and other obligations of the Company including, but not limited

to, convertible promissory notes of the Company, that include a provision entitling the holders of any such instruments to vote with

the shares of the Company’s common stock, on an as-converted to common stock basis without actually having converted the instruments

to shares of the Company’s common stock, with respect to all corporate matters of the Company on which the holders of common stock

are entitled to vote. Additionally, holders of those certain 10% secured convertible promissory notes of the Company issued between December

21, 2021 and August 12, 2022 (the “10% Convertible Notes”), shall be entitled, from the date of the filing with the Secretary

of State of the State of Nevada of the Certificate of Amendment to the Articles of the Incorporation of which this provision is a part,

to vote with the shares of the Company’s common stock, on an as-converted to common stock basis without actually having converted

the 10% Convertible Notes to shares of the Company’s common stock, with respect to all corporate matters of the Company on which

the holders of common stock are entitled to vote, as provided in Section 4.6 of the 10% Convertible Notes.

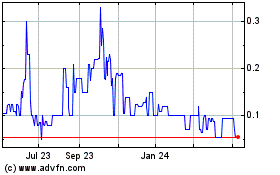

Marizyme (QB) (USOTC:MRZM)

Historical Stock Chart

From Apr 2024 to May 2024

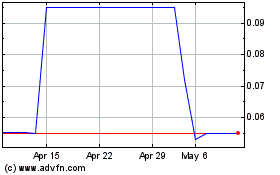

Marizyme (QB) (USOTC:MRZM)

Historical Stock Chart

From May 2023 to May 2024