Only the Best Luxury Brands Can Hike Prices -- Heard on the Street

January 27 2021 - 6:30AM

Dow Jones News

By Carol Ryan

One way to tell which luxury-goods brands are in fashion is

whether they managed to raise prices in the middle of a

pandemic.

LVMH Moët Hennessy Louis Vuitton reported resilient results

Tuesday, after the Paris market closed. While overall revenue fell

16% at constant exchange rates in 2020, the luxury conglomerate's

closely watched fashion and leather goods division did better.

Sales only slipped 5%, and operating margins were higher than in

2019. The unit is crucial as top brands such as Louis Vuitton and

Christian Dior generate two-thirds of the company's total operating

profit most years.

Price increases in particular protected LVMH's bottom line,

although other factors such as rent renegotiations also helped.

Louis Vuitton lifted prices on certain handbags by up to 6% in May

last year and a further 3% this month, according to Jefferies data.

At Christian Dior, prices were increased by up to 11% in some

markets.

Other top brands are doing the same. At privately owned Chanel,

its best-known handbag is now around one-fifth more expensive

globally than at the end of 2019. The latest increase was in the

U.S., where a classic flap bag now sets shoppers back by $400 more

than in November. Gucci, owned by LVMH's French peer Kering,

recently pushed through a 22% price increase on its Dionysus bag in

Korea.

Most years, luxury brands use price increases to offset

inflation in input and labor costs as well as currency moves. But

2020 has been exceptional. "Recent price increases have been pretty

aggressive...In normal years, a typical rise would be 5% to 6%,"

said Kathryn Parker, an analyst at Jefferies. The move boosted

profit as sales have been under pressure. LVMH's chief financial

officer Jean-Jacques Guiony told analysts that the company could

raise prices in 2020 because it was restrained in the previous four

years.

However, pricing power looks unequal across the sector. British

trench-coat maker Burberry didn't change prices on existing

products in 2020, and made only small increases in January this

year. This may be another sign that the company's turnaround is

fragile. Bottega Veneta, which is otherwise one of Kering's

most-promising smaller brands, has only increased prices modestly,

UBS data shows. After years of underperformance, it probably hasn't

yet built enough clout to drive up prices without losing

customers.

LVMH's stock has been exceptionally strong over the past year

and changes hands for 34 times prospective earnings, giving the

company a market value equivalent to $314 billion. Investors' high

expectations help explain why the shares barely rose at the Paris

open on Wednesday. Yet the company's capacity to keep profit

flowing in the face of widespread store closures offers reassurance

that it can continue to deliver -- even if shoppers pay the

price.

Write to Carol Ryan at carol.ryan@wsj.com

(END) Dow Jones Newswires

January 27, 2021 06:15 ET (11:15 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

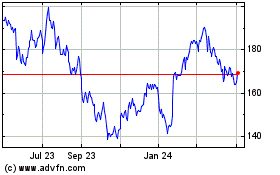

LVMH Moet Hennessy Louis... (PK) (USOTC:LVMUY)

Historical Stock Chart

From Jul 2024 to Aug 2024

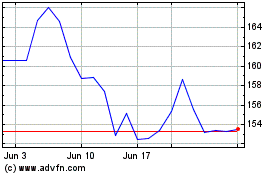

LVMH Moet Hennessy Louis... (PK) (USOTC:LVMUY)

Historical Stock Chart

From Aug 2023 to Aug 2024