Pandemic Chips at Beauty Retail's Bricks-and-Mortar Stronghold

December 31 2020 - 11:25AM

Dow Jones News

By Jinjoo Lee

Some things are just a tough sell online. Traditionally, makeup

and fragrances have fallen squarely in the category of goods that

consumers want to sample in person. Yet even this industry may not

be immune to the pandemic's effects on consumer behavior.

Major department stores like Nordstrom and Macy's got around a

quarter of sales through e-commerce channels in the fiscal year

ended Feb. 1. Cosmetics retailer Ulta Beauty, however, derived only

13% of its sales online.

Yet e-commerce sales are growing fast at Ulta: by 200% in the

quarter ended Aug. 1 compared with a year earlier. Even when stores

had fully reopened, online sales were up 90%, hinting at some

e-commerce stickiness.

This might pose a dilemma for beauty retailers. Push hard on

e-commerce and they risk making consumers too comfortable with

online shopping, potentially lowering the barrier for online

competition and rendering their store fleets obsolete. A similar

dynamic has played out with apparel, for example, as newer

competitors flooded the market, notes Simeon Siegel, an analyst at

BMO Capital Markets.

On the surface, Ulta Beauty's decision to place its shops inside

Target stores and Sephora's plan to set up inside Kohl's department

stores look like bets on traditional bricks-and-mortar. But look

more closely and they are also smart hedges against an online

future. These setups require less resources than stand-alone stores

and also include an online component, as Target and Kohl's will be

showcasing Ulta Beauty and Sephora's products on their

websites.

The online share of sales of beauty products -- defined as

prestige products sold in department stores and specialty retailers

such as LVMH-owned Sephora -- roughly doubled in 2020, accounting

for nearly half of all sales, according to Larissa Jensen, beauty

industry adviser at market research firm NPD Group. And yet,

overall sales have declined. Through November, beauty product sales

were down 21% compared with the same period of 2019, according to

NPD Group data.

Still, consumers' newfound familiarity with buying beauty

products online could have far-reaching impacts. Even when

consumers choose to go out to shop in person again, there is the

risk they will treat bricks-and-mortar stores as showrooms --

places where they try out products but ultimately transact online.

That will be less of a concern if customers are going directly to

those retailers' websites, but a headache if they migrate

elsewhere.

Amazon is dipping its toes into beauty, just as it has with a

few luxury brands. The category is attractive: Makeup and fragrance

tend to be high margin, small in size, popular as gifts and also

something that needs replenishment. In 2019, Amazon announced a

deal with Lady Gaga's beauty product line.

Beauty retailers might take comfort in Best Buy's example. The

retailer was once known as Amazon's showroom for electronics, but

impressively managed to hold on to its market share through

investing in e-commerce capabilities and creating a great in-store

experience.

Ulta Beauty and Sephora can end up like Best Buy if they make

the right moves now, or else face the fate of Barnes &

Noble.

Write to Jinjoo Lee at jinjoo.lee@wsj.com

(END) Dow Jones Newswires

December 31, 2020 11:10 ET (16:10 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

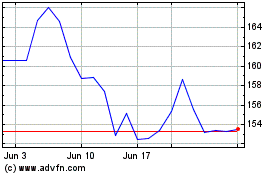

LVMH Moet Hennessy Louis... (PK) (USOTC:LVMUY)

Historical Stock Chart

From Jun 2024 to Jul 2024

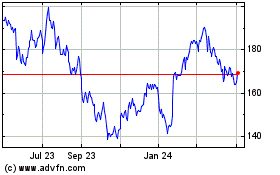

LVMH Moet Hennessy Louis... (PK) (USOTC:LVMUY)

Historical Stock Chart

From Jul 2023 to Jul 2024