UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 or 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

FOR THE MONTH OF NOVEMBER 2024

Commission File Number: 000-29870

FE BATTERY METALS CORP.

(Translation of Registrant’s name into English)

700 West Georgia Street, 25th Floor

Vancouver, British Columbia, Canada V7Y 1B3

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F

Form 20-F [ X ] Form 40-F [ ]

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

| |

FE BATTERY METALS CORP.

(Registrant) |

| |

|

|

| Date: November 29, 2024 |

By: |

/s/ Gurminder Sangha |

| |

Name: |

Gurminder Sangha |

| |

Title: |

CEO and Director |

Exhibit 99.1

CONDENSED INTERIM FINANCIAL STATEMENTS

FOR THE SIX MONTHS ENDED SEPTEMBER 30, 2024

(Expressed in Canadian dollars)

(Unaudited – Prepared by Management)

Notice

to Reader

These condensed

interim financial statements of FE Battery Metals Corp. have been prepared by management and approved by the Board of Directors of the

Company. In accordance with National Instrument 51-102 released by the Canadian Securities Administrators, the Company discloses that

its external auditors have not reviewed these condensed interim financial statements, notes to financial statements and the related quarterly

Management Discussion and Analysis.

|

FE BATTERY METALS CORP.

Condensed Interim Statements of Financial Position

(Unaudited - expressed in Canadian dollars) |

| | |

| |

|

September 30, | | |

|

March 31, | |

| | |

Note | |

|

2024 | | |

|

2024 | |

| ASSETS | |

| |

|

| | |

|

| |

| Current Assets | |

| |

| | | |

| | |

| Cash | |

| |

$ | 1,730,199 | | |

$ | 1,704,908 | |

| Amounts receivable and prepaid expenses | |

4 | |

| 74,615 | | |

| 436,788 | |

| Market

securities | |

5 | |

| 218,159 | | |

| 187,425 | |

| Total

Current Assets | |

| |

| 2,022,973 | | |

| 2,329,121 | |

| Non-current Assets | |

| |

| | | |

| | |

| Reclamation deposits | |

| |

| 11,000 | | |

| 11,000 | |

| Equipment | |

| |

| 1,579 | | |

| 1,822 | |

| Exploration

and evaluation assets | |

6 | |

| 6,955,451 | | |

| 6,955,451 | |

| Total

Non-current Assets | |

| |

| 6,968,030 | | |

| 6,968,273 | |

| Total

Assets | |

| |

$ | 8,991,003 | | |

$ | 9,297,394 | |

| LIABILITIES | |

| |

| | | |

| | |

| Current Liabilities | |

| |

| | | |

| | |

| Accounts payable and accrued liabilities | |

7 | |

$ | 296,290 | | |

$ | 236,583 | |

| Due to related parties, net | |

8 | |

| 197,943 | | |

| 254,869 | |

| Flow-through

share premium liability | |

9 | |

| 246,537 | | |

| 159,579 | |

| Total

Liabilities | |

| |

$ | 740,770 | | |

$ | 651,031 | |

| SHAREHOLDERS’

EQUITY | |

| |

| | | |

| | |

| Share capital | |

9 | |

| 59,391,152 | | |

| 59,102,110 | |

| Warrants reserve | |

| |

| 2,834,521 | | |

| 2,834,521 | |

| Share-based payments reserve | |

9 | |

| 3,129,757 | | |

| 2,889,068 | |

| Deficit | |

| |

| (57,105,197 | ) | |

| (56,179,336 | ) |

| Total

Shareholders’ Equity | |

| |

| 8,250,233 | | |

| 8,646,363 | |

| Total

Liabilities and Shareholders’ Equity | |

| |

$ | 8,991,003 | | |

$ | 9,297,394 | |

| | |

| |

| | | |

| | |

| Going concern | |

1 | |

| | | |

| | |

| Subsequent event | |

13 | |

| | | |

| | |

Approved and authorized for issue on behalf of the

board of directors on November 27, 2024 by:

| /s/ Gurminder

Sangha |

|

/s/

Jurgen Wolf |

|

| Director |

|

Director |

|

The accompanying notes are an integral part of these condensed interim

financial statements.

|

FE BATTERY METALS CORP.

Condensed Interim Statements of Loss and Comprehensive Loss

(Unaudited - expressed in Canadian dollars) |

| | |

| | |

Three months ended September 30,

| | |

Six months ended September 30,

| |

| | |

Note | | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| Expenses | |

| | |

| | | |

| | | |

| | | |

| | |

| Consulting fees | |

8 | | |

$ | 2,400 | | |

$ | 59,500 | | |

$ | 15,600 | | |

$ | 67,500 | |

| Exploration and evaluation costs | |

6 | | |

| 139,314 | | |

| 706,594 | | |

| 139,314 | | |

| 1,124,780 | |

| General and administrative | |

| | |

| 3,665 | | |

| 4,331 | | |

| 7,856 | | |

| 8,855 | |

| Investor relations | |

| | |

| 52,466 | | |

| 229,008 | | |

| 328,492 | | |

| 598,811 | |

| Professional fees | |

| | |

| 27,094 | | |

| 22,323 | | |

| 42,094 | | |

| 43,964 | |

| Salaries, fees and benefits | |

8 | | |

| 71,550 | | |

| 50,000 | | |

| 136,950 | | |

| 100,000 | |

| Shareholder communications | |

| | |

| 24,485 | | |

| 56,052 | | |

| 45,925 | | |

| 75,336 | |

| Share-based payments | |

| | |

| - | | |

| 411,249 | | |

| 240,689 | | |

| 1,841,033 | |

| Loss Before Other Income | |

| | |

| (320,974 | ) | |

| (1,539,057 | ) | |

| (956,920 | ) | |

| (3,860,279 | ) |

| Other items | |

| | |

| | | |

| | | |

| | | |

| | |

| Interst and Other income | |

| | |

| 212 | | |

| 168 | | |

| 325 | | |

| 168 | |

| Gain (loss) on marketable securities | |

| | |

| (52,774 | ) | |

| (492,195 | ) | |

| 30,734 | | |

| (236,889 | ) |

| Flow-through recovery | |

| | |

| - | | |

| 165,044 | | |

| - | | |

| 225,324 | |

| Total Other items | |

| | |

| (52,562 | ) | |

| (326,983 | ) | |

| 31,059 | | |

| (11,397 | ) |

Net

Loss and Comprehensive Loss for the Period | |

| | |

$ | (373,536 | ) | |

$ | (1,866,040 | ) | |

$ | (925,861 | ) | |

$ | (3,871,676 | ) |

Loss

per Common Share, Basic and Diluted | |

| | |

| (0.01 | ) | |

$ | (0.04 | ) | |

$ | (0.02 | ) | |

$ | (0.08 | ) |

Weighted

Average Number of Shares Outstanding – Basic and Diluted | |

| | |

| 52,585,285 | | |

| 47,356,906 | | |

| 52,414,224 | | |

| 46,378,486 | |

The accompanying notes are an integral part of these

condensed interim financial statements.

|

FE BATTERY METALS CORP.

Condensed Interim Statements of Changes in Equity

(Unaudited - expressed in Canadian dollars) |

| | |

Common Shares

Without Par Value | | |

Warrants | | |

Share | | |

Share-based

Payments | | |

| | |

| |

| | |

Shares | | |

Amount | | |

Reserve | | |

subscription | | |

Reserve | | |

Deficit | | |

Total Equity | |

| Balance, March 31, 2023 | |

| 41,920,038 | | |

$ | 54,484,848 | | |

$ | 2,705,754 | | |

$ | 19,134 | | |

$ | 1,833,998 | | |

$ | (49,544,263 | ) | |

$ | 9,499,471 | |

| Shares issued for exploration and evaluation assets | |

| 3,058,333 | | |

| 1,995,416 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 1,995,416 | |

| Private placements | |

| 1,912,231 | | |

| 1,070,849 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 1,070,849 | |

| Share based payments - stock options | |

| - | | |

| - | | |

| - | | |

| - | | |

| 1,105,283 | | |

| - | | |

| 1,105,283 | |

| Share based payments - RSU’s | |

| 1,425,000 | | |

| 735,750 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 735,750 | |

| Share issue costs | |

| - | | |

| (73,200 | ) | |

| - | | |

| - | | |

| - | | |

| - | | |

| (73,200 | ) |

| Net loss for the period | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (3,871,676 | ) | |

| (3,871,676 | ) |

| Balance, September 30, 2023 | |

| 48,315,602 | | |

| 58,213,663 | | |

| 2,705,754 | | |

| 19,134 | | |

| 2,939,281 | | |

| (53,415,939 | ) | |

| 10,461,893 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance, March 31, 2024 | |

| 50,846,156 | | |

$ | 59,102,110 | | |

$ | 2,834,521 | | |

$ | - | | |

$ | 2,889,068 | | |

$ | (56,179,336 | ) | |

$ | 8,646,363 | |

| Private placements | |

| 1,739,130 | | |

| 313,042 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 313,042 | |

| Share issue costs | |

| - | | |

| (24,000 | ) | |

| - | | |

| - | | |

| - | | |

| - | | |

| (24,000 | ) |

| Share based payments - stock options | |

| - | | |

| - | | |

| - | | |

| - | | |

| 131,314 | | |

| - | | |

| 131,314 | |

| Share based payments - RSU’s | |

| - | | |

| - | | |

| - | | |

| - | | |

| 109,375 | | |

| - | | |

| 109,375 | |

| Net loss for the period | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (925,861 | ) | |

| (925,861 | ) |

| Balance, September 30, 2024 | |

| 52,585,286 | | |

$ | 59,391,152 | | |

$ | 2,834,521 | | |

$ | - | | |

$ | 3,129,757 | | |

$ | (57,105,197 | ) | |

$ | 8,250,233 | |

The accompanying notes are an integral part of these condensed interim financial statements.

| FE BATTERY METALS CORP. |

|

Condensed Interim Statements of Cash Flows

(Unaudited - expressed in Canadian dollars) |

| | |

Six months ended September 30, | |

| | |

2024 | | |

2023 | |

| Cash provided from (used for): | |

| | | |

| | |

| Operating activities | |

| | | |

| | |

| Net loss for the period | |

$ | (925,861 | ) | |

$ | (3,871,676 | ) |

| Items not involving cash: | |

| | | |

| | |

| Amortization | |

| 243 | | |

| 122 | |

| Share-based payments | |

| 240,689 | | |

| 1,841,033 | |

| Unrealized (gain) loss on marketable securities | |

| (30,734 | ) | |

| 236,889 | |

| Flow-through recovery | |

| - | | |

| (225,324 | ) |

| Changes in non-cash working capital balances: | |

| | | |

| | |

| Amounts receivable and prepaid expenses | |

| 362,173 | | |

| 254,720 | |

| Accounts payable and accrued liabilities | |

| 59,707 | | |

| (405,905 | ) |

| Due to related parties | |

| (56,926 | ) | |

| (257,476 | ) |

| Net cash used in operating activities | |

| (350,709 | ) | |

| (2,427,617 | ) |

| Investing activities | |

| | | |

| | |

| Exploration and evaluation assets | |

| - | | |

| (52,500 | ) |

| Cash used in investing activities | |

| - | | |

| (52,500 | ) |

| Financing activities | |

| | | |

| | |

| Proceeds from financing (net of share issue costs) | |

| 376,000 | | |

| 1,146,799 | |

| Net cash from in financing activities | |

| 376,000 | | |

| 1,146,799 | |

| Net decrease in cash during the period | |

| 25,291 | | |

| (1,333,318 | ) |

| Cash, beginning of the period | |

| 1,704,908 | | |

| 3,664,578 | |

| Cash, end of the period | |

$ | 1,730,199 | | |

$ | 2,331,260 | |

| Supplemental information | |

| | | |

| | |

| Shares issued for exploration and evaluation assets | |

$ | - | | |

$ | 1,995,416 | |

The accompanying notes are

an integral part of these condensed interim financial statements.

|

FE BATTERY METALS CORP.

Notes to the Condensed Interim Financial Statements

For the six months ended September 30, 2024 and 2023

(Unaudited - expressed in Canadian dollars) |

| 1. | Nature of Operations and Going Concern |

FE Battery Metals Corp. (“FE Battery”

or the “Company”), formerly known as First Energy Metals Limited, was incorporated on October 12, 1966 in the Province of

British Columbia under the Business Corporations Act of British Columbia, and its principal business activity is the exploration of mineral

properties in Canada.

The Company’s head office and principal address

is Suite 2421 – 1055 West Georgia Street, Vancouver, B.C., Canada, V6E 3P3. The Company’s registered and records office is

25th Floor-700 West Georgia Street, Vancouver, B.C., Canada, V7Y 1B3.

These condensed interim financial statements have

been prepared on a going concern basis which assumes that the Company will be able to realize its assets and discharge its liabilities

in the normal course of business for the foreseeable future. If the going concern assumption is not appropriate for these financial statements,

then adjustments would be necessary to the carrying amount of assets and liabilities, the reported revenue and expenses and the balance

sheet classifications used.

During the period ended September 30, 2024, the Company

experienced operating losses and negative operating cash flows with the operations of the Company having been primarily funded by the

issuance of share capital. The Company expects to incur further losses in the development of its business, and these matters are indicative

of the existence of material uncertainty that casts significant doubt as to the Company’s ability to continue as a going concern.

The Company will need to raise sufficient funds as

the Company’s current assets are not sufficient to finance its operations and administrative expenses. The Company is evaluating

financing options including, but not limited to, the issuance of additional equity and debt. The Company has no assurance that such financing

will be available or be available on favourable terms. Factors that could affect the availability of financing include the Company’s

performance (as measured by numerous factors including the progress and results of its projects), the state of international debt and

equity markets, investor perceptions and expectations and the global financial and metals markets. In addition to evaluating financing

options, the Company has also implemented cost savings measures.

| 2. | Significant Accounting Policies |

| (a) | Statement of Compliance |

These unaudited condensed interim financial statements

have been prepared in accordance with International Accounting Standard, Interim Financial Reporting (“IAS 34”) as issued

by the International Accounting Standards Board (“IASB”). The policies applied in these financial statements are based on

International Financial Reporting Standards (“IFRS”) and interpretations of the International Financial Reporting Interpretations

Committee (“IFRIC”) issued and outstanding as at November 27, 2024, the date the board of directors approved these unaudited

condensed interim financial statements for issue.

These unaudited condensed interim financial statements,

prepared in conformity with IAS 34, follow the same accounting policies and methods of computation as the most recent audited annual financial

statements.

Since these unaudited condensed interim financial

statements do not include all disclosures required by the International Financial Reporting Standards (“IFRS”) for annual

financial statements, they should be read in conjunction with the Company’s annual financial statements for the year ended March

31, 2024.

| (c) | Basis of Measurement and Presentation |

These unaudited condensed interim financial statements

have been prepared using the historical cost convention using the accrual basis of accounting except for some financial instruments, which

have been measured at fair value. In the opinion of management, all adjustments (including normal recurring accruals) considered necessary

for a fair presentation have been included.

|

FE BATTERY METALS CORP.

Notes to the Condensed Interim Financial Statements

For the six months ended September 30, 2024 and 2023

(Unaudited - expressed in Canadian dollars) |

| 2. | Significant Accounting Policies (continued) |

Certain comparative figures have been reclassified

to conform to the current period’s presentation

| 3. | Critical Accounting Judgments and Estimates |

The preparation of financial statements requires management

to make judgments and estimates that affect the amounts reported in the financial statements and notes. By their nature, these judgments

and estimates are subject to change and the effect on the financial statements of changes in such judgments and estimates in future periods

could be material. These judgments and estimates are based on historical experience, current and future economic conditions, and other

factors, including expectations of future events that are believed to be reasonable under the circumstances. Actual results could differ

from these judgments and estimates. The more significant areas are as follows:

| (a) | Share-based Payment Transactions |

The Company measures the cost of equity-settled transactions

with employees by reference to the fair value of the equity instruments at the date at which they are granted. Estimating fair value for

share-based payment transactions requires determining the most appropriate valuation model, which is dependent on the terms and conditions

of the grant. This estimate also requires determining the most appropriate inputs to the valuation model including the expected life of

the share option, volatility and dividend yield and making assumptions about them. The assumptions and models used for estimating fair

value for share-based payment transactions are disclosed in Note 8.

The assessment of the Company’s ability to raise sufficient

funds to finance its exploration and administrative expenses involves judgment. Estimates and assumptions are continually evaluated and

are based on historical experience and other factors, including expectations of future events that are believed to be reasonable under

the circumstances.

| (c) | Intangible Exploration and Evaluation Assets |

Management is required to assess impairment in respect

of intangible exploration and evaluation assets. Note 6 discloses the carrying value of such assets. The triggering events for the potential

impairment of exploration and evaluation assets are defined in IFRS 6 Exploration for and Evaluation of Mineral Properties and

are as follows:

| · | the period for which the entity has the right

to explore in the specific area has expired during the period or will expire in the near future, and is not expected to be renewed; |

| · | substantive expenditure on further exploration

for and evaluation of mineral resources in the specific area is neither budgeted nor planned; |

| · | exploration for and evaluation of mineral resources

in the specific area have not led to the discovery of commercially viable quantities of mineral resources and the entity has decided to

discontinue such activities in the specific area; and |

| · | sufficient data exists to indicate that, although

a development in the specific area is likely to proceed, the carrying amount of the exploration and evaluation asset is unlikely to be

recovered in full from successful development or by sale. |

In making the assessment, management is required to

make judgments as to the status of each project and its future plans towards finding commercial reserves. The nature of exploration and

evaluation activity is such that only a proportion of projects are ultimately successful and accordingly some assets are likely to become

impaired in future periods.

Deferred income tax asset carrying amounts depend

on estimates of future taxable income and the likelihood of reversal of timing differences. Where reversals are expected, estimates of

future tax rates will be used in the calculation of deferred tax asset carrying amounts. Potential tax assets were considered not to be

recoverable at the current year end.

|

FE BATTERY METALS CORP.

Notes to the Condensed Interim Financial Statements

For the six months ended September 30, 2024 and 2023

(Unaudited

- expressed in Canadian dollars)

|

| 4. | Amounts Receivable and Prepaid Expenses |

| | |

| September 30,

2024 | | |

| March 31,

2024 | |

| GST/HST | |

| 32,234 | | |

| 126,549 | |

| Prepayments and other receivables | |

| 42,381 | | |

| 310,239 | |

| Total | |

$ | 74,615 | | |

$ | 436,788 | |

As at September 30, 2024, the fair values of the marketable

securities are as follows:

| Available -for-sale Securities | |

| Number of

shares | | |

| Cost | | |

| Accumulated

unrealized

holding loss | |

|

| Fair Value | |

| Shares in Battery Age Minerals Ltd. (Note 6) | |

| 2,125,000 | | |

$ | 804,270 | | |

$ | (586,111 | ) |

|

| 218,159 | |

As at March 31, 2024, the fair values of the marketable

securities are as follows:

| | |

| Number of | | |

| | |

| |

Accumulated unrealized | |

|

| | |

| Available -for-sale Securities | |

| shares | | |

| Cost | |

| |

holding loss | |

|

| Fair Value | |

| Shares in Battery Age Minerals Ltd. (Note 6) | |

| 2,125,000 | | |

$ | 804,270 | |

| $ |

(616,845 | ) |

|

| 187,425 | |

| 6. | Exploration and Evaluation Assets |

Exploration and evaluation assets deferred to the

statements of financial position at September 30, 2024 and March 31, 2024 are as follows:

| | |

| March 31, 2024 | | |

| Additions | | |

| Write-off | | |

| September 30,

2024 | |

| Abitibi Lithium | |

$ | 1,767,000 | | |

| - | | |

| - | | |

$ | 1,767,000 | |

| Augustus Lithium | |

| 593,290 | | |

| - | | |

| - | | |

| 593,290 | |

| Canadian Lithium | |

| 228,881 | | |

| - | | |

| - | | |

| 228,881 | |

| Cosgrave Lithium | |

| 104,750 | | |

| - | | |

| | | |

| 104,750 | |

| Electron Lithium | |

| 650,405 | | |

| - | | |

| - | | |

| 650,405 | |

| Kokanee Creek | |

| 932,125 | | |

| - | | |

| - | | |

| 932,125 | |

| McNeely | |

| 820,000 | | |

| - | | |

| - | | |

| 820,000 | |

| Rose West Lithium | |

| 884,000 | | |

| - | | |

| - | | |

| 884,000 | |

| Rose East Lithium | |

| 975,000 | | |

| - | | |

| - | | |

| 975,000 | |

| | |

$ | 6,955,451 | | |

$ | - | | |

$ | - | | |

$ | 6,955,451 | |

| (a) | Abitibi Lithium Property |

On March 12, 2021, the Company entered into a purchase

agreement to acquire a 100% interest in the Abitibi Lithium property (the “Abitibi Agreement”). The Abitibi Lithium property

is comprised of 235 mineral claims covering approximately 12,500 hectares located in the Abitibi area of western Quebec.

Under the terms of the Abitibi Agreement, the Company

acquired a 100% interest in the Abitibi Lithium property by issuing 1,078,947 common shares of the Company and by paying $250,000 on April

20, 2021. The Abitibi Lithium Property is subject to a 3% Net Smelter Returns (“NSR”) royalty, which the Company will have

the option to reduce the NSR by 1.0% to 2.0% by paying $1,000,000.

|

FE BATTERY METALS CORP.

Notes to the Condensed Interim Financial Statements

For the six months ended September 30, 2024 and 2023

(Unaudited - expressed in Canadian dollars) |

| 6. | Exploration and Evaluation Assets (continued) |

| (b) | Augustus Lithium Property |

On January 18, 2021, the Company entered into an option

agreement to acquire a 100% interest in the Augustus Lithium property (the “Augustus Agreement”). The Augustus Lithium property

is comprised of 21 mineral claims covering approximately 900 hectares located in the Abitibi area of western Quebec.

On October 29, 2022, the Company entered into amended

option agreement allowing the Company to accelerate its option to acquire a 100% interest in the Augustus Lithium property. As consideration

for the amendment, the Company issued an additional 350,000 common shares. As of November 7, 2022, the Company completed the required

option payments, common share issuances and exploration expenditures to acquire 100% interest of the Augustus Lithium property.

The Augustus Lithium Property is subject to a 2% NSR

royalty. The Company will have the option to reduce the NSR by 1.0% to 1.0% by paying $1,000,000.

| (c) | Canadian Lithium Property |

On February 3, 2021, the Company entered into an option

agreement to acquire a 100% interest in the Canadian Lithium property (the “Canadian Lithium Agreement”). The Canadian Lithium

property is comprised of 12 mineral claims covering approximately 700 hectares located in the Landrienne Township area of Quebec.

On February 3, 2023, the Company had completed the

required option payments of $60,000 and issuance of 230,263 common shares to acquire a 100% interest of the Canadian Lithium Property.

The Canadian Lithium Property is subject to a 2% NSR

royalty. The Company will have the option to reduce the NSR by 1.0% to 1.0% by paying $1,000,000.

| (d) | Cosgrave Lithium Property |

On August 24, 2023, the Company entered into a purchase

agreement to acquire a 100% interest in the Cosgrave Lithium property (the “Cosgrave Agreement”). The Cosgrave Lithium property

is comprised of 198 mineral claims covering approximately 3,700 hectares located in the Ear Falls, Ontario.

Pursuant to the terms of the Cosgrave Agreement, the

Company acquired a 100% interest in the Cosgrave Lithium property by issuing 175,000 common shares of the Company and by making the option

payment of $22,500 during the year ended March 31, 2024.

The Cosgrave Lithium Property is subject to a 1.5%

NSR royalty, which the Company will have the option to reduce the NSR by 0.75% to 0.75% by paying $500,000.

| (e) | Electron Lithium Property |

On March 2, 2022, the Company entered into a purchase

agreement to acquire a 100% interest in the Electron Lithium property (the “Electron Agreement”). The Electron Lithium property

is comprised of 438 mineral claims covering approximately 30,000 hectares of prospective land around the Augustus Lithium Property in

western Quebec.

On November 8, 2022, the Company completed the required

option payments and share issuances to acquire a 100% interest in the Electron Lithium property.

The Electron Lithium property is subject to a 3% Gross

Metal Royalty (“GMR”), which the Company will have the option to reduce the GMR by 1.0% to 2.0% by paying $1,000,000.

On November 14, 2022, the Company entered into a joint

venture agreement (the “Infini Joint Venture Agreement”) with Infini Resources Pty Ltd. (“Infini Resources”) whereby

Infini Resources may earn a 100% interest in 230 of the 438 mineral claims comprising the Electron Lithium Property.

|

FE BATTERY METALS CORP.

Notes to the Condensed Interim Financial Statements

For the six months ended September 30, 2024 and 2023

(Unaudited - expressed in Canadian dollars) |

| 6. | Exploration and Evaluation Assets (continued) |

| (e) | Electron Lithium Property (continued) |

Pursuant to the Infini Joint Venture Agreement, Infini

Resources earned an initial 50% interest by making initial cash payments of AUD$600,000 (CAD$530,925). Upon exercising the option, a joint

venture will also be formed between FE Battery and Infini Resources to further advance the project. Infini Resources has the option to

acquire an additional 25% by making a further AUD$150,000 payment and issuing shares of Infini Resources in the value of AUD$150,000 within

18 months of earning its initial 50% interest. Infini Resources may then acquire the remaining 25% interest, for a 100% beneficial interest

by making a further payment AUD$300,000 and issuing shares of Infini Resources in the value of AUD$300,000 within 12 months of earning

its 75% interest. To date, Infini Resources has not exercised its option to acquire an additional 25% interest.

The Infini Joint Venture Agreement may be terminated

in certain circumstances, including by FE Battery if certain milestones are not met in accordance with the agreement.

On January 3, 2022, the Company entered into an option

agreement to acquire a 100% interest in the Falcon Lake property (the “Falcon Lake Agreement”). The Falcon Lake property is

comprised of 48 mineral claims covering approximately 1,000 hectares located in the Thunder Bay Mining Division, Ontario.

On September 30, 2022, the Company entered into an

amended option agreement which amended certain cash payments, share issuances and exploration expenditures due dates and requirements

of the Option Agreement.

On October 21, 2022, the Company completed the required

option payments and share issuances to acquire a 100% interest in the Falcon Lake property.

On January 27, 2023, the Company executed a joint

venture agreement (the “Battery Age Minerals Joint Venture Agreement”) with Battery Age Minerals Limited (“Battery Age

Minerals”) whereby Battery Age Minerals may earn a 100% interest in the Falcon Lake Property.

Pursuant to the Battery Age Minerals Joint Venture

Agreement, Battery Age Minerals earned an initial 65% interest by making the initial option payments of AUD$150,000 (CAD$139,358) and

issuing to the Company 1,375,000 of Battery Age Mineral shares valued at $513,975. Battery Age Minerals earned a further 25% interest,

for an aggregate 90% interest, by issuing a further 750,000 shares of Battery Age Minerals valued at $290,295 and by making a cash payment

of AUD$50,000 (CAD$46,175). Battery Age Minerals may acquire the remaining 10% interest, for a 100% beneficial interest by making a further

payment equal to the lower of the price determined by independent valuation or AUD$2 million. Upon Battery Age Minerals earning its 90%

interest, a joint venture was deemed to have been formed between FE Battery and Battery Age Minerals to further advance the project.

The option agreement may be terminated in certain

circumstances, including by FE Battery if certain milestones are not met in accordance with the agreement.

| (g) | Jubilee Lithium Property |

On December 1, 2022, the Company entered into an option

agreement to acquire a 100% interest in the Jubilee Lithium Property. The property consists of 10 mining claims covering approximately

3,300 hectares area located in Ear Falls, Ontario.

|

FE BATTERY METALS CORP.

Notes to the Condensed Interim Financial Statements

For the six months ended September 30, 2024 and 2023

(Unaudited - expressed in Canadian dollars) |

| 6. | Exploration and Evaluation Assets (continued) |

| (g) | Jubilee Lithium Property (continued) |

Under the terms of the Jubilee Lithium Agreement,

the Company acquired a 100% interest in the property by completing the required option payments.

During the year ended March 31, 2024, the Company

decided it would not be pursuing any further exploration work on the Jubilee Lithium Property and the claims were allowed to lapse and

the Company wrote-off all deferred costs incurred to date.

| (h) | Kokanee Creek Gold and Independence Gold Properties |

On March 17, 2020, the Company entered in an option

agreement to acquire a 100% interest in the Kokanee Creek and Independence Gold Properties (the “Properties”). The Properties

are located in British Columbia and consist of 5 claims covering 2,690 hectares.

On February 28, 2021 and again on August 13, 2021,

the Company entered into amended option agreements which amended the due dates for certain cash payments, share issuances and exploration

expenditure requirements of the option agreement.

As of March 31, 2022, under the terms of the Properties

amended option agreement, the Company had acquired a 100% interest in the Kokanee Creek Property by completing the required option payments,

common share issuances and exploration expenditures.

The Properties are subject to a 2.0% NSR royalty of

which the Company will have the option to reduce the NSR by 1.0% by paying $1,000,000.

During the year ended March 31, 2021, the Company

decided it would not be pursuing any further exploration work on the Independence Gold property and wrote-off all deferred costs incurred

to date.

| (i) | Lac Marion Uranium Property |

On June 10, 2024, the Company entered into an option

agreement to acquire a 100% interest in the Lac Marion Uranium Property. The property consists of 47 mining claims covering approximately

2,760 hectares area in two claim blocks on land located about 40 kilometres northeast of Mont Laurier in Quebec.

Under the terms of the Lac Marion Agreement, the Company

has the option to acquire a 100% interest in the property by completing the following option payments:

| Due Dates | |

Issuance of FE

Battery common

shares | |

Exploration

Expenditures

$ | |

| On signing | |

250,000 | |

Nil | |

| June 10, 2025 | |

750,000 | |

100,000 | |

| June 10, 2026 | |

- | |

900,000 | |

The Lac Marion property has a 1% GMR payable to the

optionor of which the Company will have the option to buy-out of 0.5% by paying $1,000,000.

|

FE BATTERY METALS CORP.

Notes to the Condensed Interim Financial Statements

For the six months ended September 30, 2024 and 2023

(Unaudited - expressed in Canadian dollars) |

| 6. | Exploration and Evaluation Assets (continued) |

| (i) | McNeely Lithium Property |

Pursuant to the McNeely Lithium Property purchase

agreement entered on June 7, 2021, the Company acquired a 100% interest in the McNeely Lithium Property, by issuing 526,316 common shares

and paying $250,000. The McNeely Lithium Property is located in Quebec and consists of 66 claims covering approximately 2,400 hectares.

The McNeely Lithium Property is subject to a 3.0% GMR. Certain of the claims are subject to a pre-existing 1.0% NSR. The Company will

have the option to purchase the NSR by paying $200,000 to the NSR holder.

On June 13, 2022, the Company entered into an option

agreement to acquire a 100% interest in the North Spirit Property. The property consists of 124 mining claims covering approximately 2,500

hectares area in two claim blocks on crown land in northwestern Ontario and is located about 175 kilometres to the north of Red Lake,

Ontario.

On October 26, 2022, the Company entered into an amended

option agreement which amended the certain cash payments, share issuances and exploration requirements of the option agreement.

Under the terms of the amended North Spirit option

agreement, the Company acquired a 100% interest in the North Spirit Property by completing the share issuance of 1,105,262 common shares.

The North Spirit property has a 1% GMR payable to

the optionor.

During the year ended March 31, 2024, the Company

decided it would not be pursuing any further exploration work on the North Spirit property and wrote-off all deferred costs incurred to

date.

| (k) | Pontax West Lithium Property |

On October 13, 2023, the Company entered into an option

agreement to acquire a 100% interest in the Pontax West Lithium Property (the “Pontax Lithium Agreement”). The property consists

of 72 mining claims covering over 3,800 hectares in the James Bay lithium region of northern Quebec.

On September 13, 2024, the Company entered into an

amended option agreement which amended the certain share issuances and exploration requirements of the option agreement.

Under the terms of the amended Pontax West Lithium

agreement, the Company has the option to acquire a 100% interest in the property by issuing 2,500,000 common shares.

The Pontax West Lithium property has a 1.5% GMR payable

to the optionor.

| (l) | Rose West Lithium Property |

On November 25, 2022, the Company entered into an

option agreement to acquire a 100% interest in the Rose West Property. The Rose West Lithium property is located in the James Bay region

of northern Quebec and consists of 32 mining claims covering approximately 1,700 hectares within townships.

On December 9, 2022, the Company entered into amended

option agreement to which the Company could acquire a 100% interest in the property by issuing 1,300,000 shares and granted the Company

a 1% GMR. On April 5, 2023, the Company issued the required shares to acquire a 100% interest in the Rose West Lithium property.

The Rose West Lithium property has a 1% GMR payable

to the optionor upon the commencement of commercial production.

|

FE BATTERY METALS CORP.

Notes to the Condensed Interim Financial Statements

For the six months ended September 30, 2024 and 2023

(Unaudited - expressed in Canadian dollars) |

| 6. | Exploration and Evaluation Assets (continued) |

| (m) | Rose East Lithium Property |

On March 4, 2023, the Company entered into an option

agreement to acquire a 100% interest in the Rose East Lithium Property (“Rose East Lithium”). The Rose East Lithium Project

consists of 59 mining claims covering approximately 3,100 hectares in northern Quebec.

Under the terms of the Rose East Lithium Agreement,

the Company has the option to acquire a 100% interest in the property by completing the following option payments:

| Due Dates | |

Issuance of FE Battery

common shares | |

| March 4, 2023 (issued) | |

| 1,500,000 | |

| March 4, 2024 | |

| 1,500,000 | |

The Rose East Lithium Property is subject to a 1.0%

GMR, which the Company may repurchase by paying $1,000,000 for each 0.5%.

At September 30, 2024, the Company and the Optionor

are in discussions to amend and extend the option terms of the March 3, 2023 option agreement.

Exploration and

evaluation expenditures recorded in the statements of loss and comprehensive loss for the six months ended September 30, 2024 and 2023

are as follows:

| | |

| | |

| | |

| | |

| | |

Geological | | |

| |

| | |

| | |

| | |

| | |

| | |

and | | |

Total | |

| Six months ended | |

Assay and | | |

Drilling and | | |

Field | | |

Geological | | |

Technical | | |

September 30, | |

| September 30, 2024 | |

sampling | | |

mobilization | | |

expenditures | | |

Consulting | | |

Services | | |

2024 | |

| Quebec | |

| | |

| | |

| | |

| | |

| | |

| |

| Augustus, Abitibi, Canadian and McNeely Lithium | |

$ | - | | |

$ | 36,600 | | |

$ | - | | |

$ | - | | |

$ | 4,500 | | |

$ | 41,100 | |

| Lac Marion Uranium | |

| - | | |

| - | | |

| 60,865 | | |

| 33,500 | | |

| - | | |

| 94,365 | |

| General Exploration | |

| - | | |

| - | | |

| - | | |

| - | | |

| 3,849 | | |

| 3,849 | |

| Total | |

$ | - | | |

$ | 36,600 | | |

$ | 60,865 | | |

$ | 33,500 | | |

$ | 8,349 | | |

$ | 139,314 | |

| | |

| | |

| | |

| | |

| | |

Geological | | |

| |

| | |

| | |

| | |

| | |

| | |

and | | |

Total | |

| Six

months ended | |

Assay

and | | |

Drilling

and | | |

Field | | |

Geological | | |

Technical | | |

September 30, | |

| September

30, 2023 | |

sampling | | |

mobilization | | |

expenditures | | |

Consulting | | |

Services | | |

2023 | |

| Quebec | |

| | |

| | |

| | |

| | |

| | |

| |

| Trix

Lithium | |

| - | | |

| - | | |

| 45,000 | | |

| 54,000 | | |

| - | | |

| 99,000 | |

| Augustus,

Abitibi, Canadian and McNeely Lithium | |

| 60,342 | | |

| 305,635 | | |

| 171,604 | | |

| 167,958 | | |

| 305,841 | | |

| 1,011,380 | |

| General

Exploration | |

| - | | |

| - | | |

| - | | |

| - | | |

| 14,400 | | |

| 14,400 | |

| Total | |

$ | 60,342 | | |

$ | 305,635 | | |

$ | 216,604 | | |

$ | 221,958 | | |

$ | 320,241 | | |

$ | 1,124,780 | |

|

FE BATTERY METALS CORP.

Notes to the Condensed Interim Financial Statements

For the six months ended September 30, 2024 and 2023

(Unaudited - expressed in Canadian dollars) |

| 7. | Accounts Payable and Accrued Liabilities |

| | |

| September 30,

2024 | | |

| March 31,

2024 | |

Trade and other payables | |

$ | 266,290 | | |

$ | 206,583 | |

Accrued liabilities | |

| 30,000 | | |

| 30,000 | |

| Total | |

$ | 296,290 | | |

$ | 236,583 | |

| 8. | Related Party Transactions and Balances |

Remuneration of directors and key management personnel

of the Company for the six months ended September 30, 2024 and 2023 were as follows:

| | |

For the three months ended

September 30,

| | |

For the six months ended

September 30,

| |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| Consulting fees charged by directors of the Company | |

$ | 2,400 | | |

$ | 10,000 | | |

$ | 5,600 | | |

$ | 10,000 | |

| Exploration consulting fees charged by directors | |

| - | | |

| 4,500 | | |

| - | | |

| 9,500 | |

| Salaries, fees and benefits | |

| 71,550 | | |

| 50,000 | | |

| 136,950 | | |

| 100,000 | |

| Share-based payments | |

| - | | |

| 246,750 | | |

| 177,788 | | |

| 1,368,843 | |

Related party balances as at September 30, 2024 and

March 31, 2024 were as follows:

| | |

| September 30,

2024 | | |

| March 31,

2024 | |

Amounts due to directors and officers of the Company | |

$ | 101,243 | | |

$ | 171,294 | |

Amounts due to companies controlled by directors and officers | |

| 96,700 | | |

| 83,575 | |

| |

$ | 197,943 | | |

$ | 254,869 | |

The directors’ and officers’ balances

also include fees and expenses owing to directors and officers incurred in the normal course of business.

| (a) | Authorized - Unlimited number of common shares without par value. |

The Company had 52,585,286 common shares issued and

outstanding as at September 30, 2024 and 50,846,146 common shares issued and outstanding as at March 31, 2024.

Fiscal 2025

During the six months ended September 30, 2024:

| i) | On April 18, 2024, the Company closed a non-brokered private placement for 1,739,130 Quebec flow-through

shares (“QFT share”) priced at $0.23 per QFT share for gross proceeds of $400,000. The Company recognized a liability for

flow-through shares of $86,957 and Company also paid finder’s fees of $24,000. |

|

FE BATTERY METALS CORP.

Notes to the Condensed Interim Financial Statements

For the six months ended September 30, 2024 and 2023

(Unaudited - expressed in Canadian dollars) |

| 9. | Share Capital (continued) |

| (b) | Issued share capital (continued) |

Fiscal 2024

During the six months ended September 30, 2023:

| i) | On April 3, 2023, the Company issued 1,500,000 common shares value at $975,000, pursuant the Senay Lithium |

property option agreement and 83,333 common

shares valued at $54,166, pursuant the Trix Lithium property option agreement;

| ii) | On April 5, 2023, the Company issued 1,300,000 common shares valued at $884,000, pursuant the Rose West

Lithium property option agreement to acquire a 100% interest in the property; |

| iii) | On May 26, 2023, the Company issued 550,000 Restricted Share Units valued $324,500 to director, officers,

and consultants of the Company; |

| iv) | On June 9, 2023, the Company closed a non-brokered private placement consisting of 1,338,461 Quebec flow-through

shares (“QFT share”) priced at $0.65 per QFT share and 573,770 National flow through shares (“NFT share”) priced

at $0.61 per NFT share for aggregate gross proceeds of $1,220,000. The Company recognized a liability for flow-through shares of $149,150.

The Company also paid finder’s fees of $73,200; and |

| v) | On September 22, 2023, the Company issued 175,000 common shares value at $82,250, pursuant the Cosgrave

Lithium property option agreement as well as issued 875,000 Restricted Share Units valued $411,250 to director, officers, and consultants

of the Company. |

The Company has a shareholder approved “rolling”

stock option plan (the “Plan”) in compliance with the CSE’s policies. Under the Plan, the maximum number of shares reserved

for issuance may not exceed 10% of the total number of issued and outstanding common shares at the time of granting. The exercise price

of each stock option shall not be less than the discounted market price of the Company’s stock at the date of grant. Such options

will be exercisable for a period of up to 10 years from the date of grant. In connection with the foregoing, the number of common shares

reserved for issuance to any one optionee will not, within a twelve-month period, exceed five percent (5%) of the issued and outstanding

common shares and the number of common shares reserved for issuance to all technical consultants will not exceed, within a twelve-month

period, two percent (2%) of the issued and outstanding common shares. Options may be exercised no later than 90 days following cessation

of the optionee’s position with the Company or 30 days following cessation of an optionee conducting investor relations activities’

position.

The continuity for stock options for the six months

ended September 30, 2024 is as follows:

| | |

Number

of Shares | | |

Weighted Average

Exercise

Price | |

| Balance, fully vested and exercisable at March 31, 2024 | |

| 3,560,526 | | |

$ | 0.79 | |

| Granted | |

| 1,200,000 | | |

$ | 0.18 | |

Balance, fully vested and exercisable at September 30, 2024 | |

| 4,760,526 | | |

$ | 0.63 | |

|

FE BATTERY METALS CORP.

Notes to the Condensed Interim Financial Statements

For the six months ended September 30, 2024 and 2023

(Unaudited - expressed in Canadian dollars) |

| 9. | Share Capital (continued) |

| c) | Stock Options (continued) |

As at September 30, 2024, the following stock options

were outstanding:

| Expiry Date | |

Number Outstanding and

Exercisable | | |

Weighted average exercise

price | | |

Average Remaining

Contractual Life | |

| February 9, 2026 | |

| 694,737 | | |

$ | 0.80 | | |

| 1.37 | |

| February 11, 2026 | |

| 342,105 | | |

$ | 1.33 | | |

| 1.37 | |

| April 26, 2026 | |

| 1,200,000 | | |

$ | 0.18 | | |

| 1.57 | |

| May 14, 2026 | |

| 223,684 | | |

$ | 1.33 | | |

| 1.62 | |

| July 13, 2026 | |

| 236,842 | | |

$ | 0.95 | | |

| 1.79 | |

| January 6, 2027 | |

| 63,158 | | |

$ | 1.33 | | |

| 2.27 | |

| May 25, 2028 | |

| 2,000,000 | | |

$ | 0.59 | | |

| 3.68 | |

| | |

| 4,760,526 | | |

$ | 0.63 | | |

| 2.44 | |

| d) | Share Purchase Warrants |

The continuity for share purchase warrants for the

six months ended September 30, 2024 is as follows:

| | |

| Number of Warrants | | |

| Weighted Average Exercise Price | |

| Balance, March 31, 2024 | |

| 1,381,537 | | |

$ | 1.11 | |

| Expired | |

| (453,759 | ) | |

$ | 1.71 | |

Balance, September 30, 2024 | |

| 927,778 | | |

$ | 0.65 | |

As at September 30, 2024, the following share purchase

warrants issued in connection with private placements were outstanding:

Expiry Date | |

|

|

Exercise Price | | |

Number Outstanding and

Exercisable | | |

Average Remaining Contractual Life | |

| November 9, 2025 | |

|

$ |

0.65 | | |

| 888,889 | | |

| 1.11 | |

| November 20, 2025 | |

|

$ |

0.65 | | |

| 38,889 | | |

| 1.14 | |

| | |

|

|

| | |

| 927,778 | | |

| 1.11 | |

The Company has a shareholder approved “10%

rolling” restricted share unit plan (the “RSU Plan”) in compliance with the CSE’s policies. Under the RSU Plan,

the maximum number of RSU’s reserved for issuance may not exceed 10% of the total number of issued and outstanding common shares

at the time of granting.

A summary of the Company’s restricted share

units as at September 30, 2024 is as follows:

| | |

RSU’s outstanding | |

| Balance, March 31, 2024 | |

| - | |

| Granted | |

| 2,000,000 | |

Balance, September 30, 2024 | |

| 2,000,000 | |

|

FE BATTERY METALS CORP.

Notes to the Condensed Interim Financial Statements

For the six months ended September 30, 2024 and 2023

(Unaudited - expressed in Canadian dollars) |

| 9. | Share Capital (continued) |

| e) | Restricted share units (continued) |

As at September 30, 2024, the following restricted

share units were outstanding:

| | |

Issued | | |

Exercised | | |

Outstanding | | |

Exercisable | |

| Granted - April 22, 2024 | |

| 2,000,000 | | |

| - | | |

| 2,000,000 | | |

| 1,000,000 | |

| Balance, September 30, 2024 | |

| 2,000,000 | | |

| - | | |

| 2,000,000 | | |

| 1,000,000 | |

Fiscal 2025

On April 23, 2024, the Company granted 2,000,000 restricted

share units to officers, directors and consultants of the Company. The restricted share units vest 50% vest in four months and 50% vest

in eight months. The Company recorded $109,375 of share-based payments on the granted RSU’s during the six months ended September

30, 2024.

| f) | Share-Based Payments Reserve |

The share-based payment reserve records items recognized

as stock-based compensation expense and other share-based payments. This reserve also includes the value attributed to warrants on unit

private placements. At the time that the stock options or warrants are exercised, the corresponding amount will be transferred to share

capital.

The fair value of each option granted to employees,

officers, and directors was estimated on the date of grant using the Black-Scholes option-pricing model.

Fiscal 2025

On April 23, 2024, the Company granted 2,000,000 restricted

share units to officers, directors and consultants of the Company. The restricted share units vest 50% vest in four months and 50% vest

in eight months. The fair value of the RSU’s was $109,375 and calculated by multiplying the Company’s share price at grant

date by the number of RSU’s granted. The fair value will be recognized as the RSU’s vest.

On April 26, 2024, the Company granted 1,200,000 incentive

stock options to consultants and all of which vested at the date of grant. The options are exercisable at $0.18 per share, expiring on

April 25, 2026. The fair value of these options was $131,314 and was calculated using the Black-Scholes pricing model, based on the following

assumptions: weighted average risk-free interest rate of 4.33%, volatility factor of 129.06% and an expected life of two years.

The Company recorded $240,689 of share-based payments

on the granted RSU’s and stock options during the six months ended September 30, 2024.

Fiscal 2024

On May 26, 2023, the Company granted 550,000 RSU’s

to directors, officers, and consultants and all vested and were issued on the grant date. The fair value of the RSU’s was $324,500

and calculated by multiplying the Company’s share price at grant date by the number of RSU’s granted.

On May 26, 2023, the Company granted 2,000,000 incentive

stock options to consultants and all of which vested at the date of grant. The options are exercisable at $0.59 per share, expiring on

May 25, 2026. The fair value of these options was $1,105,283 and was calculated using the Black-Scholes pricing model, based on the following

assumptions: weighted average risk-free interest rate of 3.57%, volatility factor of 162.51% and an expected life of five years.

On September 22, 2023, the Company granted 875,000

restricted share units valued at $411,250 to officers, directors, and consultants of the Company. The restricted share units vest immediately

and are subject to a four month hold period from the date of grant.

The Company recorded $1,841,033 of share-based payments

on the granted RSU’s during the six months ended September 30, 2023.

|

FE BATTERY METALS CORP.

Notes to the Condensed Interim Financial Statements

For the six months ended September 30, 2024 and 2023

(Unaudited - expressed in Canadian dollars) |

The Company operates in one business segment being

the acquisition and exploration of exploration and evaluation assets and operates in one geographic segment being Canada. The total assets

relate to exploration and evaluation assets and have been disclosed in Note 6.

| 11. | Financial Instruments and Risk Management |

Fair Value

IFRS 7 establishes a fair value hierarchy that prioritizes

the input to valuation techniques used to measure fair value as follows:

Level 1 – Unadjusted quoted prices in active

markets that are accessible at the measurement date for identical, unrestricted assets or liabilities.

Level 2 – Quoted prices in markets that are

not active, or inputs that are observable, either directly or indirectly, for substantially the full term of the asset or liability; and

Level 3 – Prices or valuation techniques that

require inputs that are both significant to the fair value measurement and unobservable (supported by little or no market activity).

The following provides the valuation method of the

Company’s financial instruments as at September 30, 2024 and March 31, 2024:

| | |

| | |

September 30, 2024 | | |

March 31, 2024 | |

| Cash | |

1 | | |

$ | 1,730,199 | | |

$ | 1,704,908 | |

| Reclamation deposits | |

1 | | |

| 11,000 | | |

| 11,000 | |

| Market securities | |

1 | | |

| 218,159 | | |

| 187,425 | |

| Financial Liabilities | |

1 | | |

| 494,233 | | |

| 491,452 | |

Financial Risk Management

The Company’s activities expose it to a variety

of financial risks including credit risk, liquidity risk and market risk.

Liquidity Risk

Liquidity risk is the risk that an entity will encounter

difficulty in raising funds to meet commitments associated with financial instruments. The Company attempts to manage liquidity risk by

maintaining a sufficient cash balance. As at September 30, 2024, the Company had cash of $1,730,199 to settle current liabilities of $494,233.

Further information relating to liquidity risk is disclosed in Note 1.

Interest Rate Risk

The Company has no significant exposure at September

30, 2024, to interest rate risk through its financial instruments.

Credit Risk

Credit risk is the risk that one party to a financial

instrument will fail to discharge an obligation and cause the other party to incur a financial loss. Financial instruments that potentially

subject the Company to credit risk consist of cash, short-term investment, reclamation bonds and amounts receivable. The carrying amount

of financial assets recorded in the consolidated financial statements, net of any allowances for losses, represents the maximum exposure

to credit risk.

The Company deposits its cash with a high credit quality

major Canadian financial institution as determined by ratings agencies. The Company does not invest in asset-backed deposits or investments

and does not expect any credit losses. To reduce credit risk, the Company regularly reviews the collectability of its amounts receivable

and establishes an allowance.

|

FE BATTERY METALS CORP.

Notes to the Condensed Interim Financial Statements

For the six months ended September 30, 2024 and 2023

(Unaudited - expressed in Canadian dollars) |

| 11. | Financial Instruments and Risk Management (continued) |

based on its best estimate of potentially uncollectible

amounts. The Company historically has not had difficulty collecting its amounts receivable.

Currency Risk

The Company has no significant exposure at September

30, 2024, to currency risk through its financial instruments.

Financial assets and financial liabilities that bear

interest at fixed rates are subject to fair value interest rate risk. In respect of financial assets, the Company’s policy is to

invest cash at floating rates of interest in order to maintain liquidity while achieving a satisfactory return. Fluctuations in interest

rates impact the amount of return the Company may realize but interest rate risk is not significant to the Company.

There were no transfers from levels or change in

the fair value measurements of financial instruments for the period ended September 30, 2024 and year ended March 31, 2024.

The Company primarily considers shareholders’

equity in the management of its capital. The Company manages its capital structure and makes adjustments to it based on funds available

to the Company, in order to support exploration and development of mineral properties. The Board of Directors has not established quantitative

capital structure criteria management but will review on a regular basis the capital structure of the Company to ensure its appropriateness

to the stage of development of the business.

The Company’s objectives when managing capital

are:

● To maintain and safeguard its accumulated

capital in order to provide an adequate return to shareholders by maintaining sufficient level of funds, to support continued evaluation

and maintenance of the Company’s existing properties, and to acquire, explore and develop other precious metals, base metals, and

industrial mineral deposits;

● To invest cash on hand in highly liquid and

highly rated financial instruments with high credit quality issuers, thereby minimizing the risk and loss of principal; and

● To obtain the necessary financing if and when

it is required.

The properties in which the Company currently holds

an interest are in the exploration stage and the Company is dependent on external financing to explore and take the project to development.

In order to carry out planned exploration and development and pay for administrative costs, the Company will spend its existing working

capital and attempt to raise additional amounts as needed.

Management reviews its capital management approach

on an ongoing basis and believes that this approach, given the relative size of the Company, is reasonable.

In order to facilitate the management of capital and

development of its mineral properties, the Company’s management informs the Board of Directors as to the quantum of expenditures

for review and approval prior to commencement of work. In addition, the Company may issue new equity, incur additional debt, enter into

joint venture agreements, or dispose of certain assets. When applicable, the Company’s investment policy is to hold cash in interest

bearing accounts at high credit quality financial institutions to maximize liquidity. In order to maximize ongoing development efforts,

the Company does not pay dividends. The Company expects to continue to raise funds, from time to time, to continue meeting its capital

management objectives.

There were no changes in the Company’s approach

to capital management during the period ended September 30, 2024, compared to the year ended to March 31, 2024. The Company is not subject

to externally imposed capital requirements. Further information relating to management of capital is disclosed in Note 1.

|

FE BATTERY METALS CORP.

Notes to the Condensed Interim Financial Statements

For the six months ended September 30, 2024 and 2023

(Unaudited - expressed in Canadian dollars) |

On October 17, 2024, the Company closed the first

tranche of the non-brokered private placement and issued 8,750,000 flow-through common shares at a price of $0.08 cents per share for

gross proceeds of $700,000 and will pay 6% in finders’ fees of $42,000.

Exhibit 99.2

MANAGEMENT’S

DISCUSSION & ANALYSIS

For the six months ended September 30, 2024

FE

Battery Metals Corp.

Management’s

Discussion & Analysis

For the six months ended September 30, 2024 |

The following Management Discussion and Analysis

(“MD&A”) of the financial condition and results of operations of FE Battery Metals Corp. (“FE Battery” or

the “Company”) should be read in conjunction with the accompanying unaudited condensed interim financial statements and related

notes thereto for the six-months ended September 30, 2024 and 2023, (the “Financial Report”).

FE Battery Metals Corp. (“FE Battery”

or the “Company”) was incorporated on October 12, 1966 in the Province of British Columbia under the Business Corporations

Act of British Columbia, and its principal business activity is the exploration of mineral properties in Canada.

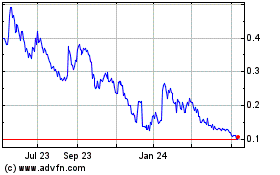

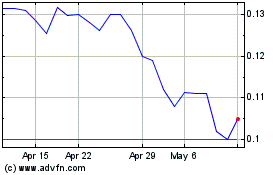

The Company’s common shares trade on the

Canadian Securities Exchange (FE), the OTCBB Exchange (FEMFF) and the Frankfurt Exchange (A2JC89).

Unless indicated otherwise, all financial data

in this MD&A has been prepared in accordance with International Financial Reporting Standards (“IFRS”) as issued by the

International Accounting Standards Board (“IASB”) and interpretations of the International Financial Reporting Interpretations

Committee (“IFRIC”).

FE Battery is a junior resource company engaged

in the exploration and development of mineral properties. It currently maintains early-stage exploration properties in Canada

This discussion focuses on key statistics from

the unaudited condensed interim financial statements for the six-month period ended September 30, 2024 and up to the date of this MD&A

and pertains to known risks and uncertainties relating to the gold exploration and development and mining industry. This discussion should

not be considered all-inclusive, as it excludes changes that may occur in general economic, political, and environmental conditions.

This MD&A contains information to November

27, 2024.

Additional information relating to the Company

is available on SEDAR at www.sedarplus.ca and on the Company’s website www.febatterymetals.com.

| ● | On

October 17, 2024, the Company closed the first tranche of the non-brokered private placement

and issued 8,750,000 flow-through common shares at a price of $0.08 cents per share for gross

proceeds of $700,000 and will pay 6% in finders’ fees of $42,000; |

| ● | The

Company commenced its 2024 exploration program at the Augustus lithium property. This program

will include trenching, stripping and channel sampling focused on lithium anomalies identified

through 2023 soil sampling efforts. Additionally, new soil sampling grids will be established

on the property to identify further lithium exploration targets. The field crew will mobilize

to the project in the by mid-September, 2024; and |

FE

Battery Metals Corp.

Management’s

Discussion & Analysis

For the six months ended September 30, 2024 |

| ● | On

April 18, 2024, the Company closed a private placement for gross proceeds of $400,000, by

issuing 1,739,130 flow-through shares priced at $0.23 per flow-through share and paid finder’s

fees of $24,000; |

OVERVIEW OF PROJECTS

| 1.2 | Augustus Lithium Property, Quebec |

The Augustus Lithium Property is located in Landrienne

& Lacorne-Townships, Quebec, Canada. The Augustus Lithium property is comprised of 21 mineral claims covering over 900 hectares located

in the Abitibi area of western Quebec.

In November 2022, the Company completed the required

option payments, common share issuances and exploration expenditures to acquire 100% interest of the Augustus Lithium property. The property

is also subject to a 2.0% NSR.

The Augustus Property is a part of the Preissac–Lacorne

pegmatite fields where spodumene bearing lithium pegmatites were discovered in 1940s’. The geology and the mineralization of the Augustus

property are similar to the geology and mineralization of the Quebec Lithium Mine located approximately 6 kilometers to the southeast

of the property. It has excellent infrastructure support with road network, railway, electricity, water, and trained manpower available

locally. Geologically the Preissac-Lacorne area lies within a belt of volcanic and sedimentary rocks intruded to the north by LaMotte

batholiths and to the south by the Preissac batholiths and Moly Hill pluton.

There are several historical and currently active

lithium and molybdenum prospects/mines located approximately 3 km to 20 km from the property. Some of the important prospects/mines are:

Mine Quebec Lithium which was formerly owned by RB Energy, Authier Lithium owned by Sayona Mining of Australia, Valor Lithium, Duval Lithium,

Lacorne Lithium, International Lithium, Vallee Lithium, and Moly Hill Mine. All these projects / prospects are at various stages of exploration

and development, out of which Mine Quebec Lithium is the most advanced project followed by Authier lithium project.

The Company commenced its 2024 exploration program

at the Augustus lithium property. This program will include trenching, stripping and channel sampling focused on lithium anomalies identified

through 2023 soil sampling efforts. Additionally, new soil sampling grids will be established on the property to identify further lithium

exploration targets. The field crew will mobilize to the project in the by mid-September, 2024.

Fiscal 2024 Exploration Highlights:

In December 2023, the Company announced the assay

results from its August to October 2023 sampling program. A total of 995 samples were collected from grid sampling on six select areas

(Grids A-F) located south of the main known mineralization. Anomalous lithium values returned from Grids C, D, E and F indicate great

potential for new LCT (lithium-cesium-tantalum) pegmatite target areas for further exploration.

FE

Battery Metals Corp.

Management’s

Discussion & Analysis

For the six months ended September 30, 2024 |

Assay Highlights

Soil survey Grid C stands out well with a NW-SE

trending lithium (Li) anomaly in the eastern part of the grid The revealed trend is still open to the southeast and possesses coincident

anomalous values of cesium (Cs), niobium (Nb) and tantalum (Ta). The results of Grid C occur far to the south of the main Augustus pegmatites

but show a trend roughly parallel to Augustus and the NAL pegmatites. This area has been selected to be a priority target for FE for the

discovery of a new LCT type pegmatite zone.

Soil survey Grid D uncovered another priority

target with a roughly E-W zone of strong lithium values which appears to curve to a N-S orientation within the western portion of the

sample grid. The anomalous lithium trend is open both to the north and south and contains coincident anomalous values of Cs, Nb and Ta.

Soil survey Grid F covered a large zone of continuous

anomalous lithium values that occur roughly over 100 to 300 meters in width and 1 kilometer south to north in the eastern half of the

sampled grid Anomalous niobium (Nb) and rubidium (Rb) occur with the lithium. FE plans to return to this area with the intent of extending

Grid F to test if the Li, Nb and Rb anomaly continuous further north as the grid terminated in high values.

Soil survey Grid E returned elevated lithium values

all over the grid except for a low-grade area in the eastern part of the grid.

Soil grids A and B returned isolated anomalous

lithium values but contained no definite trend.

Qualified Person

Technical data pertaining to the properties above

was reviewed and approved by Afzaal Pirzada, P.Geo., who is FE Battery Metals Corp.’s qualified person under National Instrument

43-101.

| 1.3 | DISCUSSION OF OPERATIONS |

For the six-months end September 30, 2024, compared to six-months

ended September 30, 2023

The net loss and comprehensive loss for the six-months

ended September 30, 2024 (“Current Period”) was $925,861, a decrease of $2,945,815 over the net loss and comprehensive loss

for the six-months ended September 30, 2023 (“Comparative Period”) of $3,871,676. The significant differences between the

two periods are as follows:

| ● | Exploration

and evaluations expenditures were $139,314 in the Current Period, a decrease of $985,466

over the Comparative Period expenditures of $1,124,780. The Comparative Period expenditures

were higher due to the Augustus Lithium Property drill program conducted during the period; |

| ● | Investor

relations were $328,492 in the Current Period, a decrease of 270,319 in expenditures over

the Comparative Period expenditures of $598,811. Investor relations consist of North American

and European Investor Marketing programs; and |

FE

Battery Metals Corp.

Management’s

Discussion & Analysis

For the six months ended September 30, 2024 |

| ● | Share-based

payments expense was $240,689 in the Current Period, while the Comparative Period was $1,841,033.

The expense was the estimated fair value of the stock options and restricted share units

granted to directors, officers, and consultants during the Current Period. |

| 1.4 | SUMMARY OF QUARTERLY RESULTS |

The financial results for each

of the eight most recently completed quarters are summarized below:

| | |

| September 30,

2024 | | |

| June 30,

2024 | | |

| March 31,

2024 | | |

| December 31,

2023 | |

| Net revenues | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | - | |

| Net loss | |

$ | (369,514 | ) | |

$ | (552,325 | ) | |

$ | (1,059,793 | ) | |

$ | (1,703,604 | ) |

| Per share | |

$ | (0.01 | ) | |

$ | (0.01 | ) | |

$ | (0.02 | ) | |

$ | (0.03 | ) |

| | |

| September 30,

2023 | | |

| June 30,

2023 | | |

| March 31,

2023 | | |

| December 31,

2022 | |

| Net revenues | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | - | |

| Net loss | |

$ | (1,866,040 | ) | |

$ | (2,005,636 | ) | |

$ | (3,927,459 | ) | |

$ | (794,743 | ) |

| Per share | |

$ | (0.04 | ) | |

$ | (0.04 | ) | |

$ | (0.15 | ) | |

$ | (0.03 | ) |

Significant variations in the net loss between

periods are primarily due to the write-down of exploration and evaluation assets, and share-based compensation as well as fluctuations

in general administrative and shareholder communications expenses.

| 1.5 | LIQUIDITY AND CAPITAL RESOURCES |

Since inception, the Company’s capital resources

have been primarily limited to proceeds raised from equity financings. The Company’s liquidity depends primarily on its ability

to obtain external financing to meet the Company’s future operating expenditures.

The Company is not exposed to any externally imposed

capital requirements. There were no changes in the Company’s approach to capital management during the period.

FE Battery began the period ended September 30,

2024, with $1,704,908 in cash. During the period ended September 30, 2024, the Company expended $350,709 on operating activities, net

of working capital changes, and generated $376,000 from financing activities which was attributable to net proceeds from share issuances,

to end at September 30, 2024 with $1,730,199 in cash.

On April 18, 2024, the Company closed a non-brokered

private placement for 1,739,130 Quebec flow-through shares (“QFT share”) priced at $0.23 per QFT share for gross proceeds

of $400,000. The Company recognized a liability for flow-through shares of $86,957 and Company also paid finder’s fees of $24,000.

FE

Battery Metals Corp.

Management’s

Discussion & Analysis

For the six months ended September 30, 2024 |

On October 17, 2024, the Company closed the first

tranche of the non-brokered private placement and issued 8,750,000 flow-through common shares at a price of $0.08 cents per share for

gross proceeds of $700,000 and will pay 6% in finders’ fees of $42,000.

At September 30, 2024, FE Battery had working

capital of $1,282,203, compared to working capital of $1,678,090 at March 31, 2024, and an accumulated deficit of $57,105,197 at September

30, 2024 compared to $56,179,336 at March 31, 2024.

Management estimates that these funds will not

be sufficient to provide the Company with the financial resources to carry out currently planned exploration and operations through the

next twelve months. Therefore, the Company will need to seek additional sources of financing to meet all exploration expenditures for

its property commitments as well its ongoing operations. While the Company was successful in obtaining its most recent financing, there

is no assurance that it will be able to obtain adequate financing in the future or that such financing will be on terms acceptable to

the Company. These material uncertainties may cast significant doubt upon the Company’s ability to continue as a going concern.

Outstanding Share Data as at the date of this

MD&A

Authorized:

an unlimited number of common

shares without par value. | |

| Common

shares issued