Current Report Filing (8-k)

January 03 2023 - 10:31AM

Edgar (US Regulatory)

0001391135

false

false

0001391135

2022-12-30

2022-12-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported)

December 30, 2022

LFTD PARTNERS INC.

(Exact name of registrant as specified in its charter)

Nevada

|

| 000-52520

|

| 87-0479286

|

(State or other jurisdiction of incorporation or organization)

|

| Commission File Number

|

| (I.R.S. Employer Identification No.)

|

|

|

|

|

|

14155 Pine Island Drive,

Jacksonville, FL

|

|

|

| 32224

|

(Address of principal executive offices)

|

|

|

| (Zip Code)

|

847-915-2446

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐

| Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

☐

| Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

☐

| Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

☐

| Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Item 8.01 Other Events.

On December 30, 2022, Lifted Liquids, Inc. doing business as Lifted Made, a wholly owned subsidiary of LFTD Partners Inc. (the “Company”), was able to reach an agreement for the forgiveness of $630,000 of payables owed to its third-party disposable vape device manufacturer. The agreement also includes credits to Lifted Liquids, Inc. against future purchases from the device manufacturer totaling $370,047. The credit is to be provided by the manufacturer at the rate of $46,255.87 per quarter beginning with the first quarter of 2023 and continuing for the next six consecutive quarters, with a final quarterly credit of $46,255.91 for the fourth quarter of 2024. The agreement is a result of the vape manufacturer agreeing to share a portion of the Company’s prior $2,313,902 write-off of certain 2 mL disposable vapes that were written off due to clogging issues.

The payable forgiveness is expected to result in a net $485,496 improvement to the cost of goods sold and accrued liabilities sections of the Company’s consolidated statements of operations as of December 30, 2022. The $370,047 in credits are expected to be booked as an asset as of December 30, 2022 and recognized as other income amortized quarterly at the rate of $46,255.87 per quarter beginning with the first quarter of 2023 and continuing for the next six consecutive quarters, with a final quarterly credit of $46,255.91 for the fourth quarter of 2024.

Item 9.01 Financial Statements and Exhibits.

1

SIGNATURES

Pursuant to the requirements of the Securities and Exchange Act of 1934, the Registrant has duly caused this Current Report to be signed on its behalf by the undersigned hereunto duly authorized.

| LFTD PARTNERS INC..

|

|

|

| /s/ Gerard M. Jacobs

|

| Gerard M. Jacobs

|

| Chief Executive Officer

|

Dated: January 3, 2023

2

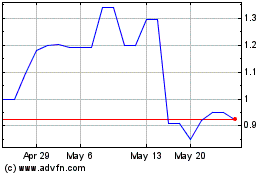

LFTD Partners (QB) (USOTC:LIFD)

Historical Stock Chart

From May 2024 to Jun 2024

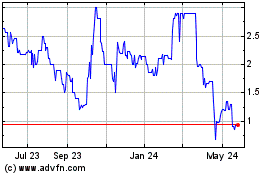

LFTD Partners (QB) (USOTC:LIFD)

Historical Stock Chart

From Jun 2023 to Jun 2024