UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-Q

(Mark One)

|

[X]

|

QUARTERLY REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the quarterly period ended

July 31, 2009

|

[ ]

|

TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE EXCHANGE ACT

|

For the transition period from __________ to __________

Commission file number

000-52161

|

JAMMIN JAVA CORP.

(FORMERLY MARLEY COFFEE INC.)

|

|

(Exact name of small business issuer as specified in its charter)

|

|

Nevada

|

|

|

|

(State or other jurisdiction of incorporation or organization)

|

|

(IRS Employer Identification No.)

|

|

375 South Fairfax Avenue Suite 321, Los Angeles, California 90036

|

|

(Address of principal executive offices)

|

|

323-316-3456

|

|

(Issuer's telephone number)

|

|

N/A

|

|

(Former name, former address and former fiscal year, if changed since last report)

|

Check whether the issuer (1) filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ]

|

Large accelerated filer ¨

|

Accelerated filer ¨

|

|

Non-accelerated filer “ (Do not check if a smaller reporting company)

|

Smaller reporting company X

|

APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY

PROCEEDINGS DURING THE PRECEDING FIVE YEARS

Check whether the issuer has filed all documents and reports required to be filed by Section 12, 13 or 15(d) of the Exchange Act after the distribution of securities under a plan confirmed by a court. Yes [ ] No [ ]

APPLICABLE ONLY TO CORPORATE ISSUERS

State the number of shares outstanding of each of the issuer's classes of common equity, as of the latest practicable date: 32,570,198

common shares issued and outstanding as of September 15, 2009.

Transitional Small Business Disclosure Format (Check one): Yes [ ] No [X]

Check whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). . Yes [ X ] No [ ].

JAMMIN JAVA CORP.

(FORMERLY MARLEY COFFEE INC.)

(A DEVELOPMENT STAGE COMPANY)

BALANCE SHEETS

|

|

|

July 31,

2009

|

|

|

January 31,

2009

|

|

|

|

|

(Unaudited)

|

|

|

|

|

|

ASSETS

|

|

|

|

|

|

|

|

Current assets

|

|

|

|

|

|

|

|

Cash

|

|

$

|

1,415

|

|

|

$

|

8,197

|

|

|

Prepaid expenses

|

|

|

-

|

|

|

|

5,600

|

|

|

Total current assets

|

|

|

1,415

|

|

|

|

13,797

|

|

|

Property and equipment, net

|

|

|

82,980

|

|

|

|

76,750

|

|

|

Total assets

|

|

$

|

84,395

|

|

|

$

|

90,547

|

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY

|

|

|

|

|

|

|

|

|

|

Current liabilities

|

|

|

|

|

|

|

|

|

|

Accounts payable

|

|

$

|

11,560

|

|

|

$

|

5,685

|

|

|

Accounts payable to related party

|

|

|

20,537

|

|

|

|

11,452

|

|

|

Shareholder advances

|

|

|

11,173

|

|

|

|

-

|

|

|

Total current liabilities

|

|

|

43,270

|

|

|

|

17,137

|

|

|

Total liabilities

|

|

|

43,270

|

|

|

|

17,137

|

|

|

Commitments and Contingencies

|

|

|

|

|

|

|

|

|

|

STOCKHOLDERS' EQUITY:

|

|

|

|

|

|

|

|

|

|

Common stock, $.001 par value, 1,704,287,175 shares authorized,

|

|

|

|

|

|

|

|

|

|

32,570,198 shares issued and outstanding

|

|

|

|

|

|

|

|

|

|

as of July 31 and January 31, 2009, respectively

|

|

|

32,570

|

|

|

|

32,570

|

|

|

Additional paid-in capital

|

|

|

334,944

|

|

|

|

334,944

|

|

|

Deficit accumulated during the development stage

|

|

|

(326,389

|

)

|

|

|

(294,104

|

)

|

|

Total Stockholders' Equity

|

|

|

41,125

|

|

|

|

73,410

|

|

|

TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY

|

|

$

|

84,395

|

|

|

$

|

90,547

|

|

See accompanying notes to financial statements.

|

JAMMIN JAVA CORP.

(FORMERLY MARLEY COFFEE INC.)

|

|

(A DEVELOPMENT STAGE COMPANY)

|

|

STATEMENTS OF OPERATIONS

|

|

Three and Six Months Ended July 31, 2009 and 2008

|

|

and period from September 27, 2004 (Inception) through July 31, 2009

|

|

(Unaudited)

|

|

|

|

Three Months

|

|

|

Three Months

|

|

|

Six Months

|

|

|

Six Months

|

|

|

Inception

|

|

|

|

|

Ended

|

|

|

Ended

|

|

|

Ended

|

|

|

Ended

|

|

|

through

|

|

|

|

|

July 31, 2009

|

|

|

July 31, 2008

|

|

|

July 31, 2009

|

|

|

July 31, 2008

|

|

|

July 31, 2009

|

|

|

Expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

General and administrative

|

|

$

|

10,701

|

|

|

$

|

34,717

|

|

|

$

|

31,743

|

|

|

$

|

55,288

|

|

|

$

|

321,493

|

|

|

Farming cost

|

|

|

271

|

|

|

|

271

|

|

|

|

542

|

|

|

|

542

|

|

|

|

4,896

|

|

|

Net loss

|

|

$

|

(10,972

|

)

|

|

$

|

(34,988

|

)

|

|

$

|

(32,285

|

)

|

|

$

|

(55,830

|

)

|

|

$

|

(326,389

|

)

|

|

Net loss per share:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted

|

|

$

|

(0.00

|

)

|

|

$

|

(0.00

|

)

|

|

$

|

(0.00

|

)

|

|

$

|

(0.00

|

)

|

|

|

|

|

|

Weighted average shares outstanding:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted

|

|

|

32,570,198

|

|

|

|

32,563,330

|

|

|

|

32,570,198

|

|

|

|

58,861,419

|

|

|

|

|

|

See accompanying notes to financial statements.

|

JAMMIN JAVA CORP.

(FORMERLY MARLEY COFFEE INC.)

|

|

(A DEVELOPMENT STAGE COMPANY)

|

|

STATEMENTS OF CASH FLOWS

|

|

Six Months Ended July 31, 2009 and 2008

|

|

and the period from September 27, 2004 (Inception) through July 31, 2009

|

|

(Unaudited)

|

|

|

|

Six Months

|

|

|

Six Months

|

|

|

Inception

|

|

|

|

|

Ended

|

|

|

Ended

|

|

|

through

|

|

|

|

|

July 31,

|

|

|

July 31,

|

|

|

July 31,

|

|

|

|

|

2009

|

|

|

2008

|

|

|

2009

|

|

|

CASH FLOWS FROM OPERATING ACTIVITIES:

|

|

|

|

|

|

|

|

|

|

|

Net loss

|

|

$

|

(32,285

|

)

|

|

$

|

(55,830

|

)

|

|

$

|

(326,389

|

)

|

|

Adjustments to reconcile net loss to cash used by operating

|

|

|

|

|

|

|

|

|

|

|

|

|

|

activities:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Imputed interest on shareholder advance

|

|

|

-

|

|

|

|

-

|

|

|

|

1,004

|

|

|

Depreciation

|

|

|

912

|

|

|

|

542

|

|

|

|

2,451

|

|

|

Net change in:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Prepaid expenses

|

|

|

5,600

|

|

|

|

(34,557

|

)

|

|

|

-

|

|

|

Accounts payable

|

|

|

5,875

|

|

|

|

(8,787

|

)

|

|

|

11,560

|

|

|

Accounts payable to related party

|

|

|

9,085

|

|

|

|

(13,562

|

)

|

|

|

20,537

|

|

|

CASH FLOWS USED IN OPERATING ACTIVITIES

|

|

|

(10,813

|

)

|

|

|

(112,194

|

)

|

|

|

(290,837

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CASH FLOWS USED IN INVESTING ACTIVITIES

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Purchase of property and equipment

|

|

|

(7,142

|

)

|

|

|

(35,716

|

)

|

|

|

(85,431

|

)

|

|

CASH FLOWS USED IN INVESTING ACTIVITIES

|

|

|

(7,142

|

)

|

|

|

(35,716

|

)

|

|

|

(85,431

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CASH FLOWS FROM FINANCING ACTIVITIES

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shareholder advances, net

|

|

|

11,173

|

|

|

|

-

|

|

|

|

11,173

|

|

|

Proceeds from sale of common stock

|

|

|

-

|

|

|

|

125,000

|

|

|

|

319,010

|

|

|

Subscription received

|

|

|

-

|

|

|

|

-

|

|

|

|

47,500

|

|

|

CASH FLOWS PROVIDED BY FINANCING

|

|

|

11,173

|

|

|

|

125,000

|

|

|

|

377,683

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NET INCREASE (DECREASE) IN CASH

|

|

|

(6,782

|

)

|

|

|

(22,910

|

)

|

|

|

1,415

|

|

|

Cash, beginning of period

|

|

|

8,197

|

|

|

|

89,802

|

|

|

|

-

|

|

|

Cash, end of period

|

|

$

|

1,415

|

|

|

$

|

66,892

|

|

|

$

|

1,415

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SUPPLEMENTAL CASH FLOW INFORMATION

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash paid for interest

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

Cash paid for income taxes

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

See accompanying notes to financial statements.

JAMMIN JAVA CORP.

(FORMERLY MARLEY COFFEE INC.)

(A DEVELOPMENT STAGE COMPANY)

NOTES TO FINANCIAL STATEMENTS

July 31, 2009

(unaudited)

NOTE 1 - BASIS OF PRESENTATION

The accompanying unaudited interim financial statements of Marley Coffee Inc. (the "Company") have been prepared in accordance with accounting principles generally accepted in the United States of America and the rules of the Securities and Exchange Commission ("SEC"), and should be read in conjunction with the audited financial statements

and notes thereto contained in the Company's registration statement filed with the SEC on Form 10-K. In the opinion of management, all adjustments, consisting of normal recurring adjustments, necessary for a fair presentation of financial position and the results of operations for the interim periods presented have been reflected herein. The results of operations for interim periods are not necessarily indicative of the results to be expected for the full year. Notes to the financial statements which would substantially

duplicate the disclosures contained in the audited financial statements for the most recent fiscal year January 31, 2009, as reported in Form 10-K, have been omitted.

Effective July 13, 2009, we changed our name from "Marley Coffee Inc." to “Jammin Java Corp.” when we merged our subsidiary, Jammin Java Corp., into our company.

NOTE 2 – PROPERTY AND EQUIPMENT

Property and equipment consist of farm improvements and farm equipment. The farm equipment is amortized using straight-line method over their estimated useful life of two years. The farm improvements will be amortized beginning when the first coffee crop is ready for harvest over the then estimated useful life.

|

|

|

July 31, 2009

|

|

|

January 31, 2009

|

|

|

Farm improvements

|

|

$

|

81,047

|

|

|

$

|

73,905

|

|

|

Equipment

|

|

|

4,384

|

|

|

|

4,384

|

|

|

|

|

|

85,431

|

|

|

|

78,289

|

|

|

Less: accumulated depreciation

|

|

|

(2,451

|

)

|

|

|

(1,539

|

)

|

|

|

|

$

|

82,980

|

|

|

$

|

76,750

|

|

Depreciation expense for the six months ending July 31, 2009 and 2008 is $912 and $542, respectively.

NOTE 3 – RELATED PARTY TRANSACTIONS

During the six months ended July 31, 2009 a director of the Company advanced $9,085 to the Company, increasing the balance owed to this director to $20,537 at July 31, 2009.

The advance is unsecured, non-interest bearing and has no specific terms of repayment.

NOTE 4 – SHAREHOLDER ADVANCES

During the six months ended July 31, 2009 a shareholder of the Company advanced $11,173 to the Company. The advance is unsecured, non-interest bearing and has no specific terms of repayment.

NOTE 5 – SHARE CAPITAL

In November 2008, the Company received $47,500 as subscription for private placement of 38,000 shares of the Company’s common stock at $1.25 per share. The related common shares were not issued by July 31, 2009.

In June 2009, a Director, David O’Neill, and Rohan Marley entered into a Stock Transfer Agreement whereby Mr. Marley transferred his 12,635,592 shares of common stock in the Company, representing 38.7% of the Company’s outstanding shares of common stock, to David O’Neill.

As a result of the above transaction, Mr. O’Neill obtained control of approximately 38.7% of the Company’s voting shares.

2. Management's Discussion and Analysis or Plan of Operation.

FORWARD-LOOKING STATEMENTS

This quarterly report contains forward-looking statements as that term is defined in the Private Securities Litigation Reform Act of 1995. These statements relate to future events or our future financial performance. In some cases, you can identify forward-looking statements by terminology such as "may", "should", "expects",

"plans", "anticipates", "believes", "estimates", "predicts", "potential" or "continue" or the negative of these terms or other comparable terminology. These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks in the section entitled "Risk Factors", that may cause our or our industry's actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance

or achievements expressed or implied by these forward-looking statements.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking

statements to conform these statements to actual results.

Our financial statements are stated in United States Dollars (US$) and are prepared in conformity with generally accepted accounting principles in the United States of America for interim financial statements. The following discussion should be read in conjunction with our financial statements and the related notes that appear elsewhere

in this quarterly report.

As used in this quarterly report, the terms "we", "us", "our company", and "Marley" mean Marley Coffee Inc., unless otherwise indicated. All dollar amounts refer to US dollars unless otherwise indicated.

Business History

Marley was incorporated on September 27, 2004 under its former name “Global Electronic Recovery Corp.” Our resident agent is Empire Stock Transfer of Nevada located at 2470 Saint Rose Parkway, Suite 304 Henderson, Nevada. Prior to the February 25, 2008, we were engaged in the recycling of electronic waste in the city of Los Angeles,

California. We commenced limited operations including a feasibility study and the search for an appropriate facility location. We also joined various recycling organizations to assist in the marketing of our recycling facility. As our management conducted due diligence on the electronic waste recycling industry, management realized that this industry did not present the best opportunity for our company to realize value for our shareholders. In an effort to substantiate shareholder

value, Marley Coffee then sought to identify, evaluate and investigate various companies and compatible or alternative business opportunities with the intent that, should the opportunity arise, a new business be pursued.

On February 5, 2008, we incorporated a subsidiary named Marley Coffee Inc. On February 25, 2008 we changed our name from” Global Electronic Recovery Corp." to "Marley Coffee Inc." when we merged our subsidiary, Marley Coffee Inc., into our company. Our common stock will be quoted on the NASD Over-the-Counter Bulletin Board

under the new symbol "MYCF" effective at the opening of the market on March 7, 2008.

Effective July 13, 2009, we changed our name from "Marley Coffee Inc." to “Jammin Java Corp.” when we merged our subsidiary, Jammin Java Corp., into our company. Our common stock will be quoted on the NASD Over-the-Counter Bulletin Board under the new symbol "JAMN" effective at the opening of the market on September 17, 2009.

Properties

Effective February 15, 2008 we entered into a lease agreement for 52 acres of coffee farmland in the Jamaican Blue Mountains. The term is eight years and has an annual lease payment of $1,000.

The farm is located at Chepstowe,Skibo in Portland,

Jamaica. The farm is spread out over 52 acres of land. Currently only 12 acres have been identified for coffee production but this will be increased but to a maximum of 30 acres to preserve ecological diversity. Due to the altitude and geographic location of the land on which the farm is located, the coffee produced can be classified as “Blue Mountain Coffee.”

Current Business Operations

Marley Coffee

In February 2008, we decided to pursue the business of premium roasted coffee to take advantage of the consumer awareness and significant trend toward packaged ground premium and super premium coffees with new Marley Coffee branded entries to the category. We also intend to develop a share of the category and create a leadership

position by capitalizing on the success of the Marley name with our new brand and franchise while using Jamaican Blue Mountain as the flagship item. The brand will be “Jammin Java” by Rohan Marley In addition, we intend to use this opportunity to take advantage of this strong increase in consumer demand by stepping forward and combining name, music and quality coffees to generate interest.

Effective July 13, 2009, we changed our name from "Marley Coffee Inc." to "Jammin Java Corp." when we merged our subsidiary, Jammin Java Corp., into our company.

We also intend to produce our own premium organic coffee on the farmland we lease in the Blue Mountain region of Jamaica. Our goal is to manage the Marley Coffee Farm in manner that ensures economic viability, optimal yields and unrivaled product quality while maintaining the environmental integrity of the ecosystem incompliance with international

organic standards.

To achieve our objectives, we will do the following:

|

1.

|

Develop and implement a sustainable fertility management program compliant with international organic standards.

|

|

2.

|

Develop and implement a sustainable pest management program compliant with international organic standards.

|

|

3.

|

Continually review and adjust the installed system for the management of our human and financial resources

|

|

4.

|

Continue the resuscitation of existing coffee trees and restoration of location-specific optimal planting density

|

|

5.

|

Conduct research into sustainable organic agronomic practices and novel marketable coffee blends

|

|

6.

|

Identify and outsource suitable local pulping and roasting facilities with the intent to construct and install washing, pulping and roasting mechanism that is compliant to international organic standards on site.

|

|

7.

|

Identify and facilitate the sale of secondary cash crops on the local market

|

Our administrative office is located at 375 South Fairfax Avenue Suite #321, Los Angeles California, USA 90036, telephone (323) 316-3456 and our registered statutory office is located at 2470 Saint Rose Parkway, Suite 304 Henderson, Nevada 89074. Our fiscal year end is January 31.

Product Research and Development

We do not anticipate that we will expend any significant funds on research and development over the twelve months ending July 31, 2010.

Employees

Currently, we currently have no employees other than our officers. We are not a party to any collective bargaining agreements. We have not entered into any employment agreements with any of our executives. We anticipate that we will enter into employment agreements without officers when, and if, our revenue production justifies

such agreements. We do not currently anticipate that we will hire any employees in the next three months, unless we successfully raise funds necessary to implement our business plan. From time-to-time, we anticipate that we will also use the services of independent contractors and consultants to support our business development. We believe our future success depends in large part upon the continued service of our senior management personnel and our ability to attract and retain highly qualified technical and

managerial personnel.

Purchase or Sale of Equipment

We purchased $7,142 of equipment for the farm we lease in Jamaica during the current fiscal period.

RISK FACTORS

Much of the information included in this quarterly report includes or is based upon estimates, projections or other "forward-looking statements". Such forward-looking statements include any projections or estimates made by us and our management in connection with our business operations. While these forward-looking statements, and any assumptions

upon which they are based, are made in good faith and reflect our current judgment regarding the direction of our business, actual results will almost always vary, sometimes materially, from any estimates, predictions, projections, assumptions, or other future performance suggested herein. We undertake no obligation to update forward-looking statements to reflect events or circumstances occurring after the date of such statements.

Such estimates, projections or other "forward-looking statements” involve various risks and uncertainties as outlined below. We caution readers of this quarterly report that important factors in some cases have affected and, in the future, could materially affect actual results and cause actual results to differ materially from the results

expressed in any such estimates, projections or other "forward-looking statements". In evaluating us, our business and any investment in our business, readers should carefully consider the following factors.

We have no operating history and have maintained losses since inception that we expect to continue into the future. If the losses continue we may go out of business. We have no assets, no experience in the proposed line of business, certifications, current customers, or negotiations or agreements with any processing centers

or refurbishes.

We were incorporated in September 27, 2004 and only just recently began commencing a new business plan. We have only just completed our business plan to grow and roast our own and third party organic coffee. We have not realized any revenues to date. We have no operating history upon which an evaluation of our future success or failure can

be made. There is a net loss since inception of $326,389 and also an accumulated deficit of $326,389. We expect to incur losses for the foreseeable future; therefore, we may not be able to achieve profitable operations and we may not even be able to generate any revenues. We will encounter difficulties as an early stage company in the rapidly evolving and highly marketed recycling end of life electronic industry. Therefore, the revenue and income potential of our business model is unproven.

We face substantial competition from established and new companies in our industry. If we are unable to compete with these companies our proposed business will fail.

We face intense competition from established coffee growers and roasters. We may not be able to compete effectively with these companies now or in the future. Many of our potential competitors have significantly greater financial, marketing, technical and other competitive resources, as well as greater name recognition, than we have. As a

result, our competitors may be able to adapt more quickly to changes in consumer requirements or may be able to devote greater resources to the promotion and sale of their services. We may not be able to compete successfully with our potential and existing competitors. In addition, competition could increase if new companies enter the market or if existing competitors expand their services. An increase in competition could result in price reductions and loss of market share and could have a material adverse effect

on our business, financial condition or results of operations. To be competitive we will need to continue to invest in sales and marketing. We may not have sufficient resources to make such investments necessary to remain competitive. In addition, current and potential competitors have established or may in the future establish collaborative relationships among themselves or with third parties, including third parties with whom we have relationships, to increase the visibility and utility of their services. Accordingly,

new competitors or alliances may emerge and rapidly acquire significant market share. If we are unable to compete with companies in end of life electronic services industry, our proposed business will fail and you will lose your entire investment.

We depend on our key personnel to manage our business effectively in a rapidly changing market. If we are unable to retain our key employees, our business, financial condition and results of operations could be harmed.

Our future success depends to a significant degree on the skills, efforts and continued services of our executive officers and other key sales, marketing and support personnel who have critical industry experience and relationships. If we were to lose the services of one or more of our key executive officers and senior management members,

we may not be able to grow our business as we expect, and our ability to compete could be harmed, adversely affecting our business and prospects.

Changes in the government regulation of our coffee farm could harm our business.

Our coffee products are subject to foreign government regulation by the Jamaican Coffee Board and international regulatory bodies. These regulatory bodies could enact regulations which affect our products or the service providers which distribute our products, such as limiting the scope of the service providers' market, capping fees for services

provided by them or imposing coffee quality control standards which impact our products.

If we are unable to obtain organic certification, our business may be impaired.

It is proposed that we obtain organic certification for our leased farmland in Jamaica from the certifying agency Certification of Environmental Standards (CERES). If we are unable to obtain certification we may be forced to grown on-organic coffee on our property. This may impair our business plan and force us buy from third party sources.

We need to continue as a going concern if our business is to succeed, if we do not we will go out of business.

Our independent accountant's report to our audited financial statements for the period ended January 31, 2009 indicates that there are a number of factors that raise substantial doubt about our ability to continue as a going concern. Such factors identified in the report are our accumulated deficit since inception, our failure to attain

profitable operations and our dependence upon adequate financing to pay our liabilities. If we are not able to continue as a going concern, it is likely investors will lose their investments.

If we do not obtain additional financing, our business will fail.

Our current operating funds are less than necessary to complete all intended exploration of the property, and therefore we will need to obtain additional financing in order to complete our business plan. As of July 31, 2009 we had cash in the amount of 1,415. We currently have minimal operations and we have no income.

Our

business plan calls for significant expenses in connection with the development of our coffee property. We will require additional financing to sustain our business operations if we are not successful in earning revenues once coffee production is complete. We do not currently have any arrangements for financing and we can provide no assurance to investors that we will be able to find such financing if required. Obtaining additional financing would be subject to a number of factors, including the market

prices for copper, silver and gold, investor acceptance of our property and general market conditions. These factors may make the timing, amount, terms or conditions of additional financing unavailable to us.

The most likely source of future funds presently available to us is through the sale of equity capital. Any sale of share capital will result in dilution to existing shareholders.

Because we have commenced limited business operations, we face a high risk of business failure.

We have only just recently commenced operations. Accordingly, we have no way to evaluate the likelihood that our business will be successful. We were incorporated on September 27, 2004 and have been involved primarily in organizational activities and the acquisition of our mineral property. We have not earned any

revenues as of the date of this document.

Prior to completion of our coffee production stage, we anticipate that we will incur increased operating expenses without realizing any significant revenues. We therefore expect to incur significant losses into the foreseeable future. There is no history upon which to base any assumption as to the likelihood that we will prove

successful, and we can provide investors with no assurance that we will generate any operating revenues or ever achieve profitable operations. If we are unsuccessful in addressing these risks, our business will most likely fail.

We lack an operating history and we expect to have losses in the future.

We have not started our proposed business operations or realized any revenues. We have no operating history upon which an evaluation of our future success or failure can be made. Our ability to achieve and maintain profitability and positive cash flow is dependent upon the following:

|

·

|

Our ability to operate a profitable coffee farm;

|

|

·

|

Our ability to generate revenues; and

|

|

·

|

Our ability to reduce farming and marketing costs.

|

Based upon current plans, we expect to incur operating losses in future periods. This will happen because there are expenses associated with the development of our coffee property. We cannot guarantee that we will be successful in generating revenues in the future. Failure to generate revenues will cause us to go out of business.

Trading of our stock may be restricted by the SEC's Penny Stock Regulations which may limit a stockholder's ability to buy and sell our stock.

The U.S. Securities and Exchange Commission has adopted regulations which generally define "penny stock" to be any equity security that has a market price (as defined) less than $5.00 per share or an exercise price of less than $5.00 per share, subject to certain exceptions. Our securities are covered by the penny stock rules,

which impose additional sales practice requirements on broker-dealers who sell to persons other than established customers and "accredited investors". The term "accredited investor" refers generally to institutions with assets in excess of $5,000,000 or individuals with a net worth in excess of $1,000,000 or annual income exceeding $200,000 or $300,000 jointly with their spouse. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from

the rules, to deliver a standardized risk disclosure document in a form prepared by the SEC which provides information about penny stocks and the nature and level of risks in the penny stock market. The broker-dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction and monthly account statements showing the market value of each penny stock held in the customer's account. The

bid and offer quotations, and the broker-dealer and salesperson compensation information, must be given to the customer orally or in writing prior to effecting the transaction and must be given to the customer in writing before or with the customer's confirmation. In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from these rules, the broker-dealer must make a special written determination that the penny stock is a suitable investment for the

purchaser and receive the purchaser's written agreement to the transaction. These disclosure requirements may have the effect of reducing the level of trading activity in the secondary market for the stock that is subject to these penny stock rules. Consequently, these penny stock rules may affect the ability of broker-dealers to trade our securities. We believe that the penny stock rules discourage investor interest in and limit the marketability of, our common stock.

We do not expect to declare or pay any dividends

.

We have not declared or paid any dividends on our common stock since our inception, and we do not anticipate paying any such dividends for the foreseeable future.

Anti-Takeover Provisions

We do not currently have a shareholder rights plan or any anti-takeover provisions in our By-laws. Without any anti-takeover provisions, there is no deterrent for a take-over of our company, which may result in a change in our management and directors.

Our By-laws contain provisions indemnifying our officer and directors against all costs, charges and expenses incurred by them.

Our By-laws contain provisions with respect to the indemnification of our officer and directors against all costs, charges and expenses, including an amount paid to settle an action or satisfy a judgement, actually and reasonably incurred by him, including an amount paid to settle an action or satisfy a judgement in a civil, criminal or

administrative action or proceeding to which he is made a party by reason of his being or having been one of our directors or officer.

Plan of Operations - Next 12 Months

We have commenced limited operations, and have generated no revenue to date. We are still a development stage corporation.

Over the next twelve months we intend to use funds to commence marketing our service, leasehold improvements and for general and administrative expenditures, as follows:

Estimated Funding Required During the Next Twelve Months

|

General and Administrative

|

|

$

|

55,000

|

|

|

Operations

|

|

|

|

|

|

Marketing/Advertising

Leasehold Improvements

|

|

$

|

25,000

$70,000

|

|

|

Working Capital

|

|

$

|

50,500

|

|

|

Total

|

|

$

|

200,500

|

|

Financial Condition, Liquidity and Capital Resources

Our principal capital resources have been through issuance of common stock and shareholder loans.

At July 31, 2009, there was negative working capital of $41,855.

At July 31, 2009, our total assets were $84,395, which consisted of cash of $1,415 and property of $82,980.

At July 31, 2009, our total current liabilities were $43,270.

For the three months ended July 31, 2009, we incurred expenditures of $10,972 and posted losses of $10,972. For the three months ending July 31, 2008, we incurred expenditures of $34,988 and posted losses of $34,988. From inception to July 31, 2009, we incurred losses of $326,389. The principal components of the losses since inception

through July 31, 2009 were administrative and farm expenses.

For the six months ended July 31, 2009, we incurred expenditures of $32,285 and posted losses of $32,285. For the six months ending July 31, 2008, we incurred expenditures of $55,830 and posted losses of $55,830. From inception to July 31, 2009, we incurred losses of $326,389. The principal components of the losses since inception

through July 31, 2009 were administrative and farm expenses.

At July 31, 2009, we had cash on hand of $1,415. We will require additional financing before we generate significant revenues. We intend to raise the capital required to meet any additional needs through sales of our securities in secondary offerings or private placements. We have no agreements in place to do this at this time.

APPLICATION OF CRITICAL ACCOUNTING POLICIES

Our unaudited financial statements and accompanying notes have been prepared in conformity with generally accepted accounting principles in the United States of America for interim financial statements. Preparing financial statements requires management to make estimates and assumptions that affect the reported amounts of assets,

liabilities, revenue, and expenses. These estimates and assumptions are affected by management's application of accounting policies. We believe that understanding the basis and nature of the estimates and assumptions involved with the following aspects of our financial statements is critical to an understanding of our financials.

Item 3. Controls and Procedures.

As required by Rule 13a-15 under the Exchange Act, we have carried out an evaluation of the effectiveness of the design and operation of our company's disclosure controls and procedures as of the end of the period covered by this quarterly report, being July 31, 2009. This evaluation was carried out under the supervision and with

the participation of our company's management, including our company's president and chief executive officer. Based upon that evaluation, our company's president and chief executive officer concluded that our company's disclosure controls and procedures are effective as at the end of the period covered by this report. There have been no significant changes in our company's internal controls or in other factors, which could significantly affect internal controls subsequent to the date we

carried out our evaluation.

Disclosure controls and procedures are controls and other procedures that are designed to ensure that information required to be disclosed in our company's reports filed or submitted under the Exchange Act is recorded, processed, summarized and reported, within the time periods specified in the Securities and Exchange Commission's rules and

forms. Disclosure controls and procedures include, without limitation, controls and procedures designed to ensure that information required to be disclosed in our company's reports filed under the Exchange Act is accumulated and communicated to management, including our company's president and chief executive officer as appropriate, to allow timely decisions regarding required disclosure.

There have been no changes to our internal controls over financial reporting during the most recent fiscal quarter.

PART II - OTHER INFORMATION

Item 1. Legal Proceedings.

We know of no material, active or pending legal proceedings against us, nor are we involved as a plaintiff in any material proceedings or pending litigation.

Item 2. Unregistered Sales of Equity Securities and Use of Proceeds

None

Item 3. Defaults Upon Senior Securities

None

Item 4. Submission of Matters to a Vote of Security Holders

None

Item 5. Other Information

None

Item 6. Exhibits.

Exhibits required by Item 601 of Regulation S-B

|

Exhibit

Number

|

Description

|

|

3.1

|

Articles of Incorporation (incorporated by reference from our Registration Statement on Form SB-2, filed on August 3, 2005).

|

|

3.2

|

By-laws (incorporated by reference from our Registration Statement on Form SB-2, filed on February 4, 2003).

|

|

4.1

|

Specimen Stock Certificate (incorporated by reference from our Registration Statement on Form SB-2, filed on August 3, 2005).

|

|

31.1

|

Section 302 Certification

|

|

32.1

|

Section 906 Certification

|

SIGNATURES

In accordance with the requirements of the Exchange Act, the registrant caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

MARLEY COFFEE INC.

|

|

|

/s/ Shane Whittle

|

|

Date: September 21, 2009

|

Shane Whittle, President, Treasurer and CEO (Principal Executive Officer)

|

|

|

|

|

|

|

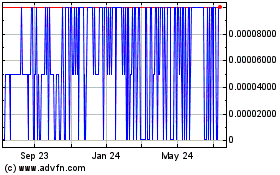

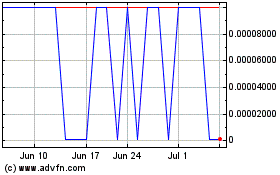

Jammin Java (PK) (USOTC:JAMN)

Historical Stock Chart

From Jun 2024 to Jul 2024

Jammin Java (PK) (USOTC:JAMN)

Historical Stock Chart

From Jul 2023 to Jul 2024