Current Report Filing (8-k)

April 14 2022 - 8:40AM

Edgar (US Regulatory)

0001572565

false

0001572565

2022-04-11

2022-04-11

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): April 11, 2022

INDOOR

HARVEST CORP.

(Exact

name of registrant as specified in charter)

| Texas |

|

000-55594 |

|

45-5577364 |

| (State

or other jurisdiction |

|

(Commission |

|

(IRS

Employer |

| of

incorporation) |

|

File

Number) |

|

Identification

No.) |

7401

W. Slaughter Lane #5078, Austin, Texas, 78739

(Address

of Principal Executive Offices) (Zip Code)

(512)

309-1776

(Registrant’s

Telephone Number, Including Area Code)

Not

Applicable

(Former

Name or Former Address, If Changed Since Last Report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act: None.

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mart if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

8.01 Other Events.

As

set forth in the Current Report on Form 8-K originally filed on February 14, 2022, Indoor Harvest Corp., a Texas corporation (the “Company”)

entered into a non-binding letter of intent (the “Letter of Intent”) with Electrum Partners, LLC, a limited liability company

(“Electrum”) on February 9, 2022. Under the terms of the Letter of Intent, the Company would acquire certain assets (the

“Assets”) of Electrum for an aggregate payment at closing and thereafter of a purchase price that will be mutually agreed

by the parties based on an independent valuation of the purchased Assets.

On

April 11, 2022, the parties mutually agreed to an amendment (the “Amendment”) to the Letter of Intent to extend (i) the date

by which Electrum and its members must prepare a definitive Asset Purchase Agreement (the “Purchase Agreement”) and other

related agreements to July 9, 2022 from April 10, 2022 as originally set forth in the Letter of Intent and (ii) the date that the Purchase

Agreement must be executed and the asset acquisition consummated to October 7, 2022 from June 9, 2022 as originally set forth in the

Letter of Intent. The Company and Electrum determined to enter into the Amendment due to recent disruptions in the financial markets

caused in part by the escalation of geopolitical tensions and the start of the military conflict between Russia and Ukraine. As a result,

certain events began to affect global and United States business conditions, including increased inflation and uncertain capital markets,

which led to a delay in completing certain terms of the Letter of Intent between the Company and Electrum.

There

can be no assurance that a definitive agreement will be entered into or that the proposed transaction will be consummated. When any such

agreement is reached the Company will file notice of such agreement with the Securities and Exchange Commission on Form 8-K. A copy of

the Amendment to the Letter of Intent is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The

statements in this Current Report on Form 8-K include statements regarding the intent, belief or current expectations of the Company

and members of its management team, as well as the assumptions on which such statements are based, and generally are identified by the

use of words such as “may,” “will,” “seeks,” “strives,” “anticipates,” “believes,”

“estimates,” “expects,” “plans,” “intends,” “should” or similar expressions.

Actual results may differ materially from those contemplated by such forward-looking statements, including as a result of those factors

set forth in the Risk Factors section of the Company’s most recent Annual Report on Form 10-K. Forward-looking statements speak

only as of the date they are made, and the Company undertakes no obligation to update or revise forward-looking statements to reflect

changed assumptions, the occurrence of unanticipated events or changes to future operating results over time, unless required by law.

Item

9.01. Financial Statement and Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| INDOOR

HARVEST CORP. |

|

| |

|

| /s/

Leslie Bocskor |

|

| Leslie

Bocskor |

|

| Chief

Executive Officer |

|

| |

|

| Date:

April 14, 2022 |

|

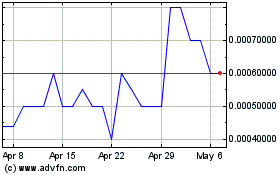

Indoor Harvest (CE) (USOTC:INQD)

Historical Stock Chart

From Jun 2024 to Jul 2024

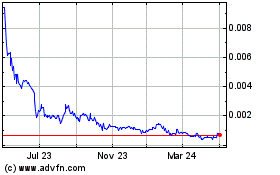

Indoor Harvest (CE) (USOTC:INQD)

Historical Stock Chart

From Jul 2023 to Jul 2024