UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

x QUARTERLY REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended September 30, 2015

o TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE EXCHANGE ACT

For the transition period from ______________ to ______________

Commission File Number:

INDOOR HARVEST CORP

(Exact name of registrant as specified in its charter)

|

Texas

|

|

45-5577364

|

|

(State or other jurisdiction of incorporation or organization)

|

|

IRS I.D.

|

|

5300 East Freeway Suite A

Houston, Texas

|

|

(Address of principal executive offices)

|

|

713-410-7903

|

|

(Registrant's telephone number, including area code)

|

N/A

(Former name, former address and former phone number, if changed since last report)

Check whether the issuer (1) filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the past 12 months (or for such shorter period that the registrant was required to file such reports), and 2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer

|

☐

|

Accelerated filer

|

☐

|

|

Non-accelerated filer

|

☐

|

Smaller Reporting Company

|

☒

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of November 13, 2015 there were 10,905,868 shares issued and outstanding of the registrant's common stock.

|

|

|

3

|

|

|

|

|

|

Item 1.

|

|

|

3

|

|

Item 2.

|

|

|

10

|

|

Item 3.

|

|

|

16

|

|

Item 4.

|

|

|

16

|

|

|

|

|

|

|

|

17

|

|

|

|

|

|

Item 1.

|

|

|

17

|

|

Item 2.

|

|

|

17

|

|

Item 3.

|

|

|

17

|

|

Item 4.

|

|

|

17

|

|

Item 5.

|

|

|

17

|

|

Item 6.

|

|

|

18

|

|

|

|

|

|

|

|

|

|

19

|

PART I — FINANCIAL INFORMATION

Item 1. Financial Statements.

|

INDOOR HARVEST CORP

|

|

|

|

BALANCE SHEETS

|

|

AS OF SEPTEMBER 30, 2015 AND DECEMBER 31, 2014

|

|

(UNAUDITED)

|

|

|

|

September 30,

2015

|

|

|

December 31,

2014

|

|

|

|

|

|

|

|

|

|

|

ASSETS

|

|

|

|

|

|

|

|

Current assets:

|

|

|

|

|

|

|

|

Cash

|

|

$

|

122,098

|

|

|

$

|

411,669

|

|

|

Prepaid expenses

|

|

|

9,315

|

|

|

|

-

|

|

|

Total current assets

|

|

|

131,413

|

|

|

|

411,669

|

|

|

|

|

|

|

|

|

|

|

|

|

Furniture and equipment, net

|

|

|

207,533

|

|

|

|

170,454

|

|

|

Security deposit

|

|

|

12,600

|

|

|

|

12,600

|

|

|

Intangible asset

|

|

|

2,000

|

|

|

|

2,000

|

|

|

Other assets

|

|

|

53,372

|

|

|

|

68,083

|

|

|

Total assets

|

|

$

|

406,918

|

|

|

$

|

664,806

|

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES

|

|

|

|

|

|

|

|

|

|

Current liabilities:

|

|

|

|

|

|

|

|

|

|

Accounts payable & accrued expenses

|

|

$

|

18,935

|

|

|

$

|

7,185

|

|

|

Accrued payroll

|

|

|

4,771

|

|

|

|

5,034

|

|

|

Deferred rent

|

|

|

9,590

|

|

|

|

9,026

|

|

|

Total current liabilities

|

|

|

33,296

|

|

|

|

21,245

|

|

|

|

|

|

|

|

|

|

|

|

|

Long term liabilities:

|

|

|

|

|

|

|

|

|

|

Note payable

|

|

|

34,699

|

|

|

|

- |

|

|

Total Liabilities

|

|

|

67,995

|

|

|

|

21,245

|

|

|

|

|

|

|

|

|

|

|

|

|

Stockholders' equity:

|

|

|

|

|

|

|

|

|

|

Preferred stock: $0.01 par value, 5,000,000 shares authorized; none shares issued and outstanding at September 30, 2015 and December 31, 2014, respectively

|

|

|

-

|

|

|

|

- |

|

|

Common stock: $0.001 par value, 50,000,000 shares authorized; 10,585,048 and 9,252,388 shares issued and outstanding at September 30, 2015 and December 31, 2014, respectively

|

|

|

10,584

|

|

|

|

9,251

|

|

|

Additional paid-in capital

|

|

|

1,954,871

|

|

|

|

1,299,389

|

|

|

Less: Stock subscription receivable

|

|

|

-

|

|

|

|

(10,000

|

) |

|

Accumulated deficit

|

|

|

(1,626,532

|

)

|

|

|

(655,079

|

) |

|

Total Stockholders' equity

|

|

|

338,923

|

|

|

|

643,561

|

|

|

|

|

|

|

|

|

|

|

|

|

Total liabilities and stockholders' equity

|

|

$

|

406,918

|

|

|

$

|

664,806

|

|

The accompanying notes are an integral part of these financial statements.

|

INDOOR HARVEST CORP

|

|

STATEMENTS OF OPERATIONS

|

|

(UNAUDITED)

|

|

|

|

|

|

|

|

|

|

|

|

For the three months ended

September 30,

|

|

|

For the nine months ended

September 30,

|

|

|

|

|

2015

|

|

|

2014

|

|

|

2015

|

|

|

2014

|

|

|

Operating Expenses

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation expense

|

|

$

|

12,484

|

|

|

$

|

4,616

|

|

|

$

|

33,928

|

|

|

$

|

10,230

|

|

|

Research and development

|

|

|

5,459

|

|

|

|

20,956

|

|

|

|

17,987

|

|

|

|

21,966

|

|

|

Professional fees

|

|

|

16,559

|

|

|

|

20,883

|

|

|

|

124,531

|

|

|

|

128,838

|

|

|

General and administrative expenses

|

|

|

346,430

|

|

|

|

64,626

|

|

|

|

784,288

|

|

|

|

154,052

|

|

|

Loss from operations

|

|

|

380,932

|

|

|

|

111,081

|

|

|

|

960,734

|

|

|

|

315,086

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other Income (Expense)

|

|

|

(655

|

)

|

|

|

6

|

|

|

|

(10,719

|

)

|

|

|

149

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss

|

|

$

|

(381,587

|

)

|

|

$

|

(111,075

|

)

|

|

$

|

(971,453

|

)

|

|

$

|

(314,937

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss per common share:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss per share, basic and diluted

|

|

$

|

(0.04

|

)

|

|

$

|

(0.01

|

)

|

|

$

|

(0.10

|

)

|

|

$

|

(0.04

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average number of common shares outstanding:

Basic and diluted

|

|

|

10,024,410

|

|

|

|

8,410,300

|

|

|

|

9,946,256

|

|

|

|

8,060,465

|

|

The accompanying notes are an integral part of these financial statements.

|

INDOOR HARVEST CORP

|

|

STATEMENTS OF SHAREHOLDERS' EQUITY

|

|

(UNAUDITED)

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Additional Paid-in Capital

|

|

|

|

|

|

|

|

|

Total Stockholders' Equity (Deficit)

|

|

| |

|

Preferred Stock, $0.01 Par Value

|

|

|

Common Stock, $0.001 Par Value

|

|

|

|

|

|

|

|

| |

|

Shares

|

|

|

Amount

|

|

|

Shares

|

|

|

Amount

|

|

|

Accumulated Deficit

|

|

|

Subscription Receivable

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balances, December 31, 2013

|

|

|

-

|

|

|

- |

|

|

|

6,505,381

|

|

|

$

|

6,505

|

|

|

$

|

359,134

|

|

|

$

|

(211,797

|

)

|

|

$

|

-

|

|

|

$

|

153,842

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Issuance of common stock

|

|

|

-

|

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For cash

|

|

|

-

|

|

|

|

-

|

|

|

|

2,474,000

|

|

|

|

2,474

|

|

|

|

872,276

|

|

|

|

-

|

|

|

|

(10,000

|

)

|

|

|

864,750

|

|

|

For services

|

|

|

-

|

|

|

|

-

|

|

|

|

273,007

|

|

|

|

272

|

|

|

|

67,979

|

|

|

|

-

|

|

|

|

-

|

|

|

|

68,251

|

|

|

Net loss

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

(443,282

|

)

|

|

|

-

|

|

|

|

(443,282

|

)

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balances, December 31, 2014

|

|

|

-

|

|

|

|

-

|

|

|

|

9,252,388

|

|

|

|

9,251

|

|

|

|

1,299,389

|

|

|

|

(655,079

|

)

|

|

|

(10,000

|

)

|

|

|

643,561

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Issuance of common stock

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For cash

|

|

|

-

|

|

|

|

-

|

|

|

|

536,000

|

|

|

|

536

|

|

|

|

267,464

|

|

|

|

-

|

|

|

|

-

|

|

|

|

268,000

|

|

|

For services

|

|

|

-

|

|

|

|

-

|

|

|

|

796,700

|

|

|

|

797

|

|

|

|

388,018

|

|

|

|

-

|

|

|

|

-

|

|

|

|

388,815

|

|

|

Collection of stock subscription receivable

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

10,000

|

|

|

|

10,000

|

|

|

Net loss

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

(971,453

|

)

|

|

|

-

|

|

|

|

(971,453

|

)

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balances, September 30, 2015

|

|

|

-

|

|

|

|

- |

|

|

|

10,585,088

|

|

|

$

|

10,584

|

|

|

$

|

1,954,871

|

|

|

$

|

(1,626,532

|

)

|

|

$

|

-

|

|

|

$

|

338,923

|

|

The accompanying notes are an integral part of these financial statements.

|

INDOOR HARVEST CORP

|

|

|

STATEMENT OF CASHFLOWS

|

|

|

(UNAUDITED)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the nine months ended September 30,

|

|

|

|

|

|

|

2015

|

|

|

2014

|

|

|

Cash flows from operating activities:

|

|

|

|

|

|

|

|

Net loss

|

|

$

|

(971,453

|

)

|

|

$

|

(314,937

|

)

|

|

Adjustments to reconcile net loss to net cash used in operating activities:

|

|

|

|

|

|

|

|

|

|

Depreciation expense

|

|

|

33,928

|

|

|

|

10,228

|

|

|

Loss on the sale other asset

|

|

|

9,250

|

|

|

|

-

|

|

|

Stock issued for services - related party

|

|

|

273,344

|

|

|

|

68,252

|

|

|

Stock issued for services

|

|

|

115,471

|

|

|

|

-

|

|

|

Change in operating liability:

|

|

|

|

|

|

|

|

|

|

Deferred rent

|

|

|

564

|

|

|

|

8,838

|

|

|

Other assets

|

|

|

-(4,589

|

)

|

|

|

(80,326

|

)

|

|

Security deposit

|

|

|

-

|

|

|

|

(12,600

|

)

|

|

Prepaid expense

|

|

|

(9,315

|

)

|

|

|

-

|

|

|

Accounts payable and accrued expenses

|

|

|

11,750

|

|

|

|

3,354

|

|

|

Accrued compensation - officers

|

|

|

-

|

|

|

|

(6,181

|

)

|

|

Accrued compensation

|

|

|

(263

|

)

|

|

|

3,885

|

|

|

Net cash used in operating activities

|

|

|

(541,313

|

)

|

|

|

(319,487

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Cash flows from investing activities:

|

|

|

|

|

|

|

|

|

|

Proceeds from sale of equipment

|

|

|

10,050

|

|

|

|

-

|

|

|

Purchase of equipment

|

|

|

(71,007

|

)

|

|

|

(64,936

|

)

|

|

Net cash used in investing activities

|

|

|

(60,957

|

)

|

|

|

(64,936

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Cash flows from financing activities:

|

|

|

|

|

|

|

|

|

|

Proceeds from note payable

|

|

|

34,699

|

|

|

|

-

|

|

|

Collection of stock subscription receivable

|

|

|

10,000

|

|

|

|

-

|

|

|

Issuance of common stock for cash

|

|

|

268,000

|

|

|

|

504,750

|

|

|

Net cash provided by financing activities

|

|

|

312,699

|

|

|

|

504,750

|

|

|

|

|

|

|

|

|

|

|

|

|

Increase cash and cash equivalents

|

|

|

(289,571

|

)

|

|

|

120,327

|

|

|

Cash and cash equivalents at beginning of period

|

|

|

411,669

|

|

|

|

122,017

|

|

|

Cash and cash equivalents at end of period

|

|

$

|

122,098

|

|

|

$

|

242,344

|

|

|

|

|

|

|

|

|

|

|

|

|

Supplemental Disclosures

|

|

|

|

|

|

|

|

|

|

Interest paid

|

|

$

|

-

|

|

|

$

|

-

|

|

|

Income taxes paid

|

|

$

|

-

|

|

|

$

|

-

|

|

The accompanying notes are an integral part of these financial statements.

INDOOR HARVEST CORP

NOTES TO FINANCIAL STATEMENTS

(UNAUDITED)

NOTE 1 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of presentation

Indoor Harvest Corp., or the "Company," is a Texas corporation formed on November 23, 2011. Indoor Harvest Corp., through its brand name Indoor Harvest™, is a company specializing in equipment design, development, marketing and direct-selling of commercial grade aeroponics fixtures and supporting systems for use in urban Controlled Environment Agriculture ("CEA") and Building Integrated Agriculture ("BIA").

The Company prepared these financial statements according to the instructions for Form 10-Q. Therefore, the financial statements do not include all disclosures required by generally accepted accounting principles in the United States. However, the Company has recorded all transactions and adjustments necessary to fairly present the financial statements included in this Form 10-Q. The adjustments made are normal and recurring. The following notes describe only the material changes in accounting policies, account details or financial statement notes during the first nine months of 2015. Therefore, please read these financial statements and notes to the financial statements together with the audited financial statements and notes thereto in our Annual Report on Form 10-K for the year ended December 31, 2014. The income statement for the nine months ended September 30, 2015 cannot necessarily be used to project results for the full year.

Use of estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States ("GAAP") requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Significant estimates include, but are not limited to the estimated useful lives of equipment for purposes of depreciation and the valuation of common shares issued for services, equipment and the liquidation of liabilities.

Stock-based Compensation

The Company follows ASC 718-10, Stock Compensation, which addresses the accounting for transactions in which an entity exchanges its equity instruments for goods or services, with a primary focus on transactions in which an entity obtains employee services in share-based payment transactions. ASC 718-10 requires measurement of the cost of employee services received in exchange for an award of equity instruments based on the grant-date fair value of the award (with limited exceptions).

Loss per Share

Basic earnings per share amounts are calculated based on the weighted average number of shares of common stock outstanding during each period. Diluted earnings per share is based on the weighted average numbers of shares of common stock outstanding for the periods, including dilutive effects of stock options, warrants granted and convertible preferred stock. Dilutive options and warrants that are issued during a period or that expire or are canceled during a period are reflected in the computations for the time they were outstanding during the periods being reported. Since Indoor Harvest has incurred losses for all periods, the impact of the common stock equivalents would be anti-dilutive and therefore are not included in the calculation.

Reclassifications

Certain expense items have been reclassified in the statement of operations for the three and nine months ended September 30, 2014, to conform to the reporting format adopted for the three and nine months ended September 30, 2015.

Recent Accounting Pronouncements

We do not believe any other recent pronouncements will have any impact on our presentation of financial position or results of operations.

NOTE 2 - GOING CONCERN

As reflected in the accompanying consolidated financial statements, the Company had a net loss of $971,453 and net cash used in operations of $541,313 for the nine months ended September 30, 2015. These factors raise substantial doubt about the Company's ability to continue as a going concern.

The ability of the Company to continue as a going concern is dependent on Management's plans which include potential asset acquisitions, mergers or business combinations with other entities, further implementation of its business plan and continuing to raise funds through debt or equity financings. The Company will likely rely upon related party debt or equity financing in order to ensure the continuing existence of the business.

The business plan of the Company is to engage in the design, development, marketing and direct-selling of commercial grade aeroponics fixtures and supporting systems for use in urban Controlled Environment Agriculture ("CEA") and Building Integrated Agriculture ("BIA"). During the next twelve months, the Company's strategy is to: (i) complete product development; (ii) commence product marketing, product assembly and sales; (iii) develop the aerofarmer.com web portal; (iv) construct a demonstration CEA and BIA farm; and (v) offer design-build services. The Company's long-term strategy is to direct sale, license and franchise their patented technologies and methods.

The accompanying consolidated financial statements have been prepared on a going concern basis, which contemplates the realization of assets and the satisfaction of liabilities in the normal course of business. These financial statements do not include any adjustments relating to the recovery of the recorded assets or the classification of the liabilities that might be necessary should the Company be unable to continue as a going concern.

NOTE 3 - LOAN PAYABLE

On June 5, 2015, the Company entered into a five year loan agreement with the principal loan amount of $36,100. The loan carries an interest rate of 10.25%. As of September 30, 2015, the remaining balance is $34,700.

NOTE 4 - RELATED PARTY TRANSACTIONS

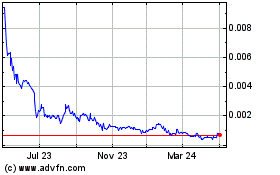

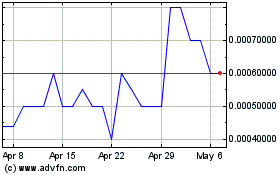

On August 14, 2015, the Company entered into an employment agreement with John Choo, the executive to serve as a Company President. The term of the agreement will continue until August 14, 2016, unless the employment is sooner terminated by the Board of Directors. As compensation for services, the employee will receive a annual compensation of $60,000. In addition, the employee will receive 355,060 shares of common stock. For the nine months ended September 30, 2015, the Company issued 355,060 shares in stock valued at $164,393 ($0.46/share) at the most recent trading price per share of the Company’s stock (See Note 5).

On June 30, 2015, the Company had accrued payroll to a related party, Chad Sykes, our CEO of $4,327. As of September 30, 2015, the payroll was paid in full. Additionally, on May 31, 2015, we issued shares for services to related parties amounting to $97,500.

In May 2015, the Company issued 50,000 shares of Common stock to Chad Sykes, our CEO with valuation of $25,450 ($0.51/share) at the most recent trading price per share of the Company’s stock.

In January of 2014, the Company entered into an advisory agreement where the advisor agreed to act as a mentor or advisor to the Company and provide advice and assistance ranging from attending quarterly meetings to providing feedback on Company strategy to making introductions and assisting in acquisitions. The Company issued 65,552 common shares in connection with this agreement with a valuation of $16,388 ($0.25/share). All shares to be issued per this agreement have been issued.

In January of 2014, the Company issued 207,455 shares of Common stock to the Company's legal counsel as part of legal fees with a valuation of $51,864 ($0.25/share).

NOTE 5 - SHAREHOLDERS' EQUITY

Preferred Stock

On August 3, 2015, the Company's Board of Directors signed a written action that included the following:

|

· |

The Board of Directors have approved the creation of 5,000,000 shares of Series A Convertible Preferred Stock and to take the required steps to amend the Corporations articles of incorporation and any other such SEC filings, or Company records as needed |

|

· |

The Board of Directors have approved a Certificate of Designation, Preferences and Rights of the Series A Convertible Preferred Stock. |

|

· |

The Board of Directors have approved a Regulation D, Rule 506(c) offering of up to 5,000,000 shares of Series A Convertible Preferred Stock in order to raise up to $5,000,000 in capital per the Company's Plan of Operation and to take the steps to file the required SEC and State filings |

|

· |

In January of 2015, the Company issued 144,000 shares of common stock to the Company's legal counsel as part of legal fees with a valuation of $72,000 ($0.50/share) at the most recent price per share for cash sales of the Company's stock. |

For the nine months ended September 30, 2015, none of the preferred stock was issued and outstanding.

Common Stock

On March 1, 2015, we entered into a Director Agreement with William Jamieson. The Company will reimburse the Director for reasonable travel and other incidental expenses incurred by the Director in performing his services and attending meetings as approved in advance by the Company. The Company shall award to the Director 166,560 shares of common stock pursuant to the Company's 2015 Stock Incentive over a two year period as directed in the Director Agreement. On May 31, 2015, the Company issued a total 20,820 shares of common stock with a valuation of $10,597 ($0.51/share) at the most recent trading price per share of the Company’s stock. On August 31, 2015, the Company issued a total 20,820 shares of common stock with a valuation of $11,451 ($0.55/share) at the most recent trading price per share of the Company’s stock.

On March 13, 2015, we entered into a Director Agreement with John Choo. The Company will reimburse the Director for reasonable travel and other incidental expenses incurred by the Director in performing his services and attending meetings as approved in advance by the Company. The Company shall award to the Director 166,560 shares of common stock pursuant to the Company's 2015 Stock Incentive over a two year period as directed in the Director Agreement. On May 31, 2015, the Company issued a total 20,820 shares of common stock with a valuation of $10,597 ($0.51/share) at the most recent trading price per share of the Company’s stock. On August 31, 2015, the Company issued a total 20,820 shares of common stock with a valuation of $11,451 ($0.55/share) at the most recent trading price per share of the Company’s stock. Effective August 14, 2015, the Company entered into an employment agreement and the Company issued 355,060 shares of Common Stock to John Choo, our President with valuation of $164,393 ($0.46/share) at the most recent trading price per share of the Company’s stock (See Note 4).

On March 23, 2015 we entered into a consulting agreement with Smallcapvoice.com to provide public and investor relations services for a period of 30 days starting on March 31, 2015. The Company paid $25,000 in cash plus issued 25,000 shares with a valuation of $25,000 ($1.00/share) based on the most recent closing price per share of our common stock traded on the OTCQB. For the three months ended March 31, 2015, the Company recorded $25,000 paid in cash and 25,000 shares of common stock as a prepaid expense. As of June 30, 2015 the services have been completed and the Company expensed the prepaid expense.

On April 15, 2015, we entered into a Director Agreement with John Zimmerman. The Company will reimburse the Director for reasonable travel and other incidental expenses incurred by the Director in performing his services and attending meetings as approved in advance by the Company. The Company shall award to the Director 166,560 shares of common stock pursuant to the Company's 2015 Stock Incentive over a two year period as directed in the Director Agreement. On July 15, 2015, the Company issued 20,820 shares, of common stock with a valuation of $9,369 ($0.45/share) at the most recent trading price per share of the Company's stock.

In May 2015, the Company issued 106,500 shares of Common Stock to various employees and consultants with a valuation of $54,315 ($0.51/share) at the most recent trading price per share of the Company’s stock.

In May 2015, the Company issued 50,000 shares of Common Stock to Chad Sykes, our CEO with a valuation of $25,450 ($0.51/share) at the most recent trading price per share of the Company’s stock (See Note 4).

On August 31, 2015, the Company issued 12,000 shares of Common Stock for consulting expense with valuation of $6,600 ($0.55/share) at the most recent trading price per share of the Company’s stock.

During the nine months ended September 30, 2015, the Company issued a total of 536,000 shares of common stock at $0.50 per share for cash totaling $268,000.

NOTE 6 - SUBSEQUENT EVENTS

On October 16, 2015, the Company issued 20,820 shares related to a Director Agreement with John Zimmerman, of common stock with a valuation of $9,992 ($0.48/share) at the most recent trading price per share of the Company’s stock.

October 15, 2015, the Company issued 300,000 shares of common stock at $0.50 per share for cash totaling $150,000.

Item 2. Management's Discussion and Analysis or Plan of Operation.

The following discussion of our financial condition and results of operations should be read in conjunction with our financial statements and the related notes, and other financial information included in this Form 10-Q.

Our Management's Discussion and Analysis contains not only statements that are historical facts, but also statements that are forward-looking. Forward-looking statements are, by their very nature, uncertain and risky. Although the forward-looking statements in this Report reflect the good faith judgment of our management, such statements can only be based on facts and factors currently known by them. Consequently, and because forward-looking statements are inherently subject to risks and uncertainties, the actual results and outcomes may differ materially from the results and outcomes discussed in the forward-looking statements. You are urged to carefully review and consider the various disclosures made by us in this report as we attempt to advise interested parties of the risks and factors that may affect our business, financial condition, and results of operations and prospects.

Forward-Looking Statements

The following discussion of our financial condition and results of operations should be read in conjunction with our audited financial statements and the related notes, and other financial information included in our Form 10-K.

Our Management's Discussion and Analysis contains not only statements that are historical facts, but also statements that are forward-looking. Forward-looking statements are, by their very nature, uncertain and risky. These risks and uncertainties include international, national, and local general economic and market conditions; our ability to sustain, manage, or forecast growth; our ability to successfully make and integrate acquisitions; new product development and introduction; existing government regulations and changes in, or the failure to comply with, government regulations; adverse publicity; competition; the loss of significant customers or suppliers; fluctuations and difficulty in forecasting operating results; change in business strategy or development plans; business disruptions; the ability to attract and retain qualified personnel; the ability to protect technology; the risk of foreign currency exchange rate; and other risks that might be detailed from time to time in our filings with the Securities and Exchange Commission.

Although the forward-looking statements in this Report reflect the good faith judgment of our management, such statements can only be based on facts and factors currently known by them. Consequently, and because forward-looking statements are inherently subject to risks and uncertainties, the actual results and outcomes may differ materially from the results and outcomes discussed in the forward-looking statements. You are urged to carefully review and consider the various disclosures made by us in this report and in our other reports as we attempt to advise interested parties of the risks and factors that may affect our business, financial condition, and results of operations and prospects.

Overview

Indoor Harvest Corp, through its brand name Indoor Harvest™, is a design-build contractor, developer, marketer and direct-seller of commercial grade aeroponic and hydroponic fixtures and supporting mechanical systems for use in urban Controlled Environment Agriculture ("CEA") and Building Integrated Agriculture ("BIA"). Indoor Harvest Corp was incorporated in the state of Texas on November 23, 2011. We did not generate revenue from operations during the period covered by this report, but have subsequently begun generating revenue as of October 21, 2015. Our independent registered public accounting firm has issued a going concern opinion. This means there is substantial doubt that we can continue as an on-going business unless we obtain additional capital to pay our ongoing operational costs. Accordingly, we must locate sources of capital to pay our operational costs.

We currently offer a vertical farm racking system with integrated LED lighting. Our vertical farm racking system was designed to be used for both aeroponic and hydroponic layered crop production within a CEA or BIA operation. Our racking system will work with any standard 48" X 96" or 24" X 48" third party flood table or aeroponic system. We also offer patent pending aeroponic fixtures that are compatible with our vertical farm racking system. We are developing our vertical farm racking system and aeroponic fixtures for use by both horticulture enthusiasts and commercial operators who seek to utilize vertical farming methods within a controlled indoor environment.

Aeroponics is the process of growing plants in an air or mist environment without the use of soil or an aggregate medium (known as geoponics). Aeroponic culture differs from both conventional hydroponics and in-vitro (plant tissue culture) growing. Unlike hydroponics, which uses water as a growing medium and essential minerals to sustain plant growth, aeroponics is conducted without a growing medium. Because water is used in aeroponics to transmit nutrients, it is sometimes considered a type of hydroponics.

Current Operations

See our concurrent press release filed as an exhibit to this Form 10-Q for additional information.

In the third quarter of 2015, the Company began offering design build services and sales of its vertical farm racking system.

Equipment Sales

As of October 26, 2015, we had received a $8,110 deposit towards a $16,220 equipment package for our vertical farm shallow raft platform.

Design-Build Agreements

On October 6, 2015, we entered into a design-build, cost plus, original equipment manufacturer ("OEM") agreement, with a specialty building integrated agricultural cultivation facility in Colorado. The design-build agreement is to develop a 2,000 square foot customer specified platform and to provide pricing for OEM services.

On October 26, 2015, an earnest money deposit of $5,000 was paid to begin design work.

On October, 15, 2015, we entered into a design-build, cost plus agreement, to engineer the cultivation and mechanical systems for a 38,000 square foot, building integrated agricultural production facility in Maryland. On October 21, 2015, an earnest money deposit of $10,000 was paid to begin design work.

Tweed Design-Build Project

On December 18, 2014, Indoor Harvest entered into the Pilot Project Agreement with Canopy Growth, a TSX Venture Exchange listed company whose wholly-owned subsidiaries Tweed Inc. ("Tweed"), Tweed Farms Inc. ("Tweed Farms"), and Bedrocan Canada Inc. ("Bedrocan") which are federally licensed producers of medical cannabis in Canada. The principal activities of Canopy Growth’s subsidiaries are the production of cannabis at Tweed Farms’ facility in Niagara-on-the-Lake, Ontario and the production and sale of cannabis from Tweed Inc.'s facility in Smiths Falls, Ontario and Bedrocan’s facility in Toronto, Ontario as regulated by the Canadian Marihuana for Medical Purposes Regulations.

On April 20, 2015, we began our test pilot at Tweed's facility in Smith Falls, Ontario, by growing a sativa dominate strain from clone in order to collect certain production data. 8 plants were grown in a 4' X 8' X 2' system using a "Screen of Green" cultivation method, in which plants are cropped and trained to produce a higher yield from a single plant. The Company's patent pending aeroponic system showed a significant increase in growth rate during the vegetative stage, as compared to more traditional production methods such as drip irrigation using coco.

Fertilizer usage was reduced by as much as 68% with the system averaging 8 gallons a day under high pressure sodium and 9 gallons a day under LED, operating drain to waste. As tuning of the system progressed, average water use was reduced to approximately 5 gallons per day drain to waste. The Company believes that through additional tuning, more water savings for drain to waste and under recirculated operation can be achieved, and water use could be reduced by as much as 98% overall. Under 2,000 watts of high-pressure sodium lighting, the aeroponic system produced 3.1 pounds of dried flowers and under 1,040 watts of LED lighting produced 2.8 pounds of dried flowers in its initial test. The Company believes that with additional tuning, yield can be increased.

On September 28, 2015, the Company and Tweed mutually agreed to extend collaborative research and development for an additional two years. The Company is now in the process of providing specifications and costs to build out 5,000 square feet of aeroponic production space at the Tweed facility in Smiths Falls. As part of the design-build process, the Company will be incorporating prototype testing of our advanced racking system with integrated proprietary HVAC and LED lighting systems that incorporate the Company's patent pending aeroponic process.

CLARA Design-Build Project

On March 31, 2015 the Company announced the signing of a LOI with the City of Pasadena, Texas to fund the establishment and provisioning of an indoor agricultural facility (vertical farm) to be located in Pasadena, Texas. Under the LOI, the City was to provide Indoor Harvest, or a partner of their designation with City approval, with two facilities owned by the City for the sum of ten dollars ($10.00) per annum for a period not to exceed twenty (20) years as well as provide tax abatements on these properties for use in the construction of a Community Located Agricultural Research Area ("CLARA") project. In addition, the Pasadena Second Century Corp. (economic development entity for the City of Pasadena) has been asked by City officials to consider a budgetary proposal of $500,000 as seed money for the project's economic development portion in north Pasadena.

The CLARA project, based on current negotiations, is expected to be divided into two phases. Phase One will focus on developing the non-profit aspects of the project and is envisioned to include the construction of a 6,000 sq. ft. vertical farm R&D facility and 6,000 sq. ft. of classroom and office space. Phase Two is envisioned to support a commercial retail operation on approximately two acres of land and additional properties adjacent to the vertical farm and education centers.

The Phase One vertical farm facility is intended to serve dual roles, with Indoor Harvest using the facility as a demonstration farm and R&D facility and Harris County BUILD Partnership, a non-profit group, using the facility for educational and charitable purposes. It is anticipated that the crops grown will be donated, or sold at cost, to provide fresh produce to low income families in the North Pasadena area. The entire proposed campus area, almost two city blocks, will be designed and built to allow the flow of tourists without impacting operations. The City has been asked to develop a project overview to be presented in August to department heads at the Pasadena Independent School District's Kirk Lewis Career & Technical High School and the Continuing and Professional Development Department of San Jacinto College regarding academic curriculum development to be located at the CLARA campus.

Phase Two of the project is anticipated to be developed on two acres of land and additional buildings currently available adjacent to the existing properties being provided by the City. Indoor Harvest, as the primary developer of the campus, expects to be able to provide commercial operators who build on the CLARA campus a unique group of incentives and key advantages in regards to distribution, manufacturing intelligence and access to resourcing and key agricultural production talent. The City of Pasadena is currently working to secure additional land surrounding the CLARA campus for use by commercial partners.

In addition, City officials are currently considering creating a tax increment reinvestment zone (TIRZ) in the immediate area surrounding the CLARA campus. A TIRZ is a public financing structure that Texas law allows to target tax revenue helping to support redevelopment in underserved areas. Such a zone, if created, could provide an additional economic incentive for tangential services to locate on the project site. As of now, the City is not obligated to create a TIRZ zone and no such zone may ever come to fruition.

We are currently in the final stages of negotiating terms with City Farms America, LLC and EB5 Solutions, LLC, to build commercial operations on the CLARA campus. EB5 Solutions would be responsible for providing investment capital to City Farms America for the construction with terms that include a multi-State expansion plan of the CLARA model. Indoor Harvest would act as the primary design-build contractor for both CLARA construction and future expansion plans. We are currently negotiating terms with City Farms America and EB5 Solutions in connections with the MOU for CLARA. As of the date of this Report, we do not yet have a binding agreement with these entities.

The unique multi-participant nature of the CLARA project has made the process of finalizing the necessary lease and economic development language of the agreement between the City of Pasadena and Indoor Harvest Corp. much more time consuming than originally anticipated. Not finding a previous agreement like this one to model meant each step required determining and defining the individual responsibilities of the City, Harris County, Pasadena Independent School System, San Jacinto College and Indoor Harvest Corp. and incorporating those responsibilities into the agreement in a way the City Attorney would recognize.

There has been no material change in the terms the City has offered, or Indoor Harvest has accepted, from the original Letter of Intent of April 4, 2015. There has been no action by City Council members or the mayor to date that indicates any lack of support for the agreement. The mayor has approved the City liaison to the CLARA project to provide a whitepaper to City Council members as soon as possible and before a vote on the project that will outline in summary the details of CLARA, Indoor Harvest’s role, the critical part the CLARA project plays in the BUILD partnership and disbursement of $250,000 in BUILD grant funds.

The City and the BUILD partnership participants are eager to get the agreement formalities behind us and move on to the IHC final environmental approval so that work may begin on refitting the facilities. All final legal approvals have been given and the mayor has scheduled it for a November 17, 2015, City Council vote. The agreement may require a second reading and Council vote at the next regularly scheduled session if legally necessary after passage on first reading but that has not been conclusively determined yet.

On April 15, 2015, the Company signed a LOI with PUE 1.0. Under the terms of the letter of intent, it is anticipated that a final agreement will include the following terms: Indoor Harvest will be responsible for the design of a vertical farming system and its related systems. PUE 1.0 will be responsible for the design of a HVAC system to be used with Indoor Harvest's vertical farming design. Both parties have agreed to share any data during the development stage. PUE 1.0 will retain all rights to its intellectual property and any new intellectual property developed as part of the collaboration. Indoor Harvest will be provided exclusive rights to market and distribute the final design for a period to be determined by way of a memorandum of understanding, to be finalized in connection with the closing of terms outlined in our letter of intent with the City of Pasadena. During the development stage, all equipment to be provided by PUE 1.0 for the purpose of the technology and economic pilot to be constructed at the 112 N Walter property will be provided at cost.

We are an "emerging growth company" ("EGC") that is exempt from certain financial disclosure and governance requirements for up to five years as defined in the Jumpstart Our Business Startups Act ("the JOBS Act"), that eases restrictions on the sale of securities; and increases the number of shareholders a company must have before becoming subject to the U.S. Securities and Exchange Commission's (SEC's) reporting and disclosure rules (See "Emerging Growth Companies" section above). We have elected to use the extended transition period for complying with new or revised accounting standards under Section 102(b)(2) of the Jobs Act, that allows us to delay the adoption of new or revised accounting standards that have different effective dates for public and private companies until those standards apply to private companies. As a result of this election, our financial statements may not be comparable to companies that comply with public company effective dates.

Our operational expenditures are primarily related to developing our line of productions, developing our in-house manufacturing and fabrication facilities, engaging in projects to refine our products, negotiating agreements related to our business focus and the costs related to being a fully reporting company with the Securities and Exchange Commission.

Results of Operations

We are in the process of developing our products and services. Consequently, we have not generated revenues as of September 30, 2015, although as described above we have begun to generate revenues thereafter. We have an accumulated deficit and have incurred operating losses since our inception and expect losses to continue during 2015. Our auditor has indicated in their Report that these conditions raise substantial doubt about our ability to continue as a going concern.

We cannot guarantee we will be successful in our business operations. Our business is subject to risks inherent in the establishment of a new business enterprise, including the financial risks associated with the limited capital resources currently available to us for the implementation of our business strategies. To become profitable and competitive, we must develop the business plan and execute the plan.

For the three month period ended September 30, 2015 vs. September 30, 2014

For the three months ended September 30, 2015 and 2014, we had a net loss of $381,587 and $111,075, respectively. The primary driver behind the increase in the loss was attributable to the increase in expenses as noted below.

For the three months ended September 30, 2015 and 2014, we incurred $380,932 and $111,081, respectively, in operating expenses. The increase in our operating expenses is due to increases in costs related to increased payroll costs, depreciation expense, travel expenses, marketing expenses, listing expenses to have our common stock traded on the OTCQB and professional expenses related to being a SEC reporting Company.

Our expenses related to research and development for the three months ended September 30, 2015 and 2014 were $5,459 and $20,956, respectively. The reduction in research and development expenses was due to collaborations in which research and development costs are shared.

For the nine month period ended September 30, 2015 vs. September 30, 2014.

For the nine months ended September 30, 2015 and 2014, we had a net loss of $971,453 and $314,937, respectively. The primary driver behind the increase in the loss was attributable to the increase in expenses as noted below.

For the nine months ended September 30, 2015 and 2014, we incurred $960,734 and $315,086, respectively, in operating expenses. The increase in our operating expenses is due to increases in costs related to increased payroll costs, depreciation expense, travel expenses, marketing expenses, listing expenses to have our common stock traded on the OTCQB and professional expenses related to being a SEC reporting Company.

Our expenses related to research and development for the nine months ended September 30, 2015 and 2014 were $17,987 and $21,966, respectively. The reduction in research and development expenses was due to collaborations in which research and development costs are shared.

Deferred rent payable at September 30, 2015 was $9,590. Deferred rent payable is the sum of the difference between the monthly rent payment and the straight-line monthly rent expense of an operating lease that contains escalated payments in future periods.

As of September 30, 2015 we had total liabilities of $67,995, while at December 31, 2014, we had total liabilities of $21,245. The increase in liabilities was due to accrued payroll, deferred rent and a $36,100 note payable to Wells Fargo Bank for tooling equipment. The tooling will be used to manufacture our aeroponic AGT fixtures.

Liquidity and Capital Resources

We anticipate taking the following steps to implement our business plan for the next 12 months. Our capital requirements for implementation of these steps are estimated at $5,000,000 as set forth in the table below. For the next 12 months, we anticipate engaging in the following operational activities, although we may vary our plans depending upon operational conditions and available funding:

|

Event

|

Actions

|

|

Estimated Time

|

|

|

Estimated Cost

|

|

|

CLARA Phase I

|

Construct Demonstration Vertical Farm

|

|

|

Q4 2015- Q3 2016

|

|

|

$

|

3,500,000

|

|

|

CLARA Phase II

|

Develop Commercial Retail Campus at CLARA

|

|

|

Q1 2016- Q4 2016

|

|

|

$

|

500,000

|

|

|

Operational Expansion

|

Expand Team, Marketing and Tooling

|

|

|

Q4 2015- Q3 2016

|

|

|

$

|

1,000,000

|

|

As of November 8, 2015, we had $199,895 in our bank account and had credit lines totaling $26,300 of which $19,581 was available for use.

The total estimated costs to maintain minimal operational activities during the next 12 months is $314,144, plus an estimated $75,000 in maintaining public company reporting requirements, as set forth below. In order to fully implement our Plan of Operations for the next 12 months, we will need an additional $5,000,000. If we are unable to raise additional funds through private placements, registered offerings, debt financing or other sources we may need to postpone the development of our business plan. Without additional funding, we may only be partially successful or completely unsuccessful in implementing our business plan.

In order to fund the CLARA activities and our expansion plans under our business plan described above, the Company plans to commence a private placement under Regulation D, Rule 506(c) for up to 5,000,000 shares of Series A Convertible Preferred Stock at a price of $1.00 per share for maximum gross proceeds of $5,000,000. There is no assurance that we will commence this private placement or, if commenced, that we will raise any or all of the funds in this proposed offering.

Management has no written or oral agreement to advance additional funds. If we do not secure additional funds either from operational cash flow and services or additional debt or equity financing, the implementation of our planned future business development activities will be delayed. We are currently working on projects to start generating cash flow. We anticipate that our current cash on hand plus cash flow we expect to start generating during the next 12 months will enable us to maintain minimum operations and working capital requirements for at least the next twelve months.

Our estimated day-to-day operational costs, exclusive of those costs in our Plan of Operations for the next 12 months, as set forth above, are estimated to be approximately $314,144 to maintain minimal operational activities during the next 12 months. Our minimal annual operating expenses include our previously executed employment agreement with our CEO and sole founder for a salary of $70,000 annually, non-management salaries and consultants of $170,144, our lease agreement for our 10,000 sq. ft. facility of $50,400 per year, our estimated annual utility expenses of $10,800 and $12,800 in miscellaneous operating expenses. In addition, we will have $75,000 in costs related to maintaining our publicly traded status over the next 12 months. However, as stated above, in order to implement our Plan of Operations for the next 12 months we will need to secure an additional $5,000,000 in funds. If we are unable to secure the necessary additional funds, we will not be able to undertake some or all of our planned business development activities. Accordingly, we anticipate, based upon the assumption of $389,144 in our minimal day-to-day operational and public company reporting costs during the next 12 months as set forth above, a minimum average monthly burn rate of no more than $32,428 during the next 12 months, which will be paid from our existing funds, plus cash flow we expect to start generating during the next 12 months.

We are actively engaged in a number of projects which could generate cash flow. In addition to our current design-build agreements and equipment sales, the Company is currently negotiating one additional design-build agreement, has provided bids on four projects and is currently preparing bids on two additional projects. However we have no final agreements concerning these potential future projects and we may not ever secure final agreements.

Based upon the assumption of our monthly burn rate exclusive of those costs in our Plan of Operations for the next 12 months as set forth above, the Company currently has sufficient funds to meet our current estimated day-to-day operations, plus SEC filing costs for the next 6 months. Assuming the burn rate continues for the first half of fiscal year 2016, we will need to secure additional funds of $189,249 either through capital raise or operating revenues to meet our minimal operating requirements for the next 12 months. There is no assurance we will obtain these funds and thus if we don't, and we don't take other measures such as cutting back operational activities, we may not have sufficient funds to continue operations for the next 12 months.

We have not generated revenues as of the date of this Report. We have an accumulated deficit and have incurred operating losses since our inception and expect losses to continue during 2015. Our auditor has indicated in their Report that these conditions raise substantial doubt about our ability to continue as a going concern.

Off-Balance Sheet Arrangements

We do not have any off-balance sheet arrangements.

Critical Accounting Policies and Estimates

For a discussion of our accounting policies and related items, please see the Notes to the Financial Statements, included in Item 1.

Item 3. Quantitative and Qualitative Disclosure about Market Risk.

Not applicable.

Item 4. Controls and Procedures.

Evaluation of Disclosure Controls and Procedures

The Company maintains disclosure controls and procedures (as defined in Rule 13a-15(e) under the Securities Exchange Act) that are designed to ensure that information required to be disclosed in the Company's Securities Exchange Act reports is recorded, processed, summarized and reported within the time periods specified in SEC rules and forms, and that such information is accumulated and communicated to the Company's management, including its Chief Executive Officer/Chief Financial Officer, as appropriate, to allow timely decisions regarding required disclosure.

The Company's management, consisting solely of the Company's Chief Executive Officer/Chief Financial Officer, has evaluated the effectiveness of the Company's disclosure controls and procedures as of the end of the period covered by this report. Based upon that evaluation, the Chief Executive Officer/Chief Financial Officer has concluded that, as of the end of the period covered by this report, the Company's disclosure controls and procedures were effective.

Changes in Internal Control over Financial Reporting

There have not been any changes in the Company's internal control over financial reporting (as such term is defined in Rule 13a-15(f) under the Securities Exchange Act) during the fiscal quarter ended September 30, 2015 that have materially affected, or are reasonably likely to materially affect, the Company's internal control over financial reporting.

PART II — OTHER INFORMATION

Item 1. Legal Proceedings.

None.

Item 2. Unregistered Sales of Equity Securities and Use of Proceeds.

During the quarter ended September 30, 2015, the Company issued a total of 300,000 shares of Common stock at $0.50 per share to 1 U.S Investor for cash totaling $150,000.

We relied upon Section 4(2) of the Securities Act of 1933, as amended for the above issuance. We believed that Section 4(2) of the Securities Act of 1933 was available because:

|

· |

None of these issuances involved underwriters, underwriting discounts or commissions. |

|

· |

Restrictive legends were and will be placed on all certificates issued as described above or noted in our Transfer Agent records. |

|

· |

The distribution did not involve general solicitation or advertising. |

|

· |

The distributions were made only to investors who were sophisticated enough to evaluate the risks of the investment. |

All of these investors had access to our SEC filings plus the opportunity to obtain additional information upon request.

Item 3. Defaults Upon Senior Securities.

None.

Item 4. Mine Safety Disclosures.

Not applicable.

Item 5. Other Information.

Not applicable.

|

Exhibit No.

|

|

Document Description

|

| |

|

|

|

31.1

|

|

|

|

32.1 *

|

|

|

|

99.1

|

|

Press release. |

|

Exhibit 101

|

|

Interactive data files formatted in XBRL (eXtensible Business Reporting Language): (i) the Consolidated Balance Sheets, (ii) the Consolidated Statements of Operations, (iii) the Consolidated Statements of Cash Flows, and (iv) the Notes to the Consolidated Financial Statements.**

|

| |

XBRL Taxonomy Extension Schema Document** |

|

|

XBRL Taxonomy Extension Calculation Linkbase Document**

|

|

|

XBRL Taxonomy Extension Definition Linkbase Document**

|

|

|

XBRL Taxonomy Extension Label Linkbase Document**

|

|

|

XBRL Taxonomy Extension Presentation Linkbase Document**

|

____________

* This exhibit shall not be deemed filed for purposes of Section 18 of the Securities Exchange Act of 1934 or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933 of the Securities Exchange Act of 1934, whether made before or after the date hereof and irrespective of any general incorporation language in any filings.

** XBRL (Extensible Business Reporting Language) information is furnished and not filed or a part of a registration statement or prospectus for purposes of Sections 11 or 12 of the Securities Act of 1933, as amended, is deemed not filed for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, and otherwise is not subject to liability under these sections.

In accordance with the requirements of the Exchange Act, the registrant caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Indoor Harvest Corp, a Texas corporation

|

Title

|

|

Name

|

|

Date

|

|

Signature

|

|

|

|

|

|

|

|

|

|

Principal Executive Officer

|

|

Chad Sykes

|

|

November 13, 2015

|

|

/s/ Chad Sykes

|

In accordance with the Exchange Act, this Report has been signed below by the following persons on behalf of the Registrant and in the capacities and on the dates indicated.

|

SIGNATURE

|

|

NAME

|

|

TITLE

|

|

DATE

|

|

|

|

|

|

|

|

|

|

/s/ Chad Sykes

|

|

Chad Sykes

|

|

Principal Executive Officer,

Principal Financial Officer and

Principal Accounting

|

|

November 13, 2015

|

19

Exhibit 31.1

CERTIFICATION

I, Chad Sykes, certify that:

1. I have reviewed this report on Form 10-Q of Indoor Harvest Corp;

2. Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by this report;

3. Based on my knowledge, the financial statements, and other financial information included in this report, fairly present in all material respects the financial condition, results of operations and cash flows of the registrant as of, and for, the periods presented in this report;

4. I am responsible for establishing and maintaining disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) and internal control over financial reporting (as defined in Exchange Act Rules 13a-15(f) and 15d-15(f)) for the registrant and have:

a) designed such disclosure controls and procedures, or caused such disclosure controls and procedures to be designed under our supervision, to ensure that material information relating to the registrant, including its consolidated subsidiaries, is made known to us by others within those entities, particularly during the period in which this report is being prepared;

b) designed such internal control over financial reporting, or caused such internal control over financial reporting to be designed under our supervision, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles;

c) evaluated the effectiveness of the registrant's disclosure controls and procedures and presented in this report our conclusions about the effectiveness of the disclosure controls and procedures, as of the end of the period covered by this report based on such evaluation; and

d) disclosed in this report any change in the registrant's internal control over financial reporting that occurred during the registrant's most recent fiscal quarter (the registrant's fourth fiscal quarter in the case of an quarterly report) that has materially affected, or is reasonably likely to materially affect, the registrant's internal control over financial reporting; and

5. I have disclosed, based on our most recent evaluation of internal control over financial reporting, to the registrant's auditors and the audit committee of the registrant's board of directors (or persons performing the equivalent function):

a) all significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect the registrant's ability to record, process, summarize and report financial information; and

b) any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal control over financial reporting.

|

|

Indoor Harvest Corp

|

|

|

|

|

|

|

|

Dated: November 13, 2015

|

By:

|

/s/ Chad Sykes

|

|

|

|

|

Chad Sykes

|

|

|

|

|

Chief Executive Officer/Chief Financial Officer

|

|

Exhibit 32.1

CERTIFICATION PURSUANT TO

18 U.S.C. SECTION 1350,

AS ADOPTED PURSUANT TO

SECTION 906 OF THE SARBANES-OXLEY ACT OF 2002

Pursuant to 18 U.S.C. § 1350, as adopted pursuant to Pursuant to Section 906 of the Sarbanes-Oxley Act of 2002, the undersigned hereby certifies that the Quarterly Report on Form 10-Q for the period ended September 30, 2015 of Indoor Harvest Corp (the "Company") fully complies with the requirements of Section 13(a) or Section 15(d) of the Securities Exchange Act of 1934 and that the information contained in such Report fairly presents, in all material respects, the financial condition and results of operations of the Company.

|

|

Indoor Harvest Corp

|

|

|

|

|

|

|

|

Dated: November 13, 2015

|

By:

|

/s/ Chad Sykes

|

|

|

|

|

Chad Sykes

|

|

|

|

|

Chief Executive Officer/Chief Financial Officer

|

|

A signed original of this written statement required by Section 906, or other document authenticating, acknowledging, or otherwise adopting the signature that appears in typed form within the electronic version of this written statement required by Section 906, has been provided to Indoor Harvest Corp and will be retained by Indoor Harvest Corp and furnished to the Securities and Exchange Commission or its staff upon request.

Exhibit 99.1

Indoor Harvest Corp Releases Key Third Quarter Summary, Sets Out Future Plans.

Houston, Texas, November 13, 2015 — Indoor Harvest Corp (OTCQB:INQD), through its brand name Indoor Harvest®, is a full service, state of the art design-build engineering firm for the indoor and vertical farming industry. Providing production platforms and complete custom designed build outs for both greenhouse and building integrated agriculture grows, tailored to the specific needs of virtually any cultivar. The Company is pleased to announce results for the nine months ended, September 30, 2015 as well as subsequent events. Our complete Third Quarter Form 10-Q Report can be downloaded from our website under the "investors" section, or through the SEC's website at http://www.sec.gov.

Mr. Chad Sykes, Chief Executive Officer of Indoor Harvest, stated, "With our current revenue generating operations we have reached another key milestone in our Company's operating history. In the third quarter of 2015 we began offering design-build and equipment packages to commercial clients. To date we have secured two design-build agreements and equipment orders and are in serious negotiations for several more which, although there’s no assurance, we hope to close in the near future. The full performance of our existing design-build agreements exceed a rough order magnitude (ROM), pre-construction estimate of $3.5M. This ROM estimate is a ‘ball park’ price and not considered the final price. Once the design process is complete a detailed, or definitive full performance estimate is provided. There is no guarantee that we will reach full performance on any of our existing or future contracts, but we have received earnest money payments and begun the design and engineering process for actual design-build and equipment packages. In addition, we have begun work on a $16,000 equipment order and just today received a $30,000 deposit on a $89,000 equipment package.”