Hitachi Construction Offers $527.4 Million for Australia's Bradken

October 03 2016 - 7:30AM

Dow Jones News

MELBOURNE, Australia—Australian manufacturer Bradken Ltd., a

frequent bid target in recent years, has accepted a 688.5 million

Australian dollar (US$527.4 million) offer from Japanese

construction and mining-machinery supplier Hitachi Construction

Machinery Co.

Hitachi Construction said in a statement released to the

Australian stock exchange on Monday that it would offer A$3.25 a

share for all of Bradken. In the absence of a superior bid and

subject to an independent expert concluding the offer was fair,

Bradken's board unanimously recommended shareholders vote to accept

the deal.

"It lets Bradken, which has a proud history in mining and

industrial services, join with one of the world's largest machinery

companies," said Phil Arnall, chairman of the Australian

company.

Bradken, which named Mr. Arnall as chairman in September 2015

and in February appointed Paul Zuckerman as its new chief

executive, earlier this year said it would seek to divest noncore

operations as it tightened focus on its mining-parts and North

American-engineered productions divisions. It narrowed its net loss

to A$195.9 million in the year ended June 30 and reduced its debt

12% to A$352.4 million.

In April, Bradken rejected a recapitalization proposal from

Champ Private Equity that would have seen Champ's stake in the

company jump from 3.1% to as much as 49.9%.

In mid-2015, a consortium of Champ and Sigdo Koppers SA proposed

a merger between Bradken and Sigdo's Magotteaux Group subsidiary,

but the suitors ended talks in September that year. Earlier that

year, Bradken's board turned down a nonbinding takeover bid from

Koch Industries Inc. and Pacific Equity Partners, and at the start

of 2015 Pacific Equity Partners and Bain Capital LLC ceased

takeover talks with Bradken after their approach was roiled by

turmoil in financial and commodity markets.

On Monday, Bradken said the agreed offer from Hitachi

Construction marked a 34% premium to the previous closing price for

its shares.

The offer is conditional on Hitachi Construction securing more

than 50% of Bradken's shares and relevant regulatory approvals. The

Japanese company, which is about 50% owned by Hitachi Ltd., has

agreed to provide Bradken with a A$450 million credit facility to

help it, if necessary, repay U.S. private placement notes it has

issued.

Write to Robb M. Stewart at robb.stewart@wsj.com

(END) Dow Jones Newswires

October 03, 2016 07:15 ET (11:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

Hitachi (PK) (USOTC:HTHIY)

Historical Stock Chart

From Apr 2024 to May 2024

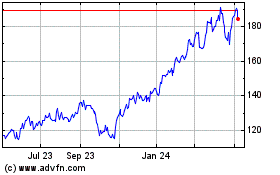

Hitachi (PK) (USOTC:HTHIY)

Historical Stock Chart

From May 2023 to May 2024