UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

6-K

REPORT

OF FOREIGN PRIVATE ISSUER

PURSUANT

TO RULE 13a – 16 OR 15d – 16 UNDER THE

THE

SECURITIES EXCHANGE ACT OF 1934

For

the month of November, 2018

Commission

File No. 0-53646

Grown

Rogue International Inc. (formerly: Novicius Corp.)

|

(Translation

of Registrant’s name into English)

1

King Street West, Suite 1505

Toronto,

Ontario, Canada M5H 1A1

|

(Address

of principal executive office)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40F.

Form

20-F ☒ Form 40-F ☐

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes

☐ No ☒

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes

☐ No ☒

TABLE

OF CONTENTS

1.

Grown Rogue International Inc. (formerly: Novicius Corp.), Material Change Report dated November 2, 2018, as

filed on Sedar on November 8, 2018.

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned thereunto duly authorized.

|

Dated: November

8, 2018

|

GROWN

ROGUE INTERNATIONAL INC

.

|

|

|

(Formerly:

Novicius Corp.)

|

|

|

|

|

|

|

By:

|

/s/

James Cassina

|

|

|

Name: James

Cassina

|

|

|

Title: Chief

Financial Officer

|

FORM

51-102F3

MATERIAL CHANGE REPORT

|

|

Item

1.

|

Name

and Address of Company

|

Novicius

Corp. (“

Novicius

”

or the "

Company

")

Suite

1505, 1 King Street West,

Toronto,

Ontario, M5H 1A1

|

|

Item

2.

|

Date

of Material Change

|

November

1, 2018

Novicius

issued a press release with respect to the material change referred to in this report via a Canadian news wire service on November

1, 2018, a copy of which has been filed on SEDAR.

|

|

Item

4.

|

Summary

of Material Change

|

The

Company announced that the Canadian Securities Exchange (the “

CSE

”)

has conditionally approved the reverse-takeover transaction as described below (the “

Transaction

”)

between the Company and Grown Rogue Unlimited, LLC, an Oregon limited liability company (“

Grown Rogue

”)

as previously announced in the Company’s press releases dated September 28, 2017, October 2, 2017, March 29, 2018 and July

12, 2018. The Transaction will result in the listing of the resulting issuer's (the “

Resulting Issuer

”)

common shares on the CSE, with such listing to be effective concurrently with the completion of the Transaction. The Transaction

remains subject to the final approval of the CSE.

|

|

Item

5.

|

Full

Description of Material Change

|

Upon

receipt of conditional approval, the Company entered into a definitive agreement with Grown Rogue dated October 31, 2018 (the

“

Definitive Agreement

”) to acquire a 100% interest in Grown Rogue by way of a securities exchange between the

Company and all of the unitholders of Grown Rogue, which will constitute a reverse takeover of the Company by the unitholders

of Grown Rogue (the “

GR Acquisition

”). Pursuant to the Transaction, the issued and outstanding units of Grown

Rogue will be exchanged for common shares of the Company on a one (1) unit for one (1) share basis for a deemed price of C$0.44

per share and all outstanding convertible securities of Grown Rogue will be exchanged for convertible securities of the Resulting

Issuer.

Concurrently

with the GR Acquisition, the Company will also acquire Grown Rogue Canada Inc. (“

GRC

”), a related company to

Grown Rogue, pursuant to a three-cornered amalgamation under the

Business Corporations Act

(Ontario). The acquisition of

GRC will result in the Company acquiring all the funds raised by GRC through a brokered subscription receipt offering. As of the

date of this release, GRC has sold a total of 6,193,916 subscription receipts for total gross proceeds of C$2,725,323. See the

Company’s press release dated July 12, 2018 for more details relating to this offering.

As

a pre-closing condition of the Transaction, the Company has changed its name to “Grown Rogue International Inc.” and

effected the consolidation of its common shares on the basis of 1.4 pre-consolidation common share into (1) post-consolidation

common share such that as of this date there are 3,773,689 post-consolidation common shares issued and outstanding in the capital

of the Company. The new CUSIP Number is 39986R106 and the ISIN Number is CA39986R1064.

The

completion of the Transaction is subject to certain other additional conditions precedent, including, but not limited to: (i)

the completion of the GR Acquisition (ii) the approval of the Transaction by each of the Company’s and Grown Rogue’s

respective board of directors and managers; (iii) the approval of the shareholders of the Company as required by CSE policies;

(iv) the approval of the unitholders of Grown Rogue and the shareholders of GRC; (v) the approval from the CSE to list the Resulting

Issuer’s shares; (vi) the absence of any material change or change in a material fact which might reasonably be expected

to have a material adverse effect on the financial and operational conditions on the assets of each of the parties to the Definitive

Agreement; and (vii) certain other conditions typical in a transaction of this nature.

Financings

by Grown Rogue

As

part of the Transaction, Grown Rogue has completed a non-brokered private placement of subscription receipts for gross proceeds

of C$1,646,050 with each GRUS Subscription Receipt being sold for C$0.44. Under its terms, each GRUS Subscription Receipt is automatically

converted and immediately cancelled, without any further action by the holder of such GRUS Subscription Receipt, and for no additional

consideration, into one unit of Grown Rogue upon the satisfaction of the following conditions, among others: (a) GRC shall have

sold subscription receipts for not less than C$2,490,000 in aggregate gross proceeds; (b) requisite shareholder and regulatory

approvals of the Transaction including, but not limited to, conditional approval of the CSE for the listing of the Resulting Issuer’s

shares; and (c) all documents and instruments have been tabled for the concurrent closing of the Transaction. Each GR Unit consists

of one common unit and one Grown Rogue purchase warrant. Each warrant is exercisable into one common unit of Grown Rogue at an

exercise price of C$0.55 per unit for 24 months. The common units and purchase warrants will be exchanged on closing of the Transaction

for common shares and purchase warrants of the Resulting Issuer on substantially the same terms.

Separate

from the GRUS Subscription Receipt offering, Grown Rogue has also completed an offering of units with a single investor for gross

proceeds of C$649,351 with each unit being sold for C$0.44. Each unit consists of one common unit of Grown Rogue and one purchase

warrant. Each warrant is exercisable into one common unit of Grown Rogue at an exercise price of C$0.55 per unit for 24 months.

The common units and purchase warrants will be exchanged on closing of the Transaction for common shares and warrants of the Resulting

Issuer on substantially the same terms.

Additionally,

Grown Rogue completed a private placement of convertible debentures (the “

Debentures

”) for gross proceeds of

C$1,500,000. A rate of interest of 2% per quarter from the date of issuance of the Debentures is payable quarterly in arrears

on the last day of March, June, September and December of each year. The Debentures mature 24 months from the date of issuance.

The Debentures are convertible into common units of Grown Rogue at a price of C$0.44 per unit and the Debentures are secured by

a general security agreement granting a security interest in all of Grown Rogue’s and its subsidiaries' property and assets.

As part of Grown Rogue’s Debenture offering, GRC issued an aggregate of 3,409,091 warrants to the purchasers of the debentures.

Each purchase warrant is exercisable into one common shares of GRC at an exercise price of C$0.55 per unit for 24 months. The

Debentures and warrants will be exchanged for debentures and warrants of the Resulting Issuer, on substantially the same terms,

upon the completion of the Transaction.

Directors

and Senior Officers of the Resulting Issuer

Subject

to and following the closing of the Transaction, the directors and senior officers of the Resulting Issuer are expected to be

the following individuals:

J.

Obie Strickler – President, Chief Executive Officer and Director

Mr.

Strickler is the CEO, President and founder of Grown Rogue. He founded Canopy Management, LLC in 2015 to consolidate the three

medical facilities he had operated since 2006 within one company. Mr. Strickler formed Grown Rogue in 2016 and entered the Oregon

recreational cannabis market with a plan to build a multi-national cannabis brand. Mr. Strickler has been active in the Oregon

medical marijuana market since early 2000 where he organically scaled a single 15 plant property to four separate facilities with

approximately 200 outdoor plants and 30 lights operating indoors. Mr. Strickler has a BS in Geology from Southern Oregon University

and is also an Oregon Professional Geologist.

Michael

Johnston – Chief Financial Officer and Corporate Secretary

Mr.

Johnston is a graduate of Western University, and joined Forbes Andersen LLP, Chartered Professional Accountants in 2004 and became

a partner in 2012. Mr. Johnston has over 10 years of experience with both private and public companies in various capacities,

including that of Chief Financial Officer.

Jacques

Habra – Chief Strategy Officer

Mr.

Habra is the Chief Strategy Officer of Grown Rogue responsible for branding, marketing, communications, and strategy. Mr. Habra

is an award-winning entrepreneur who has launched multiple companies with successful exits in various sectors including technology,

electronics, and real estate. Mr. Habra graduated from the University of Michigan with a degree in English and Philosophy with

Honors.

Abhilash

Patel – Director

Mr.

Patel is a serial entrepreneur, venture investor, speaker, and philanthropist. He is currently founder & principal at Lotus

Capital, an early-stage investment fund in Santa Monica, CA. Mr. Patel holds a Bachelor of Arts in Economics and Philosophy from

Columbia University, and a Master of Business Administration from the University of California, Los Angeles’ Anderson School

of Management.

Stephen

Gledhill – Director

Mr.

Gledhill is a founding member and Managing Director of RG Mining Investments Inc. and RG Management Services Inc., both of which

are accounting, administrative and corporate secretarial services companies. In 1992, he formed Keshill Consulting Associates

Inc., a boutique management consulting practice. Mr. Gledhill has over 25 years of financial-control experience and acts as CFO

and Corporate Secretary for multiple publicly-traded companies, several of which he was instrumental in scaling-up and taking

public. Mr. Gledhill is a Chartered Public Accountant and Certified Management Accountant and holds a Bachelor of Math Degree

from the University of Waterloo.

|

|

Item

6.

|

Reliance

on Subsection 7.1(2) of National Instrument 51-102

|

Not

Applicable.

|

|

Item

7.

|

Omitted

Information

|

No

information has been omitted from this material change report.

|

|

Item

8.

|

Executive

Officer

|

The

following executive officer of the Company is knowledgeable about the material change and this report and may be contacted by

the Commission as follows:

James

Cassina, Chief Financial Officer

Telephone:

416 364-4039

Facsimile: 416

364-8244

November

2, 2018

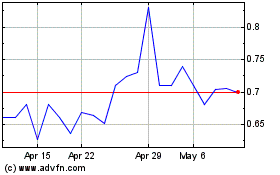

Grown Rogue (QB) (USOTC:GRUSF)

Historical Stock Chart

From Nov 2024 to Dec 2024

Grown Rogue (QB) (USOTC:GRUSF)

Historical Stock Chart

From Dec 2023 to Dec 2024