UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN ISSUER

PURSUANT TO RULE 13a-16 OR 15b-16 OF

THE SECURITIES EXCHANGE ACT OF 1934

For the month of July 2024

Commission File Number 001-35991

AENZA S.A.A.

(Exact name of registrant as specified in its charter)

N/A

(Translation of registrant’s name into English)

Republic of Peru

(Jurisdiction of incorporation or organization)

Avenida Paseo de la República 4667, Lima

34,

Surquillo, Lima

Peru

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

Indicate by check mark whether the registrant by furnishing the information

contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange

Act of 1934.

Yes ☐ No ☒

If “Yes” is marked, indicate below the file number assigned

to the registrant in connection with Rule 12g3-2(b): Not applicable.

In accordance with the provisions set forth in

article 30 of the Unified Text of the Securities Market Law (Texto Único Ordenado de la Ley del Mercado de Valores) approved

by Supreme Decree No. 020-2023-EF, and the Regulation of Relevant Events and Reserved Information (Reglamento de Hechos de Importancia

e Información Reservada), approved by SMV Resolution No. 005-2014-SMV-01, we hereby report as a Relevant Information Communication,

that the Board of Directors of AENZA S. A.A. (the “Company”), held held on the date hereof, unanimously resolved as follows:

| 1. | To call the General Shareholders’ Meeting to be held on first call on August 20, 2024, on second call

on August 26, 2024, and on third call on September 2, 2024, in all cases at 9:00 a.m., via the Teams Platform, to address the following

agenda: |

| a) | Capital increase by new monetary contributions up to the amount in local currency equivalent to US$55’000,000,

exercise of preemptive subscription rights and delegation of powers to the Board of Directors. |

| b) | Delegation and granting of powers for the formalization of resolutions. |

| 2. | To propose to the General Shareholders’ Meeting that the funds from the capital increase to be approved

be used to capitalize the new platform for infrastructure investments resulting from the Company’s Corporate Reorganization process

approved in the General Shareholders Meeting held on February 7, 2024. |

| 3. | To propose to the General Shareholders’ Meeting that the placement price of the shares to be issued

be no less than the VWAP at 60 days, minus 15%. |

| 4. | To propose to the General Shareholders’ Meeting to delegate to the Board of Directors sufficient

powers to, subject to the provisions of the proposals described in the preceding paragraphs: (a) fix the amount of the capital increase

to be offered and the number of shares to be created and the price per share; (b) determine the terms and conditions for the exercise

of the preemptive subscription rights in accordance with the provisions of applicable laws, including the establishment of the record

date and delivery date, as well as the trading term of the preemptive subscription certificates; (c) fix the exchange rate applicable

for the conversion of the monetary contributions from U.S. Dollars to Soles, considering market values; (d) establish the form of representation

of the securities to be issued, in accordance with the provisions of the applicable laws; (e) fix the amount by which the capital will

be increased; (f) determine the procedure to be followed in the event of any shares remaining to be subscribed after the second subscription

round, including the conducting of a private offering of such shares, being able to set the terms and conditions thereof; (g) determine

the issuance of provisional share certificates in accordance with the provisions of the bylaws and applicable laws, as well as the issuance

of definitive shares, including in both cases the establishment of the record date and delivery date; (h) determine the new wording of

article 5 of the Company’s by-laws, which shall reflect the results of the preferential share subscription procedure and the eventual

private offering of unsubscribed shares in the share subscription process; (i) delegate, in turn, to the Management sufficient powers

to approve the terms and conditions of the capital increase without additional approval of the Board of Directors or the General Shareholders’

Meeting; and, (j) approve, fix or execute any complementary act that may be convenient or necessary in order to formalize and improve

the capital increase, without requiring additional approval by the General Shareholders’ Meeting. |

| 5. | To inform that the preemptive subscription certificates to be issued to subscribe the shares to be created

within the framework of the capital increase to be approved, as well as the shares to be issued as a consequence of such capital increase,

have not been and will not be registered under the Securities Act of 1933 of the United States of America, as amended (“U.S. Securities

Act of 1933”, as amended), or under the securities laws of any state or jurisdiction outside Peru. |

In that sense, the preferred subscription

certificates to be issued will be made available to investors only in Peru pursuant to the provisions of the applicable Peruvian legislation

(General Corporations Law, Law No. 26887 and the Unified Text of the Securities Market Law approved by Supreme Decree No. 020-2023-EF),

and may not be offered, sold, resold, transferred, delivered or distributed, directly or indirectly, in or within the United States of

America under the securities laws of that country or in other jurisdictions where this is prohibited. Furthermore, the shares to be issued

may not be offered, sold or subscribed for, directly or indirectly, except in a transaction that is exempt from, or not subject to, the

registration requirements of the U.S. Securities Act of 1933, as amended.

It is hereby expressly stated that

this communication does not constitute an offer for the sale or solicitation of an offer to buy the above-mentioned securities in the

United States of America or any other jurisdiction where such an offer is prohibited, and that the above-mentioned securities may not

be offered for sale in the United States of America without registration or an exemption from registration in accordance with the Securities

Act of 1933, as amended.

| 6. | To call the General Shareholders’ Meeting to be held on first call on August 20, 2024, on second call

on August 26, 2024, and on third call on September 2, 2024, in all cases at 11:00 a.m., via the Teams Platform, to address the following

agenda: |

| a) | Determination of the Company’s number of directors for the August 2024 - March 2027 period. |

| b) | Appointment of the Company’s directors for the August 202 - March 2027 period. |

| c) | Delegation and granting of powers for the formalization of resolutions. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

AENZA S.A.A.

| By: |

/s/ CRISTIAN RESTREPO HERNANDEZ |

|

| Name: |

Cristian Restrepo Hernandez |

|

| Title: |

VP of Corporate Finance |

|

| Date: |

July 24, 2024 |

|

AENZA S.A.A. GENERAL SHAREHOLDERS’ MEETING

First Call – August 20, 2024

Second Call – August 26, 2024

Third Call – September 2, 2024

MOTION N° 1

Capital increase by new monetary contributions

up to the amount in local currency equivalent to US$55’000,000, exercise of preemptive subscription rights and delegation of powers

to the Board of Directors

Whereas:

That, by means of a meeting held on July 24, 2024,

the Board of Directors agreed to request the General Shareholders’ Meeting to approve:

| a) | That a capital increase be performed by new monetary contributions, to use the funds from said capital

increase to capitalize the new platform for infrastructure investments resulting from the Company’s Corporate Reorganization process

approved in the General Shareholders Meeting held on February 7, 2024. |

| b) | That the capital increase be up to the amount in local currency equivalent to US$55’000,000 (fifty-five

million and 00/100 United States Dollars). |

| c) | That the Board of Directors be delegated the power to fix the amount of the capital increase to be offered

and the number of shares to be created and the price per share. |

| d) | That the placement price of the shares for purposes of the preemptive subscription right be no less than

the VWAP at 60 days prior to the date of the General Shareholders Meeting approving the capital increase, minus 15%. |

| e) | That the Board of Directors be delegated the power to determine the terms and conditions for the exercise

of the preemptive subscription right in accordance with the provisions of applicable laws, including the record date and delivery date,

as well as the trading period of the preemptive subscription certificates. |

| f) | That the Board of Directors be delegated the power to set the exchange rate applicable for the conversion

of the monetary contributions from US Dollars to Soles, considering market values. |

| g) | That the Board of Directors be delegated the power to determine the form of representation of the securities

to be issued as a consequence of the capital increase, in accordance with the provisions of the applicable laws, as well as whether provisional

share certificates will be issued and to establish the registration date and delivery date for such purpose. |

| h) | That the Board of Directors be delegated the power to determine the amount by which the capital will be

increased, as well as to establish the registration date and the date of delivery for the issuance of the shares. |

| i) | That the Board of Directors be delegated the power to determine the procedure to be followed in the event

that shares remain available for subscription after the conclusion of the second subscription round, including conducting a private offering

of such shares, being able to set the terms and conditions of such private offering. |

| j) | That the Board of Directors be delegated the power to determine the new wording of article 5 of the Company’s

by-laws, which shall reflect the results of the preferential share subscription procedure and the eventual private offering of unsubscribed

shares in the share subscription process. |

| k) | That the Board of Directors be delegated and authorized to delegate to the Management any other power

or authority that may be considered convenient or necessary to formalize and improve the capital increase to be approved. |

Motion:

To agree on the following:

| (i) | Increase the capital stock by new monetary contributions, under the terms proposed by the Board of Directors. |

| (ii) | To delegate to the Board of Directors sufficient powers to, subject to the provisions of the proposals

described in paragraphs a) to k) of the first preceding recital: (a) fix the amount of the capital increase to be offered and the number

of shares to be created and the price per share; (b) determine the terms and conditions for the exercise of the preemptive subscription

rights in accordance with the provisions of applicable laws, including the establishment of the record date and delivery date, as well

as the trading term of the preemptive subscription certificates; (c) fix the exchange rate applicable for the conversion of the monetary

contributions from U.S. Dollars to Soles, considering market values; (d) establish the form of representation of the securities to be

issued, in accordance with the provisions of the applicable laws; (e) fix the amount by which the capital will be increased; (f) determine

the procedure to be followed in the event of any shares remaining to be subscribed after the second subscription round, including the

conducting of a private offering of such shares, being able to set the terms and conditions thereof; (g) determine the issuance of provisional

share certificates in accordance with the provisions of the bylaws and applicable laws, as well as the issuance of definitive shares,

including in both cases the establishment of the record date and delivery date; (h) determine the new wording of article 5 of the Company’s

by-laws, which shall reflect the results of the preferential share subscription procedure and the eventual private offering of unsubscribed

shares in the share subscription process; (i) delegate, in turn, to the Management sufficient powers to approve the terms and conditions

of the capital increase without additional approval of the Board of Directors or the General Shareholders’ Meeting; and, (j) approve,

fix or execute any complementary act that may be convenient or necessary in order to formalize and improve the capital increase, without

requiring additional approval by the General Shareholders’ Meeting. |

MOTION N° 2

Preemptive subscription right pursuant to a

Peruvian legal mandate

Whereas:

That, in accordance with Article 207 of the General

Corporations Law, Law No. 26887 (“LGS”), and 105 of the Unified Text of the Securities Market Law approved by Supreme

Decree No. 020-2023-EF (“LMV”), in the capital increase by new contributions, the Company’s shareholders have

a preferential right to subscribe, pro rata to their shareholding, the shares that are created.

That, in accordance with Article 208 of the LGS

and Article 108 of the LMV, the preemptive subscription right must be exercised in at least two rounds, in accordance with the procedure

established by the General Shareholders’ Meeting or, if applicable, by the Board of Directors of the Company.

That, furthermore, in accordance with Article

209 of the LGS, Article 106 of the LMV, and Articles 258, 259 and 260 of the Securities Law, Law No. 27287 (“LTV”),

the preemptive subscription right must be incorporated in a title called preemptive subscription certificate, freely transferable - totally

or partially - which confers to its holder the preemptive right to subscribe the new shares in the opportunities, amount, conditions and

procedure established by the General Shareholders’ Meeting or, as the case may be, by the Board of Directors.

That, articles 107 and 110 of the LMV, contain

complementary provisions that must be observed in relation to the preferential subscription certificates to be issued.

That, likewise, by means of the aforementioned

meeting held on July 24, 2024, the Board of Directors informed that the preemptive subscription certificates to be issued to subscribe

the shares to be created within the framework of the capital increase to be approved, as well as the shares to be issued as a consequence

of such capital increase, have not been and will not be registered under the Securities Act of 1933 of the United States of America, as

amended (“U.S. Securities Act of 1933”, as amended), or under the securities laws of any state or jurisdiction outside Peru.

That, in the same sense, the Board of Directors

clarified that the preferred subscription certificates to be issued will be made available to investors only in Peru pursuant to the provisions

of the applicable Peruvian legislation (LGS and LMV), and may not be offered, sold, resold, transferred, delivered or distributed, directly

or indirectly, in or within the United States of America under the securities laws of that country or in other jurisdictions where this

is prohibited. The Board of Directors also clarified that the shares to be issued may not be offered, sold or subscribed for, directly

or indirectly, except in a transaction that is exempt from, or not subject to, the registration requirements of the U.S. Securities Act

of 1933, as amended.

That, finally, the Board of Directors clarified

that this proposal does not constitute an offer to sell or a solicitation of an offer to purchase securities in the United States of America

or to persons in the United States of America.

Motion:

To agree on the following in connection with the

preemptive subscription right derived from the capital increase to be approved:

| (i) | That the preemptive subscription right be exercised in two rounds, under the terms set forth in the LGS,

the LMV, and the LTV and those set forth (or which are a matter of delegation) in the Motion No. 1; and, |

| (ii) | That the preemptive subscription certificates to subscribe the shares of the Company to be created, as

well as the shares to be issued as a consequence of the exercise of the preemptive subscription right -whether such shares are represented

by provisional certificates or definitive certificates-, comply with the legal mandate set forth in the aforementioned provisions, and

will not be registered or offered in the United States of America, as explained by the Board of Directors. |

MOTION N° 3

Delegation and granting of powers for the formalization

of resolutions

Motion:

To grant powers of attorney to certain officers,

so that they may sign, on behalf of the Company, all public and private documents required for the formalization and registration of the

resolutions adopted at the Meeting.

AENZA S.A.A. GENERAL SHAREHOLDERS’ MEETING

First Call – August 20, 2024

Second Call – August 26, 2024

Third Call – September 2, 2024

MOTION N° 1

Determination of the Company’s number

of directors the August 2024 – March 2027 period

Whereas:

That, by means of a meeting held on July 24, 2024,

the Board of Directors agreed to call a General Shareholders’ Meeting to determine the number of the Company’s directors and

to approve the appointment of the Company’s Board of Directors for the August 2024 – March 2027 period.

That, in accordance with the provisions of Article

48 of the Company’s Bylaws and Article 5 of the Regulations of the Board of Directors of the Company, the Board of Directors must

propose to the General Shareholders’ Meeting the number of directors to be elected for the August 2024 – March 2027 period.

That, after an analysis of the complexity of the

Company’s business, the number of Board committees and the frequency of their meetings, it is proposed to the General Shareholders’

Meeting that the number of directors to be appointed for the August 2024 – March 2027 period be set at nine (9).

Motion:

Determine that the Company’s Board of Directors

for the August 2024 – March 2027 period, shall be composed of nine (9) members.

MOTION N° 2

Appointment of directors of the Company for

the August 2024 - March 2027 period

Whereas:

That, by means of a meeting held on July 24, 2024,

the Board of Directors agreed to call the General Shareholders’ Meeting for the appointment of the Company’s Board of Directors

for the August 2024 – March 2027 period.

That, the candidates for the Board of Directors

for the August 2024 – March 2027 period, will be proposed to the General Shareholders Meeting once it has been verified that they

comply with the requirements set forth in the Company’s Board of Directors Regulations.

Motion:

To appoint the members of the Board of Directors

of the Company for the August 2024 – March 2027 period.

MOTION N° 3

Delegation and granting of powers for the formalization

of resolutions

Whereas:

It is necessary to ensure that the resolutions

adopted by the general shareholders’ meeting during this meeting are valid and enforceable against third parties; and

It is proposed to delegate powers to officers

of the Company to achieve the purpose described in the preceding recital.

Motion:

To grant powers of attorney to certain officers,

so that they may sign, on behalf of the Company, all public and private documents required for the formalization and registration of the

resolutions adopted at the Meeting.

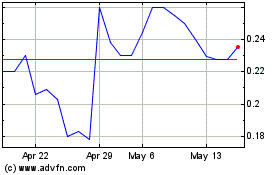

Gold Flora (QB) (USOTC:GRAM)

Historical Stock Chart

From Oct 2024 to Nov 2024

Gold Flora (QB) (USOTC:GRAM)

Historical Stock Chart

From Nov 2023 to Nov 2024