FXCM Reports Monthly Metrics

February 15 2017 - 6:30AM

FXCM Inc. (NASDAQ:FXCM) today announced

certain key customer trading metrics for January 2017 for its

retail and institutional foreign exchange business, excluding Forex

Capital Markets LLC, (“FXCM US”).

January 2017 Customer Trading Metrics from Continuing

Operations (excluding United States business because of imminent

accounts sale and business withdrawal)

Customer Trading Metrics

- Customer trading volume(1) of $253 billion in January

2017, 18% higher than December 2016 and 17% lower than January

2016.

- Average customer trading volume(1) per day of $12.0

billion in January 2017, 18% higher than December 2016 and 21%

lower than January 2016.

- An average of 488,917 client trades per day in January 2017,

15% higher than December 2016 and 18% lower than January 2016.

- Retail Active accounts(2) of 132,008 as of January

31, 2017, a decrease of 448, or 0.3%, from December 31, 2016,

and an increase of 1,281, or 1%, from January 31, 2016.

- Retail Tradeable accounts(3) of 106,206 as of January 31,

2017, an increase of 624, or 0.6% from December 31, 2016, and a

decrease of 2,887, or 3%, from January 31, 2016.

More information, including historical results for each of the

above metrics, can be found on the investor relations page of

FXCM's corporate website www.fxcm.com.

This operating data is preliminary and subject to revision and

should not be taken as an indication of the financial performance

of FXCM Inc. FXCM undertakes no obligation to publicly update or

review previously reported operating data. Any updates to

previously reported operating data will be reflected in the

historical operating data that can be found on the Investor

Relations page of the Company's corporate

website www.fxcm.com.

(1) Volume that FXCM customers traded in period is

translated into US dollars. (2) An Active Account represents

an account that has traded at least once in the previous twelve

months. (3) A Tradeable Account is an account with sufficient

funds to place a trade in accordance with FXCM trading

policies.

Disclosure Regarding Forward-Looking

Statements

In addition to historical information, this release contains

"forward-looking statements" within the meaning of Section 27A of

the Securities Act of 1933, Section 21E of the Securities Exchange

Act of 1934 and/or the Private Securities Litigation Reform Act of

1995, which reflect FXCM's current views with respect to, among

other things, its operations and financial performance in the

future. These forward-looking statements are not historical facts

and are based on current expectations, estimates and projections

about FXCM's industry, business plans, management's beliefs and

certain assumptions made by management, many of which, by their

nature, are inherently uncertain and beyond our control.

Accordingly, readers are cautioned that any such forward-looking

statements are not guarantees of future performance and are subject

to certain risks, uncertainties and assumptions that are difficult

to predict including, without limitation, risks associated with

FXCM’s plans to shut down its US subsidiary and a potential sale of

its US customer accounts, risks associated with FXCM’s strategy to

focus on its operations outside the United States, risks associated

with the events that took place in the currency markets on January

15, 2015 and their impact on FXCM's capital structure, risks

associated with FXCM's ability to recover all or a portion of any

capital losses, risks relating to the ability of FXCM to satisfy

the terms and conditions of or make payments pursuant to the terms

of the finance agreements with Leucadia, as well as risks

associated with FXCM’s obligations under its other financing

agreements, risks related to FXCM's dependence on FX market makers,

market conditions, risks associated with FXCM’s litigation with the

National Futures Association and the Commodity Futures Trading

Commission or any other potential litigation or regulatory

inquiries to which FXCM may become subject, risks associated with

potential reputational damage to FXCM resulting from FXCM’s plans

to shut down its US subsidiary, and those other risks described

under "Risk Factors" in FXCM Inc.'s Annual Report on Form 10-K,

FXCM Inc.'s latest Quarterly Report on Form 10-Q, and other reports

or documents FXCM files with, or furnishes to, the SEC from time to

time, which are accessible on the SEC website at sec.gov. This

information should also be read in conjunction with FXCM's

Consolidated Financial Statements and the Notes thereto contained

in FXCM's Annual Report on Form 10-K, FXCM Inc.'s latest Quarterly

Report on Form 10-Q, and in other reports or documents FXCM files

with, or furnishes to, the SEC from time to time, which are

accessible on the SEC website at sec.gov.

These factors should not be construed as exhaustive and should

be read in conjunction with the other cautionary statements that

are included in this release and in our SEC filings. FXCM Inc.

undertakes no obligation to publicly update or review any

forward-looking statement, whether as a result of new information,

future developments or otherwise, except as required by law.

About FXCM Inc.

FXCM Inc. (NASDAQ:FXCM) is a publicly traded company which

owns 50.1% of FXCM Group, LLC (FXCM Group).

FXCM Group is a holding company of Forex Capital Markets

LLC, (FXCM US), Forex Capital Markets Limited, inclusive of all EU

branches (FXCM UK), FXCM Australia Pty. Limited, (FXCM AU), and all

affiliates of aforementioned firms, or other firms under the FXCM

group of companies [collectively "FXCM"]. FXCM Group is owned and

operated by FXCM Inc. (NASDAQ:FXCM) and Leucadia National

Corporation (NYSE:LUK). Leucadia National Corporation is a

multi-billion dollar diversified holding company engaged through

its consolidated subsidiaries in a variety of businesses.

FXCM is a leading provider of online foreign exchange (FX)

trading, CFD trading, spread betting and related services. The

company's mission is to provide global traders with access to the

world's largest and most liquid market by offering innovative

trading tools, hiring excellent trading educators, meeting strict

financial standards and striving for the best online trading

experience in the market. Clients have the advantage of mobile

trading, one-click order execution and trading from real-time

charts. In addition, FXCM offers educational courses on FX trading

and provides trading tools proprietary data and premium

resources. FXCM Pro provides retail brokers, small

hedge funds and emerging market banks access to wholesale execution

and liquidity, while providing high and medium frequency funds

access to prime brokerage services via FXCM Prime.

Trading foreign exchange and CFDs on margin carries a high level

of risk, which may result in losses that could exceed your

deposits, therefore may not be suitable for all investors. Read

full disclaimer.

Jaclyn Sales, 646-432-2463

Vice-President, Corporate Communications

jsales@fxcm.com

investorrelations@fxcm.com

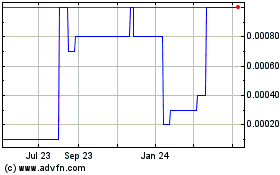

Global Brokerage (CE) (USOTC:GLBR)

Historical Stock Chart

From Dec 2024 to Jan 2025

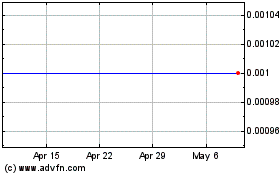

Global Brokerage (CE) (USOTC:GLBR)

Historical Stock Chart

From Jan 2024 to Jan 2025