UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) off The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 24, 2014

GENUFOOD ENERGY ENZYMES CORP.

(Exact name of registrant as specified in charter)

| Nevada | 333-171784 | 68-0681158 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

| Two Allen Center 1200 Smith Street, Suite 1600 Houston, Texas | 77002 |

| (Address of principal executive offices) | (Zip Code) |

(713) 353-8834

Registrant’s telephone number

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a -12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d -2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e -4(c))

Item 1.01. Entry Into a Material Definitive Agreement

Item 3.02. Unregistered Sales of Equity Securities

On September 25, 2014, Genufood Energy Enzymes Corp. (the “Company”) completed a share exchange (the “Share Exchange”) with 100% of the issued and outstanding shares of Natfresh Beverages Corp. (“Natfresh”). The Share Exchange was approved by a majority vote of the shareholders of both the Company and Natfresh, by written consent. Pursuant to the Share Exchange, the Company issued shares of common stock to the shareholders of Natfresh on a 1 for 1 basis. The Company has issued a total of 1,156,460,641 shares of common stock to the shareholders of Natfresh. After the Share Exchange, Natfresh has become a wholly-owned subsidiary of the Company and the Company has acquired all of its assets and liabilities. As of Natfresh’s audited financial statements for the year ended August 31, 2013, Natfresh had total assets of $989,857, including cash of $785,312, total liabilities of $190,445 and stockholders’ equity of $799,412. A copy of Natfresh’s audited financial statements for the year ended August 31, 2013 are included as an exhibit to this Form 8-K.

The shares pursuant to the Share Exchange were issued in reliance upon the exemptions from the registration requirements of the Securities Act of 1933, as amended, afforded the Company under Regulation S as the securities were issued in an "offshore transaction", as defined in Rule 902(h) of Regulation and the Company did not engage in any directed selling efforts, as defined in Regulation S, in the United States in connection with the sale of the securities. Each stockholder was not a U.S. person, as defined in Regulation S, and was not acquiring the securities for the account or benefit of a U.S. person. The issuance of shares to one investor, Access Equity Capital Management Corp., a company controlled by the Company’s President, were issued in reliance upon the exemptions from the registration requirements of the Securities Act of 1933, as amended, afforded the Company under Section 4(a)(2) promulgated thereunder, as such issuance did not involve a public offering of securities.

On September 24, 2014, Access Finance and Securities (NZ) Ltd. (“Access Finance”) a company controlled by the Company’s President, entered into a private placement subscription agreement, whereby Access Finance invested $100,000 into the Company. Access Finance was issued shares at the closing price of the company's common stock on September 24, 2014 which was $0.0025 per share, which came to 40,000,000 shares of common stock.

The shares issued to Access Finance were issued in reliance upon the exemptions from the registration requirements of the Securities Act of 1933, as amended, afforded the Company under Regulation S as the securities were issued in an "offshore transaction", as defined in Rule 902(h) of Regulation and the Company did not engage in any directed selling efforts, as defined in Regulation S, in the United States in connection with the sale of the securities. Access Finance is not a U.S. person, as defined in Regulation S, and was not acquiring the securities for the account or benefit of a U.S. person.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits

| Exhibit

Number | Description of Exhibit |

| 99.1 | Natfresh audited financial statements for the year ended August 31, 2013 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | GENUFOOD ENERGY ENZYMES CORP. | |

| | | | |

| Date: September 25, 2014 | By: | /s/ Yi Lung Lin | |

| | | Yi Lung Lin, Director | |

|

|

|

|

|

|

| NATfresh BEVERAGES CORP. |

| |

| (A Development Stage Company) |

|

| FINANCIAL STATEMENTS |

|

| August 31, 2013 |

|

| Audited |

|

|

|

|

|

|

|

|

|

|

| BALANCE SHEET Page 1 |

|

| STATEMENT OF OPERATIONS Page 2 |

|

| STATEMENT OF STOCKHOLDERS' DEFICIT Page 3 |

|

| STATEMENT OF CASH FLOW Page 4 |

|

| NOTES TO FINANCIAL STATEMENTS Page 5 |

| | NATfresh BEVERAGES CORP. | |

| | (A Development Stage Company) | |

| | BALANCE SHEET | |

| | August 31, 2013 | |

| | | | | | |

| | | | | | |

| | | August 31, 2013 | | August 31, 2012 | |

| Assets | | | | |

| Current assets | | | | |

| Cash | | $ 785,312 | | $ 3,100,449 |

| Prepaid expenses | | 8,500 | | - |

| Inventories | | 80,214 | | - |

| Accounts receivable to related parties | | 2,093 | | - |

| Tax Receivable | | 5,370 | | - |

| Total current assets | | 881,489 | | 3,100,449 |

| | | | | |

| Other assets | | | | |

| Intangibles and other assets Trademarks, net of accumulated amortizationof $450 | | 9,353 | | - |

| Other Receivable to related party | | 83,333 | | - |

| Security Deposit | | 15,682 | | - |

| Total assets | | 989,857 | | 3,100,449 |

| | | | | |

| Liabilities and stockholders' equity (deficit) | | | | |

| Current liability | | | | |

| Accounts payable - related party | | 169,552 | | 123,476 |

| Accounts payable and accrued liabilities | | 18,996 | | - |

| Other payables | | 1,897 | | - |

| Total current liability | | 190,445 | | 123,476 |

| | | | | |

| Total liabilities | | 190,445 | | 123,476 |

| | | | | |

| Stockholders' equity (deficit) | | | | |

| Common stock, $0.001 par value; 2,000,000,000 shares authorized;

1,156,460,641 and 310,000,0000 shares issued and outstanding as of August 31, 2013 and August 31, 2012, respectively. | | 1,156,461 | | 310,000 |

| Additional paid-in capital | | 2,801,872 | | 200,000 |

| Common stock payable | | - | | 3,000,000 |

| Deficit accumulated during development stage | | (3,150,255) | | (533,027) |

| Other comprehensive loss - cumulative translation adjustment | | (8,666) | | - |

| Total stockholders' (deficit) | | 799,412 | | 2,976,973 |

| | | | | |

| Total liabilities and stockholders'(deficit) | | 989,857 | | 3,100,449 |

| | | | | | |

| | | | | | |

| | The accompanying notes are an integral part of these financial statements. | |

| | | | | | | | | | | | | | | |

| NATfresh BEVERAGES CORP. |

|

(A Development Stage Company)

|

| STATEMENT OF OPERATIONS |

| For the period from inception (June 18, 2012) to August 31, 2013 |

| | | | | | | | |

| | | Year Ended August 31, 2013 | | Year Ended August 31, 2012 | | June 18, 2012 (Inception) Through August 31, 2013 | |

| Revenue | | | | | | | |

| Revenue | | $ 333 | | $ - | | $ 333 | |

| Related party revenue | | 3,189 | | - | | 3,189 | |

| Total Revenue | | 3,522 | | - | | 3,522 | |

| | | | | | | | |

| Cost of Goods Sold | | | | | | | |

| Product costs | | 2,267 | | - | | 2,267 | |

| Total Cost of Goods Sold | | 2,267 | | - | | 2,267 | |

| | | | | | | | |

| Gross Margin | | 1,255 | | - | | 1,255 | |

| | | | | | | | |

| Expenses | | | | | | | |

| Amortisation | | 450 | | - | | 450 | |

| Bank services | | 5,080 | | 578 | | 5,658 | |

| Computer and internet | | 237 | | 114 | | 351 | |

| Consulting service fees | | 1,048,995 | | 506,433 | | 1,555,428 | |

| Insurance | | 86 | | - | | 86 | |

| Legal and professional | | 400,691 | | 19,910 | | 420,601 | |

| Logistics and freight charges | | 7,198 | | - | | 7,198 | |

| Marketing & advertising | | 6,106 | | - | | 6,106 | |

| Meals and entertainment | | 9,604 | | 2,638 | | 12,242 | |

| Meeting expenses - AGM | | 40,233 | | - | | 40,233 | |

| Miscellaneous expense | | 5,043 | | - | | 5,043 | |

| Office supplies | | 1,268 | | - | | 1,268 | |

| Payroll | | 23,336 | | - | | 23,336 | |

| Postage and delivery | | 5,462 | | - | | 5,462 | |

| Printing and reproduction | | 557 | | - | | 557 | |

| Product design fees | | 2,291 | | 1,279 | | 3,570 | |

| Recruitment | | 28 | | - | | 28 | |

| Rent | | 40,894 | | 1,800 | | 42,694 | |

| Telephone expenses | | 2,123 | | - | | 2,123 | |

| Travel | | 18,186 | | 279 | | 18,465 | |

| Total operating expenses | | 1,617,868 | | 533,031 | | 2,150,899 | |

| | | | | | | | |

| Operating income (loss) | | (1,616,613) | | (533,031) | | (2,149,644) | |

| | | | | | | | |

| Other income and expense | | | | | | | |

| Interest income | | 698 | | 4 | | 702 | |

| Impairment of GEEC investment | | (500,000) | | - | | (500,000) | |

| Impairment of related party note receivable | | (500,000) | | - | | (500,000) | |

| Foreign currency exchange gain/(loss) | | (1,313) | | - | | (1,313) | |

| Net Income/(loss ) | | (2,617,228) | | $ (533,027) | | $ (3,150,255) | |

| Other comprehensive loss | | (8,666) | | $ - | | $ (8,666) | |

| | | | | | | | |

| Total comprehensive loss | | (2,625,894) | | $ (533,027) | | $ (3,158,921) | |

| | | | | | | | |

| Weight average number of common shares outstanding-basic and diluted | | 1,113,107,115 | | 310,000,000 | | | |

| | | | | | | | |

| Net loss per share-basic and diluted | | (0.00) | | (0.00) | | | |

The accompanying notes are an integral part of these financial statements

| NATfresh BEVERAGES CORP. | |

|

(A Development Stage Company)

| |

| STATEMENT OF STOCKHOLDERS' DEFICIT | |

| From inception (June 18, 2012) to August 31, 2013 | |

| | |

| | | Common | | | | | | | | | | |

| | | Shares | | Amount | | Additional Paid-in Capital | | Common Stock Payable | | Deficit Accumulated During the Development

Stage | | Foreign currency - translation adjustment | | Total |

| Balance at June 18, 2012 (inception) | | - | | - | | - | | - | | - | | - | | - |

| Common stock issued for service at $0.001 per share on July 2, 2012 | | 200,000,000 | | 200,000 | | 200,000 | | | | - | | - | | 400,000 |

| Common stock issued for cash at $0.001 per share on July 9, 2012 | | 10,000,000 | | 10,000 | | | | | | | | | | 10,000 |

| Common stock issued for cash at $0.001 per share on July 12, 2012 | | 50,000,000 | | 50,000 | | | | | | | | | | 50,000 |

| Common stock issued for cash at $0.001 per share on August 13, 2012 | | 50,000,000 | | 50,000 | | | | | | | | | | 50,000 |

| Common stock payable | | | | | | | | 3,000,000 | | | | | | 3,000,000 |

| Net Loss | | | | | | | | | | (533,027) | | - | | (533,027) |

| | | | | | | | | | | | | | | |

| Balance August 31, 2012 | | 310,000,000 | | 310,000 | | 200,000 | | 3,000,000 | | (533,027) | | - | | 2,976,973 |

| Common stock issued for common stock payable at $0.001 per share on September 7, 2012 | | 546,040,000 | | 546,040 | | - | | (546,040) | | | | | | - |

| Common stock issued for common stock payable at $0.002 per share on September 13, 2012 | | 22,350,000 | | 22,350 | | 22,350 | | (44,700) | | | | | | - |

| Common stock issued for common stock payable at $0.0025 per share on September 17, 2012 | | 20,120,000 | | 20,120 | | 30,180 | | (50,300) | | | | | | - |

| Common stock issued for common stock payable at $0.003 per share on September 21, 2012 | | 20,780,000 | | 20,780 | | 41,560 | | (62,340) | | | | | | - |

| Common stock issued for common stock payable at $0.0035 per share on September 25, 2012 | | 22,340,000 | | 22,340 | | 55,850 | | (78,190) | | | | | | - |

| Common stock issued for common stock payable at $0.004 per share on October 1, 2012 | | 20,240,000 | | 20,240 | | 60,720 | | (80,960) | | | | | | - |

| Common stock issued for common stock payable at $0.0045 per share on October 4, 2012 | | 21,720,000 | | 21,720 | | 76,020 | | (97,740) | | | | | | - |

| Common stock issued for common stock payable at $0.005 per share on October 10, 2012 | | 79,000,000 | | 79,000 | | 316,000 | | (395,000) | | | | | | - |

| Common stock issued for common stock payable at $0.0055 per share on October 15, 2012 | | 10,000,000 | | 10,000 | | 45,000 | | (55,000) | | | | | | - |

| Common stock issued for common stock payable at $0.006 per share on October 17, 2012 | | 10,000,000 | | 10,000 | | 50,000 | | (60,000) | | | | | | - |

| Common stock issued for common stock payable at $0.0065 per share on October 19, 2012 | | 6,910,000 | | 6,910 | | 38,005 | | (44,915) | | | | | | - |

| Common stock issued for common stock payable at $0.007 per share on October 22, 2012 | | 6,100,000 | | 6,100 | | 36,600 | | (42,700) | | | | | | - |

| Common stock issued for common stock payable at $0.0075 per share on October 24, 2012 | | 6,000,000 | | 6,000 | | 39,000 | | (45,000) | | | | | | - |

| Common stock issued for common stock payable at $0.008 per share on October 26, 2012 | | 5,600,000 | | 5,600 | | 39,200 | | (44,800) | | | | | | - |

| Common stock issued for common stock payable at $0.0085 per share on October 29, 2012 | | 5,200,000 | | 5,200 | | 39,000 | | (44,200) | | | | | | - |

| Common stock issued for common stock payable at $0.009 per share on October 31, 2012 | | 5,200,000 | | 5,200 | | 41,600 | | (46,800) | | | | | | - |

| Common stock issued for common stock payable at $0.0095 per share on November 5, 2012 | | 5,200,000 | | 5,200 | | 44,200 | | (49,400) | | | | | | - |

| Common stock issued for common stock payable at $0.01 per share on November 5, 2012 | | 5,000,000 | | 5,000 | | 45,000 | | (50,000) | | | | | | - |

| Common stock issued for common stock payable at $0.015 per share on November 8, 2012 | | 5,000,000 | | 5,000 | | 70,000 | | (75,000) | | | | | | - |

| Common stock issued for common stock payable at $0.02 per share on November 9, 2012 | | 3,200,000 | | 3,200 | | 60,800 | | (64,000) | | | | | | - |

| Common stock issued for common stock payable at $0.025 per share on November 13, 2012 | | 3,027,000 | | 3,027 | | 72,648 | | (75,675) | | | | | | - |

| Common stock issued for common stock payable at $0.03 per share on November 15, 2012 | | 2,003,000 | | 2,003 | | 58,087 | | (60,090) | | | | | | - |

| Common stock issued for common stock payable at $0.035 per share on November 19, 2012 | | 2,150,000 | | 2,150 | | 73,100 | | (75,250) | | | | | | - |

| Common stock issued for common stock payable at $0.04 per share on November 23, 2012 | | 2,030,000 | | 2,030 | | 79,170 | | (81,200) | | | | | | - |

| Common stock issued for common stock payable at $0.045 per share on November 27, 2012 | | 2,000,000 | | 2,000 | | 88,000 | | (90,000) | | | | | | - |

| Common stock issued for common stock payable at $0.05 per share on November 28, 2012 | | 2,000,000 | | 2,000 | | 98,000 | | (100,000) | | | | | | - |

| Common stock issued for common stock payable at $0.055 per share on November 30, 2012 | | 2,000,000 | | 2,000 | | 108,000 | | (110,000) | | | | | | - |

| Cash paid for offering costs | | | | | | (135,000) | | | | | | | | (135,000) |

| Common stock issued for common stock payable at $0.06 per share on December 3, 2012 | | 2,000,000 | | 2,000 | | 118,000 | | (120,000) | | | | | | - |

| Common stock issued for common stock payable at $0.065 per share on December 5, 2012 | | 1,200,000 | | 1,200 | | 76,800 | | (78,000) | | | | | | - |

| Common stock issued for common stock payable at $0.07 per share on December 7, 2012 | | 1,000,000 | | 1,000 | | 69,000 | | (70,000) | | | | | | - |

| Common stock issued for common stock payable at $0.08 per share on December 10, 2012 | | 400,000 | | 400 | | 31,600 | | (32,000) | | | | | | - |

| Common stock issued for common stock payable at $0.09 per share on December 13, 2012 | | 230,000 | | 230 | | 20,470 | | (20,700) | | | | | | - |

| Common stock issued for common stock payable at $0.1 per share on December 14, 2012 | | 100,000 | | 100 | | 9,900 | | (10,000) | | | | | | - |

| Common stock issued for common stock payable at $0.15 per share on December 17, 2012 | | 66,666 | | 67 | | 9,933 | | (10,000) | | | | | | - |

| Common stock issued for common stock payable at $0.2 per share on December 19, 2012 | | 50,000 | | 50 | | 9,950 | | (10,000) | | | | | | - |

| Common stock issued for common stock payable at $0.25 per share on December 21, 2012 | | 40,000 | | 40 | | 9,960 | | (10,000) | | | | | | - |

| Common stock issued for common stock payable at $0.3 per share on December 28, 2012 | | 33,333 | | 33 | | 9,967 | | (10,000) | | | | | | - |

| Common stock issued for common stock payable at $0.35 per share on January 2, 2013 | | 28,571 | | 29 | | 9,971 | | (10,000) | | | | | | - |

| Common stock issued for common stock payable at $0.40 per share on January 4, 2013 | | 25,000 | | 25 | | 9,975 | | (10,000) | | | | | | - |

| Common stock issued for common stock payable at $0.45 per share on January 7, 2013 | | 22,222 | | 22 | | 9,978 | | (10,000) | | | | | | - |

| Common stock issued for common stock payable at $0.50 per share on January 9, 2013 | | 20,000 | | 20 | | 9,980 | | (10,000) | | | | | | - |

| Common stock issued for common stock payable at $0.55 per share on January 11, 2013 | | 18,182 | | 18 | | 9,982 | | (10,000) | | | | | | - |

| Common stock issued for common stock payable at $0.60 per share on January 14, 2013 | | 16,667 | | 17 | | 9,983 | | (10,000) | | | | | | - |

| Proceeds from sale of GEEC shares | | | | | | 583,333 | | | | | | | | 583,333 |

| Net Loss | | | | | | | | | | (2,617,228) | | | | (2,617,228) |

| Foreign currency - translation adjustment | | | | | | | | | | | | (8,666) | | (8,666) |

| Balance August 31, 2013 | | 1,156,460,641 | | 1,156,461 | | 2,801,872 | | - | | (3,150,255) | | (8,666) | | 799,412 |

| | | | | | | | | | | | | |

| | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements

| NATfresh BEVERAGES CORP. |

| |

| (A Development Stage Company) |

| STATEMENT OF CASH FLOW |

| Audited |

| For the period from inception (June 18, 2012) to August 31, 2013 |

| | | | | | | |

| | | August 31, 2013 | | August 31, 2012 | | From Inception (June 18, 2012) to August 31, 2013 |

| CASH FLOWS FROM OPERATING ACTIVITIES | | | | | | |

| Net loss | $ | (2,617,228) | $ | (533,027) | $ | (3,150,255) |

| Adjustments to reconcile net loss to net cash used in operating activities | | | | | | |

| Impairment of related party investment | | 500,000 | | - | | 500,000 |

| Impairment of related party note receivable | | 500,000 | | - | | 500,000 |

| Contributed capital | | 583,333 | | - | | 583,333 |

| Amortization - trademarks | | 450 | | - | | 450 |

| Shares issued for consulting services expense | | - | | 400,000 | | 400,000 |

| Change in operating assets and liabilities: | | | | | | |

| Prepaid expenses | | (8,500) | | - | | (8,500) |

| Inventory | | (80,214) | | - | | (80,214) |

| Accounts receivable – Related Party | | (2,093) | | - | | (2,093) |

| Other current assets | | (5,370) | | - | | (5,370) |

| Other assets | | (1,099,015) | | - | | (1,099,015) |

| Accounts payable – related party | | 51,052 | | - | | 51,052 |

| Accounts payable and accrued liabilities | | 15,917 | | 123,476 | | 139,393 |

| NET CASH USED IN OPERATING ACTIVITES | | (2,161,668) | | (9,551) | | (2,171,219) |

| | | | | | | |

| CASH FLOWS FROM INVESTING ACTIVITIES | | | | | | |

| Cash paid for trademarks | | (9,803) | | - | | (9,803) |

| NET CASH USED IN INVESTING ACTIVITIES | | (9,803) | | - | | (9,803) |

| | | | | | | |

| NET CASH FLOWS FROM FINANCING ACTIVITIES | | | | | | |

| Common stock payable | | - | | 3,000,000 | | 3,000,000 |

| Cash paid for issuing cost | | (135,000) | | - | | (135,000) |

| Proceeds from sale of common shares | | - | | 110,000 | | 110,000 |

| NET CASH USED BY FINANCING ACTIVITIES | | (135,000) | | 3,110,000 | | 2,975,000 |

| | | | | | | |

| EFFECT OF EXCHANGE RATE CHANGES ON CASH AND CASH EQUIVALENTS | | (8,666) | | - | | (8,666) |

| NET INCREASE IN CASH | | (2,315,137) | | 3,100,449 | | 785,312 |

| CASH, BEGINNING OF PERIOD | | 3,100,449 | | - | | - |

| CASH, END OF PERIOD | | 785,312 | | 3,100,449 | | 785,312 |

| | | | | | | |

| Supplemental disclosure of cash flow information Non-cash financing activities: | | | | | | |

| Reduction of common stock payable | $ | (3,000,000) | | - | | - |

The accompanying notes are an integral part of these financial statements

NOTE 1 – NATURE OF OPERATIONS AND BASIS OF PRESENTATION

Organization and Business Operations

The Company was incorporated in the State of Nevada as a for-profit Company on June 18, 2012 and established a fiscal year end of August 31. It is a company that will import and distribute natural spring water. At the same time, it focuses through its wholly owned subsidiary company in Singapore, NATfresh Productions (S) Pte Ltd (NPSPL), processed and bottled the natural spring water. The natural spring water is also used for the production of instant tea, and microbrewery operations for the production of lager beer. All manufactured goods will be marketed, promoted and distributed in the Republic of Singapore and for export to the neighboring countries, Malaysia. The Company is the owner of the following brands or trademarks: NATfresh  , Tani Premium and Tani Magic.

, Tani Premium and Tani Magic.

Development Stage Activities

The Company is currently in the development stage as defined under FASB ASC 915-10, “Development Stage Entities" and has as yet no products and with no significant revenues. All activities of the Company to date relate to its organization, initial funding, share issuances, and target markets identification and developing marketing plans, and equipment and factory premise sourcing.

NOTE 2 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Going Concern

The Company’s financial statements are prepared in accordance with generally accepted accounting principles applicable to a going concern. This contemplates the realization of assets and the liquidation of liabilities in the normal course of business. Currently, the Company does not have material assets, nor it has operations or a source of revenue sufficient to cover its operation costs and allow it to continue as a going concern. The Company has an accumulated deficit since inception of $3,150,255. The Company will be dependent upon the raising of additional capital through placement of our common stock in order to implement its business plan, or merge with an operating company. There can be no assurance that the Company will be successful in either situation in order to continue as a going concern. The Company funded its initial operations by way of issuing Founder’s shares. These financial statements do not include any adjustments relating to the recoverability and classification of recorded assets or the amounts of and classification of liabilities that might be necessary in the event the company cannot continue in existence. Accordingly, these circumstances raise substantial doubt as to the Company’s ability to continue as a going concern.

Due to the start-up nature of the Company, the Company expects to incur additional losses in the immediate future. To-date, the Company’s cash flow requirements have been primarily met through advances from related parties and proceeds from sales of common stock.

The officers and directors have committed to advancing certain operating costs of the Company, including Legal, Audit, Transfer Agency and Edgarizing costs.

Basis of Presentation

The financial statements present the balance sheet, statements of operations as at August 31, 2013 and August 31, 2012, stockholders' equity (deficit) and cash flows of the Company. These financial statements are presented in United States dollars and have been prepared in accordance with accounting principles generally accepted in the United States of America (U.S. GAAP).

Foreign Currency Translation and Transactions

The reporting and functional currency of the Company is United States Dollar (“U.S. dollar”). The functional currency of NPSPL, a wholly owned subsidiary of the Company, is the Singapore Dollar (“SGD”).

For financial reporting purpose, the financial statements of the Company’s Singapore subsidiary, which are prepared using the SGD, are translated into the Company’s reporting currency, the U.S. dollar. Assets and liabilities are translated using the exchange rate on the balance sheet date, which was 0.7841 as of August 31, 2013. Revenue and expenses are translated using average exchange rates prevailing during each reporting period. The 0.7891 average exchange rate was used to translate revenues and expenses for the reporting period ended August 31, 2013. Stockholders’ equity is translated at historical exchange rates. Adjustments resulting from the translation are recorded as a separate component of accumulated other comprehensive income in stockholders’ equity.

Transactions denominated in currencies other than the functional currency are translated into the functional currency at the exchange rates prevailing at the dates of the transactions. The resulting exchange differences are included in the statements of operations.

Cash and Cash Equivalents

For the purposes of the statements of cash flows, the Company considers highly liquid financial instruments purchased with a maturity date of three months or less to be cash equivalent.

As at Aug 31, 2013 and August 31, 2012 the Company held $785,312 and 3,100,449 respectively in cash and zero in cash equivalents.

Use of Estimates and Assumptions

Preparation of the financial statements in conformity with accounting principles generally accepted in the United States requires management to make estimates and assumptions that affect certain reported amounts and disclosures. Accordingly, actual results could differ from those estimates.

Income Taxes

The Company follows the liability method of accounting for income taxes. Deferred tax assets and liabilities are recognized for the future tax consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax balances. Deferred tax assets and liabilities are measured using enacted or substantially enacted tax rates expected to apply to the taxable income in the years in which those differences are expected to be recovered or settled. Deferred tax assets are reduced by a valuation allowance when, in the opinion of management, it is more likely than not that some portion or all of the deferred tax assets will not be realized. The effect on deferred tax assets and liabilities of a change in tax rates is recognized in income in the period that includes the date of enactment or substantive enactment.

Net Loss per Share

Basic loss per share includes no dilution and is computed by dividing loss available to common stockholders by the weighted average number of common shares outstanding for the period. Dilutive loss per share reflects the potential dilution of securities that could share in the losses of the Company. Because the Company does not have any potentially dilutive securities, the accompanying presentation is only of basic loss per share.

Revenue Recognition

Revenue from the sale of beverages is recognized once a sales arrangement exists, delivery has occurred, the revenue is determinable and collectability is reasonably assured, which is upon the later of shipment or when title passes to the customer, depending on the contractual terms. Deposits received before supplies are shipped are recorded as deferred revenue.

Accounts Receivable Policy

The Company’s accounts receivable are composed of trade receivables from customers for sales of products. Trade receivables include accounts receivable for sales of product.

Accounts receivable are stated at their principal balances and are non-interest bearing and unsecured. The Company maintains an allowance for doubtful accounts for the estimated probable losses on uncollectible accounts receivable.

Uncollectible accounts receivable are written off when a settlement is reached for an amount less than the outstanding historical balance or when we determine that it is highly unlikely the balance will be collected. At August 31, 2013 and 2012, the Company’s allowance for doubtful accounts was $0.

Inventory

The Company’s inventories include beverages, packaging, labeling materials, freight charges and transport and handling cost that directly attributable to the acquisition of the products. Inventories are stated at the lower of cost or market value. Cost is determined using weighted average cost method. As of August 31, 2013 and 2012, the Company had inventory balances of $80,214 and $0, respectively.

Intangible Assets

The Company’s intangible assets consist primarily of trademarks, which are carried at amortized cost. The company capitalizes filing and legal fees related to the trademark registration. All trademarks have legal lives from 7 to 10 years and are amortized over their respective legal lives upon approval.

The Company reviews its intangible assets for impairment whenever events or circumstances indicate that the carrying amount of an asset may not be recoverable. The Company assesses recoverability by reference to future cash flows from the products underlying these intangible assets. If these estimates change in the future, the Company may be required to record impairment charges for these assets. As of September 30, 2013 and September 30, 2012, no impairment was recorded.

Shipping and Handling Costs

Shipping and handling costs incurred for inventory purchases are capitalized as part of the cost of inventory.

Advertising Expenses

Advertising costs are expensed as incurred and are included in general and administrative expenses for all periods presented. Advertising expenses for the year ended August 31, 2013 and 2012 were $6,106 and $0, respectively.

Concentration of Risk

The Company maintains its cash in institutions insured by the Federal Deposit Insurance Corporation (FDIC) and at times, balances may exceed government insured limits. The Company has never experienced any losses related to these balances. In the year ended August 31, 2013, the Company sold its products to two related parties whose sales comprised 50%, and 41% of net sales, respectively. Net accounts receivable from these related parties as of August 31, 2013 and 2012 were $2,093 and $0 respectively.

Comprehensive Income (loss)

Comprehensive income (loss) is comprised of net income and other comprehensive income (loss). For the year ended August 31, 2013 and 2012, the Company had other comprehensive loss of $8,666 and $0.

Recent Accounting Pronouncements

In February 2013, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU)No. 2013-02, Comprehensive Income (Topic 220): Reporting of Amounts Reclassified Out of Accumulated Other Comprehensive Income, to improve the transparency of reporting these reclassifications. Other comprehensive income includes gains and losses that are initially excluded from net income for an accounting period. Those gains and losses are later reclassified out of accumulated other comprehensive income into net income. The amendments in the ASU do not change the current requirements for reporting net income or other comprehensive income in financial statements. All of the information that this ASU requires already is required to be disclosed elsewhere in the financial statements under U.S. GAAP. The new amendments will require an organization to:

- Present (either on the face of the statement where net income is presented or in the notes) the effects on the line items of net income of significant amounts reclassified out of accumulated other comprehensive income - but only if the item reclassified is required under U.S. GAAP to be reclassified to net income in its entirety in the same reporting period; and

- Cross-reference to other disclosures currently required under U.S. GAAP for other reclassification items (that are not required under U.S. GAAP) to be reclassified directly to net income in their entirety in the same reporting period. This would be the case when a portion of the amount reclassified out of accumulated other comprehensive income is initially transferred to a balance sheet account (e.g., inventory for pension-related amounts) instead of directly to income or expense.

The amendments apply to all public and private companies that report items of other comprehensive income. Public companies are required to comply with these amendments for all reporting periods (interim and annual). The amendments are effective for reporting periods beginning after December 15, 2012, for public companies. Early adoption is permitted. The adoption of ASU No. 2013-02 is not expected to have a material impact on our financial position or results of operations.

In January 2013, the FASB issued ASU No. 2013-01, Balance Sheet (Topic 210): Clarifying the Scope of Disclosures about Offsetting Assets and Liabilities, which clarifies which instruments and transactions are subject to the offsetting disclosure requirements originally established by ASU 2011-11. The new ASU addresses preparer concerns that the scope of the disclosure requirements under ASU 2011-11 was overly broad and imposed unintended costs that were not commensurate with estimated benefits to financial statement users. In choosing to narrow the scope of the offsetting disclosures, the Board determined that it could make them more operable and cost effective for preparers while still giving financial statement users sufficient information to analyze the most significant presentation differences between financial statements prepared in accordance with U.S. GAAP and those prepared under IFRSs. Like ASU 2011-11, the amendments in this update will be effective for fiscal periods beginning on, or after January 1, 2013. The adoption of ASU 2013-01 is not expected to have a material impact on our financial position or results of operations.

In October 2012, the FASB issued Accounting Standards Update ASU 2012-04, “Technical Corrections and Improvements” in Accounting Standards Update No. 2012-04. The amendments in this update cover a wide range of Topics in the Accounting Standards Codification. These amendments include technical corrections and improvements to the Accounting Standards Codification and conforming amendments related to fair value measurements. The amendments in this update will be effective for fiscal periods beginning after December 15, 2012. The adoption of ASU 2012-04 is not expected to have a material impact on our financial position or results of operations.

In August 2012, the FASB issued ASU 2012-03, “Technical Amendments and Corrections to SEC Sections: Amendments to SEC Paragraphs Pursuant to SEC Staff Accounting Bulletin (SAB) No. 114, Technical Amendments Pursuant to SEC Release No. 33-9250, and Corrections Related to FASB Accounting Standards Update 2010-22 (SEC Update)” in Accounting Standards Update No. 2012-03. This update amends various SEC paragraphs pursuant to the issuance of SAB No. 114. The adoption of ASU 2012-03 is not expected to have a material impact on our financial position or results of operations.

In July 2012, the FASB issued ASU 2012-02, “Intangibles – Goodwill and Other (Topic 350): Testing Indefinite-Lived Intangible Assets for Impairment” in Accounting Standards Update No. 2012-02. This update amends ASU 2011-08, Intangibles – Goodwill and Other (Topic 350): Testing Indefinite-Lived Intangible Assets for Impairment and permits an entity first to assess qualitative factors to determine whether it is more likely than not that an indefinite-lived intangible asset is impaired as a basis for determining whether it is necessary to perform the quantitative impairment test in accordance with Subtopic 350-30, Intangibles - Goodwill and Other - General Intangibles Other than Goodwill. The amendments are effective for annual and interim impairment tests performed for fiscal years beginning after September 15, 2012. Early adoption is permitted, including for annual and interim impairment tests performed as of a date before July 27, 2012, if a public entity’s financial statements for the most recent annual or interim period have not yet been issued or, for nonpublic entities, have not yet been made available for issuance. The adoption of ASU 2012-02 has not had a material impact on our financial position or results of operations.

In December 2011, the FASB issued ASU 2011-12, “Deferral of the Effective Date for Amendments to the Presentation of Reclassifications of Items out of Accumulated Other Comprehensive Income in Accounting Standards Update No. 2011-05. This update defers the requirement to present items that are reclassified from accumulated other comprehensive income to net income in both the statement of income where net income is presented and the statement where other comprehensive income is presented. The adoption of ASU 2011-12 has not had a material impact on our financial position or results of operations.

In December 2011, the FASB issued ASU No. 2011-11 “Balance Sheet: Disclosures about Offsetting Assets and Liabilities” (“ASU 2011-11”). This Update requires an entity to disclose information about offsetting and related arrangements to enable users of its financial statements to understand the effect of those arrangements on its financial position. The objective of this disclosure is to facilitate comparison between those entities that prepare their financial statements on the basis of U.S. GAAP and those entities that prepare their financial statements on the basis of IFRS. The amended guidance is effective for annual reporting periods beginning on or after January 1, 2013, and interim periods within those annual periods. The Company is currently evaluating the impact, if any, that the adoption of this pronouncement may have on its results of operations or financial position.

Stock-based Compensation

The Company has not adopted a stock option plan and has not granted any stock options. Accordingly, no stock-based compensation has been recorded to date.

Fair Value of Financial Instruments

On July 1, 2010, the Company adopted guidance which defines fair value, establishes a framework for using fair value to measure financial assets and liabilities on a recurring basis, and expands disclosures about fair value measurements. Beginning on July 1, 2010, the Company also applied the guidance to non-financial assets and liabilities measured at fair value on a non-recurring basis, which includes goodwill and intangible assets. The guidance establishes a hierarchy for inputs used in measuring fair value that maximizes the use of observable inputs and minimizes the use of unobservable inputs by requiring that the most observable inputs be used when available. Observable inputs are inputs that market participants would use in pricing the asset or liability developed based on market data obtained from sources independent of the Company. Unobservable inputs are inputs that reflect the Company’s assumptions of what market participants would use in pricing the asset or liability developed based on the best information available in the circumstances. The hierarchy is broken down into three levels based on the reliability of the inputs as follows:

• Level 1 - Valuation is based upon unadjusted quoted market prices for identical assets or liabilities in active markets that the Company has the ability to access.

• Level 2 -Valuation is based upon quoted prices for similar assets or liabilities in active markets; quoted prices for identical or similar assets or liabilities in inactive markets; or valuations based on models where the significant inputs are observable in the market.

• Level 3 - Valuation is based on models where significant inputs are not observable. The unobservable inputs reflect the Company's own assumptions about the inputs that market participants would use.

The following table presents assets and liabilities that are measured and recognized at fair value as of August 31, 2013 on a recurring and non-recurring basis:

| | | | | | | | | | | | Gains | |

| Description | | Level 1 | | | Level 2 | | | Level 3 | | | (Losses) | |

| Trading account securities | | $ | - | | | $ | - | | | $ | - | | | $ | - | |

| | | | | | | | | | | | | | | | | |

The Company has determined the estimated fair value of financial instruments using available market information and appropriate valuation methodologies. The fair value of financial instruments classified as current assets or liabilities approximate their carrying value due to the management of the Company has the intention to sell the instruments in the near future.

NOTE 3 – CAPITAL

The Company was initially authorized to issue an aggregate of 1,000,000,000 common shares with a par value of $0.001 per share (“Common Stock”). The Company filed an amendment to its articles on November 9, 2012 to increase the number of authorized common stock to 2,000,000,000. No preferred shares have been authorized or issued.

Each holder of Common Stock shall be entitled to cast one vote for each share held at all stockholders’ meetings for all purposes, including the election of directors. The Common Stock does not have cumulative voting rights.

On July 2, 2012, 200,000,000 common shares were issued to two consultants for services directly related to the S-1 registration and offering. These shares were valued at $0.001 per share using fair market value on the date of the grant.

On July 9, 2012, the Company received stock subscriptions from a related party. 10,000,000 common shares were sold to one stockholder being the first founding member, at a purchase price of $0.001 per share for cash received of $10,000.

On July 12, 2012, the Company further received stock subscriptions from a stockholder being the second founder member. 50,000,000 common shares were sold to that stockholder at a purchase price of $0.001 per share for cash received of $50,000.

On August 13, 2012, the Company further received stock subscriptions from a related party being the third founder member. 50,000,000 common shares were sold to that related party at a purchase price of $0.001 per share for cash received of $50,000.

During three months ended November 30, 2012, the Company issued 841,210,000 shares to thirty five stockholders at prices between $0.001 and 0.055 per share. These shares were issued with the corresponding reduction in common stock payable as the cash was received prior to August 31, 2012.

During three months ended November 30, 2012, the Company paid a total of $135,000 cash to a consultant for offering costs associated with the $3,000,000 common stock payable referred to above.

As of November 30, 2012, the Company has $430,700 common stock payable held under Trust.

During three months ended February 28, 2013, the Company issued 5,250,641 shares to sixteen stockholders at prices between $0.06 and 0.6 per share. These shares were issued with the corresponding reduction in common stock payable as the cash was received prior to August 31, 2012.

As of August 31, 2013 and 2012, the Company has $0 and $3,000,000 common stock payable held under Trust, respectively.

NOTE 4 – INCOME TAXES

We did not provide any current or deferred U.S. federal income tax provision or benefit for any of the periods presented because we have experienced operating losses since inception. Accounting for Uncertainty in Income Taxes when it is more likely than not that a tax asset cannot be realized through future income the Company must allow for this future tax benefit. We provided a full valuation allowance on the net deferred tax asset, consisting of net operating loss carry forwards, because management has determined that it is more likely than not that we will not earn income sufficient to realize the deferred tax assets during the carry forward period.

The components of the Company’s deferred tax asset and reconciliation of income taxes computed at the statutory rate to the income tax amount recorded as of May 31, 2013 and August 31, 2012 is as follows:

| | August 31, 2013 | August 31, 2012 |

| Net operating loss carry forward | (133,027) | - |

| Net loss | (2,617,228) | (533,027) |

| Less: Impairment of investment | 500,000 | - |

| Less: Impairment of Note Receivable | 500,000 | - |

| Less: shares issued for services | - | 400,000 |

| Net operating loss after shares issued for services | (1,750,255) | (133,027) |

| Effective tax rate | 35% | 35% |

| Deferred tax assets | (612,589) | (46,559) |

| Less: valuation allowance | 612,589 | 46,559 |

| Net deferred tax asset | $ 0 | $ 0 |

| | |

NOTE 5 – RELATED PARTY TRANSACTIONS

The President and CEO of the Company is the managing director of the two consulting companies that provide consulting services for the Company.

On July 9, 2012, the Company sold 10,000,000 shares of Common Stock at $0.001 per share to a company where the President of the Company has control and voting rights. These shares were sold for cash consideration of $10,000.

On August 13, 2012, the Company sold 50,000,000 shares of Common Stock at $0.001 per share to a party who is the wife of the President of the Company for cash consideration of $50,000.

As of August 31, 2013 and August 31, 2012, there were amounts due to related parties of $169,552 and $123,476 respectively.

As of August 31, 2013 and 2012, there were amounts due from related party of $83,333 and $0 respectively. On September 3, 2013, the Company received $83,333 from the related party.

During the year ended August 31, 2013, the Company generated $3,189 in revenue on sales to related parties.

NOTE 6 – INVESTMENT IN RELATED PARTY

On September 24, 2012, the Company purchased 1,666,667 common stock of Genufood Energy Enzymes Corp (GEEC) at a price of $0.3 per share, representing less than 1% of the total outstanding shares of GEEC. The Company’s President is also the President of GEEC. As of February 28, 2013, the value of the investment was impaired to zero. On August 19, 2013, the Company sold the 1,666,667 common stock to Access Equity Capital Management Corp (“AECM”) at a price of $0.35 per share, amounting to $583,333 in total. This amount is due on February 18, 2015 as per the signed Promissory Note dated August 19, 2013 between the Company and AECM and was credited to Additional Paid-in Capital. It is probable that the Company will be unable to collect all amounts due from AECM, therefore, on August 31, 2013 the Company recognized the impairment of $500,000 for the Note Receivable. As of August 31, 2013, the amount due from AECM is $83,333. On September 3, 2013, the Company received $83,333 from AECM. The Company’s President is also the President of AECM.

NOTE 7 - COMMITMENTS

The Company leases a virtual office. The lease term is from June 18, 2012 through June 17, 2013 and renewable annually. On May 1, 2013, the Company signed a Memorandum of Understanding with two related parties for share of office premises for the period from May 1, 2013 to March 14, 2016. Below is the future 5 year lease schedule:

2013 $40,893

2014 to 2017 $288,950

NOTE 8 - SUBSEQUENT EVENTS

On September 4, 2013, the Company further invested $180,070 in Natfresh Productions (S) Pte Ltd.

On September 3, 2013, the Company received $83,333 from AECM being part payment of the Promissory Note dated August 19, 2013.

On October 31, 2013, the Board approved to increase the paid-in capital of the Company by additional $4,030,000 by way of exercising a Rights Issue on the basis of every one Shareholder to subscribe 113,000 shares at an issue price of $0.65 per share.

On November 25, 2013, the board agreed to hold and convey the Company’s Second Annual General Meeting on Monday, January 20, 2014 in Singapore.

On December 20, 2013, the Board approved the Notice of Call to exercise the Rights Issue for increase in the paid-in capital of $4,030,000 or 6,200,000 common shares at an issue price of $0.65 per share to commence on Monday, March 10, 2014.

On December 23, 2013, the Company further invested $100,000 in Natfresh Productions (S) Pte Ltd.

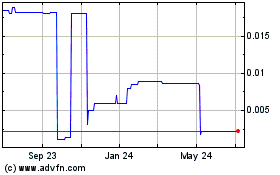

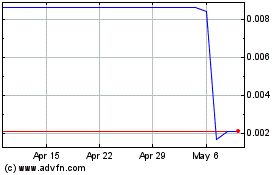

Genufood Energy Enzymes (CE) (USOTC:GFOO)

Historical Stock Chart

From Oct 2024 to Nov 2024

Genufood Energy Enzymes (CE) (USOTC:GFOO)

Historical Stock Chart

From Nov 2023 to Nov 2024