UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act 1934

Date of Report (Date of earliest event reported):

December 30, 2015

General

Steel Holdings, Inc.

(Exact name of registrant as specified in charter)

|

Nevada |

|

001-33717 |

|

41-2079252 |

| (State or Other Jurisdiction of Incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

|

Level 2, Building G,

No. 2A Chen Jia Lin, Ba Li Zhuang,

Chaoyang District, Beijing, China 100025 |

| (Address of Principal Executive Offices) |

| Registrant’s telephone number, including area code: |

+ 86 (10) 85723073 |

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of registrant under any of the following provisions:

¨ Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12(b) under the

Exchange Act (17 CFR 240.14a-12(b))

¨ Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e-4(c))

Item 1.01. Entry into a

Material Definitive Agreement.

On December 30, 2015, the Board of Directors of General Steel

Holdings, Inc. (“General Steel” or the “Company”) approved the entry into by its 100% owned subsidiary,

General Steel Investment Co., Ltd. (“BVI”), of a Sales and Purchase Agreement (the “Sale Agreement”) with

Victory Energy Resource Limited (“Victory Energy”), a Hong Kong registered company indirectly owned by the Company’s

Chairman, Henry Yu, pursuant to which BVI sold its 100% equity ownership in General Steel (China) Co., Ltd. (“GS China”)

to Victory Energy for $1 million. Although payment has not yet been completed and the share transfer is required to be registered

with the State Administration for Industry and Commerce, the Sale Agreement provides that Victory Energy shall immediately have

the right to exercise rights as a shareholder of GS China and be entitled to the rolling profits (if any) of GS China in proportion

to the equity so transferred. The remaining actions required under the Sale Agreement are expected to be effected in the next seven

to ten days following the date of this Current Report on Form 8-K.

Item 3.01 Notice

of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing.

On January 4, 2016, General Steel received a notice (the “NYSE

Notice”) from NYSE Regulations, Inc. that it is not in compliance with the continued listing standards set forth in Section

802.01C of the Listed Company Manual (“Section 802.01C”) of the New York Stock Exchange, Inc. (the “NYSE”).

Such noncompliance is based on the average closing price of the Company’s common stock being less than $1.00 over a consecutive

30 trading-day period. The Company will provide the NYSE with the required response within 10 business days of its receipt of the

NYSE Notice, stating its intent to cure this deficiency.

In accordance with the NYSE Notice, the Company has 6 months

from the date of receipt of the NYSE Notice to achieve compliance with the continued listing standards of Section 802.01C. The

Company’s common stock will continue to be listed and traded on the NYSE during this 6 month cure period, subject to NYSE’s

discretion, under the symbol “GSI,” but will continue to be assigned a “.BC” indicator by the NYSE to signify

that the Company is not currently in compliance with the NYSE’s continued listing standards. In the event that the Company

fails to achieve compliance with the continued listing standards of Section 802.01C by the expiration of the 6 month cure period,

the NYSE may commence suspension and delisting procedures.

Item 8.01 Other Events.

On January 5, 2016, General Steel issued a press release announcing

receipt of the NYSE Notice and also on January 5, 2016 a press release announcing the entry into of the Sale Agreement regarding

the GS China disposition. Copies of the press releases are attached hereto as Exhibits 99.1 and 99.2 and are incorporated by reference

into this Item 8.01.

Item 9.01. Financial Statements and

Exhibits

(d) Exhibits

| 99.1 |

Press Release issued on January 5, 2016 regarding NYSE non-compliance |

| 99.2 |

Press Release issued on January 5, 2016 regarding sale transaction |

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the Company has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

GENERAL STEEL HOLDINGS, INC. |

| |

|

| |

By: |

/s/ John Chen |

| |

Name: |

John Chen |

| |

Title: |

Chief Financial Officer |

Dated: January 5, 2016

Exhibit Index

| Exhibit No. |

Description |

| 99.1 |

Press Release issued on January 5, 2016 regarding NYSE non-compliance |

| 99.2 |

Press Release issued on January 5, 2016 regarding sale transaction |

Exhibit 99.1

General Steel Receives NYSE Notification

Regarding Closing Price Requirement Under NYSE's Continued Listing Standard

BEIJING, Jan. 5, 2016 /PRNewswire/ -- General Steel Holdings,

Inc. ("General Steel" or the "Company") (NYSE: GSI), announced today that, the New York Stock Exchange, Inc.

(the "NYSE") has notified the Company that it has fallen below the NYSE's continued listing standard set forth in Section

802.01C of the Listed Company Manual ("Section 802.01C") that requires a minimum average closing price of $1.00 per share

of the Company's common stock over a consecutive 30-trading-day period.

In a notification letter dated January 4, 2016, the NYSE notified

the Company that as of December 30, 2015, the average closing price of the Company over a consecutive 30-day trading period of

$0.97. Under the NYSE regulations, the Company has a cure period of six months from receipt of the NYSE's notice to achieve compliance

with the continued listing standard of Section 802.01C. The Company can regain compliance at any time during the six-month cure

period if on the last trading day of any calendar month during the cure period, the Company has a closing share price and an average

closing share price of at least $1.00 over the 30 trading-day period ending on the last trading day of that month.

The Company will provide the NYSE with the required response

within 10 business days of its receipt of the NYSE Notice, stating its intent to cure this deficiency. Subject to compliance with

the NYSE's other continued listing standards and ongoing oversight, the Company's common stock will continue to be listed and traded

on the NYSE during the six-month cure period, under the symbol "GSI", but will continue to be assigned a ".BC"

indicator. The Company's business operations and United States Securities and Exchange Commission reporting requirements are not

affected by the receipt of the NYSE's notice. The Company intends to actively monitor the closing price of its common stock during

the cure period and will evaluate all available options to resolve this non-compliance and regain compliance with the pricing standard.

About General Steel

General Steel Holdings, Inc. is headquartered in Beijing, China

and produces a variety of steel products including rebar and high-speed wire. Through its majority equity interest in Catalon,

the Company also develops and manufactures De-NOx honeycomb catalysts and industrial ceramics.

To be added to the General Steel email list to receive Company

news, or to request a hard copy of the Company's Annual Report on Form 10-K, please send your request to investor.relations@gshi-steel.com.

Forward-Looking Statements

This press release may contain certain forward-looking statements

within the meaning of the Private Securities Litigation Reform Act of 1995. These statements are based on management's current

expectations or beliefs about future events and financial, political and social trends and assumptions it has made based on information

currently available to it. The Company cannot assure that any expectations, forecasts or assumptions made by management in preparing

these forward-looking statements will prove accurate, or that any projections will be realized. Actual results could differ materially

from those projected in the forward-looking statements as a result of inaccurate assumptions or a number of risks and uncertainties.

These risks and uncertainties are set forth in the Company's filings under the Securities Act of 1933 and the Securities Exchange

Act of 1934 under "Risk Factors" and elsewhere, and include, but are not limited to: (a) those risks and uncertainties

related to general economic conditions in China, including regulatory factors that may affect such economic conditions; (b) whether

the Company is able to manage its planned growth efficiently and operate profitable operations, including whether its management

will be able to identify, hire, train, retain, motivate and manage required personnel or that management will be able to successfully

manage and exploit existing and potential market opportunities; (c) whether the Company is able to generate sufficient revenues

or obtain financing to sustain and grow its operations; (d) whether the Company is able to successfully fulfill our primary requirements

for cash; and (e) other risks, including those disclosed in the Company's most recent Annual Report on Form 10-K, filed with the

United States Securities and Exchange Commission. Forward-looking statements contained herein speak only as of the date of this

release. The Company does not undertake any obligation to update or revise publicly any forward-looking statements, whether to

reflect new information, future events or otherwise.

Contact Us

General Steel Holdings, Inc.

Joyce Sung

Tel: +1-347-534-1435

Email: joyce.sung@gshi-steel.com

Asia Bridge Capital Limited

Carene Toh

Tel: +1-888-957-3362

Email: generalsteel@asiabridgegroup.com

Exhibit 99.2

General Steel to Divest Steel Manufacturing

Business

BEIJING, Jan. 5, 2016 /PRNewswire/ -- General Steel Holdings,

Inc. ("General Steel" or the "Company") (NYSE: GSI), announced today that on December 30, 2015, the Company

signed a series of restructuring agreements to effect the sale of its steel manufacturing business.

Due to persistently depressed market trends for the steel business

in China, the Company's steel manufacturing business had repeatedly suffered heavy net losses in recent years, and as the depressed

market is expected to prolong in 2016 it is estimated that the steel manufacturing business will continue to further deplete the

Company's working capital. The Company and its Board, as previously announced, had thoroughly evaluated strategic alternatives

and been exploring optimal solutions for the divesture of its steel manufacturing business.

On December 30, 2015, the Board approved the Company's entering

into an agreement to sell its wholly-owned General Steel (China) Co., Ltd. and its entire equity interest in Shaanxi Longmen Iron

and Steel Co., Ltd. for $1 million to an affiliate of Victory Energy Resource Limited, a HK registered company indirectly-owned

by Henry Yu, the Company's Chairman. Comparatively, the net equity of the assets and liabilities included in the transaction was

negatively valued by a third party.

Through the transaction, the Company expects to receive a net

working capital injection of $1 million, and realize a reversal of equity deficiency of approximately $1.6 billion, benefiting

from a large reduction in total liabilities. The transaction will also save the Company from incurring future losses and obligations

from steel manufacturing.

After the sale, the Company plans to focus on accelerating its

cleantech business via its 84.5% equity ownership in Catalon Chemical Corp. ("Catalon"), which develops and manufactures

De-NOx honeycomb catalysts and industrial ceramics. The Company will also own 32% of Tianwu Tongyong (Tianjin) International Trading

Co., Ltd, which mainly sources overseas iron ore for steel mills, and 99% of Maoming Hengda Iron and Steel Co., Ltd, which holds

valuable land assets worth an estimated RMB 250 million.

"The timely divesture of the steel manufacturing business

is necessary for General Steel in order to preserve liquid assets that will enable the Company to survive and to focus on the promising

cleantech business," commented Ms. Yunshan Li, Chief Executive Officer of General Steel, "We are thankful to Chairman

Yu with his generous offer to acquire our steel manufacturing business which will alleviate the Company from incurring further

losses that would potentially consume all of our remaining working capital. Following the transaction, we expect our balance sheet

will be much stronger due to a lower debt burden and higher equity. We also expect to be able to liquidate the land assets

in Maoming that could potentially provide as much as $30-40 million cash gain."

"As we concentrate our efforts on where we can have the

greatest growth and return on investments, we are fully committed to accelerating our cleantech business. With the air pollution

getting worse throughout China, the government in December launched a new policy to curb emissions from coal in its next five-year

plan. The new policy will offer additional subsidies for power plants that can meet ultra-low emission requirements, including

minimum oxygen content and concentration level of smoke dust, sulfur dioxide, and NOx emission. We anticipate our De-NOx honeycomb

catalysts business will contribute to our growth and profitability in 2016." Ms. Li concluded.

About General Steel

General Steel Holdings, Inc. is headquartered in Beijing, China

and produces a variety of steel products including rebar and high-speed wire. Through its majority equity interest in Catalon,

the Company also develops and manufactures De-NOx honeycomb catalysts and industrial ceramics.

To be added to the General Steel email list to receive Company

news, or to request a hard copy of the Company's Annual Report on Form 10-K, please send your request to investor.relations@gshi-steel.com.

Forward-Looking Statements

This press release may contain certain forward-looking statements

within the meaning of the Private Securities Litigation Reform Act of 1995. These statements are based on management's current

expectations or beliefs about future events and financial, political and social trends and assumptions it has made based on information

currently available to it. The Company cannot assure that any expectations, forecasts or assumptions made by management in preparing

these forward-looking statements will prove accurate, or that any projections will be realized. Actual results could differ materially

from those projected in the forward-looking statements as a result of inaccurate assumptions or a number of risks and uncertainties.

These risks and uncertainties are set forth in the Company's filings under the Securities Act of 1933 and the Securities Exchange

Act of 1934 under "Risk Factors" and elsewhere, including those disclosed in the Company's most recent Annual Report

on Form 10-K, filed with the United States Securities and Exchange Commission. Forward-looking statements contained herein speak

only as of the date of this release. The Company does not undertake any obligation to update or revise publicly any forward-looking

statements, whether to reflect new information, future events or otherwise.

Contact Us

General Steel Holdings, Inc.

Joyce Sung

Tel: +1-347-534-1435

Email: joyce.sung@gshi-steel.com

Asia Bridge Capital Limited

Carene Toh

Tel: +1-888-957-3362

Email: generalsteel@asiabridgegroup.com

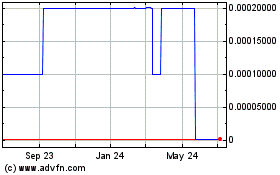

General Steel (CE) (USOTC:GSIH)

Historical Stock Chart

From Jun 2024 to Jul 2024

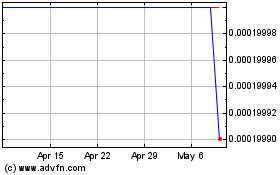

General Steel (CE) (USOTC:GSIH)

Historical Stock Chart

From Jul 2023 to Jul 2024