As filed with

the Securities and Exchange Commission on May 10, 2024

Registration

No. 333-278956

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Amendment No.

1 to

FORM

S-1

REGISTRATION

STATEMENT

UNDER

THE

SECURITIES ACT OF 1933

FINTECH

SCION LIMITED

(Exact

name of registrant as specified in its charter)

| Nevada |

|

6199 |

|

30-0803939 |

(State or other jurisdiction of

incorporation or organization) |

|

(Primary Standard Industrial

Classification Code Number) |

|

(I.R.S. Employer

Identification Number) |

M

Floor & 1st Floor,

No.

33, Jalan Maharajalela,

50150,

Kuala Lumpur, Malaysia

+603

9226 0908

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Lim

Chun Hoo

M

Floor & 1st Floor,

No.

33, Jalan Maharajalela,

50150,

Kuala Lumpur, Malaysia

+603

9226 0908

(Name,

address, including zip code, and telephone number, including area code, of agent for service)

Copies

to:

Jeffery

J. Fessler, Esq.

Emily

A. Mastoloni, Esq.

Sheppard,

Mullin, Richter & Hampton LLP

30 Rockefeller Plaza

New York, NY 10112

Telephone: (212) 653-8700

|

|

Ross

David Carmel, Esq.

Philip

Magri, Esq.

Sichenzia

Ross Ference Carmel LLP

1185

Avenue of the Americas, 31st Floor

New

York, NY 10036

Telephone:

(212) 930-9700

|

Approximate

date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration

statement.

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under

the Securities Act of 1933 check the following box: ☒

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please

check the following box and list the Securities Act registration statement number of the earlier effective registration statement

for the same offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list

the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list

the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting

company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer |

☐ |

|

Accelerated filer |

☐ |

| Non-accelerated filer |

☒ |

|

Smaller reporting company |

☒ |

| |

|

|

Emerging growth company |

☐ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided to Section 7(a)(2)(B) of the Securities Act. ☐

The

registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until

the registrant shall file a further amendment which specifically states that this registration statement shall thereafter

become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement

shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may

determine.

EXPLANATORY

NOTE

This

Registration Statement contains two forms of prospectuses: one to be used in connection with the initial public offering of shares

of our common stock through the underwriters named on the cover page of this prospectus (the “IPO Prospectus”) and

one to be used in connection with the potential resale by certain selling stockholders of an aggregate amount up to 2,050,000

shares of our Common Stock, as adjusted for the 1-for-10 reverse split (the “Selling Stockholder Prospectus”). The

IPO Prospectus and the Selling Stockholder Prospectus will be identical in all respects except for the alternate pages for the

Selling Stockholder Prospectus included herein which are labeled “Alternate Pages for Selling Stockholder Prospectus.”

The

Selling Stockholder Prospectus is substantively identical to the IPO Prospectus, except for the following principal points:

| ● |

they contain different

outside and inside front covers; |

| |

|

| ● |

they contain different Offering sections in

the Prospectus Summary section; |

| |

|

| ● |

they contain different Use of Proceeds sections; |

| |

|

| ● |

the Capitalization section is deleted from the

Selling Stockholder Prospectus; |

| |

|

| ● |

the Dilution section is deleted from the Selling

Stockholder Prospectus; |

| |

|

| ● |

a Selling Stockholder section is included in

the Selling Stockholder Prospectus; |

| |

|

| ● |

the Underwriting section from the IPO Prospectus

is deleted from the Selling Stockholder Prospectus and a Plan of Distribution is inserted in its place; and |

| |

|

| ● |

the Legal Matters section in the Selling Stockholder

Prospectus deletes the reference to counsel for the underwriters. |

We

have included in this Registration Statement, after the financial statements, a set of alternate pages to reflect the foregoing

differences of the Selling Stockholder Prospectus as compared to the IPO Prospectus.

While

the selling stockholders have expressed an intent not to sell the shares of common stock registered pursuant to the Selling Stockholder

Prospectus concurrently with the initial public offering, the sales of our common stock registered in the IPO Prospectus and the

Selling Stockholder Prospectus may result in two offerings taking place concurrently, which could affect the price and liquidity

of, and demand for, our common stock. This risk and other risks are included in “Risk Factors” beginning on page [ ] of the IPO Prospectus.

The

information contained in this preliminary prospectus is not complete and may be changed. These securities may not be sold until

the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not

an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale

is not permitted.

| PRELIMINARY

PROSPECTUS |

SUBJECT

TO COMPLETION |

DATED

MAY 10, 2024

|

Shares

Common

Stock

Fintech

Scion Limited

This

is a firm commitment public offering of shares of our common stock at an assumed public offering price of $_______, based

on the last sale price of our common stock as reported on the OTC Pink Market of the OTC Markets Group (the “OTC”)

on , 2024 and giving effect to a one-for-ten share reverse stock split of our common stock to be effected prior to or upon

the date of this prospectus. The assumed public offering price used throughout this prospectus has been included for illustration

purposes only. The actual offering price may differ materially from the assumed price used in the prospectus and will be determined

by negotiations between us and the underwriters and may not be indicative of prices of the actual offering price.

Our

common stock is quoted on the OTC Pink Market under the symbol “FINR.” We intend to apply to list our common stock

on The Nasdaq Capital Market under the symbol “FINR,” which listing is a condition to this offering. No assurance

can be given that our application will be approved.

Investing

in our common stock involves a high degree of risk. See “Risk Factors” beginning on page . Neither the Securities

and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this

prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| |

|

Per

Share |

|

|

Total |

|

| Public offering price |

|

$ |

|

|

|

$ |

|

|

| Underwriting discounts and commissions(1) |

|

$ |

|

|

|

$ |

|

|

| Proceeds, before expenses, to us (2) |

|

$ |

|

|

|

$ |

|

|

| (1) | Represents

underwriting discounts equal to 7% per share. |

| (2) | Does

not include a non-accountable expense allowance equal to 1% of the gross proceeds of

this offering, payable to the underwriters, or the reimbursement of certain expenses

of the underwriters. We have also agreed to issue the representative of the underwriters

a warrant to purchase a number of shares of common stock equal to 5.0% of the total number

of shares of common stock sold in this offering at an exercise price equal to 120% of

the initial public offering price of the shares of common stock sold in this offering.

For additional information regarding underwriters’ compensation, see “Underwriting”

beginning on page . |

We have granted the underwriters a 45-day option to purchase up to additional shares of our common stock at the public offering

price, less underwriting discounts and commissions.

The

underwriters expect to deliver the shares on or about , 2024.

Spartan

Capital Securities, LLC

The

date of this prospectus is , 2024

TABLE

OF CONTENTS

You

should rely only on the information contained in this prospectus and any free writing prospectus that we have authorized for use

in connection with this offering. Neither we nor the underwriters have authorized anyone to provide you with information that

is different. We are offering to sell and seeking offers to buy the securities covered hereby only in jurisdictions where offers

and sales are permitted. The information in this prospectus is accurate only as of the date of this prospectus, regardless of

the time of delivery of this prospectus or any sale of the securities covered hereby. Our business, financial condition, results

of operations, and prospects may have changed since that date. We are not, and the underwriters are not, making an offer of these

securities in any jurisdiction where the offer is not permitted. This prospectus contains summaries of certain provisions contained

in some of the documents described herein, but reference is made to the actual documents for complete information. All of the

summaries are qualified in their entirety by the actual documents. Copies of some of the documents referred to herein have been

filed or will be filed as exhibits to the registration statement of which this prospectus is a part, and you may obtain copies

of those documents as described below under the heading “Where You Can Find Additional Information.”

For

investors outside the United States: Neither we nor any of the underwriters have taken any action that would permit this offering

or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in

the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about

and observe any restrictions relating to the offering of the securities covered hereby and the distribution of this prospectus

outside of the United States.

Unless

otherwise indicated, the information contained in this prospectus concerning our industry and the markets in which we operate,

including our general expectations and market position, market opportunity and market share, is based on information from our

own management estimates and research, as well as from industry and general publications and research, surveys and studies conducted

by third parties. Industry publications, third-party research, surveys and studies generally indicate that their information has

been obtained from sources believed to be reliable, although they do not guarantee the accuracy or completeness of such information.

We believe that the data obtained from these industry publications and third-party research, surveys and studies are reliable.

Management estimates are derived from publicly available information, our knowledge of our industry and assumptions based

on such information and knowledge, which we believe to be reasonable. Our management estimates have not been verified by any independent

source, and we have not independently verified any third-party information. In addition, assumptions and estimates of our and

our industry’s future performance are necessarily subject to a high degree of uncertainty and risk due to a variety of factors,

including those described in “Risk Factors.” These and other factors could cause our future performance to differ

materially from our assumptions and estimates. See “Cautionary Note Regarding Forward-Looking Statements.” We are

ultimately responsible for all disclosure included in this prospectus.

This

prospectus contains references to our trademarks and service marks and to those belonging to other entities. Solely for convenience,

trademarks and trade names referred to in this prospectus may appear without the ® or ™ symbols, but such references

are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the

rights of the applicable licensor to these trademarks and trade names. We do not intend our use or display of other companies’

trade names, trademarks or service marks to imply a relationship with, or endorsement or sponsorship of us by, any other companies.

PRESENTATION

OF FINANCIAL INFORMATION

All

references in this prospectus to “US$,” “U.S. dollars,” and “dollars” mean U.S. dollars, and

all references to “RM” mean the Malaysian ringgit, unless otherwise noted. This report contains translations of ringgit

and pound stealing amounts into U.S. dollars solely for the convenience of the reader.. We make no representation that the ringgit,

pound stealing or U.S. dollar amounts referred to herein could have been or could be converted into U.S. dollars, pound stealing

or ringgit, as the case may be, at any particular rate or at all.

Any

discrepancies in tables included herein between the total sum of amounts listed and the totals thereof are due to rounding. Accordingly,

figures shown as totals in certain tables may not be an arithmetic aggregation of the figures that precede them.

PROSPECTUS

SUMMARY

The

following summary highlights selected information contained elsewhere in this prospectus and is qualified in its entirety by the

more detailed information and financial statements included elsewhere in this prospectus. It does not contain all the information

that may be important to you and your investment decision. You should carefully read this entire prospectus, including the matters

set forth under “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results

of Operations,” and our financial statements and related notes included elsewhere in this prospectus. In this prospectus,

unless the context requires otherwise, references to “we,” “us,” “our,” “Fintech,”

or “the Company” refer to Fintech Scion Limited.

The

share and per share information in this prospectus reflects, other than in our Financial Statements and the Notes thereto, a reverse

stock split of the authorized and outstanding common stock at an anticipated ratio of one-for-ten (1:10) to occur immediately

following the effective date but prior to the closing of the offering.

Overview

We are a fintech enterprise looking to revolutionize the financial landscape through our digital Software-as-a-Service (SaaS)

platform. Our mission is to empower merchants by furnishing them with an integrated suite of tools, skills, and solutions that

streamline payment services, unlocking a realm of secure, online, and fully managed transactions and settlements.

At

the core of our enterprise lies a sophisticated financial ecosystem, underpinned by a robust technological infrastructure. This

infrastructure has been developed with the mission of empowering financial institutions to offer seamless, consolidated experiences

across diverse verticals encompassing business-to-business, business-to-consumer, and consumer-to-business domains.

In

an era where merchants are leveraging an array of software solutions and digital tools to bolster their competitive edge, our

role has emerged as a pivotal enabler. The intricate challenge of managing disparate software systems sourced from various providers

has become an impediment for merchants of all sizes to seamlessly embrace payments.

Our

current clientele encompasses an array of enterprises and organizations, spanning varied sectors, all with a common objective:

to minimize the intricacies and costs associated with fund transfers. We extend our services to online businesses, providing comprehensive

solutions encompassing payment collection, cross-border transactions, FX services, and corporate bank accounts. Notably, we cater

to a specific subset of online businesses that grapple with establishing and maintaining physical bank accounts across multiple

territories. This subset includes but not limited to small and medium enterprises (SMEs) and online businesses.

Our

cutting-edge payments platform boasts a comprehensive suite of integrated payment products and services tailored to various channels–be

it in-store, online, or through mobile and tablet interfaces. This suite encompasses end-to-end payment processing for an array

of payment types, merchant acquiring and issuing, diverse methods of mobile and contactless payments, and QR code-based solutions.

Complementary software integrations, virtual international bank account numbers (IBAN), integrated mobile point-of-sale (POS)

solutions, risk management tools, and robust reporting and analytics capabilities augment our platform’s offerings.

Our

payment services seamlessly integrate e-money remittance solutions within the global marketplace, spanning open banking and credit

card processing to wire transfers. Our SaaS model empowers clients to focus on their core operations and sales while we handle

the intricate aspects of payment processing. This streamlined approach facilitates efficient onboarding, elevates customer retention,

and cultivates new revenue streams.

Our

vision transcends boundaries as we aspire to cement our position as a global leader in the payments and banking sphere. Our team,

comprising seasoned experts across operations, technology, sales, legal, compliance, and more, forms the backbone of our enterprise.

The

crux of our vision lies in simplifying and automating global fund transfers while upholding the highest standards of security.

We endeavor to furnish merchants with an all-encompassing Merchant Payment Ecosystem (MPE), a unified platform catering to their

diverse payment needs.

Our

diverse merchant base ranges from small to medium-sized enterprises, or SMEs, to large enterprises. While we are rooted in the

SaaS framework, our belief in democratizing technology has led us to offer an initial free platform, generating revenue through

value-added services. Our revenue streams encompass processing fees based on payment volumes, a hybrid model featuring fixed transaction

fees and monthly charges, and diverse layers that allow us to cross-sell services and nurture lasting client relationships.

In

the competitive landscape, our distinct layers constitute the heart of our approach, underpinned by a commitment to exemplary

customer service. We understand the nuanced needs of various merchants and have meticulously curated layers tailored to their

requirements, including cutting-edge technology, diverse payment processing and integrated banking. These layers collectively

form the bedrock of our operations, fostering seamless merchant experiences and propelling us to the forefront of the industry.

As

we chart our course, we stand poised to not only cater to our diverse clientele but to exceed their expectations. Our pursuit

of excellence remains unwavering as we continue to innovate, expand our offerings, and forge new partnerships to reshape the payments

and banking landscape.

Range

of Services

Our

comprehensive suite of services is carefully tailored across six strategic business areas, each designed to cater to the distinct

needs of our diverse clientele. These business areas represent the core of our operations, enabling us to offer a seamless and

integrated payment ecosystem to merchants worldwide.

| 1. | Payment

Services Provider (PSP): Operating under the brand name FintechCashier, we excel

as a PSP, facilitating international payment solutions for merchants by collaborating

with card acquiring banks and alternative payment solution providers. Our expertise in

this domain empowers merchants to effortlessly navigate the complexities of cross-border

transactions. |

| 2. | Business

Accounts: Our specialized business account services extend across diverse industries

and currencies, offering tailored solutions to corporate entities. We assist our clients

in establishing and managing corporate accounts, ensuring they can seamlessly operate

on a global scale, irrespective of their sector. |

| 3. | SEPA

& SWIFT Payments: Our proficient settlement services encompass SEPA and SWIFT

payments, enabling swift and secure fund transfers for merchants and business clients

across international banks. Our streamlined process involves efficient inter-account

fund transfers, culminating in the issuance of SWIFT or SEPA payments. |

| 4. | Foreign

Exchange (FX) Conversion: Through strategic partnerships, we provide foreign exchange

payment solutions, facilitating seamless currency conversion for clients. Whether it’s

settling invoices, processing payrolls, or making payments for goods and services, our

FX conversion services ensure seamless and efficient transactions. |

| 5. | Acquirer

Services: As a global player, we specialize in offering debit and credit card acquiring

services to online merchants across the globe. |

| 6. | Whitelabelling:

Our whitelabelling service presents a fully customizable merchant back office platform,

complete with comprehensive access to an array of banking payment methods. This tailored

solution empowers merchants to seamlessly integrate their operations within a unified

framework. |

Within

these strategic business areas, we have structured three distinct service layers, all seamlessly integrated within a single platform.

This holistic approach empowers merchants to expand their operational horizons, fueling their growth within a unified payment

ecosystem.

Fintech Digital Solution Limited is a software

technology provider combining hundreds of payment providers and payment methods under one platform. In response to updated regulatory

compliance mandates from the United Kingdom, potentially impacting our operations as of December 2023, our management has opted to discontinue

the use of an Electronic Money Directive (EMD) agency service to instead implement an individual and case by case approach to ensure

our operations comply with the varying regulatory requirements throughout multiple jurisdictions. Our management team remains committed

to collaborating with various firms across these multiple jurisdictions where regulatory licenses or registrations are essential for

our operations. We are actively engaging with licensed and regulated entities on a referral basis to ensure seamless continuity of our

services including Business Accounts, SEPA & SWIFT Payments and Foreign Exchange (FX) Conversion services and maintaining our commitment

to delivering reliable payment solutions without any interruption.

Market

Opportunity

By

targeting three different layers within the payment space, FintechCashier expands its reach across

multiple layers in the payment space, unlocking substantial potential instead of confining itself to a single market. This approach

minimizes the necessity to compete for a dominant market share within any specific layer, opting instead to pursue smaller market

shares across multiple layers, thereby fostering opportunities for growth.

The

global digital payment market is estimated to reach $361.30 billion by 2030 with a CAGR of 20.5% according

to a September 2022 report published by Grand View Research, Inc.

The

global cashless transactions are likely to foresee significant growth amid the usage and preference for cashless transactions

and by 2025, a growth of 1.9 trillion transactions is estimated.

Accenture

conducted a research study that shows transactions worth US$7 trillion is expected to shift from cash to card and other

digital payments by 2023 and grow to US$48 trillion by 2030.

The

COVID-19 pandemic brought a positive impact to the digital payment market with an increase in online shopping and the fear of

virus transmission through physical monetary transactions.

The

key market trends include:

| a) | The

increasing preference for online shopping is a driving factor for the market. It offers

the users a number of benefits such as fast checkout options, customized customer experience,

and multiple payment options. In addition, companies are also designing enhanced

smartwatches that are capable of making contactless payments, similar to the process

used in smartphones. For instance, Xiaomi launched the brand new Mi Smart Band 6

in collaboration with Master Card in December 2021, which is capable of conducting

contactless payments at Master Card terminals. |

| b) | Smart

city initiative is a significant component in the digital payment market growth, as digital

payments are used throughout the various departments to cover multiple Citizen-to-Government

(C2G), and Government-to-Citizen (G2C) payments. |

| c) | Introduction

of digital wallets, and the decreasing number of worldwide unbanked population, seem

favorable for the digital payment vendors to expand their customer base. Overall, the

digital payment market is expected to witness a much higher rate of growth, owing to

the driving factors like the promotion of digital payments, rise in internet penetration,

high proliferation of smartphones that enables m-commerce growth, and a hike in e-commerce

sales. |

| d) | Constant

acceleration of e-commerce supports the use of ePayments and brings about significant

benefits. ePayments help overcome the complicated and costly process of physically collecting

cash for a product purchased or sold online. Furthermore, innovations in ePayments can

ease the process of carrying out payments and other financial services, which can boost

additional e-commerce opportunities. Thus, rising e-commerce sales are expected to positively

impact the growth of the payment processing solutions market. |

| e) | Internet

access has reached all corners of the world, and this has led to a boost in the online

shopping industry. Smartphones have also become an essential part of several people in

the 21st century. The growth of e-commerce is driven by the rapid technology adoption,

which is led by the rising use of devices, such as smartphones and tablets, and access

to the internet through 4G, 5G, and so on. |

To

take advantage of this trend, merchants worldwide are actively pursuing international expansion, thereby increasing their demand

for seamless payment processing across diverse methods and channels within intricate and fragmented payment ecosystems.

| ● | Contactless

Payment Market - The global contactless payment market size is expected to reach

USD 6.25 trillion by 2028, according to a new report by Grand View Research, Inc. In

a survey conducted by Thales Group in November 2022, it stated it is anticipated to register

a CAGR of 20.3% from 2021 to 2028. Various benefits, such as improved service delivery

and reduction in transaction time offered by contactless payments, are expected to propel

the market growth over the forecast period. |

| ● | Mobile

Payment Market - The global mobile payment market size is expected to reach USD 587.52

billion by 2030, expanding at a CAGR of 35.3% from 2022 to 2030, according to a new report

by Grand View Research, Inc. The market growth can be attributed to the increasing shift

toward contactless payment amid the COVID-19 pandemic. Moreover, the increasing popularity

of the e-commerce industry across the globe is expected to accelerate the adoption of

mobile payment over the forecast period. |

| ● | Payment

As A Service Market - The global payment as a service market size is expected to

reach USD 25.7 billion by 2027, expanding at a CAGR of 16.9%, according to a new report

by Grand View Research, Inc. Digital disruption in the money transfer ecosystem, combined

with the rise in need for quick money transfer methods, has transformed the payment gateway

model. As a result of digital money transfer methods, consumers now demand secure digital

transaction processing systems to transfer money to their merchants and individuals. |

Competitive

Strengths

FintechCashier

competes with a range of providers, each of whom may provide a component of our offering, but do not provide an integrated offering

capable of solving complex business challenges for software partners and merchants. For certain services and solutions, including

end-to-end payments, we compete with third-party payment processors and integrated payment providers.

The

competitive landscape across the three layers are shown in the table

| Layer |

Market

Sector |

Competitors |

| Technical |

Payment

Gateway Market |

Crassula,

Contis, Mambu, SBlock |

| Payments |

Payment

Processing Market |

Nuvei,

Worldpay, Checkout, Ayden |

| Banking |

Digital

Payment Market |

Solaris

Bank, Tide Mollie, Revolut, |

| Issuing |

Issuing

Layer |

Marqueta |

We

believe our market opportunity is demonstrated by a number of recent transactions completed by our competitors throughout the

three layers outlined above. With respect to the technical layer, in a December 2021 Series E funding round, Mambu raised $265.7

million, for a company valuation of $5.4 billion post-money. With respect to the banking layer, Revolut, a competitor on our banking

layer, cites a $33 billion market cap, while Marqueta, our competitor in the issuing layer is valued today at nearly $3.7 billion.

Unlike

many players in the market FintechCashier is not exclusively focused on payments. By targeting different layers, it can provide

full solutions for customers covering all their payment needs.

Combining

all layers under one platform, FintechCashier solution creates a greater market opportunity and potential for increasing market

penetration.

Intellectual

Property

We

rely on a combination of trademark, domain names and trade secret laws, as well as employee and third-party nondisclosure, confidentiality

and other types of contractual arrangements to establish, maintain and enforce our intellectual property rights, including with

respect to our proprietary rights related to our products and services. In addition, we use service platform technology, have

an exclusive distribution technology license and license technology from third parties.

Recent

Developments

On

December 27, 2023, our Board of Directors appointed Lim Chun Hoo as Chief Executive Officer of the Company concurrently with its

acceptance of the resignation of Shalom Dodun as the Company’s CEO and as a member of the Company’s Board of Directors.

Mr. Lim previously served as Chief Financial Officer of the Company since November 2022 and is a member of the Board. Mr. Dodoun’s

resignation was not the result of any disagreement with the Company relating to its operations, policies or practices. In connection

with Mr. Dodoun’s resignation from the Board, the Board approved a reduction in the size of the Board to three directors.

On December 27, 2023, the Board appointed Colin Ellis as Chief Financial Officer of the Company. Mr. Ellis had served as a non-executive

director of the Company since February 2023 and transitioned to an executive director upon his appointment as Chief Financial

Officer of the Company.

Corporate

History and Structure

We

were incorporated in the state of Nevada on November 19, 2013 as “Albero, Corp.” On January 8, 2016, we changed our

name to “Vitaxel Group Limited.” On March 2, 2022, we changed our name to “HWGC Holdings Limited.” On

May 16, 2023, we changed our name to “Fintech Scion Limited.”

On

July 21, 2022, we entered into a share exchange agreement with FintechCashier Asia P.L.C. (formerly known as HWGG Capital P.L.C.),

a Labuan company (“FintechAsia”), and all of the shareholders of FintechAsia pursuant to which all shareholders of

FintechAsia irrevocably agreed to transfer and assign to the Company all FintechAsia’s shares held by the shareholders in

exchange for newly issued shares of the Company’s common stock. Following the closing of the share exchange on November

15, 2022, FintechAsia became a wholly-owned subsidiary of the Company.

On

August 9, 2022, we entered into another share exchange agreement with Fintech Scion Limited (“Fintech”), a private

limited company incorporated in the United Kingdom, and all of the shareholders of Fintech pursuant to which All shareholders

of Fintech irrevocably agreed to transfer and assign to the Company all of Fintech’s shares held by such shareholders in

exchange for newly issued shares of the Company’s common stock. Following the closing of the share exchange on November

30, 2022, Fintech became a wholly-owned subsidiary of the Company.

On

December 30, 2022, we entered into a stock purchase agreement with Mr. Leong Yee Ming, the previous Chief Executive Officer of

the Company (the “Purchaser”), pursuant to which the Company sold to the Purchaser all issued and outstanding shares

of Aelora Sdn Bhd (“ASB” and formerly known as Vitaxel Sdn Bhd) and Vitaxel Online Mall Sdn Bhd (“Vionmall”,

and together with ASB, the “Former Subsidiaries”). The Company sold the Former Subsidiaries for an aggregate purchase

price of RM4,500,002 (the “Purchase Price”), with RM4,500,000 allocated for the purchase price of ASB and RM2 for

the purchase of Vionmall. The Purchase Price was paid by the Purchaser’s assumption of a certain amount of intercompany

debt owed by the Company to ASB. Pursuant to the terms of the agreement, the Company and ASB assigned, and the Purchaser’s

assumed, that portion of intercompany debt equal to the Purchase Price and in full satisfaction of the Purchase Price. Following

the completion of the disposal of the Former Subsidiaries to the Purchaser on the same day, ASB and Vionmall ceased to be the

subsidiaries of the Company as of December 30, 2022.

On

October 11, 2023, we entered into an Asset Conveyance Agreement (the “Purchase Agreement”) with CICO Digital Solutions

Limited, a British Columbia company (“CICO” and a related party company that has a common control by a major shareholder

of the Company). The Purchase Agreement provided for the acquisition by the Company of substantially all of the assets of CICO

(the “Assets”) related to CICO’s business of providing a service platform and software application for payment

services from CICO. As consideration for the transfer and sale of the Assets, the Company issued CICO 10,000,000 restricted shares

of common stock of the Company, par value $0.01 per share, as adjusted for the 1-for-10 reverse split (the “Shares”).

On

December 27, 2023, the Company and CICO mutually and voluntarily agreed to unwind the transaction contemplated by the Purchase

Agreement. Upon termination, each of the parties to the Purchase Agreement were relieved of their respective rights, liabilities,

expenses and other obligations under the Purchase Agreement. In connection therewith, CICO transferred the Shares back to the

Company for cancellation upon receipt. The Shares were cancelled and removed from the Company’s issued and outstanding shares

of common stock on January 30, 2024.

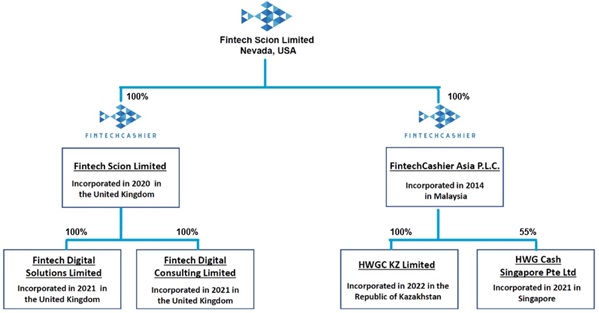

The

diagram below illustrates our current corporate structure:

Risk

Factor Summary

Our

business is subject to a number of risks of which you should be aware before making an investment decision. You should carefully

consider all of the information set forth in this prospectus and, in particular, should evaluate the specific factors set forth

under “Risk Factors” in deciding whether to invest in our securities. Among these important risks are the following:

Risks

Related to Our Business and Industry

| ● | We

have a limited operating history with financial results that may not be indicative of future performance, and our revenue growth

rate is likely to slow down as our business matures. |

| ● | Impairment

of goodwill may adversely impact future results of operations. |

| ● | Substantial

and increasing competition, both within our industry and from other payment methods, and disintermediation from other participants

in the payment chain may harm our business. |

| ● | Interruption

or failure of our information technology and communications systems could impair our operations, which could also damage our reputation

and harm our results of operations. |

| ● | Cybersecurity

risks, including cyber-attacks, data breaches, and system vulnerabilities could adversely affect our business and disrupt our

operations. |

| ● | Our

reliance on the platform and internal systems from third parties may adversely affect our business operations and financial results. |

| ● | If

we cannot retain our key personnel, our business, financial condition and results of operations may be adversely affected. |

| ● | In

a dynamic industry like ours, the ability to attract, recruit, develop and retain qualified employees is critical to our success

and growth. If we are not able to do so, our business and prospects may be materially and adversely affected. |

| ● | If

we fail to raise additional capital, our ability to implement our business model and strategy could be compromised. |

| ● | The

financial technology industry in which we operate is characterized by rapid technological changes, new product introductions,

evolving industry standards and changing customer needs. |

Risks

Related to Our Intellectual Property

| ● | If

we are unable to successfully obtain, maintain, protect, enforce, or otherwise manage our intellectual property and proprietary

rights, we may incur significant expenses, and our business may be adversely affected. |

| ● | Claims

by others that we have infringed their proprietary technology or other intellectual property rights could harm our business. |

| ● | If

we are unable to obtain or fail to comply with the required licenses to operate our business or experience disputes with licensors

or disruptions to our business relationships with our licensors, we could lose license rights that are important to our business. |

| ● | Third

parties may assert that our employees or consultants have wrongfully used or disclosed confidential information or misappropriated

trade secrets. |

Risks

Related to Regulation

| ● | Complex

and enhanced regulatory oversight in the banking and financial services industry could adversely affect our operations or our

relationships with our banking partners. |

| ● | We

are subject to chargeback and refund liability risk when our merchants refuse to or cannot reimburse chargebacks and refunds resolved

in favor of their customers. Any increase in chargebacks and refunds not paid by our merchants may adversely affect our business,

financial condition or results of operations. |

| ● | We

are subject to costs and risks associated with new or changing laws and regulations and governmental action affecting our business. |

| ● | Changes

in tax law, changes in our effective tax rate or exposure to additional tax liabilities could affect our profitability and financial

condition. |

| ● | Transfer

pricing rules may result in increased tax costs. |

| ● | New

and evolving regulations in respect of the protection of personal data and any failure to comply with these regulations could

have a material adverse effect on our business and financial condition. |

| ● | We

collect, process, store, and use data, including personal information, which subjects us to governmental regulation and other

legal obligations, including EU financial services regulation, particularly related to privacy, data protection and information

security, marketing, and consumer protection laws across different markets where we conduct our business. Our actual or perceived

failure to comply with such obligations could harm our business and/or result in reputational harm, loss of customers, material

financial penalties and legal liabilities. |

| ● | We

may not be able to continue to expand our share of the existing payment processing markets or expand into new markets, which would

inhibit our ability to grow and increase our profitability. |

| ● | We

are subject to anti-corruption, anti-bribery and anti-money laundering laws and regulations. |

| ● | We

may be subject to further queries or requests regarding the SEC Subpoena. |

Risks

Related to Our Common Stock and This Offering

| ● | If

you purchase our common stock in this offering, you will incur immediate and substantial dilution in the book value of your shares. |

| ● | We

presently do not intend to pay cash dividends on our common stock. |

| ● | If

we are unable to establish appropriate internal financial reporting controls and procedures, it could cause us to fail to meet

our reporting obligations, result in the restatement of our financial statements, harm our operating results, subject us to regulatory

scrutiny and sanction, cause investors to lose confidence in our reported financial information and have a negative effect on

the market price for shares of our common stock. |

| ● | The

price of our stock may be volatile, and you could lose all or part of your investment. |

| ● | Even

if our common stock is listed on Nasdaq, there can be no assurance that we will be able to comply with the continued listing standards

of Nasdaq, a failure of which could result in a delisting of our common stock. |

| ● | Certain

shareholders may exercise significant control over our business policies. |

| ● | The

requirements of being a public company are expensive and administratively burdensome. |

| ● | Anti-takeover

provisions in our Articles of Incorporation and Bylaws and Nevada law could discourage, delay or prevent a change in control of

our company and may affect the trading price of our common stock. |

| ● | Our

Articles of Incorporation allow for our board of directors to create new series of preferred stock without further approval by

our shareholders which could adversely affect the rights of the holders of our common stock. |

| ● | If

securities or industry analysts do not publish research or publish inaccurate or unfavorable research about our business, our

stock price and any trading volume could decline. |

| ● | Future

sales and issuances of our common stock or rights to purchase common stock, including pursuant to our equity incentive plan or

otherwise, could result in dilution of the percentage ownership of our shareholders and could cause our stock price to fall. |

| ● | Our

common stock may be subject to the “penny stock” rules of the SEC, which may make it more difficult for shareholders

to sell our common stock. |

| ● | We

have never paid cash dividends on our capital stock and do not anticipate paying dividends in the foreseeable future. |

Proposed

Changes to Our Capital Structure

We

plan to effect a 1-for-10 reverse split of our outstanding shares of common stock prior to the date of this prospectus. No fractional

shares will be issued in connection with the reverse stock split and all such fractional interests will be rounded up to the nearest

whole number of shares of common stock. The conversion and/or exercise prices of our issued and outstanding convertible securities,

including shares issuable upon exercise of outstanding stock options and warrants, and conversion of our outstanding convertible

notes will be adjusted accordingly. All information presented in this prospectus assumes the 1-for-10 reverse split of our outstanding

shares of common stock, and unless otherwise indicated, all such amounts and corresponding conversion price and/or exercise price

data set forth in this prospectus have been adjusted to give effect to the assumed reverse stock split.

Implications

of Being a Smaller Reporting Company

We

are a “smaller reporting company” as defined in the Securities Exchange Act of 1934 as amended (the “Exchange

Act”). We may continue to be a smaller reporting company so long as either (i) the market value of our common stock held

by non-affiliates is less than $250 million measured on the last business day of our second fiscal quarter or (ii) our annual

revenue was less than $100 million during the most recently completed fiscal year and the market value of our common stock held

by non-affiliates is less than $700 million measured on the last business day of our second fiscal quarter. Specifically, as a

smaller reporting company, we may choose to present only the two most recent fiscal years of audited financial statements in our

Annual Report on Form 10-K and have reduced disclosure obligations regarding executive compensation, and, similar to emerging

growth companies, if we are a smaller reporting company under the requirements of (ii) above, we would not be required to obtain

an attestation report on internal control over financial reporting issued by our independent registered public accounting firm.

Corporate

Information

Our

principal executive office is located at M Floor & 1st Floor, No. 33, Jalan Maharajalela, 50150, Kuala Lumpur, Malaysia,

and our telephone number is +603 9226 0908.

Our

website is www.fintechcashier.com. Information provided on, or accessible through, our website, however, is not part of

this prospectus and is not incorporated herein by reference.

THE

OFFERING

| Common stock offered by us: |

|

___

shares of common stock |

| |

|

|

| Common stock outstanding prior to this Offering: |

|

___ shares

of common stock |

| |

|

|

| Common

stock to be outstanding immediately after this Offering: |

|

___

shares (__ shares if the underwriters exercise their option to cover over-allotments, if any) |

| |

|

|

| Over-allotment Option: |

|

We have granted

the underwriters an option for a period of 45 days from the date of this prospectus to purchase up to an additional __ shares

of common stock, representing 15% of the shares of common stock sold in the offering at a purchase price per additional share

of common stock equal to the public offering price per share of common stock, less the underwriting discount. |

| |

|

|

| Representative’s Warrant: |

|

We have agreed to

issue Spartan Capital Securities, LLC, the representative of the underwriters in this offering, a warrant to issue the number

of shares of common stock equal to 5.0% of the shares of common stock being offered in this offering (the “Representative’s

Warrant”). The Representative’s Warrant will be exercisable at any time, and from time to time, in whole or in

part, commencing on a date that is 180 days after the commencement of sales of the share of common stock in this offering

and expiring four and a half years from the date of the commencement of sales at an exercise price of $[●] (120% of

the offering price per share). See “Underwriting.” |

| |

|

|

| Lock-up Agreements: |

|

We have agreed with

the underwriters not to sell additional equity securities for a period of 180 days after the effective date of this Offering.

Our directors and officers have agreed with the underwriters not to offer for sale, sell, contract to sell, pledge or otherwise

dispose of any of their shares of our common stock or securities convertible into our common stock, subject to certain exceptions,

for a period of 180 days after the date of this prospectus, which restriction may be waived in the discretion of the Representative. |

| |

|

|

| Use of Proceeds: |

|

We

estimate that the net proceeds from this offering will be approximately $ million,

assuming a public offering price of $_______, based on the last sale price of our common stock as reported on the OTC

Pink Market of the OTC Markets Group (the “OTC”) on , 2024 or approximately $

million if the underwriters exercise their over-allotment option in full, after deducting the underwriting discounts and

commissions and estimated offering expenses payable by us.

We

intend to use the net proceeds of this offering for continuing operating expenses and working capital. See “Use of Proceeds.” |

| |

|

|

| Risk Factors: |

|

Investing in our

securities involves a high degree of risk. See “Risk Factors” starting on page ______ of this prospectus

for a discussion of factors you should carefully consider before investing in our securities. |

| |

|

|

| Trading Symbol/Nasdaq Listing Application: |

|

Our

common stock is currently quoted on the OTC Pink Market under the trading symbol “FINR.”

We

intend to apply to list our common stock on The Nasdaq Capital Market under the symbol “FINR.” However, no assurance

can be given that our listing application will be approved. If Nasdaq does not approve our listing application, we will not consummate

this offering. |

Except

as otherwise indicated herein, all information in this prospectus reflects or assumes:

| ● | a

one-for-ten share reverse stock split of our common stock to be effected on ________, 2024; |

| ● | no

exercise of the underwriters’ option to purchase up to an additional [ ] shares of our common stock to cover over-allotments,

if any; and |

| ● | the

cancellation, on January 30, 2024, of the 10,000,000 shares that were issued to CICO for the acquisition of assets. |

SUMMARY

HISTORICAL CONSOLIDATED FINANCIAL DATA

The

following tables summarize consolidated financial data for the periods indicated. We have derived the consolidated statement of

operations data for the years ended December 31, 2023, and 2022. Our historical results are not necessarily indicative of the

results that may be expected in the future. The following summary of financial data should be read with “Management’s

Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and

related notes and other information included elsewhere in this prospectus.

Consolidated

Statement of Operations Data:

| | |

| | |

| |

| | |

For the Years Ended

December, 31 | |

| | |

2023 | | |

2022 | |

| REVENUE | |

$ | 2,420,184 | | |

$ | 3,084,279 | |

| | |

| | | |

| | |

| COST OF REVENUE | |

| (688,630 | ) | |

| (430,281 | ) |

| | |

| | | |

| | |

| GROSS PROFIT | |

| 1,731,554 | | |

| 2,653,998 | |

| | |

| | | |

| | |

| OPERATING EXPENSES | |

| | | |

| | |

| Selling expense | |

| — | | |

| (9,790 | ) |

| General and administrative expenses | |

| (3,415,786 | ) | |

| (1,863,982 | ) |

| Impairment of goodwill | |

| (39,136,871 | ) | |

| — | |

| Total Operating Expenses | |

| (42,552,657 | ) | |

| (1,873,772 | ) |

| | |

| | | |

| | |

| PROFIT/(LOSS) FROM OPERATIONS | |

| (40,821,103 | ) | |

| 780,226 | |

| | |

| | | |

| | |

| OTHER INCOME / (EXPENSE), NET | |

| | | |

| | |

| Other income | |

| 397,532 | | |

| 5,531,606 | |

| Other expense | |

| (73,660 | ) | |

| (387,805 | ) |

| Total other income / (expense), net | |

| 323,872 | | |

| 5,143,801 | |

| NET INCOME / (LOSS) BEFORE TAX | |

| (40,497,231 | ) | |

| 5,924,027 | |

| | |

| | | |

| | |

| Income tax | |

| (165,485 | ) | |

| (5,057 | ) |

| NET INCOME / (LOSS) | |

$ | (40,662,716 | ) | |

$ | 5,918,970 | |

| | |

| | | |

| | |

| Loss attributable to non-controlling interest | |

| 913 | | |

| — | |

| NET INCOME / (LOSS) FOR THE PERIOD | |

| (40,661,803 | ) | |

| 5,918,970 | |

| | |

| | | |

| | |

| OTHER COMPREHENSIVE INCOME / (LOSS) | |

| | | |

| | |

| Foreign currency translation adjustment | |

| 3,404 | | |

| 308,288 | |

| | |

| | | |

| | |

| TOTAL COMPREHENSIVE INCOME / (LOSS) | |

$ | (40,658,399 | ) | |

$ | 6,227,258 | |

| | |

| | | |

| | |

| Weighted average number of common shares outstanding - basic and diluted | |

| 298,742,643 | | |

| 198,742,643 | |

| | |

| | | |

| | |

| Net

income / (loss) per share - basic and diluted | |

$ | (0.14 | ) | |

$ | 0.03 | |

Consolidated

Balance Sheet Data:

| | |

December 31, 2023 | |

| | |

| | |

| |

| | |

Actual | | |

As Adjusted (1) | |

| | |

| | |

| |

| Cash and cash equivalents | |

$ | 3,765,959 | | |

| | |

| Working capital | |

$ | 1,591,522 | | |

| | |

| Total assets | |

$ | 21,078,344 | | |

| | |

| Total stockholders’ equity | |

$ | 18,322,482 | | |

| | |

(1)

On an as adjusted basis giving effect to the sale by us of ________ shares of common stock at an assumed public offering price

of $_____ per share in this offering (based on the last reported sale price of $____ per share of our common stock as reported

on the OTC Pink Market on ___, 2024) after deducting the estimated underwriting discounts and commissions and estimated offering

expenses payable by us in connection with this offering.

RISK

FACTORS

Investing

in our securities involves a high degree of risk. You should carefully consider the risks and information below and elsewhere

in this prospectus, including our consolidated financial statements and the related notes thereto, before making an investment

decision. We describe risks below that we currently believe are the material risks of our business, our industry and our securities.

These are not the only risks we face. We are subject to risks that are currently unknown to us, or that we may currently believe

are remote or immaterial. If any of these risks or events occurs, our business, financial condition and operating results could

be harmed. In that case, the trading price of our securities could decline, and you might lose all or part of your investment

in our securities.

Risks

Related to Our Business and Industry

We

have a limited operating history with financial results that may not be indicative of future performance, and our revenue growth

rate is likely to slow down as our business matures.

As

a result of our limited operating history, we have limited financial data that can be used to evaluate our current business, and

such data may not be indicative of future performance. In particular, we have experienced periods of high revenue growth since

we began selling our products and services, and we do not expect to be able to maintain the same rate of revenue growth as our

business matures. In addition, estimates of future revenue growth are subject to many risks and uncertainties, and our future

revenue may be materially lower than projected.

We

have encountered, and expect to continue to encounter, risks and difficulties frequently experienced by growing companies, including

challenges in financial forecasting accuracy, hiring of experienced personnel, hiring of technology employees, determining appropriate

investments, developing new products and features, assessing legal and regulatory risks, among others. Any evaluation of our business

and prospects should be considered in light of our limited operating history, and the risks and uncertainties inherent in investing

in early-stage companies.

Impairment

of goodwill may adversely impact future results of operations.

Accounting

standards require that we account for acquisitions using a method that could result in goodwill. If the purchase price of the

acquired assets exceeds the fair value of the acquired net assets, the excess will be included in our Statement of Financial Condition

as goodwill. We have a significant goodwill balance, and in accordance with GAAP, we evaluate it for impairment at least annually

and more often if events or circumstances indicate the possibility of impairment. Evaluations may be based on many factors, some

of which are the price of our common stock, discounted cash flow projections and data from comparable market acquisitions. A significant

and sustained decline in our stock price and market capitalization, a significant decline in our expected future cash flows, a

significant adverse change in the business climate or slower growth rates could result in impairment of our goodwill. Future evaluations

of goodwill may result in the impairment and write-down of our goodwill balance which could have a material adverse impact on

our earnings and adversely affect our operating results.

Our

independent auditors have issued an audit opinion for our company, which includes a statement in the critical audit matters, describing

the impairment of goodwill and its financial implications.

In

their audit report included in this prospectus, our auditors expressed any further goodwill impairment will cause a significant

adverse financial impact on the Company. Furthermore, the Company generate losses for the year 2023 and the Company cannot guarantee

that it will generate profits in the future. The impact of the goodwill impairment and the losses generated by the Company could

raise substantial doubt about the Company’s ability to continue as a going concern and this may significantly affect the

stock price of the Company

If

we cannot keep pace with rapid developments and changes in our industry and continue to acquire new merchants and partners rapidly,

the use of our services could decline, reducing our revenue.

The

electronic payments market in which we compete is subject to rapid and significant changes. This market is characterized by rapid

technological change, new product and service introductions, evolving industry standards, changing client needs, consolidation

and the entrance of non-traditional competitors. In order to remain competitive and continue to acquire new merchants and partners

rapidly, we are continually involved in a number of projects to develop new services and improve our existing services. These

projects may not be successful and carry some risks, such as cost overruns, delays in delivery, performance problems and lack

of client adoption, and may cause us to become subject to additional regulation. Moreover, the merchant base that we target is

varied and non-geographically bound or restricted by scale, making it more challenging to predict demand for our offerings. Any

inability to develop or delay in the delivery of new services or the failure to differentiate our services or to accurately predict

and address market demand could render our services less desirable, or even obsolete, to our clients. In addition, many current

or prospective customers may find competing services more attractive if we do not keep pace with market innovation, and many may

choose to switch to competing services even if we do our best to innovate and provide superior services.

We

rely in part, and may in the future rely in part, on third parties, including some of our competitors and potential competitors,

for the development of and access to new technologies. If we are unable to maintain these relationships, we may lose access to

new technologies or may not have the speed-to-market necessary to launch new offerings successfully.

Our

future success will depend on our ability to adapt to technological changes and evolving industry standards. We cannot predict

the effects of technological changes on our business. If we are unable to adapt to technological changes or evolving industry

standards on a timely and cost-effective basis by introducing new services and improving existing services, our business, financial

condition, and results of operations could be materially adversely affected.

Substantial

and increasing competition, both within our industry and from other payment methods, and disintermediation from other participants

in the payment chain may harm our business.

The

market for payment processing services is highly competitive. Other providers of payment processing services have established

a sizable market share in the merchant acquiring sector. Our growth will depend on a combination of the continued growth of electronic

payments and our ability to increase our market share.

Our

competitors include traditional merchant acquirers such as financial institutions, affiliates of financial institutions and global

payment providers, as well as local payment providers. These competitors and other industry participants may develop products

and services that compete with or replace our value-added products and services, including products and services that enable payment

networks and banks to transact with consumers directly.

Many

of our competitors, particularly those affiliated with large financial institutions, also have substantially greater financial,

technological, operational, and marketing resources than we have. Accordingly, these competitors may be able to offer their products

and services at more competitive prices. As a result, we may need to reduce our fees or otherwise modify the terms of use of our

products and services to retain existing clients and attract new ones. If we are required to materially reduce our fees to remain

competitive, we will need to aggressively control our costs to maintain our profit margins, and our revenue may be adversely affected.

Our risk management team monitors our client relationships and we have at times terminated, and may continue to terminate, client

relationships that may no longer be profitable to us due to such pricing pressure. Moreover, our competitors may have the ability

to devote significantly more financial and operational resources than we can to the development of new products, services or new

technologies or to acquire other companies or technology so that they can provide improved operating functionality and features

to their existing service offerings. If successful, their efforts in this regard could render our products or services less desirable

to clients, resulting in the loss of existing clients, an inability to obtain new clients, or a reduction in the fees we could

generate from our offerings.

Any

of the foregoing could have a material adverse effect on our business, financial condition and results of operations.

In

addition, we are currently facing new competitive pressure from non-traditional payment processors and other parties entering

the payments industry, which may compete in one or more of the functions performed in processing merchant transactions. These

competitors have significant financial resources and robust networks and are highly regarded by consumers. If these competitors

gain a greater share of total electronic payments transactions, or if we are unable to successfully react to changes in the industry

spurred by the entry of these new market participants, then it could have a material adverse effect on our business, financial

condition and results of operations.

Interruption

or failure of our information technology and communications systems could impair our operations, which could also damage our reputation

and harm our results of operations.

Our

success and ability to process payments and provide high quality client service depend on the efficient and uninterrupted operation

of our computer and information technology systems, as our merchant customers expect a consistent level of quality in providing

our services. Any failure of our computer systems and information technology to operate effectively or to integrate with other

systems, performance inadequacy or breach in security may cause interruptions in the availability of our sites, delays in payment

processing and reduced efficiency of our operations. Factors that could occur and significantly disrupt our operations include

system failures and outages caused by fire, floods, earthquakes, power loss, telecommunications failures, sabotage, vandalism,

terrorist attacks and similar events, software errors, computer viruses, worms, physical or electronic break-ins and similar disruptions

from unauthorized tampering with our computer systems and payments platform. While we have certain backup systems and basic recovery

plans for certain aspects of our operations and business processes, we do not have full redundancy in our infrastructure and our

planning does not account for all possible scenarios, and requires further development, review and updates. Any disruptions or

service interruptions that affect our systems could damage our reputation, require us to spend significant capital and other resources

and expose us to a risk of loss or litigation and possible liability. Certain of our agreements with third-party service providers

do not require those providers to indemnify us for losses resulting from any disruption in service. Furthermore, certain critical

processes, such as hosting, cloud and other IT related services, rely on single vendors or components without built-in redundancy.

Accordingly, we are exposed to potential single point of failure issues that could lead to service interruptions. Any such disruptions

could materially adversely affect our results of operations.

In

addition, our platform and internal systems rely on software developed by us or third parties that is highly technical and complex,

and depend on the ability of such software to store, retrieve, process and manage large amounts of data. The software on which

we rely has contained, and may now or in the future contain, undetected programming errors or flaws. Some errors may only be discovered

after the code has been released for external or internal use. Errors or other design defects within the software on which we

rely may result in a negative experience for companies or end users using any elements of our platform, disruptions to the operations

of our merchants, errors, or compromise our ability to support effective user service and user engagement or make us susceptible

to cybersecurity breaches and attacks, or delay introductions of new features or enhancements. Any errors, bugs or defects discovered

in the software on which we rely could result in harm to our reputation and loss of users, which could adversely affect our business,

results of operations and financial conditions.

Cybersecurity

risks, including cyber-attacks, data breaches, and system vulnerabilities could adversely affect our business and disrupt our

operations.

We

rely heavily on our platform and internal systems rely on software developed by us or third parties for the effective operation

of our business. We routinely collect, receive, process, and store personal information and sensitive data via our information

technology systems, including intellectual property and other proprietary information about our business and that of our customers,

employees, suppliers, business partners, and others. These information technology systems are subject to damage or interruption

from a number of potential sources, including, but not limited to, natural disasters, destructive or inadequate code, malware,

bugs, viruses, system vulnerabilities, power failures, phishing attacks, denial-of-service attacks, cyber-attacks, internal

negligence, malfeasance, or other events.

Cyber-attacks

are increasing in number and sophistication, are well-financed, in some cases supported by state actors, and are designed to not

only attack, but also to evade detection. Since the techniques used to obtain unauthorized access to systems and data, or to otherwise

sabotage them, change frequently and are often not recognized until launched against a target, we may be unable to anticipate

these techniques or to implement adequate preventative measures. Accidental or willful security breaches or other unauthorized

access to our information technology systems or the systems of our third-party service providers, or the existence of computer

viruses, malware (such as ransomware), or vulnerabilities in our or their data or software could expose us to a risk of information

loss, business disruption, or misappropriation of proprietary and confidential information, including information relating to

our products or customers or the personal information of our employees or third parties. Despite our internal controls and investment

in security measures, we have in the past, and may again in the future, be subject to cyber-attacks or unauthorized network intrusions.

These events, should they occur, could disrupt our business and result in, among other things, unfavorable publicity, damage to

our reputation, loss of our trade secrets and other competitive information, litigation by affected parties and possible financial

obligations for liabilities and damages related to the theft or misuse of such information, significant remediation costs, disruption

of key business operations, and significant diversion of our resources, as well as fines and other sanctions resulting from any

related breaches of data privacy laws and regulations, any of which could have a material adverse effect on our business, profitability,

and financial condition.

In

addition, despite our internal controls and processes, malicious code, and cybersecurity vulnerabilities in our products and services

may expose our customers to cyberattacks and other security risks, which may result in claims, regulatory action, or reputational

damage. While we may be entitled to damages if an adverse event arises from our third-party service providers’ failure to

perform under their agreements with us, any award may be insufficient to cover the actual costs incurred by us and, as a result

of a service provider’s failure to perform, we may be unable to collect any damages. Although to date no such cyber security

incidents have had a material adverse impact on our business, we cannot guarantee that future incidents or breaches will not have

a materially adverse impact on our business.

We

may in the future incur significant costs in order to implement, maintain, and/or update security systems that are designed to

protect our information technology systems and the design of our products and services, and we may miscalculate the level of investment

necessary to protect our systems adequately. Since the techniques used to obtain unauthorized access or to sabotage systems change

frequently and are often not recognized until launched against a target, we may be unable to anticipate these techniques or to

implement adequate preventive measures.

To

the extent that any system failure, known or unknown vulnerability, incident or security breach results in material disruptions

or interruptions to our operations or the theft, loss, unauthorized access or disclosure of, or damage to our data (including

personal information) or confidential information, including our intellectual property, or exposes our customers to cybersecurity

threats and attacks, our reputation, business, results of operations, and/or financial condition could be materially adversely

affected.

Our

reliance on the platform and internal systems from third parties may adversely affect our business operations and financial results.

The

use of the third-party software and reliance on third-party platform services may adversely affect our business operations and

financial results. For example, we are dependent on our relationship with a third-party platform provider to provide us with a

platform that facilitates transactions across various payment options, acquiring processors, and jurisdictions, and also facilitates

user management services from onboarding to monitoring transactions and customer data. If the platform is unavailable or our users

are unable to proceed with transactions through the platform within a reasonable amount of time or at all, our business could

be harmed.

If

we experience an interruption in platform for any reason, our services would similarly be interrupted. An interruption in our

services to our customers could cause our customers unable to process the payment, which could have a material adverse effect

on our business, operations, financial results, customer relationships, and reputation.

If

we cannot retain our key personnel, our business, financial condition and results of operations may be adversely affected.

We

are dependent upon the ability and experience of our senior leadership, including the President of our Fintech subsidiary, who

have substantial experience with our operations, the rapidly changing payment processing industry, and emerging markets. It is

possible that the loss of the services of one or a combination of our senior executives or key managers, including key executive

officers, could have a material adverse effect on our business, financial condition, and results of operations.

In

a dynamic industry like ours, the ability to attract, recruit, develop and retain qualified employees is critical to our success