0000730669true--03-31FY2023Amended filing is to correct the shell status that was incorrectly marked in the original filing.

00220000003461022346102202022-10-3100007306692022-04-012023-03-310000730669fccc:DavidHeMember2023-03-310000730669fccc:DavidHeMember2022-03-310000730669fccc:MrFarrarMember2023-03-310000730669fccc:MrFarrarMember2022-03-310000730669fccc:MrFarrarMember2020-09-012020-09-210000730669us-gaap:RetainedEarningsMember2023-03-310000730669us-gaap:AdditionalPaidInCapitalMember2023-03-310000730669us-gaap:CommonStockMember2023-03-310000730669us-gaap:RetainedEarningsMember2022-04-012023-03-310000730669us-gaap:AdditionalPaidInCapitalMember2022-04-012023-03-310000730669us-gaap:CommonStockMember2022-04-012023-03-310000730669us-gaap:RetainedEarningsMember2022-03-310000730669us-gaap:AdditionalPaidInCapitalMember2022-03-310000730669us-gaap:CommonStockMember2022-03-310000730669us-gaap:RetainedEarningsMember2021-04-012022-03-310000730669us-gaap:AdditionalPaidInCapitalMember2021-04-012022-03-310000730669us-gaap:CommonStockMember2021-04-012022-03-3100007306692021-03-310000730669us-gaap:RetainedEarningsMember2021-03-310000730669us-gaap:AdditionalPaidInCapitalMember2021-03-310000730669us-gaap:CommonStockMember2021-03-3100007306692021-04-012022-03-3100007306692022-03-3100007306692023-03-3100007306692023-07-1400007306692022-09-30iso4217:USDxbrli:sharesiso4217:USDxbrli:sharesxbrli:pure

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

AMENDED

(Mark One)

☒ | Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the Fiscal Year Ended March 31, 2023

or

☐ | Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the Transition Period From ________ to ________.

Commission file number 001-08589

FCCC, Inc. |

(Exact Name of Registrant as Specified in its Charter) |

Nevada | | 06-0759497 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | |

40 Wall St, Floor 60, New York City, NY | | 10005 |

(Address of principal executive offices) | | (Zip Code) |

(812) 933-8888

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act: None

Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

None | | Not applicable | | Not applicable |

Securities registered pursuant to Section 12(g) of the Act: Common Stock, no par value

Indicate by check mark whether the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act of 1933. Yes ☐ No ☒

Indicate by check mark whether the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ☐ | Accelerated filer | ☐ |

Non-accelerated Filer | ☒ | Smaller reporting company | ☒ |

| | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. Yes ☐ No ☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of the common stock held by non-affiliates as of September 30, 2022, the last business day of the registrant’s most recently completed second fiscal quarter, was approximately $574,912 based on the price at which the registrant’s common stock was last sold as of the same date.

As of July 14, 2023, the registrant had 3,461,022 shares of common stock issued and outstanding.

Amended filing is to correct the shell status that was incorrectly marked in the original filing.

FCCC, INC.

ANNUAL REPORT ON FORM 10-K

Table of Contents

SPECIAL NOTE REGARDING FORWARD-LOOKING INFORMATION

This annual report on Form 10-K and other publicly available documents, including the documents incorporated herein by reference, contain, and our officers and representatives may from time to time make, “forward-looking” statements within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by words such as: “anticipate,” “believe,” “expect,” “future,” “intend”, “likely,” “may,” “plan,” “seek,” “will” and similar references to future periods actions or results. Examples of forward-looking statements include our prospects for one or more future material transactions, potential sources of financing, and expenses for future periods.

Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based only on our current beliefs, expectations and assumptions regarding the future of our business, future plans and strategies, projections, anticipated events and trends, the economy and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of our control. Our actual results and financial condition may differ materially from those indicated in the forward-looking statements. Therefore, you should not rely on any of these forward-looking statements.

Any forward-looking statement made by us in this annual report on Form 10-K is based only on information currently available to us and speaks only as of the date on which it is made. We undertake no obligation to publicly update any forward-looking statement, whether written or oral, that may be made from time to time, whether as a result of new information, future developments or otherwise.

PART I

Item 1. Business.

General

FCCC, Inc. (OTCQB “FCIC”) was incorporated under the laws of the State of Connecticut on May 6, 1960 under the name The First Connecticut Small Business Investment Company. The Company changed its name to The First Connecticut Capital Corporation on January 27, 1993, and then to FCCC, Inc. on June 4, 2003. The Company maintains its principal executive offices at 40 Wall St, Floor 60, New York City, NY 10005, Telephone Number (812) 933-8888. The Company is authorized to issue 22,000,000 shares of common stock, no par value. The Company had 3,461,022 shares of common stock issued and outstanding at March 31, 2023.

The Company has had limited operations since June 30, 2003; however, has merged in Amerihe Corporation and is no longer a “shell company” as defined in Rule 13b-2 of the Exchange Act. Such operations consist of a search for appropriate transactions such as a merger, acquisition, reverse merger or other business combination with an operating business or other appropriate financial transaction. See “Current Business” below.

Current Business

Since June 2003, the Company’s operations consist of a search for a merger, acquisition, reverse merger or a business transaction opportunity with an operating business or other financial transaction; however, there can be no assurance that this plan will be successfully implemented. Until a transaction is effectuated, the Company does not expect to have significant operations. Accordingly, during this period we do not expect to achieve sufficient income to offset our operating expenses, resulting in operating losses that may require us to use and thereby reduce our limited cash balance. Until we complete a merger, reverse merger or other financial transaction, and unless interest rates increase dramatically, we expect to incur a loss of between $19,000 to $25,000 for the first quarter and thereafter of between $18,000 to $20,000 per quarter. The increase in first quarter expenses relates to a Company audit and tax return. At this time, the Company has no binding arrangements with respect to any potential merger, acquisition, reverse merger or business combination candidate pursuant to which it may become an operating company.

Opportunities may come to the Company’s attention from various sources, including its management, its stockholders, professional advisors, securities broker-dealers, venture capitalists, members of the financial community, and others who may present unsolicited proposals. At this time, the Company has no plans, understandings, agreements, or commitments with any individual or entity to act as a finder in regard to any business opportunities for it. While it is not currently anticipated that the Company will engage unaffiliated professional firms specializing in business acquisitions, reorganizations or other such transactions, such firms may be retained if such arrangements are deemed to be in the best interest of the Company. Compensation to a finder or business acquisition firm may take various forms, including one-time cash payments, payments involving issuance of securities (including those of the Company), or any combination of these or other compensation arrangements. Consequently, the Company is currently unable to predict the cost of utilizing such services.

The Company has not restricted its search to any particular business, industry, or geographical location. In evaluating a potential transaction, the Company analyzes all available factors and makes a determination based on a composite of available facts, without reliance on any single factor.

It is not possible at this time to predict the nature of a transaction in which the Company may participate. Specific business opportunities would be reviewed as well as the respective needs and desires of the Company and the legal structure or method deemed by management to be suitable would be selected. In implementing a structure for a particular transaction, the Company may become a party to a merger, consolidation, reorganization, tender offer, joint venture, license, purchase and sale of assets, or purchase and sale of stock, or other arrangement the exact nature of which cannot now be predicted. Additionally, the Company may act directly or indirectly through an interest in a partnership, corporation or other form of organization. Implementing such structure may require the merger, consolidation or reorganization of the Company with other business organizations and there is no assurance that the Company would be the surviving entity. In addition, the present management and stockholders of the Company may not have control of a majority of the voting shares of the Company following reorganization or other financial transaction. As part of such a transaction, some or all of the Company’s existing directors may resign and new directors may be appointed. The Company’s operations following its consummation of a transaction will be dependent on the nature of the transaction. There may also be various risks inherent in the transaction, the nature and magnitude of which cannot be predicted.

The Company may also be subject to increased governmental regulation following a transaction; however, it is not possible at this time to predict the nature or magnitude of such increased regulation, if any.

The Company does not have any arrangements with banks or financial institutions with respect to the availability of financing in the future.

The payment of any cash distributions is subject to the discretion of the Company’s Board of Directors. At this time the Company has no plans to pay any additional cash distributions in the foreseeable future.

The company has recently merged in Amerihe Corporation and is no longer considered a shell company.

Competition

The Company is in direct competition with many other entities in its efforts to locate a suitable transaction. Included in the competition are business development companies, special purpose acquisition companies (“SPACs”), venture capital firms, small business investment companies, venture capital affiliates of industrial and financial companies, broker-dealers and investment bankers, management consultant firms and private individual investors. Many of these entities possess greater financial resources and are able to assume greater risks than those which the Company could consider. Many of these competing entities also possess significantly greater experience and contacts than the Company’s management. Moreover, the Company also competes with numerous other companies similar to it for such opportunities.

Employees and Consultants

The Company currently has three executive officers. Fnu Oudom serves as Chairman and President. Huijun He serves as Chief Executive Officer, Vice Presdient and Chief Financial Officer.

The Company has no employees and management of the Company expects to use consultants, attorneys and accountants as necessary, and it is not expected that the Company will have any full-time or other employees, except as may be the result of completing a transaction.

Available Information

Members of the public may read and copy any materials we file with the SEC. The SEC maintains a website that contains reports and information statements and other information about us and other issuers that file electronically at http://www.sec.gov.

Item 1A. Risk Factors.

Smaller reporting companies are not required to provide the information required by this item.

Item 1B. Unresolved Staff Comments.

None.

Item 2. Properties.

None.

Item 3. Legal Proceedings.

We are not aware of any legal proceeding to which any director or officer or any of their affiliates is a party adverse to our Company or in which such persons have a material interest adverse to our Company.

Item 4. Mine Safety Disclosures.

Not applicable.

PART II

Item 5. Market For Registrant’s Common Equity, Related Stockholder Matters And Issuer Purchases Of Equity Securities.

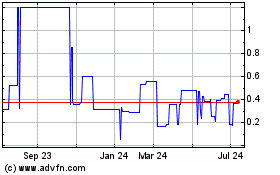

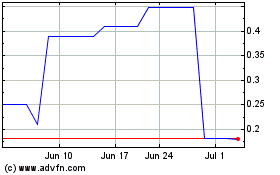

On July 13, 2022, the closing price per share of our common stock, as reported on the OTCQB, was $0.315 As of the same date, our common stock was held by 517 shareholders of record.

The Company’s common stock is quoted on the OTCQB, administered by OTC Markets Group, LLC under the symbol “FCIC.” There is no “established trading market” for our shares of common stock and, despite eligibility for quotation, no assurance can be given that any market for our common stock will develop or be maintained.

The following are the low and high bid prices for the Company’s common stock during each quarter of the fiscal years ended March 31, 2023 and 2022 as quoted on the OTCQB. The information shown below was obtained from OTC Markets Group, LLC. All prices reflect inter-dealer prices, without retail mark-up, mark-down or commissions and may not represent actual transactions.

Period | | Low | | | High | |

| | | | | | |

Fiscal Year ended March 31, 2023 | | | | | | |

First Quarter | | $ | 1.8000 | | | $ | 1.8000 | |

Second Quarter | | $ | 1.9800 | | | $ | 1.3000 | |

Third Quarter | | $ | 0.6600 | | | $ | 0.6600 | |

Fourth Quarter | | $ | 0.5400 | | | $ | 0.5400 | |

| | | | | | | | |

Fiscal Year ended March 31, 2022 | | | | | | | | |

First Quarter | | $ | 0.7550 | | | $ | 0.9500 | |

Second Quarter | | $ | 1.6800 | | | $ | 1.6800 | |

Third Quarter | | $ | 2.7900 | | | $ | 3.0000 | |

Fourth Quarter | | $ | 2.7000 | | | $ | 2.7000 | |

Transfer Agent

The transfer agent for the Company’s common stock is Computershare.

Recent Sales of Unregistered Securities; Use of Proceeds from Registered Services

We have not issued any unregistered securities within the period covered by this report.

Purchases of Equity Securities by the Small Business Issuer and Affiliated Purchasers

We did not repurchase any shares of our common stock during the fiscal quarter ended March 31, 2023.

Item 6. Reserved.

Reserved.

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

The following discussion of our financial condition and results of operations should be read in conjunction with the selected historical consolidated financial data and consolidated financial statements and notes thereto appearing elsewhere in this annual report on Form 10‑K. This discussion and analysis contains forward-looking statements that involve risks and uncertainties. Our actual results may differ materially from those anticipated in these forward-looking statements as a result of various factors. See “Special Note Regarding Forward-Looking Information.”

General

The Company has limited operations and is actively seeking merger, reverse merger, acquisition or business combination opportunities with an operating business or other financial transaction opportunities. Until a transaction is effectuated, the Company does not expect to have significant operations. Accordingly, during such period, the Company does not expect to achieve sufficient income to offset its operating expenses, resulting in operating losses that may require the Company to use and thereby reduce its cash balance. For further information on the Company’s plan of operation and business, see Item I, Current Business. Until the Company completes a merger, reverse merger or other financial transaction, and unless interest rates increase dramatically, the Company expects to continue to incur a loss of between $19,000 to $25,000 for the first quarter and thereafter of between $18,000 to $22,000 per quarter. The increase in first quarter expenses relates to a Company audit and tax return.

Results of Operations and Financial Condition

During the year ended March 31, 2023, the Company had a loss from operations of $126,000. The loss is attributable to the operating, administrative and legal expenses incurred during the year. During the year ended March 31, 2022, the loss from operations was $183,000. The decrease in the loss for the year ended March 31, 2023 is attributable to decreases in legal, operating and administrative expenses.

Liquidity and Capital Resources

Stockholders’ equity (deficit) as of March 31, 2023 was ($308,000), as compared to ($184,000) at March 31, 2022. The decrease is attributable to the operating loss incurred in 2022.

The Company had cash on hand at March 31, 2023 of $112,000, as compared to $25,000 at March 31, 2022. The increase in cash on hand is attributable to loans due to related parties.

The Company does not have any arrangements with banks or financial institutions with respect to the availability of financing in the future.

The payment of any cash distribution or dividend is subject to the discretion of the Company’s Board of Directors. At this time the Company has no plans to pay any cash distributions or dividends in the foreseeable future.

Off-Balance Sheet Arrangements

None.

Recently Issued Accounting Standards

From time to time, new accounting pronouncements are issued by the Financial Accounting Standard Board (“FASB”) or other standard setting bodies that are adopted by the Company as of the specified effective date. Unless otherwise discussed, the Company believes that the effect of recently issued standards that are not yet effective will not have a material effect on its financial position or results of operations upon adoption.

Critical accounting policies and Estimates

In August 2018, the FASB issued ASU No. 2018-13, “Fair Value Measurement (Topic 820).” This standard modifies disclosure requirements related to fair value measurement and is effective for all entities for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2019. Early adoption is permitted. Implementation on a prospective or retrospective basis varies by specific disclosure requirement. The standard also allows for early adoption of any removed or modified disclosures upon issuance while delaying adoption of the additional disclosures until their effective date. The Company adopted ASU No. 2018-13 effective on January 1, 2020 and it did not have a material impact on the Company’s financial statements.

In December 2019, the FASB issued ASU No. 2019-12, “Simplifying the Accounting for Income Taxes (Topic 740)”. This standard simplifies the accounting for income taxes. This standard is effective for fiscal years beginning after December 15, 2020, including interim periods within those fiscal years. Early adoption is permitted for all entities. The Company is currently assessing the impact of adopting this standard on its financial statements.

In August 2020, the FASB issued ASU 2020-06, “Debt – Debt with Conversion and Other Options (Subtopic 470-20) and Derivatives and Hedging – Contracts in Entity’s Own Equity (Subtopic 815 – 40)” (“ASU 2020-06”). ASU 2020-06 simplifies the accounting for certain financial instruments with characteristics of liabilities and equity, including convertible instruments and contracts on an entity’s own equity. The ASU is part of the FASB’s simplification initiative, which aims to reduce unnecessary complexity in U.S. GAAP. The ASU’s amendments are effective for fiscal years beginning after December 15, 2023, and interim periods within those fiscal years. The Company is currently evaluating the impact of ASU 2020-06 on its financial statements..

Item 7A. Quantitative and Qualitative Disclosures About Market Risk.

Smaller reporting companies are not required to provide the information required by this item.

Item 8. Financial Statements.

FCCC, INC.

INDEX TO FINANCIAL STATEMENTS

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and Shareholders of FCCC, Inc.

Opinion on the Financial Statements

We have audited the accompanying balance sheets of FCCC, Inc. (the “Company”) as of March 31, 2023, the related statements of operations, stockholders’ deficit, and cash flows for the years then ended, and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Company as of March 31, 2023, and the results of its operations and its cash flows for the years then ended, in conformity with accounting principles generally accepted in the United States.

Going Concern Matter

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 1, the Company has generated no revenues to date, suffered recurring losses from operations and has a net capital deficiency that raises substantial doubt about its ability to continue as a going concern. Management’s plans regarding these matters are also described in Note 1. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

Basis for Opinion

These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on the Company’s financial statements based on our audit. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB. We conducted our audit in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. Our audit included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audit also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audit provides a reasonable basis for our opinion.

Critical Audit Matters

The critical audit matters communicated below are matters arising from the current period audit of the financial statements that were communicated or required to be communicated to the audit committee and that: (1) relate to accounts or disclosures that are material to the financial statements and (2) involved our especially challenging, subjective, or complex judgments. The communication of critical audit matters does not alter in any way our opinion on the financial statements, taken as a whole, and we are not, by communicating the critical audit matters below, providing separate opinions on the critical audit matters or on the accounts or disclosures to which they relate. We determined that there are no critical matters.

OLAYINKA OYEBOLA & CO

We have served as the Company’s auditor since 2022.

Lagos, Nigeria

July 13, 2023

FCCC, INC.

BALANCE SHEETS

MARCH 31, 2023, AND 2022

(Dollars in thousands, except share data)

| | March 31, | |

| | 2023 | | | 2022 | |

ASSETS | | | | | | |

Current assets: | | | | | | |

Cash | | $ | 112 | | | $ | 25 | |

Other Assets | | | 25 | | | | - | |

| | | | | | | | |

Total current assets | | | 137 | | | | 25 | |

| | | | | | | | |

TOTAL ASSETS | | $ | 137 | | | $ | 25 | |

| | | | | | | | |

LIABILITIES AND STOCKHOLDERS’ DEFICIT | | | | | | | | |

Current liabilities: | | | | | | | | |

Accrued expenses | | $ | 17 | | | $ | 16 | |

Due to related party | | | 221 | | | | 123 | |

Convertible note payable | | | 65 | | | | 65 | |

Loan from Public Company | | | 135 | | | | - | |

Accrued interest | | | 7 | | | | 5 | |

Current Liabilities | | | 445 | | | | 209 | |

| | | | | | | | |

TOTAL LIABILITIES | | | 445 | | | | 209 | |

| | | | | | | | |

Stockholders’ deficit: | | | | | | | | |

| | | | | | | | |

Common stock, no par value, 22,000,000 shares authorized, 3,461,022 and 3,461,022 shares issued and outstanding at March 31, 2023 and March 31, 2022, respectively | | | 800 | | | | 800 | |

Additional paid-in capital | | | 8,398 | | | | 8,396 | |

Accumulated deficit | | | (9,506 | ) | | | (9,380 | ) |

Total stockholders’ deficit | | | (308 | ) | | | (184 | ) |

| | | | | | | | |

TOTAL LIABILITIES AND STOCKHOLDERS’ DEFICIT | | $ | 137 | | | $ | 25 | |

The accompanying notes are an integral part of the financial statements.

FCCC, INC.

STATEMENTS OF OPERATIONS

FOR THE YEARS ENDED MARCH 31, 2023 AND 2022

(Dollars in thousands, except share data)

| | Year Ended March 31, | |

| | 2023 | | | 2022 | |

| | | | | | |

Expenses: | | | | | | |

Professional expenses | | | 91 | | | | 105 | |

Operating and administrative expenses | | | 33 | | | | 75 | |

Total Operating Expenses | | | 124 | | | | 180 | |

Non-Operating Expenses: | | | | | | | | |

Interest expense | | | 2 | | | | 3 | |

| | | | | | | | |

Total expenses | | | 126 | | | | 183 | |

| | | | | | | | |

Loss before provision for income taxes | | | (126 | ) | | | (183 | ) |

| | | | | | | | |

Income tax provision | | | - | | | | - | |

| | | | | | | | |

Net loss: | | $ | (126 | ) | | $ | (183 | ) |

| | | | | | | | |

Basic and diluted loss per share: | | $ | (0.03 | ) | | $ | (0.05 | ) |

| | | | | | | | |

Weighted average common shares outstanding: | | | | | | | | |

Basic | | | 3,461,022 | | | | 3,461,022 | |

Diluted | | | 3,461,022 | | | | 3,461,022 | |

The accompanying notes are an integral part of the financial statements.

FCCC, INC.

STATEMENTS OF CHANGES IN STOCKHOLDERS’ DEFICIT

FOR THE YEARS ENDED MARCH 31, 2023, AND 2022

(Dollars in thousands, except share data)

| | Common Stock | | | Paid-in | | | Accumulated | | | | |

| | Shares | | | Amount | | | Capital | | | Deficit | | | Total | |

| | | | | | | | | | | | | | | |

Balance, March 31, 2021 | | | 3,461,022 | | | | 800 | | | | 8,396 | | | | (9,197 | ) | | | (1 | ) |

| | | | | | | | | | | | | | | | | | | | |

Net Loss – Year Ended March 31, 2022 | | | – | | | | - | | | | - | | | | (183 | ) | | | (183 | ) |

| | | | | | | | | | | | | | | | | | | | |

Balance, March 31, 2022 | | | 3,461,022 | | | $ | 800 | | | $ | 8,396 | | | $ | (9,380 | ) | | $ | (184 | ) |

| | | | | | | | | | | | | | | | | | | | |

Net Loss – Year Ended March 31, 2023 | | | – | | | | - | | | | 2 | | | | (126 | ) | | | (126 | ) |

| | | | | | | | | | | | | | | | | | | | |

Balance, March 31, 2023 | | | 3,461,022 | | | $ | 800 | | | $ | 8,398 | | | $ | (9,506 | ) | | $ | (308 | ) |

The accompanying notes are an integral part of the financial statements.

FCCC, INC.

STATEMENTS OF CASH FLOWS

FOR THE YEARS ENDED MARCH 31, 2023, AND 2022

(Dollars in thousands, except share data)

| | Year Ended March 31, | |

| | 2023 | | | 2022 | |

| | | | | | |

Cash Flows from Operating Activities: | | | | | | |

Net loss | | $ | (126 | ) | | $ | (183 | ) |

Adjustments to reconcile net loss to net cash used in operating activities: | | | | | | | | |

Changes in operating assets and liabilities: | | | | | | | | |

Prepaid expenses | | | (25 | ) | | | 4 | |

Accounts payable | | | 1 | | | | 12 | |

Due to Relate Party | | | 98 | | | | 123 | |

Accrued interest | | | 2 | | | | 3 | |

Net cash used in operating activities | | | (50 | ) | | | (41 | ) |

| | | | | | | | |

Cash Flows from Investing Activities: | | | | | | | | |

Proceeds from loan from public company | | | 135 | | | | - | |

| | | 135 | | | | | |

Cash Flows from Financing Activities: | | | | | | | | |

Additional paid in capital | | | 2 | | | | - | |

| | | 2 | | | | - | |

Net increase (decrease) in cash | | | 87 | | | | (41 | ) |

Cash, beginning of year | | | 25 | | | | 66 | |

Cash, end of year | | $ | 112 | | | $ | 25 | |

SUPPLEMENTAL DISCLOSURES: | | | | | | |

Cash paid for income tax | | $ | - | | | $ | - | |

Cash paid for Interest | | $ | - | | | $ | - | |

The accompanying notes are an integral part of the financial statements.

FCCC, INC.

NOTES TO FINANCIAL STATEMENTS

NOTE 1 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES:

Company Operations:

The accompanying financial statements of FCCC, Inc. (the “Company”) have been prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”) and pursuant to the rules and regulations of the U.S. Securities and Exchange Commission (the “SEC”).

The Company has limited operations and is actively seeking merger, acquisition or business combination opportunities with an operating business or other financial transaction opportunities. Until a transaction is effectuated, the Company does not expect to have significant operations. Accordingly, during such period, the Company does not expect to achieve sufficient income to offset its operating expenses, resulting in operating losses that may require the Company to use and thereby reduce its cash balance.

Cash and Cash Equivalents:

The Company has defined cash as including cash on hand and cash in interest bearing and non-interest bearing operating bank accounts. Highly liquid instruments purchased with original maturities of three months or less are considered to be cash equivalents.

Concentration of Credit Risk:

The Company maintains cash balances at a financial institution. Accounts are insured by the Federal Deposit Insurance Corporation (“FDIC”) up to $250,000 at such institution. At various times throughout the course of business, cash balances may exceed FDIC limits. At March 31, 2023 and 2022, the amount uninsured was $0.

Estimates:

The preparation of financial statements in conformity with US GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of expenses during the reporting period. Actual results could differ from those estimates.

Dividends:

The Company may or may not pay cash dividends or make other distributions in the future depending on a number of factors. The Company may, however, pay a cash dividend or other distribution as part of a merger, acquisition, reverse merger or business combination transaction or if the Board of Directors deems it advisable for the benefit of all shareholders at any time.

Income Taxes:

The Company utilizes the asset and liability method of accounting for deferred income taxes as prescribed by the FASB Accounting Standard Codification, (“ASC”), 740 “Income Taxes”. This method requires the recognition of deferred tax liabilities and assets for the expected future tax consequences of temporary differences between the tax return and financial statement reporting basis of certain assets and liabilities.

As required by ASC 740-10, “Income Taxes”, the Company recognizes the financial statement benefit of a tax position only after determining that the relevant tax authority would more likely than not sustain the position following an audit. For tax positions meeting the more-likely-than-not threshold, the amount recognized in the financial statements is the largest benefit that has a greater than 50% likelihood of being realized upon ultimate settlement with the relevant tax authority. Management does not believe that there are any uncertain tax positions which would have a material impact on the financial statements. The Company has elected to include interest and penalties related to uncertain tax positions as a component of income tax expense. To date, the Company has not recorded any interest or penalties related to uncertain tax positions.

FCCC, INC.

NOTES TO FINANCIAL STATEMENTS

NOTE 1 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED):

Earnings (Loss) Per Common Share:

The Company follows FASB ASC 260. Basic Earnings Per Share (“EPS”) is based on the weighted average number of common shares outstanding for the period, excluding the effects of any potentially dilutive securities. Diluted EPS reflects the potential dilution that could occur if securities or other contracts to issue common stock were exercised or converted. Net income (loss) per share is calculated by dividing net income (loss) by the weighted average number of common shares outstanding during the period.

Basic and diluted loss per common share was calculated using the following number of shares:

| | March 31, | |

| | 2023 | | | 2022 | |

Weighted average number of common shares outstanding - Basic | | | 3,461,022 | | | | 3,461,022 | |

Weighted average number of common shares outstanding - Diluted | | | 3,461,022 | | | | 3,461,022 | |

Going Concern Consideration

As of March 31, 2023, the Company had cash $112,000, and working capital deficit as $308,000. In addition, the Company operated a net loss of $126,000. The Company highly relied on the funding from the related parties to cover the operating expenses. Management believes that, on March 31, 2023, the company has insufficient working capital to cover its short-term operating needs. The Company has no revenue before the Business Combination. These factors raise substantial doubt about the Company's ability to continue as a going concern one year from the date the financial statement is issued.

Recently Issued Accounting Pronouncements:

The Company has implemented all new accounting pronouncements that are in effect and that may impact its financial statements and does not believe that there are any other new accounting pronouncements that have been issued that might have a material impact on its financial position or results of operations.

NOTE 2 - FINANCIAL INSTRUMENTS:

Fair Value of Financial Instruments:

The Company follows FASB ASC 825 “Fair Value of Financial Instruments”, which requires disclosure of the fair value of financial instruments for which the determination of fair value is practicable. The fair value of a financial instrument is defined as the amount at which the instrument could be exchanged in a current transaction between willing parties. The carrying amounts of the Company’s financial instruments (eligible assets and liabilities ) approximate their fair value because of the short maturity of these instruments.

NOTE 3 - INCOME TAXES:

The Company’s deferred tax asset relates to net operating losses that may be carried forward to future years. At March 31, 2023 and 2022, the Company has available carryforward net operating losses of approximately $965,000 and $839,000 for federal, $989,000 and $807,000 for state income taxes, respectively. No tax benefit has been reported in the financial statements, because the Company believes there is a 50% or greater chance the carry-forwards will not be utilized. Accordingly, the potential tax benefits of the loss carry-forward are offset by a valuation allowance of the same amount. The Company’s increase in valuation allowance of $26,460 and $45,345 during the year ended March 31, 2023 and 2022 was recorded to offset the deferred tax benefit of the Company’s tax loss for the year, respectively.

FCCC, INC.

NOTES TO FINANCIAL STATEMENTS

The Company’s deferred tax asset and valuation allowance as of March 31, 2023 and 2022 were as follows:

| | March 31 | |

| | 2023 | | | 2022 | |

Net Operating Losses | | $ | 257,577 | | | $ | 231,117 | |

Valuation Allowance | | | (257,577 | ) | | | (231,117 | ) |

The Company’s provision for federal and state income taxes for the years ended March 31, 2023 and 2022 consisted of the following:

| | March 31 | |

| | 2023 | | | 2022 | |

Current Tax Expense (Benefit) | | $ | - | | | $ | - | |

Deferred Tax Expense (Benefit) | | | (26,460 | ) | | | (45,345 | ) |

Increase (Decrease) in Valuation Allowance | | | 26,460 | | | | 45,345 | |

Net tax provision | | $ | - | | | $ | - | |

The Company’s effective tax rate differed from the federal statutory income tax rate for the years ended March 31, 2023, and 2022 as follows:

| | March 31 | |

| | 2023 | | | 2022 | |

Federal statutory rate | | | 21.0 | % | | | 21.0 | % |

State tax, net of federal tax effect | | | 3.87 | % | | | 3.87 | % |

Valuation allowance | | | (24.87 | %) | | | (24.87 | %) |

Effective tax rate | | | 0.0 | % | | | 0.0 | % |

As of March 31, 2023 and 2022, the Company does not believe that it has taken any tax positions that would require the recording of any additional tax liability nor does it believe that there are any unrealized tax benefits that would either increase or decrease within the next twelve months. The Company’s income tax returns are subject to examination by the appropriate taxing jurisdictions. As of March 31, 2023, the Company’s income tax returns generally remain open for examination for three years from the date filed with each taxing jurisdiction.

NOTE 4 – CONVERTIBLE NOTE PAYABLE:

On September 21, 2020, the Company entered into a Note Purchase Agreement, pursuant to which the Company issued and sold to Frederick L. Farrar, a former executive officer, director and significant stockholder of the Company, a Convertible Promissory Note in the principal amount of $65,000 (the “Note”) in exchange for a loan of the same amount. The Note accrues interest at 5.0% per annum and is scheduled to mature and become payable on October 31, 2022. The Company’s payment obligations under the Note are unsecured and the Company can prepay the amount due in whole or in part at any time without penalty or premium. The holder of the Note has the option, on or prior to maturity, to convert all (but not less than all) of the amount due under the Note to into shares of the Company’s common stock at a conversion price of $0.23 per share. The Company intends to use the proceeds from the issuance of the Note for general corporate purposes. As of March 31, 2023 and 2022 respectively, the principal and interest due under the Note totaled $72,000 and $70,000.

FCCC, INC.

NOTES TO FINANCIAL STATEMENTS

NOTE 5 – COMMON STOCK:

The Company’s capital structure consists of 22,000,000 shares of authorized common stock with no par value and 3,461,022 shares were issued and outstanding at both March 31, 2023 and 2022. There were no changes to the Company’s capital structure during the years ended March 31, 2023 and 2022.

NOTE 6 – RELATED PARTY TRANSACTIONS:

As of March 31, 2023 and 2022, the related party payable amounts to the Director David He are $221,000 and $123,000, respectively, in purpose for cover certain operating expenses for the Company.

NOTE 7 – SUBSEQUENT EVENTS:

The Company evaluated subsequent events and transactions that occurred after the balance sheet date up to the date that the financial statements were issued. Based upon this review, the Company did not identify any subsequent events that would have required adjustment or disclosure in the financial statements.

Item 9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure.

None.

Item 9A. Controls and Procedures.

Evaluation of Disclosure Controls and Procedures

Our Chief Executive Officer and Chief Financial Officer, after evaluating the effectiveness of our “disclosure controls and procedures” (as defined in Sections 13a-15(e) and 15d-15(e) of the Securities Exchange Act of 1934) as of the end of the period reported in this annual report (the “Evaluation Date”), concluded that our disclosure controls and procedures were effective and designed to ensure that material information relating to the Company is accumulated and would be made known to them by others as appropriate to allow timely decisions regarding required disclosures.

Management’s Annual Report on Internal Control over Financial Reporting

The Company’s management is responsible for establishing and maintaining adequate internal control over financial reporting, as defined in Rule 13a-15(f) and 15d-15(f) under the Securities Exchange Act of 1934. Our internal control over financial reporting is a process designed by, or under the supervision of, the Company’s Chief Executive Officer and Chief Financial Officer, to provide reasonable assurance to the Company’s Board of Directors regarding the reliability of financial reporting and the preparation and fair presentation of published financial statements in accordance with accounting principles generally accepted in the United States of America (“GAAP”). Internal control over financial reporting including those policies and procedures that (1) pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect the Company’s transactions and dispositions of the Company’s assets; (2) provide reasonable assurances that the Company’s transactions are recorded as necessary to permit preparation of the Company’s financial statements in accordance with GAAP, and that receipts and expenditures are being made only in accordance with authorizations of the Company’s management and directors; and (3) provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of the Company’s assets that could have a material effect on the Company’s financial statements.

Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate. All internal control systems, no matter how well designed, have inherent limitations. Therefore, even those systems determined to be effective can provide only reasonable assurance with respect to financial statement preparation and presentation. Because of the inherent limitations of internal control, there is a risk that material misstatements may not be prevented or detected on a timely basis by internal control over financial reporting. However, these inherent limitations are known features of the financial reporting process. Therefore, it is possible to design into the process safeguards to reduce, though not eliminate, this risk.

The Company’s management assessed the effectiveness of the Company’s internal control over financial reporting as of March 31, 2023, and concluded that such internal controls were effective. In making this assessment, management used the criteria set forth by the Committee of Sponsoring Organizations (COSO) of the Treadway Commission in Internal Control – Integrated Framework (2013).

This annual report does not include an attestation report of the Company’s registered public accounting firm regarding internal control over financial reporting. Management’s report was not subject to attestation by the Company’s registered public accounting firm pursuant to the rules of the Securities and Exchange Commission that permit the Company to provide only management’s report in this annual report.

During the Company’s fourth fiscal quarter ended March 31, 2023, there was no change in the Company’s internal control over financial reporting that has materially affected, or is reasonably likely to materially affect, the Company’s internal control over financial reporting.

Item 9B. Other Information.

None.

PART III

Item 10. Directors, Executive Officers and Corporate Governance.

The directors and executive officers of the Company are as follows:

Name | | Age | | Position |

Fnu Oudom | | 68 | | Chairman, President, Director |

Huijun He | | 63 | | Chief Executive Officer, Vice President, Director |

Mopohku Sompong | | 32 | | Director |

Tsun-Cheng (Mark) Lin | | 64 | | Director |

Mr. Oudom has served as Chairman, President, and Director of the Company Since April 2021. From 2014 to 2016, Mr. Oudom served as Yongyong representative of the Republic of Tuvalu to the United Nations Economic and Social Council for Asia and the Pacific, and Yongyong representative of the Republic of Vanuatu to the United Nations Economic and Social Council for Asia-Pacific from April 2018 to June 2020. Since 2015, Mr. Oudom has served as Chairman of Times Chain Group. From 1989 to 1995, Mr. Oudom studied as a postgraduate at the Institute of Political Science and Law at the French Academy of Social Sciences and served as a visiting professor at Taiwan Mingdao University in 2014. Mr. Oudom received his bachelor’s degree in Philosophy from Sichan University.

Mr. He has served as Chief Executive Officer and Vice President of the Company since April 2021 and as a Director of the Company since May 2021. Since February 2019, Mr. He has served as the chief executive officer of China Liaoning Dingxu Ecological Agriculture Development, Inc., and in June 2016, Mr. He founded and served as president of Romada Realty Inc., a real estate development company. Prior to 1996, Mr. He previously served as the general manager of China Nonferrous Metal Equipment Zhuhai Company, a large domestic state-owned enterprise import and export company, and the general manager of a U.S. import and export company. As a seasoned entrepreneur and corporate level executive, Mr. He brings his vast management experience to the company. Mr. He received his bachelor’s degree from Wuhan Huazhong Institute of Technology, Mechanical Manufacturing.

Mopohku Sompong has served as a Director of the Company since May 2021. From May 2021 to present, Mr. Sompong has been house counsel at Tai Xi Co., Ltd., and from March 2019 to June 2020, as an associate at Decha & Co Limited. From February 2019 to November 2019, Mr. Sompong was a manager at Tonglian Exchange Co., Ltd. and from May 2017 to October 2019, as internal coordinator at IPMTV and GOBATV. Mr. Sompong received his BLA in Business Management and in U.S. and International Law from Hangdong Global University, and his LLM from Regent University, and JD from Handong International Law School.

Tsun-Cheng (Mark) Lin has served as a Director of the Company since May 2021. From 2013 to present, Mr. Lin is the senior vice president of Thailand Thai Seal Group, and from 2000 to 2013, he served as the vice president of Thailand Lucky Group. Mr. Lin was also the vice president of SEG Group from 1991 to 2000, and the deputy generalmanager of U.S. YC Everygreen Inc. from 1989 through 1990. Mr. Lin graduated from the Mechanical Engineering Department of Shude Engineering College, Department of Industrial Engineering, Feng Chia University, and earned his EMBA from West Coast University.

The Company’s Board of Directors is responsible for establishing broad corporate policies and for overseeing our overall management. In addition to considering various matters which require board approval, the Board provides advice and counsel to, and ultimately monitors the performance of, our executive officer(s). All directors hold office until the next annual meeting of stockholders and until their successors are duly elected and qualified. Officers are elected to serve, subject to the discretion of the Board, until their successors are appointed. The Company has not held an annual meeting of stockholders since 2003.

Board Leadership Structure

The roles of Chairman and Chief Executive Officer are currently held by separate individuals. We believe that this structure is appropriate for the Company at this time. Specifically, we believe that the current leadership structure provides leadership and engagement while we seek and evaluate opportunities.

Role of the Board in Risk Oversight

One of the key functions of our Board of Directors is informed oversight of our Company’s risk management processes. Our Board administers its oversight functions primarily through monitoring and assessing risks through its full membership rather than through standing committees, including assessing significant financial risks and risks of compliance with legal and regulatory requirements.

Committees of the Board

Our Board of Directors does not have any committees. We believe this structure is appropriate in light of the Company’s current capital structure and level of operations. If the Company’s capital structure, level of operations or Board composition changes significantly, we intend to consider forming formal audit and/or compensation committees and to adopt appropriate written charters for such committees. Currently, however, there are no plans to appoint certain directors to specific committees. Until such time as an audit committee or compensation committee is formed, the full Board of Directors will continue to conduct the functions typically assigned to those committees.

Family Relationships

There are no family relationships among our directors and any of our executive officers.

Audit Committee Financial Expert

None of our directors are eligible to qualify as an “audit committee financial expert” as that term is defined in Regulation S-K promulgated under the Exchange Act. If and when the Company commences operations and adds independent directors to serve on its board, it expects to add one or more such persons who qualify as “audit committee financial expert.”

Code of Ethics

We do not currently have a code of ethics. We believe this approach is appropriate in light of the Company’s current capital structure and level of operations, but we expect to continue to evaluate the appropriateness of adopting a code of ethics as our Company continues to develop.

Communication to the Board of Directors

You may contact our Board of Directors or any director by mail addressed to the attention of our entire Board or the specific director identified by name or title, at FCCC, Inc., 17800 Castleton St, #695 City of Industry, CA. All communications will be submitted to our Board or the specified director on a periodic basis.

Item 11. Executive Compensation.

Executive Compensation

For each of the fiscal years ended March 31, 2023 and March 31, 2022 there was no direct compensation awarded to, earned by or paid by us to any of our executive officers.

Stock Options/SAR Grants

There were no (i) stock option/SARs grants, (ii) aggregated option/SAR exercises or (iii) long-term incentive plan awards in the fiscal years ended March 31, 2023 and 2022.

Compensation of Directors

During the fiscal year ended March 31, 2023, directors who did not serve as officers of the Company were eligible to receive a fee of $100 for each Board of Directors meeting attended. All such board meetings were held telephonically. The following table identifeid all compensation received by members of the board of directors for that period.

Subsequent to the change in control on April 26, 2021, it was determined that current members of the Board of Directors will not receive compensation for their service, which determination is subject to reevaluation by the board from time to time.

Director Compensation for the Fiscal Year Ended March 31, 2023

Name | | Fees Earned or Paid in Cash | | Stock Awards | | Option Awards | | All Other Compensation | | Total |

David He | | – | | – | | – | | – | | – |

Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters.

The following table, together with the accompanying footnotes, sets forth information, as of July 8, 2021, regarding stock ownership of all persons known by the Company to own beneficially more than 5% of the Company’s outstanding common stock, and named executive officers, directors, and all directors and officers of the Company as a group. Unless otherwise indicated below, the mailing address for each such beneficial owner is 17800 Castleton St, #695 City of Industry, CA.

Name and Address of Beneficial Owner | | Amount and Nature of Beneficial Ownership(1) | | | Percent of Outstanding Shares | |

Fnu Oudom | | | 1,064,000 | (2) | | | 54.9 | % |

Huijin He | | | 1,822,110 | (3) | | | 41.0 | % |

Mopohku Sompong | | | – | | | | – | |

Tsun-Cheng Lin | | | – | | | | – | |

All directors and current executive officers as a group (5 persons) | | | 2,886,110 | | | | 64.9 | % |

Martin Cohen PS Plan 27 E. 65th Street Suite 11A New York, NY 10021 | | | 244,440 | (4) | | | 7.1 | % |

Bernard Zimmerman and Company, Inc. 597 Westport Avenue, Apt 239 B Norwarlk, CT 06851 | | | 206,800 | (5) | | | 6.0 | % |

__________________________________

* | Less than 1.0%. |

(1) | This table is based upon 3,461,022 shares of common stock issued and outstanding as of July 8, 2021. As used in this section, the term beneficial ownership with respect to a security is defined by Rule 13d-3 under the Securities Exchange Act of 1934, as amended, as consisting of sole or shared voting power (including the power to vote or direct the vote) and/or sole or shared investment power (including the power to dispose of or direct the disposition of) with respect to the security through any contract, arrangement, understanding, relationship or otherwise, subject to community property laws where applicable. Accordingly, shares of common stock which an individual or group has a right to acquire within sixty (60) days pursuant to the exercise of options or warrants are deemed to be outstanding for the purpose of computing the percentage ownership of such individual or group, but are not deemed to be beneficially owned and outstanding for the purpose of computing the percentage ownership of any other person shown in the table. Unless otherwise indicated in the footnotes to this table, (a) the listed beneficial owner has sole voting power and investment power with respect to the number of shares shown, and (b) no director or executive officer has pledged as security any shares shown as beneficially owned. |

(2) | All 1,064,000 shares held by American Public Investment Co., of which Mr. Oudom owns a 70% ownership interest and serves as its President. |

(3) | Includes (i) 695,652 shares of common stock issuable pursuant to the Private Placement which will take place on or before July 25, 2021, (ii) 290,458 shares of common stock available upon conversion of a promissory note subject to the Option Agreement, and (iii) 456,000 shares held by American Public Investment Co., of which Mr. He holds thirty percent (30%) ownership interest. |

(4) | Based solely on information provided in a Schedule 13D/A (Amendment No. 5) filed with the SEC on October 6, 2017. Mr. Bernard Zimmerman is the president and sole owner of Bernard Zimmerman & Company, Inc. |

(5) | Based solely on information provided in a Schedule 13D/A (Amendment No. 3) filed with the SEC on May 30, 2008. Mr. Martin Cohen is the trustee of principal of the Martin Cohen PS Plan. |

Item 13. Certain Relationships and Related Transactions, and Director Independence.

Related Party Transactions

On September 21, 2020, the Company entered into a Note Purchase Agreement (the “Purchase Agreement”) with Frederick L. Farrar, who then served as the Company’s Chief Executive Officer and Chief Financial Officer, pursuant to which the Company issued and sold to Mr. Farrar a Convertible Promissory Note in aggregate principal amount of $65,000 bearing 5.0% interest per annum due and payable in cash on October 31, 2022 (the “Note”). The Note is unsecured and may be prepaid by the Company in whole or in part at any time without penalty or premium, at the option of the Company. Mr. Farrar has the option, on or prior to the maturity date, to convert all (but not less than all) of the principal and accrued but unpaid interest under this Note into the Company’s common stock, no par value, at a conversion price of $0.23 per share.

On April 26, 2021, the Company entered into an agreement to issue and sell 695,652 shares (the “New Shares”) of the Company’s common stock, no par value, to Huijun He, the Company’s Chief Executive Officer Vice President, and a Director, for a price of $159,999.96, or $0.23 per share (the “Subscription Agreement”). Pursuant to the terms of the Subscription Agreement, the sale of the New Shares will take place on or before July 25, 2021, which is the 90th day after the execution of the Subscription Agreement.

Since the beginning of the fiscal year ended March 31, 2021, the Company has not been a party to any other related party transactions.

Director Independence

Based upon a review of the material relationships between our directors and our Company, we have determined that none of our directors are eligible for designation as “independent directors” as defined under the applicable rules of The Nasdaq Stock Market, which we have voluntarily adopted as our standard for director independence. However, this information is provided for disclosure purposes only. Because we do not have shares listed for trading on any securities exchange, our Company is not required to have any independent directors on its Board of Directors, or any particular committee of the Board of Directors.

Item 14. Principal Accountant Fees and Services.

Olayinka Oyebola and Co has served as the Company’s independent public accountant since 2022.

The following table summarizes the aggregate fees billed by the Company’s independent registered public accounting firm Somerset, for audit services for each of the last two fiscal years and for other services rendered to the Company in each of the last two fiscal years.

| | Fiscal Year Ended | |

| | March 31, 2023 | | | March 31, 2022 | |

Audit Fees(1) | | $ | 7,000 | | | $ | 9,000 | |

Audit-Related Fees(2) | | | | | | | | |

Tax Fees(3) | | | | | | | | |

All Other Fees(4) | | | | | | | | |

Total | | $ | 7,000 | | | $ | 9,000 | |

(1) | Audit fees consist of fees for the audit of our financial statements, the review of the interim financial statements included in our quarterly reports on Form 10-Q, and other professional services provided in connection with statutory and regulatory filings or engagements. |

(2) | Audit-related fees consist of fees for assurance and related services that are reasonably related to the performance of the audit and the review of our financial statements and which are not reported under “Audit Fees”. No such services were provided during the periods reported. |

(3) | Tax fees consist of fees for tax compliance, tax advice and tax planning services. Tax compliance services, which relate to the preparation of tax returns, claims for refunds and tax payment-planning services, accounted for all of the tax fees incurred for services provided for the 2020 and 2021 fiscal years. |

(4) | The Company was not billed by its independent registered public accounting firm for any other services rendered for the 2020 or 2021 fiscal year. |

All Other Fees

Any permitted non-audit services are pre-approved by the Board of Directors or a non-employee director pursuant to delegated authority by the Board of Directors, other than de minimus non-audit services for which the pre-approval requirements are waived in accordance with the rules and regulations of the Securities and Exchange Commission.

PART IV

Item 15. Exhibits.

| (a) | Documents filed as part of this annual report on Form 10-K: |

| | | |

| | 1. | Consolidated Financial Statements (See Item 8 above): |

| | | |

| | | Report of Independent Registered Public Accounting Firms |

| | | |

| | | Balance Sheets as of March 31, 2023 and 2022 |

| | | |

| | | Statements of Operations for the fiscal years ended March 31, 2023 and 2022 |

| | | |

| | | Statements Changes in Stockholders’ Equity (Deficit) for the fiscal years ended March 31, 2023 and 2022 |

| | | |

| | | Statements of Cash Flows for the fiscal years ended March 31, 2023 and 2022 |

| | | |

| | | Notes to the Financial Statements |

| | 2. | Financial Statement Schedules: |

All schedules for which provision is made in the applicable accounting regulations of the SEC are not required under the related instructions or are inapplicable and therefore have been omitted.

Exhibit Number | | Description | | Method of Filing |

3.1 | | Composite Amended and Restated Certificate of Incorporation, as amended through January 23, 2004 | | Incorporated by reference to Exhibit 3.1 to annual report on Form 10-K for fiscal year ended March 31, 2015 |

3.2 | | Composite Amended and Restated By-Laws, as amended through November 27, 2007 | | Incorporated by reference to Exhibit 3.2 annual report on Form 10-K for fiscal year ended March 31, 2015 |

4.1 | | Description of Capital Stock of Registrant | | Incorporated by reference to Exhibit 4.1 annual report on Form 10-K for fiscal year ended March 31, 2019 |

10.1 | | Note Purchase Agreement, by and between FCCC, Inc. and Frederick Farrar, dated September 21, 2020 | | Incorporated by reference to Exhibit 10.1 to Form 8-K filed September 23, 2020 |

10.2 | | Convertible Promissory Note of FCCC, Inc. in favor of Frederick Farrar, dated September 21, 2020 | | Incorporated by reference to Exhibit 10.2 to Form 8-K filed September 23, 2020 |

10.3 | | Subscription Agreement, dated as of April 26, 2021, by and between FCCC, Inc. and Huijun He. | | Incorporated by reference to Exhibit 10.1 to current report on Form 8-K filed April 26, 2021 |

31.1 | | Certificate of the Chief Executive Officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 | | Filed herewith |

31.2 | | Certificate of the Chief Financial Officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 | | Filed herewith |

32.1 | | Certificate of the Chief Executive Officer pursuant to 18 U.S.C. Section 1350 as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 | | Filed herewith |

32.2 | | Certificate of the Chief Financial Officer pursuant to 18 U.S.C. Section 1350 as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 | | Filed herewith |

101.INS | | Inline XBRL Instance Document (the instance document does not appear in the Interactive Data File because its XBRL tags are embedded within the Inline XBRL document). | | Filed herewith |

101.SCH | | Inline XBRL Taxonomy Extension Schema Document. | | Filed herewith |

101.CAL | | Inline XBRL Taxonomy Extension Calculation Linkbase Document. | | Filed herewith |

101.DEF | | Inline XBRL Taxonomy Extension Definition Linkbase Document. | | Filed herewith |

101.LAB | | Inline XBRL Taxonomy Extension Labels Linkbase Document. | | Filed herewith |

101.PRE | | Inline XBRL Taxonomy Extension Presentation Linkbase Document. | | Filed herewith |

104 | | Cover Page Interactive Data File (formatted as inline XBRL and contained in Exhibit 101). | | Filed herewith |

Item 16. Form 10-K Summary.

None.

SIGNATURES

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the Registrant has duly caused this Report to be signed on its behalf by the undersigned, thereunto duly authorized, on August 21, 2023.

| | FCCC, INC. | |

| | | | |

| By: | /s/ Huijun He | |

| | Huijun He | |

| | | Chief Executive Officer and Vice President | |

Pursuant to the requirements of the Securities Exchange Act of 1934, this Report has been signed below by the following persons on behalf of the Registrant and in the capacities indicated on August 21, 2023.

Name | | Title |

| | |

/s/ Fnu Oudom | | Chairman, President, Director |

Fnu Oudom | |

| | |

/s/ Huijun He | | Chief Executive Officer, Vice President, Director (principal executive officer) |

Huijun He | |

| | |

/s/ Huijun He | | Chief Financial Officer (principal financial and accounting officer) |

Huijun He | |

| | |

/s/ Mopohku Sompong | | Director |

Mopohku Sompong | | |

| | |

/s/ Tsun-Cheng Lin | | Director |

Tsun-Cheng Lin | | |

nullnullnullnull

v3.23.2

| X |

- DefinitionDescription of changes contained within amended document.

| Name: |

dei_AmendmentDescription |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionPCAOB issued Audit Firm Identifier Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 10-K

-Number 249

-Section 310

Reference 2: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 20-F

-Number 249

-Section 220

-Subsection f

Reference 3: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 40-F

-Number 249

-Section 240

-Subsection f

| Name: |

dei_AuditorFirmId |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:nonemptySequenceNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 10-K

-Number 249

-Section 310

Reference 2: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 20-F

-Number 249

-Section 220

-Subsection f

Reference 3: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 40-F

-Number 249

-Section 240

-Subsection f

| Name: |

dei_AuditorLocation |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:internationalNameItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 10-K

-Number 249

-Section 310

Reference 2: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 20-F

-Number 249

-Section 220

-Subsection f

Reference 3: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 40-F

-Number 249

-Section 240

-Subsection f

| Name: |

dei_AuditorName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:internationalNameItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true only for a form used as an annual report. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 10-K

-Number 249

-Section 310

Reference 2: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 20-F

-Number 249

-Section 220

-Subsection f

Reference 3: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 40-F

-Number 249

-Section 240

-Subsection f

| Name: |

dei_DocumentAnnualReport |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFiscal period values are FY, Q1, Q2, and Q3. 1st, 2nd and 3rd quarter 10-Q or 10-QT statements have value Q1, Q2, and Q3 respectively, with 10-K, 10-KT or other fiscal year statements having FY.

| Name: |

dei_DocumentFiscalPeriodFocus |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fiscalPeriodItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThis is focus fiscal year of the document report in YYYY format. For a 2006 annual report, which may also provide financial information from prior periods, fiscal 2006 should be given as the fiscal year focus. Example: 2006.

| Name: |

dei_DocumentFiscalYearFocus |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gYearItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true only for a form used as a transition report. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Forms 10-K, 10-Q, 20-F

-Number 240

-Section 13

-Subsection a-1

| Name: |

dei_DocumentTransitionReport |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate number of shares or other units outstanding of each of registrant's classes of capital or common stock or other ownership interests, if and as stated on cover of related periodic report. Where multiple classes or units exist define each class/interest by adding class of stock items such as Common Class A [Member], Common Class B [Member] or Partnership Interest [Member] onto the Instrument [Domain] of the Entity Listings, Instrument.

| Name: |

dei_EntityCommonStockSharesOutstanding |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:sharesItemType |

| Balance Type: |

na |

| Period Type: |

instant |

|

| X |

- DefinitionIndicate 'Yes' or 'No' whether registrants (1) have filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that registrants were required to file such reports), and (2) have been subject to such filing requirements for the past 90 days. This information should be based on the registrant's current or most recent filing containing the related disclosure.

| Name: |

dei_EntityCurrentReportingStatus |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:yesNoItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |