false

0001618835

0001618835

2024-07-17

2024-07-17

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES

EXCHANGE ACT OF 1934

Date

of Report (Date of earliest event reported): July 17, 2024

EVOFEM

BIOSCIENCES, INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-36754 |

|

20-8527075 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(I.R.S.

Employer

Identification

No.) |

7770

Regents Road, Suite 113-618

San

Diego, California 92122

(Address

of principal executive offices)

(858)

550-1900

(Registrant’s

telephone number, including area code)

N/A

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the Registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a -12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d -2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e -4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of exchange on which registered |

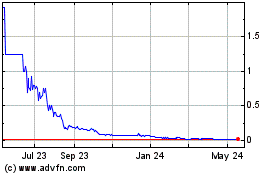

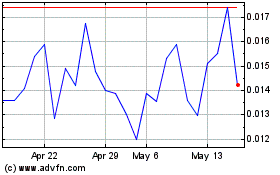

| Common

stock, par value $0.0001 per share |

|

EVFM |

|

OTCQB |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging Growth Company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

1.01. Entry into a Material Definitive Agreement.

Collaboration

Agreement and IP License Agreement

On

July 17, 2024 (the “Effective Date”), Evofem Biosciences, Inc. (the “Company”), entered into a License Agreement

(the “License Agreement”) with Pharma 1 Drug Store L.L.C, a United Arab Emirates limited liability company (“Pharma

1”), to grant Pharma 1 an exclusive license to develop, market, advertise, promote, distribute, offer for sale, sell,

and import the Company’s Product in the United Arab Emirates (UAE), Kuwait, Saudi Arabia, Qatar and certain other countries

in the Middle East region (the “Territory”) for a period of five years commencing on the Effective Date (the “Term”).

Under

the License Agreement, Pharma 1 shall create a Development Plan (as defined in the License Agreement) to pursue all reasonable actions

necessary to obtain governmental approval of (i) Phexxi® (lactic acid, citric acid and potassium bitartrate) and (ii) any

related formulation of the Company’s licensed technology whether now existing or subsequently developed (the “Product”)

in the Territory. Furthermore, subject to the terms and conditions of the License Agreement, the Company granted to Pharma 1 an exclusive,

royalty-free, sublicensable license to the Product to advertise, promote, distribute for commercial sale, offer for sale, sell, and import

for commercial sale the Licensed Product in the Territory. Within three (3) months from the Effective Date, Pharma 1 must file the regulatory

dossier for the Product with the UAE. Within twelve (12) months of the Effective Date, Pharma 1

must place an order for sufficient quantities of the Product to support commercial launch of the Product in the UAE. Within eighteen

(18) months after the last governmental approval of the Product, Pharma 1 must seek governmental approval of the Product in a different

country/state in the Territory.

As

consideration for the License Agreement, Pharma 1 has agreed to pay the Company the cost to manufacture the Product, plus a fee,

and has agreed to maintain an inventory of the Product reasonably sufficient to satisfy at least four (4) months’

worth of its requirements at all times for the duration of the Term.

The

License Agreement contains customary representations, warranties and indemnities of the Company and Pharma 1 relating to the Product.

Securities

Purchase Agreement

As

previously reported in that Current Report on Form 8-K dated July 18, 2024, on July 12, 2024, the

Company, Aditxt, Inc., a Delaware Corporation (“Aditxt”), and Adifem, Inc., f/k/a Adicure, Inc., a Delaware corporation and

wholly-owned subsidiary of Aditxt entered into an Amended and Restated Merger Agreement (the “A&R Merger Agreement”).

As

part of the consideration for the A&R Merger Agreement, the Company agreed to enter into a Securities Purchase Agreement (the “Purchase

Agreement”) for a private placement (the “Private Placement”) with Aditxt. The closing of the Private Placement was

completed on July 23, 2024 (the “Closing Date”).

Pursuant

to the Purchase Agreement, Aditxt agreed to purchase an aggregate of 500 shares of the Company’s Series F-1 Preferred Stock, par

value $0.0001 per share (the “F-1 Preferred Stock”) for an aggregate purchase price of $500,000.The powers, preferences,

rights, qualifications, limitations and restrictions applicable to the F-1 Preferred Stock are set forth in the F-1 Preferred Stock certificate

of designation, as filed with the US Securities and Exchange Commission (the “Commission”) in that Current Report on Form

8-K dated on December 12, 2023.

The

Purchase Agreement contains customary representations and warranties of the Company and Aditxt.

Registration

Rights Agreement

In

connection with the closing of the Purchase Agreement, the Company entered into a Registration Rights Agreement (the “Registration

Rights Agreement”) with Aditxt, which provides that the Company will register the resale the shares of Company common stock issuable

upon conversion of the F-1 Preferred Shares. The Company is required to prepare and file a registration statement on Form S-3 with the

Commission no later than the 300th calendar day following the signing date for the Purchase Agreement and to use its commercially reasonable

efforts to have the registration statement declared effective by the Commission within 90 days of the filing of such registration statement,

subject to certain exceptions and specified penalties if timely effectiveness is not achieved.

The

Company has also agreed to, among other things, indemnify Aditxt, its officers, directors, agents, partners, members, managers, stockholders,

affiliates, investment advisers and employees of each of them under the registration statement from certain liabilities and pay all fees

and expenses (excluding any underwriting discounts and selling commissions) incident to the Company’s obligations under the Registration

Rights Agreement.

The

securities to be issued and sold to Aditxt under the Purchase Agreement will not be registered under the Securities Act of 1933, as amended

(the “Securities Act”) in reliance on the exemption from registration provided by Section 4(a)(2) of the Securities Act and/or

Rule 506 of Regulation D promulgated thereunder, or under any state securities laws. The Company relied on this exemption from registration

based in part on representations made by the Purchasers. The securities may not be offered or sold in the United States absent registration

or an applicable exemption from registration requirements. Neither this Current Report on Form 8-K, nor the exhibits attached hereto,

is an offer to sell or the solicitation of an offer to buy the securities described herein.

The

foregoing summary of the License Agreement, Purchase Agreement and the Registration Rights Agreement do not purport to be complete and

are qualified in their entirety by reference to the License Agreement, Purchase Agreement and the Registration Rights Agreement,

copies of which are filed as Exhibits 10.1, 10.2, and 10.3 to this Current Report on Form 8-K, respectively, and are incorporated by

reference herein.

Item

3.02 Unregistered Sales of equity Securities.

To

the extent required by Item 3.02, the information contained in Item 1.01 is incorporated herein by reference. The transaction was exempt

from registration pursuant to Section 4(a)(2) of the Securities Act of 1933 and Rule 506(b) of Regulation D promulgated thereunder.

Item

7.01 Regulation FD Disclosure

On

July 23, 2024, the Company issued a press release regarding its entry into the License Agreement. A copy of the foregoing press release

is attached as Exhibit 99.1 to this Current Report on Form 8-K (this “Current Report”) and is incorporated by reference herein.

The

information set forth under Item 7.01 of this Current Report, including Exhibit 99.1 attached hereto, is being furnished and shall not

be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”),

or otherwise subject to the liabilities of such section. The information in Item 7.01 of this Current Report, including Exhibit 99.1,

shall not be incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless

of any incorporation by reference language in any such filing, except as expressly set forth by specific reference in such a filing.

This Current Report will not be deemed an admission as to the materiality of any information in this Current Report that is required

to be disclosed solely by Regulation FD.

This

Current Report, including Exhibit 99.1, contains forward-looking statements. These forward-looking statements are not guarantees of future

performance and involve risks, uncertainties and assumptions that are difficult to predict. Forward-looking statements are based upon

assumptions as to future events that may not prove to be accurate. Actual outcomes and results may differ materially from what is expressed

in these forward-looking statements

Item

9.01. Financial Statements and Exhibits.

(d)

Exhibits

| Exhibit

No. |

|

Description |

| 10.1+ |

|

License Agreement, by and between the Company and Pharma 1 Drug Store, L.L.C. |

| 10.2 |

|

Securities

Purchase Agreement, by and between the Company and Aditxt, Inc., dated as of July 12, 2024. |

| 10.3 |

|

Registration Rights Agreement, by and between the Company and Aditxt, Inc., dated as of July 12, 2024. |

| 99.1 |

|

Press release dated July 23, 2024. |

| 104 |

|

Cover

Page Interactive Data File (embedded within the Inline XBRL document). |

+

Certain schedules, exhibits, annexes and similar attachments have been omitted pursuant to Item 601(b)(10)(iv) of Regulation S-K. A copy

of any omitted schedule or exhibit will be furnished supplementally to the Securities and Exchange Commission upon request; provided,

however, that the Company may request confidential treatment pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended,

for any schedule or exhibit so furnished.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

EVOFEM

BIOSCIENCES, INC. |

| |

|

|

| Dated:

July 23, 2024 |

By: |

/s/

Saundra Pelletier |

| |

|

Saundra

Pelletier |

| |

|

Chief

Executive Officer |

Exhibit

10.1

CERTAIN

INFORMATION CONTAINED IN THIS EXHIBIT, MARKED BY “[*]” HAS BEEN EXCLUDED FROM THE EXHIBIT BECAUSE IT IS BOTH (i) NOT MATERIAL,

AND (ii) IS THE TYPE THAT THE COMPANY TREATS AS PRIVATE OR CONFIDENTIAL.

DEVELOPMENT

AND SUPPLY AGREEMENT

This

Development and Supply Agreement (this “Agreement”) is made as of July 17, 2024, (the “Effective

Date”) by and between Evofem Biosciences, Inc., a Delaware corporation on behalf of itself and its wholly owned subsidiaries

Evofem Biosciences Operations, Inc. and Evofem, Inc. (“Licensor”), and Pharma 1 Drug Store L.L.C., a United

Arab Emirates limited liability company (“Licensee”). Licensor and Licensee are sometimes referred to collectively

herein as the “Parties” or individually as a “Party.”

WHEREAS,

Licensor wishes to grant to Licensee, and Licensee wishes to obtain from Licensor, an exclusive license to develop, market, advertise,

promote, distribute, offer for sale, sell, and import Licensor’s contraceptive product in the Middle East region on the terms and

subject to the conditions set forth herein.

NOW,

THEREFORE, in consideration of the foregoing recitals and the mutual covenants and agreements contained herein, the Parties hereto, intending

to be legally bound, do hereby agree as follows:

In

addition to the capitalized terms defined elsewhere in this Agreement, the following terms used in this Agreement shall have the meaning

set forth below:

“ADE”

means any Adverse Event associated with the Licensed Product (including Adverse Drug Reactions).

“Adverse

Event” or “AE” means any untoward medical occurrence in a patient or clinical investigation subject

administered Licensed Product and which does not necessarily have to have a causal relationship with such treatment.

“Adverse

Reaction” or “Adverse Drug Reaction” or “ADR” means a response to a

Licensed Product which is noxious and unintended and which occurs at doses normally used in humans for prophylaxis, diagnosis or therapy

of disease or for modification of physiological function.

“Affiliate”

means, with respect to any Party, any other Party who directly or indirectly, through one or more intermediaries, controls, is controlled

by, or is under common control with, such Party. For the purposes of this definition only, the term “control” means the possession,

directly or indirectly, of the power to direct or cause the direction of the management and policies of a Party, whether through the

ownership of voting securities, by contract or otherwise, and the terms “controlled” and “controlling” have meanings

correlative thereto.

“Applicable

Laws” means all applicable laws, rules, regulations and guidelines that may apply to the development, marketing, manufacturing

or sale of Licensed Products or the performance of either Party’s obligations under this Agreement, including but not limited to

all laws, regulations and guidelines governing the import, export, development, marketing, distribution and sale of the Licensed Product

in the Territory and in the United States of America, all Good Manufacturing Practices or Good Clinical Practices standards or guidelines

promulgated by the US Food and Drug Authority, other Competent Authorities, or the International Conference on Harmonization.

“Business

Day” means any day except any Saturday, any Sunday, any day which is a federal legal holiday in the United States, or any

day on which banking institutions in the State of Delaware are authorized or required by law or other governmental action to close.

“Calendar

Quarter” means the respective periods of three consecutive calendar months ending on March 31, June 30, September 30 and

December 31, provided the initial Calendar Quarter under this Agreement shall begin on the Effective Date and end on the first March

31, June 30, September 30 or December 31 following the Effective Date.

“Commercially

Reasonable Efforts” means, except as otherwise explicitly set forth in this Agreement, efforts consistent with the reasonable

exercise of prudent scientific and business judgment and generally accepted practices in the pharmaceutical industry, as applied to similar

products having comparable market potential.

“Competent

Authorities” means collectively the governmental entities in the Territory responsible for the regulation of medicinal

products intended for human use and the United States Food and Drug Authority.

“Competing

Product” means an acidic-based female contraceptive product.

“Confidential

Information” means any confidential or proprietary information of a Party, whether in oral, written, graphic or electronic

form, provided that any of the following information, which the receiving Party can prove by competent evidence, shall

not be Confidential Information:

(a) information

that is now, or hereafter becomes, through no act or failure to act on the part of the receiving Party, generally known or available;

(b) information

that is known by the receiving Party at the time of receiving such information, as evidenced by its written records maintained in the

ordinary course of business;

(c) information

that is hereafter furnished to the receiving Party by a Third Party, as a matter of right and without restriction on disclosure;

(d) information

that is independently developed by the receiving Party without use of, or reference to, the disclosing Party’s Confidential Information;

or

(e) information

that is the subject of a written permission to disclose provided by the disclosing Party.

“Control”

means the possession of the ability to grant a license or sublicense as provided for herein without violating the terms of any agreement

or other arrangement with any Third Party existing on the Effective Date or, with respect to any intellectual property rights acquired

from a Third Party following the Effective Date, any agreements in effect at the time such rights are acquired.

“Development

Documentation” means all documentation, including notes, summaries and analyses related thereto, developed in connection

with all research, development, or clinical trials performed by or on behalf of Licensee in the Territory under this Agreement (including

but not limited to any research and development or post-marketing studies performed following Governmental Approval).

“Field”

means use for female contraception.

“Governmental

Approval” means all permits, licenses and authorizations, including but not limited to, import permits and marketing authorizations

required by any Competent Authority as a prerequisite to the manufacturing, marketing or selling of the Licensed Product for human therapeutic

use in the Territory.

“Improvements”

means any and all developments, inventions or discoveries relating to the Licensed Technology that are developed or acquired by, or otherwise

come under the Control of, a Party, a Sublicensee, or any Affiliate thereof and shall include, but not be limited to, such developments

intended to enhance the safety and/or efficacy of the Licensed Product.

“Licensed

Know-How” means all know-how, trade secrets, inventions, data, processes, techniques, procedures, compositions, devices,

methods, formulas, protocols and information, whether or not patentable, which are not generally publicly known, including, without limitation,

all chemical, biochemical, toxicological, and scientific research information, whether in written, graphic or video form or any other

form or format, in each case related to the Licensed Product which is under the Control of Licensor as of the Effective Date.

“Licensed

Patent Rights” means all Patent Rights in the Territory claiming the Licensed Product, or that are necessary to develop,

manufacture and commercialize the Licensed Product in the Territory (including all such patents claiming Improvements or the composition

of matter, formulation or method of manufacture or use of the Licensed Products), to the extent under the Control of Licensor.

“Licensed

Product” means (i) Phexxi® and (ii) any related formulation covered by the Licensed Technology whether now

existing or subsequently developed, in each case that is supplied to Licensee by (or on behalf of) Licensor.

“Licensed

Technology” means the Licensed Patent Rights and the Licensed Know-How.

“Licensed

Trademark” means Phexxi® unless such trademark is determined to be unacceptable to the Competent Authorities

in the Territory, in which event the Parties shall mutually agree upon an alternative trademark.

“Order”

means a written purchase order for Licensed Products, which order shall include a delivery schedule specifying the requested delivery

date and quantity for each Licensed Product ordered.

“Patent

Rights” means all rights under patents and patent applications, and any and all patents issuing therefrom (including utility,

model and design patents and certificates of invention), together with any and all substitutions, extensions (including supplemental

protection certificates), registrations, confirmations, reissues, divisionals, continuations, continuations-in-part, re-examinations,

renewals and domestic and foreign counterparts of the foregoing.

“Product

Development” means all actions reasonably necessary in connection with seeking and obtaining Governmental Approval of the

Licensed Product in Field in the Territory, including, if and as necessary, the performance of clinical trials of the Licensed Product

in the Field in the Territory in accordance with this Agreement.

“Product

Specifications” means the manufacturing and product specifications for the applicable Licensed Product as provided by Licensor

to Licensee and may be amended from time to time in accordance with this Agreement, Applicable Laws and requirement of Competent Authorities.

“Results”

means the results from all research, development, and clinical trials performed by or on behalf of Licensee, Sublicensee’s, or

any Affiliates thereof, including but not limited to that reported on Development Documentation.

“Sublicensee”

means a Third Party to which a Party has granted a sublicense under the licensed rights granted to such Party hereunder, to the extent

such sublicense grant is permitted and made in accordance with the terms thereof.

“Territory”

means United Arab Emirates, Saudi Arabia, Kuwait, Jordan, Qatar, and Oman, with potential to expand into Algeria, Bahrain, Cyprus, Egypt,

Iran, Iraq, Israel, Libya, Lebanon, Morocco, Palestinian Territories, Syria, Tunisia, Turkey, and Yemen; provided that Licensor may exclude

any country or region from the Territory, by written notice to Licensee, upon the occurrence of any trade ban relating to such country

or region imposed by any government entity with jurisdiction over Licensee or Licensor or any of their Affiliates.

“Third

Party” means any entity other than: (a) Licensor, (b) Licensee, or (c) an Affiliate of Licensor or Licensee.

| 2. |

CLINICAL, REGULATORY AND GOVERNMENTAL APPROVAL. |

2.1 Licensee

shall use Commercially Reasonable Efforts to pursue Product Development. Licensee will carry out development work substantially pursuant

to a detailed development plan that is (i) initially drafted by Licensee, (ii) includes regulatory requirements of the Competent Authorities

in the Territory and (ii) is approved in writing by Licensor, such approval not to be unreasonably withheld, prior to Licensee undertaking

any activities pursuant to this Agreement (such plan, as approved, the “Development Plan”). Licensee shall

not perform, nor enable any Affiliate or Third Party to perform, any research and development concerning the Licensed Product except

as provided in the Development Plan. The Development Plan may be amended by Licensee from time to time, subject to the advance review

and written approval by Licensor in writing of each such amendment. Licensee shall provide Licensor with detailed written reports regarding

the status, progress, and outcome, as well as major findings and major decision points, of Product Development at least once per Calendar

Quarter during the Term, which reports shall be delivered no later than five (5) Business Days following the end of the applicable Calendar

Quarter; and, without limiting the generality of other rights granted herein, Licensor shall have the right to share data contained in

such reports with Third Parties as necessary.

2.2 Regardless

of the approval of a Development Plan, Licensee shall separately present all plans for any pre-clinical and clinical trials related to

the Licensed Product including, but not limited to trial design and trial protocols.

2.3 Licensee

shall maintain books and records in connection with the Development Plan in accordance with Applicable Laws and otherwise in sufficient

detail and in good scientific manner appropriate for patent and regulatory purposes, including to obtain Governmental Approvals, and

shall properly reflect all material work done and results achieved by or on behalf of Licensee in the performance of the Development

Plan in such books and records. Once per year and upon five (5) Business Day’s prior written notice Licensor and its designees

shall have the right to access, audit, and inspect the materials in such books and records and any facilities engaged in Product Development

by or on behalf of Licensee at Licensor’s expense, and Licensee shall without undue delay provide copies of such books and records,

and access to any such facilities, to Licensor and/or its designees upon their reasonable request.

2.4 Licensee

shall be responsible for the compilation and submission of the regulatory filings in respect of the Licensed Product in the Territory,

the holder of any Governmental Approvals granted for the Licensed Product, and responsible for interaction with Competent Authorities

in the Territory, provided that (i) no filing, submission, or correspondence shall be made to any Competent Authority or other governmental

authority or agency concerning the Licensed Product in the Territory without providing Licensor a reasonable opportunity to review such

filing, submission, or correspondence and obtaining Licensor’s prior written consent with respect to the content thereof and (ii)

Licensee shall provide Licensor prompt advance written notice of, and a reasonable opportunity to attend and participate in, any meetings

(in person, telephonic or otherwise) with any Competent Authorities or other governmental authorities or agencies concerning Licensed

Products in the Territory. Licensee shall reasonably advise Licensor in detail regarding the status of, or developments with respect

to, the regulatory filings and Governmental Approvals but not less than at the end of every Calendar Quarter in accordance with terms

of this Agreement.

2.5 Licensor

shall, upon Licensee’s reasonable request, promptly provide to Licensee all material information, which is in Licensor’s

possession and that Licensor has the right to provide to Licensee, regarding Licensor’s (or its Third Party contractors’)

manufacturing facilities, methods and process controls for the manufacture of the Licensed Product, and will reasonably assist Licensee

in compilation of information for the chemistry, manufacturing and control documentation which Licensee reasonably determines in good

faith is needed for completion of the regulatory filings. In the event that Licensor reasonably determines that any such information

constitutes proprietary, confidential, or trade secret information belonging to Licensor or its Third Party contractor(s), the Parties

will cooperate to take appropriate steps to preserve the confidential, proprietary and/or trade secret status of such information.

2.6 Licensee

shall, as promptly as reasonably possible, provide to Licensor, in English, a summary report to any interactions with any Competent Authorities

with respect to the Licensed Product. Licensee will provide Licensor, in English, with a summary report of any interactions with any

Competent Authorities as soon as reasonably possible. Should Licensor request additional information regarding the interaction with the

Competent Authorities, Licensee will, as soon as reasonably possible, provide at Licensor cost, full translations, in English, of any

Licensee documents (including any minutes, notes or other documents) Licensor might request concerning the Licensed Product or any activities

of Licensee or its Affiliates related thereto. On or after the date of the first commercial sale of the Licensed Product, each Party

shall provide the other Party with a status update with regard to any audit or inspection conducted by any Competent Authority which

relates directly to the Licensed Product in the Territory.

2.7 Licensee

shall be responsible for obtaining and maintaining all Governmental Approvals (including, but not limited to, all supplements, amendments

and variations) necessary (a) for the commercial marketing, sale, and distribution of the Licensed Product in the Territory and (b) for

Licensee to contract Licensor to manufacture and package the Licensed Product into final packaging.

2.8 Licensee

shall be solely responsible for the payment of all costs incurred by it with respect to the Licensed Product in the Territory, including

any and all costs incurred with respect to the development of the Licensed Product as a condition to the granting of Governmental Approval

of the Licensed Product for in the Field.

2.9 Subject

to Sections 3.6 and 9.6, Licensee shall own all rights in and to any Governmental Approval and related documentation, including all notes,

summaries and analyses related thereto, developed in connection with such Governmental Approval.

2.10 Licensor

shall provide Licensee with copies of and access to Licensed Know-How in Licensor’s possession and that Licensor has the right

to provide to Licensee, including but not limited to information reasonably sufficient for allowing Licensee to (a) establish and undertake

Commercially Reasonable Efforts to obtain the Governmental Approvals and (b) if obtained, maintain and comply with Governmental Approvals

in the Territory.

2.11 The

Parties shall keep each other promptly and fully informed about any material adverse events, side effects, injury, toxicity or sensitivity

reaction associated with the Licensed Product of which such Party becomes aware, whether or not any such effect is attributable to the

Licensed Product. Licensee shall be responsible for reporting relevant side effects (a) to the appropriate Competent Authorities in accordance

with the terms of this Agreement and all Applicable Laws and (b) to Licensor according to a Safety Management Plan which will be mutually

agreed between Licensor and Licensee prior to the first commercial sale of the Licensed Product in the Territory. Each shall promptly

inform the other by telephone and in writing in the event any circumstances occur which may precipitate a possible or actual recall of

any Licensed Product.

2.12 Licensee

shall be entitled to carry out the Development Plan through the use of Third Party contractors, provided that Licensee shall be responsible

and liable for such Third Party’s performance of and compliance with Licensee’s obligations hereunder.

2.13 To

the extent that any Sublicensee of Licensee performs Product Development, the terms of this Section 2 shall apply to such person as if

such person were the Licensee.

3.1 Subject

to the terms and conditions of this Agreement, Licensor hereby grants to Licensee during the Term an exclusive (even as to Licensor),

royalty-free, sublicensable (subject to Section 3.4), license, in the Field under the Licensed Technology to market, advertise, promote,

distribute for commercial sale, offer for sale, sell, and import for commercial sale the Licensed Product in the Territory.

3.2 Subject

to the terms and conditions of this Agreement, Licensor hereby grants to Licensee during the Term an exclusive (even as to Licensor),

royalty-free, sublicensable (subject to Section 3.4), license in the Field under the Licensed Trademarks to market, advertise, promote,

distribute for commercial sale, offer for sale, sell, and import for commercial sale the Licensed Product in the Territory provided,

that Licensor’s prior written approval shall be required for all such uses of Licensed Trademarks, which prior approval

shall not be unreasonably withheld. Notwithstanding anything to the contrary, all use of the Licensed Trademarks shall be subject to

Licensor’s internal usage policies, which may change from time to time. Licensor shall solely retain all goodwill and intellectual

property rights associated with the Licensed Trademarks and all related trademarks derived therefrom, and the license granted in this

Section 3.2 shall be subject to customary restrictions on usage.

3.3 Licensee

shall not, and shall ensure that its Affiliates and Sublicensees shall not (a) develop, manufacture, market, sell, distribute, or offer

for sale, or enable or provide any assistance to any Third Party with respect to the development, manufacturing, marketing, sale, or

distribution of, any Licensed Product or substantially similar product in any jurisdiction outside the Territory and (b) use any trademark,

trade name or other designation that is confusingly similar to the Licensed Trademarks. Licensee shall use Commercially Reasonable Efforts

to ensure, and shall ensure that its Affiliates and Sublicensees use Commercially Reasonable Efforts to ensure, that no Licensed Products,

or samples thereof, are manufactured, distributed to, exported to, or otherwise made available for use or sale in any jurisdiction outside

the Territory.

3.4 Licensee

may sublicense the rights granted to Licensee by Licensor under this Agreement to Affiliates and Third Parties in accordance with this

Section 3.4. Any sublicense granted by Licensee shall be consistent in all material respects with, and subject to, the terms of this

Agreement and, with respect to any sublicensee other than a sublicensee to a Third Party who is acting solely as a service provider to

Licensee, shall include a requirement to make Commercially Reasonable Efforts to promote the sale, marketing, and distribution of, and

otherwise commercialize and sell, the Licensed Product in the Territory in the Field. Licensee shall send Licensor an executed copy of

such sublicense entered into with Third Parties promptly, but in no case later than thirty (30) days, after such sublicense is entered

into by Licensee, and shall keep Licensor reasonably informed with respect to any sublicense granted by it hereunder.

3.5 Licensee

shall be responsible and liable for the acts and omissions of its Affiliates, subcontractors and other Sublicensees performing Licensee’s

rights or obligations under this Agreement on behalf of Licensee as if the same were performed by Licensee and no sublicense or subcontract

arrangement pursuant to Section 3.4 shall relieve Licensee of any of its obligations under this Agreement. Sublicensees shall participate

in the Governance Committee.

3.6 Subject

to the rights of Licensee or any Sublicensee under this Agreement, Licensee hereby grants, and shall cause any Sublicensee to grant,

to Licensor an exclusive royalty-free, fully-paid, irrevocable, worldwide perpetual license and right of reference, with rights of sublicense,

under the Governmental Approvals, Development Documentation, and Results for any purpose.

3.7 During

the Term of this Agreement, Licensor shall not sell, market, or offer for sale the Licensed Product in the Territory. Notwithstanding

anything to the contrary, nothing in this Agreement shall limit Licensor’s or Licensor’s sublicensees’ right to research

or develop, commercialize, market, sell, promote, distribute, import or manufacture any products, other than the Licensed Product, in

the Territory, or to manufacture, use, sell, offer for sale, promote, import, or distribute the Licensed Product or any other products

for use outside the Territory or enter into an agreement with any Third Party enabling such Third Party to engage in such activities

with respect to the Licensed Product.

3.8 Licensee

acknowledges that it shall have no right, title, or interest in or to the Licensed Technology or Licensed Product except to the extent

set forth in this Agreement, and Licensor reserves all rights to make, have made, use, sell, offer for sale, and import the Licensed

Technology and Licensed Product except as otherwise expressly granted to Licensee pursuant to this Agreement. Nothing in this Agreement

shall be construed to grant Licensee any rights or license to any intellectual property of Licensor other than as expressly set forth

herein.

| 4. |

DEVELOPMENT AND COMMERCIALIZATION |

4.1 A

joint governance committee (“Governance Committee”) shall oversee and manage the relationship between the Parties

and any Sublicensee under this Agreement, including without limitation, the coordination of the transfer of information between the Parties,

the facilitation of the development of the Licensed Product in the Territory in accordance with the Development Plan, and proposed clinical

trial design and protocols (if any). The Governance Committee shall include up to three (3) members of each Party and one (1) member

of any Sublicensee. Notwithstanding the foregoing, nothing in this Section 4.1 or the operations of the Governance Committee shall supersede

Licensor’s rights to approve a Development Plan or any pre-clinical or clinical trial pursuant to Sections 2.1 and 2.2 respectively.

The Governance Committee shall be co-chaired by a representative of Licensee and a representative of Licensor. The co-chairpersons shall

be responsible for calling meetings, setting the agenda, circulating the agenda at least ten (10) days prior to each meeting and distributing

minutes of the meetings within ten (10) days following such meetings (provided that each co-chairperson may elect to delegate the performance

of its responsibilities to other members of the Governance Committee from time to time), but shall not otherwise have any greater power

or authority than any other member of the Governance Committee. Each Party shall disclose to the co-chairpersons any proposed agenda

items, along with appropriate information at least twenty (20) days in advance of each meeting of the Governance Committee. Each member

of the Governance Committee selected by each Party shall have substantial experience in biopharmaceutical product development, manufacturing

and/or commercialization and other such expertise as appropriate to the activities of the Governance Committee. Each Party may replace

its members of the Governance Committee upon written notice to the other Party and shall replace its members as the expertise required

by the Governance Committee changes over time. The Governance Committee shall hold meetings at such times as shall be determined by a

majority of the entire membership of the committee, but in no event, shall such meetings be held less frequently than once every month.

Meetings of the Governance Committee shall be held by videoconference. Meetings of the Governance Committee shall be effective if at

least two (2) members of the Governance Committee, representing each Party, are in attendance or participating in the meeting. Each Party

shall be responsible for the expenses incurred in connection with its employees, consultants and its members of the Governance Committee

attending or otherwise participating in Governance Committee meetings.

4.2 In

the event that the objective(s) set forth in the Development Plan are not achieved in accordance with the terms of the Development Plan,

Licensor shall notify Licensee thereof in writing, and Licensee shall have thirty (30) days following such notification to establish,

to the reasonable satisfaction of Licensor, that any failures have been remedied as contemplated above. In the event Licensee fails to

establish the same to Licensor’s reasonable satisfaction, Licensor shall have the right, in its sole discretion, to terminate the

licenses granted to Licensee under this Agreement, either in whole or on a country-by-country basis, effective immediately.

4.3 Licensee

or its Sublicensees, at its or their own expense, will be responsible for all sales and marketing activities related to the Licensed

Product in the Territory.

4.4 Upon

the receipt of Governmental Approval, Licensee agrees to use Commercially Reasonable Efforts to promote the sale, marketing, and distribution

of, and otherwise commercialize and sell, the Licensed Product in the Territory in the Field. Licensee shall provide Licensor with quarterly

written reports of Licensee’s commercialization efforts and activities for such quarter and a description of its plans for future

commercialization efforts and activities. In addition, Licensee shall provide such other information, financial or otherwise, Licensor

may reasonably request relating to the marketing, sale or distribution of the Licensed Product.

4.5 Beginning

on the date of first commercial sale of the Licensed Product in the Territory, Licensee shall use Commercially Reasonable Efforts to

deploy its sales representatives to sell the Licensed Product in the Territory. In the event Licensee materially fails to meet any commercialization

objective set forth on Schedule 1 attached hereto (the “Commercialization Objectives”), Licensor shall notify

Licensee thereof in writing, and Licensee shall have thirty (30) days following such notification to establish, to the reasonable satisfaction

of Licensor, that any failures have been remedied as contemplated above. In the event Licensee fails to establish the same to Licensor’s

reasonable satisfaction, Licensor shall have the right, in its sole discretion, to terminate the license granted to Licensee under this

Agreement, either in whole or on a country-by-country basis, effective immediately.

| 5. |

PATENTS AND INTELLECTUAL PROPERTY |

5.1 Licensee

shall not, and shall ensure that none of its Affiliates, Sublicensees, contractors, or other agents does not, take any action or make

any statement that, directly or indirectly, adversely affects, or would reasonably be expected to adversely affect, any of the Licensed

Patent Rights. Licensed Trademark(s) or Licensed Know-How, or Licensor’s or any Licensor Affiliate’s or Licensor’s

sublicensees’ rights or ability to make, use, sell, offer for sale, or import Licensed Product or any other products.

5.2 Licensor

shall own all right, title and interest in and to any Improvements made by or on behalf of either Party (or any Affiliate or Sublicensee

thereof), solely or jointly with the other Party, any Sublicensee or any other Third Parties, and all intellectual property rights related

thereto, and Licensee hereby assigns to Licensor all right, title, and interest to any Improvements generated by or on behalf of Licensee,

any Sublicensee or its or their Affiliates, solely or jointly with any other Party, and all intellectual property rights related thereto.

Licensee shall take all actions and execute all documents necessary to effect the purposes of the foregoing, as requested by Licensor,

and cause its Affiliates, Sublicensees, employees, contractors, and other representatives to do the same. Licensee shall promptly notify

Licensor in writing of Improvements made, solely or jointly with other persons, by Licensee or any Affiliate thereof. Licensee shall

ensure that any contracts it may execute with any Sublicensee, Affiliate or other Third Party concerning Licensed Products shall be consistent

with, and enable Licensee to comply with, this Section 5.2.

5.3 Licensee

shall, at Licensor’s expense, take all such steps as Licensor may reasonably require to assist Licensor in maintaining the validity

and enforceability of the Licensed Trademarks during the Term. Licensee shall not make an

application to or actually register any unregistered Licensed Trademarks in the Territory without Licensor’s prior written consent.

5.4 Except

as otherwise expressly provided herein, Licensor shall have the sole right and obligation to prosecute and maintain the Licensed Patent

Rights in the Territory. Licensee shall reasonably cooperate in connection with the prosecution of the Licensed Patent Rights. Should

Licensor decide that it is no longer interested in maintaining or prosecuting a particular Licensed Patent Rights in the Territory in

respect of which it has the rights to so maintain and prosecute, Licensee may assume such prosecution and maintenance in the Territory

at its sole expense.

5.5 Each

of Licensee and Licensor shall promptly notify the other Party in writing of any alleged or threatened infringement of any Licensed Patent

Rights or Licensed Trademarks by a Third Party, of which the Party becomes aware. Licensor shall have the first right to bring and control

any action or proceeding with respect to any alleged or threatened infringement of Licensed Patent Rights or Licensed Trademark(s) in

the Territory. If Licensor does not bring and continue pursuing an action or proceeding against, or otherwise take appropriate steps

to cause the cessation of such an infringement of any Licensed Patent Rights or Licensed Trademark by or after the earlier of (i) one

hundred and eighty (180) days following the notice of alleged infringement then Licensee shall have the right to bring and control an

infringement action under the applicable Licensed Patent Rights with respect to such infringement at its own expense and by counsel of

its own choice provided that Licensee may not settle an action or proceeding brought under this Section 5.5 in a manner that, or knowingly

take any other action in the course thereof that, adversely affects the value, scope or validity of the Licensed Patent Rights or Licensed

Trademarks without the written consent of the Licensor, which consent shall not be unreasonably withheld. For any action or proceeding

brought by a Party under this Section 5.5 each Party shall reasonably cooperate with the other Party. Any recovery realized as a result

of any litigation under this Section 5.5 (including, for greater certainty, the proceeds of any settlement relating to such litigation),

after reimbursement of any litigation expenses of Licensee and Licensor, as applicable, shall be retained by the Party that brought and

controlled such litigation for purposes of this Agreement, except that the other Party shall be entitled to receive twenty-five percent

(25%) of any recovery realized by the Party that brought and controlled such litigation under this Section 5.5, after reimbursement of

each of the Parties’ related litigation expenses.

6.1 Subject

to Licensee’s obligations upon termination pursuant to this Agreement, Licensee shall, following final Governmental Approval by

a given Competent Authority in the Territory, be the holder and owner of such Governmental Approval in the Territory. Licensee agrees

that neither it nor its Affiliates or Sublicensees will do anything to recklessly, negligently, or intentionally adversely affect any

Governmental Approval.

6.2 With

respect to the Licensed Product, Licensee agrees, at its sole cost and expense, to maintain all Governmental Approvals throughout the

Term including obtaining any supplemental applications, annual reports, variations or renewals thereof.

6.3 After

the Effective Date, Licensee shall promptly provide Licensor a copy of any material correspondence or materials that it receives from

a Competent Authority regarding any Licensed Product. If such correspondence is not received in English, Licensee will provide Licensor

with a summary report in English of all material matters addressed. Should Licensor request additional information regarding the interaction

with the Competent Authorities, Licensee will, as soon as reasonably possible, provide at Licensor’s cost, full translations, in

English, or any documents (including any minutes, notes or other documents) Licensor might request.

6.4 Licensee

shall, at its sole cost and expense, be responsible for, and perform, all reporting of ADEs and Phase IV surveillance (surveillance during

commercialization of the Licensed Product) in the Territory, as required by Competent Authorities and Applicable Laws. Licensee shall

provide Licensor with a copy of all safety-related correspondence with any Competent Authority within one (1) Business Day of its receipt

or submission. Licensee shall provide all information necessary for Licensor to fulfill any requirements of Applicable Law related to

ADEs and Phase IV surveillance of the Licensed Product in the United States of America.

6.5 Following

Governmental Approval, in the Territory, Licensee will be responsible for (i) maintaining the Company Core Safety Information (or the

substantial equivalent in the Territory) (“CCSI”), as included in the Company Core Data Sheet (or the substantial

equivalent in the Territory) (“CCDS”) (as developed and provided by the Licensor) and (ii) maintaining the

CCSI, as included in the package insert and prescribing information (or the substantial equivalent in the Territory) (“PI”).

Licensee will also be responsible for submission of any safety-related supplemental applications for changes to any package insert or

other labeling.

6.6 Following

Governmental Approval, Licensee and each Sublicensee will maintain a pharmacovigilance database, and any other information required by

Applicable Law in the Territory, for the Licensed Product in the Territory. The database will include all ADE reports from spontaneous

sources, scientific literature, and post-marketing surveillance reports (serious) and SAE reports from clinical studies coming into the

knowledge of Licensee as well as all other reports required by Applicable Law in the Territory. Spontaneous cases will include reports

received from both healthcare professionals and consumers. AE data will be carried out in accordance with Licensee’s or Sublicensee’s

standard operating procedures and Licensee will use World Health Organization ADR terminology. All reasonable assistance and access requested

by either Party in responding to safety inquiries will be provided upon request. Information in Licensee’s safety databases will

be used by Licensee to prepare safety-related supplemental applications for changes in the package insert(s)/labelling for Licensed Product.

Licensee shall report any change to package insert(s)or labelling in any jurisdiction in the Territory to the Licensor within three (3)

Business Days. Licensor will inform Licensee of safety- or efficacy- related labelling changes to the Core Data Sheet or as applicable

to labeling of the License Product in the United States of America.

6.7 The

Parties shall keep each other informed (including, but not limited to, in accordance with the Safety Management Plan) on all safety matters

related to the Licensed Product and on any information received from any source concerning any ADR coming to either Party’s knowledge

with regard to the Licensed Product.

6.8 Each

Party is responsible for fulfilling its reporting obligations to the appropriate regulatory authorities with respect to the Licensed

Product in accordance with Applicable Laws.

6.9 The

Parties shall in relation to the Licensed Product report to each other all SAEs with a reasonable suspicion of causal relationship to

the Licensed Products and all serious spontaneously reported suspected ADRs within one (1) Business Day after having come to a Party’s

attention including a case description and medical causality assessment on the International Adverse Event Report Form (CIOMS form) in

English. Licensee shall carry out follow up on all SARs (listed and unlisted) and non-serious unlisted ADRs in the Territory according

to its standard operating procedures, which shall be commercially reasonable and consistent with industry standards. Pregnancy and in

utero reports will be followed up by Licensee at the expected due date. Reasonable attempts shall be made by Licensee to obtain the required

minimum information: identifiable patient, reporter, suspect drug, and AE.

6.10 Licensee

shall report life-threatening or fatal SAEs in the Territory with a reasonable suspicion of causal relationship to the Licensed Product

to Licensor and to appropriate Competent Authorities within one (1) Business Day. In the case of incomplete or insufficient data available,

an initial report has to be issued meeting the time frame, followed by as complete a report as possible within the earlier of ten (10)

Business Days or the date required by Applicable Law. Licensee shall report all other serious, unexpected ADRs to Competent Authorities

as soon as possible but no later than ten (10) Business Days after first knowledge by Licensee.

6.11 In

any case where a change in the risk-benefit-ratio of the Licensed Product becomes evident or safety actions due to ADR seem to be necessary

(e.g. change of the label, product information, special information/warnings to the medical profession, patients, authorities or Product

Recall), the Parties hereto will inform each other without delay and use commercially reasonable efforts to harmonize further measures

as appropriate. Such exchange of information is realized through direct contacts between the responsible departments. Therefore, both

Parties undertake to timely inform each other of any change in the responsible persons, the address, telephone and email addresses. If

specific safety measures are to be taken in the Territory with respect to any Licensed Product, Licensee will ensure the implementation

of such in the Territory within mutually agreed timeframes or according to regulatory obligations.

6.12 Regulatory

inquiries from Competent Authorities in the Territory related to safety concerns for the Licensed Product received by either Party will

be promptly forwarded to the other Party. The Parties shall work in good faith to develop a mutually agreeable response with respect

to any such inquiry in the Territory at least five (5) Business Days before the response is required. The aforementioned information

shall be addressed to:

In

case of Licensor:

Ellen

Thomas, Chief of Staff

Evofem

Biosciences, Inc.

7770

Regents Road Suite 113-618

San Diego, California 92122

T:

+1 718.490.3248

ethomas@evofem.com

info@evofem.com

In

case of Licensee:

Ghada

Ahmed

Pharma

1 Drug Store

Mansoor

Building 2, Al Qusais, Store 02, Amman St

Dubai,

United Arab Emirates

T:

+971507502021

ra@pharmaoneco.com

6.13 Licensee

will have the primary responsibility for reviewing relevant scientific literature for any serious and non-serious unlisted ADRs related

to the Licensed Product in the Territory according to Applicable Laws.

6.14 Licensee

will perform signal detection concerning the Licensed Product according to its own internal documented practices (as outlined in standard

operating procedures/guidelines), which shall be commercially reasonable and consistent with industry standards. Any conclusion raised

from the subsequent analysis revealing relevant safety concerns regarding the Licensed Product will be communicated to Licensor immediately.

6.15 Licensee

will be responsible for preparing the periodic reports either required to be submitted to Competent Authorities in the Territory or in

accordance with its own standard operating procedures, which shall be commercially reasonable and consistent with industry standards,

and Applicable Laws. Licensee shall provide such periodic reports to Licensor. Licensor will, on Licensee’s reasonable request,

provide Licensee with all data in its possession, and which Licensor has the right to provide to Licensee, which may reasonably be required

for regulatory report compilation in the Territory.

6.16 If,

after the date of the first commercial sale, a Competent Authority in the Territory requires additional testing, modification or communication

related to approved indications of any Licensed Product, then Licensee shall, subject to Licensor’s prior written approval of any

such testing, modification, or communication, design any such testing, modification, or communication. Licensor shall, if and as agreed

to by Licensor in writing, be responsible for any additional formulation or chemistry, manufacturing and control work as required, at

Licensee’s cost. Licensee shall be responsible for any additional pre-clinical and/or clinical testing and any other items required

by such Competent Authority, at Licensee’s cost, provided that Licensee shall not initiate any such testing or other activities

without Licensor’s prior written consent.

6.17 Upon

receipt of a written request, each Party shall provide reasonable assistance to the other Party, in connection with such Party’s

obligations pursuant to this Section 6, subject to reimbursement of all of its pre-approved out-of-pocket costs by the requesting Party,

provided that the requesting Party shall not unreasonably withhold approval of any such costs.

6.18 Licensee

and Licensor shall comply with all Applicable Laws in exercising their rights and performing their obligations under this Agreement,

including the provision of information by Licensee and Licensor, to the extent in its possession, to each other necessary for Licensor

and Licensee to comply with any applicable reporting requirements. Each Party shall promptly notify the other Party of any comments,

responses or notices received from any applicable Competent Authorities, which relate to or may impact any Licensed Product or the sales

and marketing of any Licensed Product, and shall promptly inform the other Party of any responses to such comments, responses, notices

or inspections and the resolution of any issue raised by any Competent Authorities with respect to any Licensed Product.

7.1 If

at any time or from time to time, a Competent Authority requests Licensee to conduct a recall or market withdrawal of any Licensed Product

from or in the Territory (a “Product Recall”) or if a voluntary Product Recall of any Licensed Product in the

Territory is contemplated by Licensee, Licensee shall immediately notify Licensor in writing, and Licensee will conduct such Product

Recall (with full support from Licensor, subject to the conditions of Section 7.4) in as reasonable, prudent, and expeditious a manner

as possible to preserve the goodwill and reputation of the Licensed Product and the goodwill and reputation of the Parties.

7.2 Licensee

shall not carry out a voluntary Product Recall in the Territory with respect to any Licensed Product without the prior written approval

of Licensor, such approval not to be unreasonably withheld (for the avoidance of doubt, any Product Recall that is reasonably deemed

necessary in order to avoid serious personal injury shall not be considered as a voluntary Product Recall, provided that Licensee shall

provide Licensor the opportunity to advise and comment with respect to any such Product Recall prior to its execution); and the Parties

shall reasonably cooperate, in the conduct of any Product Recall for such Licensed Product in the Territory. Product Recall cost shall

be borne in accordance with Section 7.5.

7.3 Notwithstanding

the foregoing, Licensee may, without Licensor’s prior consent, immediately affect any Product Recall (A) resulting from any death

or life-threatening adverse event associated with any Licensed Product or (B) required to comply with any regulatory or legal requirements,

guidelines, directives, orders, or injunctions with respect to any Licensed Product. In the event Licensee does not undertake such a

Product Recall in a reasonable period of time, Licensor shall be entitled to do so without Licensee’s prior written consent.

7.4 Licensee

shall have the right to control and/or conduct any Product Recall in the Territory, subject to the terms of this Agreement. The Product

Recall shall be the responsibility of Licensee and their Affiliates and shall be carried out by Licensee or its Affiliates in as reasonable,

prudent, and expeditious a manner as possible to preserve the goodwill and reputation of the Licensed Product and the goodwill and reputation

of the Parties and Licensor shall provide all necessary support to Licensee to carry out the Product Recall. Licensee shall maintain

records of all sales and distribution of Licensed Product and customers in the Territory sufficient to reasonably adequately administer

a Product Recall, for the period required by Applicable Law, and make such records available to Licensor or any designee thereof immediately

upon request.

7.5 Licensee

shall bear any and all costs and expenses related to any Product Recall in the Territory (including but not limited to any Product Recall

undertaken by Licensor in accordance with Section 7.3).

7.6 Throughout

the duration of this Agreement and with respect to all Licensed Product the Parties shall immediately notify each other of any information

a Party receives regarding any threatened or pending action, inspection or communication by or from a concerned Competent Authority which

may affect the safety or efficacy claims of the Licensed Product or the continued marketing of the Licensed Product. Upon receipt of

such information during the duration of this Agreement, Licensee shall not take any action whatsoever without Licensor’s prior

review and approval, such approval shall not be unreasonably withheld.

| 8. |

FINANCIAL TERMS; SUPPLY |

8.1 Licensee

shall purchase solely from Licensor all of its or its Sublicensee’s requirements for Licensed Product to be used, sold, or distributed

in the Territory. Licensee shall not, and shall cause its Affiliates and Sublicensees to not, manufacture or have manufactured, nor obtain

from any other person, any Licensed Product.

8.2 All

Licensed Product sold by Licensor pursuant to this Agreement shall be sold at the price as listed on Schedule 2 hereto (the “Purchase

Price”). Licensee shall, in its sole discretion, have the sole and exclusive right to determine all terms and conditions

of sale of the Licensed Product to customers, subject to the constraints and requirements of any applicable Governmental Approvals and

the terms of this Agreement.

8.3 The

manner and style of the labeling and trade dress of the Licensed Product shall be as mutually agreed upon by the Parties in writing consistent

with this Agreement, and upon such mutual agreement shall be deemed part of the Product Specifications, subject to any future changes

reasonably requested by Licensee, agreed upon in writing by Licensor, and paid for by Licensee. For the avoidance of doubt, Licensee

shall be solely responsible for the contents of any product label and Licensor shall not be responsible in any manner, including but

not limited to under any provision of this Agreement, for any error, mistake, violation of any Applicable Law or any other problem with

the content of the label unless Licensor does not follow label instructions provided by Licensee in accordance with this Agreement. Any

Licensee-requested change or modification to a Licensed Product’s label or packaging shall be subject to Licensor’s prior

written approval of such change or modification. Licensee shall reimburse Licensor for the reasonable total direct and indirect cost

of any Licensed Product labels rendered obsolete by such change.

8.4 Licensee

may from time-to-time place, and Licensor will accept, Orders for the Licensed Product, as further described below and Licensor will

use Commercially Reasonable Efforts to supply Licensed Products to Licensee. Licensor may, in its sole discretion, contract with Third

Parties for the manufacture or supply of Licensed Products hereunder provided that Licensor shall be responsible and liable for such

Third Party’s performance of and compliance with Licensor obligations hereunder. All Orders must comply with the terms set forth

on Schedule 3 attached hereto and the terms set forth in any agreement between Licensor and a Third Party contractor (a “Third

Party Manufacturing Agreement”).

8.5 Within

one (1) month following submission of the initial application for Governmental Approval to a Competent Authority in the Territory with

respect to the Licensed Product, Licensee shall provide Licensor with a forecast of requirements for Licensed Products for the twelve

(12) month period following receipt of such Governmental Approval. Thereafter, Licensee shall provide Licensor with a forecast for each

following calendar year on or before June 1 of the preceding calendar year. Except as otherwise provided herein, all such forecasts made

hereunder shall be nonbinding and made to assist Licensor in planning its production and Licensee in planning marketing and sales. All

Orders made by Licensee shall become firm three (3) months before Licensee’s forecasted needs with delivery dates based on the

longest component lead time.

8.6 Licensor

shall, at Licensee’s cost and expense, procure certain raw materials a minimum of forty-five (45) days prior to the scheduled start

of production of Licensed Product. Further, Licensee shall be responsible for any fees and costs incurred by Licensor in addition to

the Purchase Price as set forth on Schedule 2 (including, but not limited to, items such as brokerage fees, courier expenses, duty fees

payable, etc.) that are incurred in the procurement of any materials, including packaging and labeling components.

8.7 No

terms and conditions contained in any Order, acknowledgment, invoice, bill of lading, acceptance or other preprinted form issued by either

Party shall be effective to the extent they are inconsistent with, modify or add to the terms and conditions contained herein.

8.8 Licensee

may reject any Licensed Product which fails to meet the Specifications in accordance with any applicable Third-Party Manufacturing Agreement.

8.9 Licensee

shall maintain an inventory of Licensed Product reasonably sufficient, consistent with industry standards, to satisfy at least four (4)

months’ worth of its requirements at all times and, for the avoidance of doubt, Licensee’s initial Order shall be of a sufficient

amount to meet such inventory requirements.

8.10 Licensor

warrants that all Licensed Products supplied pursuant to this Agreement shall on the date of delivery comply with the Product Specifications.

Changes to the Product Specifications may be made as (a) reasonably requested by Licensee and agreed upon in writing by Licensor, (b)

necessary to conform to the regulatory requirements necessary to obtain and maintain Governmental Approvals and agreed upon in writing

by Licensor, or (c) reasonably requested by Licensor or otherwise necessary to enable Licensor and any Third Party manufacturing Licensed

Products on behalf of Licensor to comply with the legal and regulatory requirements applicable to Licensed Products outside the Territory

(including those of any regulatory filing or approval outside the Territory). For clarity, prior to Licensor’s supplying any Licensed

Product to Licensee that does not comply with the then current Product Specifications, Licensor will obtain Licensee’s written

consent. Replacement or refund, as elected by Licensor in its sole discretion, shall be Licensee’s sole remedy for breach of such

warranty unless such breach is the result of Licensor’s gross negligence or willful misconduct.

8.11 Licensor

shall, as soon as reasonably possible, provide written notice of any significant changes proposed by Licensor to the Licensed Product

or method of manufacture of the Licensed Product.

8.12 Licensor

shall retain (or cause any relevant Third Party contractors to retain), at Licensee’s cost, a reasonably sufficient quantity of

each batch of Licensed Product to perform quality control testing. Licensor shall maintain such samples of each batch in a reasonably

suitable storage facility until at least one (1) year after such Licensed Product expires, or such longer period as may be required under

Applicable Laws, rules, and regulations. Portions of all such samples shall be made reasonably available for testing by Licensee, at

Licensee’s expense, upon request.

8.13 Licensor

shall maintain (or shall use commercially reasonable efforts to ensure that any relevant Third Party contractors maintain) all records

as necessary to comply with manufacturing regulations imposed by any regulatory authority.

8.14 Licensee

shall have the right to inspect the facilities where Licensed Product is manufactured pursuant to this Agreement and to review the pertinent

records relating to the manufacturing, and quality control of the Licensed Product provided that such right is only exercisable

(i) upon reasonable prior written notice, (ii) unless for cause, no more frequently than on an annual basis, (iii) during normal business

hours, and (iv) with a maximum of two (2) individuals.

8.15 Delivery

of the Licensed Product shall be effected EXW (Incoterms 2020) Licensor’s or Third Party contractor’s facility, at which

time all risk of loss and damage to the Licensed Product shall pass to Licensee, and Licensee shall carry out all customs and export

clearances necessary for the shipment, export, and import of Licensed Product out of and/or into any jurisdiction and obtain, at its

own expense, any export or import license or other governmental authority required for exportation and/or importation into and/or out

of any jurisdiction.

8.16 Prior

to shipment, Licensor shall perform release testing in any manner required by the Product Specifications, if specifically described therein,

and all Applicable Laws, rules and regulations, including the Governmental Approvals.

8.17 Licensee

shall pay the amounts due for all Licensed Product upon the placement of an Order by Licensee. Any payments due under this Agreement

will be made by wire transfer to a bank account, designated by the Licensor. All amounts payable will be specified and paid in United

States Dollars.

8.18 If

Licensee refuses or fails to take delivery of Licensed Product ordered under this Agreement at the time stated for delivery in the applicable

Order, Licensor shall be entitled, at its discretion, to invoice Licensee in full for the amounts due hereunder for such Licensed Product

and to store Licensed Product at Licensee’s cost, which shall be commercially reasonable and include insurance with coverage in

amounts and types reasonably sufficient to cover the loss of such Licensed Product. Any amounts due under the foregoing sentence shall

be paid by Licensee within thirty (30) days of its receipt of an invoice concerning such amounts.

8.19 In

the event that any payment due hereunder is not made when due, each such payment shall accrue interest from the date due at a rate equal

to twelve percent (12%) or, if less, the maximum legally permissible interest rate, calculated on the number of days such payments are

paid after the date such payments are due. The payment of such interest shall not limit Licensor from exercising any other rights it

may have under this Agreement as a consequence of the lateness of any payment.

8.20 All

taxes levied on account of the payments accruing to a Party under this Agreement shall be paid by such Party for its own account, including

taxes levied thereon as income to such Party. If provision is made in Applicable Law or regulation for withholding on any payment due

to the other Party under this Agreement, such tax shall be deducted from the payment made by a Party (the “Paying Party”)

to the other Party (the “Paid Party”) hereunder, shall be paid to the proper taxing authority by the Paying

Party, and a receipt of payment of such tax shall be secured and promptly delivered to the Paid Party. Each Party agrees to reasonably

assist the other Party in claiming exemption from such deductions or withholdings under any double taxation or similar agreement or treaty

from time to time in force or in otherwise seeking the return, refund, or credit of any such withheld amount as applicable.

8.21 Any

Licensee-specific inventory relating to a Licensed Product, including, but not limited to, materials, expired materials, work-in-process,

waste by-products, testing supplies, stability samples, work-in-process, and any Licensed Product or finished good rendered obsolete

as a result of formula, artwork, or labeling or packaging changes requested by Licensee or by changes required by a Competent Authority,

shall be reimbursed to Licensor (or its Third Party contractor) by Licensee and Licensee will bear all fees and costs related thereto.

Unless otherwise instructed by Licensee and agreed to by Licensor (or its Third Party contractor), will be shipped to Licensee for destruction

by Licensee. Licensee shall bear one hundred percent (100%) of all shipping and destruction costs related to said obsolete inventory.

Licensee shall destroy any such inventory in accordance with all Applicable Laws and Licensee shall indemnify Licensor (or its Third

Party contractor) for any liability, costs or expenses, including attorney’s fees and court costs, relating to Licensee’s

failure to dispose of such inventory in accordance with such Applicable Laws. Licensee shall also provide Licensor (or its Third Party

contractor) with all manifests and other applicable evidence of proper destruction as may be requested by Licensor (or its Third Party

contractor) or required by Applicable Law. Licensor (or its Third Party contractor) shall provide written notification to Licensee of

its intent to dispose of or store obsolete inventory. If Licensor (or its Third Party contractor) does not receive disposition instructions

from Licensee within thirty (30) days from date of notification, obsolete inventory remaining at Licensor’s (or its Third Party

contractor’s) facilities shall be subject to a deposit covering the standard cost of the obsolete inventory and storage and or

destruction fees at Licensor’s (or its Third Party contractor’s) discretion.

Notwithstanding

anything to the contrary herein, in the event that Licensor no longer manufactures and sells the Licensed Product on its own behalf,

for a continuous period of two (2) years, and for a reason other than the safety of the Licensed Product, Licensee shall have the right

to manufacture or have manufactured on its behalf the Licensed Product and continue to exercise the licenses granted pursuant to Sections

3.1 and 3.2 for the remainder of the Term (or any extension thereof), and the terms of Section 4 and 9.4(c) shall no longer apply.

[*]

Licensee

shall pay the Alternative Manufacturing Fee payable semi-annually no later than August 1st for amounts payable for the first

half of a calendar year and January 31st for amounts payable for the second half of a calendar year. For any period in which

the Alternative Manufacturing Fee is payable, Licensee shall furnish to Licensor a written report for such period which includes the

information necessary for the determination of the amounts payable as the Alternative Manufacturing Fee (on behalf of itself and its