false

0001618835

0001618835

2024-05-15

2024-05-15

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d)

of

the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): May 15, 2024

EVOFEM

BIOSCIENCES, INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-36754 |

|

20-8527075 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

7770

Regents Road, Suite 113-618

San

Diego, CA 92122

(Address

of Principal Executive Offices)

(858)

550-1900

(Registrant’s

telephone number, including area code)

Not

applicable.

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, par value $0.0001 per share |

|

EVFM |

|

OTCQB |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

2.02. Results of Operations and Financial Condition.

On

May 15, 2024, Evofem Biosciences, Inc. issued a press release announcing its financial results for the three months ended March 31, 2024.

A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The

information set forth under this Item 2.02 and in Exhibit 99.1 is not being filed for purposes of Section 18 of the Securities Exchange

Act of 1934 and is not to be incorporated by reference into any filing of the registrant under the Securities Act of 1933 or the Securities

Exchange Act of 1934, whether made before or after the date hereof, regardless of any general incorporation language in any such filing,

except as shall be expressly set forth by specific reference in such a filing.

Item

9.01. Financial Statements and Exhibits.

(d)

Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

EVOFEM

BIOSCIENCES, INC. |

| |

|

|

| Date:

May 15, 2024 |

By: |

/s/

Ivy Zhang |

| |

|

Ivy

Zhang |

| |

|

Chief

Financial Officer |

Exhibit

99.1

Evofem

Biosciences Announces Financial Results for the First Quarter of 2024

SAN

DIEGO, CA, May 15, 2024 — The company behind the hormone-free contraceptive Phexxi® (lactic acid, citric acid and potassium

bitartrate), Evofem Biosciences, Inc. (“Evofem” or “the Company”) (OTCQB: EVFM) today announced financial results

for the first quarter of 2024. Highlights of and since the quarter include:

| ● |

Received

$1 million from Aditxt, Inc. (Nasdaq: ADTX) in May 2024 in consideration for reinstating and amending the Merger Agreement, as amended,

between the companies. Aditxt agreed to invest an additional $2.5 million in Evofem by July 1, 2024. The companies are working

to close the contemplated transaction in the second half of 2024. |

| |

|

| ● |

Strengthened

Phexxi intellectual property with the allowance of a new Composition of Matter Patent by the USPTO. Once issued, this will be the

fifth U.S. patent covering Evofem’s hormone-free contraceptive. |

| |

|

| ● |

Launched

a partnership with Modern Remedies, one of the top pharmacies dispensing Phexxi in the Northeast, effective May 2024. |

| |

|

| ● |

Successfully

renegotiated the rebate for Phexxi with Medi-Cal, the California state Medicaid program serving more than 15.4 million beneficiaries.

Effective July 1, 2024, Evofem will pay a 7.4% lower rebate to Medi-Cal on Phexxi prescriptions dispensed to its beneficiaries. |

| |

|

| ● |

Net

sales were $3.6 million for the first quarter of 2024, reflecting anticipated cyclical softness following the wholesale acquisition

cost (WAC) increase on January 1, 2024, and the impact of the cyberattack on Change Healthcare on February 19, 2024. |

| |

|

| ● |

Total

operating expenses decreased 31% vs. the first quarter of 2023 to $6.4 million. |

| |

|

| ● |

Narrowed

loss from operations to $2.8 million, a 21% improvement compared to the first quarter of 2023. |

“We

expect 2024 will be our fourth consecutive year of net sales growth, driven in part by continued execution of our market access strategy

with payer wins and successful rebate reductions,” said Saundra Pelletier, Evofem’s CEO. “We also expect lift from

increasing use of Phexxi for supplemental contraception among women of reproductive age who take oral birth control pills in conjunction

with GLP-1 agonists like Mounjaro and Zepbound. These drugs may make oral contraceptives less effective at certain points in the dosing

schedule – specifically for four weeks after initiation and for another four weeks after each dose escalation. Adding a hormone-free,

woman-controlled contraceptive like Phexxi is a logical choice for these patients for additional protection against unintended pregnancy

during these times.”

Financial

Results

For

the three months ended March 31, 2024, net sales were $3.6 million compared to $5.8 million in the prior year period. The 38% decrease

reflects cyclical softness related to the timing of orders relative to WAC increases and the unfavorable impact of the cyberattack

on Change Healthcare.

The typical cycle is that our customers A)

place larger orders ahead of a price increase, B) sell from this inventory for several months after the price increase, and C) resume

ordering the following quarter. Phexxi WAC increased on January 1, 2024, resulting in softer first quarter 2024 net sales (stage B).

By contrast, following the October 2022 WAC increase and the near-absence of sales in the fourth quarter of 2022, net sales in the first

quarter of 2023 were strong (stage C).

Following

the cyberattack on Change Healthcare on February 19, 2024, retail

pharmacies across the country experienced delays processing prescriptions and were unable to send orders through insurance plans, and

there were delays in the processing of insurance claims, which lowered dispensed units of many prescription products, including Phexxi.

Additionally, Change Healthcare was the sole adjudicator (processor) used by Evofem’s co-pay card vendor and Evofem received

no claims for several weeks following the cyberattack. In mid-March, our co-pay card vendor established an alternative adjudicator.

Initially the cost to Evofem was significantly higher, which negatively impacted our first quarter results. Costs have

dropped back down in the second quarter of 2024 to approximately 8% above pre-cyberattack levels.

Total

operating expenses decreased 31% to $6.4 million, compared to $9.4 million in the prior year period. The improvement reflects a 39% decrease

in selling and marketing costs and 22% decrease in general and administrative costs.

As

a result, loss from operations improved to $2.8 million, compared with a loss from operations of $3.6 million for the three months ended

March 31, 2023.

Liquidity

At

March 31, 2024, we had $0.7 million of restricted cash, as compared to $0.6 million of restricted cash at December 31, 2023.

Subsequent

to the quarter close, in April 2024 Evofem made the required quarterly payment of $0.1 million to a U.S.-based, healthcare-focused

institutional investor as required by the Fourth Amendment to the Securities Purchase and Security Agreement dated April 2020, as amended,

under which this investor purchased $25 million of convertible senior secured promissory notes from Evofem in 2020.

In

May 2024, Evofem received $1 million from Aditxt in consideration of reinstating and amending the

Agreement and Plan of Merger, as amended on January 10, 2024, January 30, 2024, February

29, 2024, and May 2, 2024 by and between the companies. Under the Fourth Amendment to the Agreement and Plan of Merger,

Aditxt agreed to invest an additional $2.5 million in Evofem by July 1, 2024. The companies are working to close the contemplated transaction

in the second half of 2024.

About

Evofem Biosciences

Evofem

Biosciences, Inc., is developing and commercializing innovative products to address unmet needs in women’s sexual and reproductive

health. The Company’s first FDA-approved product, Phexxi® (lactic acid, citric acid and potassium bitartrate), is a hormone-free,

on-demand prescription contraceptive vaginal gel. It comes in a box of 12 pre-filled applicators and is applied 0-60 minutes before each

act of sex. Learn more at phexxi.com and evofem.com.

Phexxi®

is a registered trademark of Evofem Biosciences, Inc.

Forward-Looking

Statements

This

press release includes “forward-looking statements” within the meaning of the safe harbor for forward-looking statements

provided by Section 21E of the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995

including, without limitation, statements related to the Company’s anticipated financial performance, the anticipated benefits

of the contemplated Aditxt transaction, and timing thereof. You are cautioned not to place undue reliance on these forward-looking

statements, which are current only as of the date of this press release. Each of these forward-looking statements involves risks and

uncertainties. Important factors that could cause actual results to differ materially from those discussed or implied in the

forward-looking statements are disclosed in the Company’s SEC filings, including its Annual Report on Form 10-K for the year

ended December 31, 2023 filed with the SEC on March 27, 2024, its Quarterly Report on Form 10-Q for quarter ended March 31, 2024,

filed with the SEC on May 15, 2024, and

any subsequent filings. All forward-looking statements are expressly qualified in their entirety by such factors. The Company does

not undertake any duty to update any forward-looking statement except as required by law.

Contact

Amy

Raskopf

Evofem

Biosciences, Inc.

araskopf@evofem.com

(917)

673-5775

—

Financial Tables Follow —

EVOFEM

BIOSCIENCES, INC. AND SUBSIDIARIES

CONDENSED

CONSOLIDATED BALANCE SHEET DATA

(Unaudited)

(In

thousands)

| | |

As of | |

| | |

March 31, 2024 | | |

December 31, 2023 | |

| Cash and cash equivalents | |

$ | - | | |

$ | - | |

| Restricted cash | |

| 689 | | |

| 580 | |

| Trade accounts receivable, net | |

| 4,306 | | |

| 5,738 | |

| Total current liabilities | |

| 74,239 | | |

| 72,463 | |

| Total stockholders’ deficit | |

| (70,666 | ) | |

| (66,510 | ) |

| Total liabilities, convertible and redeemable preferred stock and stockholders’ deficit | |

| 8,217 | | |

| 10,554 | |

EVOFEM

BIOSCIENCES, INC. AND SUBSIDIARIES

CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

(In

thousands, except share and per share data)

| | |

Three Months Ended March 31, | |

| | |

2024 | | |

2023 | |

| Product sales, net | |

$ | 3,603 | | |

$ | 5,809 | |

| | |

| | | |

| | |

| Operating Expenses: | |

| | | |

| | |

| Cost of goods sold | |

| 684 | | |

| 1,376 | |

| Research and development | |

| 594 | | |

| 540 | |

| Selling and marketing | |

| 2,345 | | |

| 3,854 | |

| General and administrative | |

| 2,824 | | |

| 3,618 | |

| Total operating expenses | |

| 6,447 | | |

| 9,388 | |

| Loss from operations | |

| (2,844 | ) | |

| (3,579 | ) |

| Other income (expense): | |

| | | |

| | |

| Interest income | |

| 4 | | |

| 18 | |

| Other expense, net | |

| (616 | ) | |

| (318 | ) |

| Loss on issuance of financial instruments | |

| (3,275 | ) | |

| (84 | ) |

| Gain on debt extinguishment | |

| 1,120 | | |

| - | |

| Change in fair value of financial instruments | |

| 802 | | |

| 1,612 | |

| Total other income (expense), net | |

| (1,965 | ) | |

| 1,228 | |

| Loss before income tax | |

| (4,809 | ) | |

| (2,351 | ) |

| Income tax expense | |

| - | | |

| (3 | ) |

| Net loss | |

| (4,809 | ) | |

| (2,354 | ) |

| Convertible preferred stock deemed dividends | |

| (47 | ) | |

| - | |

| Net loss attributable to common stockholders | |

$ | (4,856 | ) | |

$ | (2,354 | ) |

| Net loss per share attributable to common stockholders

(basic and diluted): |

|

$ |

(0.16 |

) |

|

$ |

(1.85 |

) |

| Weighted-average shares used to compute net loss per share

attributable to common shareholders (basic and diluted): |

|

|

31,194,393 |

|

|

|

1,271,524 |

|

###

v3.24.1.1.u2

Cover

|

May 15, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

May 15, 2024

|

| Entity File Number |

001-36754

|

| Entity Registrant Name |

EVOFEM

BIOSCIENCES, INC.

|

| Entity Central Index Key |

0001618835

|

| Entity Tax Identification Number |

20-8527075

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

7770

Regents Road

|

| Entity Address, Address Line Two |

Suite 113-618

|

| Entity Address, City or Town |

San

Diego

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

92122

|

| City Area Code |

(858)

|

| Local Phone Number |

550-1900

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

Stock, par value $0.0001 per share

|

| Trading Symbol |

EVFM

|

| Entity Emerging Growth Company |

false

|

| Entity Information, Former Legal or Registered Name |

Not

applicable.

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

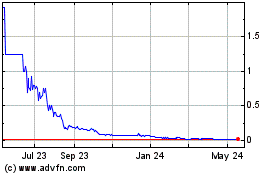

Evofem Biosciences (QB) (USOTC:EVFM)

Historical Stock Chart

From Nov 2024 to Dec 2024

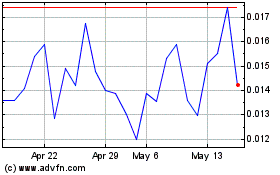

Evofem Biosciences (QB) (USOTC:EVFM)

Historical Stock Chart

From Dec 2023 to Dec 2024