false

--12-31

Q1

0001618835

P5Y

P5Y

P2Y

P5Y

P5Y

P5Y

0001618835

2024-01-01

2024-03-31

0001618835

2024-05-10

0001618835

2024-03-31

0001618835

2023-12-31

0001618835

EVFM:BakerBrosNotesMember

2024-03-31

0001618835

EVFM:BakerBrosNotesMember

2023-12-31

0001618835

EVFM:AdjuvantNotesMember

2024-03-31

0001618835

EVFM:AdjuvantNotesMember

2023-12-31

0001618835

EVFM:SeriesE1ConvertibleAndRedeemablePreferredStockMember

2024-03-31

0001618835

EVFM:SeriesE1ConvertibleAndRedeemablePreferredStockMember

2023-12-31

0001618835

EVFM:SeriesF1ConvertibleAndRedeemablePreferredStockMember

2024-03-31

0001618835

EVFM:SeriesF1ConvertibleAndRedeemablePreferredStockMember

2023-12-31

0001618835

2023-01-01

2023-03-31

0001618835

EVFM:SeriesE1ConvertibleAndRedeemablePreferredStockMember

us-gaap:PreferredStockMember

2023-12-31

0001618835

EVFM:SeriesF1ConvertibleAndRedeemablePreferredStockMember

us-gaap:PreferredStockMember

2023-12-31

0001618835

us-gaap:CommonStockMember

2023-12-31

0001618835

us-gaap:AdditionalPaidInCapitalMember

2023-12-31

0001618835

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-12-31

0001618835

us-gaap:RetainedEarningsMember

2023-12-31

0001618835

us-gaap:CommonStockMember

2022-12-31

0001618835

us-gaap:AdditionalPaidInCapitalMember

2022-12-31

0001618835

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-12-31

0001618835

us-gaap:RetainedEarningsMember

2022-12-31

0001618835

2022-12-31

0001618835

EVFM:SeriesE1ConvertibleAndRedeemablePreferredStockMember

us-gaap:PreferredStockMember

2024-01-01

2024-03-31

0001618835

EVFM:SeriesF1ConvertibleAndRedeemablePreferredStockMember

us-gaap:PreferredStockMember

2024-01-01

2024-03-31

0001618835

us-gaap:CommonStockMember

2024-01-01

2024-03-31

0001618835

us-gaap:AdditionalPaidInCapitalMember

2024-01-01

2024-03-31

0001618835

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2024-01-01

2024-03-31

0001618835

us-gaap:RetainedEarningsMember

2024-01-01

2024-03-31

0001618835

us-gaap:CommonStockMember

2023-01-01

2023-03-31

0001618835

us-gaap:AdditionalPaidInCapitalMember

2023-01-01

2023-03-31

0001618835

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-01-01

2023-03-31

0001618835

us-gaap:RetainedEarningsMember

2023-01-01

2023-03-31

0001618835

EVFM:SeriesE1ConvertibleAndRedeemablePreferredStockMember

us-gaap:PreferredStockMember

2024-03-31

0001618835

EVFM:SeriesF1ConvertibleAndRedeemablePreferredStockMember

us-gaap:PreferredStockMember

2024-03-31

0001618835

us-gaap:CommonStockMember

2024-03-31

0001618835

us-gaap:AdditionalPaidInCapitalMember

2024-03-31

0001618835

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2024-03-31

0001618835

us-gaap:RetainedEarningsMember

2024-03-31

0001618835

us-gaap:CommonStockMember

2023-03-31

0001618835

us-gaap:AdditionalPaidInCapitalMember

2023-03-31

0001618835

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-03-31

0001618835

us-gaap:RetainedEarningsMember

2023-03-31

0001618835

2023-03-31

0001618835

EVFM:PhexxiMember

2022-01-01

2022-12-31

0001618835

EVFM:PhexxiMember

2023-01-01

2023-12-31

0001618835

2022-10-03

0001618835

us-gaap:SubsequentEventMember

2024-05-10

0001618835

us-gaap:SalesRevenueNetMember

EVFM:ThreeLargestCustomersCombinedMember

us-gaap:CustomerConcentrationRiskMember

2024-01-01

2024-03-31

0001618835

us-gaap:SalesRevenueNetMember

EVFM:ThreeLargestCustomersCombinedMember

us-gaap:CustomerConcentrationRiskMember

2023-01-01

2023-03-31

0001618835

us-gaap:AccountsReceivableMember

EVFM:FourLargestCustomersCombinedMember

us-gaap:CustomerConcentrationRiskMember

2024-01-01

2024-03-31

0001618835

us-gaap:AccountsReceivableMember

EVFM:FourLargestCustomersCombinedMember

us-gaap:CustomerConcentrationRiskMember

2023-01-01

2023-12-31

0001618835

us-gaap:BuildingAndBuildingImprovementsMember

2023-03-31

0001618835

us-gaap:LetterOfCreditMember

us-gaap:BuildingAndBuildingImprovementsMember

2023-01-01

2023-03-31

0001618835

us-gaap:EmployeeStockOptionMember

2024-01-01

2024-03-31

0001618835

us-gaap:EmployeeStockOptionMember

2023-01-01

2023-03-31

0001618835

us-gaap:WarrantMember

2024-01-01

2024-03-31

0001618835

us-gaap:WarrantMember

2023-01-01

2023-03-31

0001618835

us-gaap:RightsMember

2024-01-01

2024-03-31

0001618835

us-gaap:RightsMember

2023-01-01

2023-03-31

0001618835

us-gaap:ConvertibleDebtSecuritiesMember

2024-01-01

2024-03-31

0001618835

us-gaap:ConvertibleDebtSecuritiesMember

2023-01-01

2023-03-31

0001618835

EVFM:SeriesEOneAndFOnePreferredStockMember

2024-01-01

2024-03-31

0001618835

EVFM:SeriesEOneAndFOnePreferredStockMember

2023-01-01

2023-03-31

0001618835

srt:MinimumMember

2024-01-01

2024-03-31

0001618835

srt:MaximumMember

2024-01-01

2024-03-31

0001618835

EVFM:BakerBrosNotesMember

us-gaap:ConvertibleNotesPayableMember

2020-04-23

0001618835

EVFM:BakerBrosNotesMember

EVFM:BakerSecondClosingNotesMember

2020-06-09

0001618835

EVFM:BakerBrosNotesMember

2020-06-09

2020-06-09

0001618835

EVFM:BakerBrosNotesMember

us-gaap:ConvertibleNotesPayableMember

2020-04-22

2020-04-24

0001618835

EVFM:BakerBrosNotesMember

us-gaap:ConvertibleNotesPayableMember

2020-04-24

0001618835

EVFM:BakerBrosNotesMember

us-gaap:ConvertibleNotesPayableMember

2024-01-01

2024-03-31

0001618835

EVFM:BakerBrosNotesMember

us-gaap:ConvertibleNotesPayableMember

2023-01-01

2023-03-31

0001618835

EVFM:BakerBrosNotesMember

us-gaap:ConvertibleNotesPayableMember

us-gaap:DebtInstrumentRedemptionPeriodTwoMember

2020-04-22

2020-04-24

0001618835

EVFM:BakerBrosNotesMember

us-gaap:ConvertibleNotesPayableMember

us-gaap:DebtInstrumentRedemptionPeriodOneMember

2020-04-22

2020-04-24

0001618835

EVFM:BakerBrosNotesMember

2021-11-20

0001618835

2021-11-20

2021-11-20

0001618835

2023-06-30

0001618835

EVFM:JuneTwoThousandTwentyTwoBakerWarrantsMember

2021-11-20

0001618835

us-gaap:SubsequentEventMember

2024-04-19

0001618835

EVFM:SecondBakerAmendmentMember

2022-03-21

0001618835

EVFM:SecondBakerAmendmentMember

2022-03-21

2022-03-21

0001618835

EVFM:BakerBrosNotesMember

2022-03-21

2022-03-21

0001618835

EVFM:SecondBakerAmendmentMember

EVFM:BakerWarrantsMember

2022-09-30

0001618835

EVFM:SecondBakerAmendmentMember

2023-06-30

0001618835

EVFM:ThirdBakerAmendmentMember

2022-09-15

0001618835

EVFM:BakerBrosNotesMember

2022-09-14

2022-09-15

0001618835

EVFM:SecuredCreditorForbearanceAgreementMember

2022-12-19

2022-12-19

0001618835

2023-03-07

2023-03-07

0001618835

2023-09-08

2023-09-08

0001618835

2023-10-01

2023-10-01

0001618835

2023-09-01

2023-09-30

0001618835

EVFM:OldBakerNotesMember

2023-12-31

0001618835

EVFM:BakerBrosNotesMember

2023-09-08

0001618835

2023-01-01

2023-12-31

0001618835

EVFM:BakerBrosNotesMember

2024-02-26

0001618835

EVFM:ShortTermConvertibleNotesMember

2024-03-31

0001618835

EVFM:AdjuvantNotesMember

us-gaap:ConvertibleNotesPayableMember

2020-10-14

0001618835

EVFM:AdjuvantNotesMember

us-gaap:ConvertibleNotesPayableMember

2020-10-14

2020-10-14

0001618835

EVFM:AdjuvantNotesMember

us-gaap:ConvertibleNotesPayableMember

2024-01-01

2024-03-31

0001618835

EVFM:AdjuvantNotesMember

us-gaap:ConvertibleNotesPayableMember

2023-06-30

0001618835

EVFM:AdjuvantNotesMember

2022-04-04

0001618835

EVFM:AdjuvantNotesMember

us-gaap:ConvertibleNotesPayableMember

2022-04-04

2022-04-04

0001618835

EVFM:AdjuvantNotesMember

us-gaap:ConvertibleNotesPayableMember

2022-04-04

0001618835

EVFM:AdjuvantNotesMember

us-gaap:ConvertibleNotesPayableMember

2022-09-15

0001618835

EVFM:AdjuvantNotesMember

us-gaap:ConvertibleNotesPayableMember

2022-09-14

2022-09-15

0001618835

EVFM:AdjuvantNotesMember

us-gaap:ConvertibleNotesPayableMember

2024-03-31

0001618835

EVFM:AdjuvantNotesMember

us-gaap:ConvertibleNotesPayableMember

2023-12-31

0001618835

EVFM:AdjuvantNotesMember

us-gaap:ConvertibleNotesPayableMember

2022-12-31

0001618835

EVFM:AdjuvantNotesMember

2024-01-01

2024-03-31

0001618835

us-gaap:UnsecuredDebtMember

EVFM:A80SeniorSubordinatedNotesDue2025IssuedDecember2022Member

2022-12-31

0001618835

EVFM:A80SeniorSubordinatedNotesDue2025IssuedDecember2022Member

2022-12-31

0001618835

us-gaap:CommonStockMember

2023-12-21

0001618835

EVFM:SeriesFOneSharesMember

2023-12-21

0001618835

EVFM:PriorToSeptemberEightTwoThousandAndTwentyFourMember

EVFM:BakerNotesMember

2023-09-08

0001618835

EVFM:SeptemberNineTwoThousandAndTwentyFourToSeptemberEightTwoThousandAndTwentyFiveMember

EVFM:BakerNotesMember

2023-09-08

0001618835

EVFM:SeptemberNineTwoThousandAndTwentyFiveToSeptemberEightTwoThousandAndTwentySixMember

EVFM:BakerNotesMember

2023-09-08

0001618835

EVFM:SeptemberNineTwoThousandAndTwentySixToSeptemberEightTwoThousandAndTwentySevenMember

EVFM:BakerNotesMember

2023-09-08

0001618835

EVFM:SeptemberNineTwoThousandAndTwentySevenToSeptemberEightTwoThousandAndTwentyEightMember

EVFM:BakerNotesMember

2023-09-08

0001618835

EVFM:December2022NotesMember

2024-03-31

0001618835

EVFM:December2022NotesMember

2024-01-01

2024-03-31

0001618835

EVFM:December2022NotesMember

2022-09-30

0001618835

EVFM:December2022NotesMember

2023-03-31

0001618835

EVFM:December2022NotesMember

2023-06-30

0001618835

EVFM:December2022NotesMember

2023-09-30

0001618835

EVFM:December2022NotesMember

2023-12-31

0001618835

EVFM:February2023NotesMember

2024-03-31

0001618835

EVFM:February2023NotesMember

2024-01-01

2024-03-31

0001618835

EVFM:February2023NotesMember

2022-09-30

0001618835

EVFM:February2023NotesMember

2023-03-31

0001618835

EVFM:February2023NotesMember

2023-06-30

0001618835

EVFM:February2023NotesMember

2023-09-30

0001618835

EVFM:February2023NotesMember

2023-12-31

0001618835

EVFM:March2023NotesMember

2024-03-31

0001618835

EVFM:March2023NotesMember

2024-01-01

2024-03-31

0001618835

EVFM:March2023NotesMember

2022-09-30

0001618835

EVFM:March2023NotesMember

2023-03-31

0001618835

EVFM:March2023NotesMember

2023-06-30

0001618835

EVFM:March2023NotesMember

2023-09-30

0001618835

EVFM:March2023NotesMember

2023-12-31

0001618835

EVFM:MarchTwo2023NotesMember

2024-03-31

0001618835

EVFM:MarchTwo2023NotesMember

2024-01-01

2024-03-31

0001618835

EVFM:MarchTwo2023NotesMember

2022-09-30

0001618835

EVFM:MarchTwo2023NotesMember

2023-06-30

0001618835

EVFM:MarchTwo2023NotesMember

2023-09-30

0001618835

EVFM:MarchTwo2023NotesMember

2023-12-31

0001618835

EVFM:MarchTwo2023NotesMember

2023-03-31

0001618835

EVFM:April2023NotesMember

2024-03-31

0001618835

EVFM:April2023NotesMember

2024-01-01

2024-03-31

0001618835

EVFM:April2023NotesMember

2022-09-30

0001618835

EVFM:April2023NotesMember

2023-06-30

0001618835

EVFM:April2023NotesMember

2023-09-30

0001618835

EVFM:April2023NotesMember

2023-12-31

0001618835

EVFM:April2023NotesMember

2023-03-31

0001618835

EVFM:July2023NotesMember

2024-03-31

0001618835

EVFM:July2023NotesMember

2024-01-01

2024-03-31

0001618835

EVFM:July2023NotesMember

2022-09-30

0001618835

EVFM:July2023NotesMember

2023-09-30

0001618835

EVFM:July2023NotesMember

2023-12-31

0001618835

EVFM:July2023NotesMember

2023-03-31

0001618835

EVFM:August2023NotesMember

2024-03-31

0001618835

EVFM:August2023NotesMember

2024-01-01

2024-03-31

0001618835

EVFM:August2023NotesMember

2022-09-30

0001618835

EVFM:August2023NotesMember

2023-09-30

0001618835

EVFM:August2023NotesMember

2023-12-31

0001618835

EVFM:August2023NotesMember

2023-03-31

0001618835

EVFM:September2023NotesMember

2024-03-31

0001618835

EVFM:September2023NotesMember

2024-01-01

2024-03-31

0001618835

EVFM:September2023NotesMember

2022-09-30

0001618835

EVFM:September2023NotesMember

2023-09-30

0001618835

EVFM:September2023NotesMember

2023-12-31

0001618835

us-gaap:SeniorSubordinatedNotesMember

2024-03-31

0001618835

us-gaap:SeniorSubordinatedNotesMember

2024-01-01

2024-03-31

0001618835

EVFM:PlacementAgentMember

EVFM:DecemberTwoThousandTwentyTwoToSeptemberTwoThousandTwentyThreeMember

2023-02-28

0001618835

EVFM:PlacementAgentMember

EVFM:DecemberTwoThousandTwentyTwoToSeptemberTwoThousandTwentyThreeMember

2023-03-31

0001618835

EVFM:PlacementAgentMember

EVFM:DecemberTwoThousandTwentyTwoToSeptemberTwoThousandTwentyThreeMember

us-gaap:SeriesAPreferredStockMember

2023-09-30

0001618835

EVFM:PlacementAgentMember

EVFM:DecemberTwoThousandTwentyTwoToSeptemberTwoThousandTwentyThreeMember

us-gaap:SeriesBPreferredStockMember

2023-09-30

0001618835

us-gaap:EquipmentMember

2024-03-31

0001618835

us-gaap:EquipmentMember

2023-12-31

0001618835

us-gaap:ComputerEquipmentMember

2024-03-31

0001618835

us-gaap:ComputerEquipmentMember

2023-12-31

0001618835

EVFM:ComputerEquipmentAndSoftwareMember

2024-03-31

0001618835

us-gaap:ConstructionInProgressMember

2024-03-31

0001618835

us-gaap:ConstructionInProgressMember

2023-12-31

0001618835

us-gaap:ConvertibleDebtMember

2024-01-01

2024-03-31

0001618835

EVFM:BakerBrosNotesMember

us-gaap:ConvertibleDebtMember

us-gaap:FairValueInputsLevel3Member

2024-03-31

0001618835

EVFM:AdjuvantNotesMember

us-gaap:ConvertibleDebtMember

us-gaap:FairValueInputsLevel3Member

2024-03-31

0001618835

EVFM:AdjuvantNotesMember

us-gaap:ConvertibleDebtMember

2024-03-31

0001618835

EVFM:AdjuvantNotesMember

us-gaap:ConvertibleDebtMember

us-gaap:CarryingReportedAmountFairValueDisclosureMember

2024-03-31

0001618835

EVFM:AdjuvantNotesMember

us-gaap:EstimateOfFairValueFairValueDisclosureMember

us-gaap:ConvertibleDebtMember

2024-03-31

0001618835

EVFM:December2022NotesMember

us-gaap:ConvertibleDebtMember

us-gaap:FairValueInputsLevel3Member

2024-03-31

0001618835

EVFM:February2023NotesMember

us-gaap:ConvertibleDebtMember

us-gaap:FairValueInputsLevel3Member

2024-03-31

0001618835

EVFM:February2023NotesMember

us-gaap:ConvertibleDebtMember

us-gaap:FairValueInputsLevel3Member

2023-12-31

0001618835

EVFM:March2023NotesMember

us-gaap:ConvertibleDebtMember

us-gaap:FairValueInputsLevel3Member

2024-03-31

0001618835

EVFM:March2023NotesMember

us-gaap:ConvertibleDebtMember

us-gaap:FairValueInputsLevel3Member

2023-03-31

0001618835

EVFM:April2023NotesMember

us-gaap:ConvertibleDebtMember

us-gaap:FairValueInputsLevel3Member

2024-03-31

0001618835

EVFM:July2023NotesMember

us-gaap:ConvertibleDebtMember

us-gaap:FairValueInputsLevel3Member

2024-03-31

0001618835

EVFM:August2023NotesMember

us-gaap:ConvertibleDebtMember

us-gaap:FairValueInputsLevel3Member

2024-03-31

0001618835

EVFM:September2023NotesMember

us-gaap:ConvertibleDebtMember

us-gaap:FairValueInputsLevel3Member

2024-03-31

0001618835

us-gaap:ConvertibleDebtMember

2024-03-31

0001618835

EVFM:BakerBrosNotesMember

us-gaap:ConvertibleDebtMember

us-gaap:FairValueInputsLevel3Member

2023-12-31

0001618835

EVFM:AdjuvantNotesMember

us-gaap:ConvertibleDebtMember

us-gaap:FairValueInputsLevel3Member

2023-12-31

0001618835

EVFM:AdjuvantNotesMember

us-gaap:ConvertibleDebtMember

2023-12-31

0001618835

EVFM:AdjuvantNotesMember

us-gaap:ConvertibleDebtMember

us-gaap:CarryingReportedAmountFairValueDisclosureMember

2023-12-31

0001618835

EVFM:AdjuvantNotesMember

us-gaap:EstimateOfFairValueFairValueDisclosureMember

us-gaap:ConvertibleDebtMember

2023-12-31

0001618835

EVFM:December2022NotesMember

us-gaap:ConvertibleDebtMember

us-gaap:FairValueInputsLevel3Member

2023-12-31

0001618835

EVFM:March2023NotesMember

us-gaap:ConvertibleDebtMember

us-gaap:FairValueInputsLevel3Member

2023-12-31

0001618835

EVFM:April2023NotesMember

us-gaap:ConvertibleDebtMember

us-gaap:FairValueInputsLevel3Member

2023-12-31

0001618835

EVFM:July2023NotesMember

us-gaap:ConvertibleDebtMember

us-gaap:FairValueInputsLevel3Member

2023-12-31

0001618835

EVFM:August2023NotesMember

us-gaap:ConvertibleDebtMember

us-gaap:FairValueInputsLevel3Member

2023-12-31

0001618835

EVFM:September2023NotesMember

us-gaap:ConvertibleDebtMember

us-gaap:FairValueInputsLevel3Member

2023-12-31

0001618835

us-gaap:ConvertibleDebtMember

2023-12-31

0001618835

us-gaap:FairValueInputsLevel3Member

2024-03-31

0001618835

us-gaap:FairValueInputsLevel3Member

2023-12-31

0001618835

EVFM:BakerNotesMember

us-gaap:ConvertibleDebtMember

2024-01-01

2024-03-31

0001618835

EVFM:BakerNotesMember

us-gaap:ConvertibleDebtMember

2023-01-01

2023-12-31

0001618835

us-gaap:LongTermDebtMember

EVFM:BakerNotesAssignedToAditxtNotesMember

us-gaap:FairValueInputsLevel3Member

2023-12-31

0001618835

us-gaap:LongTermDebtMember

EVFM:TotalOfferingsMember

us-gaap:FairValueInputsLevel3Member

2023-12-31

0001618835

us-gaap:LongTermDebtMember

us-gaap:FairValueInputsLevel3Member

2023-12-31

0001618835

us-gaap:LongTermDebtMember

EVFM:BakerNotesAssignedToAditxtNotesMember

us-gaap:FairValueInputsLevel3Member

2024-01-01

2024-03-31

0001618835

us-gaap:LongTermDebtMember

EVFM:TotalOfferingsMember

us-gaap:FairValueInputsLevel3Member

2024-01-01

2024-03-31

0001618835

us-gaap:LongTermDebtMember

us-gaap:FairValueInputsLevel3Member

2024-01-01

2024-03-31

0001618835

us-gaap:LongTermDebtMember

EVFM:BakerNotesAssignedToAditxtNotesMember

us-gaap:FairValueInputsLevel3Member

2024-03-31

0001618835

us-gaap:LongTermDebtMember

EVFM:TotalOfferingsMember

us-gaap:FairValueInputsLevel3Member

2024-03-31

0001618835

us-gaap:LongTermDebtMember

us-gaap:FairValueInputsLevel3Member

2024-03-31

0001618835

us-gaap:LongTermDebtMember

EVFM:BakerNotesAssignedToAditxtNotesMember

us-gaap:FairValueInputsLevel3Member

2022-12-31

0001618835

us-gaap:LongTermDebtMember

EVFM:TotalOfferingsMember

us-gaap:FairValueInputsLevel3Member

2022-12-31

0001618835

us-gaap:LongTermDebtMember

us-gaap:FairValueInputsLevel3Member

2022-12-31

0001618835

us-gaap:LongTermDebtMember

EVFM:BakerNotesAssignedToAditxtNotesMember

us-gaap:FairValueInputsLevel3Member

2023-01-01

2023-03-31

0001618835

us-gaap:LongTermDebtMember

EVFM:TotalOfferingsMember

us-gaap:FairValueInputsLevel3Member

2023-01-01

2023-03-31

0001618835

us-gaap:LongTermDebtMember

us-gaap:FairValueInputsLevel3Member

2023-01-01

2023-03-31

0001618835

us-gaap:LongTermDebtMember

EVFM:BakerNotesAssignedToAditxtNotesMember

us-gaap:FairValueInputsLevel3Member

2023-03-31

0001618835

us-gaap:LongTermDebtMember

EVFM:TotalOfferingsMember

us-gaap:FairValueInputsLevel3Member

2023-03-31

0001618835

us-gaap:LongTermDebtMember

us-gaap:FairValueInputsLevel3Member

2023-03-31

0001618835

us-gaap:DerivativeFinancialInstrumentsLiabilitiesMember

us-gaap:FairValueInputsLevel3Member

us-gaap:RightsMember

2023-12-31

0001618835

us-gaap:DerivativeFinancialInstrumentsLiabilitiesMember

us-gaap:FairValueInputsLevel3Member

2023-12-31

0001618835

us-gaap:DerivativeFinancialInstrumentsLiabilitiesMember

us-gaap:FairValueInputsLevel3Member

us-gaap:RightsMember

2024-01-01

2024-03-31

0001618835

us-gaap:DerivativeFinancialInstrumentsLiabilitiesMember

us-gaap:FairValueInputsLevel3Member

2024-01-01

2024-03-31

0001618835

us-gaap:DerivativeFinancialInstrumentsLiabilitiesMember

us-gaap:FairValueInputsLevel3Member

us-gaap:RightsMember

2024-03-31

0001618835

us-gaap:DerivativeFinancialInstrumentsLiabilitiesMember

us-gaap:FairValueInputsLevel3Member

2024-03-31

0001618835

us-gaap:DerivativeFinancialInstrumentsLiabilitiesMember

us-gaap:FairValueInputsLevel3Member

EVFM:DerivativeLiabilityConvertiblePreferredStockMember

2022-12-31

0001618835

us-gaap:DerivativeFinancialInstrumentsLiabilitiesMember

us-gaap:FairValueInputsLevel3Member

EVFM:May2022PublicOfferingWarrantsMember

2022-12-31

0001618835

us-gaap:DerivativeFinancialInstrumentsLiabilitiesMember

us-gaap:FairValueInputsLevel3Member

EVFM:June2022BakerWarrantsMember

2022-12-31

0001618835

us-gaap:DerivativeFinancialInstrumentsLiabilitiesMember

us-gaap:FairValueInputsLevel3Member

EVFM:December2022WarrantsMember

2022-12-31

0001618835

us-gaap:DerivativeFinancialInstrumentsLiabilitiesMember

us-gaap:FairValueInputsLevel3Member

EVFM:FebruaryAndMarch2023NotesMember

2022-12-31

0001618835

us-gaap:DerivativeFinancialInstrumentsLiabilitiesMember

us-gaap:FairValueInputsLevel3Member

us-gaap:RightsMember

2022-12-31

0001618835

us-gaap:DerivativeFinancialInstrumentsLiabilitiesMember

us-gaap:FairValueInputsLevel3Member

2022-12-31

0001618835

us-gaap:DerivativeFinancialInstrumentsLiabilitiesMember

us-gaap:FairValueInputsLevel3Member

EVFM:DerivativeLiabilityConvertiblePreferredStockMember

2024-01-01

2024-03-31

0001618835

us-gaap:DerivativeFinancialInstrumentsLiabilitiesMember

us-gaap:FairValueInputsLevel3Member

EVFM:May2022PublicOfferingWarrantsMember

2023-01-01

2023-03-31

0001618835

us-gaap:DerivativeFinancialInstrumentsLiabilitiesMember

us-gaap:FairValueInputsLevel3Member

EVFM:June2022BakerWarrantsMember

2023-01-01

2023-03-31

0001618835

us-gaap:DerivativeFinancialInstrumentsLiabilitiesMember

us-gaap:FairValueInputsLevel3Member

EVFM:December2022WarrantsMember

2023-01-01

2023-03-31

0001618835

us-gaap:DerivativeFinancialInstrumentsLiabilitiesMember

us-gaap:FairValueInputsLevel3Member

EVFM:FebruaryAndMarch2023NotesMember

2023-01-01

2023-03-31

0001618835

us-gaap:DerivativeFinancialInstrumentsLiabilitiesMember

us-gaap:FairValueInputsLevel3Member

us-gaap:RightsMember

2023-01-01

2023-03-31

0001618835

us-gaap:DerivativeFinancialInstrumentsLiabilitiesMember

us-gaap:FairValueInputsLevel3Member

2023-01-01

2023-03-31

0001618835

us-gaap:DerivativeFinancialInstrumentsLiabilitiesMember

us-gaap:FairValueInputsLevel3Member

EVFM:DerivativeLiabilityConvertiblePreferredStockMember

2024-03-31

0001618835

us-gaap:DerivativeFinancialInstrumentsLiabilitiesMember

us-gaap:FairValueInputsLevel3Member

EVFM:May2022PublicOfferingWarrantsMember

2023-03-31

0001618835

us-gaap:DerivativeFinancialInstrumentsLiabilitiesMember

us-gaap:FairValueInputsLevel3Member

EVFM:June2022BakerWarrantsMember

2023-03-31

0001618835

us-gaap:DerivativeFinancialInstrumentsLiabilitiesMember

us-gaap:FairValueInputsLevel3Member

EVFM:December2022WarrantsMember

2024-03-31

0001618835

us-gaap:DerivativeFinancialInstrumentsLiabilitiesMember

us-gaap:FairValueInputsLevel3Member

EVFM:FebruaryAndMarch2023NotesMember

2023-03-31

0001618835

us-gaap:DerivativeFinancialInstrumentsLiabilitiesMember

us-gaap:FairValueInputsLevel3Member

us-gaap:RightsMember

2023-03-31

0001618835

us-gaap:DerivativeFinancialInstrumentsLiabilitiesMember

us-gaap:FairValueInputsLevel3Member

2023-03-31

0001618835

EVFM:BakerBrosNotesMember

EVFM:MeasurementInputRoyaltyRateMember

2024-03-31

0001618835

EVFM:BakerBrosNotesMember

us-gaap:MeasurementInputDiscountRateMember

2024-03-31

0001618835

us-gaap:SeniorSubordinatedNotesMember

2023-01-01

2023-03-31

0001618835

EVFM:LeaseContractTermOneMember

us-gaap:VehiclesMember

2019-12-31

0001618835

EVFM:LeaseContractTermMember

us-gaap:VehiclesMember

2019-12-31

0001618835

EVFM:SecuritiesDepositMember

us-gaap:VehiclesMember

2024-03-31

0001618835

EVFM:LeaseContractTermOneMember

2022-09-01

2022-09-30

0001618835

EVFM:LeaseContractTermOneMember

2022-09-30

0001618835

2019-10-03

0001618835

us-gaap:LetterOfCreditMember

2019-10-03

0001618835

2020-04-14

0001618835

us-gaap:LetterOfCreditMember

2020-04-14

0001618835

us-gaap:LetterOfCreditMember

us-gaap:BuildingAndBuildingImprovementsMember

2023-03-20

0001618835

2023-03-20

0001618835

2023-06-01

2023-06-30

0001618835

2022-05-27

0001618835

2022-05-27

2022-05-27

0001618835

EVFM:RushLicenseAgreementMember

srt:MinimumMember

2021-01-01

2021-01-01

0001618835

EVFM:RushLicenseAgreementMember

srt:MaximumMember

2021-01-01

2021-01-01

0001618835

EVFM:RushLicenseAgreementMember

2024-01-01

2024-03-31

0001618835

EVFM:RushLicenseAgreementMember

2023-01-01

2023-03-31

0001618835

EVFM:RushLicenseAgreementMember

2024-03-31

0001618835

EVFM:RushLicenseAgreementMember

2023-12-31

0001618835

us-gaap:ResearchAndDevelopmentExpenseMember

2024-01-01

2024-03-31

0001618835

us-gaap:ResearchAndDevelopmentExpenseMember

2023-01-01

2023-03-31

0001618835

us-gaap:SellingAndMarketingExpenseMember

2024-01-01

2024-03-31

0001618835

us-gaap:SellingAndMarketingExpenseMember

2023-01-01

2023-03-31

0001618835

us-gaap:GeneralAndAdministrativeExpenseMember

2024-01-01

2024-03-31

0001618835

us-gaap:GeneralAndAdministrativeExpenseMember

2023-01-01

2023-03-31

0001618835

EVFM:BakerBrosPurchaseAgreementMember

2020-04-30

0001618835

EVFM:BakerWarrantsMember

2024-03-31

0001618835

EVFM:UnderwrittenPublicOfferingMember

2022-05-31

0001618835

us-gaap:IPOMember

2022-05-31

0001618835

EVFM:June2022BakerWarrantsMember

2022-05-31

0001618835

2022-05-31

0001618835

us-gaap:WarrantMember

2024-03-31

0001618835

EVFM:June2022BakerWarrantsMember

2022-06-30

0001618835

srt:MinimumMember

EVFM:June2022BakerWarrantsMember

2022-06-01

2022-06-30

0001618835

srt:MaximumMember

EVFM:June2022BakerWarrantsMember

2022-06-01

2022-06-30

0001618835

EVFM:June2022BakerWarrantsMember

2024-03-31

0001618835

EVFM:SecurityPurchaseAgreementMember

2024-03-31

0001618835

EVFM:SecurityPurchaseAgreementMember

us-gaap:CommonStockMember

srt:MaximumMember

2024-03-31

0001618835

us-gaap:CommonStockMember

srt:MaximumMember

2024-03-31

0001618835

EVFM:SecurityPurchaseAgreementMember

us-gaap:CommonStockMember

srt:MinimumMember

2024-03-31

0001618835

us-gaap:CommonStockMember

srt:MinimumMember

2024-03-31

0001618835

EVFM:SecurityPurchaseAgreementMember

us-gaap:WarrantMember

2024-03-31

0001618835

2023-12-21

0001618835

EVFM:SeriesFOneMember

2023-12-21

0001618835

2021-12-15

0001618835

EVFM:SeriesE1ConvertiblePreferredStockMember

2023-08-07

0001618835

2023-08-07

0001618835

EVFM:SeriesE1ConvertiblePreferredStockMember

2023-08-07

2023-08-07

0001618835

EVFM:SeriesE1ConvertiblePreferredStockMember

us-gaap:PreferredStockMember

2023-08-07

0001618835

EVFM:SeriesE1ConvertiblePreferredStockMember

2024-03-31

0001618835

EVFM:SeriesE1ConvertiblePreferredStockMember

2023-12-11

0001618835

EVFM:SeriesFOneCommonStockMember

2023-12-21

0001618835

EVFM:SeriesF1ConvertibleAndRedeemablePreferredStockMember

2023-12-21

0001618835

EVFM:SeriesDNonConvertiblePreferredStockMember

2022-12-16

0001618835

EVFM:AdjuvantAndMay2022NotesMember

2022-09-15

2022-09-15

0001618835

EVFM:ExchangeAgreementsMember

2024-01-01

2024-03-31

0001618835

EVFM:ExchangeAgreementsMember

2023-01-01

2023-03-31

0001618835

EVFM:ExchangeAgreementsMember

2024-03-31

0001618835

EVFM:CommonWarrantsMember

2014-06-11

0001618835

EVFM:CommonWarrantsMember

2014-06-11

2014-06-11

0001618835

EVFM:CommonWarrantsMember

2018-05-24

0001618835

EVFM:CommonWarrantsMember

2018-05-24

2018-05-24

0001618835

EVFM:CommonWarrantsMember

2019-04-11

0001618835

EVFM:CommonWarrantsMember

2019-04-11

2019-04-11

0001618835

EVFM:CommonWarrantsMember

2019-06-10

0001618835

EVFM:CommonWarrantsMember

2019-06-10

2019-06-10

0001618835

EVFM:CommonWarrantsMember

2020-04-24

0001618835

EVFM:CommonWarrantsMember

2020-04-24

2020-04-24

0001618835

EVFM:CommonWarrantsMember

2020-06-09

0001618835

EVFM:CommonWarrantsMember

2020-06-09

2020-06-09

0001618835

EVFM:CommonWarrantsMember

2022-01-13

0001618835

EVFM:CommonWarrantsMember

2022-01-13

2022-01-13

0001618835

EVFM:CommonWarrantsMember

2022-03-01

0001618835

EVFM:CommonWarrantsMember

2022-03-01

2022-03-01

0001618835

EVFM:CommonWarrantsMember

2022-05-04

0001618835

EVFM:CommonWarrantsMember

2022-05-04

2022-05-04

0001618835

EVFM:CommonWarrantsMember

2022-05-24

0001618835

EVFM:CommonWarrantsMember

2022-05-24

2022-05-24

0001618835

EVFM:CommonWarrantsMember

2022-06-28

0001618835

EVFM:CommonWarrantsMember

2022-06-28

2022-06-28

0001618835

EVFM:CommonWarrantsMember

2022-12-21

0001618835

EVFM:CommonWarrantsMember

2022-12-21

2022-12-21

0001618835

EVFM:CommonWarrantsMember

2023-02-17

0001618835

EVFM:CommonWarrantsMember

2023-02-17

2023-02-17

0001618835

EVFM:CommonWarrantsMember

2023-03-20

0001618835

EVFM:CommonWarrantsMember

2023-03-20

2023-03-20

0001618835

EVFM:CommonWarrantsMember

2023-04-05

0001618835

EVFM:CommonWarrantsMember

2023-04-05

2023-04-05

0001618835

EVFM:CommonWarrantsMember

2023-07-03

0001618835

EVFM:CommonWarrantsMember

2023-07-02

2023-07-03

0001618835

EVFM:CommonWarrantsMember

2023-04-08

0001618835

EVFM:CommonWarrantsMember

2023-08-04

0001618835

EVFM:CommonWarrantsMember

2023-08-03

2023-08-04

0001618835

EVFM:CommonWarrantsMember

2023-09-27

0001618835

EVFM:CommonWarrantsMember

2023-09-26

2023-09-27

0001618835

EVFM:PrefundedCommonWarrantsMember

2023-09-27

0001618835

EVFM:PrefundedCommonWarrantsMember

2023-09-26

2023-09-27

0001618835

EVFM:EmployeeStockPurchasePlan2019Member

2024-03-31

0001618835

EVFM:AmendedAndRestated2014PlanMember

2024-03-31

0001618835

EVFM:InducementPlanMember

2024-03-31

0001618835

us-gaap:EmployeeStockOptionMember

2024-01-01

2024-03-31

0001618835

us-gaap:EmployeeStockOptionMember

2023-01-01

2023-03-31

0001618835

EVFM:EmployeeStockPurchasePlan2019Member

us-gaap:EmployeeStockMember

2024-01-01

2024-03-31

0001618835

EVFM:EmployeeStockPurchasePlan2019Member

us-gaap:EmployeeStockMember

2024-03-31

0001618835

us-gaap:RestrictedStockMember

2024-03-31

0001618835

EVFM:FourthAmendmentMergerAgreementMember

us-gaap:SubsequentEventMember

2024-05-02

2024-05-02

0001618835

us-gaap:SubsequentEventMember

EVFM:SeriesF1PreferredStockMember

2024-05-02

0001618835

us-gaap:SubsequentEventMember

EVFM:SeriesF1PreferredStockMember

2024-05-02

2024-05-02

0001618835

us-gaap:SubsequentEventMember

EVFM:SeriesF1PreferredStockMember

srt:MaximumMember

2024-05-02

2024-05-02

0001618835

us-gaap:SubsequentEventMember

EVFM:SeriesF1PreferredStockMember

srt:MaximumMember

2024-06-17

2024-06-17

0001618835

us-gaap:SubsequentEventMember

EVFM:SeriesF1PreferredStockMember

2024-07-01

2024-07-01

0001618835

us-gaap:SubsequentEventMember

2024-04-01

2024-05-15

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

EVFM:Integer

utr:sqft

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-Q

(Mark

One)

| ☒ |

QUARTERLY

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For

the quarterly period ended March 31, 2024

or

| ☐ |

TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For

the transition period from to

Commission

File Number: 001-36754

EVOFEM

BIOSCIENCES, INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

20-8527075 |

(State

or other jurisdiction

of

incorporation) |

|

(IRS

Employer

Identification

No.) |

7770

Regents Road, Suite 113-618

San

Diego, CA 92122 |

|

92122 |

| (Address

of Principal Executive Offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (858) 550-1900

N/A

(Former

name or former address, if changed since last report.)

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, par value $0.0001 per share |

|

EVFM |

|

OTCQB |

Indicate

by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2)

has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule

405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant

was required to submit such files). Yes ☒ No ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company,

or an emerging growth company. See the definitions of “large accelerated filer”, “accelerated filer”, “smaller

reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large

accelerated filer ☐ |

|

Accelerated

filer ☐ |

| |

|

|

| Non-accelerated

filer ☒ |

|

Smaller

reporting company ☒ |

| |

|

Emerging

growth company ☐ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The

number of shares of the registrant’s common stock, $0.0001 par value per share, outstanding as of May 10, 2024 was 62,060,395.

Table

of Contents

FORWARD-LOOKING

STATEMENTS

This

quarterly report on Form 10-Q (Quarterly Report), contains forward-looking statements that involve substantial risks and uncertainties.

The forward-looking statements are contained principally in the section entitled “Management’s Discussion and Analysis of

Financial Condition and Results of Operations.” All statements, other than statements of historical facts, contained in this Quarterly

Report, including statements regarding our strategy, future operations, future financial position, projected costs, prospects, plans

and objectives of management, are forward-looking statements. Words such as, but not limited to, “anticipate,” “aim,”

“believe,” “contemplate,” “continue,” “could,” “design,” “estimate,”

“expect,” “intend,” “may,” “might,” “plan,” “possible,” “potential,”

“predict,” “project,” “seek,” “should,” “suggest,” “strategy,”

“target,” “will,” “would,” and similar expressions or phrases, or the negative of those expressions

or phrases, are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying

words.

These

forward-looking statements include, among other things, statements about:

| |

●

|

our

ability to continue as a going concern; |

| |

● |

the consummation of the transactions contemplated by the Merger Agreement

and documents related thereto; |

| |

●

|

our

ability to remediate the material weaknesses in our internal controls and procedures identified by management; |

| |

●

|

our

ability to obtain necessary approvals of any corporate action needing stockholder, FINRA, or other approvals; |

| |

●

|

our

ability to file Annual and Quarterly Reports on a timely basis; |

| |

●

|

our

ability to raise additional capital to fund our operations; |

| |

● |

our

ability to achieve and sustain profitability; |

| |

●

|

our

estimates regarding our future performance including, without limitation, any estimates of potential future revenues; |

| |

●

|

estimates

regarding market size; |

| |

●

|

our

estimates regarding expenses, revenues, financial performance and capital requirements, including the length of time our capital

resources will sustain our operations; |

| |

●

|

our

ability to maintain the listing of our shares on the OTCQB® Venture Market; |

| |

●

|

our

ability to comply with the provisions and requirements of our debt arrangements, to avoid future defaults pursuant to our debt arrangements

and to pay amounts owed, including any amounts that may be accelerated, pursuant to our debt arrangements; |

| |

●

|

estimates

regarding health care providers’ (HCPs) recommendations of Phexxi® (lactic acid, citric acid, and potassium

bitartrate) vaginal gel (Phexxi) to patients; |

| |

●

|

the

rate and degree of market acceptance of Phexxi; |

| |

●

|

our

ability to successfully commercialize and distribute Phexxi and continue to develop our sales and marketing capabilities, particularly

after any product rebrand; |

| |

●

|

our

estimates regarding the effectiveness of our marketing campaigns; |

| |

●

|

our

strategic plans for our business, including the commercialization of Phexxi; |

| |

●

|

the

potential for changes to current regulatory mandates requiring health insurance plans to cover U.S. Food and Drug Administration

(FDA)-cleared or -approved contraceptive products without cost sharing; |

| |

●

|

our

ability to obtain or maintain third-party payer coverage and adequate reimbursement, and our reliance on the willingness of patients

to pay out-of-pocket for Phexxi absent full or partial third-party payer reimbursement; |

| |

●

|

our

ability to protect and defend our intellectual property position and our reliance on third party licensors; |

| |

●

|

our

ability to obtain additional patent protection for our product; |

| |

●

|

our

dependence on third parties for the manufacture of Phexxi; |

| |

●

|

our

ability to expand our organization to accommodate potential growth; and |

| |

●

|

our

ability to retain and attract key personnel. |

Although

we believe that we have a reasonable basis for each forward-looking statement contained in this Quarterly Report, we caution you that

these statements are based on our projections of the future that are subject to known and unknown risks and uncertainties and other factors

that may cause our actual results, level of activity, performance or achievements expressed or implied by these forward-looking statements,

to differ. We may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements, and you should

not place undue reliance on our forward-looking statements. All forward-looking statements are qualified in their entirety by this cautionary

statement. Forward-looking statements should be regarded solely as our current plans, estimates and beliefs. You should read this Quarterly

Report and the documents that we have filed as exhibits to this Quarterly Report and incorporated by reference herein completely and

with the understanding that our actual results may be materially different from the plans, intentions and expectations disclosed in the

forward-looking statements we make. Moreover, we operate in a very competitive and rapidly changing environment and new risks emerge

from time to time. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business

or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any

forward-looking statements we may make. The forward-looking statements contained in this Quarterly Report are made as of the date of

this Quarterly Report, and we do not assume any obligation to update any forward-looking statements, whether as a result of new information,

future events or otherwise, except as required by applicable law.

This

Quarterly Report contains estimates and other statistical data made by independent parties and by the Company relating to market size

and growth and other data about its industry. This data involves a number of assumptions and limitations, and you are cautioned not to

give undue weight to such estimates.

Our

first commercial product, Phexxi, was approved by the FDA on May 22, 2020. Phexxi is the first and only non-hormonal, prescription contraceptive gel that women only use when they have sex. Because Phexxi is a non-hormonal contraceptive, it is not

associated with side effects like depression, weight gain, headaches, loss of libido, mood swings and irritability. Taking hormones

may not be right for some women especially those with certain medical conditions including clotting disorders and cancer, or when

they are breast feeding, have a BMI over 30, smoke, or have diabetes. More than 23.3 million women in the U.S. do not want to get pregnant

and will not use a hormonal contraceptive.

We

have delivered Phexxi net sales growth in each consecutive year since it was launched in Sept 2020. Key growth drivers for 2024 include

expanded use of Phexxi in women who take oral birth control pills in conjunction with GLP-1 prescription medications like Ozempic, Mounjaro,

and Zepbound for weight loss. These drugs may make oral birth control pills less effective at certain points in the dosing schedule.

Per the USPI, prescribers may “advise patients using oral contraceptives to switch to a non-oral contraceptive method or add a

barrier method” to prevent unintended pregnancy during these times.

Phexxi was approved in Nigeria on October 6, 2022, as

Femidence™ by the National Agency for Food and Drug Administration and Control. Phexxi has been submitted for approval

in Mexico, Ethiopia and Ghana.

Unless

the context requires otherwise, references in this Quarterly Report to “Evofem,” “Company,” “we,”

“us” and “our” refer to Evofem Biosciences, Inc. and its subsidiaries.

This

Quarterly Report includes our trademarks, trade names and service marks, including “Phexxi®” and “Femidence™”

which are protected under applicable intellectual property laws and are the property of Evofem Biosciences, Inc. or its subsidiaries.

Solely for convenience, trademarks, trade names and service marks referred to in this Quarterly Report may appear without the ®,

™ or SM symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under

applicable law, our rights or the right of the applicable licensor to these trademarks, trade names and service marks. We do not intend

our use or display of other parties’ trademarks, trade names or service marks to imply, and such use or display should not be construed

to imply a relationship with, or endorsement or sponsorship of us by, these other parties.

PART

I. FINANCIAL INFORMATION

Item

1. Financial Statements

EVOFEM

BIOSCIENCES, INC. AND SUBSIDIARIES

CONDENSED

CONSOLIDATED BALANCE SHEETS

(Unaudited)

(In

thousands, except par value and share data)

| | |

March

31, 2024 | | |

December

31, 2023 | |

| | |

As of | |

| | |

March 31, 2024 | | |

December 31, 2023 | |

| Assets | |

| | | |

| | |

| Current assets: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | - | | |

$ | - | |

| Restricted cash | |

| 689 | | |

| 580 | |

| Trade accounts receivable, net | |

| 4,306 | | |

| 5,738 | |

| Inventories | |

| 1,306 | | |

| 1,697 | |

| Prepaid and other current assets | |

| 622 | | |

| 1,195 | |

| Total current assets | |

| 6,923 | | |

| 9,210 | |

| | |

| | | |

| | |

| Property and equipment, net | |

| 1,200 | | |

| 1,203 | |

| Operating lease right-of-use assets | |

| 59 | | |

| 106 | |

| Other noncurrent assets | |

| 35 | | |

| 35 | |

| Total assets | |

$ | 8,217 | | |

$ | 10,554 | |

| Liabilities, convertible and redeemable preferred stock and stockholders’ deficit | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable | |

$ | 16,294 | | |

$ | 17,020 | |

| Notes - carried at fair value (Note 4) | |

| 13,252 | | |

| 14,731 | |

| Convertible notes - Adjuvant (Note 4) | |

| 29,101 | | |

| 28,537 | |

| Convertible notes | |

| 29,101 | | |

| 28,537 | |

| Accrued expenses | |

| 4,575 | | |

| 4,227 | |

| Accrued compensation | |

| 3,261 | | |

| 2,609 | |

| Operating lease liabilities-current | |

| 55 | | |

| 97 | |

| Derivative liabilities | |

| 4,310 | | |

| 1,926 | |

| Other current liabilities | |

| 3,391 | | |

| 3,316 | |

| Total current liabilities | |

| 74,239 | | |

| 72,463 | |

| Operating lease liabilities- noncurrent | |

| 4 | | |

| 8 | |

| Total liabilities | |

| 74,243 | | |

| 72,471 | |

| Commitments and contingencies (Note 7) | |

| - | | |

| - | |

| Convertible and redeemable preferred stock, $0.0001 par value, Senior to common stock | |

| | | |

| | |

| Series E-1, and F-1 convertible preferred stock, 2,300

and

95,000

shares

authorized; 1,921

and

1,874

shares

of E-1 issued and outstanding at March 31, 2024 and December 31, 2023, respectively; 22,280

shares

of F-1 issued and outstanding at each of March 31, 2024 and December 31, 2023 | |

| 4,640 | | |

| 4,593 | |

| Stockholders’ deficit: | |

| | | |

| | |

| Preferred stock, $0.0001

par value; 5,000,000

shares authorized; no

shares issued and outstanding at March 31, 2024 and December 31, 2023 | |

| - | | |

| - | |

| Common Stock, $0.0001

par value; 3,000,000,000

shares authorized; 48,710,395

and 20,007,799

shares issued and outstanding as of March 31, 2024 and December 31, 2023, respectively | |

| 5 | | |

| 2 | |

| Additional paid-in capital | |

| 823,409 | | |

| 823,036 | |

| Accumulated other comprehensive loss | |

| (525 | ) | |

| (849 | ) |

| Accumulated deficit | |

| (893,555 | ) | |

| (888,699 | ) |

| Total stockholders’ deficit | |

| (70,666 | ) | |

| (66,510 | ) |

| Total liabilities, convertible and redeemable preferred stock and stockholders’ deficit | |

$ | 8,217 | | |

$ | 10,554 | |

See

accompanying notes to the condensed consolidated financial statements (unaudited).

EVOFEM

BIOSCIENCES, INC. AND SUBSIDIARIES

CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

(In

thousands, except share and per share data)

| | |

2024 | | |

2023 | |

| | |

Three Months Ended March 31, | |

| | |

2024 | | |

2023 | |

| Product sales, net | |

$ | 3,603 | | |

$ | 5,809 | |

| | |

| | | |

| | |

| Operating Expenses: | |

| | | |

| | |

| Cost of goods sold | |

| 684 | | |

| 1,376 | |

| Research and development | |

| 594 | | |

| 540 | |

| Selling and marketing | |

| 2,345 | | |

| 3,854 | |

| General and administrative | |

| 2,824 | | |

| 3,618 | |

| Total operating expenses | |

| 6,447 | | |

| 9,388 | |

| Loss from operations | |

| (2,844 | ) | |

| (3,579 | ) |

| Other income (expense): | |

| | | |

| | |

| Interest income | |

| 4 | | |

| 18 | |

| Other expense, net | |

| (616 | ) | |

| (318 | ) |

| Loss on issuance of financial instruments (Note 8) | |

| (3,275 | ) | |

| (84 | ) |

| Gain on debt extinguishment | |

| 1,120 | | |

| - | |

| Change in fair value of financial instruments (Note 6) | |

| 802 | | |

| 1,612 | |

| Total other income (expense), net | |

| (1,965 | ) | |

| 1,228 | |

| Income tax expense | |

| - | | |

| (3 | ) |

Net loss | |

| (4,809 | ) | |

| (2,354 | ) |

| Convertible preferred stock deemed dividends | |

| (47 | ) | |

| - | |

| Net loss attributable to common stockholders | |

$ | (4,856 | ) | |

$ | (2,354 | ) |

| Net loss per share attributable to common stockholders | |

| | | |

| | |

| (basic and diluted): | |

$ | (0.16 | ) | |

$ | (1.85 | ) |

| Weighted-average shares used to compute net | |

| | | |

| | |

| loss per share attributable to common shareholders (basic and diluted): | |

| 31,194,393 | | |

| 1,271,524 | |

See

accompanying notes to condensed consolidated financial statements (unaudited).

EVOFEM

BIOSCIENCES, INC. AND SUBSIDIARIES

CONDENSED

CONSOLIDATED STATEMENTS OF COMPREHENSIVE OPERATIONS

(Unaudited)

(In

thousands, except share and per share data)

| | |

2024 | | |

2023 | |

| | |

Three Months Ended March 31, | |

| | |

2024 | | |

2023 | |

| Net loss | |

$ | (4,809 | ) | |

$ | (2,354 | ) |

| Other comprehensive income: | |

| | | |

| | |

| Change in fair value of financial instruments attributed to

credit risk change (Note 4) | |

| 324 | | |

| 15,460 | |

| Comprehensive income (loss) | |

$ | (4,485 | ) | |

$ | 13,106 | |

See

accompanying notes to condensed consolidated financial statements (unaudited).

EVOFEM

BIOSCIENCES, INC. AND SUBSIDIARIES

CONDENSED

CONSOLIDATED STATEMENTS OF CONVERTIBLE AND REDEEMABLE PREFERRED STOCK AND STOCKHOLDERS’ DEFICIT

(Unaudited)

(In

thousands, except share data)

| | |

Shares | | |

Amount | | |

Shares | | |

Amount | | |

Shares | | |

Amount | | |

Capital | | |

Income

(Loss) | | |

Deficit | | |

Deficit | |

| | |

Series

E-1 Convertible and Redeemable Preferred Stock | | |

Series

F-1 Convertible and Redeemable Preferred Stock | | |

Common

Stock | | |

Additional

Paid-in | | |

Accumulated

Other Comprehensive | | |

Accumulated | | |

Total

Stockholders’ | |

| | |

Shares | | |

Amount | | |

Shares | | |

Amount | | |

Shares | | |

Amount | | |

Capital | | |

Income (Loss) | | |

Deficit | | |

Deficit | |

| Balance

as of January 1, 2024 | |

| 1,874 | | |

$ | 1,874 | | |

| 22,280 | | |

$ | 2,719 | | |

| 20,007,799 | | |

$ | 2 | | |

$ | 823,036 | | |

$ | (849 | ) | |

$ | (888,699) | | |

$ | (66,510) | |

| Balance | |

| 1,874 | | |

$ | 1,874 | | |

| 22,280 | | |

$ | 2,719 | | |

| 20,007,799 | | |

$ | 2 | | |

$ | 823,036 | | |

$ | (849 | ) | |

$ | (888,699) | | |

$ | (66,510) | |

| Issuance

of common stock upon exercise of warrants | |

| - | | |

| - | | |

| - | | |

| - | | |

| 246,153 | | |

| - | | |

| 15 | | |

| - | | |

| - | | |

| 15 | |

| Issuance

of common stock upon noncash exercise of purchase rights | |

| - | | |

| - | | |

| - | | |

| - | | |

| 17,725,000 | | |

| 2 | | |

| 87 | | |

| - | | |

| - | | |

| 89 | |

Issuance of common stock upon

conversion of notes

| |

| - | | |

| - | | |

| - | | |

| - | | |

| 10,731,443 | | |

| 1 | | |

| 34 | | |

| - | | |

| - | | |

| 35 | |

| Stock-based

compensation | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 237 | | |

| - | | |

| - | | |

| 237 | |

| Change

in fair value of financial instruments attributed to credit risk change (Note 4) | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 324 | | |

| - | | |

| 324 | |

| Series E-1 shares dividends | |

| 47 | | |

| 47 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (47 | ) | |

| (47 | ) |

| Net

loss | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (4,809 | ) | |

| (4,809 | ) |

| Balance

as of March 31, 2024 | |

| 1,921 | | |

$ | 1,921 | | |

| 22,280 | | |

$ | 2,719 | | |

| 48,710,395 | | |

$ | 5 | | |

$ | 823,409 | | |

$ | (525 | ) | |

$ | (893,555 | ) | |

$ | (70,666 | ) |

| Balance

| |

| 1,921 | | |

$ | 1,921 | | |

| 22,280 | | |

$ | 2,719 | | |

| 48,710,395 | | |

$ | 5 | | |

$ | 823,409 | | |

$ | (525 | ) | |

$ | (893,555 | ) | |

$ | (70,666 | ) |

| |

|

Shares | | |

Amount | | |

Capital | | |

Income | | |

Deficit | | |

Deficit | |

| |

|

Common

Stock | | |

Additional

Paid-in | | |

Accumulated

Other Comprehensive | | |

Accumulated | | |

Total

Stockholders’ | |

| |

|

Shares | | |

Amount | | |

Capital | | |

Income | | |

Deficit | | |

Deficit | |

| Balance

as of January 1, 2023 |

|

| 984,786 | | |

$ | - | | |

$ | 817,367 | | |

$ | 49,527 | | |

$ | (938,694 | ) | |

$ | (71,800 | ) |

| Balance

,value |

|

| 984,786 | | |

$ | - | | |

$ | 817,367 | | |

$ | 49,527 | | |

$ | (938,694 | ) | |

$ | (71,800 | ) |

| Issuance

of common stock upon cash exercise of warrants |

|

| 24,200 | | |

| - | | |

| 67 | | |

| - | | |

| - | | |

| 67 | |

| Issuance

of common stock upon noncash exercise of Purchase Rights (Note 4) |

|

| 718,704 | | |

| - | | |

| 180 | | |

| - | | |

| - | | |

| 180 | |

| Issuance

of SSNs (Note 4) |

|

| - | | |

| - | | |

| 1,629 | | |

| - | | |

| - | | |

| 1,629 | |

| Change

in fair value of financial instruments attributed to credit risk change (Note 4) |

|

| - | | |

| - | | |

| - | | |

| 15,460 | | |

| - | | |

| 15,460 | |

| Stock-based

compensation |

|

| - | | |

| - | | |

| 417 | | |

| - | | |

| - | | |

| 417 | |

| Net

loss |

|

| - | | |

| - | | |

| - | | |

| - | | |

| (2,354 | ) | |

| (2,354 | ) |

| Balance

as of March 31, 2023 |

|

| 1,727,690 | | |

$ | - | | |

$ | 819,660 | | |

$ | 64,987 | | |

$ | (941,048 | ) | |

$ | (56,401 | ) |

| Balance

,value |

|

| 1,727,690 | | |

$ | - | | |

$ | 819,660 | | |

$ | 64,987 | | |

$ | (941,048 | ) | |

$ | (56,401 | ) |

See

accompanying notes to condensed consolidated financial statements (unaudited).

EVOFEM

BIOSCIENCES, INC. AND SUBSIDIARIES

CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

(In

thousands)

| | |

2024 | | |

2023 | |

| | |

Three months ended March 31, | |

| | |

2024 | | |

2023 | |

| Cash flows from operating activities: | |

| | | |

| | |

| Net loss | |

$ | (4,809 | ) | |

$ | (2,354 | ) |

| Adjustments to reconcile net loss to net cash, cash equivalents and restricted cash provided by (used in) operating activities: | |

| | | |

| | |

| Loss on issuance of financial instruments | |

| 3,275 | | |

| 84 | |

| Change in fair value of financial instruments | |

| (802 | ) | |

| (1,612 | ) |

| Gain on debt extinguishment | |

| (1,120 | ) | |

| - | |

| Stock-based compensation | |

| 237 | | |

| 417 | |

| Depreciation | |

| 12 | | |

| 245 | |

| Noncash interest expense | |

| 564 | | |

| 565 | |

| Noncash right-of-use amortization | |

| 47 | | |

| 504 | |

| Net loss on disposal of property and equipment | |

| 5 | | |

| - | |

| Changes in operating assets and liabilities: | |

| | | |

| | |

| Trade accounts receivable | |

| 1,432 | | |

| (6,278 | ) |

| Inventories | |

| 391 | | |

| (99 | ) |

| Prepaid and other assets | |

| 573 | | |

| 1,518 | |

| Accounts payable | |

| (726 | ) | |

| 3,813 | |

| Accrued expenses and other liabilities | |

| 438 | | |

| (352 | ) |

| Accrued compensation | |

| 652 | | |

| (800 | ) |

| Operating lease liabilities | |

| (46 | ) | |

| (591 | ) |

| Net cash and restricted cash provided by (used in) operating activities | |

| 123 | | |

| (4,940 | ) |

| Cash flows from investing activities: | |

| | | |

| | |

| Purchases of property and equipment | |

| (14 | ) | |

| (3 | ) |

| Net cash and restricted cash used in investing activities | |

| (14 | ) | |

| (3 | ) |

| Cash flows from financing activities: | |

| | | |

| | |

| Proceeds from issuance of common stock - exercise of warrants | |

| - | | |

| 61 | |

| Borrowings under term notes | |

| - | | |

| 1,640 | |

| Net cash and restricted cash provided by financing activities | |

| - | | |

| 1,701 | |

| Net change in cash, cash equivalents and restricted cash | |

| 109 | | |

| (3,242 | ) |

| Cash, cash equivalents and restricted cash, beginning of period | |

| 580 | | |

| 4,776 | |

| Cash, cash equivalents and restricted cash, end of period | |

$ | 689 | | |

$ | 1,534 | |

| Supplemental disclosure of noncash investing and financing activities: | |

| | | |

| | |

| Issuance of common stock upon exercise of purchase rights | |

| 89 | | |

| 180 | |

| Purchases of property and equipment included in accounts payable and accrued expenses | |

| 78 | | |

| 140 | |

Series E-1 shares deemed dividends | |

| 47 | | |

| - | |

| Issuance of common stock upon conversion of notes | |

| 35 | | |

| - | |

| Issuance of common stock upon exercise of warrants | |

| 15 | | |

| - | |

| Financing costs included in accounts payable and accrued expenses | |

| - | | |

| 125 | |

See

accompanying notes to condensed consolidated financial statements (unaudited).

EVOFEM

BIOSCIENCES, INC. AND SUBSIDIARIES

NOTES

TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

1.

Description of Business and Basis of Presentation

Description

of Business

Evofem

is a San Diego-based, commercial-stage biopharmaceutical company committed to commercializing innovative products to address unmet needs

in women’s sexual and reproductive health.

The

Company’s first commercial product, Phexxi® (lactic acid, citric acid, and potassium bitartrate) vaginal gel

(Phexxi), was approved by the U.S. Food and Drug Administration (FDA) on May 22, 2020, and is the first and only FDA-approved,

hormone-free, woman-controlled, on-demand prescription contraceptive gel for women. The Company commercially launched Phexxi in

September 2020. Phexxi net product sales were $16.8

million in 2022 and increased to $18.2

million in 2023.

On

December 11, 2023, the Company entered into an Agreement and Plan of Merger, as amended (the Merger Agreement) with Aditxt, Inc., a

Delaware corporation (Aditxt) and Adifem, Inc. (f/k/a Adicure, Inc.), a Delaware corporation, and a wholly-owned Subsidiary of

Aditxt (Merger Sub), pursuant to which, and on the terms and subject to the conditions thereof, the Merger Sub was expected to merge

with and into the Company, with the Company surviving as a wholly owned subsidiary of Aditxt (the Merger). As discussed in Note

10 – Subsequent Events, on April 26, 2024, the Company delivered a termination notice to Aditxt notifying it that the

Company was exercising its right to terminate the Merger Agreement in accordance with Section 8.1(f) of the Merger Agreement. As

further described (and defined) in Note 10 – Subsequent Events, on May 2, 2024, the Company entered into

the Reinstatement and Fourth Amendment to the Merger Agreement with Aditxt in order to reinstate and amend the Merger

Agreement.

Basis

of Presentation and Principles of Consolidation

The

Company prepared the unaudited interim condensed consolidated financial statements included in this Quarterly Report in accordance with

accounting principles generally accepted (GAAP) in the United States for interim financial information and the rules and regulations

of the Securities and Exchange Commission (SEC) related to quarterly reports on Form 10-Q.

The

Company’s financial statements are presented on a consolidated basis, which include the accounts of the Company and its

wholly-owned subsidiaries. Intercompany accounts and transactions have been eliminated in consolidation. The unaudited interim

condensed consolidated financial statements do not include all information and disclosures required by GAAP for annual audited

financial statements and should be read in conjunction with the Company’s condensed consolidated financial statements and

notes thereto for the year ended December 31, 2023 included in its Annual Report on Form 10-K as filed with the SEC on March 27,

2024 (the 2023 Audited Financial Statements).

The

unaudited interim condensed consolidated financial statements included in this report have been prepared on the same basis as the Company’s

audited consolidated financial statements and include all adjustments (consisting only of normal recurring adjustments) necessary for

a fair statement of the financial position, results of operations, cash flows, and statements of convertible and redeemable preferred

stock and stockholders’ deficit for the periods presented. The results for the three months ended March 31, 2024 are not necessarily

indicative of the results expected for the full year. The condensed consolidated balance sheet as of December 31, 2023 was derived from

the 2023 Audited Financial Statements.

Risks,

Uncertainties and Going Concern

Any

disruptions in the commercialization of Phexxi and/or its supply chain could have a material adverse effect on the Company’s business,

results of operations and financial condition.

The

condensed consolidated financial statements have been prepared on a going concern basis, which contemplates the realization of assets

and settlement of liabilities, in the normal course of business, and does not include any adjustments to reflect the possible future

effects on the recoverability and classification of assets or amounts and classification of liabilities that may result from the outcome

of this uncertainty.

The

Company’s principal operations are related to the commercialization of Phexxi. Additional activities have included raising capital,

identifying alternative manufacturing to lower the cost of goods sold (COGS), seeking ex-U.S. licensing partners and product in-licensing/acquisition

opportunities to add non-dilutive capital to the balance sheet, and establishing and maintaining a corporate infrastructure to support

a commercial product. The Company has incurred operating losses and negative cash flows from operating activities since inception. As

of March 31, 2024, the Company a working capital deficit of $67.3

million and an accumulated deficit of $893.6

million.

Since

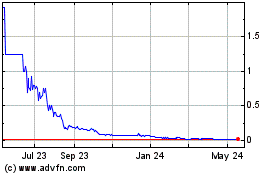

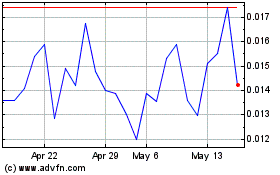

October 3, 2022, the Company’s common stock has traded on the OTC Venture Market (the OTCQB) of the OTC Markets Group, Inc., a

centralized electronic quotation service for over-the-counter securities, under the symbol “EVFM.” The OTCQB imposes,

among other requirements, a minimum $0.01

per share bid price requirement (the Bid Price Requirement) for continued inclusion on the OTCQB. The closing bid price for the

Company’s common stock must remain at or above $0.01

per share to comply with the Bid Price Requirement for continued listing. As of May 10, 2024, the closing price was $0.0136.

Management’s

plans to meet its cash flow needs in the next 12 months include generating recurring product revenue, restructuring its current payables,

and obtaining additional funding through means such as the issuance of its capital stock, non-dilutive financings, or through collaborations

or partnerships with other companies, including license agreements for Phexxi in the U.S. or foreign markets, or other potential business

combinations.

The

Company anticipates it will continue to incur net losses for the foreseeable future. According to management estimates, liquidity resources

as of March 31, 2024 were not sufficient to maintain the Company’s cash flow needs for the twelve months from the date of issuance

of these condensed consolidated financial statements.

If

the Company is not able to obtain the required funding through a significant increase in revenue, equity or debt financings, license

agreements for Phexxi in the U.S. or foreign markets, or other means, or is unable to obtain funding on terms favorable to the

Company, or if there is another event of default affecting the notes payable, there will be a material adverse effect on

commercialization operations and the Company’s ability to execute its strategic development plan for future

growth. If the Company cannot successfully raise additional funding and implement its strategic development plan, the Company may be

forced to make further reductions in spending, including spending in connection with its commercialization activities, extend

payment terms with suppliers, liquidate assets where possible at a potentially lower amount than as recorded in the condensed

consolidated financial statements, suspend or curtail planned operations, or cease operations entirely. Any of these could

materially and adversely affect the Company’s liquidity, financial condition and business prospects, and the Company would not

be able to continue as a going concern. The Company has concluded that these circumstances and the uncertainties associated with the

Company’s ability to obtain additional equity or debt financing on terms that are favorable to the Company, or at all, and

otherwise succeed in its future operations raise substantial doubt about the Company’s ability to continue as a going

concern.

2.

Summary of Significant Accounting Policies

Use

of Estimates

The

preparation of condensed consolidated financial statements in conformity with GAAP requires management to make estimates and assumptions

that affect the amounts reported in the condensed consolidated financial statements and the notes thereto.

Significant

estimates affecting amounts reported or disclosed in the condensed consolidated financial statements include, but are not limited

to: the assumptions used in measuring the revenue gross-to-net variable consideration items; the trade accounts receivable credit

loss reserve estimate; the assumptions used in estimating the fair value of convertible notes, preferred stock, warrants and

purchase rights issued; the assumptions used in the valuation of inventory; the useful lives of property and equipment; the

recoverability of long-lived assets; and the valuation of deferred tax assets. These assumptions are more fully described in Note 3 – Revenue, Note

4 – Debt, Note 6 - Fair Value of Financial Instruments, Note 7 - Commitments and

Contingencies, and Note 9 - Stock-based Compensation. The Company bases its estimates on historical

experience and other market-specific or other relevant assumptions that it believes to be reasonable under the circumstances and

adjusts when facts and circumstances dictate. The estimates are the basis for making judgments about the carrying values of assets,

liabilities and recorded expenses that are not readily apparent from other sources. As future events and their effects cannot be

determined with precision, actual results may materially differ from those estimates or assumptions.

Segment

Reporting

Operating

segments are identified as components of an enterprise about which separate discrete financial information is available for evaluation

by the chief operating decision-maker, the Chief Executive Officer of the Company, in making decisions regarding resource allocation

and assessing performance. The Company views its operations and manages its business in one operating segment.

Concentrations

of Credit Risk

Financial