Digital Shelf Space Announces Closing of Over-Subscribed $1,500,000 Brokered Private Placement

March 06 2012 - 8:30AM

Marketwired

Digital Shelf Space Corp. (the "Company" or "Digital Shelf Space")

(TSX VENTURE:DSS)(OTCQX:DTSRF) is pleased to announce that the

Company has completed its previously announced CDN$1,500,000

brokered private placement financing (the "Offering") through

Fin-XO Securities Inc. ("Fin-XO"). The Offering was over subscribed

for gross proceeds of CDN$1,562,325.

The Offering consisted of units of the Company at a price of

$0.15 per unit. Each unit consists of one common share and one half

common share purchase warrant. Each whole purchase warrant entitles

the holder to purchase one common share of the Company at the price

of $0.25 per common share on or before the date occurring 18 months

following the closing of the Offering (the "Offering Warrants"). In

the event the Company's common shares trade above $0.35 for ten

(10) consecutive trading days, the Offering Warrants, if

unexercised, will expire 30 days thereafter.

In connection with the Offering, the Company has paid a cash

commission to Fin-XO equal to 7% of the gross proceeds raised

pursuant to the Offering (excluding proceeds from the sale of units

purchased by insiders and affiliates of the Company). The Company

has also paid Fin- XO a corporate finance fee of CDN$15,000, and

has reimbursed Fin-XO's reasonable expenses. Additionally, the

Company has issued Fin-XO 708,085 broker warrants (the "Broker

Warrants") for the purchase of common shares in the Company. The

Broker Warrants have an exercise price of $0.15 per common share

and expire 18 months following the closing of the Offering. In the

event the Company's common shares trade above $0.35 for ten (10)

consecutive trading days, the Broker Warrants, if unexercised, will

expire 30 days thereafter.

In accordance with applicable securities legislation, securities

issued pursuant to the Offering are subject to a hold period of

four months plus one day from the date of the closing of the

Offering.

Funds raised from this financing will be used toward marketing

and advertising, content development and new projects, transaction

and related expenses, and working capital and general corporate

purposes.

The Offering is subject to final approval of the TSX Venture

Exchange.

About Digital Shelf Space Corp.

Digital Shelf Space is an independent creator, producer and

distributor of home entertainment content targeted at the fitness

and sports instruction market. Digital Shelf Space's overall

content partnership strategy is to align itself with world-class,

global brand partners. For more information please visit

www.digitalshelfspace.com and to view our flagship project with

Georges St-Pierre, please visit www.gsprushfit.com.

ON BEHALF OF THE BOARD

Jeffrey Sharpe, President & CEO

Forward Looking Statements

Forward-looking information is generally identifiable by use of

the words "believes", "may", "plans", "will", "anticipates",

"intends", "budgets", "could", "estimates", "expects", "forecasts",

"projects" and similar expressions, and the negative of such

expressions. Forward-looking information in this news release

include statements about the use of proceeds from the Offering and

the strategies and future plans of Digital Shelf Space.

In connection with the forward-looking information contained in

this news release, Digital Shelf Space has made numerous

assumptions, regarding, among other things, current financial need

and expected cash runways; and expected growth of sales and

consumer demand. While Digital Shelf Space considers these

assumptions to be reasonable, these assumptions are inherently

subject to significant uncertainties and contingencies.

Additionally, there are known and unknown risk factors which

could cause Digital Shelf Space's actual results, performance or

achievements to be materially different from any future results,

performance or achievements expressed or implied by the

forward-looking information contained herein. Known risk factors

include, among others: the funds raised in the Offering may not be

used as currently planned; retail distribution of GSP RUSHFIT may

not increase in the quantum and in the timeframe anticipated, or at

all; there may be no further retail distributors for the GSP

RUSHFIT series; Direct Response TV spots and traditional

November/December retail fitness section rests may not result in

increased sales of GSP RUSHFIT; the Northern Response partnership

may not grow Digital Shelf Space's retail presence as anticipated;

the substantial investment of capital required to produce and

market video and entertainment productions, the need to obtain

additional financing and uncertainty as to the availability and

terms of future financing, unpredictability of the commercial

success of our programming, difficulties in integrating

technological changes and other trends affecting the entertainment

industry, significant competition in the global economic market,

the possibility the rate of growth of the market for fitness media

will slow, reliance on the health and marketability of celebrity

fitness talent in productions owned by Digital Shelf Space, the

possibility of competition from other ecommerce and online

marketing vendors, the continued strong growth in adoption of

digital media, the possibility of new fitness titles from

traditional large studios that target the male demographic, large

media production companies may move ecommerce operations in-house

rather than outsourcing, reliance on production studios continuing

to outsource ecommerce operations, reliance on a number of key

employees, limited operating history, the possibility of claims

against the intellectual property rights of Digital Shelf Space,

the possibility of infringements upon the intellectual property

rights of Digital Shelf Space, and volatility of the market price

of Digital Shelf Space shares.

A more complete discussion of the risks and uncertainties facing

Digital Shelf Space is disclosed in Digital Shelf Space's Filing

Statement dated November 16, 2010 and continuous disclosure filings

with Canadian securities regulatory authorities at www.sedar.com.

All forward-looking information herein is qualified in its entirety

by this cautionary statement, and Digital Shelf Space disclaims any

obligation to revise or update any such forward-looking information

or to publicly announce the result of any revisions to any of the

forward-looking information contained herein to reflect future

results, events or developments, except as required by law.

This news release contains "forward-looking information" within

the meaning of the Canadian securities laws.

Neither TSX Venture Exchange nor its Regulation Services

Provider (as that term is defined in the policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or

accuracy of the release.

Contacts: Digital Shelf Space Corp. Jeff Sharpe President &

CEO (604) 736-7977 ext.111 (604) 736-7944 (FAX)

jeff[at]digitalshelfspace.com www.digitalshelfspace.com

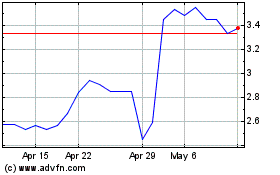

Ether Cap (PK) (USOTC:DTSRF)

Historical Stock Chart

From Apr 2024 to May 2024

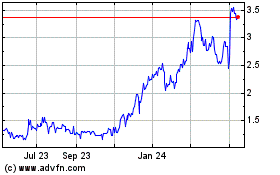

Ether Cap (PK) (USOTC:DTSRF)

Historical Stock Chart

From May 2023 to May 2024