Engie Remains Mired in Red Ink on Energy Plant Write-Downs--Update

March 02 2017 - 3:18AM

Dow Jones News

By Inti Landauro

PARIS--French energy utility Engie (ENGI.FR) remained mired in

red ink last year on another hefty write-down of the value of its

conventional power plants, struggling with low electricity prices

across Europe, and provisions for its Belgian nuclear

facilities.

The company, formerly known as GDF Suez, said posted a net loss

of 400 million euros ($421.3 million), though that was smaller than

the EUR4.6 billion recorded the previous year.

Engie's net recurring income--a measure that strips out

restructuring costs and other impairments--fell slightly to EUR2.5

billion from EUR2.6 billion thought the figure was in line with

management's target set for the year

The company booked impairments worth EUR3.7 billion during the

year, partly offset by capital gains made on the sale of assets.

The impairments also include higher provisions for its nuclear

plants in Belgium.

The weight of write-downs on Engie's balance sheet for another

year shows how sluggish demand for energy and subsidies for

renewable energy has hit European utilities hard by making

traditional power plants unprofitable. The company has written down

a massive $30 billion worth of assets over the past four years.

The company confirmed that it would keep its dividend at EUR1 a

share this year and next and then lower it to EUR0.70 a share

thereafter.

In reaction to the tough market conditions, Engie's Chief

Executive Isabelle Kocher has decided to get rid of some of its

assets exposed to commodity prices and energy markets and plans

instead to focus on businesses with regulated prices, on services

and on renewables.

The company has said last year it planned to sell assets worth

EUR15 billion and invest EUR22 billion between 2016 and 2018 to

bring its share of earnings before interest, taxes, depreciation

and amortization from contracted and regulated activities to 85%

from 50% at the end of 2015.

After selling many thermal power plants, mainly coal-fired ones,

Engie has brought the proportion of its assets made up of

regulated, services and renewables businesses to 75% at the end of

2016.

The company said last year's revenue fell 4.7% to EUR66.6

billion, while Ebitda fell 5.2% to EUR10.7 billion.

A group of analysts polled by FactSet expected an average net

profit of EUR2.42 billion on sales of EUR65.99 billion and Ebidta

of EUR10.77 billion.

-Write to Inti Landauro at inti.landauro@wsj.com

(END) Dow Jones Newswires

March 02, 2017 03:03 ET (08:03 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

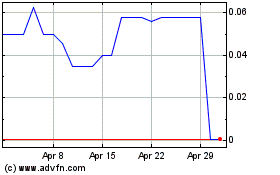

Energy One (CE) (USOTC:EGOC)

Historical Stock Chart

From Dec 2024 to Jan 2025

Energy One (CE) (USOTC:EGOC)

Historical Stock Chart

From Jan 2024 to Jan 2025