Dragon Capital Group Corp. (PINKSHEETS: DRGV), a leading holding

company of emerging high-tech companies in China, announced today

the company's financial results for the third quarter ended

September 30, 2009.

Financial Highlights:

Revenue for the third quarter ended September 30, 2009 was $14.2

million, a 24.56% increase over the $11.4 million recorded in the

third quarter of 2008. Cost of sales for the third quarter of 2009

were $13.3 million compared to $10.6 million in the third quarter

of 2008. Net income from continuing operations for the third

quarter of 2009 was $356,187, slight decrease from the $383,126

recorded in the third quarter of 2008. Net income in the third

quarter of 2009 was approximately $291,000, slight decrease from

approximately $310,000 for the third quarter of 2008. The decrease

in net income was largely attributable to the Company's efforts to

increase sales and market share through an aggressive pricing

strategy in a very difficult market environment.

Nine-Month Financial Results

Revenue for the first nine months of 2009 reached record $41.1

million, a 20% increase from the $33.7 million recorded in the

first nine months of 2008. For the first nine months of 2009, net

income from continuing operations was $799,553 down from $1.11

million in the first nine months of 2008, mainly a result of

reduced margins of its main technological product sales.

Mr. Lawrence Wang, CEO of Dragon Capital Group, stated, "As we

are emerging away from a very challenging sales environment, Dragon

has made a strong effort to increase sales volume and market share

through aggressive pricing. Our dedication to this strategy has

enabled Dragon to post record sales while remaining profitable for

the quarter and the first nine months of the year. We are confident

that these gains in market share will result in a significant

expansion in our top and bottom line performance as the economy

continues to improve in the coming quarters and margins return to

normalized levels. We are confident that China's high-tech industry

will provide a significant growth opportunity for Dragon as we

continue to seek to grow internally and through opportunistic

acquisition of complimentary high tech operations for the benefit

of our shareholders."

Consolidated financial Statements

DRAGON CAPITAL GROUP, CORP. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEET

(Unaudited)

ASSETS

September 30 December 31,

------------ -------------

2009 2008

------------ -------------

CURRENT ASSETS:

Cash and cash equivalents $ 1,173,001 $ 1,812,809

Accounts receivable, net of allowance for

doubtful accounts of $152,903 and $152,533,

respectively 5,042,323 2,921,310

Other receivables 870,868 2,088,449

Inventories 5,909,810 5,829,686

Loan receivable - 114,000

Investment in marketable securities 112,000 266,000

Prepaid expenses and other 338,562 264,791

Subsidiaries held for sale - 2,273,900

------------ -------------

Total Current Assets 13,446,564 15,570,945

DUE FROM RELATED PARTY 71,663 71,489

PROPERTY AND EQUIPMENT - Net 232,503 275,098

------------ -------------

Total Assets $ 13,750,730 $ 15,917,532

============ =============

LIABILITIES AND STOCKHOLDERS' EQUITY

CURRENT LIABILITIES:

Loans payable $ 521,876 $ 320,971

Loans payable-related party - 43,769

Accounts payable and accrued expenses 4,572,367 3,675,375

Other payable 411,138 336,426

Taxes payable (150,047) 68,235

Advances from customers 1,521 1,230,135

Subsidiaries held for sale - 895

------------ -------------

Total Current Liabilities 5,356,855 5,675,806

------------ -------------

EQUITY:

Dragon Capital Group, Corp.

Common Stock ($0.001 Par Value; 500,000,000

Shares Authorized;

259,644,578 shares issued and outstanding) 259,645 259,645

Additional paid-in capital 5,061,071 6,108,800

Accumulated retained earnings 2,214,854 2,569,941

Subscription receivable (2,000) -

Accumulated comprehensive income (248,329) 245,235

------------ -------------

Total Dragon Capital Group, Corp. 7,285,241 9,183,621

------------ -------------

Noncontrolling interest 1,108,634 1,058,105

------------ -------------

Total Equity 8,393,875 10,241,726

------------ -------------

Total Liabilities and Equity $ 13,750,730 $ 15,917,532

============ =============

DRAGON CAPITAL GROUP, CORP. AND SUBSIDIARIES

CONSOLIDATED STATEMENT OF OPERATIONS

(Unaudited)

For the Three Months Ended For the Nine Months Ended

September 30, September 30,

-------------------------- --------------------------

2009 2008 2009 2008

------------ ------------ ------------ ------------

NET REVENUES $ 14,165,556 $ 11,352,590 $ 41,065,365 $ 33,695,969

COST OF SALES 13,299,065 10,640,081 38,746,832 31,534,898

------------ ------------ ------------ ------------

GROSS PROFIT 866,491 712,509 2,318,533 2,161,071

------------ ------------ ------------ ------------

OPERATING EXPENSES:

Selling expenses 341,807 150,560 910,513 464,261

General and

administrative 168,497 178,823 608,467 586,132

------------ ------------ ------------ ------------

Total Operating

Expenses 510,304 329,383 1,518,980 1,050,393

------------ ------------ ------------ ------------

INCOME FROM

OPERATIONS 356,187 383,126 799,553 1,110,678

------------ ------------ ------------ ------------

OTHER INCOME

Other income 142 (73) 2,847 (19)

Interest income

(expense) (22,827) (1,706) (23,931) (1,170)

------------ ------------ ------------ ------------

Total Other

expense (22,685) (1,779) (21,084) (1,189)

------------ ------------ ------------ ------------

INCOME BEFORE

DISCONTINUED

OPERATIONS,

INCOME TAX AND

NONCONTROLLING

INTEREST 333,502 381,347 778,469 1,109,489

DISCOUNTINUED

OPERATIONS:

Loss on sale of

Fomde

subsidiaries - - (714,983) -

Gain from

discontinued

operations - 3,226 5,603 17,360

------------ ------------ ------------ ------------

Total (loss)

gain from

discontinued

operations - 3,226 (709,380) 17,360

INCOME BEFORE

INCOME TAXES AND

NONCONTROLLING

INTEREST 333,502 384,573 69,089 1,126,849

INCOME TAXES (42,838) (74,530) (218,220) (255,103)

------------ ------------ ------------ ------------

NET (LOSS) INCOME 290,664 310,043 (149,131) 871,746

Less: Net income

attributable to

noncontrolling

interest (91,762) (44,780) (205,956) (141,532)

------------ ------------ ------------ ------------

NET (LOSS) INCOME

ATTRIBUTABLE TO

DRAGON CAPITAL

GROUP, CORP. 198,902 265,263 (355,087) 730,214

------------ ------------ ------------ ------------

NET INCOME (LOSS)

PER COMMON SHARE:

Net (loss) income

from continuing

operations $ 0.00 $ 0.00 $ 0.00 $ 0.00

============ ============ ============ ============

Net (loss) income

from

discontinued

operations $ - $ 0.00 $ (0.00) $ 0.00

============ ============ ============ ============

NET (LOSS) INCOME

PER COMMON SHARE $ 0.00 $ 0.00 $ (0.00) $ 0.00

============ ============ ============ ============

WEIGHTED AVERAGE

COMMON SHARES

OUTSTANDING:

Basic and Diluted 259,644,578 240,066,800 259,644,578 236,566,800

============ ============ ============ ============

AMOUNTS

ATTRIBUTABLE TO

DRAGON CAPITAL

GROUP, CORP.

COMMON

SHAREHOLDERS:

Income from

continuing

operations, net

of tax 198,902 262,037 354,293 712,854

Discontinued

operations, net

of tax - 3,226 (709,380) 17,360

------------ ------------ ------------ ------------

Net income 198,902 265,263 (355,087) 730,214

============ ============ ============ ============

DRAGON CAPITAL GROUP, CORP. AND SUBSIDIARIES

CONSOLIDATED STATEMENT OF CASH FLOWS

For the Nine Months

Ended Septemeber 30,

2009 2008

----------- -----------

CASH FLOWS FROM OPERATING ACTIVITIES: (Unaudited) (Unaudited)

Income from continuing operations $ 354,293 $ 712,854

Adjustments to reconcile income from operations

to net cash used in continuing operations:

Depreciation and amortization 31,586 41,197

Allowance for doubtful accounts - -

Stock based compensation - 16,737

Noncontrolling interest 205,957 141,532

Changes in assets and liabilities:

Accounts receivable (2,112,403) (703,091)

Other receivable 1,221,774 (63,363)

Inventories (65,924) (537,623)

Prepaid and other current assets (72,004) (44,052)

Accounts payable and accrued expenses 888,827 (554,043)

Other payable 73,843 65,153

Income tax payable (218,291) (17,500)

Advances from customers (1,230,716) 545,566

----------- -----------

Net cash used in continuing operations (923,058) (396,633)

----------- -----------

(Loss) income from discontinued operations (709,380) 17,360

Adjustments to reconcile (loss) income from

discontinued operations to net cash used in

discontinued operations

Non-cash loss from discontinued operations 714,983 -

Assets from discontinued operations (11,112) (2,362)

Liabilities from discontinued operations 126 (31,677)

Minority interest 5,383 16,679

----------- -----------

Net cash used in discontinued operations - -

----------- -----------

NET CASH USED IN OPERATING ACTIVITIES (923,058) (396,633)

----------- -----------

CASH FLOWS FROM INVESTING ACTIVITIES:

Cash acquired in acquisition - 221,684

Disposition (purchase) of property, plant and

equipment 11,646 (63,596)

----------- -----------

NET CASH PROVIDE BY INVESTING ACTIVITIES 11,646 158,088

----------- -----------

CASH FLOWS FROM FINANCING ACTIVITIES:

Write off the uncollectible loan 112,926 -

Proceeds from loans 292,290

Payments made - loans (102,302) (116,738)

Repayments of related party advance (33,844) (74,420)

----------- -----------

NET CASH PROVIDED BY (USED IN) FINANCING

ACTIVITIES 269,070 (191,158)

----------- -----------

EFFECT OF EXCHANGE RATE ON CASH 2,534 150,106

NET DECREASE IN CASH (639,808) (279,597)

CASH - beginning of the year 1,812,809 1,562,756

----------- -----------

CASH - end of period $ 1,173,001 $ 1,283,159

=========== ===========

SUPPLEMENTAL DISCLOSURE OF CASH FLOW

INFORMATION:

Cash paid for: Interest $ 7,397 $ 1,416

=========== ===========

Income taxes $ 55,909 $ 34,905

=========== ===========

NON-CASH INVESTING ACTIVITIES:

Subscription receivable for disposal of

Fomde subsidiary $ 2,000 $ -

=========== ===========

About Dragon Capital Group Corporation

Dragon Capital Group Corporation is a holding company serving as

a business incubator for emerging Chinese businesses. Dragon

currently controls seven subsidiaries operating in high-tech, IT

products and services and management consulting. Three of the

subsidiaries are growing strong recurring revenue streams from

electronics hardware distribution and network integration. The

company's other three subsidiaries, still in the emergent stage,

are focused on wireless Internet applications, mobile business

solutions, software development, enterprise management,

computerized automations systems integration and network

integration. For more information, visit,

http://www.dragoncapital.us.

Safe Harbor Statement

This news release contains forward-looking statements within the

meaning of the Private Securities Litigation Reform Act of 1995.

These forward-looking statements are based on current expectations

or beliefs, including, but not limited to, statements concerning

the company's operations, financial performance and, condition. For

this purpose, statements that are not statements of historical fact

may be deemed to be forward-looking statements. The company

cautions that these statements by their nature involve risks and

uncertainties, and actual results may differ materially depending

on a variety of important factors, including, but not limited to,

the impact of competitive products, pricing and new technology;

changes in consumer preferences and tastes; and effectiveness of

marketing; changes in laws and regulations; fluctuations in costs

of production, and other factors as those discussed in the

company's reports filed with the Securities and Exchange Commission

from time to time. In addition, the company disclaims any

obligation to update any forward-looking statements to reflect

events or circumstances after the date hereof.

Contact: Investor Relations: Gary Liu Tel: 954-363-7333 ext.

318

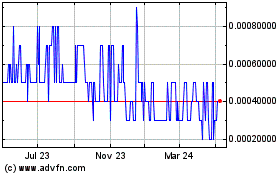

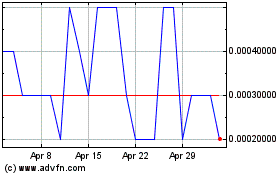

Dragon Capital (PK) (USOTC:DRGV)

Historical Stock Chart

From Jun 2024 to Jul 2024

Dragon Capital (PK) (USOTC:DRGV)

Historical Stock Chart

From Jul 2023 to Jul 2024