Market Advisors, Inc. Issues "Initiating Coverage" Report on Dragon Capital Group With a Speculative Buy and a Price Objective o

August 26 2009 - 7:00AM

Marketwired

A new research report has been issued regarding Dragon Capital

Group Corporation (PINKSHEETS: DRGV) by Market Advisors, Inc.

"Fundamental Analysis for Today's Investments" with a "Speculative

Buy" and a $0.047 intermediate price objective. To view the report,

please visit www.dragoncapital.us, a leading holding company of

emerging high-tech companies in China.

Dragon Capital Group's (PINKSHEETS: DRGV) mission is to be a

leader in the development of wireless 3G-based applications and

business solutions. Two companies that Dragon has acquired are

among the leading providers of mobile Internet applications and

business solutions in China.

NEWS FLASH

On June 30, 2009, total assets were $14.6 million compared to

$15.9 million at December 31, 2008. In addition, 2009, shareholder

equity was $7.1 million and total current assets were $14.3 million

with working capital of approximately $7.8 million. Revenue for the

first six months of 2009 reached $26.9 million, increasing by 20%

from the $22.3 million recorded in the first six months of 2008.

Mr. Lawrence Wang, CEO of Dragon Capital Group, stated, "Dragon

continues to post increasing sales in this challenging

environment."

INITIATING COVERAGE

The Company offers consulting services for US enterprises

seeking to invest in China. DRGV directs clients' management of

investments in the Shenzhen and Shanghai stock markets Diversified

across product categories, end markets, and geographic regions

primarily in China. The Company has on board experienced

professionals knowledgeable with both the laws and business

practices of China. The Company has emerged as a profitable company

in a difficult environment and improved in almost all balance sheet

items including growing their cash position by approximately 12%.

China has encouraged growth in many sectors -- an abrupt change

from state control.

WHY CHINA

The Chinese government has relaxed laws and is allowing the

formation of rural enterprises and private businesses,

significantly opened foreign trade and investment, pulled back on

state control over commodity prices, and invested in industrial

production. They have also taken positive steps on educating its

work force. Because of this, it is hard not to be bullish on

China.

China has a vast populace and its large physical size alone

marks it as a very powerful global force. Since encouraging the

growth of rural enterprises and not focusing exclusively on the

urban industrial sector, China has successfully moved millions of

workers off farms and into factories without creating an urban

crisis. In addition, China has allowed more outside intervention

which in turn has spurred foreign investment. As a result, more

jobs have been created linking China with world markets.

UPDATE

The Company was founded in 2000 and is led by Mr. Lawrence Wang,

who serves as Chairman, CEO and General Manager of Shanghai Yazheng

and has been its General Manager since their inception. Mr. Wang's

goal is to lead DRGV in the high-growth potential in the universe

of Chinese stocks publicly-traded in global stock markets. Analysts

agree that over the next twenty to thirty years, it should be a

golden period for a rising China. As China's influence of the world

markets grows over time, many great investment opportunities will

continue to emerge. We currently feel stocks like DRGV and similar

stocks in related sectors are more promising than others. Current

steps taken by the Chinese government to stimulate the economy will

be a boom for many technology stocks. As a result, the sectors with

the best potential will be those that stand to benefit from the

rising middle class and its increased spending on transportation,

food services, and especially consumer electronics, which is right

where DRGV is positioned. Most financial professionals will

recommend between 10-20% of a portfolio to be placed into

international securities. Chinese stocks have been a popular

securities selection for investment portfolios in recent years as

their economy has been rising steadily. In fact, China has been

posting double digit growth numbers for several years, and of

particular interest, over the past couple of years when many other

countries have faced economic problems.

KEY POINTS

While investing in stocks always has its risks, just like the

US, China also has regulatory bodies in place designed to protect

investors. These regulatory bodies monitor which companies are

listed on the exchanges; audits are implemented with regularity,

and buying and selling of securities are closely regulated.

Regardless, any financial decision still needs to be carefully

evaluated and should match the investment style and risk tolerance

of the investor.

SUBSIDIARIES

Our positive outlook on Dragon Capital reflects our confidence

in a management team focused on growth through acquisition and

subsequent exploitation of capital-starved subsidiaries. Management

has successfully employed this strategy over the past few years in

both strong and weak markets. Current subsidiaries include:

Shanghai Yazheng Information Technology Co., Ltd engaged in

developing information technology in China by introducing advanced

software and hardware products from the US. Shanghai Cnnest

Technology Co., Ltd which is dedicated to commercial Third

Generation (3G) wireless applications and mobile business

solutions. In addition, Dragon also operates Shanghai Zhaoli

Technology Co., Ltd, Shanghai Longri Technology Development Co.,

Ltd and Shanghai Hulce Electronic System Integration Co. Ltd.

Please visit www.dragoncapital.us for additional details on these

entities.

About Market Advisors, Inc.

Officers of Market Advisors, Inc. have been in business since

1983 and have provided stock market research for their clients

since 1985. Company officials have often been quoted in a wide

array of financial publications such as the Wall Street Journal,

Investor's Business Daily, Barron's, Forbes Magazine and The Dick

Davis Digest to name a few.

About Dragon Capital Group Corporation

Dragon Capital Group Corporation (PINKSHEETS: DRGV) is a holding

company serving as a business incubator for emerging Chinese

businesses. Dragon currently controls subsidiaries operating in

high-tech, IT products and services and management consulting.

Three of the subsidiaries are growing strong recurring revenue

streams from electronics hardware distribution and network

integration. Dragon's wholly owned management firm, Shanghai

Dragon, is expected to realize its initial revenue and profits in

2007. The company's other three subsidiaries, still in the emergent

stage, are focused on wireless Internet applications, mobile

business solutions, software development, enterprise management,

computerized automations systems integration and network

integration. For more information, visit, www.dragoncapital.us.

Safe Harbor Statement

This news release contains forward-looking statements within the

meaning of the Private Securities Litigation Reform Act of 1995.

These forward-looking statements are based on current expectations

or beliefs, including, but not limited to, statements concerning

the company's operations, financial performance and, condition. For

this purpose, statements that are not statements of historical fact

may be deemed to be forward-looking statements. The company

cautions that these statements by their nature involve risks and

uncertainties, and actual results may differ materially depending

on a variety of important factors, including, but not limited to,

the impact of competitive products, pricing and new technology;

changes in consumer preferences and tastes; and effectiveness of

marketing; changes in laws and regulations; fluctuations in costs

of production, and other factors as those discussed in the

company's reports filed with the Securities and Exchange Commission

from time to time. In addition, the company disclaims any

obligation to update any forward-looking statements to reflect

events or circumstances after the date hereof.

Contact: Dragon Capital Group - Investor Relations Gary Liu

954-363-7333 ext. 318

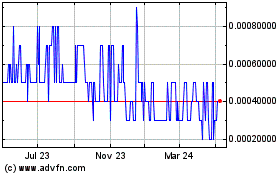

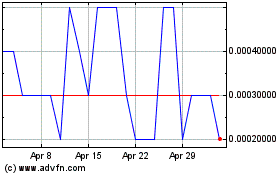

Dragon Capital (PK) (USOTC:DRGV)

Historical Stock Chart

From Jun 2024 to Jul 2024

Dragon Capital (PK) (USOTC:DRGV)

Historical Stock Chart

From Jul 2023 to Jul 2024