Current Report Filing (8-k)

May 23 2014 - 6:01AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

May 22, 2014

Date of Report (Date of earliest event

reported)

MINDESTA INC.

(Exact name

of registrant as specified in its charter)

| Delaware |

11-3763974 |

| (State or other jurisdiction of incorporation or

organization) |

(I.R.S. Employer Identification Number)

|

Suite 201, 290 Picton Avenue, Ottawa, Ontario, Canada K1Z 8P8

(Address of Principal Executive Offices) (Zip Code)

(613) 241-9959

(Registrant's telephone number,

including area code)

Check the appropriate box below if the Form 8-K filing is

intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

[_] Written communications pursuant to Rule 425 under the

Securities Act (17 CFR 230.425)

[_] Soliciting material pursuant to Rule 14a-12 under the

Exchange Act (17 CFR 240.14a -12)

[_] Pre-commencement communications pursuant to Rule

14d-2(b)under the Exchange Act (17 CFR 240.14d -2(b))

[_] Pre-commencement communications pursuant to Rule

13e-4(c)under the Exchange Act (17 CFR 240.13e -4(c))

Item 3.02 Unregistered Sales of Equity Securities

On May 20, 2014, Mindesta Inc. completed a non brokered private

placement consisting of the sale of 15,783,332 units at a price of US$0.015 per

unit for total proceeds of US$236,750. Each unit consists of one common share

and one half of a share purchase warrant. Each whole warrant entitles the holder

to purchase one common share at a price of $0.0175 until December 31, 2016.

In addition, on May 20, 2014, Mindesta Inc. reached agreement

with Nubian Gold Corporation (“Nubian”) to convert the US$100,000 that is owed

to Nubian by the Company, and in turn by Nubian to its major shareholder Gregory

Bowes, into 10,000,000 common shares of the Company at a price of $0.01 per

share. Mr. Bowes and related companies have also agreed to restructure the

balance of funds owing to them by the Company being approximately $142,000.

Approximately $22,000 in interest will be forgiven, $50,000 will be repayable

immediately and the balance will be repayable in one year. Mr. Bowes is also

director and officer of Mindesta.

At all times relevant:

- The sale was made to a sophisticated or accredited investor;

- The purchaser was given the opportunity to ask questions and receive

answers concerning the terms and conditions of the offering and to obtain any

additional information which the Company possessed or could acquire without

unreasonable effort or expense that was necessary to verify the accuracy of

information furnished;

- At a reasonable time prior to the sale of securities, the purchaser was

advised of the limitations on resale of the securities; and

- Neither the Company nor any person acting on its behalf sold the

securities by any form of general solicitation or general advertising

- In issuing the foregoing securities, the Company relied on the exemptive

provisions of Section 4(2), Regulation D and/or Reg S of the Securities Act.

Item 9.01 Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of

1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

Mindesta Inc.

|

| |

|

| |

|

| Dated May 22, 2014 |

By: //Gregory

Bowes

|

| |

Gregory B. Bowes

|

| |

Chief Executive

Officer and Chief |

| |

Financial Officer

|

Exhibit 99.1

Mindesta Announces Private Placement and Debt

Restructuring

Ottawa, Canada – May 22, 2014 – Mindesta Inc.

(“Mindesta” or the “Company”) (OTCBB: MDST) announces that it has completed

a non brokered private placement consisting of the sale of 15,783,332 units at a

price of US$0.015 per unit for total proceeds of US$236,750. Each unit consists

of one common share and one half of a share purchase warrant. Each whole warrant

entitles the holder to purchase one common share at a price of $0.0175 until

December 31, 2016.

In addition, Mindesta has reached agreement with Nubian Gold

Corporation (“Nubian”) to convert the US$100,000 that is owed to Nubian by the

Company, and in turn by Nubian to its major shareholder Gregory Bowes, into

10,000,000 common shares of the Company at a price of $0.01 per share. Mr. Bowes

and related companies have also agreed to restructure the balance of funds owing

to them by the Company being approximately $142,000. Approximately $22,000 in

interest will be forgiven, $50,000 will be repayable immediately and the balance

will be repayable in one year. Mr. Bowes is also director and officer of

Mindesta.

Upon the completion of these transactions Mindesta will have

35,196,913 shares outstanding.

About Mindesta

Mindesta is a junior exploration

company that trades on the OTCBB and is an SEC registrant current on all 10k and

10Q filings. The Company is currently seeking new business opportunities.

This press release does not constitute an offer to sell or the

solicitation of an offer to buy securities in any jurisdiction.

For additional information, please contact:

Gregory

Bowes, CEO (613) 241-9959

"Safe Harbor" Statement under the Private Securities

Litigation Reform Act of 1995: This press release contains forward-looking

statements (within the meaning of Section 27a of the Securities Act of 1933 and

Section 21e of the Securities Exchange Act of 1934) regarding us and our

business, financial condition, results of operations and prospects.

Forward-looking statements in this report reflect the good faith judgment of our

management and the statements are based on facts and factors as we currently

know them. Forward-looking statements are subject to risks and uncertainties and

actual results and outcomes may differ materially from the results and outcomes

discussed in the forward-looking statements. Actual results could differ

materially from those projected in the forward-looking statements, as a result

of either the matters set forth or incorporated in this report generally or

certain economic and business factors, some of which may be beyond our control.

Readers are urged not to place undue reliance on these forward-looking

statements which speak only as of the date of this press release. We undertake

no obligation to revise or update any forward-looking statements in order to

reflect any event or circumstance that may arise after the date of the press

release.

NO REGULATORY AUTHORITY HAS APPROVED OR DISAPPROVED OF THE

CONTENTS OF THIS RELEASE

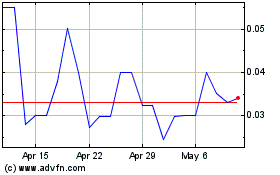

CTT Pharmaceutical (PK) (USOTC:CTTH)

Historical Stock Chart

From Jun 2024 to Jul 2024

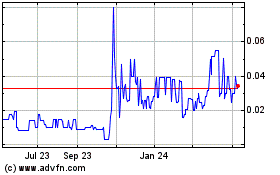

CTT Pharmaceutical (PK) (USOTC:CTTH)

Historical Stock Chart

From Jul 2023 to Jul 2024